Global Functional Confectionery Market Size, Share Report By Nature (Organic, Conventional), By Product Type (Gummies, Chocolates, Bars, Capsules, Liquids, Powders, Others), By Function ( Cognitive Wellness, Performance Enhancers, Wellness Enhancers, Oral Care, Others), By Application (Children, Middle Age, Senior, Youth), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Drug Stores/Pharmacies, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154256

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

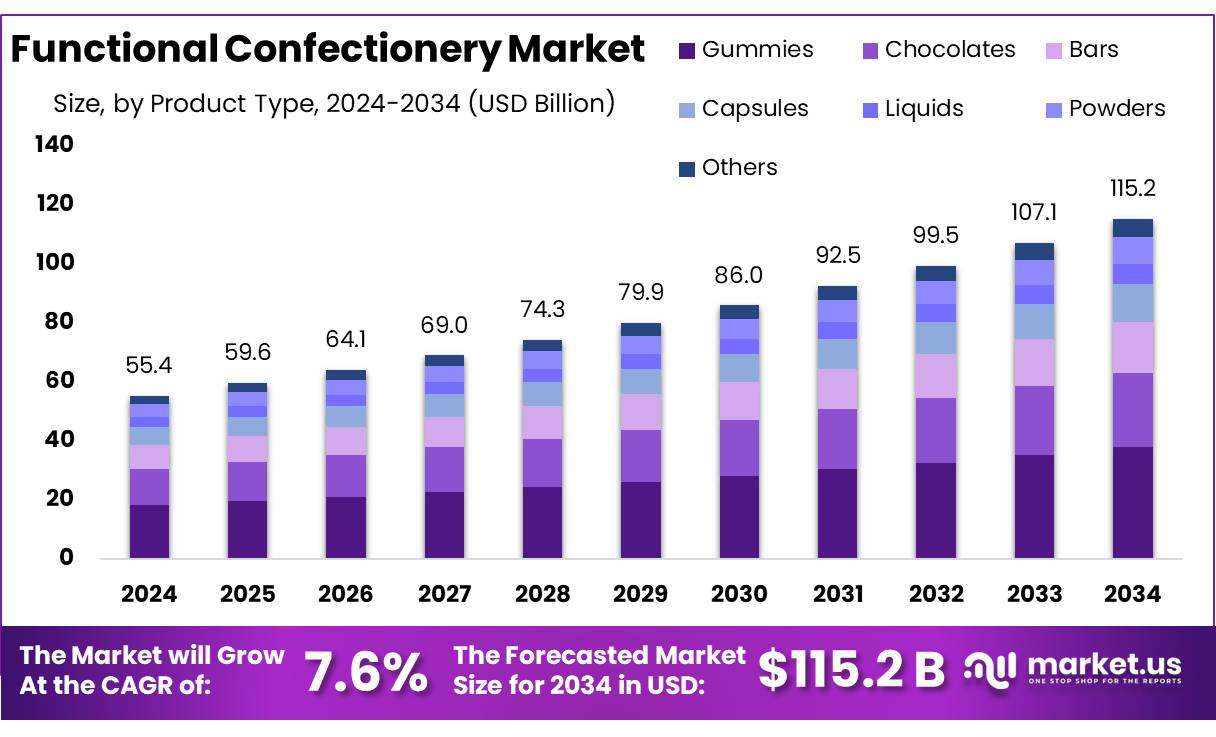

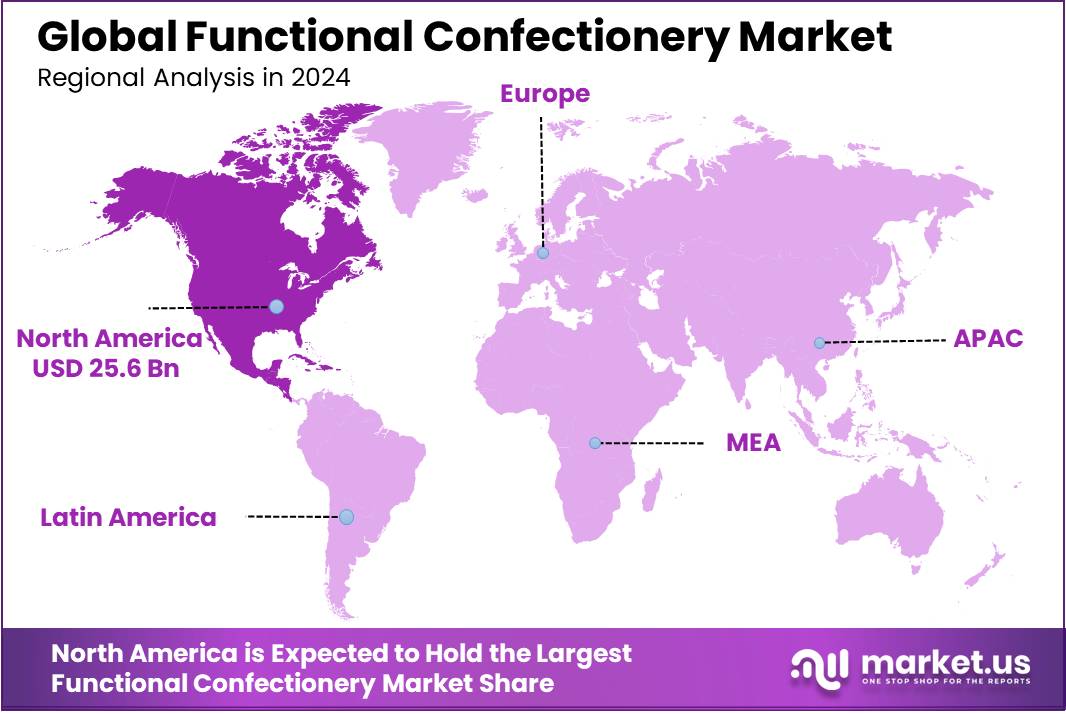

The Global Functional Confectionery Market size is expected to be worth around USD 115.2 Billion by 2034, from USD 55.4 Billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 41.60% share, holding USD 20.9 Billion in revenue.

Functional confectionery concentrates refer to formulation bases—such as powders, syrups, or emulsions—infused with active ingredients (e.g. probiotics, vitamins, herbal extracts, omega‑3s, collagen) that are incorporated into candies, gums, chocolates, and lozenges to deliver specific health benefits. The growth of the market can be attributed to rising consumer interest in wellness‑oriented snacking, clean‑label formulations, and multi‑functionality in indulgent formats.

The Indian confectionery industry is undergoing a transformation, with a notable shift towards health-conscious products. According to the Food Processing Industry Ministry, the segment for functional drinks has seen a growth of nearly 30% in the last two years. This trend is paralleled in the confectionery sector, where consumers are increasingly seeking products that offer health benefits alongside indulgence. The rise in disposable incomes, urbanization, and changing lifestyles are contributing to this demand.

At the national level, Government Initiatives in India provide a regulatory and supportive context for growth. The Food Safety and Standards Authority of India (FSSAI), under the Ministry of Health and Family Welfare, sets product standards including for “sweets & confectionery” and “nutritional supplements/health supplements” . Under the Food Fortification Initiative (FFI), coordinated with FSSAI, the Haryana pilot program began distribution of fortified atta (wheat flour) enriched with iron, folic acid and vitamin B12, reaching ~177,000 individuals and aiming to scale to ~12 million consumers in the state—part of an ambition to reach 400 million people across multiple states.

Government initiatives have significantly bolstered this growth. The “Pradhan Mantri Kisan Sampada Yojana” aims to improve infrastructure and modernize food processing facilities, indirectly benefiting the confectionery sector. Additionally, the “Operation Greens” scheme, with an allocation of INR 500 crore (approximately $60 million), promotes value addition in fruits and vegetables, enhancing the supply of quality ingredients for functional confectionery .

Key Takeaways

- Functional Confectionery Market size is expected to be worth around USD 115.2 Billion by 2034, from USD 55.4 Billion in 2024, growing at a CAGR of 7.6%.

- Conventional held a dominant market position, capturing more than a 69.4% share in the global Functional Confectionery market.

- Gummies held a dominant market position, capturing more than a 32.8% share in the global Functional Confectionery market.

- Wellness Enhancers held a dominant market position, capturing more than a 28.3% share in the global Functional Confectionery market.

- Middle Age held a dominant market position, capturing more than a 37.50% share in the global Functional Confectionery market.

- North America held a dominant position in the global Functional Confectionery market, accounting for more than 46.3% of the overall revenue and reaching a market value of approximately USD 25.6 billion.

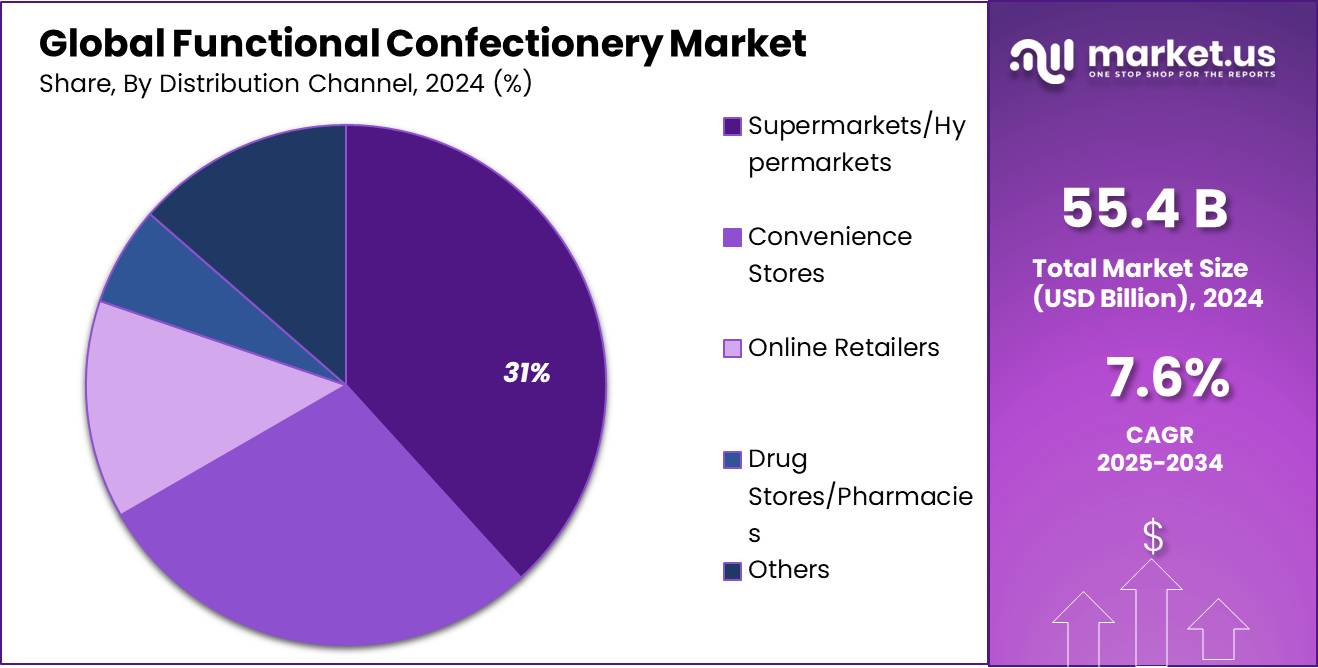

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 31.2% share in the global Functional Confectionery market.

By Nature Analysis

Conventional Leads with 69.4% Share Due to Wide Consumer Acceptance and Easy Availability

In 2024, Conventional held a dominant market position, capturing more than a 69.4% share in the global Functional Confectionery market. This strong share is mainly supported by its widespread availability across supermarkets, retail outlets, and convenience stores. Consumers continue to prefer conventional functional confectionery products, such as vitamin-enriched candies or energy chews, due to familiarity in taste and brand trust. Manufacturers also favor conventional options for their cost-effectiveness and easier production scalability compared to organic or specialty variants.

In 2025, the segment is expected to maintain its lead, driven by expanding demand in developing countries where price-sensitive consumers prioritize affordable yet functional sweets. Additionally, large-scale promotional campaigns and greater shelf space for conventional confectionery formats across global retail chains are expected to reinforce this trend into the near future.

By Product Type Analysis

Gummies dominate with 32.8% due to their taste appeal and easy consumption format

In 2024, Gummies held a dominant market position, capturing more than a 32.8% share in the global Functional Confectionery market. Their popularity is largely driven by their chewable format, fruity flavors, and suitability for all age groups. Gummies are especially favored among children and adults who find tablets or capsules less appealing. These products are commonly fortified with vitamins, minerals, collagen, or probiotics, making them a convenient and enjoyable way to support daily health.

By 2025, the gummies segment is expected to maintain strong growth momentum as more functional ingredients—such as adaptogens and fiber—are being introduced in gummy forms. The ease of incorporating health benefits into a familiar confectionery product has made gummies a top choice among health-conscious consumers seeking taste without compromise.

By Function Analysis

Wellness Enhancers lead with 28.3% as consumers prioritize daily health support through treats

In 2024, Wellness Enhancers held a dominant market position, capturing more than a 28.3% share in the global Functional Confectionery market. This strong demand is mainly driven by growing consumer interest in supporting immunity, energy levels, and mental clarity through everyday snacking. Products in this category often include ingredients like vitamins, zinc, adaptogens, or herbal extracts, making them attractive for people seeking preventive wellness.

The appeal of combining health benefits with indulgence has boosted the popularity of wellness-focused treats such as fortified chocolates and gummies. By 2025, the segment is expected to witness further growth as more brands introduce multifunctional formulations targeting stress relief, focus, and immune health. The shift towards proactive self-care and rising health awareness are expected to keep wellness enhancers at the forefront of functional confectionery demand.

By Application Analysis

Middle Age dominates with 37.5% driven by rising focus on preventive health

In 2024, Middle Age held a dominant market position, capturing more than a 37.50% share in the global Functional Confectionery market. This dominance is attributed to the growing demand among individuals aged 35 to 55 who are increasingly focused on preventive health and wellness. Functional confectionery products enriched with collagen, antioxidants, vitamins, and probiotics are particularly appealing to this group due to their benefits for joint health, skin vitality, and immunity.

By 2025, this segment is expected to continue its upward trajectory as middle-aged consumers are actively seeking healthier snacking options that combine indulgence with nutritional support. The shift towards proactive self-care and the convenience of on-the-go functional treats will further strengthen the presence of this age group in the market.

By Distribution Channel Analysis

Supermarkets/Hypermarkets lead with 31.2% due to high product visibility and consumer reach

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 31.2% share in the global Functional Confectionery market. This strong foothold is supported by their wide distribution network, product variety, and the ability to provide consumers with a physical shopping experience where they can compare brands, ingredients, and pricing directly.

These retail formats offer high shelf visibility and space for promotional activities, which helps boost impulse purchases of functional confectionery. By 2025, the segment is expected to sustain its lead as new product launches and in-store sampling continue to attract health-conscious shoppers. Additionally, the growing presence of functional snacks in dedicated health aisles within supermarkets is further driving consumer access and awareness.

Key Market Segments

By Nature

- Organic

- Conventional

By Product Type

- Gummies

- Chocolates

- Bars

- Capsules

- Liquids

- Powders

- Others

By Function

- Cognitive Wellness

- Performance Enhancers

- Wellness Enhancers

- Oral Care

- Others

By Application

- Children

- Middle Age

- Senior

- Youth

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- Drug Stores/Pharmacies

- Others

Emerging Trends

Emphasis on Plant-Based and Functional Ingredients

A notable trend in the functional confectionery market is the increasing incorporation of plant-based and functional ingredients into products. Consumers are becoming more health-conscious and are seeking snacks that offer both indulgence and nutritional benefits. This shift in consumer preferences is driving manufacturers to innovate and develop confectionery products that align with these health trends.

Government initiatives are also playing a crucial role in supporting this trend. For instance, the Pradhan Mantri Kisan Sampada Yojana aims to increase investments in food processing and infrastructure, with a target to generate an additional 10 million jobs by 2024. Such initiatives enhance the appeal for both domestic and foreign investments in the Indian food processing sector, including functional confectionery.

In summary, the emphasis on plant-based and functional ingredients in confectionery products is a response to the growing consumer demand for healthier and more nutritious snacks. This trend, supported by a growing market and government initiatives, presents significant opportunities for innovation and growth in the functional confectionery sector.

Drivers

Growing Health and Wellness Trends

A major driving factor for the functional confectionery market is the rising health and wellness trend among consumers. As people become more conscious about their health, the demand for healthier food alternatives, including confectioneries, has increased. Consumers are now seeking snacks that not only satisfy their sweet cravings but also provide added nutritional value. This shift in consumer behavior is contributing significantly to the growth of the functional confectionery sector.

Government initiatives like the Pradhan Mantri Kisan Sampada Yojana aim to modernize food processing facilities and strengthen supply chain infrastructure. These efforts indirectly support the growth of functional confectionery products by improving the accessibility and quality of ingredients used in these products. As urbanization accelerates and disposable incomes increase, the demand for functional confectionery is expected to continue rising, driven by the growing awareness of health-conscious consumers.

This trend of healthier indulgence is creating an exciting market for innovations in confectionery, offering opportunities for companies to introduce new products with added health benefits to cater to the evolving needs of today’s consumers.

Restraints

High Production Costs

One of the major restraining factors for the functional confectionery market is the high production costs associated with these products. The incorporation of functional ingredients such as vitamins, minerals, and probiotics into confectionery items significantly raises the production cost. These specialized ingredients, often sourced from niche suppliers, are more expensive than traditional sugar or flavoring agents. Additionally, the need for specialized manufacturing processes to maintain the integrity of these active ingredients during production can further increase costs.

Government initiatives like the Pradhan Mantri Kisan Sampada Yojana, which aims to modernize food processing and strengthen the supply chain, could help address some of these cost challenges. However, even with such efforts, the high cost of functional ingredients remains a hurdle. Companies must balance the rising demand for health-oriented products with the challenge of keeping prices competitive while maintaining product quality.

Ultimately, while the demand for functional confectionery continues to grow, the high production costs remain a significant challenge for manufacturers looking to expand their product offerings and reach a broader consumer base. The long-term sustainability of this market depends on how companies manage these cost challenges while delivering value to consumers.

Opportunity

Expanding Health-Conscious Consumer Base

A significant growth opportunity for the functional confectionery market lies in catering to the expanding health-conscious consumer base. This growth is driven by a shift in consumer preferences towards healthier alternatives, including functional confectionery products that offer added nutritional benefits.

Government initiatives play a pivotal role in supporting this market expansion. The Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme, for instance, provides financial assistance and technical support to micro-level food processing units. In the financial year 2024-25, Bihar emerged as a leader in implementing this scheme, with over 6,500 units receiving loans and subsidies, facilitating the growth of small-scale enterprises in the food processing sector .

Furthermore, the government’s focus on promoting organic and fortified food products aligns with the increasing consumer demand for functional confectionery. Programs aimed at enhancing food safety and quality standards contribute to building consumer trust in functional confectionery products, thereby driving market growth.

Regional Insights

North America dominates with 46.3% share, valued at USD 25.6 billion in 2024

In 2024, North America held a dominant position in the global Functional Confectionery market, accounting for more than 46.3% of the overall revenue and reaching a market value of approximately USD 25.6 billion. This regional leadership is primarily attributed to a strong consumer base with high health awareness, widespread access to functional food products, and growing demand for convenient wellness solutions. The United States continues to lead the region, supported by an established nutraceuticals industry and high penetration of fortified confectionery products, including gummies, lozenges, and chews enriched with vitamins, minerals, probiotics, and collagen.

The region benefits from a mature retail infrastructure, with supermarkets, hypermarkets, and specialty health stores offering a wide variety of functional confectionery products. In addition, the rise in e-commerce platforms has significantly contributed to product accessibility, especially among younger and tech-savvy demographics. Regulatory support from agencies such as the U.S. Food and Drug Administration (FDA), which oversees label accuracy and functional claims, has also contributed to consumer trust in fortified confectionery offerings.

A key factor driving growth in North America is the increasing adoption of preventive healthcare habits among middle-aged adults and seniors. Consumers are actively incorporating functional snacks into their daily routines to manage energy levels, immunity, and cognitive performance. Looking forward to 2025, North America is expected to maintain its leading position, as manufacturers continue to introduce targeted solutions catering to aging populations, active lifestyles, and clean-label preferences. Continuous innovation and favorable consumer attitudes toward functional indulgence are projected to reinforce the region’s market dominance.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mars Inc, a prominent name in the confectionery industry, offers a diverse portfolio that includes popular brands like M&M’s and Snickers. Mars has expanded into the functional confectionery market by introducing products with added health benefits, such as enhanced protein content and natural ingredients. The company’s commitment to sustainability, product innovation, and its focus on consumer preferences has positioned it as a key player in the evolving landscape of functional confectionery.

Nestle SA, a major player in the global food and beverage sector, has leveraged its strong brand presence to enter the functional confectionery market. Nestle offers a range of products that combine traditional confectionery with functional ingredients, such as vitamins and probiotics. The company’s emphasis on sustainability, health, and wellness aligns with its strategy to diversify and grow within the functional food sector, addressing consumer trends for more nutritious and health-enhancing confectionery options.

The Hershey Company, a leading player in the global confectionery market, is renowned for its range of chocolates and sweets. With a strong focus on innovation, Hershey has increasingly incorporated functional ingredients like vitamins and minerals into its products to cater to health-conscious consumers. The company’s strategic growth initiatives, including sustainable sourcing and product diversification, have strengthened its market position and enabled it to meet the evolving demands of the functional confectionery sector.

Top Key Players Outlook

- The Hershey Company

- Mars Inc

- Mondelez International

- Nestle SA

- Barry Callebaut Group

- Ferrero SpA

- Orion Corporation

- Haribo GmbH & Co. KG

- August Storck KG

- LOTTE Confectionery Co., Ltd

Recent Industry Developments

Financially, Mars Inc. reported annual sales exceeding $50 billion in 2024, with a workforce of more than 150,000 employees globally .

In 2024, Mondelez International generated USD 36.44 billion in total net revenue globally, achieving USD 4.61 billion in net earnings, supported by 90,000 employees worldwide.

Report Scope

Report Features Description Market Value (2024) USD 55.4 Bn Forecast Revenue (2034) USD 115.2 Bn CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Product Type (Gummies, Chocolates, Bars, Capsules, Liquids, Powders, Others), By Function ( Cognitive Wellness, Performance Enhancers, Wellness Enhancers, Oral Care, Others), By Application (Children, Middle Age, Senior, Youth), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Drug Stores/Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Hershey Company, Mars Inc, Mondelez International, Nestle SA, Barry Callebaut Group, Ferrero SpA, Orion Corporation, Haribo GmbH & Co. KG, August Storck KG, LOTTE Confectionery Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Functional Confectionery MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Functional Confectionery MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Hershey Company

- Mars Inc

- Mondelez International

- Nestle SA

- Barry Callebaut Group

- Ferrero SpA

- Orion Corporation

- Haribo GmbH & Co. KG

- August Storck KG

- LOTTE Confectionery Co., Ltd