Global Fuel Oil Burner Market Size, Share Analysis Report By Type (Automatic Fuel Oil Burners, Manual Fuel Oil Burners, Dual-Fuel Burners), By Application (Boilers, Furnaces, Ovens and Dryers, Kilns), By End-user (Industrial, Commercial, Residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168494

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

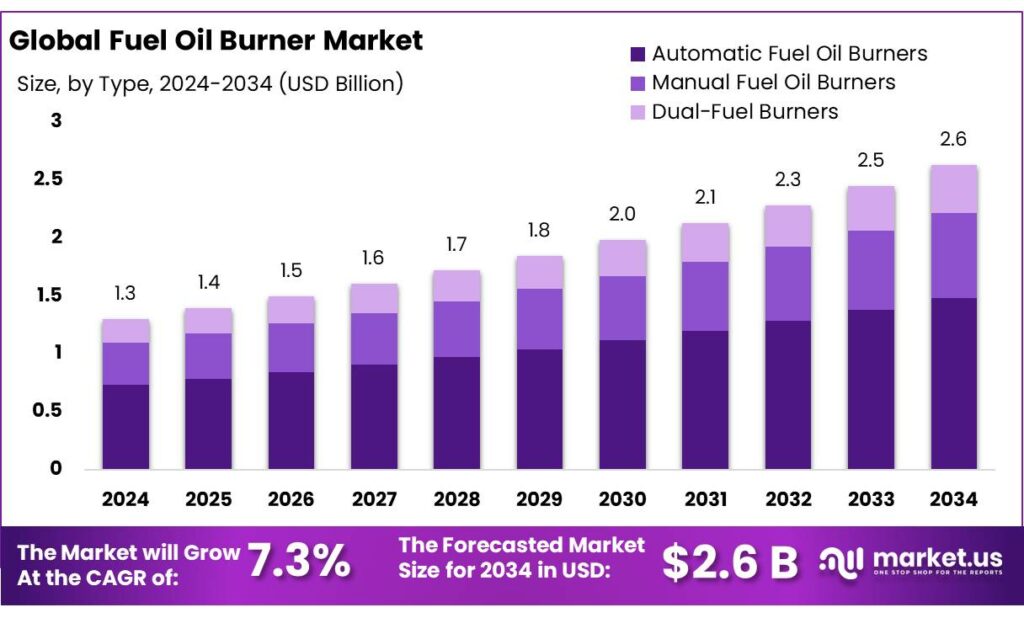

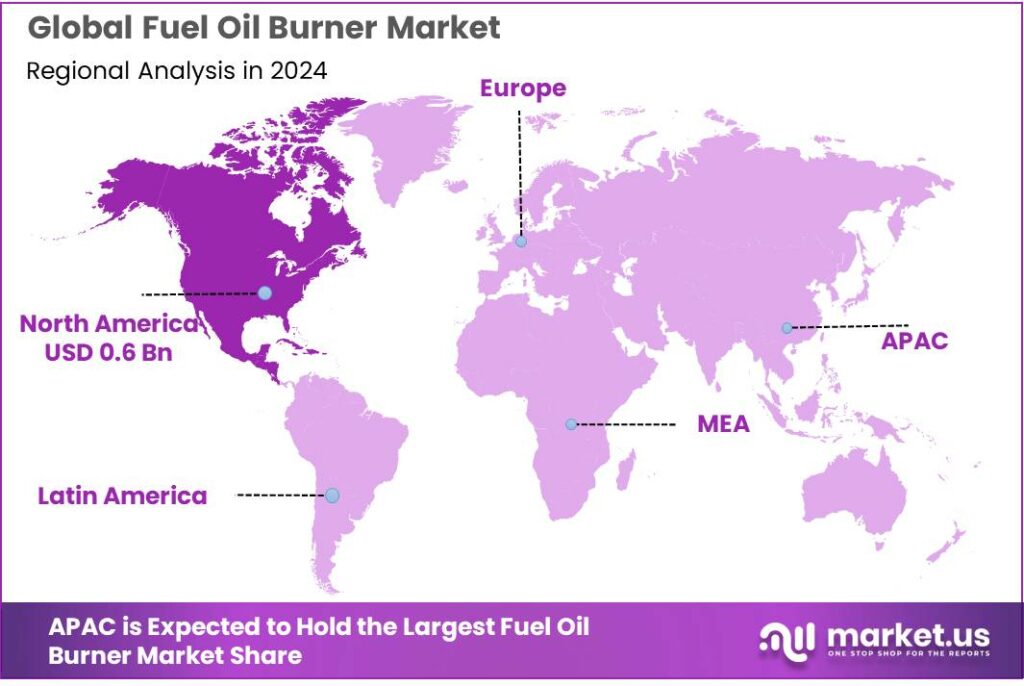

The Global Fuel Oil Burner Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.6% share, holding USD 2.3 Billion revenue.

Fuel oil burners are a core component of thermal systems that use heavy or medium fuel oils to generate controllable high-temperature heat for boilers, process heaters, furnaces and large commercial heating systems. They remain embedded in the wider oil-based energy system, where oil products still supply about 40% of total final energy consumption worldwide in 2023, underlining the scale of installed combustion equipment that relies on liquid fuels. At the same time, the industrial sector itself accounts for 37% of global energy use, or around 166 exajoules in 2022, making industrial combustion – including fuel oil burners – a major focus for efficiency and decarbonisation strategies.

In the current industrial scenario, fuel oil burners are most common in refineries, petrochemicals, cement, metals, pulp and paper, and food and beverages, as well as in district heating and some commercial buildings. Although many OECD markets have shifted space heating and smaller boilers toward gas, electrification or biomass, robust demand for process heat in emerging economies keeps fuel oil systems relevant.

- The International Energy Agency (IEA) estimates that total oil use rose to roughly 193 exajoules in 2024, after a strong rebound in 2023. The World Bank likewise projects global oil demand at around 103 million barrels per day in 2024, with further growth of about 1 million barrels per day in 2025, indicating a still-expanding pool of oil-fired equipment in the near term.

However, environmental regulation is reshaping how fuel oil burners are specified and operated. In marine applications – a key outlet for residual fuel oil – the IMO 2020 global sulphur cap cut the allowable sulphur content in ship fuel oil from 3.5% to 0.50% mass by mass from January 2020. Technical assessments based on IMO estimates suggest this change could reduce sulphur oxide emissions from shipping by about 77%, equivalent to roughly 8.5 million tonnes of SOx before 2025, pushing shipowners toward low-sulphur fuels, scrubbers and cleaner burner designs. Similar tightening of industrial emissions and efficiency standards in Europe, North America and parts of Asia is driving demand for low-NOx, high-turndown and digitally controlled fuel oil burners that can meet stricter limits while optimising fuel use.

Key demand drivers for fuel-oil-fired systems are concentrated in fast-growing regions. The Government of India, summarising IEA’s “Indian Oil Market Outlook to 2030”, reports that India is on track to increase oil demand by almost 1.2 million barrels per day by 2030, accounting for more than one-third of the projected 3.2 million barrels per day global increase and reaching about 6.6 million barrels per day of consumption. This industrialisation-led growth underpins continued investment in boilers, process heaters and backup generation where liquid fuel burners provide flexibility and resilience in grids that may still be constrained.

Key Takeaways

- Fuel Oil Burner Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 7.3%.

- Automatic Fuel Oil Burners held a dominant market position, capturing more than a 56.3% share of the global fuel oil burner market.

- Boilers held a dominant market position, capturing more than a 51.9% share of the global fuel oil burner market.

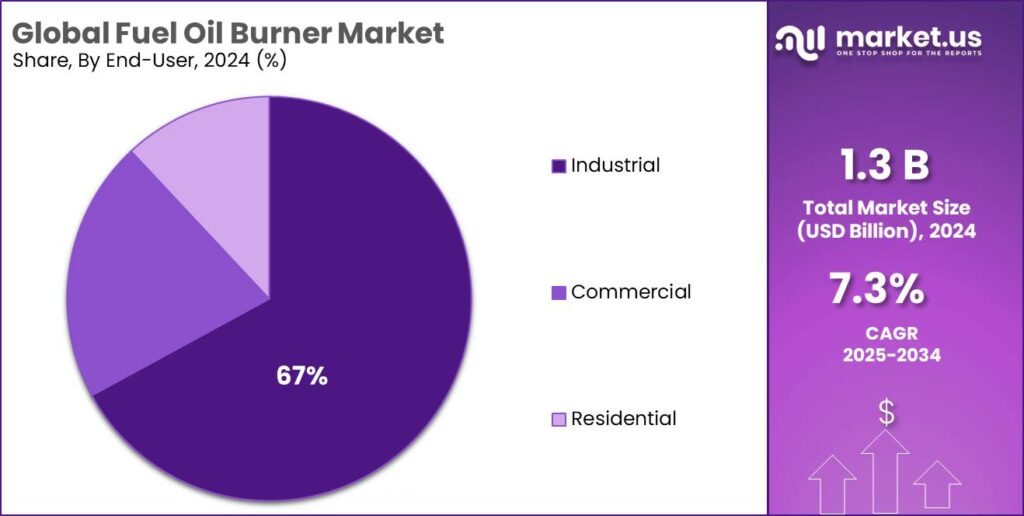

- Industrial applications held a dominant market position, capturing more than a 67.2% share of the fuel oil burner market.

- North America held a leading position in the global fuel oil burner market, capturing 48.9% of the market share, valued at approximately USD 0.6 billion.

By Type Analysis

Automatic Fuel Oil Burners dominate with 56.3% share due to their efficiency and precision

In 2024, Automatic Fuel Oil Burners held a dominant market position, capturing more than a 56.3% share of the global fuel oil burner market. The growing preference for automatic systems can be attributed to their ability to ensure precise fuel regulation, higher energy efficiency, and reduced operational costs compared to manual burners. These burners are widely used in industrial, commercial, and residential heating systems due to their ease of use, low maintenance, and ability to optimize combustion performance.

In 2025, the demand for automatic fuel oil burners is expected to remain strong, driven by increasing energy efficiency regulations and a shift towards automation in heating systems. This market segment is poised to continue growing as more industries and consumers prioritize sustainability and cost savings in energy consumption.

By Application Analysis

Boilers dominate with 51.9% share due to their widespread use in industrial and residential applications

In 2024, Boilers held a dominant market position, capturing more than a 51.9% share of the global fuel oil burner market. The strong demand for fuel oil burners in boiler systems can be attributed to their critical role in providing heat and steam for various industrial processes, as well as heating in commercial and residential buildings. Boilers are essential in sectors such as manufacturing, power generation, and HVAC, where reliable and efficient heating is required.

In 2025, the demand for fuel oil burners in boiler applications is expected to remain robust, supported by ongoing industrial activities and a focus on energy efficiency. As industries continue to modernize their systems, the use of advanced burners in boilers is likely to increase, further solidifying the segment’s dominant position in the market.

By End-user Analysis

Industrial applications dominate with 67.2% share due to high demand for efficient heating solutions

In 2024, Industrial applications held a dominant market position, capturing more than a 67.2% share of the fuel oil burner market. The high demand for fuel oil burners in industrial settings is driven by their essential role in providing reliable, consistent heat for manufacturing processes, power generation, and heavy machinery operations. Industries such as chemical production, textiles, and food processing rely on efficient heating systems for production, making industrial fuel oil burners a critical component.

This segment is expected to continue its strong growth, fueled by increasing industrial activities, a focus on improving energy efficiency, and the adoption of more automated and high-performance burners to meet stringent operational requirements. The industrial sector’s demand for reliable, cost-effective heating solutions ensures that this market segment remains the largest contributor to the overall fuel oil burner market.

Key Market Segments

By Type

- Automatic Fuel Oil Burners

- Manual Fuel Oil Burners

- Dual-Fuel Burners

By Application

- Boilers

- Furnaces

- Ovens and Dryers

- Kilns

By End-user

- Industrial

- Commercial

- Residential

Emerging Trends

Data-Driven Efficiency Upgrades in Food Plants’ Fuel-Oil Burners

One of the clearest new trends around fuel oil burners in the food industry is the quiet but steady shift toward “energy-smart” combustion: plants are keeping their oil-fired boilers, but pairing them with digital controls, efficiency upgrades and better heat management instead of running them as simple on/off machines. The backdrop is huge energy use. Joint work by IRENA and FAO estimates that agri-food chains account for about 30% of global energy consumption, from farm to cooking.

FAO’s Energy-Smart Food work shows how much of that energy turns into heat. One World Bank summary based on FAO data notes that roughly 45% of energy in agri-food systems is used in processing and distribution, and another 30% at retail, preparation and cooking. In other words, three-quarters of the energy that keeps food chains running is basically steam, hot water or hot air – all areas where fuel-oil burners still sit in many bakeries, dairies, edible-oil refineries and canning plants.

Food-sector policy is now pulling in the same direction. In India, the Ministry of Food Processing Industries reports that, as of June 2024, 41 Mega Food Parks, 399 cold-chain projects and 588 food-processing units have been approved under PMKSY, with more schemes like PMFME supporting thousands of micro processors. A later government review notes that the ministry’s budget estimate for 2024-25 has risen to ₹3,290 crore, a jump of about 30.19% over the previous year, and that processed food exports now make up 23.4% of India’s agri-food exports.

Another fresh policy lever is coming from the energy side. India’s new ADEETIE scheme sets aside ₹1,000 crore, including ₹875 crore for interest-subvention, to help MSMEs adopt advanced efficiency technologies. It explicitly targets energy-intensive clusters, including food-processing hubs.

Drivers

Expansion of Food Processing and Agro-Food Industry Heat Demand

A major force behind fuel oil burner demand is the steady expansion of the food and agro-food processing industry, which needs reliable high-temperature heat every single day. From baking, frying and spray-drying to sterilising cans and bottles, most food plants still rely on boilers, thermal-oil heaters or direct-fired ovens where fuel-oil burners are a practical, proven option.

Global agriculture and food value chains are growing, and that growth pulls more processing capacity. FAO estimates that global agriculture value added rose from USD 3.0 trillion in 2013 to USD 3.8 trillion in 2022, an average annual increase of 2.9%. The OECD-FAO Agricultural Outlook also points to continued expansion of agricultural and food markets over 2024-2033, underlining a long pipeline of raw material that must be milled, cooked, dried and packaged in energy-intensive plants.

India shows how this plays out on the ground. Government data indicate that Gross Value Added in India’s food processing sector increased from ₹1.61 lakh crore in 2015-16 to ₹1.92 lakh crore in 2022-23, while employment in food processing industries rose from 17.73 lakh to 20.68 lakh workers over the same period.Industry events now project India’s food processing industry to reach about USD 535 billion by FY26, contributing 7.7% to manufacturing output and supporting more than 7 million jobs. This rapid build-out translates directly into more bakeries, dairies, ready-meal factories and cold-chain hubs that need dependable heat sources.

Public policy is amplifying the trend. Under the Pradhan Mantri Kisan Sampada Yojana (PMKSY), India’s Ministry of Food Processing Industries has approved 1,217 food processing projects with a total project cost of about ₹31,308 crore, including nearly ₹8,698 crore in grants, attracting over ₹22,610 crore of private investment and creating large volumes of new processing and preservation capacity.A recent Cabinet decision added ₹1,920 crore to PMKSY to further expand agro-processing, cold chains and food laboratories.

Restraints

Rising Push for Electrification and Renewable Energy — a Key Drag on Fuel-Oil Burners

One major restraining factor for the use of fuel-oil burners is the growing shift by food and agro-processing industries toward electrification and renewable energy — driven by both environmental regulation and long-term cost-efficiency goals. As electricity and clean energy become more accessible and cheaper, many companies and policymakers are stepping away from fossil-fuel-based burners, reducing the attractiveness of fuel-oil systems.

According to a recent review, the share of renewable energy in global energy consumption is rising strongly: renewable sources now account for nearly 13% of total energy use, with continuing growth in electricity-based solutions across agriculture, buildings, industry and transport. For the food and agro-food sector specifically, energy-efficiency is becoming a priority.

From the demand-side as well, the industry itself is pivoting. A 2023 review of Indian food & beverage sector energy use finds that many firms are adopting a “3C” strategy — Conserve, Convert, Create — to reduce energy consumption and carbon footprint. In the same study, it was observed that while food, beverage and agriculture sectors historically used mostly non-renewable energy, there is now a meaningful shift, with around 40% of energy needs being met through renewable or more efficient sources in progressive setups.

Moreover, environmental regulation is tightening. For example, recent amendments in India’s environmental regulatory framework for industrial boilers — as part of Environmental (Protection) Amendment Rules, 2022 — impose stricter standards for particulate emissions and air pollution from fuel/oil-fired boilers. This adds compliance costs and heightens pressure on food and beverage producers to adopt cleaner heating or cooking technologies, including electric boilers, steam generation through electricity or use of biomass & renewable fuels.

Opportunity

Biofuel-Ready Retrofits in Expanding Food Chains

One big growth opportunity for fuel oil burners sits inside the food chain itself: cutting food loss and powering new cold-chain and processing assets with smarter, cleaner burners that can also handle bio-based fuels. Globally, FAO estimates that about 13.3% of food is lost after harvest and before retail. Another FAO platform puts the figure closer to 14%, worth around US$400 billion each year. Every extra tonne that is safely processed, dried, pasteurised or frozen needs reliable heat – for now, often coming from liquid-fuel burners.

This is especially visible in countries building large food-processing ecosystems. India’s Ministry of Food Processing Industries reports that, under the Pradhan Mantri Kisan SAMPADA Yojana, 1,608 projects have been sanctioned by February 2025, including 41 Mega Food Parks and 394 cold chain projects. A total of ₹6,198.76 crore has already been released as grants. Each cold store, freezing tunnel, or ready-to-eat plant needs steam or thermal oil for blanching, cooking, canning, CIP and packaging. That creates a concrete opening for burner makers who can supply compact, efficient, food-grade systems tailored to these new sites.

Policy support makes this opportunity more durable. The same Indian press note highlights that the food-processing ministry’s budget for 2024-25 rose by about 30.19% over the previous year, and that the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) carries an outlay of ₹10,900 crore from 2021-22 to 2026-27, with 171 companies already approved and incentives of ₹1,155.296 crore disbursed.These schemes aim to raise processing levels, cut wastage and boost exports. In simple terms: more plants, more lines, more ovens and kettles – and, in many regions without stable gas grids, more liquid-fuel burners.

Regional Insights

North America dominates with 48.9% share, valued at USD 0.6 billion due to strong industrial demand and infrastructure

In 2024, North America held a leading position in the global fuel oil burner market, capturing 48.9% of the market share, valued at approximately USD 0.6 billion. This dominance is largely driven by robust industrial demand, particularly from sectors such as manufacturing, oil and gas, and power generation, where fuel oil burners are critical for heating systems and production processes. North America’s strong industrial base, coupled with significant investments in infrastructure and industrial modernization, has fueled continuous demand for efficient and reliable fuel oil burners.

The region’s adoption of advanced burner technologies, including automated and high-efficiency burners, has further supported market growth. This trend is driven by ongoing efforts to meet stringent energy efficiency and environmental regulations, as industries seek to optimize energy use and reduce emissions. The United States and Canada, in particular, continue to be key markets for fuel oil burners, with industrial operations across these countries utilizing fuel oil for heating and power generation purposes.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Weishaupt Group — Weishaupt operates as a diversified energy-technology group with a broad range of burners, condensing boilers, heat pumps and control systems. The group reported an organizational scale of about 4,400 employees and maintains a strong presence in Europe and export markets. Investments in combustion efficiency and digital control systems have been emphasized to meet regulatory and commercial demands for lower emissions and higher fuel economy. The company is positioned as a leading, owner-managed supplier in heating and energy equipment.

Oilon Group Oy — Oilon is an industrial burner and heat-technology group that reported turnover growth to about €85.2 million (2022), an ~18% increase year-on-year, and employs roughly 400 staff. The group has expanded presence in the Americas and Europe, and product development has centred on low-emission burners, heat pumps and electrification-compatible systems. The scale and recent revenue expansion reflect the company’s successful pivot toward environmentally friendlier combustion technologies and growing aftermarket services.

Riello S.p.A. — Riello is a century-old burner manufacturer, founded in 1922, and is described as holding the industry’s largest burner production capacity. The company’s portfolio covers light and heavy oil burners, gas burners, and hybrid systems, and ongoing R&D has prioritized low-NOx and hydrogen-ready solutions. Its global footprint supports sales and service networks across multiple regions, reinforcing supply reliability for industrial and commercial heating projects. The firm’s long history (over 100 years) underpins its market reputation.

Top Key Players Outlook

- Riello S.p.A.

- Weishaupt Group

- Baltur S.p.A.

- Oilon Group Oy

- Bentone

- Ecoflam

- Suntec Industries

- EOGB Energy Products Ltd.

Recent Industry Developments

Oilon Group Oy is a Finland-based energy-technology company that in 2025 reports a turnover of about €50–100 million and employs roughly 250–500 people worldwide. The company manufactures burners and combustion systems for liquid and gaseous fuels — with capacity range from about 10 kW up to 90 MW — making them suitable for anything from small boilers to large industrial boilers.

In 2024, Riello S.p.A. stands out for its century-old expertise, huge burner power range (5 kW–32,000 kW), and forward-looking low-emission, fuel-flexible burner designs — making it a cornerstone supplier in the fuel-oil burner market.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 2.6 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Automatic Fuel Oil Burners, Manual Fuel Oil Burners, Dual-Fuel Burners), By Application (Boilers, Furnaces, Ovens and Dryers, Kilns), By End-user (Industrial, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Riello S.p.A., Weishaupt Group, Baltur S.p.A., Oilon Group Oy, Bentone, Ecoflam, Suntec Industries, EOGB Energy Products Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Riello S.p.A.

- Weishaupt Group

- Baltur S.p.A.

- Oilon Group Oy

- Bentone

- Ecoflam

- Suntec Industries

- EOGB Energy Products Ltd.