Global Fuel Cell Stacks Market Size, Share, And Enhanced Productivity By Type (Air Cooled, Liquid Cooled), By Capacity (5 kW, 5 kW-100 kW, 100 kW-200 kW, Greater Than 200 kW), By Technology (Polymer Electrolyte Membrane (PEM) Fuel Cell Stacks, Solid Oxide Fuel Cell (SOFC) Stacks, Alkaline Fuel Cell (AFC) Stacks, Direct Methanol Fuel Cell (DMFC) Stacks), By Application (Portable Power, Backup Power, Motive Power, Material Handling Equipment, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170586

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

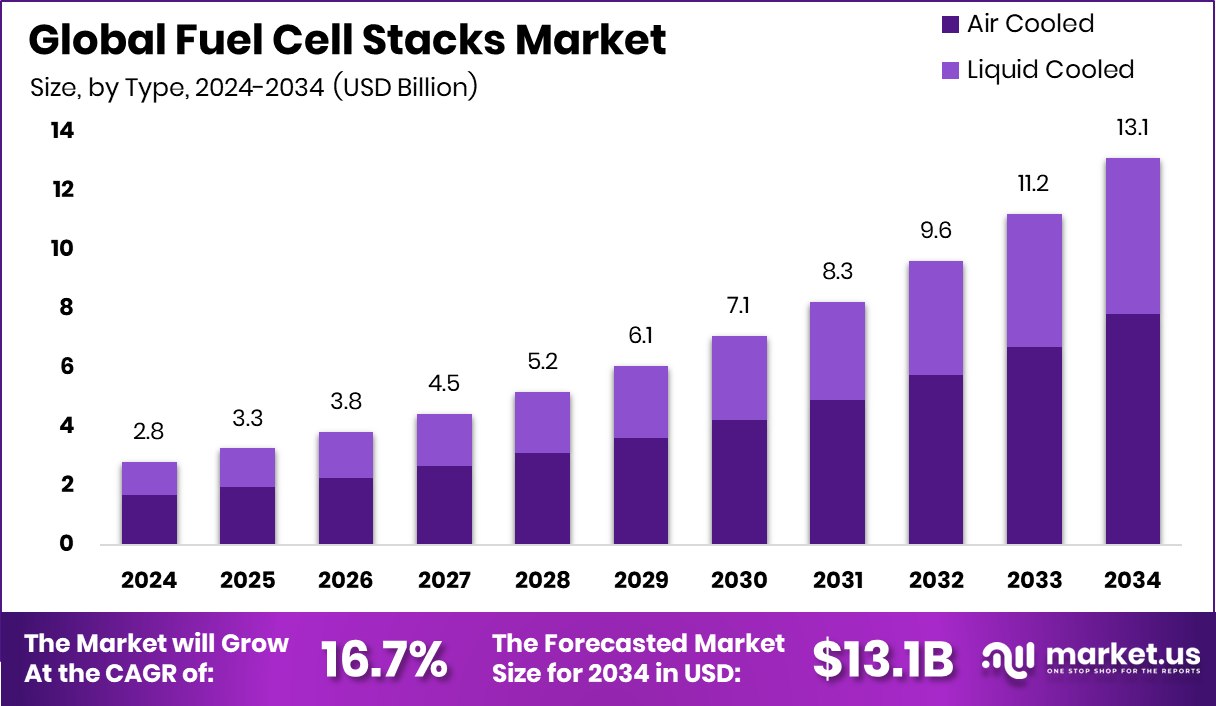

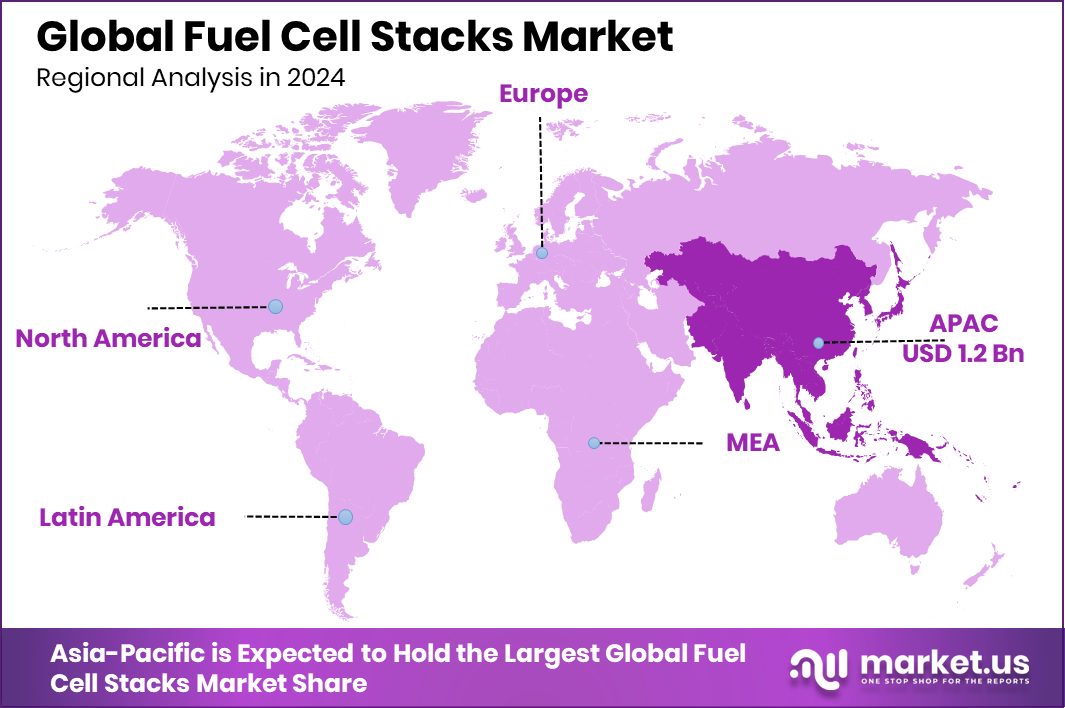

The Global Fuel Cell Stacks Market is expected to be worth around USD 13.1 billion by 2034, up from USD 2.8 billion in 2024, and is projected to grow at a CAGR of 16.7% from 2025 to 2034. The Asia-Pacific Fuel Cell Stacks Market accounts for a 39.40% share, totaling USD 1.2 Bn.

Fuel cell stacks are the core working units of a fuel cell system. They consist of multiple individual fuel cells layered together to generate electricity through an electrochemical reaction, typically using hydrogen and oxygen. Each stack converts chemical energy directly into electrical power with heat and water as by-products, making fuel cell stacks an efficient and clean power source for stationary, mobility, and backup applications.

The fuel cell stacks market refers to the global ecosystem involved in designing, manufacturing, and deploying these stack assemblies across different power ranges and end uses. The market is shaped by growing interest in low-emission energy systems, grid resilience, and alternatives to combustion-based power generation. Continuous technical refinement has kept fuel cell stacks relevant across industrial, transport, and energy-security applications.

One major growth factor is sustained investment in stack performance and manufacturing scale. EKPO receiving EUR 177 million for high-performance stack refinement and the 2Sky project securing €26.5 million for aviation-optimized stacks show how funding directly accelerates efficiency, durability, and new use cases. Public programs such as the Department of Energy’s $142 million research grants, including $17.1 million for hydrogen and fuel cell projects, further strengthen innovation pipelines.

Demand is increasing as fuel cell stacks prove reliable for both critical power and mobility needs. The $40 million DOE grant supporting an integrated fuel cell production facility in Texas and $750 million in U.S. hydrogen spending reflect confidence in scaling domestic manufacturing. Commercial milestones, such as the completion of a 100 kW PEM fuel cell stack in Narvik, reinforce real-world readiness.

Future opportunity lies in aviation, heavy transport, and decentralized energy systems. Strategic capital injections, including ZeroAvia’s $30 million, Cemt’s $31.39 million, Shanghai Refire’s HK$78 million, TECO 2030’s NOK 50 million, and Bramble Energy’s £35 million, highlight strong momentum toward broader adoption.

Key Takeaways

- The Global Fuel Cell Stacks Market is expected to be worth around USD 13.1 billion by 2034, up from USD 2.8 billion in 2024, and is projected to grow at a CAGR of 16.7% from 2025 to 2034.

- In the Fuel Cell Stacks Market, air-cooled systems lead with 59.7% share due to compact design.

- 5 kW–100 kW capacity dominates the Fuel Cell Stacks Market with 47.2% share, supporting distributed power needs.

- Polymer Electrolyte Membrane fuel cell stacks hold a 49.1% share in the Fuel Cell Stacks Market, driven by efficiency.

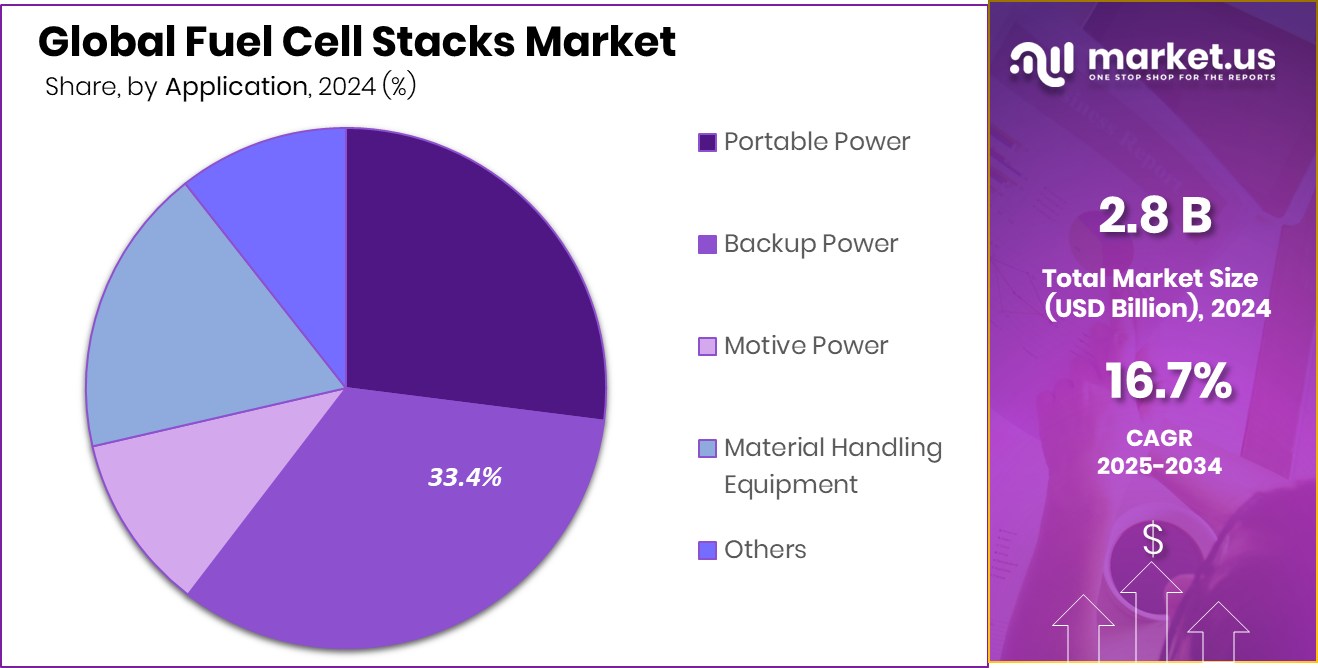

- Backup power applications account for a 33.4% share of the Fuel Cell Stacks Market, ensuring reliable power continuity.

- Strong adoption across Asia-Pacific supports Fuel Cell Stacks Market growth at 39.40%, reaching USD 1.2 Bn.

By Type Analysis

Air-cooled systems dominate the fuel cell stacks market, holding a 59.7% share globally.

In 2024, Air Cooled held a dominant market position in the By Type segment of the Fuel Cell Stacks Market, with a 59.7% share, reflecting its strong acceptance across commercial and industrial fuel cell deployments. This dominance is closely linked to the simpler system design of air-cooled stacks, which reduces the need for complex auxiliary components and supports easier integration into compact fuel cell systems. As a result, manufacturers and system integrators increasingly prefer air-cooled configurations to balance performance reliability with operational simplicity.

The strong share also indicates stable demand from applications where controlled thermal management and lower maintenance requirements are critical. Air-cooled fuel cell stacks offer consistent operational stability under variable load conditions, supporting wider adoption in distributed energy solutions. This position highlights the segment’s role as a dependable and scalable choice within the evolving fuel cell stacks market.

By Capacity Analysis

5 kW-100 kW capacity leads the fuel cell stacks market with 47.2% demand.

In 2024, 5 kW–100 kW held a dominant market position in the capacity segment of the Fuel Cell Stacks Market, with a 47.2% share, underlining its importance in mid-range power applications. This capacity range aligns well with growing demand for decentralized power generation, where balanced output and system efficiency are essential. Market adoption in this segment reflects its suitability for both stationary and portable fuel cell systems requiring dependable power without excessive scale.

The segment’s strong presence also shows how this capacity range supports flexible deployment across multiple operational settings. Fuel cell stacks within 5 kW–100 kW offer a practical balance between energy output, system size, and cost efficiency. Consequently, this range continues to serve as a preferred capacity choice, reinforcing its leading contribution to overall market performance.

By CapacityAnalysis

PEM technology dominates the fuel cell stacks market, accounting for 49.1% adoption globally.

In 2024, Polymer Electrolyte Membrane (PEM) Fuel Cell Stacks held a dominant market position in the By Technology segment of the Fuel Cell Stacks Market, with a 49.1% share, highlighting their central role in modern fuel cell development. PEM technology is widely valued for its fast start-up capability and stable power output, which supports consistent performance across varied operating conditions. This technological reliability has strengthened its position as a mainstream solution within the market.

The strong share further reflects broad industry confidence in PEM fuel cell stacks for both current and future applications. Their compact design and operational efficiency make them well-suited for systems that demand responsiveness and steady energy delivery. As adoption continues, PEM technology remains a key contributor to the overall advancement of fuel cell stack solutions.

By Application Analysis

Backup power applications drive the fuel cell stacks market, capturing 33.4% usage worldwide.

In 2024, Backup Power held a dominant market position in the By Application segment of the Fuel Cell Stacks Market, with a 33.4% share, emphasizing the growing reliance on fuel cells for power continuity solutions. This segment benefits from the increasing need for uninterrupted energy supply across critical infrastructure, where reliability and rapid response are essential. Fuel cell stacks used in backup power systems provide stable performance during grid disruptions, supporting operational resilience.

The leading share indicates steady adoption of fuel cell stacks as an alternative to conventional backup solutions. Their ability to deliver clean and consistent power strengthens their role in backup applications that prioritize long-term reliability. As energy security becomes more important, backup power continues to remain a key application area shaping market demand.

Key Market Segments

By Type

- Air Cooled

- Liquid Cooled

By Capacity

- 5 kW

- 5 kW-100 kW

- 100 kW-200 kW

- >200 kW

By Capacity

- Polymer Electrolyte Membrane (PEM) Fuel Cell Stacks

- Solid Oxide Fuel Cell (SOFC) Stacks

- Alkaline Fuel Cell (AFC) Stacks

- Direct Methanol Fuel Cell (DMFC) Stacks

By Application

- Portable Power

- Backup Power

- Motive Power

- Material Handling Equipment

- Others

Driving Factors

Rising Demand for Reliable Clean Power Systems

One major driving factor for the Fuel Cell Stacks Market is the growing need for reliable, clean, and flexible power solutions across transport, urban infrastructure, and off-grid energy systems. Governments and private players are actively supporting energy systems that reduce emissions while ensuring uninterrupted power.

For example, Illinois’ awarding $20 million for public EV charging reflects rising demand for supporting infrastructure that benefits fuel cell-based backup and hybrid power systems. Similarly, ANA raising $50 million in growth funding to expand hybrid power solutions highlights increasing interest in combining fuel cells with other energy technologies for stable output.

Urban and mobile power demand is also shaping adoption trends. EMO Energy securing $6.2 million in Series A funding supports next-generation urban energy solutions, where fuel cell stacks can play a key role in compact, low-emission systems. Meanwhile, UK-based Mobile Power, receiving €3 million to scale solar-charged battery rentals in Africa, shows how clean power models are expanding globally, creating indirect demand for advanced fuel cell stack technologies that complement hybrid and mobile energy needs.

Restraining Factors

Strong Competition From Advanced Portable Power Alternatives

A key restraining factor for the Fuel Cell Stacks Market is rising competition from advanced portable and battery-based power solutions that are easier to deploy and maintain. New technologies, such as Instagrid’s 400 V three-phase portable power solution, are offering high output without hydrogen handling, which limits fuel cell adoption in temporary and mobile use cases. At the same time, portable power storage developers backed by Esid, Great Power, and Scud Group, valued at $1 billion, show how investor confidence is shifting toward battery-led systems.

Public funding also highlights this shift. The Energy Department’s $19 million award for long-duration energy storage in remote communities and military housing strengthens non-fuel-cell solutions. In addition, Solus Power’s £22 million investment pledge to advance portable EV charging technology reinforces battery innovation momentum, increasing competitive pressure on fuel cell stack deployment.

Growth Opportunity

Hydrogen Power Expansion in Heavy-Duty Mobility

A major growth opportunity for the Fuel Cell Stacks Market lies in the rapid expansion of heavy-duty and mobile power solutions that demand long range and fast refueling. The $100 million Series B funding raised by Harbinger for electric truck development signals strong momentum in zero-emission freight, where fuel cell stacks can support extended driving cycles and high payload operations.

In parallel, distributed and mobile energy use is growing, as shown by EcoFlow DELTA Pro securing $9 million to scale portable power stations that serve off-grid and emergency needs. Regional energy access models are also expanding, with Yorkshire’s Mobile Power receiving €3 million to grow battery rental services in Africa, highlighting increasing demand for reliable, transportable power systems.

Together, these investments point to widening opportunities for fuel cell stacks to integrate into mobility and mobile energy ecosystems that require scalable, clean, and dependable power solutions.

Latest Trends

Rising Investment in Modular Industrial Fuel Cells

One of the latest trends in the Fuel Cell Stacks Market is growing investment in modular and industrial-grade fuel cell systems designed for flexible deployment. Watt Fuel Cell raising $67 million, shows rising confidence in solid oxide and modular fuel cell stack technologies that can deliver steady power for buildings and industrial sites. In Europe, Elcogen receiving a €24.9 million grant from the EU Innovation Fund highlights strong support for improving fuel cell stack efficiency, durability, and scalable manufacturing.

At the same time, changes in industrial equipment usage are influencing power solutions. A 29% increase in used forklift inventory reflects shifting material-handling patterns, encouraging interest in cleaner and more efficient energy systems that can integrate into warehouses and logistics operations. Together, these developments indicate a clear trend toward flexible, high-efficiency fuel cell stacks that support industrial energy needs and evolving operational models.

Regional Analysis

Asia-Pacific leads the Fuel Cell Stacks Market with 39.40% share, valued at USD 1.2 Bn.

Asia-Pacific stands out as the dominating region in the Fuel Cell Stacks Market, accounting for 39.40% of global demand and valued at USD 1.2 Bn. This leadership reflects the region’s strong focus on fuel cell deployment across transportation, stationary power, and industrial energy systems, supported by expanding manufacturing capabilities and growing regional adoption.

Asia-Pacific’s market strength is reinforced by its broad ecosystem of component suppliers and system integrators, enabling faster commercialization and scale-up of fuel cell stack technologies. In comparison, North America represents a mature and technology-driven market, characterized by steady adoption of advanced fuel cell stack designs across backup power and mobility applications, with an emphasis on performance reliability and system efficiency.

Europe follows with a strong regulatory-driven transition toward clean energy systems, where fuel cell stacks are increasingly integrated into low-emission power solutions. The Middle East & Africa region remains at an emerging stage, with gradual uptake focused on energy diversification and long-term sustainability strategies.

Latin America shows developing interest, driven by energy security needs and the gradual integration of alternative power technologies. Together, these regions shape a balanced global landscape, while Asia-Pacific continues to define overall market direction.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Advent Technologies Holding continues to position itself as a focused innovator within the fuel cell stacks ecosystem, emphasizing material science and membrane-based technologies. In 2024, the company’s activities reflect a clear intent to strengthen stack performance, durability, and operating flexibility across diverse conditions. From an analyst perspective, Advent’s approach highlights long-term differentiation through proprietary technology development rather than volume-led expansion. This strategy supports applications requiring higher efficiency and resilience, particularly where system reliability is critical over extended operating cycles.

Ballard Power Systems remains one of the most established and technically experienced players in the global fuel cell stacks market. In 2024, Ballard’s role is shaped by its consistent focus on stack optimization, scale readiness, and integration across mobility and stationary platforms. Analysts view Ballard as a benchmark company that influences technology standards within the sector. Its continued emphasis on improving power density and lifecycle performance reinforces confidence among system developers seeking proven and commercially mature fuel cell stack solutions.

Commonwealth Automation Technologies operates with a specialized and application-driven perspective within the fuel cell stacks space. In 2024, the company’s relevance lies in its engineering-focused capabilities and tailored system designs. From an analyst viewpoint, Commonwealth Automation Technologies demonstrates strength in customization and integration, addressing specific operational requirements rather than broad-market scale. This targeted positioning allows the company to maintain relevance in niche and precision-driven fuel cell applications, supporting steady participation in the evolving market landscape.

Top Key Players in the Market

- Advent Technologies Holding

- Ballard Power Systems

- Commonwealth Automation Technologies

- Dana Incorporated

- ElringKlinger

- FuelCell Energy Solutions

- Freudenberg Group

- Horizon Fuel Cell Technologies

- Intelligent Energy Limited

- Nedstack Fuel Cell Technology

Recent Developments

- In February 2025, Advent was approved for a €2.16 million RESCUE project, which will use hydrogen and hydrogen-rich fuels to improve energy resilience and environmental sustainability in fuel cell applications.

- In April 2024, Ballard signed a long-term supply agreement to provide 1,000 hydrogen fuel cell engines to Solaris through 2027. This deal represents one of the largest commitments in the company’s history, with approximately 80% FCmove®-HD and 20% FCmove®-HD+ engines planned for deployment across European bus fleets.

Report Scope

Report Features Description Market Value (2024) USD 2.8 Billion Forecast Revenue (2034) USD 13.1 Billion CAGR (2025-2034) 16.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Air Cooled, Liquid Cooled), By Capacity (5 kW, 5 kW-100 kW, 100 kW-200 kW, >200 kW), By Technology (Polymer Electrolyte Membrane (PEM) Fuel Cell Stacks, Solid Oxide Fuel Cell (SOFC) Stacks, Alkaline Fuel Cell (AFC) Stacks, Direct Methanol Fuel Cell (DMFC) Stacks), By Application (Portable Power, Backup Power, Motive Power, Material Handling Equipment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Advent Technologies Holding, Ballard Power Systems, Commonwealth Automation Technologies, Dana Incorporated, ElringKlinger, FuelCell Energy Solutions, Freudenberg Group, Horizon Fuel Cell Technologies, Intelligent Energy Limited, Nedstack Fuel Cell Technology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fuel Cell Stacks MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Fuel Cell Stacks MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Advent Technologies Holding

- Ballard Power Systems

- Commonwealth Automation Technologies

- Dana Incorporated

- ElringKlinger

- FuelCell Energy Solutions

- Freudenberg Group

- Horizon Fuel Cell Technologies

- Intelligent Energy Limited

- Nedstack Fuel Cell Technology