Global Frozen Yogurt Market Size, Share, And Business Benefits By Flavours (Chocolate, Mango, Banana, Strawberry, Pineapple, Others), By Fat Contents (Low fat (0.5% -2%), No fat (Less Than 0.5%)), By Product Type (Dairy-Based, Non-Dairy Based), By Sales Channel (Offline Sales Channel (Hypermarkets/Supermarkets, Departmental Stores, Convenience Store, Others), Online Sales Channel (Company Website, E-commerce Platform, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145486

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

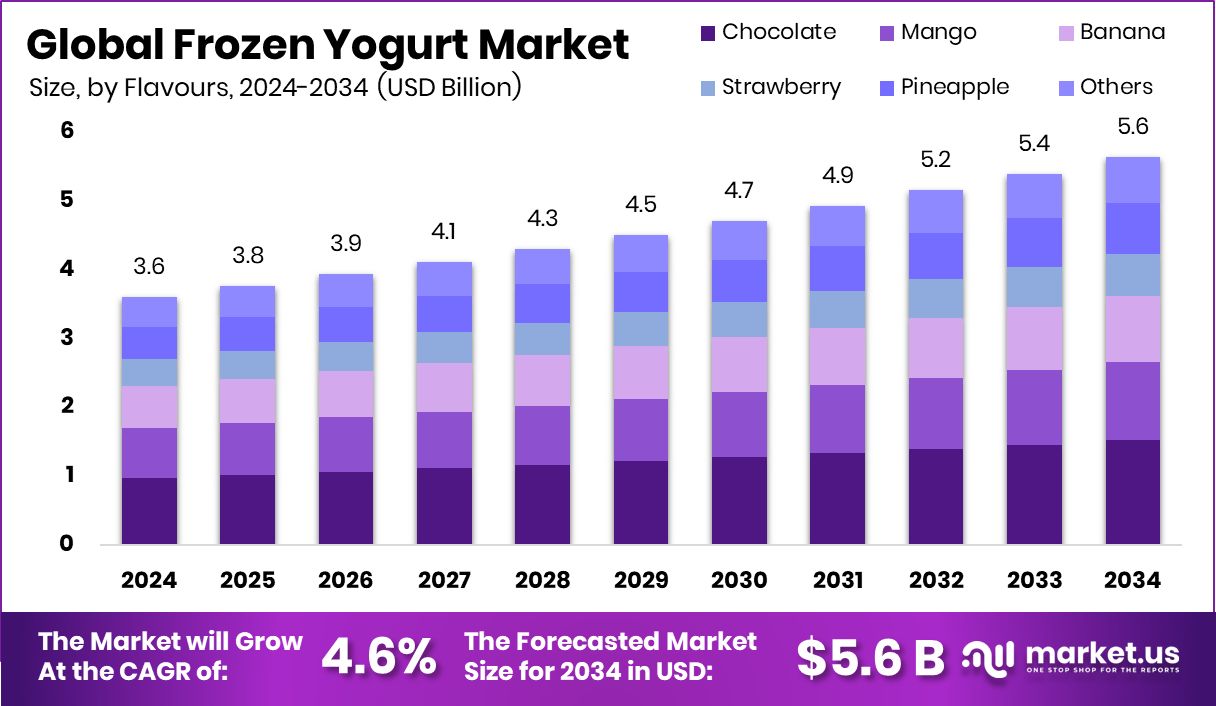

The Global Frozen Yogurt Market is expected to be worth around USD 5.6 billion by 2034, up from USD 3.6 billion in 2024, and grow at a CAGR of 4.6% from 2025 to 2034. Strong urban demand in Asia-Pacific pushed frozen yogurt consumption to 43.30% regionally.

Frozen yogurt is a popular dessert made from yogurt and sometimes other dairy products. It’s cherished for its creamy texture and tart flavor, which differentiates it from traditional ice cream. Besides being served as a soft serve, it is also available in a variety of flavors and can be customized with numerous toppings.

The Frozen Yogurt Market encompasses the production, distribution, and sale of frozen yogurt. This market has seen growth due to the increasing consumer preference for desserts that are perceived as healthier alternatives to ice cream. Frozen yogurt often contains less fat and fewer calories, which appeals to health-conscious consumers.

One significant growth factor for the frozen yogurt market is the rising awareness of health and wellness. Many consumers are looking for desserts that satisfy their sweet tooth without compromising their dietary goals. Frozen yogurt, often enriched with probiotics and boasting lower fat content, meets this demand.

The demand for frozen yogurt is also driven by its versatility. Frozen yogurt is not only enjoyed as a dessert but is also incorporated into breakfast and snack menus. Its adaptability in flavors and uses makes it a popular choice across different meals and cuisines.

Key Takeaways

- The Global Frozen Yogurt Market is expected to be worth around USD 5.6 billion by 2034, up from USD 3.6 billion in 2024, and grow at a CAGR of 4.6% from 2025 to 2034.

- The chocolate flavor dominates the Frozen Yogurt Market with a share of 27.30%.

- Low-fat options, ranging from 0.5% to 2% fat, represent 67.30% of the market.

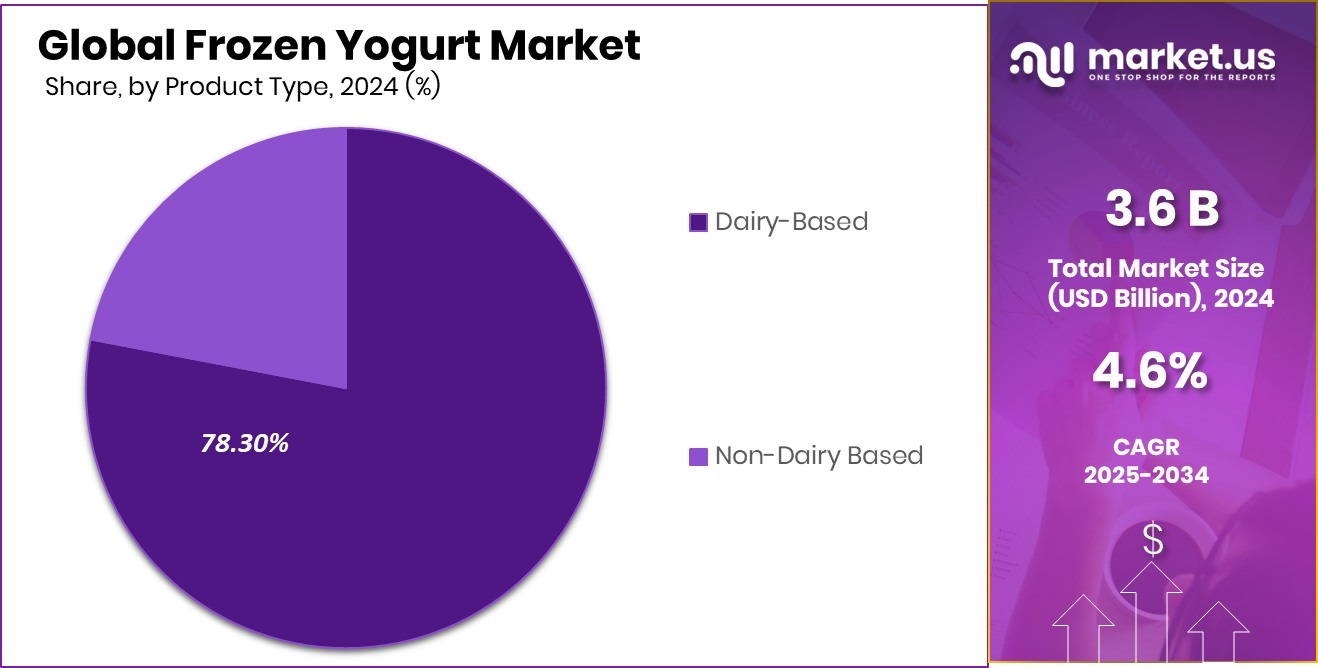

- Dairy-based frozen yogurt products hold a substantial market share at 78.30%.

- Offline sales channels lead in distribution, accounting for 74.30% of frozen yogurt sales.

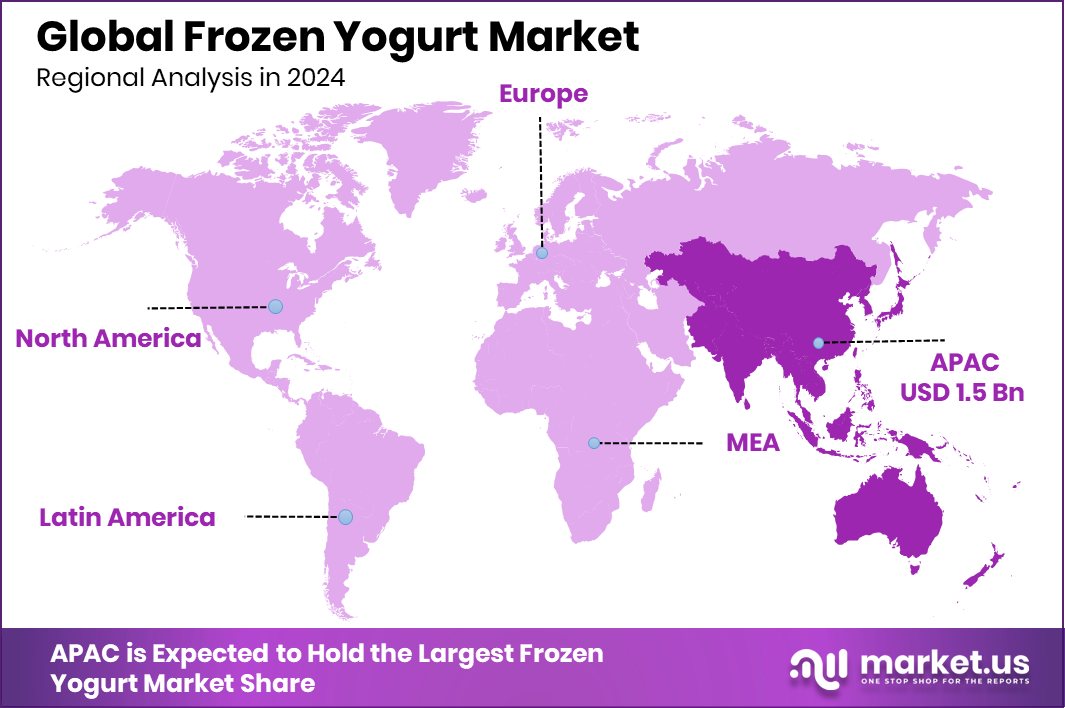

- The Asia-Pacific frozen yogurt market reached a value of USD 1.5 billion.

By Flavours Analysis

The chocolate flavor holds a 27.30% share in the Frozen Yogurt Market.

In 2024, Chocolate held a dominant market position in the By Flavours segment of the Frozen Yogurt Market, with a 27.30% share. Its popularity stems from broad consumer acceptance across age groups, particularly among children and young adults.

The flavor’s versatility, both as a standalone offering and in combination with toppings like brownies or chocolate chips, has reinforced its lead. Retailers and frozen yogurt chains continue to prioritize chocolate in their core flavor portfolios due to consistently high sales volume.

Following closely behind were flavors such as vanilla and strawberry, which together contributed a substantial portion to the overall market. However, no single flavor matched the individual performance of chocolate. Seasonal variations like mango and blueberry showed increased traction during warmer months but lacked year-round consistency. Limited edition and regionally inspired flavors made minor contributions, serving niche demand segments.

Consumer loyalty and impulse-driven preferences continue to favor chocolate-based variants, both in on-the-go servings and in take-home tubs. Its strong association with indulgence, paired with evolving formulations such as dairy-free or high-protein chocolate options, is expected to help maintain its relevance in an increasingly health-conscious market.

By Fat Content Analysis

Low fat varieties, containing 0.5% to 2% fat, dominate with a 67.30% share.

In 2024, low-fat (0.5% 2%) held a dominant market position in the By Fat Contents segment of the Frozen Yogurt Market, with a 67.30% share. This significant lead reflects a strong consumer preference for healthier dessert alternatives that balance taste and nutritional value. The segment’s performance was driven by rising demand from health-conscious consumers seeking reduced-fat options without compromising on flavor or texture.

Low fat frozen yogurt continues to appeal to a wide demographic, including individuals following calorie-controlled diets and those managing cholesterol levels. Retail and foodservice outlets have expanded their low fat product lines, responding to consistent demand and shifting dietary patterns. These products are especially popular in urban regions where lifestyle-related health concerns influence purchase decisions.

In contrast, regular and non-fat frozen yogurt segments captured relatively smaller portions of the market. While non-fat options are attractive to fitness-focused consumers, they have not matched the mainstream appeal of low fat variants. Regular fat offerings, though flavorful, have seen reduced traction amid growing wellness trends.

By Product Type Analysis

Dairy-based frozen yogurt products lead, capturing 78.30% of the market share.

In 2024, Dairy-Based held a dominant market position in the by-product type segment of the Frozen Yogurt Market, with a 78.30% share. This strong performance was primarily driven by traditional consumer preferences and the widespread availability of dairy-based offerings across supermarkets, specialty dessert outlets, and quick-service restaurants. Known for their rich texture and creamy mouthfeel, dairy-based frozen yogurts have long been perceived as a satisfying yet healthier alternative to traditional ice creams.

The segment’s growth was further reinforced by product diversification within the dairy category, including Greek-style frozen yogurt, probiotic-rich formulations, and low-lactose options. These innovations helped retain consumer interest and expand the market base, especially among those seeking functional benefits such as improved digestion and gut health.

In comparison, the non-dairy segment, while gradually emerging, accounted for a smaller share. Its adoption remained limited to specific consumer groups, such as vegans or individuals with lactose intolerance. Although plant-based alternatives using almond, coconut, and oat milk have been introduced, they have yet to match the mainstream appeal and sales volume of dairy-based variants.

By Sales Channel Analysis

Offline sales channels are predominant, accounting for 74.30% of frozen yogurt sales.

In 2024, Offline Sales Channel held a dominant market position in the By Sales Channel segment of the Frozen Yogurt Market, with a 74.30% share. This dominance was largely attributed to the strong presence of frozen yogurt parlors, convenience stores, supermarkets, and hypermarkets that offer immediate product access and in-store promotions.

Self-serve frozen yogurt shops and quick-service restaurant chains further contributed to the segment’s growth, providing experiential value that online platforms cannot replicate. Impulse purchases also played a significant role in boosting offline sales, particularly in urban centers and high-traffic retail locations.

While online sales channels showed gradual growth, their contribution remained secondary in 2024. Factors such as delivery constraints, the need for cold chain logistics, and limited flavor customization restricted their expansion. Despite rising digital penetration and e-commerce trends, frozen yogurt continues to be a product category where immediate consumption and physical interaction drive consumer decisions.

Key Market Segments

By Flavours

- Chocolate

- Mango

- Banana

- Strawberry

- Pineapple

- Others

By Fat Contents

- Low fat (0.5% -2%)

- No fat (<0.5%)

By Product Type

- Dairy-Based

- Non-Dairy Based

By Sales Channel

- Offline Sales Channel

- Hypermarkets/Supermarkets

- Department Stores

- Convenience Store

- Others

- Online Sales Channel

- Company Website

- E-commerce Platform

- Others

Driving Factors

Rising Demand for Healthier Dessert Alternatives

One of the main driving factors for the frozen yogurt market is the increasing demand for healthier dessert options. Many people are becoming more health-conscious and are looking for snacks that are lower in fat and calories.

Frozen yogurt is seen as a better choice compared to traditional ice cream because it offers a similar taste and texture but with added benefits like probiotics and lower sugar content.

This shift in eating habits, especially among young adults and urban consumers, is pushing up frozen yogurt sales. As people focus more on fitness and balanced diets, they are more likely to choose frozen yogurt as a guilt-free treat, helping the market grow steadily year after year.

Restraining Factors

High Competition from Ice Cream Brands

A major factor holding back the frozen yogurt market is the strong competition from well-established ice cream brands. Many consumers still prefer ice cream because of its wide variety, rich taste, and long-standing popularity. Big ice cream companies have strong brand loyalty, larger marketing budgets, and better retail reach, which makes it harder for frozen yogurt brands to compete.

Even though frozen yogurt is healthier, some customers still choose ice cream when they want a more indulgent treat. This preference, especially in areas where health trends are less strong, limits the growth of frozen yogurt. To overcome this, frozen yogurt brands need to focus on innovation, taste variety, and clear health benefits to attract more consumers.

Growth Opportunity

Expanding Plant-Based Frozen Yogurt Options

The growing interest in plant-based diets presents a significant opportunity for the frozen yogurt market. Many consumers are seeking dairy-free alternatives due to lactose intolerance, vegan lifestyles, or health preferences.

By introducing frozen yogurt made from almond, coconut, or oat milk, brands can cater to this expanding customer base. These plant-based options not only appeal to vegans but also to those curious about trying new, health-focused desserts.

Offering a variety of non-dairy flavors can set a brand apart in a competitive market. Additionally, as awareness of environmental sustainability grows, plant-based products are often viewed as more eco-friendly, further attracting environmentally conscious consumers.

Latest Trends

Growing Popularity of High-Protein Frozen Yogurt

A notable trend in the frozen yogurt market is the increasing demand for high-protein options. Consumers are seeking desserts that not only satisfy their sweet cravings but also offer nutritional benefits, particularly higher protein content.

This shift is driven by a broader focus on health and wellness, where protein-rich diets are associated with satiety and muscle maintenance. Frozen yogurt brands are responding by introducing products fortified with additional protein, appealing to fitness enthusiasts and health-conscious individuals.

Regional Analysis

In 2024, Asia-Pacific led the frozen yogurt market with a 43.30% share.

In 2024, the Asia-Pacific region dominated the Frozen Yogurt Market, accounting for 43.30% of the global share, with a recorded market value of USD 1.5 billion. This leading position was largely driven by increasing health awareness, urbanization, and rising disposable incomes in key countries such as China, Japan, and South Korea. The region’s growing middle class and preference for healthier dessert alternatives significantly contributed to this demand surge.

North America followed closely, supported by the presence of established frozen yogurt brands and a well-developed retail infrastructure. The region showed strong consumer interest in low-fat and high-protein frozen yogurt products, particularly across the U.S. and Canada.

Europe showed steady growth, fueled by demand from health-conscious consumers and increasing availability of plant-based frozen yogurt options in countries like Germany, France, and the UK.

Latin America presented moderate market growth, with rising awareness of frozen yogurt benefits among younger urban consumers.

Meanwhile, the Middle East & Africa region saw gradual adoption, driven by growing retail expansion and influence of western dietary trends in urban centers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Honey Hill Farms remains a stronghold in the global frozen yogurt market due to its extensive distribution network across foodservice outlets. Its diversified flavor portfolio and consistent partnerships with self-serve frozen yogurt stores continue to drive volume sales. The company’s focus on high-quality ingredients and reliable bulk supply formats strengthens its foothold in the institutional segment, particularly in the U.S. and select international locations.

Scott Brothers Dairy leverages its vertically integrated operations to ensure consistent supply and cost efficiency, giving it an edge in the premium segment. Its strong reputation for farm-fresh, hormone-free dairy resonates with health-conscious consumers. In 2024, the company strategically expanded its co-packing services for private-label frozen yogurt, tapping into rising demand from smaller brands.

Red Mango Inc. maintains its premium image through in-store experiences, emphasizing probiotic-rich formulations and clean labels. Despite competition from new entrants, Red Mango sustains brand loyalty by focusing on wellness-focused consumers.

Its strong presence in urban centers and college campuses continues to pay off, especially as Gen Z and millennial customers demand functional indulgence. In 2024, Red Mango introduced limited-edition seasonal flavors and plant-based variants, which helped increase foot traffic and same-store sales across key locations.

Top Key Players in the Market

- Danone

- Pinkberry

- Honey Hill Farms

- Scott Brothers Dairy

- Red Mango Inc.

- Yogurtland Inc.

- Gujarat Cooperative Milk Marketing Federation

- Nestle S.A.

- General Mills

- Nancy’s Yogurt

- Mixmi

- Wallaby Organic

- Glenisk

- Weeel

- Snog

Recent Developments

- In April 2024, Danone North America introduced the REMIX line, featuring yogurts and dairy snacks with mix-ins under brands like Oikos, Light + Fit, and Too Good & Co., aiming to cater to evolving snacking habits.

- In March 2024, Pinkberry Launched Mango Lemonade frozen yogurt, blending sweet mangoes with tangy lemonade, available for a limited time.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Billion Forecast Revenue (2034) USD 5.6 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Flavours (Chocolate, Mango, Banana, Strawberry, Pineapple, Others), By Fat Contents (Low fat (0.5% -2%), No fat (Less Than 0.5%)), By Product Type (Dairy-Based, Non-Dairy Based), By Sales Channel (Offline Sales Channel (Hypermarkets/Supermarkets, Departmental Stores, Convenience Store, Others), Online Sales Channel (Company Website, E-commerce Platform, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Danone, Pinkberry, Honey Hill Farms, Scott Brothers Dairy, Red Mango Inc., Yogurtland Inc., Gujarat Cooperative Milk Marketing Federation, Nestle S.A., General Mills, Nancy’s Yogurt, Mixmi, Wallaby Organic, Glenisk, Weeel, Snog Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Danone

- Pinkberry

- Honey Hill Farms

- Scott Brothers Dairy

- Red Mango Inc.

- Yogurtland Inc.

- Gujarat Cooperative Milk Marketing Federation

- Nestle S.A.

- General Mills

- Nancy's Yogurt

- Mixmi

- Wallaby Organic

- Glenisk

- Weeel

- Snog