Global Frozen Desserts Market Size, Share Analysis Report By Product Type (Ice Cream, Yogurts, Cakes, Others), By Category (Conventional, Sugar-Free), By Distribution Channel (Supermarket/hypermarket, Convenience Store, Café and Bakery Shops, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152769

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

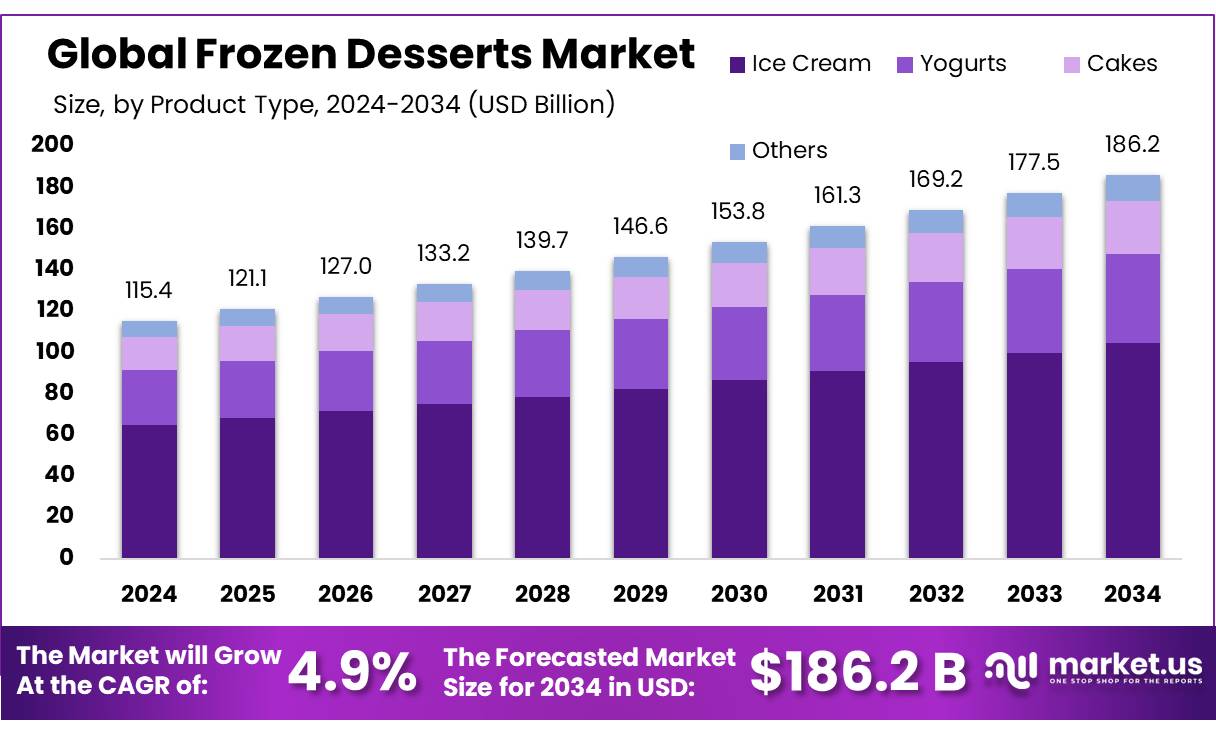

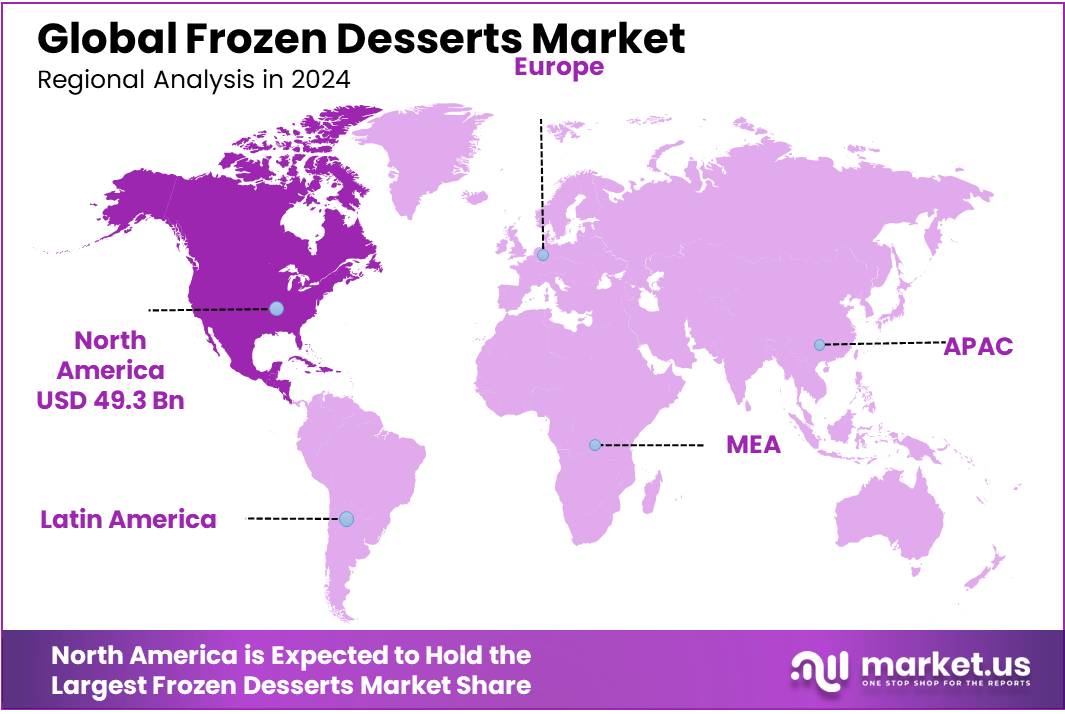

The Global Frozen Desserts Market size is expected to be worth around USD 186.2 Billion by 2034, from USD 115.4 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 42.8% share, holding USD 49.3 Billion revenue.

Frozen dessert concentrates have become a significant segment within the broader frozen food industry, driven by the growing demand for convenient and indulgent dessert options. These concentrates are typically formulated to simplify the production of frozen desserts, including ice creams, sorbets, and frozen yogurts, offering a convenient and cost-effective way for manufacturers to create a variety of products with consistent flavor and texture.

The global market for frozen desserts is expanding, as consumer preferences continue to shift towards convenience, affordability, and unique flavor profiles. According to the U.S. Department of Agriculture (USDA), frozen dairy product consumption has shown a steady increase, with the per capita consumption of ice cream and related frozen desserts reaching 18.4 pounds in 2020, up from 17.4 pounds in 2019.

The global demand for frozen desserts concentrates is projected to be fueled by technological advancements in food processing and improvements in the quality and shelf-life of concentrate products. These advancements have not only enhanced product consistency but have also facilitated the production of a diverse range of frozen desserts that cater to changing dietary preferences.

In terms of driving factors, the increasing adoption of convenient food products, especially in the post-pandemic era, has spurred growth in the frozen desserts industry. The convenience of ready-to-use concentrates that reduce preparation time for manufacturers and provide a consistent final product is highly appealing to producers.

Additionally, the increasing consumption of frozen desserts in emerging markets is expected to drive further demand for concentrates. The World Health Organization (WHO) has noted a steady increase in the consumption of processed and packaged foods in developing nations, with frozen foods being a significant part of this shift. For example, in China, frozen desserts experienced an annual growth of 11% in the last five years, highlighting the potential for concentrates in the Asian market.

Additionally, under India’s Twelfth Five Year Plan (2012–17), nearly USD 1 billion was allocated towards developing food parks, integrated cold chains, and processing facilities. In the U.S., USDA and BEA data confirm consistent industrial output growth in frozen dessert manufacturing, with U.S. BEA industrial production indices rising from 100 in 2021 to over 123 by late 2024.

Key Takeaways

- Frozen Desserts Market size is expected to be worth around USD 186.2 Billion by 2034, from USD 115.4 Billion in 2024, growing at a CAGR of 4.9%.

- Ice Cream held a dominant market position, capturing more than a 56.3% share of the global frozen desserts market.

- Conventional held a dominant market position, capturing more than an 82.4% share of the global frozen desserts market.

- Supermarket/hypermarket held a dominant market position, capturing more than a 48.1% share of the global frozen desserts market.

- North America emerged as the dominant region in the global frozen desserts market, accounting for 42.8% of the total market share, which is valued at approximately USD 49.3 billion.

By Product Type Analysis

Ice Cream dominates with 56.3% share due to its popularity and global consumption trends

In 2024, Ice Cream held a dominant market position, capturing more than a 56.3% share of the global frozen desserts market. This strong performance is largely driven by the product’s wide appeal across all age groups, cultural preferences, and its availability in numerous flavor profiles and formats. Ice cream continues to remain the most recognized and consumed frozen dessert, benefiting from both traditional retail and foodservice channels. Seasonal demand, especially during warmer months, alongside rising urbanization and increasing disposable incomes in developing countries, has further pushed sales.

By Category Analysis

Conventional Frozen Desserts lead with 82.4% share due to strong consumer familiarity and wide product range

In 2024, Conventional held a dominant market position, capturing more than an 82.4% share of the global frozen desserts market. This category’s stronghold can be attributed to its deep-rooted presence in household consumption patterns and retail offerings. Products under the conventional label—including regular dairy-based ice creams, frozen yogurts, and sorbets—are widely accessible, affordable, and aligned with established consumer tastes. The widespread presence of conventional frozen desserts in supermarkets, convenience stores, and foodservice outlets ensures steady demand throughout the year.

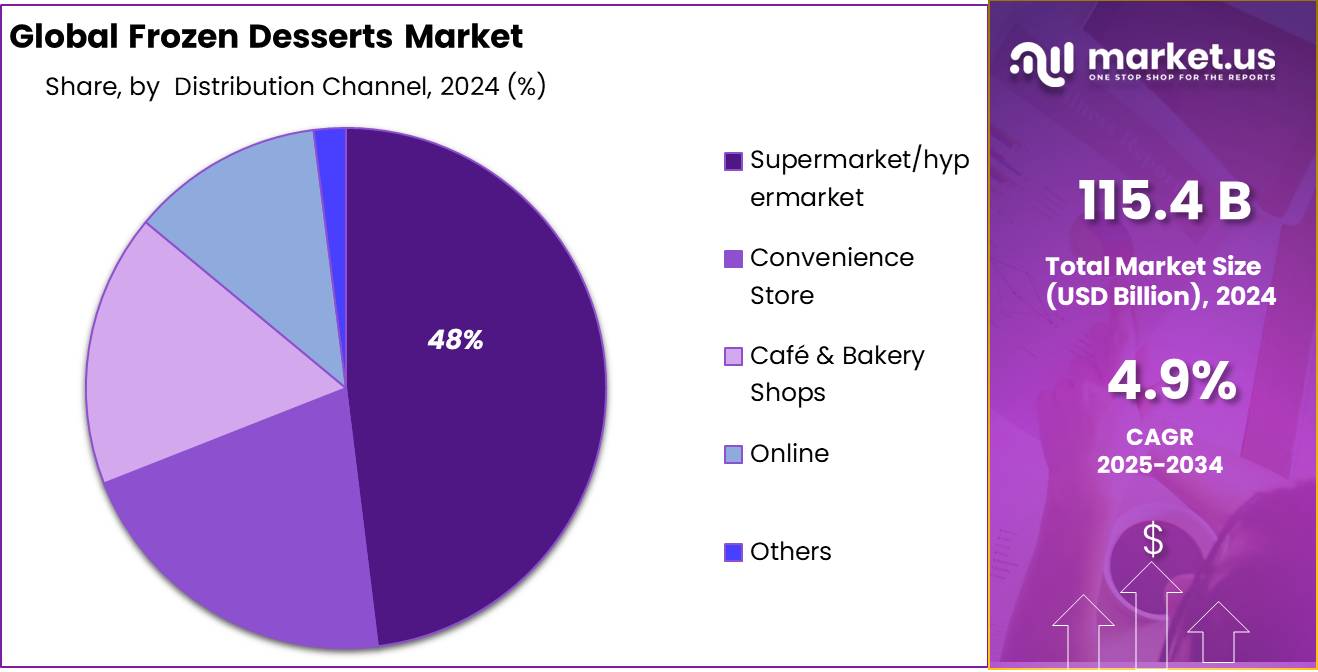

By Distribution Channel Analysis

Supermarkets and hypermarkets lead with 48.1% share thanks to easy accessibility and product variety

In 2024, Supermarket/hypermarket held a dominant market position, capturing more than a 48.1% share of the global frozen desserts market. This dominance is mainly driven by their wide geographical presence, well-established cold chain infrastructure, and the ability to offer a large variety of frozen dessert brands under one roof. These retail formats continue to attract consumers looking for convenience, promotions, and bulk buying options. In addition, in-store visibility, dedicated freezer sections, and impulse-driven purchases contribute significantly to sales.

Key Market Segments

By Product Type

- Ice Cream

- Yogurts

- Cakes

- Others

By Category

- Conventional

- Sugar-Free

By Distribution Channel

- Supermarket/hypermarket

- Convenience Store

- Café & Bakery Shops

- Online

- Others

Emerging Trends

Rise of High-Protein Frozen Desserts

A notable trend in the frozen desserts market is the increasing demand for high-protein options. This shift is driven by health-conscious consumers seeking to balance indulgence with nutritional benefits. High-protein frozen desserts, such as ice creams and yogurts enriched with protein, are gaining popularity as they offer a healthier alternative to traditional sugary treats.

In the United States, sales of food products containing 25 grams or more of protein per serving saw an 8% increase between July 2023 and June 2024, outpacing the growth of lower-protein items. This surge indicates a growing consumer preference for protein-rich foods, including desserts.

The trend is also supported by social media platforms, where content related to “protein desserts” has garnered significant attention. For instance, TikTok videos featuring protein dessert recipes have collectively amassed over 68 million views, reflecting widespread interest and engagement among consumers.

Government initiatives further bolster this trend. In 2023, the U.S. Department of Agriculture awarded over $10 million in grants to support innovation in plant-based food processing, indirectly benefiting the development of high-protein frozen desserts. Additionally, state-level programs in California and New York are offering incentives for sustainable food innovation, including plant-based dairy alternatives.

Major food companies are capitalizing on this trend by introducing high-protein frozen dessert products. For example, 16 Handles launched a high-protein chocolate peanut butter banana frozen yogurt flavor, catering to consumers seeking indulgent yet nutritious options.

Drivers

Growing Consumer Preference for Healthier Frozen Desserts

The demand for healthier frozen desserts has surged in recent years, largely due to an increased focus on health and wellness among consumers. This shift is particularly noticeable among younger generations, such as millennials and Gen Z, who are more health-conscious and prioritize better-for-you ingredients. As a result, there has been a notable rise in the popularity of frozen desserts made with plant-based, organic, and low-sugar alternatives.

In 2024, the American Frozen Food Institute (AFFI) reported that frozen desserts with low-sugar and plant-based ingredients accounted for nearly 25% of the total frozen dessert market in the U.S. This growth aligns with a wider global trend towards healthier eating, with consumers increasingly seeking options that cater to dietary restrictions such as lactose intolerance, gluten-free diets, and vegan lifestyles. According to the Plant-Based Foods Association (PBFA), plant-based frozen desserts saw an increase of 8.4% in sales in 2023, illustrating the growing demand for these alternatives.

Additionally, the U.S. government’s Healthier US Initiative, which encourages healthier food options in various sectors, has played a role in driving consumer awareness. By promoting nutrition standards and creating incentives for the development of healthier products, the government has indirectly boosted the popularity of better-for-you frozen desserts. This is reflected in the food industry, where companies are reformulating their products to offer reduced sugar, fewer calories, and more natural ingredients.

Restraints

High Production Costs of Healthier Frozen Desserts

One major challenge that continues to restrict the growth of the frozen desserts market is the high production costs associated with healthier alternatives. While consumer demand for low-sugar, plant-based, and organic frozen desserts is increasing, the ingredients required to produce these options often come at a premium. For example, plant-based milk alternatives like almond, oat, and coconut milk cost more than traditional dairy, and organic ingredients are generally more expensive due to the production methods involved. This results in higher costs for manufacturers, which are often passed on to consumers in the form of higher retail prices.

In 2023, the U.S. Department of Agriculture (USDA) reported a 15% increase in the price of organic dairy products compared to traditional dairy. This price hike is a significant barrier for frozen dessert companies looking to keep prices competitive while incorporating healthier ingredients. Many small to medium-sized brands struggle to absorb these costs, especially when competing with larger companies that have greater economies of scale.

Government policies also play a role in this issue. While some initiatives encourage the development of healthier food options, others can make it more challenging for manufacturers to access affordable ingredients. For example, tariffs on imported goods such as certain nuts or specialized plant-based ingredients further inflate costs. These trade restrictions are particularly burdensome for frozen dessert companies relying on international suppliers for key components of their products.

Opportunity

Expansion of Health-Conscious Frozen Desserts

The frozen desserts market has seen a notable shift towards health-conscious options, driven by increasing consumer demand for products that align with healthier lifestyles. This growth opportunity is being fueled by the rising popularity of plant-based, low-sugar, and dairy-free alternatives. In 2024, the demand for plant-based frozen desserts grew by 18.5% compared to the previous year, driven by an increased awareness of the health benefits of plant-based diets. According to the Plant-Based Foods Association, the plant-based frozen dessert category now represents over US$ 600 million in retail sales in the United States, a trend that is expected to continue as more consumers opt for dairy-free and low-calorie alternatives.

Governments around the world are also encouraging healthier food choices through regulations and initiatives. In 2023, the U.S. Food and Drug Administration (FDA) launched initiatives aimed at reducing the sugar content in packaged foods, including frozen desserts, to combat rising obesity and diabetes rates. The “Healthy Eating Research” program, funded by the Robert Wood Johnson Foundation, is providing grants to support the development of healthier dessert alternatives that meet the nutritional needs of children and adults alike.

This focus on health has led to significant innovation in the sector. Companies are introducing frozen desserts with functional ingredients such as probiotics, plant-based proteins, and fiber, targeting both taste and nutrition. For example, companies like So Delicious and Ben & Jerry’s have expanded their product lines to include keto-friendly, sugar-free, and high-protein frozen dessert options, which are expected to capture a larger portion of the market as health-conscious consumers continue to seek out indulgent yet nutritious alternatives.

Regional Insights

In 2024, North America emerged as the dominant region in the global frozen desserts market, accounting for 42.8% of the total market share, which is valued at approximately USD 49.3 billion. This regional dominance is largely driven by strong consumer demand for both traditional and health-oriented frozen desserts, along with widespread availability across retail channels such as supermarkets, hypermarkets, and specialty stores. The U.S., being the largest contributor within the region, exhibits a long-standing cultural preference for frozen treats like ice cream, frozen yogurt, and novelties, with ice cream alone consumed by over 90% of households, according to the International Dairy Foods Association.

The rising popularity of lactose-free, plant-based, and high-protein frozen desserts is further shaping consumer choices in North America. In the U.S., non-dairy frozen dessert sales have shown double-digit growth, supported by changing dietary patterns and growing interest in vegan and flexitarian lifestyles. Additionally, the region leads in innovation, with frequent product launches featuring clean labels, lower sugar content, and sustainable packaging, aligning with evolving health and environmental concerns.

Another key driver in North America is the expanding e-commerce penetration in frozen food retail. The U.S. Census Bureau reports that online grocery sales—including frozen desserts—have grown steadily, with e-commerce accounting for over 15.4% of total retail food and beverage sales in 2023. This shift is supported by improved cold-chain logistics and rapid home delivery services, enabling broader reach and product access.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amul, a leading Indian dairy cooperative, plays a major role in the frozen desserts market with a wide range of ice creams and frozen treats. Known for affordability and pan-India distribution, Amul’s frozen dessert portfolio includes milk-based cones, kulfis, sundaes, and sugar-free options. Its dominance is backed by strong brand trust and rural-to-urban market penetration. In 2024, Amul continued expanding cold chain infrastructure to support demand across tier-2 and tier-3 cities, strengthening its competitive position in domestic markets.

Arun Ice Cream, a brand under Hatsun Agro Product Ltd, holds a significant share in South India’s frozen dessert segment. It offers an extensive product line including cones, cups, bars, and family packs. Known for affordability and wide flavor options, Arun benefits from Hatsun’s strong retail network. The company has also expanded presence in western and eastern India. In 2024, Arun invested in storage and logistics improvements, targeting broader reach in semi-urban markets with consistent product availability.

Baskin Robbins LLC, a globally recognized frozen dessert brand, is known for its wide range of premium ice creams and frozen novelties. Operating in over 50 countries, including India, the brand offers 31 rotating flavors and seasonal innovations. In 2024, Baskin Robbins continued its strategy of launching limited-time flavors and partnering with food delivery apps for extended market access. Its focus on experiential retail and premium dessert categories reinforces its position in urban centers and upscale retail outlets.

Top Key Players Outlook

- Amul

- Arun Ice Cream

- Baskin Robbins LLC

- Bulla Dairy foods

- Cielo

- ConAgra Foods

- Dunkin’ Brands Group Inc.

- Ferrero Spa

- Fonterra Co-operative Group Limited

- General Mills Inc.

- Kraft foods group Inc.

- London Dairy Co. ltd

- Meiji Holdings Co. Ltd

- Mondelēz International Inc.

- Mother Dairy

- Nestlé SA

Recent Industry Developments

In 2024, Amul’s broader dairy business exceeded ₹80,000 crore in revenue, rising to over ₹90,000 crore in FY 2025—showing its robust growth trajectory.

In 2024, ConAgra Brands contributed notably to the frozen desserts market through its Refrigerated & Frozen segment, which generated approximately USD 4.87 billion in net sales—a 5.6% decline from fiscal 2023 levels.

Report Scope

Report Features Description Market Value (2024) USD 115.4 Bn Forecast Revenue (2034) USD 186.2 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ice Cream, Yogurts, Cakes, Others), By Category (Conventional, Sugar-Free), By Distribution Channel (Supermarket/hypermarket, Convenience Store, Café and Bakery Shops, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amul, Arun Ice Cream, Baskin Robbins LLC, Bulla Dairy foods, Cielo, ConAgra Foods, Dunkin’ Brands Group Inc., Ferrero Spa, Fonterra Co-operative Group Limited, General Mills Inc., Kraft foods group Inc., London Dairy Co. ltd, Meiji Holdings Co. Ltd, Mondelēz International Inc., Mother Dairy, Nestlé SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amul

- Arun Ice Cream

- Baskin Robbins LLC

- Bulla Dairy foods

- Cielo

- ConAgra Foods

- Dunkin' Brands Group Inc.

- Ferrero Spa

- Fonterra Co-operative Group Limited

- General Mills Inc.

- Kraft foods group Inc.

- London Dairy Co. ltd

- Meiji Holdings Co. Ltd

- Mondelēz International Inc.

- Mother Dairy

- Nestlé SA