Global Frozen Bakery Market Size, Share Analysis Report By Product Type (Breads, Cakes And Pastries, Pizza Crusts, Pancake/Waffle, Donuts, Cookies And Biscuits, and Others), By Category (Ready to Cook, Ready to Bake, Ready to Eat, and Ready to Proof), By End-Use (Household and Foodservice), By Distribution Channel (Direct Sales and Indirect Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169458

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

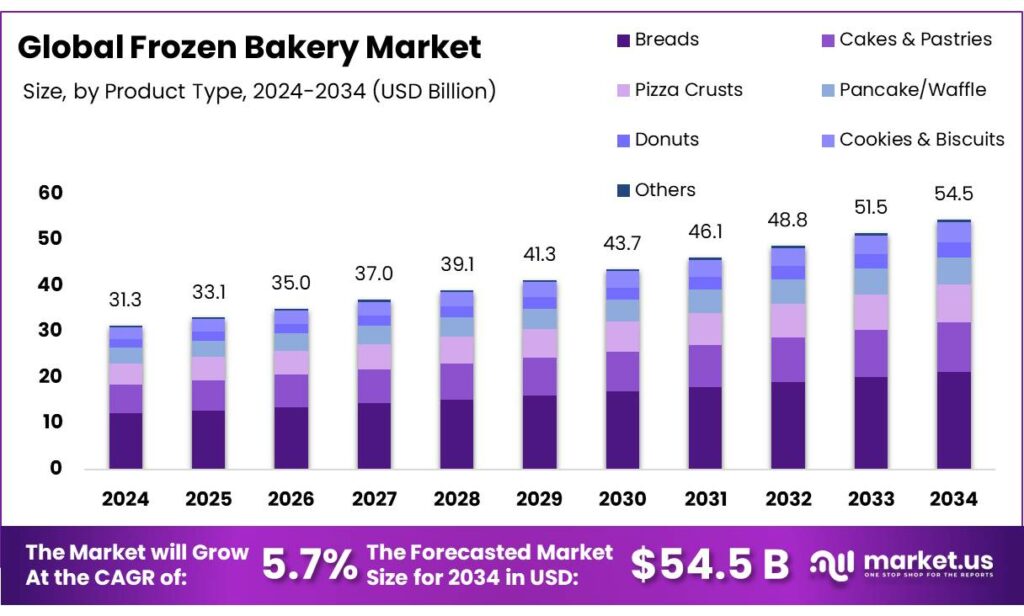

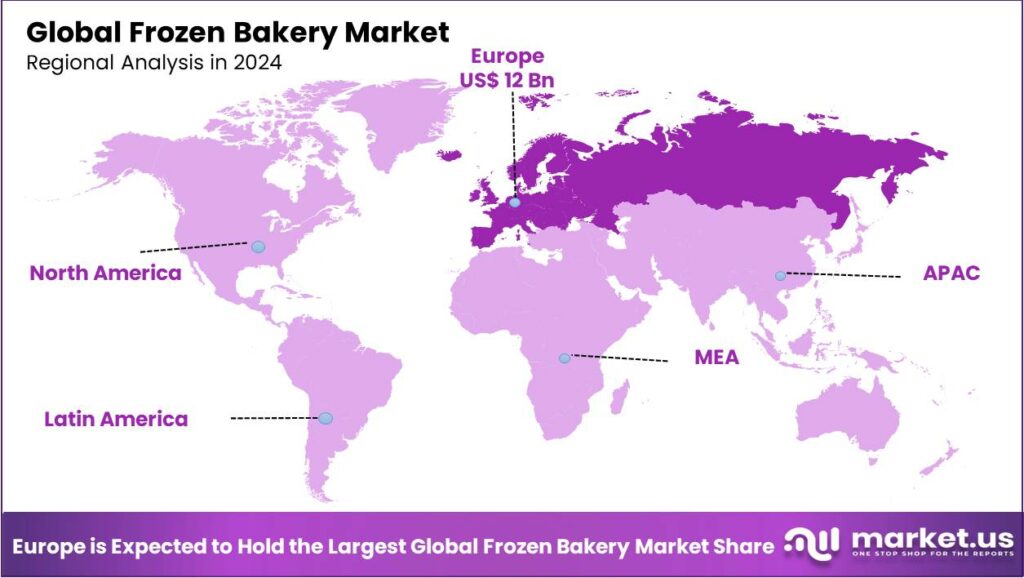

The Global Frozen Bakery Market size is expected to be worth around USD 54.5 Billion by 2034, from USD 31.3 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 59.4% share, holding USD 12 Billion revenue.

Frozen bakery refers to a wide range of baked goods, dough, batters, and fillings that are frozen to extend their shelf life and maintain freshness. This approach offers convenience, consistency, and reduced waste for both businesses and households. The frozen bakery market has seen significant growth, driven by evolving consumer demands for convenience, product innovation, and versatility. As busy lifestyles become more prevalent, consumers increasingly seek less time-consuming solutions without compromising on taste or quality, which has fueled the popularity of frozen bakery products.

In particular, ready-to-bake items have gained traction for their ability to provide a fresh-baked experience with minimal effort. In the food service sector, frozen bakery products are favored for their consistency, cost-effectiveness, and ease of use, allowing businesses to streamline operations and reduce waste. Additionally, several companies offer gluten-free, low-sugar, and plant-based options, while diversifying product lines with unique flavors and international influences. Despite the advances, the market faces challenges such as sustainability concerns, energy consumption in production, and the complexities of distribution.

- According to the U.S. Census data and Simmons National Consumer Survey (NHCS), approximately 326.91 million consumers utilized bread in 2020, and about 335.49 million consumers in 2024 in the United States alone.

Key Takeaways

- The global frozen bakery market was valued at USD 31.3 billion in 2024.

- The global frozen bakery market is projected to grow at a CAGR of 5.7% and is estimated to reach USD 54.5 billion by 2034.

- On the basis of types of bakery products, breads dominated the frozen bakery market, constituting 38.9% of the total market share.

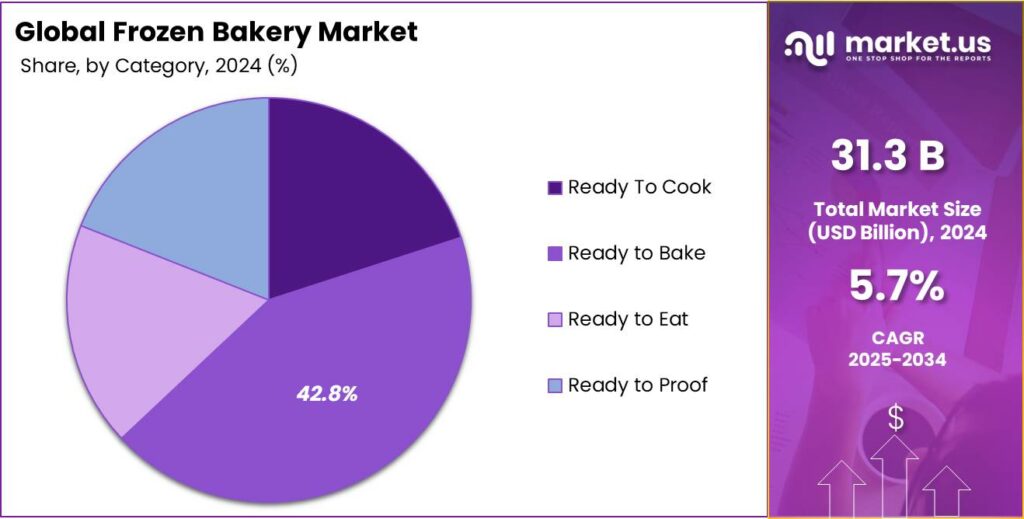

- Based on the category of bakery products, ready-to-bake products dominated the frozen bakery market, with a substantial market share of around 42.8%.

- Based on the end-uses, the food service sector led the frozen bakery market, comprising 54.8% of the total market.

- Among the distribution channels, indirect sales held a major share in the frozen bakery market, 59.4% of the market share.

- In 2024, Europe was the most dominant region in the frozen bakery market, accounting for 59.4% of the total global consumption.

Product Type Analysis

Breads are a Prominent Segment in the Frozen Bakery Market.

The frozen bakery market is segmented based on types of bakery products into breads, cakes & pastries, pizza crusts, pancake/waffle, donuts, cookies & biscuits, and others. The breads led the frozen bakery market, comprising 38.9% of the market share, due to their versatility, longer shelf life, and broad consumer appeal. Bread is a staple in households of many countries, making it a consistent and essential product in the daily diets of consumers. Additionally, frozen bread provides a convenient solution, allowing consumers to store it for longer periods while maintaining freshness and quality when needed.

Moreover, frozen bread products, such as loaves, rolls, and baguettes, cater to a wide range of occasions, such as casual meals and formal gatherings, making them more universally adaptable. In contrast, other frozen bakery items, such as cakes, pastries, or donuts, are often seen as indulgent or less versatile, with a more specific consumption window. The ease of preparing bread and its ability to complement a variety of meals further solidify its dominance in the frozen bakery market.

Category Analysis

Ready-to-Bake Products Dominated the Frozen Bakery Market.

On the basis of the category, the frozen bakery market is segmented into ready-to-cook, ready-to-bake, ready-to-eat, and ready-to-proof. The ready-to-bake products dominated the frozen bakery market, comprising 42.8% of the market share, due to their convenience, versatility, and ability to deliver a fresh-baked experience with minimal effort. Consumers prefer ready-to-bake frozen items at home as they allow for preserving the smell and texture of freshly baked goods without spending significant time or effort in preparation.

Unlike ready-to-eat products, which may not always have the same appeal as freshly made items, or ready-to-proof products, which require additional time and steps, ready-to-bake goods offer an ideal balance of convenience and quality. These products can be stored long-term, only requiring baking when needed, and allow for customization, such as adjusting baking time for desired crispness. The convenience, combined with freshness, makes ready-to-bake options highly appealing to consumers with busy lifestyles.

End-Uses Analysis

Frozen Bakery Products Are Mostly Utilized in the Food Service Sector.

Based on the end-uses, the frozen bakery market is divided into household and foodservice. The food service sector dominated the frozen bakery market, with a notable market share of 54.8%, due to the operational efficiencies. In food service sectors, such as restaurants, cafes, and hotels, frozen bakery products provide a quick and cost-effective solution to meet high demand while maintaining consistency in quality. Ready-to-bake items, such as rolls, croissants, and pizza dough, allow food service operators to streamline their workflows, reduce labor costs, and minimize waste.

Furthermore, these products eliminate the need for in-house baking facilities and the associated skill set, which can be costly and complex to manage. In contrast, households often prioritize freshly made or artisanal bakery items, with many consumers preferring to bake their own bread or pastries. The households often consume smaller quantities of frozen bakery goods, whereas food service establishments require large volumes to meet customer demand, making frozen bakery products more integral to their operations.

Distribution Channel Analysis

Indirect Sales Held a Major Share of the Frozen Bakery Market.

Among the distribution channels, 59.4% of the total global consumption of frozen bakery products is sold through indirect sales, due to the extensive distribution networks required to reach a broad consumer base. Indirect sales, through retailers such as supermarkets, convenience stores, and wholesalers, allow manufacturers to tap into established networks that have the infrastructure to store, distribute, and market frozen goods effectively.

These retailers possess the necessary refrigeration systems and logistics to handle frozen products, ensuring the freshness of the products. Additionally, indirect sales provide wider visibility, enabling products to reach a larger customer base without the need for manufacturers to invest heavily in retail operations or customer-facing resources.

Key Market Segments

By Product Type

- Breads

- Cakes & Pastries

- Pizza Crusts

- Pancake/Waffle

- Donuts

- Cookies & Biscuits

- Others

By Category

- Ready to Cook

- Ready to Bake

- Ready to Eat

- Ready to Proof

By End-Use

- Household

- Foodservice

By Distribution Channel

- Direct Sales

- Indirect Sales

- Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail/E-commerce

- Others

Drivers

Busy Lifestyles of Consumers Drive the Frozen Bakery Market.

According to the World Employment Confederation, in 2023, the global working population was estimated to be around 3.63 billion people. As the number of working individual’s increases, the increasing pace of modern life significantly influences consumer behavior, with convenience becoming a priority in food choices. According to the Bureau of Labor Statistics (BLS), in 2024, Americans spent an average of just under an hour per day, specifically 53 minutes, on food preparation and cleanup. Due to this unwillingness to spend time on food preparation, the demand for less time-consuming, ready-to-eat products has surged, particularly in the frozen bakery sector.

Frozen bakery products, such as pre-baked croissants, pizza dough, and ready-to-bake bread, provide consumers with the convenience of high-quality baked goods without the need for extensive preparation. These products require minimal effort and offer fresh outcomes, meeting the growing need for quick and nutritious meals. Moreover, the global trend towards on-the-go lifestyles has amplified this shift. The appeal of these products is further strengthened by advancements in freezing technology, which ensures a longer shelf life and retains the freshness of baked goods, making them more appealing to consumers.

Restraints

High Operational Costs Might Pose a Challenge to the Frozen Bakery Market.

High operational costs present a significant challenge for the frozen bakery market, as they directly impact profitability and pricing strategies. Energy consumption is a major factor, as storing and transporting bakery products require substantial refrigeration. In addition, the production of frozen bakery items through freezing is an energy-intensive process, which significantly increases costs.

- According to the European Commission, in 2024, industrial electricity prices in the EU reached Eur0.199 per kWh, in China to Eur0.082, and in the US to Eur0.075.

Additionally, the costs of specialized equipment, such as industrial freezers and packaging machinery, demand high initial investments and maintenance costs. Similarly, fluctuating raw material prices, such as wheat due to ongoing geopolitical tensions, further increase the cost of production of frozen bakery items. Furthermore, maintaining the constant temperature required for frozen products makes transportation and storage costly, a challenge particularly for smaller businesses.

Opportunity

Expansion of E-Commerce and Food Service Sector Creates Opportunities in the Frozen Bakery Market.

The rapid growth of e-commerce and the food service sector has created significant opportunities for the frozen bakery market. As global internet access and adoption rapidly increase, with over five billion internet users worldwide, the number of people making purchases online is increasing. In 2025, retail e-commerce sales are estimated to exceed 4.3 trillion U.S. dollars worldwide. As the trend towards online shopping continues to rise, consumers increasingly seek the convenience of purchasing frozen bakery products on e-commerce sites. E-commerce platforms offer a wide range of frozen items, such as pastries and breads, delivered directly to consumers, enhancing accessibility and improving customer experience.

Similarly, in 2024, there were over a million restaurants in the U.S. alone. The food service sector, including cafes, restaurants, and hotels, increasingly relies on frozen bakery products to streamline operations and reduce costs associated with in-house baking. Ready-to-bake or pre-baked items ensure consistency in quality and save time for businesses. This growing reliance on frozen products has prompted several food service chains to expand their menus to include frozen pastries and breads, catering to the increasing demand for convenience without compromising on quality or taste. These shifts reflect a broader trend toward convenience in both retail and hospitality.

Trends

Focus on Product Innovations.

Product innovation has become a key driver in the frozen bakery market, with manufacturers responding to evolving consumer preferences for healthier, more diverse options. As consumers increasingly prioritize health-conscious choices, frozen bakery brands are introducing products that cater to dietary needs such as gluten-free, low-sugar, plant-based, and high-protein offerings. For instance, the rise in demand for gluten-free and vegan products has led to the development of frozen breads, muffins, and pastries that meet these dietary requirements without compromising on taste or texture.

In addition, the incorporation of various flavors and international influences in frozen bakery products is a trend in the market. For instance, frozen bakery products are available in a wide array of innovative flavors, such as matcha-infused croissants and Mediterranean-inspired flatbreads, reflecting consumers’ shift towards new taste experiences. Furthermore, advances in packaging and preservation techniques ensure to maintenance of freshness, taste, and nutritional value in frozen formats. This evolution aligns with the market shift towards customization and personalization in food products.

Geopolitical Impact Analysis

Increased Raw Material Prices Affecting Frozen Bakery Market Amid Geopolitical Tensions.

The geopolitical tensions have had a considerable impact on the frozen bakery market, particularly in terms of supply chain disruptions, raw material costs, and shifts in consumer behavior. Trade barriers, sanctions, and political instability have led to higher costs for key ingredients such as wheat, flour, and other grains, which are essential for frozen bakery production. For instance, conflicts in key wheat-producing regions, such as the Russia-Ukraine conflict, have caused shortages and price hikes, directly affecting the cost of production for bakery manufacturers. Additionally, over 60% of bakery additives rely on agricultural derivatives, making the market highly sensitive to agricultural disruptions.

Similarly, political instability in oil-producing regions of Middle Eastern countries has driven up energy prices, which has increased the costs of transportation, production, particularly the energy-intensive freezing process, and storage. Furthermore, transportation bottlenecks and delays in global shipping due to conflicts, such as in the South China Sea and the Strait of Hormuz, made it difficult to source ingredients or distribute finished products, prompting many companies to diversify their supply chains, either by localizing production or exploring alternative suppliers. As these geopolitical factors continue to evolve, the frozen bakery market may face further pressure to adapt and innovate.

Regional Analysis

Europe Held the Largest Share of the Global Frozen Bakery Market.

In 2024, Europe dominated the global frozen bakery market, holding about 38.4% of the total global consumption, driven by strong consumer demand for convenience and a rich tradition of bakery products. Countries such as France, Italy, and Germany are known for their culinary heritage, particularly in the bakery sector, and this has influenced consumer preferences and industry practices. The consumers in the European countries have a high level of familiarity with bakery items such as croissants, baguettes, and pastries, which align with the region’s penchant for high-quality baked goods.

Additionally, the busy lifestyles of European consumers, particularly in urban areas, have led to an increased demand for time-saving, ready-to-bake options. Similarly, robust retail and food service sectors in the region further bolster this demand, with supermarkets, convenience stores, and cafés offering a wide range of frozen bakery products. Furthermore, as the demand for health-conscious and innovative bakery items grows, Europe continues to lead the way in adapting to consumer trends while maintaining its rich baking traditions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the frozen bakery market employ a variety of strategies to increase sales and gain a competitive edge. The major players focus on product innovation, such as health-conscious options like gluten-free, low-sugar, or plant-based baked goods to cater to changing consumer preferences. In addition, the companies innovate diverse flavors and ethnic-inspired products to appeal to the adventurous tastes of young consumers. Similarly, the companies try to enhance their distribution channels by expanding their presence in retail and food service sectors, ensuring greater accessibility through supermarkets, online platforms, and restaurants. Furthermore, several large brands focus on mergers and acquisitions to expand the product portfolio of the company and for market expansion.

The Major Players in The Industry

- Grupo Bimbo S.A.B. de C.V.

- ARYZTA AG

- Lantmännen Unibake International

- Europastry S.A.

- General Mills, Inc.

- Associated British Foods plc

- Conagra Brands, Inc.

- Rich Products Corporation

- Vandemoortele NV

- Dawn Foods Global Inc.

- Tyson Foods, Inc.

- Flowers Foods Inc.

- FGF Brands Inc.

- Alpha Baking Company Inc.

- Sunbulah Group

- Other Key Players

Key Development

- In May 2025, Swedish agri-food group Lantmännen invested about US$73 million in a production facility in Örebro to bolster its bread business.

- In September 2025, Europastry, the Spanish baking giant with a major subsidiary in Milan, expanded in Southeast Asia by acquiring a majority stake of 60% in Art of Baking in Thailand. The stake was acquired from Minor International Public Co. and Srifa Frozen Food as part of a strategic partnership.

Report Scope

Report Features Description Market Value (2024) USD 31.3 Bn Forecast Revenue (2034) USD 54.5 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Breads, Cakes & Pastries, Pizza Crusts, Pancake/Waffle, Donuts, Cookies & Biscuits, and Others), By Category (Ready To Cook, Ready to Bake, Ready to Eat, and Ready to Proof), By End-Use (Household and Foodservice), By Distribution Channel (Direct Sales and Indirect Sales) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Grupo Bimbo S.A.B. de C.V., ARYZTA AG, Lantmännen Unibake International, Europastry S.A., General Mills, Inc., Associated British Foods plc, Conagra Brands, Inc., Rich Products Corporation, Vandemoortele NV, Dawn Foods Global Inc., Tyson Foods, Inc., Flowers Foods Inc., FGF Brands Inc., Alpha Baking Company Inc., Sunbulah Group, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Grupo Bimbo S.A.B. de C.V.

- ARYZTA AG

- Lantmännen Unibake International

- Europastry S.A.

- General Mills, Inc.

- Associated British Foods plc

- Conagra Brands, Inc.

- Rich Products Corporation

- Vandemoortele NV

- Dawn Foods Global Inc.

- Tyson Foods, Inc.

- Flowers Foods Inc.

- FGF Brands Inc.

- Alpha Baking Company Inc.

- Sunbulah Group

- Other Key Players