Global Fracking Water Treatment Systems Market Size, Share, And Enhanced Productivity By Water Source (Flowback Water, Produced Water), By Treatment Process (Media Filtration, Electrocoagulation, Reverse Osmosis, Microbial Treatment, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170864

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

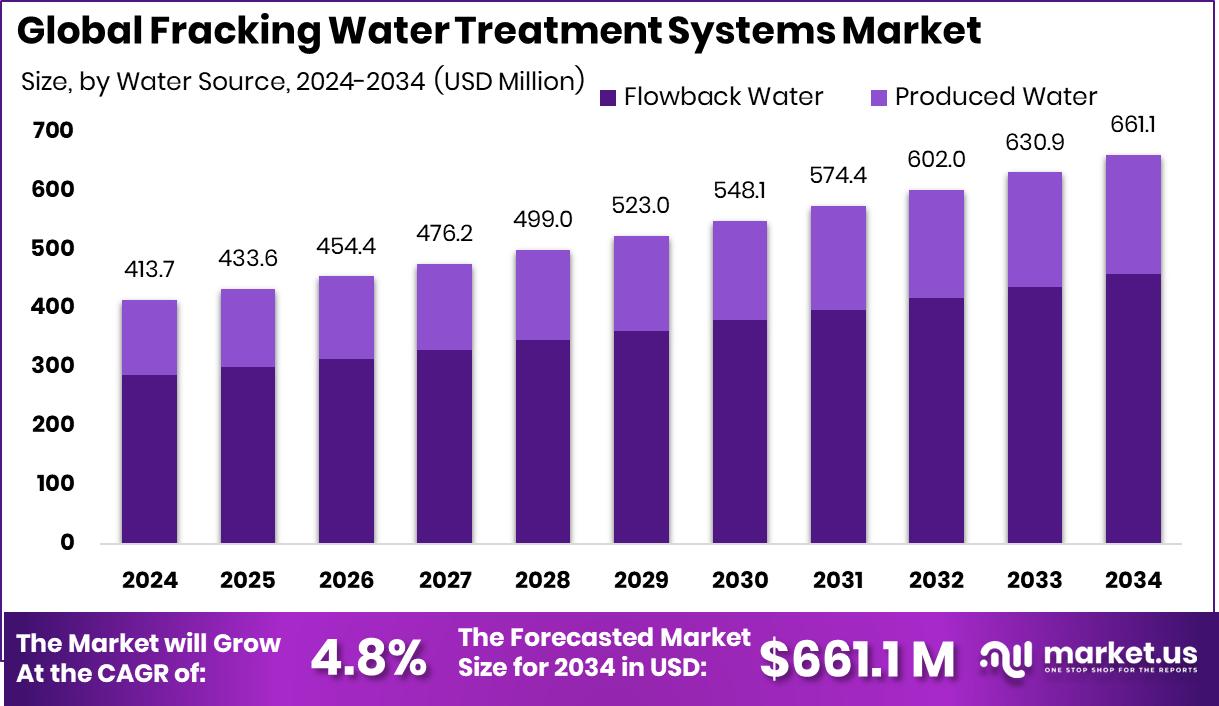

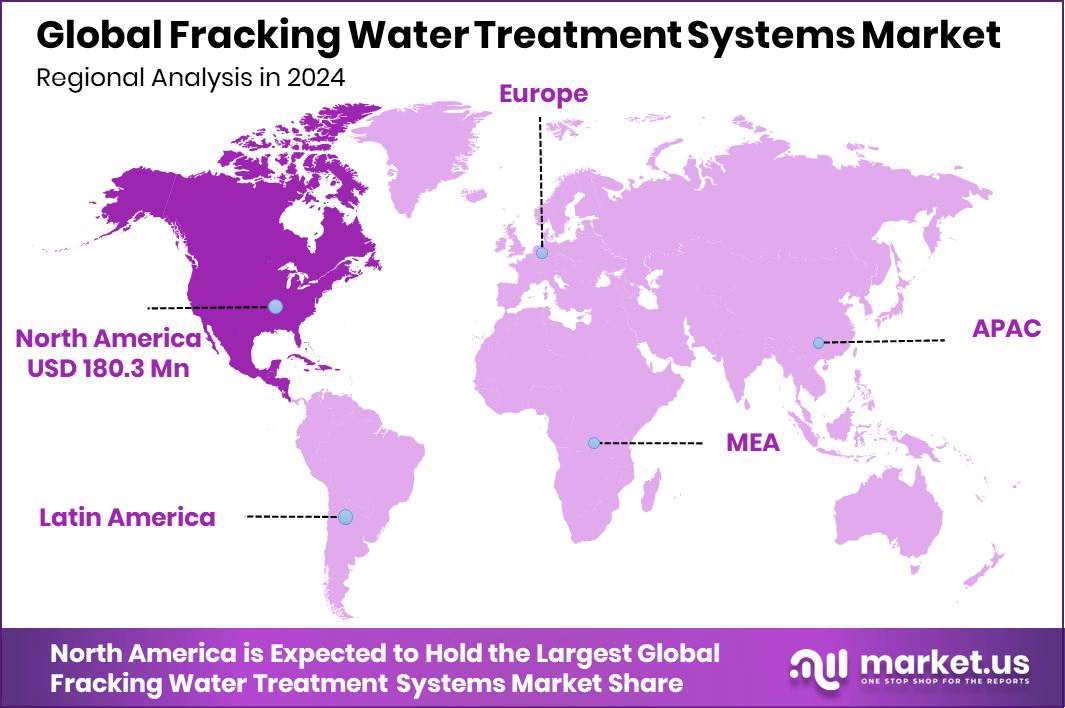

The Global Fracking Water Treatment Systems Market is expected to be worth around USD 661.1 million by 2034, up from USD 413.7 million in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034. North America leads the Fracking Water Treatment Systems Market at 43.60%, totaling USD 180.3 Mn.

Fracking water treatment systems are engineered solutions used to clean and manage water generated during hydraulic fracturing operations. Large volumes of water mixed with sand and chemicals return to the surface after fracturing. These systems remove solids, salts, and contaminants so the water can be reused, safely discharged, or disposed of responsibly. In simple terms, they help operators handle water efficiently while reducing environmental pressure.

The Fracking Water Treatment Systems Market refers to the demand and deployment of these technologies across shale oil and gas operations. The market exists because fracking is water-intensive and produces wastewater that cannot be released untreated. As drilling activity continues, treatment systems are becoming standard operational infrastructure rather than optional equipment.

Growth factors are strongly linked to rising focus on water reuse and cost control. Treating water on-site lowers freshwater intake and transport needs. Public and private investments in water infrastructure reflect this shift. For example, Valley wastewater systems received a $35 million boost from state funding, highlighting how water treatment capacity is expanding across industrial uses.

Demand is also shaped by growing scrutiny of water management efficiency. The demolition of eleven RO plants costing ₹15–20 lakh each in Bengaluru shows how poor planning increases waste, reinforcing the need for robust, adaptable treatment systems. Innovation funding supports this demand shift.

- NALA Membranes raised $1.5 million to commercialize advanced membrane technology

- Flocean secured US$9 million to deliver desalination solutions

Opportunities lie in advanced filtration and membrane technologies that improve recovery rates and reduce treatment footprints. Funding such as Blue Earth receiving $19 million from the PFA and DrinkPrime raising both ₹60 crore and $3 million for RO water supply signals strong confidence in scalable water treatment solutions, which directly supports long-term market expansion.

Key Takeaways

- The Global Fracking Water Treatment Systems Market is expected to be worth around USD 661.1 million by 2034, up from USD 413.7 million in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

- Flowback water accounts for 69.3% share as shale operations generate large contaminated water volumes globally.

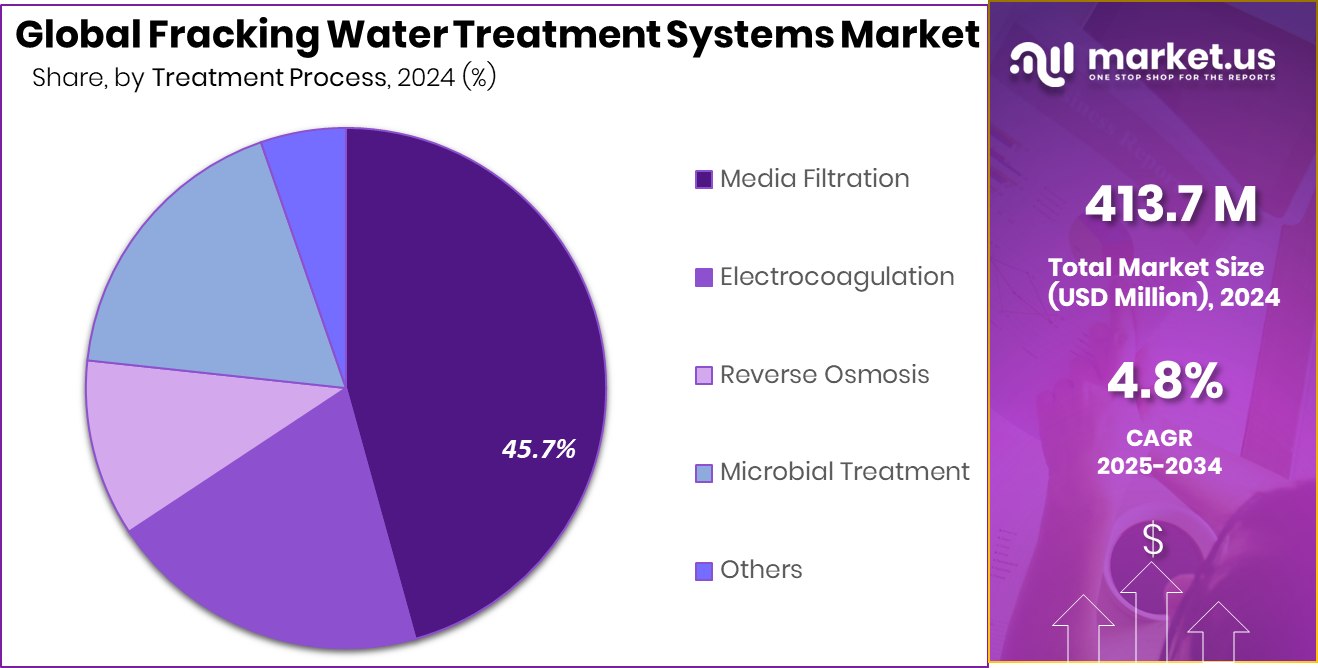

- Media filtration holds a 45.7% share due to low cost, reliability, and compatibility with reuse systems.

- The North America Fracking Water Treatment Systems Market holds 43.60% share, reaching USD 180.3 Mn.

By Water Source Analysis

Flowback water dominates the fracking water treatment systems market with a 69.3% share globally.

In 2024, Flowback Water held a dominant market position in By Water Source segment of the Fracking Water Treatment Systems Market, with a 69.3% share. This dominance reflects the operational reality of hydraulic fracturing, where large volumes of water return to the surface after initial injection. Managing this water stream efficiently has become a core focus for operators, as it directly affects drilling continuity, water reuse potential, and overall field productivity.

Flowback water treatment systems are therefore positioned as essential infrastructure rather than optional add-ons. Their widespread adoption is driven by the need for consistent treatment performance under variable water quality conditions. The strong 69.3% share indicates that market demand remains concentrated around solutions specifically designed to handle flowback water characteristics, supporting stable system utilization across active fracking operations.

By Treatment Process Analysis

Media filtration leads the fracking water treatment systems market with a 45.7% adoption rate.

In 2024, Media Filtration held a dominant market position in By Treatment Process segment of the Fracking Water Treatment Systems Market, with a 45.7% share. This leadership highlights the process’s reliability in removing suspended solids and particulates commonly present in fracking water streams. Media filtration continues to be favored for its operational simplicity and adaptability across different treatment setups.

The 45.7% share signals a steady preference for treatment processes that deliver predictable outcomes without excessive complexity. Media filtration systems are widely integrated into treatment trains because they support continuous operations and consistent water quality control. Their dominant position reflects strong alignment with industry needs for efficient, scalable, and dependable water treatment within fracking environments.

Key Market Segments

By Water Source

- Flowback Water

- Produced Water

By Treatment Process

- Media Filtration

- Electrocoagulation

- Reverse Osmosis

- Microbial Treatment

- Others

Driving Factors

Rising Investment in Advanced Water Treatment Infrastructure

One major driving factor for the Fracking Water Treatment Systems Market is the rising investment in advanced water treatment infrastructure. Fracking operations generate large volumes of wastewater that must be treated before reuse or disposal. Governments and utilities are increasingly funding modern treatment plants to strengthen water security and improve treatment efficiency. These investments signal strong confidence in reverse osmosis and advanced filtration systems, which are also widely applied in fracking water treatment. Improved infrastructure helps operators manage water more reliably, reduce freshwater dependence, and meet stricter operational standards. As water treatment capacity expands across regions, similar technologies are increasingly adopted in oil and gas fields, supporting steady market growth and wider system deployment.

- Pender Co Utilities received an additional $25 million to expand the Hampstead reverse osmosis plant

- UAE’s Mirfa 2 RO plant raised $620 million after achieving financial closure

Alongside large projects, smaller funding. also plays a role. A USDA grant of $830,000 was awarded to benefit the Olivia, Minnesota water system, showing consistent public support for upgrading water treatment capabilities at multiple scales.

Restraining Factors

High Capital Requirements Slow System Deployment

A key restraining factor for the Fracking Water Treatment Systems Market is the high capital requirement needed to build and operate advanced treatment facilities. Large-scale water treatment projects demand significant upfront investment, long approval timelines, and complex financing structures. This financial burden can delay or limit adoption, especially for smaller operators or short-term drilling programs.

The scale of funding required is evident from major desalination and water treatment projects, which use technologies similar to those applied in fracking water management. Such costs often make operators cautious, slowing decision-making and system upgrades even when treatment needs are clear. TAQA, ENGIE, and EWEC closed $620 million financing for a large UAE desalination plant

Even at smaller scales, funding pressures remain visible. A last-minute earmark added $10 million for the Indiantown water treatment plant, showing how projects often rely on additional public support to move forward. These financial constraints continue to act as a restraint on faster market expansion.

Growth Opportunity

Advanced Microbial Technologies Transform Wastewater Treatment

A major growth opportunity in the Fracking Water Treatment Systems Market lies in the adoption of advanced microbial technologies for wastewater treatment. These solutions use engineered microbes to break down complex contaminants and recover useful resources from wastewater streams. Such approaches can lower chemical use, improve treatment efficiency, and reduce operating costs, making them attractive for fracking sites handling difficult water compositions.

Strong public and private funding shows growing confidence in biological treatment methods, which are moving from research to real-world deployment. As these technologies mature, they can open new pathways for treating fracking wastewater more sustainably and effectively, creating long-term growth potential for system providers.

- DOE’s ARPA-E program awarded $2.7 million to Northwestern engineers for microbial wastewater resource recovery technology

- BioConsortia raised $15 million to support global rollout of Always-N™ and advance microbial research

In parallel, a $104 million federal project led by an HMS researcher highlights large-scale commitment to microbial solutions, reinforcing the opportunity for innovation-driven growth in wastewater treatment systems.

Latest Trends

Microbial Innovation Reshapes Advanced Water Treatment

A key latest trend in the Fracking Water Treatment Systems Market is the growing use of microbial science to handle complex wastewater challenges. Researchers are focusing on extreme microbes that can survive high salinity and harsh chemical conditions similar to fracking wastewater. This scientific push is supported by strong institutional funding, showing confidence in biology-driven treatment solutions. These microbes help break down contaminants naturally, reduce chemical dependence, and improve overall treatment efficiency.

As research moves closer to practical application, microbial systems are gaining attention as flexible and adaptive treatment tools. Funding momentum highlights how biology is becoming a core part of future water treatment design, supporting cleaner and more resilient systems for industrial wastewater environments.

The National Science Foundation granted $22 million to establish a research hub for extreme microbes, while a $1.9 million NIH grant supports microbiome research. In parallel, Aphea.Bio raised $10 million in Series A and grant funding, reinforcing the growing role of microbial technology in advanced water treatment innovation.

Regional Analysis

North America dominates the Fracking Water Treatment Systems Market with 43.60%, valued at USD 180.3 Mn.

North America remains the dominating region in the Fracking Water Treatment Systems Market, holding a 43.60% share and valued at USD 180.3 Mn. This leadership reflects the region’s mature shale development landscape, where water treatment is embedded into standard fracking operations to maintain operational efficiency and regulatory alignment.

Europe represents a more controlled and selective market, shaped by cautious resource development and structured water management practices, which keeps demand focused on compliance-driven treatment needs.

Asia Pacific is gradually emerging as operators explore unconventional resources, creating steady interest in treatment systems that can support evolving drilling activity. The Middle East & Africa market is linked to broader energy development strategies, where water handling efficiency is increasingly viewed as a technical requirement rather than a cost center.

Latin America shows developing potential, supported by ongoing exploration efforts and growing awareness of responsible water use in hydraulic fracturing. Across all regions, market participation is influenced by local operational intensity, water reuse priorities, and regulatory expectations, while North America’s 43.60% share and USD 180.3 Mn valuation clearly position it as the central hub of market activity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Schlumberger Limited continues to play a central role in the fracking water treatment systems market through its strong integration of water management within upstream operations. In 2024, the company’s focus remains on helping operators manage complex water flows generated during hydraulic fracturing. Its approach emphasizes operational efficiency, system reliability, and field-level adaptability, making water treatment a core part of well completion strategies rather than a standalone service.

Halliburton Company maintains a strong market presence by aligning water treatment solutions closely with drilling and stimulation activities. The company positions water treatment as an operational enabler that supports continuous fracking performance. In 2024, Halliburton’s strength lies in deploying scalable treatment systems that can operate across varying shale conditions, helping operators reduce downtime and improve water reuse efficiency within active fields.

Veolia Environnement S.A. brings a different but complementary perspective to the fracking water treatment systems market. The company applies its broader water treatment expertise to address complex produced and flowback water challenges. In 2024, Veolia’s role is centered on treatment consistency, environmental compliance, and long-term water management planning. Its participation reflects the growing importance of specialized water treatment knowledge in supporting sustainable hydraulic fracturing operations globally.

Top Key Players in the Market

- Schlumberger Limited

- Halliburton Company

- Veolia Environnement S.A

- Baker Hughes

- Weatherford International plc

- Nuverra Environmental Solutions

- FTS International

- Select Energy Services

- Xylem Inc

- Aquatech International

Recent Developments

- In May 2025, Veolia signed an agreement to acquire the remaining 30% stake of its Water Technologies and Solutions (WTS) subsidiary from CDPQ, giving it full ownership of this global water treatment business. This move strengthens Veolia’s ability to deliver advanced water treatment and reuse technologies — such as systems for produced and injection water — to key industries, including energy and oil & gas sectors.

- In September 2024, Halliburton introduced the OCTIV® Auto Frac service, the first autonomous fracturing solution that automates well stimulation execution without human intervention. This digital technology aims to improve operational consistency and fracture equipment coordination, helping reduce variability in fracking jobs and boosting overall efficiency. This platform is part of Halliburton’s intelligent fracturing portfolio, which supports better control over fluid and resource management on site.

- In April 2024, Schlumberger (SLB) announced it had entered into an agreement to acquire ChampionX, a company known for production optimization technologies. This move aims to strengthen SLB’s overall services portfolio by combining deep industry expertise and digital integration capabilities, potentially enhancing its offerings around fluid management and water treatment processes.

Report Scope

Report Features Description Market Value (2024) USD 413.7 Million Forecast Revenue (2034) USD 661.1 Million CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Water Source (Flowback Water, Produced Water), By Treatment Process (Media Filtration, Electrocoagulation, Reverse Osmosis, Microbial Treatment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Schlumberger Limited, Halliburton Company, Veolia Environnement S.A, Baker Hughes, Weatherford International plc, Nuverra Environmental Solutions, FTS International, Select Energy Services, Xylem Inc, Aquatech International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fracking Water Treatment Systems MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Fracking Water Treatment Systems MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Schlumberger Limited

- Halliburton Company

- Veolia Environnement S.A

- Baker Hughes

- Weatherford International plc

- Nuverra Environmental Solutions

- FTS International

- Select Energy Services

- Xylem Inc

- Aquatech International