Global FPSO Market Size, Share, Growth Analysis By Water Depth (Shallow Water, Deep Water, Ultra-deep Water), By Storage Capacity (Less than 1 MMBBLs, 1-2 MMBBLs, More than 2 MMBBLs), By Construction Type (Converted, New Build), By Hull Type (Single Hull, Double Hull), By Ownership (Operator-owned, Contractor-owned) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168406

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

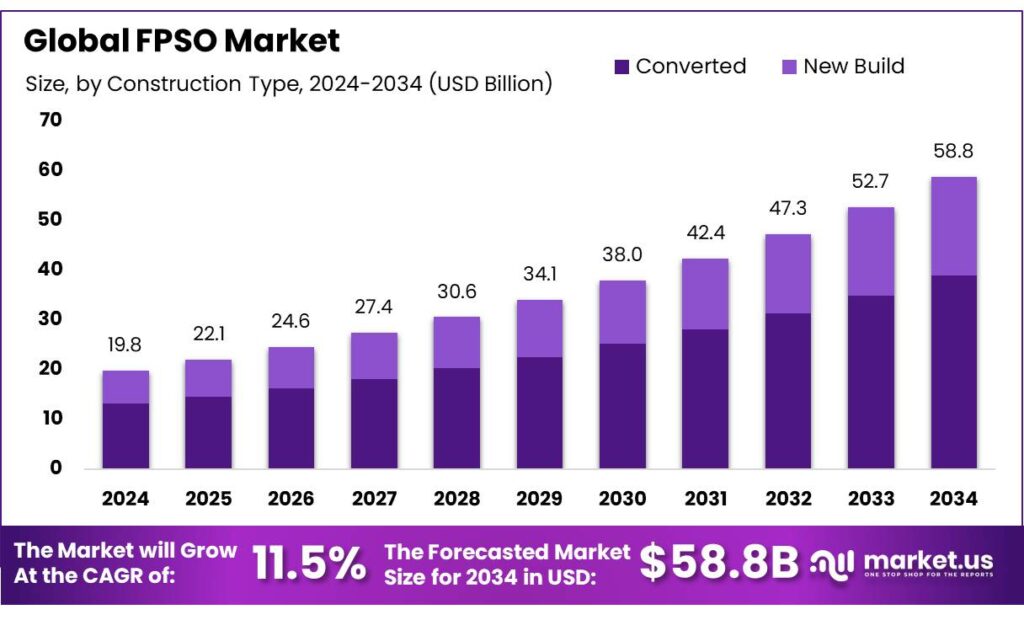

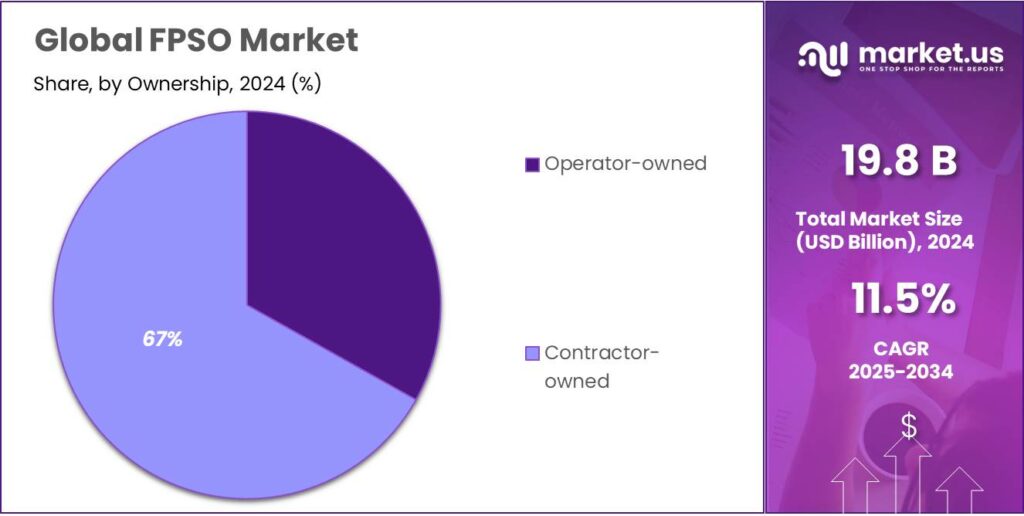

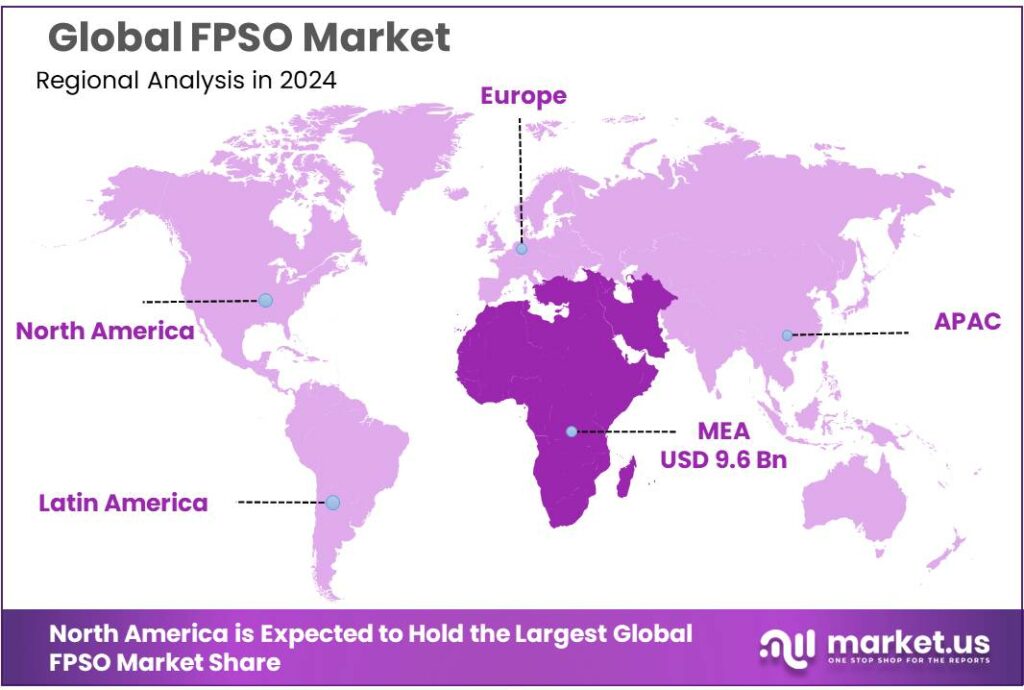

The Global FPSO Market size is expected to be worth around USD 58.8 Billion by 2034, from USD 19.8 Billion in 2024, growing at a CAGR of 11.5% during the forecast period from 2025 to 2034. In 2024, Middle East And Africa (MEA) held a dominant market position, capturing more than a 48.90% share, holding USD 9.6 Billion revenue.

Floating Production Storage and Offloading (FPSO) units are ship-shaped facilities that receive hydrocarbons from subsea wells, process them onboard and store stabilized crude for export. They sit at the centre of the offshore value chain: offshore fields have produced about 30% of the world’s oil and 27% of global gas in recent years, underlining how critical floating and fixed offshore systems are for supply security.

The industrial landscape is anchored in deepwater regions such as Brazil’s pre-salt, West Africa and parts of Asia. Petrobras reports that pre-salt oil production reached 1,813 thousand barrels per day in 2024, supported by new FPSOs like Sepetiba, Almirante Barroso and Anita Garibaldi. In 1Q24, Petrobras’ total oil, NGL and gas output averaged 2,776 thousand barrels of oil equivalent per day, up 3.7% year-on-year, with ramp-up of multiple FPSOs cited as a key driver. On the supply side, leading leasing players also illustrate scale: SBM Offshore reports a fleet of 15 FPSOs and 1 semi-submersible in operation worldwide in its 2024 annual report.

Structurally, FPSO demand is underpinned by decline in existing fields and the shift toward more complex offshore reservoirs. The IEA’s recent field decline study finds that deep-offshore oil fields decline at around 10.3% per year, compared with 4.2% per year for onshore fields. The analysis draws on production records from roughly 15,000 oil and gas fields worldwide, highlighting the continuous need for new upstream projects, many of which will be offshore and therefore FPSO-relevant. Even as energy systems transition, the IEA estimates total energy investment at USD 3.3 trillion in 2025, with USD 1.1 trillion still flowing to oil, gas and coal alongside USD 2.2 trillion into clean energy and related technologies.

Near-term dynamics are influenced by capital discipline. The IEA expects overall upstream oil spending to fall 6% in 2025, to about USD 535 billion, within a broader USD 3.3-trillion energy-investment envelope. For FPSO contractors and shipyards, this reinforces a “fewer, larger, more capital-intensive projects” scenario, favouring deepwater hubs with long-life reserves and competitive breakevens.

Key Takeaways

- FPSO Market size is expected to be worth around USD 58.8 Billion by 2034, from USD 19.8 Billion in 2024, growing at a CAGR of 11.5%.

- Deep Water held a dominant market position, capturing more than a 52.7% share.

- 1-2 MMBBLs held a dominant market position, capturing more than a 56.9% share.

- Converted held a dominant market position, capturing more than a 66.2% share.

- Double Hull held a dominant market position, capturing more than a 69.7% share.

- Contractor-owned held a dominant market position, capturing more than a 66.6% share.

- Middle East & Africa (MEA) region accounted for a dominant share of the FPSO market, representing 48.90% equivalent to approximately US$9.6 billion.

By Water Depth Analysis

Deep Water leads the FPSO market with a 52.7% share, supported by rising offshore project investments.

In 2024, Deep Water held a dominant market position, capturing more than a 52.7% share, as operators continued to focus on large offshore reserves where conventional platforms are not feasible. The expansion of deep-water exploration programs in regions such as West Africa and Brazil supported this dominance, as production systems in these zones were driven by higher reservoir potential and long-term output stability. The preference for FPSO units in deep water was reinforced because these systems reduce dependence on fixed infrastructure and offer flexible deployment throughout the field lifecycle.

In 2025, the demand for deep-water FPSOs was expected to remain stable as new field developments moved toward final investment decisions. The steady rise in global offshore spending encouraged operators to prioritize floating production solutions in deeper basins where technically challenging environments require robust and adaptable production assets. The ongoing shift toward maximizing recovery from remote reservoirs further strengthened the role of deep-water FPSOs, and the segment continued to benefit from improvements in subsea technologies that support safer and more efficient operations.

By Storage Capacity Analysis

1-2 MMBBLs dominates with 56.9% as operators prefer mid-sized storage for operational balance.

In 2024, 1-2 MMBBLs held a dominant market position, capturing more than a 56.9% share, as this storage band was preferred for its balance between on-board inventory and vessel economics. The 1–2 MMBBL capacity range was favored because it allowed for sustained export flexibility while avoiding the higher capital and mooring demands of ultra-large storage units. Deployment was driven by brownfield upgrades and new developments where reservoir output and export cadence matched mid-range tank sizes; consequently, FPSO designs were optimized to integrate processing capacity with 1–2 MMBBL storage to reduce offloading frequency and improve uptime.

In 2025, the segment continued to be prioritized in project planning as operators sought solutions that offered a pragmatic trade-off between storage efficiency and capital intensity, and engineering efforts were concentrated on improving cargo handling and stability for this capacity class.

By Construction Type Analysis

Converted FPSOs dominate with 66.2% as operators prefer faster delivery and lower upfront costs.

In 2024, Converted held a dominant market position, capturing more than a 66.2% share, as existing tankers and shuttle vessels were increasingly repurposed to meet near-term production needs and reduce capital expenditure. The conversion route was chosen because project schedules were shortened, costs were lowered relative to newbuilds, and proven hulls could be adapted to meet processing and storage requirements with limited lead time. Conversion projects were supported by retrofitting practices that improved safety and production capability while avoiding the extended yard slots required for new construction. In 2025, the preference for converted units was expected to persist for brownfield developments and fast-track greenfield projects where time to first oil was prioritized, and engineering efforts were concentrated on optimizing topside layouts and lifecycle maintenance plans for converted hulls.

By Hull Type Analysis

Double Hull leads with 69.7% due to stronger spill protection and regulatory preference.

In 2024, Double Hull held a dominant market position, capturing more than a 69.7% share, as operators and regulators favoured hull designs that provide improved environmental protection and structural redundancy. The adoption was driven by stricter safety standards and a preference for designs that reduce the risk of hydrocarbon release during collisions or grounding. Selection of double-hull FPSOs was also encouraged because retrofit and newbuild programmes incorporated enhanced segregation of cargo and ballast spaces, simplifying leak detection and maintenance. In 2025, double-hull architectures continued to be prioritised in procurement and field development plans, with project teams and classification societies emphasising lifecycle integrity and reduced environmental liability when choosing hull types.

By Ownership Analysis

Contractor-owned dominates with 66.6% as contractors assume asset and operational responsibility.

In 2024, Contractor-owned held a dominant market position, capturing more than a 66.6% share. This preference was driven by the transfer of construction, commissioning and operational risks to specialist contractors, allowing operators to preserve balance-sheet flexibility and accelerate project schedules. Under this model, financing and long-term operation were frequently bundled with engineering and installation services, which reduced the burden on host companies and streamlined decision-making during field start-ups. In 2025, contractor-owned arrangements continued to be favoured for brownfield tie-backs and fast-track developments, and procurement strategies were shaped to capitalise on contractors’ ability to offer integrated asset life-cycle services while maintaining predictable operating expenditure.

Key Market Segments

By Water Depth

- Shallow Water

- Deep Water

- Ultra-deep Water

By Storage Capacity

- Less than 1 MMBBLs

- 1-2 MMBBLs

- More than 2 MMBBLs

By Construction Type

- Converted

- New Build

By Hull Type

- Single Hull

- Double Hull

By Ownership

- Operator-owned

- Contractor-owned

Emerging Trends

Sustainability and Low-Emission FPSOs Becoming the New Norm

A major trend reshaping the global Floating Production Storage and Offloading (FPSO) industry today is the strong shift toward low-emission, environmentally conscious FPSO designs that reduce flaring and carbon output. As global pressure mounts on oil and gas producers to cut greenhouse-gas emissions, operators and shipbuilders are increasingly embracing technologies such as offshore electrification, gas-re-injection, zero-flaring systems, and digital monitoring of emissions to keep FPSOs viable and acceptable under tighter regulation.

For instance, a 2025 worldwide report on offshore oil and gas production highlights that advanced electrification of offshore platforms — including FPSOs — can reduce CO₂ emissions by up to 95% in certain key basins compared to traditional gas-turbine powered operations. Meanwhile, global data show the urgent need for such measures: a recent assessment by the World Bank revealed that global gas flaring reached 151 billion cubic meters (bcm) in 2024, up from 148 bcm in 2023 — the highest level since 2007. That single statistic underscores both the environmental burden and the renewed drive toward cleaner offshore operations.

- According to the International Energy Agency (IEA), total global energy investment in 2025 is estimated to reach USD 3.3 trillion, of which only USD 1.1 trillion goes to fossil fuels (oil, gas, coal), while USD 2.2 trillion is flowing into renewables, efficiency, electrification and low-emission technologies.

This imbalance sends a clear signal to oil and gas operators — to remain competitive and finance-worthy, new offshore projects must increasingly demonstrate environmental responsibility. As a result, next-generation FPSOs are being designed with carbon management in mind from the start.

For operators, this shift offers a dual benefit — continued access to offshore resources (including in deepwater fields) while reducing environmental footprint and aligning with global climate goals. It also helps safeguard social license to operate in regions increasingly sensitive to emissions and environmental impact. Given that flaring in 2024 alone generated roughly 389 million tonnes of CO₂-equivalent emissions, including a large share of unburnt methane, according to the World Bank’s Global Gas Flaring Tracker, transitioning to low-emission FPSOs is no longer optional — it is rapidly becoming a baseline requirement.

Drivers

Rising Deepwater Oil Production Drives Global FPSO Demand

One of the strongest driving factors for Floating Production Storage and Offloading (FPSO) systems is the rapid shift of offshore oil production toward deepwater and ultra-deepwater fields. Many of the world’s new oil discoveries are located far from shore, in water depths where fixed platforms are technically difficult and expensive. FPSOs offer a flexible solution because they can operate in water depths beyond 2,000 meters, be relocated after field depletion, and reduce the need for long export pipelines. This technical adaptability makes FPSOs the preferred production system for modern offshore developments.

- According to the International Energy Agency (IEA), offshore oil fields contribute around 30% of global oil production, with deepwater fields accounting for a growing portion of new capacity additions. The IEA’s field decline analysis also shows that deep-offshore oil fields decline at an average rate of about 10.3% per year, much higher than onshore fields.

Brazil is the clearest example of this trend. Government-controlled Petrobras reports that pre-salt production reached 1.8 million barrels per day in 2024, driven largely by FPSO-based developments. New FPSOs such as Almirante Barroso and Sepetiba are designed to individually process more than 150,000 barrels per day, highlighting how single vessels now function as large offshore hubs rather than marginal assets. Brazil’s Ministry of Mines and Energy continues to prioritize pre-salt development as a national energy and revenue strategy, reinforcing long-term FPSO demand.

Government policy in emerging offshore regions is another important catalyst. Countries like Nigeria, Guyana, and Angola are actively encouraging offshore investment through licensing rounds and local-content frameworks. Nigeria’s Offshore Energy Industry Content policies require higher in-country participation and aim to retain more value from offshore developments. These policies indirectly support FPSO deployment by accelerating project approvals and encouraging long-term offshore production systems rather than short-lived tiebacks.

Global energy investment data further supports this driver. The IEA estimates total energy investment at around USD 3.3 trillion in 2025, with about USD 1.1 trillion still allocated to oil, gas, and coal supply to meet near-term energy security needs. Offshore deepwater projects remain among the most competitive oil sources due to large reserve sizes and long plateau production periods, both of which favor FPSO-based development concepts.

Restraints

High Capital Cost and Long Project Timelines Restrain FPSO Adoption

One of the most important restraining factors for Floating Production Storage and Offloading (FPSO) projects is their very high upfront capital cost combined with long development timelines. An FPSO is not a standard vessel; it is a complex offshore industrial plant built to operate continuously for 20–25 years in harsh marine conditions. Designing, converting, or building an FPSO requires advanced shipyards, specialized equipment, and long engineering cycles, which significantly raise project risk and financial exposure for operators and governments.

Trusted industry sources show how costly these assets have become. Offshore Energy and Reuters report that a single large FPSO for deepwater fields typically costs between USD 1.5 billion and USD 2.5 billion, depending on processing capacity, water depth, and local content requirements. In some ultra-deepwater cases, total field development costs, including subsea equipment and wells, can exceed USD 8–10 billion before first oil is produced. These capital requirements limit FPSO adoption to only very large discoveries with long reserve lives.

Cost pressure is further intensified by inflation across shipbuilding and offshore supply chains. The International Energy Agency (IEA) highlighted that upstream project costs have risen strongly since 2021 due to steel price increases, tighter labor markets, and supply bottlenecks in specialized equipment. The IEA estimates that global upstream oil and gas investment reached about USD 538 billion in 2023, but operators are becoming more selective in approving capital-intensive offshore projects to protect returns.

Long construction and integration schedules add another restraint. Building or converting an FPSO typically takes 30 to 48 months, not including subsea installation and drilling activities. Any delay in shipyard delivery, topside integration, or commissioning directly postpones first oil, increasing interest costs and reducing project net present value. Government audits in Brazil have previously shown that offshore project delays can cost operators hundreds of millions of dollars annually in deferred revenue, reinforcing caution around new FPSO sanctions.

Energy transition policies also influence long-term risk perception. While oil demand remains significant, governments are accelerating low-carbon investment. The IEA projects global clean-energy investment to reach USD 2.2 trillion in 2025, compared with about USD 1.1 trillion for fossil fuels. This growing imbalance raises concerns among lenders and asset owners about long-lived offshore assets that may operate beyond 2040–2050, a period when demand uncertainty increases.

Opportunity

New Deepwater Discoveries in Emerging Offshore Regions Create Strong Growth Opportunities for FPSOs

One of the strongest growth opportunities for Floating Production Storage and Offloading (FPSO) systems comes from a wave of new deepwater discoveries in emerging offshore regions, especially South America and West Africa. These regions are finding large oil and gas reservoirs far from shore, where FPSOs offer the fastest and most economical production solution. Unlike fixed platforms, FPSOs can be deployed in water depths beyond 2,000 meters, store crude onboard, and export oil directly to tankers, making them ideal for frontier offshore basins with limited infrastructure.

Guyana stands out as a flagship growth market. According to the Government of Guyana and operator disclosures, offshore discoveries in the Stabroek Block exceed 11 billion barrels of oil equivalent, one of the largest offshore finds globally in recent decades. The country produced around 390,000 barrels per day in 2023 and aims to cross 1 million barrels per day by 2027, largely supported by multiple FPSOs. Each FPSO deployed offshore Guyana is designed to process between 220,000 and 250,000 barrels per day, creating sustained long-term demand for new vessels.

Brazil continues to be another major opportunity driver. Petrobras reports that the pre-salt region holds oil with high productivity and low lifting costs, supporting long-life offshore projects. In 2024, pre-salt production reached about 1.8 million barrels per day, representing more than half of Brazil’s total oil output. Petrobras’ strategic plan emphasizes continued deployment of large FPSOs through the end of the decade to maintain production above 2.7 million barrels of oil equivalent per day.

Government support further strengthens this opportunity. Brazil’s Ministry of Mines and Energy continues to prioritize offshore development through licensing rounds and infrastructure planning. Similarly, West African governments such as Angola and Nigeria are offering new offshore blocks with improved fiscal terms to attract foreign investment. Nigeria’s offshore licensing framework and local content policy encourage long-term offshore installations, indirectly supporting FPSO-based field development.

Regional Insights

Middle East & Africa dominates with 48.9% and US$9.6 Bn due to concentrated deepwater developments and growing FPSO investments.

In 2024, the Middle East & Africa (MEA) region accounted for a dominant share of the FPSO market, representing 48.90% equivalent to approximately US$9.6 billion, as the region’s mature basins and newly sanctioned developments supported strong demand for floating production and storage solutions. This dominance was underpinned by a dense project pipeline in West Africa and persistent upgrade and retrofit activity across Gulf facilities, which together sustained high utilisation of yards and contractor capacity.

Investment was driven by a combination of brownfield life-extension projects and greenfield deepwater discoveries that favoured FPSO deployment where fixed platforms were uneconomic; subsea tiebacks and expanding export corridors reinforced the economics of floating systems.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Petrobras retained a leading role in the FPSO market through extensive Brazilian pre-salt developments and a fleet of operating units. In 2024 the company accelerated deployments and secured environmental approvals for additional Santos and Búzios field projects, enabling phased FPSO start-ups and capacity expansion. Investment focused on combining newbuilds and conversions to balance delivery time and cost. Operational priorities included production optimization, local content in yards, and lifecycle management to extend field value while maintaining regulatory compliance and stakeholder alignment.

Royal Dutch Shell sustained diversified FPSO engagement across West Africa, the North Sea and selected deepwater assets, executing FPSO installations and field tie-backs in 2024. The company pursued emission-reduction measures in new floating assets while progressing project FIDs and topside optimisations. Shell emphasised integrated supply-chain execution, local stakeholder engagement, and modular fabrication to reduce schedule risk. Financial planning balanced near-term production with longer-term energy-transition investments, enabling continued deployment of FPSOs where they delivered commercial and energy-security benefits and operational resilience.

ExxonMobil scaled FPSO activity notably in Guyana, commissioning multiple large FPSOs and acquiring leased units to consolidate field operations in 2024. The company advanced successive Stabroek developments, increasing production capacity and securing long-term reserves via staged FPSO deployments. Project execution emphasised schedule discipline, local employment and acquisition of vessels to reduce lifecycle costs. Capital allocation balanced high-value offshore growth with corporate discipline, while operational priorities targeted production optimisation, topside reliability and integration of associated gas handling to maximise field recovery.

Top Key Players Outlook

- Petrobras

- CNOOC

- Royal Dutch Shell

- Chevron

- ExxonMobil

- BP

- Equinor

- Woodside Energy

- Aker Solutions

- Dana Petroleum Limited

- Vår Energi

Recent Industry Developments

In December 2024, ExxonMobil assumed ownership of Liza Destiny – paying about USD 535 million to acquire it from its previous lessor. Meanwhile, construction is underway on additional FPSOs for upcoming developments aimed at further boosting output in the coming years.

In 2024 Shell reported group-level data (e.g. USD 16.5 billion income, USD 19.6 billion adjusted earnings, 58 million tonnes CO₂e emissions, Net Carbon Intensity 71 gCO₂e/MJ), the continued commissioning of FPSOs underpins its long-term upstream strategy.

Report Scope

Report Features Description Market Value (2024) USD 19.8 Bn Forecast Revenue (2034) USD 58.8 Bn CAGR (2025-2034) 13.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Water Depth (Shallow Water, Deep Water, Ultra-deep Water), By Storage Capacity (Less than 1 MMBBLs, 1-2 MMBBLs, More than 2 MMBBLs), By Construction Type (Converted, New Build), By Hull Type (Single Hull, Double Hull), By Ownership (Operator-owned, Contractor-owned) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Petrobras, CNOOC, Royal Dutch Shell, Chevron, ExxonMobil, BP, Equinor, Woodside Energy, Aker Solutions, Dana Petroleum Limited, Vår Energi Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Petrobras

- CNOOC

- Royal Dutch Shell

- Chevron

- ExxonMobil

- BP

- Equinor

- Woodside Energy

- Aker Solutions

- Dana Petroleum Limited

- Vår Energi