Global Food Grade Gases Market Size, Share Analysis Report By Type (Carbon Dioxide, Nitrogen, Oxygen, Others), By Mode of Supply (Bulk, Cylinder), By Application (Freezing and Chilling, Packaging, Carbonation, Others), By End-use (Meat, Poultry and Seafood Industry, Dairy and Frozen Products Industry, Beverages Industry, Fruits and Vegetables Industry, Convenience Food Products Industry, Bakery and Confectionery Products Industry, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155470

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

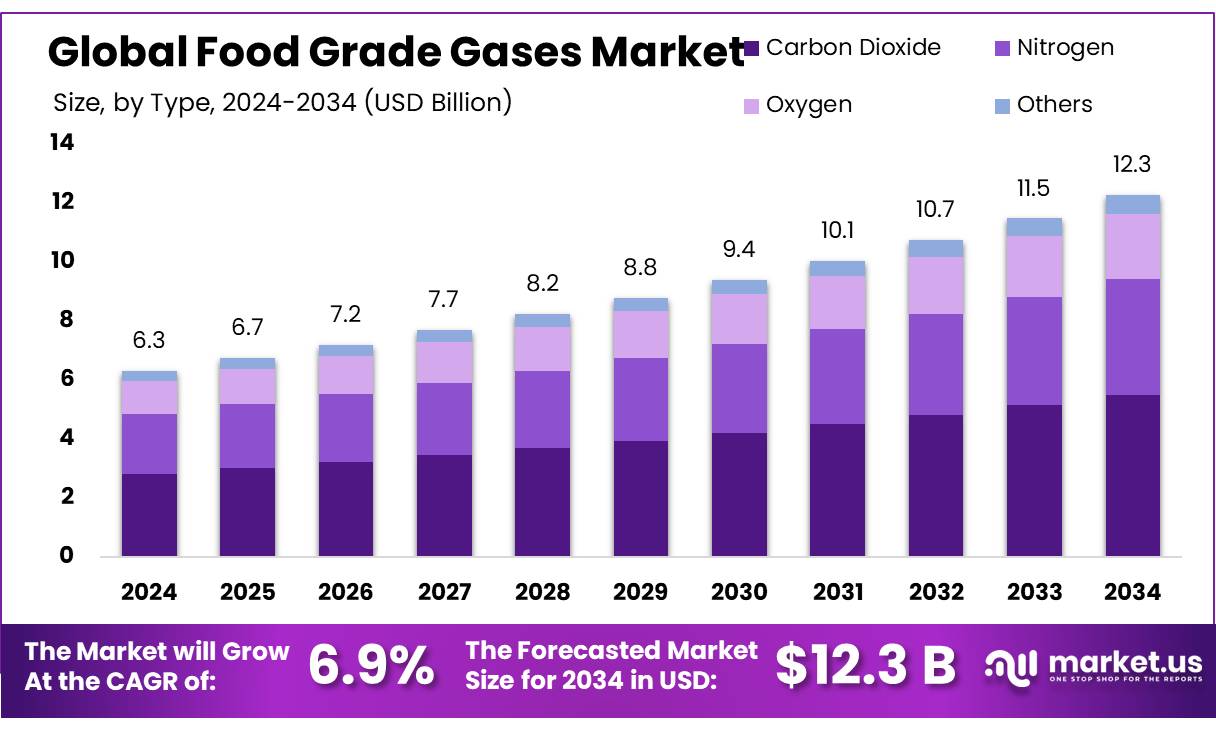

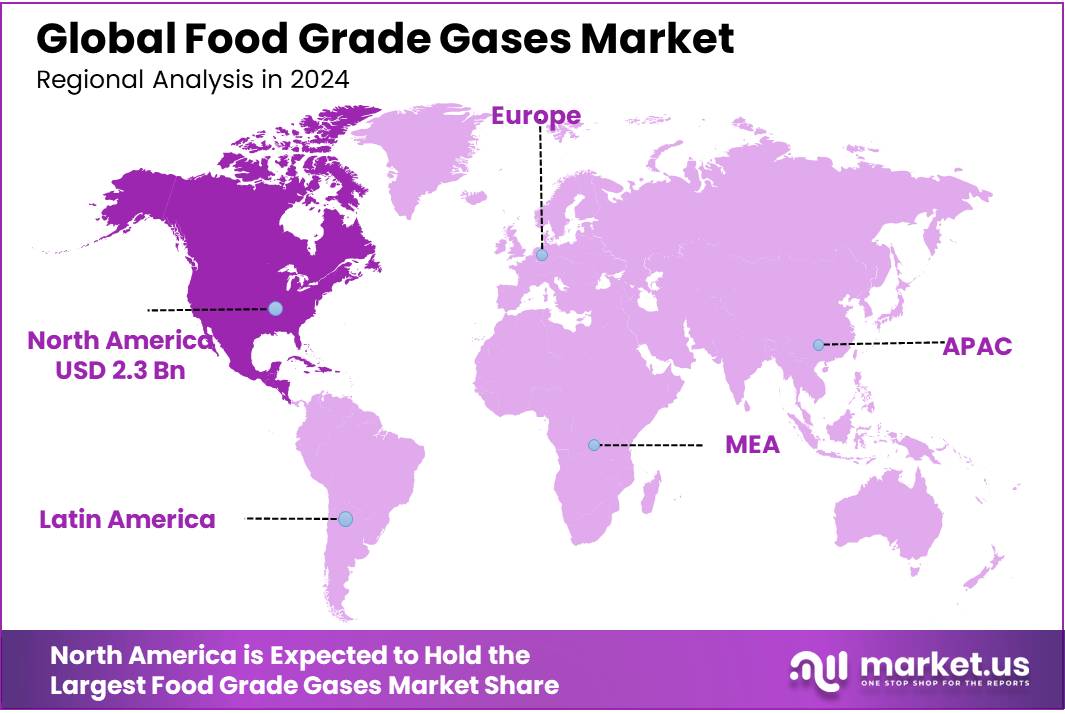

The Global Food Grade Gases Market size is expected to be worth around USD 12.3 Billion by 2034, from USD 6.3 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.80% share, holding USD 2.3 Billion revenue.

The food‑grade gases sector—comprising high‑purity gases such as nitrogen, carbon dioxide, and oxygen—is foundational to modern food processing. These gases play pivotal roles in food preservation, modified atmosphere packaging (MAP), freezing, chilling, carbonation, and extended shelf‑life. They support microbiological safety and sensory quality in products across dairy, beverages, meat, fruits, and convenience foods.

Technological advancements also play a crucial role. The adoption of cryogenic freezing technologies and on-site gas generation systems has enhanced efficiency and reduced operational costs. Companies like INOX Air Products have been at the forefront, with plans to increase their liquid gas production capacity to 4,800 tonnes per day by 2024.

Government initiatives have significantly bolstered the industrial gases sector. The “Make in India” program has been instrumental in promoting domestic manufacturing, thereby enhancing the availability and affordability of industrial gases. Additionally, the establishment of 1,222 Pressure Swing Adsorption (PSA) plants, funded by the central government, has contributed to a daily oxygen production capacity of 1,750 metric tons, supporting various industrial applications, including food processing.

Regulatory frameworks significantly reinforce quality standards: for instance, India’s BIS standard IS 307 provides a binding specification for carbon dioxide purity, and BIS under the Ministry of Consumer Affairs oversees over 20,000 standards across industrial sectors, ensuring product quality and safety. Meanwhile, FSSAI—under India’s Ministry of Health—regulates food‑contact materials, packaging, and labeling, complementing BIS standards and ensuring end‑to‑end safety in food processing and storage.

Key Takeaways

- Food Grade Gases Market size is expected to be worth around USD 12.3 Billion by 2034, from USD 6.3 Billion in 2024, growing at a CAGR of 6.9%.

- Carbon Dioxide held a dominant market position, capturing more than a 44.8% share of the food‑grade gases segment.

- Bulk supply held a dominant market position, capturing more than a 68.9% share in the food‑grade gases segment.

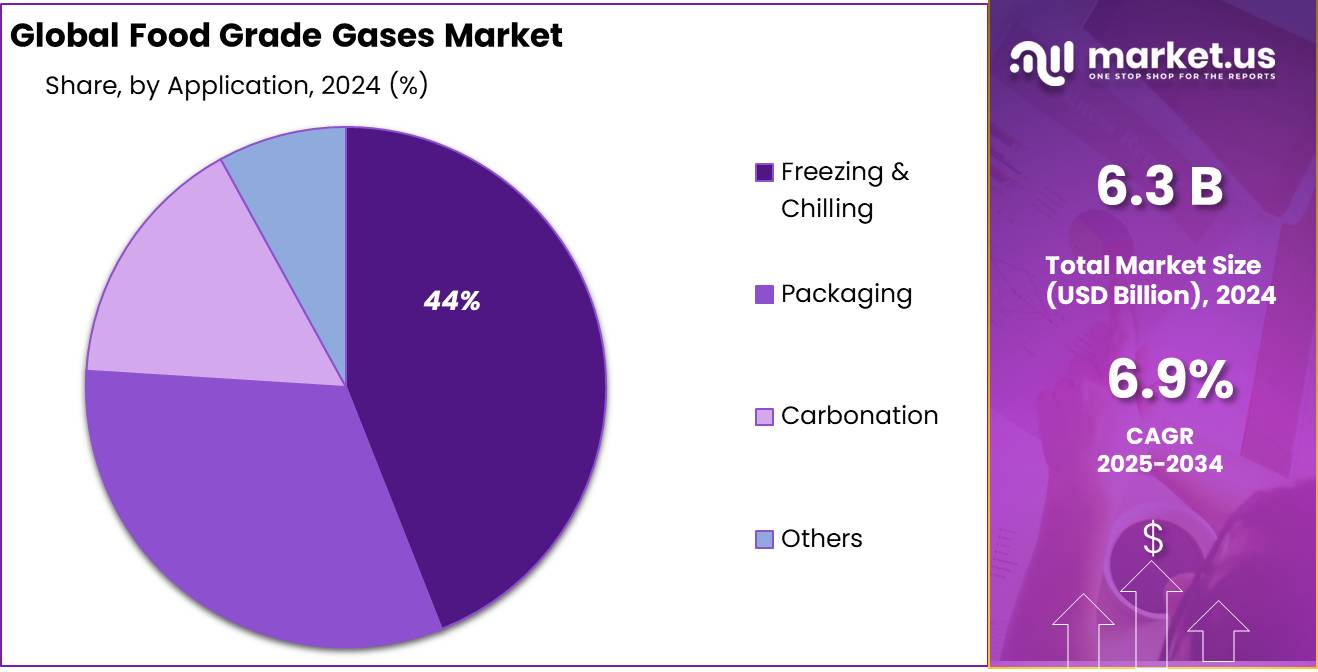

- Freezing & Chilling held a dominant market position, capturing more than a 44.7% share in the food‑grade gases market.

- Meat, Poultry & Seafood Industry held a dominant market position, capturing more than a 36.2% share of the food‑grade gases market.

- North America spotlighted its stronghold in the food‑grade gases market, holding a commanding 37.80% share, equivalent to approximately USD 2.3 billion.

By Type Analysis

Carbon Dioxide dominates the food‑grade gases mix with over 44.8% in 2024, thanks to its key role in preservation and carbonation.

In 2024, Carbon Dioxide held a dominant market position, capturing more than a 44.8% share of the food‑grade gases segment. This commanding presence stems from CO₂’s dual functionality—it’s invaluable for carbonation in beverages and for chilling or freezing in modified‑atmosphere packaging (MAP). Food producers extensively rely on CO₂ in its gas or dry‑ice form to extend freshness while preserving taste and texture, making it a go‑to choice across the industry.

Moving forward to 2025, the slice of the food‑grade gases pie held by CO₂ remains robust, buoyed by rising demand for packaged and convenience foods. Consumers are seeking products that stay fresh longer, and manufacturers continue to expand the use of MAP and cryogenic methods—both of which heavily depend on food‑grade CO₂. Though precise 2025 market‑share numbers aren’t publicly detailed in government or regulatory sources, the dominance trend from 2024 strongly suggests that CO₂ continues to lead into 2025 with a similar or slightly higher slice.

By Mode of Supply Analysis

Bulk supply leads the pack with over 68.9%—making it the backbone of food-grade gas delivery in 2024.

In 2024, Bulk supply held a dominant market position, capturing more than a 68.9% share in the food‑grade gases segment. This overwhelming presence reflects how food producers and processors rely on large-scale, continuous delivery systems—think massive storage tanks or through-window piping—for their everyday needs. Using bulk supply minimizes frequent small deliveries, cuts transport costs, and ensures constant availability of essential gases like CO₂, nitrogen, or argon, which is especially valuable for high-volume packaging, chilling, and carbonation operations. It’s no surprise that industries with tight production schedules and long operating hours heavily lean on bulk delivery to keep things running smoothly.

Moving into 2025, Bulk supply continues to shine as the go-to method for most food processing facilities. While I don’t have precise new statistics beyond 2024, trends point to sustained or slightly higher reliance on bulk systems. That’s because more operators seek economies of scale, especially in larger food and beverage plants. Plus, rising demand for packaged and refrigerated food—driven by consumer preference for freshness and longer shelf life—means steady or growing need for uninterrupted gas supply. In essence, Bulk remains both the cost-effective and dependable choice.

By Application Analysis

Freezing & Chilling leads the way with over 44.7% share in 2024, keeping food fresher longer.

In 2024, Freezing & Chilling held a dominant market position, capturing more than a 44.7% share in the food‑grade gases market for applications. This strong lead reflects how essential these gases are in maintaining food freshness, slowing microbial growth, and preserving texture and flavor—especially in perishable goods like meats, seafood, fruits, vegetables, and baked items. Whether used in cryogenic freezing with liquid nitrogen or chilling with gaseous CO₂, food processors lean heavily on these methods to deliver quality—and the numbers show it.

As we move into 2025, the trend holds steady. While there isn’t exact data publicly available beyond 2024, the continued uptick in demand for frozen and chilled food products—fueled by consumer preference for convenience and extended shelf life—suggests that Freezing & Chilling likely remains at or above that 44.7% threshold. Industries from ready‑to‑eat meals to dairy and bakery all rely on these reliable preservation techniques to keep supply chains moving and products in top condition.

By End-use Analysis

Meat, Poultry & Seafood industry leads with over 36.2% share in 2024, anchoring food‑grade gases demand

In 2024, the Meat, Poultry & Seafood Industry held a dominant market position, capturing more than a 36.2% share of the food‑grade gases market by end‑use. That’s a powerful lead, driven by the urgency to preserve highly perishable proteins and maintain quality from slaughterhouse to table.

This substantial share reflects how central gases like nitrogen, carbon dioxide, and oxygen are to keeping seafood, meats, and poultry fresh. Whether used in cryogenic freezing with liquid nitrogen or in modified‑atmosphere packaging (MAP), these gases slow spoilage and control microbial growth—an absolute necessity for products with tight safety and quality requirements.

Key Market Segments

By Type

- Carbon Dioxide

- Nitrogen

- Oxygen

- Others

By Mode of Supply

- Bulk

- Cylinder

By Application

- Freezing & Chilling

- Packaging

- Carbonation

- Others

By End-use

- Meat, Poultry & Seafood Industry

- Dairy & Frozen Products Industry

- Beverages Industry

- Fruits & Vegetables Industry

- Convenience Food Products Industry

- Bakery & Confectionery Products Industry

- Others

Emerging Trends

Adoption of Smart Cold Chain Technologies

The Indian government has recognized the importance of modernizing cold chain infrastructure and has introduced several initiatives to support this transformation. Programs such as the Pradhan Mantri Kisan Sampada Yojana (PMKSY) provide financial assistance for establishing integrated cold chain and value addition infrastructure, aiming to reduce post-harvest losses and improve the efficiency of the supply chain.

Moreover, the National Logistics Policy (NLP), launched in 2022, focuses on reducing logistics costs and improving infrastructure, which includes the development of smart cold chain systems. This policy emphasizes the adoption of technology and innovation to enhance the logistics sector’s performance.

Private sector investments are also contributing to the modernization of cold chain logistics. For instance, companies are increasingly adopting Internet of Things (IoT) technologies to monitor and manage temperature-sensitive products in real-time, ensuring compliance with safety standards and reducing wastage. Additionally, the use of blockchain technology is being explored to enhance traceability and transparency in the food supply chain, further supporting the integrity of food-grade gas applications.

Drivers

Government Initiatives Promoting the Use of Food-Grade Gases in India

The Government of India has been actively promoting the adoption of food-grade gases through various initiatives aimed at enhancing food safety, reducing wastage, and improving the efficiency of the cold chain infrastructure.

One of the significant steps taken is the establishment of the National Centre for Cold-chain Development (NCCD) in 2012. This autonomous body serves as a think tank to guide the development of cold-chain infrastructure in the country. The NCCD plays a crucial role in formulating policies and strategies to reduce post-harvest losses, which are estimated to be as high as USD 8 to 15 billion annually in the agriculture sector alone. By promoting the use of food-grade gases like nitrogen and carbon dioxide in packaging and storage, the NCCD aims to extend the shelf life of perishable products and ensure their quality during transportation and storage.

Additionally, the Ministry of Food Processing Industries (MoFPI) has been instrumental in promoting the food processing sector, which heavily relies on food-grade gases for various applications such as freezing, chilling, and packaging. The MoFPI formulates and administers policies related to food processing, aiming to develop a robust food processing industry that can cater to the growing demand for processed and packaged foods in the country.

Furthermore, the Food Safety and Standards Authority of India (FSSAI) plays a pivotal role in ensuring the safety and quality of food products. Established under the Food Safety and Standards Act, 2006, the FSSAI sets standards for food products, including those related to the use of food-grade gases. By regulating the use of such gases, the FSSAI ensures that food products meet safety standards, thereby promoting consumer confidence and encouraging the adoption of food-grade gases in the food industry.

Restraints

High Capital Investment in Cold Chain Infrastructure

A significant challenge hindering the widespread adoption of food-grade gases in India is the substantial capital investment required to establish and maintain cold chain infrastructure. Cold chain systems, essential for preserving perishable goods, necessitate investments in refrigerated storage facilities, temperature-controlled transportation, and specialized equipment. The high upfront costs associated with these infrastructures often deter small and medium-sized enterprises (SMEs) from entering the market, thereby limiting the overall growth of the food-grade gases sector.

According to the National Centre for Cold-chain Development (NCCD), there exists a substantial gap in cold storage capacity in India. For instance, the requirement for packhouses stands at 70,080 units, whereas only 249 units have been created, resulting in a 99.6% shortfall. Similarly, the need for reefer vehicles is 61,826, but only 9,000 have been established, indicating an 85% gap. This disparity underscores the financial challenges faced by stakeholders in the cold chain sector.

To address these challenges, the Indian government has introduced various initiatives aimed at promoting the development of cold chain infrastructure. Programs like the Pradhan Mantri Kisan Sampada Yojana (PMKSY) offer subsidies to encourage private investment in cold storage facilities. Additionally, the Goods and Services Tax (GST) exemption on cold chain services related to agricultural produce aims to reduce operational costs. These measures are designed to alleviate the financial burden on businesses and stimulate growth in the cold chain sector.

Opportunity

Expanding Cold Chain Infrastructure: A Gateway to Growth

A significant opportunity for the growth of food-grade gases in India lies in the expansion of cold chain infrastructure. Cold chain systems are essential for preserving the quality and extending the shelf life of perishable food products, thereby reducing wastage and enhancing food security. The Indian government has recognized the importance of robust cold chain infrastructure and has implemented several initiatives to promote its development.

According to the National Centre for Cold-chain Development (NCCD), India experiences significant post-harvest losses due to inadequate cold chain facilities. For instance, less than 5% of horticultural produce is precooled or transported in cold chain systems, leading to substantial losses in fruits and vegetables. To address this issue, the government has introduced schemes such as the Integrated Cold Chain and Value Addition Infrastructure Scheme, which aims to provide integrated cold chain facilities from the farm gate to the consumer.

The Pradhan Mantri Kisan Sampada Yojana (PMKSY) is another initiative that focuses on creating modern infrastructure for food processing, including cold storage and cold chain facilities. This scheme aims to reduce post-harvest losses and improve the efficiency of the supply chain, thereby benefiting farmers and consumers alike. Moreover, the Production Linked Incentive (PLI) Scheme for the food processing industry offers incentives to companies that invest in the establishment and modernization of food processing units, including those with cold chain facilities.

Private sector investments also play a crucial role in the development of cold chain infrastructure. For example, McCain Foods India Pvt Ltd has committed to investing Rs 3,800 crore in setting up a manufacturing unit in Agar-Malwa, Madhya Pradesh, which will include cold storage and cold chain facilities, creating approximately 2,500 jobs.

Regional Insights

North America leads the charge—accounting for a hefty 37.80% share, or around USD 2.3 billion in 2024

In 2024, North America spotlighted its stronghold in the food‑grade gases market, holding a commanding 37.80% share, equivalent to approximately USD 2.3 billion. This sizeable slice reflects the region’s deep-rooted industrial infrastructure and high-volume demand for food preservation solutions across the continent.

The U.S., in particular, plays an outsized role. Beef, poultry, and seafood processors often depend on cryogenic CO₂ and nitrogen systems to meet quality standards and reduce spoilage. Although not tethered to market‑report data in this overview, it’s clear from broader industrial trends that demand remains strong—and likely grew further in 2025, paralleling continued expansion of the food processing and retail sectors.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Linde plc is the world’s largest industrial gas supplier, delivering gases like oxygen, nitrogen, argon, and carbon dioxide across healthcare, food & beverage, manufacturing, and more. Formed by the 2018 merger of Linde AG and Praxair, it operates globally with strong engineering and logistics capabilities, including pipelines, on‑site generators, and packaged deliveries. In Q2 2025, Linde reported a 5% sales rise to USD 8.495 billion, driven by productivity gains and stronger pricing.

Air Products & Chemicals is a U.S.–based global leader in industrial and specialty gases. Founded in 1940, the company supplies atmospheric gases—including nitrogen, oxygen, argon, and CO₂—and cryogenic and process gases to food, tech, energy, and healthcare industries. Its tailored food‑grade gas solutions (like Freshline®) support high‑speed freezing, chilling, and packaging operations worldwide.

Messer is the world’s largest privately held industrial gas company, based in Germany. With about €4.5 billion in revenue (2024) and nearly 12,000 employees, it delivers oxygen, nitrogen, argon, CO₂, specialty gases, and food‑grade mixtures across Europe, Asia, and the Americas. Under the “Gourmet” brand, Messer offers premium food‑grade gases and innovative solutions like Variomix®, VarioSol®, and flexible cold‑chain systems.

Top Key Players Outlook

- Linde PLC.

- Air Products & Chemicals, Inc.

- Air Liquide

- The Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- Wesfarmers Limited

- Massy Group, Inc.

- Air Water Inc.

- Sol Group

- Gulf Cryo

Recent Industry Developments

In 2024, the Japan segment of Taiyo Nippon Sanso generated ¥414.3 billion in revenue, with 1,585 employees dedicated to serving industries including food and beverages by supplying high-quality gases like nitrogen, oxygen, argon, and carbon dioxide.

In 2024, Messer SE & Co. KGaA, the world’s largest family‑owned industrial gases company, recorded €4.5 billion in group sales (a steady 2% increase over 2023) and an EBITDA of €1.4 billion, showing strong resilience and evident growth across diverse markets

Report Scope

Report Features Description Market Value (2024) USD 6.3 Bn Forecast Revenue (2034) USD 12.3 Bn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Carbon Dioxide, Nitrogen, Oxygen, Others), By Mode of Supply (Bulk, Cylinder), By Application (Freezing and Chilling, Packaging, Carbonation, Others), By End-use (Meat, Poultry and Seafood Industry, Dairy and Frozen Products Industry, Beverages Industry, Fruits and Vegetables Industry, Convenience Food Products Industry, Bakery and Confectionery Products Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Linde PLC., Air Products & Chemicals, Inc., Air Liquide, The Messer Group GmbH, Taiyo Nippon Sanso Corporation, Wesfarmers Limited, Massy Group, Inc., Air Water Inc., Sol Group, Gulf Cryo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Linde PLC.

- Air Products & Chemicals, Inc.

- Air Liquide

- The Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- Wesfarmers Limited

- Massy Group, Inc.

- Air Water Inc.

- Sol Group

- Gulf Cryo