Global Food Binders Market Size, Share, And Enhanced Productivity By Source (Plant Based, Animal Based), By Nature (Natural Binder, Synthetic Binder), By Form (Powder, Liquid, Granule), By Product Type (Starch, Gum, Protein), By Application (Bakery and Confectionery, Meat Analogues Products, Dairy and Frozen Desserts), By End-user Industry (Food and Beverage, HoReCa, Retail and Household), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177350

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Source Analysis

- By Nature Analysis

- By Form Analysis

- By Product Type Analysis

- By Application Analysis

- By End-user Industry Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

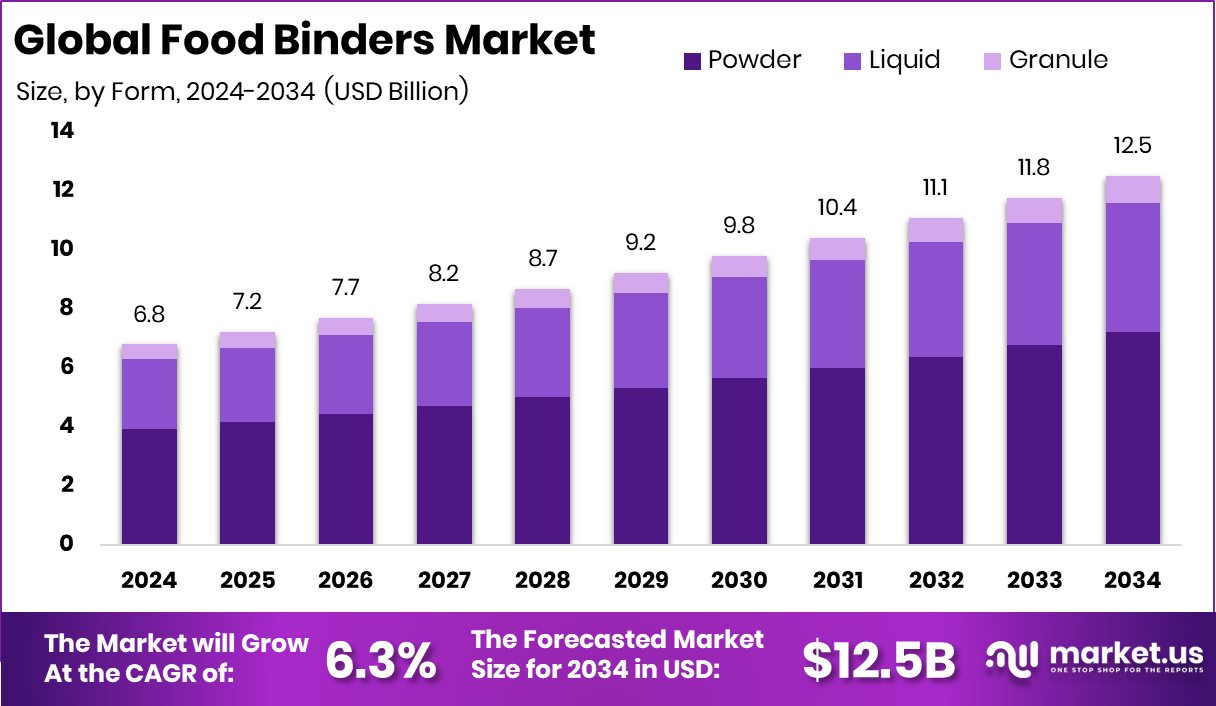

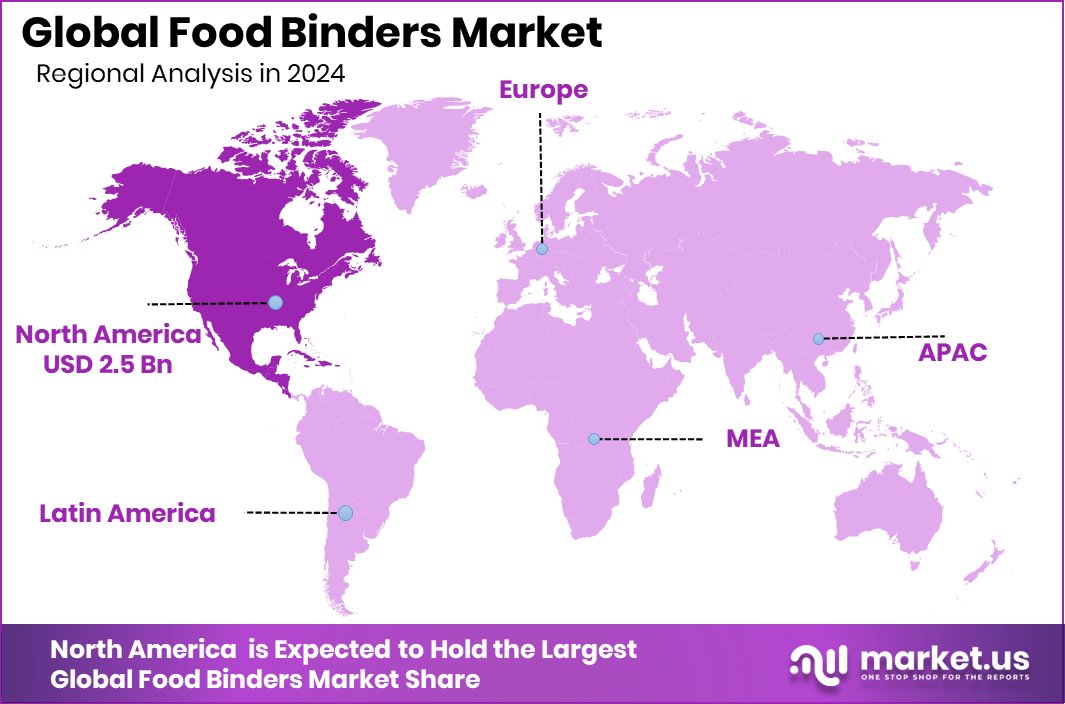

The Global Food Binders Market is expected to be worth around USD 12.5 billion by 2034, up from USD 6.8 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. In North America, the Food Binders Market reached 37.9% and USD 2.5 Bn.

Food binders are functional ingredients used to hold food components together, improve texture, enhance moisture retention, and stabilize product structure. They are widely used in bakery, confectionery, dairy, meat analogues, beverages, and household preparations. The Food Binders Market refers to the commercial ecosystem that produces, supplies, and innovates binders such as starches, gums, and proteins across powder, liquid, and granular formats for food and HoReCa industries.

Growth in this market is driven by rising demand for clean-label, plant-based, and natural binder options across global food manufacturing. Increasing investments in innovative binding proteins further expand opportunities, supported by major funding rounds such as Bactolife securing over €30m, raising $35m Series B, and landing US$33m to commercialize next-generation gut-friendly binding proteins.

Market demand is also strengthened by expanding food processing capacity and regional ingredient production. Long-term growth prospects are supported by strategic investments such as the €200 million funding into Casalasco, the $55 million round raised by The EVERY Co., and $9.9m funding for Yeastup, enabling new functional protein development.

Additional opportunities come from digital food platforms and sustainable supply chains, highlighted by The Modern Milkman’s $60m raise, demonstrating continued investor confidence in food innovation. Together, these developments create a strong pathway for advanced binder technologies and wider market adoption across global food sectors.

Key Takeaways

- The Global Food Binders Market is expected to be worth around USD 12.5 billion by 2034, up from USD 6.8 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- In the Food Binders Market, plant-based sources lead with 69.2%, driven by clean-label demand.

- Natural binder dominance in the Food Binders Market reaches 78.8%, supported by rising health-focused formulations.

- Powder form holds 57.6% share in the Food Binders Market due to enhanced processing flexibility.

- Starch remains essential in the Food Binders Market, securing 49.1% through broad food industry applications.

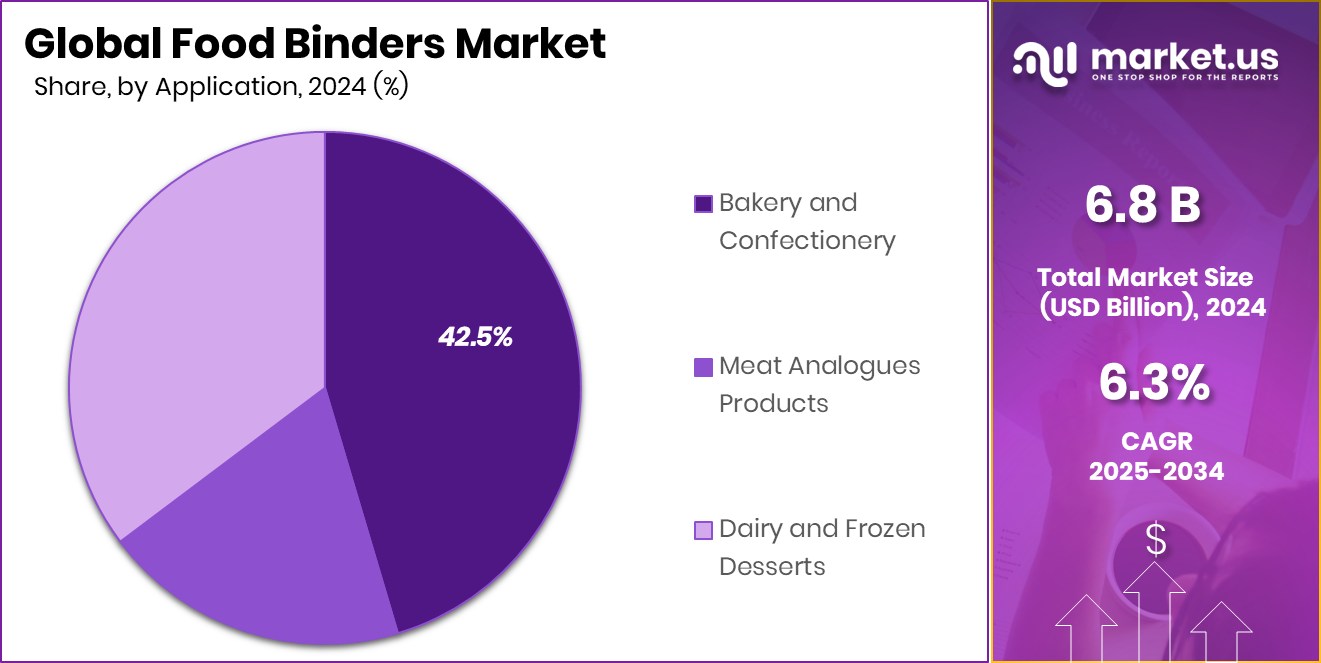

- Bakery and confectionery applications drive 42.5% of the Food Binders Market through consistent usage expansion.

- The Food and Beverage sector contributes 74.4% to the Food Binders Market, sustaining overall category growth.

- North America leads the Food Binders Market with 37.9% and USD 2.5 Bn revenue.

By Source Analysis

The Food Binders Market grows steadily as plant-based binders gain strong adoption.

In 2024, the Food Binders Market saw strong momentum for plant-based sources, which dominated the segment with a 69.2% share. This shift reflected rising consumer interest in clean-label and minimally processed food ingredients. Manufacturers increasingly preferred plant-derived binders such as guar gum, pectin, and starches due to their functional versatility and regulatory acceptance.

Food producers used these ingredients to enhance texture, moisture retention, and stability across bakery, snacks, confectionery, and ready meals. Additionally, plant-based binders aligned well with vegan and vegetarian product expansion, encouraging broader adoption across global food companies. As sustainability commitments increased, plant-based binder sourcing improved supply chain transparency, making this category a central driver in the overall Food Binders Market during the year.

By Nature Analysis

Rising demand boosts the Food Binders Market, especially within natural binder categories worldwide.

In 2024, natural binders dominated the Food Binders Market with an impressive 78.8% share, driven by growing demand for chemical-free and label-friendly ingredients. Food manufacturers favored naturally derived binders such as starches, gums, gelatin alternatives, and plant fibers to meet evolving consumer expectations for healthier, additive-free formulations.

Clean-label product launches significantly increased across bakery, sauces, processed meat, confectionery, and dairy replacements, strengthening the position of natural binders. Their ability to improve viscosity, binding strength, and product stability helped brands maintain quality without relying on synthetic additives. This trend also aligned with regulatory pressure to reduce artificial components in packaged foods, making natural binders an essential choice for both premium and mass-market food categories.

By Form Analysis

Powder formulations dominate the Food Binders Market, driven by longer shelf life advantages.

In 2024, powder-based binders captured a leading 57.6% share of the Food Binders Market, reflecting their superior shelf stability and ease of incorporation into industrial formulations. Food processors valued powdered binders for their consistent performance, simplified storage, and long-term usability across large-scale production lines. These powdered ingredients offered better dispersion and compatibility with high-speed manufacturing systems used in bakery mixes, beverage powders, confectionery coatings, and processed foods. Their ability to retain functionality during thermal processing made them ideal for diverse applications.

Rising demand for ready-to-cook and ready-to-eat products further strengthened the preference for powdered binders, as they enable uniform texture and structural integrity throughout distribution and consumer preparation.

By Product Type Analysis

Starch-based solutions strengthen the Food Binders Market, supporting clean-label product development globally.

In 2024, starch emerged as the dominant product type in the Food Binders Market, accounting for 49.1% of the total share. Its widespread use across bakery, sauces, meat systems, dairy analogs, and confectionery made it one of the most versatile binding ingredients. Food manufacturers relied on starch for its strong thickening capacity, moisture control, and texture enhancement, especially in cost-sensitive product categories.

Modified starches also gained popularity for their improved heat and shear stability, supporting advanced processing needs. The continued shift toward plant-based and allergen-free ingredients further strengthened starch demand, particularly from corn, potato, tapioca, and rice sources. As global food sectors expanded convenience-oriented offerings, starch maintained a strategic role in product optimization.

By Application Analysis

Bakery and confectionery applications fuel the Food Binders Market through consistent industrial usage.

In 2024, the bakery and confectionery sector led Food Binders Market applications with a 42.5% share, driven by rising consumption of baked goods, pastries, candies, and premium confectionery items. Binders played a critical role in improving dough elasticity, crumb structure, moisture retention, and overall product consistency. As global manufacturers increased production of gluten-free and clean-label bakery lines, demand for high-function binders such as starches, hydrocolloids, and fibers grew sharply.

Confectionery producers also use binders to stabilize fillings, enhance chewiness, and support extended shelf life in chocolates and gummies. Innovation in artisanal-style and indulgent bakery formats further strengthened the market need for efficient binding solutions in both mass-market and specialty food segments.

By End-user Industry Analysis

The Food and beverage industries significantly expand the Food Binders Market every year.

In 2024, the food and beverage industry remained the primary end-user of the Food Binders Market, holding a commanding 74.4% share. The growing production of processed foods, plant-based alternatives, bakery products, and packaged snacks significantly increased the reliance on functional binders. Food companies sought ingredients that could enhance stability, maintain texture during distribution, and ensure high-quality sensory experiences for consumers.

Binders also played a major role in fortifying new product development across dairy substitutes, protein-rich foods, and low-sugar formulations. As manufacturers expanded investments in reformulation and clean-label initiatives, binder usage continued to rise across both established and emerging food categories, reinforcing its importance in modern food processing operations.

Key Market Segments

By Source

- Plant Based

- Animal Based

By Nature

- Natural Binder

- Synthetic Binder

By Form

- Powder

- Liquid

- Granule

By Product Type

- Starch

- Gum

- Protein

By Application

- Bakery and Confectionery

- Meat Analogues Products

- Dairy and Frozen Desserts

By End-user Industry

- Food and Beverage

- HoReCa

- Retail and Household

Driving Factors

Rising demand for clean-label ingredients

The Food Binders Market continues to expand as consumers increasingly seek clean-label, transparent, and minimally processed food products. Rising preference for plant-based ingredients, starches, gums, and protein binders has encouraged manufacturers to upgrade formulations to match evolving expectations. This demand aligns with ongoing developments in the frozen dessert and bakery space, where ingredient quality matters for texture, stability, and product authenticity.

Supporting this momentum, Doughlicious gained a $5 million funding boost to enhance its range, reflecting investor confidence in clean-label innovation. Such funding activities strengthen market growth because companies can invest in new formulations, improve production capabilities, and develop binders that comply with natural standards while offering functional performance needed across modern food categories.

Restraining Factors

Higher costs limit mass adoption

Despite steady market expansion, the Food Binders Market faces challenges due to higher costs associated with natural, plant-based, or specialty functional binders. Many processors struggle to balance pricing with performance when replacing synthetic alternatives, especially in cost-sensitive food categories. These financial pressures limit rapid adoption across small and mid-scale manufacturers. Additionally, global companies are investing heavily in environmental improvements rather than solely ingredient upgrades.

For example, Mars unveiled progress in its emissions-reduction programs while launching a $250 million green investment fund, shifting focus toward sustainability commitments. While these investments are positive for the broader food ecosystem, they can temporarily divert budgets away from innovation in binder technologies, slowing mass transition to advanced or cleaner binder systems.

Growth Opportunity

Expansion in protein-rich formulations

The growth of protein-rich foods, confectionery innovation, and nutritionally enhanced snacks is creating strong opportunities for advanced food binders. Manufacturers increasingly require protein-compatible binders that improve structure, chewiness, and moisture balance in high-protein bars, candies, dairy alternatives, and fortified frozen desserts. Supporting this trend, Turkiye’s Kervan Gida secured a €40 million sustainability loan to strengthen modern confectionery production.

In another noteworthy success, an entrepreneur who once spent $3,500 launching a small popsicle business now oversees operations generating $63 million a year, showing the scale achievable in value-added frozen treats. These developments highlight how innovative formulations and consumer interest in high-protein, functional foods are opening new spaces for binders designed for better stability and performance.

Latest Trends

Rapid shift toward natural binders

Natural binder adoption is accelerating as consumers place greater value on authenticity, clean labels, and recognizable ingredients in daily food consumption. Brands are reformulating to remove synthetic additives while enhancing product stability through starches, gums, and plant proteins. This shift is visible in the frozen dessert and premium snacking sector, supported by fresh investments and brand expansions. Doughlicious recently secured €4.3 million to drive its global frozen dessert growth, showcasing increasing market attention toward natural ingredient-focused brands

. In addition, an Alexandria frozen custard shop received a $50,000 historic preservation grant, reflecting community-supported food innovation. These activities reinforce how natural binder demand is shaping new product launches, improved textures, and cleaner ingredient lists across multiple food categories.

Regional Analysis

The Food Binders Market in North America holds 37.9%, valued at USD 2.5 Bn.

In the Food Binders Market, North America emerged as the leading region in 2024, holding a dominant 37.9% share and reaching a market value of USD 2.5 Bn. This leadership reflects strong demand for processed foods, bakery products, and clean-label formulations across the U.S. and Canada.

Europe followed with steady adoption driven by its mature food manufacturing base and rising preference for natural and plant-derived binders, supporting broader applications in bakery, confectionery, and ready meals. The Asia Pacific region demonstrated rapid expansion as large-scale food production and changing consumption patterns increased the use of binders in packaged foods and confectionery.

Meanwhile, the Middle East & Africa region showed gradual growth, supported by expanding food processing activities and rising reliance on imported formulations. Latin America continued to develop consistently, with growing interest in bakery and confectionery products strengthening the demand for functional binders.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill focused on ingredient diversification, especially within starches and plant-based binding solutions, supporting manufacturers seeking reliable functionality in bakery, confectionery, and processed food systems. Its wide operational footprint allowed the company to meet rising demand for clean-label and stable binders across multiple regions.

ADM strengthened its position through advancements in texture-modifying ingredients designed to meet evolving consumer expectations for healthier, better-formulated packaged foods. The company emphasized natural and plant-derived binders tailored for beverages, bakery items, and alternative protein products. ADM’s broad ingredient portfolio supported customers aiming to balance performance with simplified labeling, reinforcing its strategic role in the segment.

Ingredion Incorporated played a critical role by expanding its specialty starch offerings and enhancing performance-based solutions for viscosity control, stability, and moisture management. Its focus on plant-based and functional binding systems positioned the company strongly within applications such as bakery, dairy alternatives, and snacks. In 2024, all three companies contributed significantly to improving binder quality, sustainability alignment, and operational efficiency within the global Food Binders Market.

Top Key Players in the Market

- Cargill, Inc.

- Archer Daniels Midland (ADM)

- Ingredion Incorporated

- Tate & Lyle PLC

- IFF (International Flavors & Fragrances)

- Kerry Group plc

- DSM-Firmenich

- Avebe

- Beneo GmbH

- Ashland Inc.

Recent Developments

- In September 2024, ADM agreed to acquire a multi-seed and corn germ crush facility in Hungary. This move added non-GM processing capabilities that help ADM produce more diversified ingredients used in food and feed applications, including starches and binder materials. The acquisition strengthened ADM’s ability to supply functional food-grade raw materials across Europe.

- In August 2024, Cargill opened a new blending facility in Pandaan, East Java, to better serve customers with starches, sweeteners, and texturizers used in sugar confectionery and other foods. This facility improves Cargill’s ability to supply food makers in the Asia Pacific region with more consistent and functional ingredient blends.

Report Scope

Report Features Description Market Value (2024) USD 6.8 Billion Forecast Revenue (2034) USD 12.5 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant Based, Animal Based), By Nature (Natural Binder, Synthetic Binder), By Form (Powder, Liquid, Granule), By Product Type (Starch, Gum, Protein), By Application (Bakery and Confectionery, Meat Analogues Products, Dairy and Frozen Desserts), By End-user Industry (Food and Beverage, HoReCa, Retail and Household) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Inc., Archer Daniels Midland (ADM), Ingredion Incorporated, Tate & Lyle PLC, IFF (International Flavors & Fragrances), Kerry Group plc, DSM-Firmenich, Avebe, Beneo GmbH, Ashland Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill, Inc.

- Archer Daniels Midland (ADM)

- Ingredion Incorporated

- Tate & Lyle PLC

- IFF (International Flavors & Fragrances)

- Kerry Group plc

- DSM-Firmenich

- Avebe

- Beneo GmbH

- Ashland Inc.