Global Food-Based Essence Market Size, Share, And Enhanced Productivity By Source (Fruit-Based Essences (Apple, Grape, Banana, Others), Vegetable-Based Essences (Cucumber, Tomato, Celery, Others)), By Form (Liquid, Powder), By Application (Beverages, Bakery and Confectionery, Dairy and Frozen Desserts, Savory and Snacks, Processed and Convenience Foods, Specialty and Functional Nutrition, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176140

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

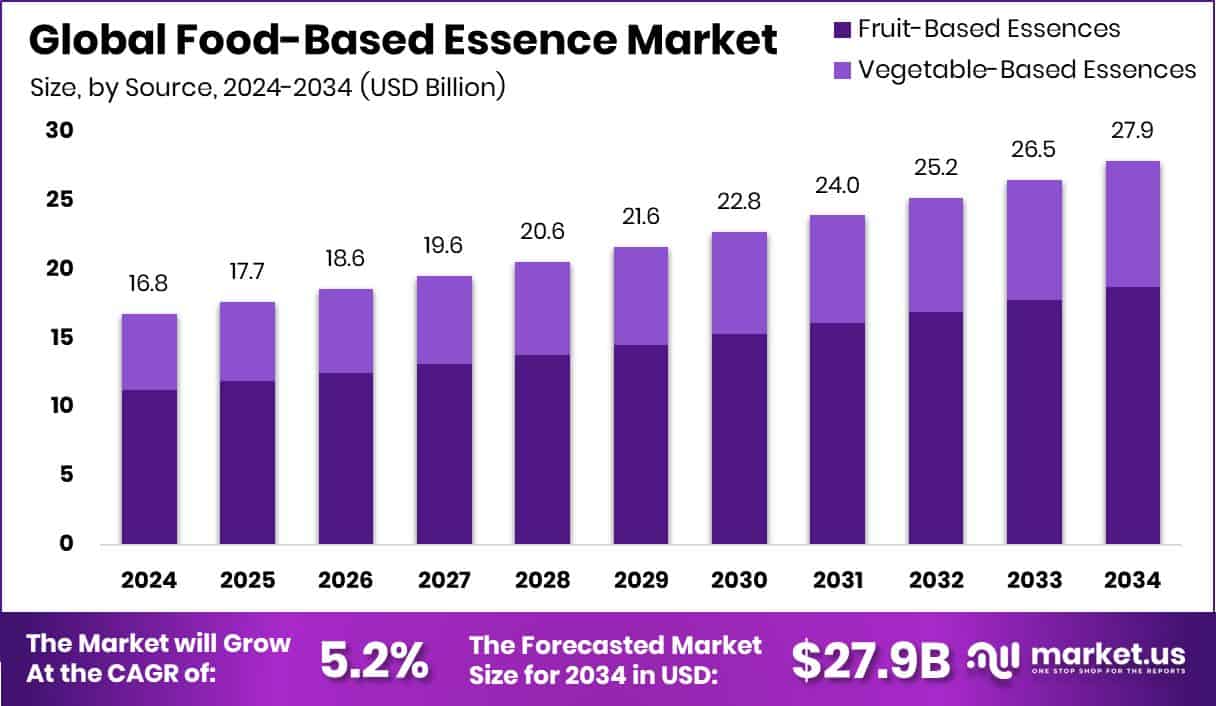

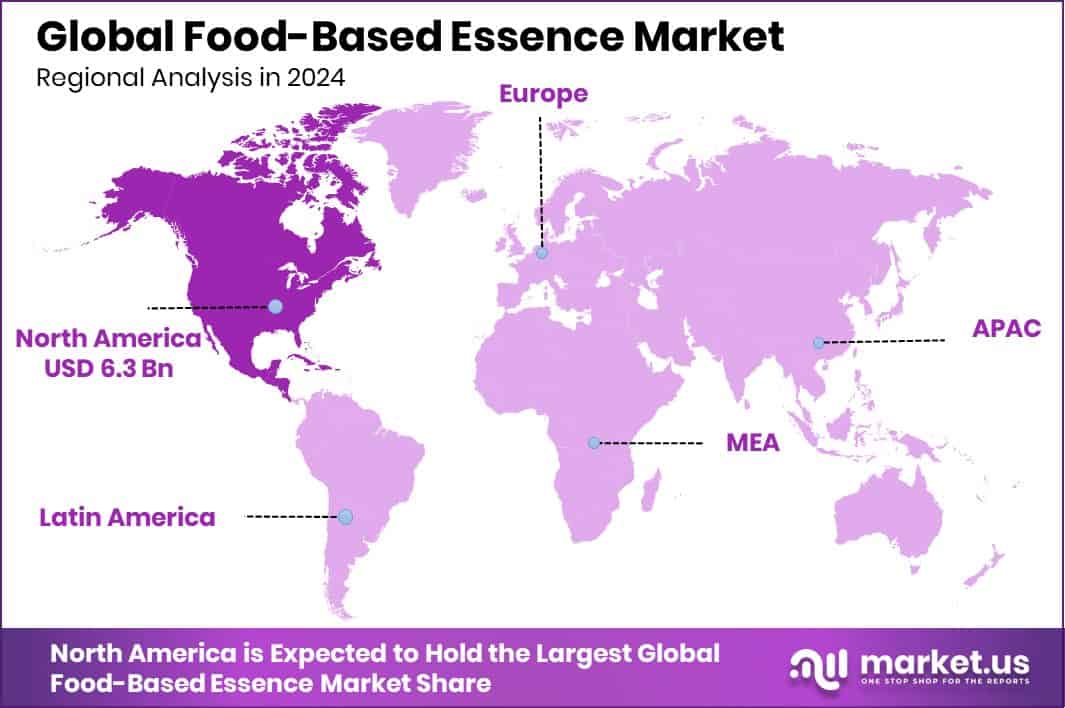

The Global Food-Based Essence Market is expected to be worth around USD 27.9 billion by 2034, up from USD 16.8 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. The region North America secured 37.5%, totaling USD 6.3 Bn market value.

The Global Food-Based Essence Market centers on concentrated flavor extracts derived from fruits, vegetables, herbs, and other natural ingredients. These essences capture the true aroma and taste of raw materials such as apple, grape, cucumber, tomato, and many others. Food-based essences are widely used across beverages, bakery, dairy, snacks, and specialty nutrition products to enhance flavor without synthetic additives. As consumers look for cleaner, more natural ingredient labels, these essences have become essential in modern food formulation. The market represents the commercial ecosystem of producing, processing, and supplying these concentrated flavor solutions in liquid and powder forms.

Demand for food-based essences continues to grow as people increasingly prefer natural taste profiles and plant-derived ingredients. Rising interest in flavored beverages, premium bakery items, and nutrient-rich functional foods plays a major role in expanding adoption. The shift toward healthier and minimally processed products has also boosted the requirement for fruit-based and vegetable-based essences across global food manufacturing.

Several growth factors support this market’s momentum. Consumer awareness around authentic taste, sustainable sourcing, and clean-label nutrition encourages wider use of natural essences in packaged foods. At the same time, evolving eating habits and experimentation with new flavors add fresh opportunities for developers to introduce region-specific and fusion taste profiles.

Opportunities are also expanding through funding activities that strengthen innovation in natural ingredients. True Essence secured $5.25 million in Series A2 funding to advance flavor technology, while The Black Farmer Fund raised $11 million to support agricultural development. Platforms addressing food insecurity, such as Goodr, raised $8 million, and Brightseed obtained $27 million to explore phytonutrients—each contributing to a broader environment of innovation that indirectly supports progress within the food-based ecosystem.

Key Takeaways

- The Global Food-Based Essence Market is expected to be worth around USD 27.9 billion by 2034, up from USD 16.8 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- Fruit-based essences hold a strong 67.2% share, shaping overall Food-Based Essence Market demand globally.

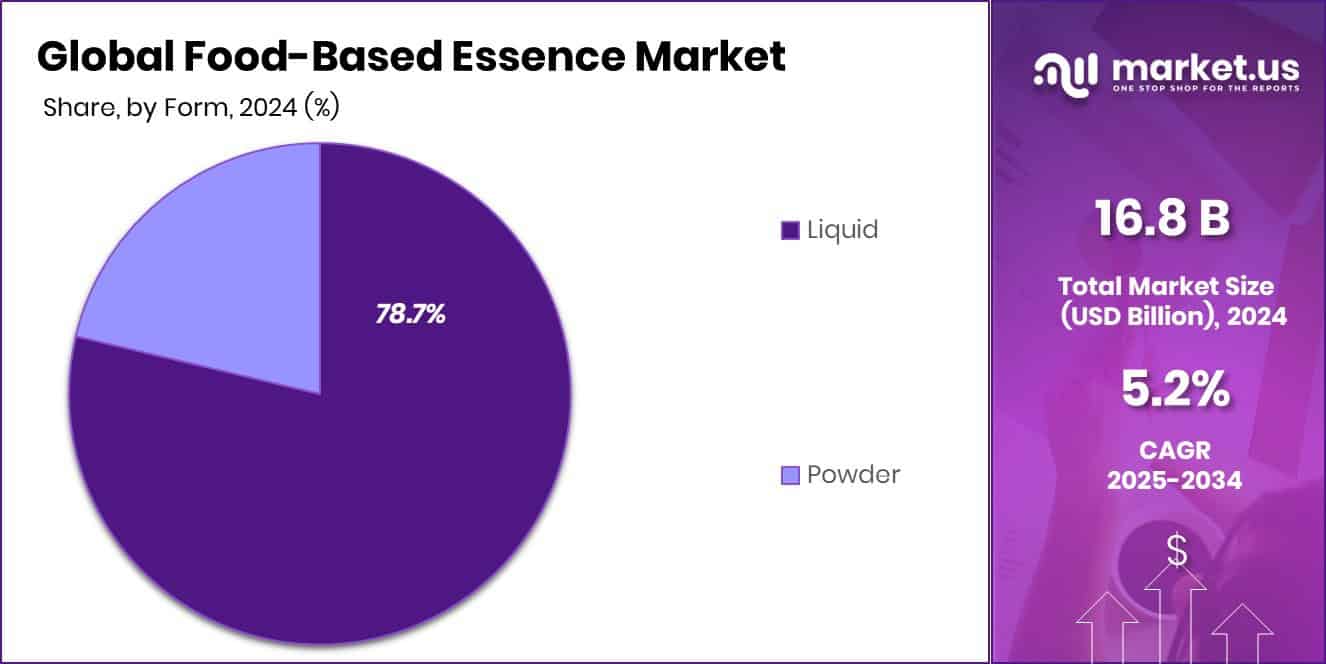

- Liquid forms dominate the Food-Based Essence Market with 78.7% adoption due to easy blending applications.

- Beverages account for 39.9% usage, making them the largest application segment in the Food-Based Essence Market.

- In North America, the Food-Based Essence Market achieved 37.5% and USD 6.3 Bn.

By Source Analysis

Fruit-based essences dominate the Food-Based Essence Market with 67.2% share today.

In 2024, the Food-Based Essence Market was strongly led by Fruit-Based Essences, capturing a dominant 67.2% share. Their wide acceptance in food, beverages, bakery items, and nutraceutical formulations reflects consumers’ growing preference for natural, clean-label, and plant-derived flavors. Fruits like citrus, berries, apple, and tropical varieties remain the backbone of commercial formulations due to their familiar taste and ability to enhance aroma without synthetic additives.

Manufacturers increasingly rely on fruit essences for improving taste profiles in low-sugar or functional products. The rise of flavored water, ready-to-drink juices, and wellness beverages further supports this segment. With consumers prioritizing freshness and authenticity, fruit essences continue to strengthen their role across global FMCG and food processing industries.

By Form Analysis

Liquid form leads the Food-Based Essence Market, capturing a strong 78.7% share.

In 2024, the Liquid Form dominated the Food-Based Essence Market with a substantial 78.7% share, driven by its versatility, ease of blending, and strong solubility in beverage and dairy formulations. Liquid essences allow food manufacturers to achieve consistent flavor distribution, making them ideal for large-scale production. Their compatibility with syrups, concentrates, confectionery coatings, and frozen desserts further boosts their adoption.

Food service operators also prefer liquid essences due to their precision in dosing and ability to maintain flavor integrity during heating or mixing. As demand rises for flavored beverages, bakery fillings, and artisanal products, liquid formats continue to outperform powder alternatives, establishing themselves as the most reliable and convenient option in commercial food applications.

By Application Analysis

Beverages remain the largest application segment in the Food-Based Essence Market at 39.9%.

In 2024, the Beverages segment held a leading 39.9% share of the Food-Based Essence Market, supported by rapid growth in flavored drinks, functional beverages, and low-calorie refreshments. The rising popularity of infused water, sparkling drinks, herbal blends, and energy beverages has increased the demand for natural essences that offer aroma without artificial additives. Beverage manufacturers increasingly incorporate fruit, floral, and herbal essences to enhance taste while meeting clean-label standards.

Trends toward healthier hydration—especially among young consumers—have further accelerated adoption. Ready-to-drink juices, smoothies, and fortified beverages rely heavily on stable essence formulations to maintain flavor consistency, making beverages the most influential application segment in shaping product innovation across the global essence industry.

Key Market Segments

By Source

- Fruit-Based Essences

- Apple

- Grape

- Banana

- Others

- Vegetable-Based Essences

- Cucumber

- Tomato

- Celery

- Others

By Form

- Liquid

- Powder

By Application

- Beverages

- Bakery and Confectionery

- Dairy and Frozen Desserts

- Savory and Snacks

- Processed and Convenience Foods

- Specialty and Functional Nutrition

- Others

Driving Factors

Rising demand for natural flavor solutions

Rising demand for natural flavor solutions continues to push the Food-Based Essence Market forward, especially as consumers look for clean, plant-derived taste profiles that fit better into modern diets. Brands use fruit and vegetable essences to keep products simple and authentic, which strengthens long-term adoption across beverages, bakery items, and functional foods. The push toward sustainable farming and improved ingredient sourcing also supports this rise.

Adding to this momentum, Abundant Robotics secured $10 million for apple-harvesting robots, a development that reinforces supply stability for fruit-based essence producers. As raw material availability improves, manufacturers gain better access to quality inputs, allowing them to meet the growing demand for natural flavor solutions across global food production.

Restraining Factors

Higher production costs limit scalability

Higher production costs continue to limit scalability in the Food-Based Essence Market, especially when sourcing high-quality fruits and vegetables for natural extracts. These costs affect manufacturers trying to maintain purity, consistency, and clean-label standards while competing with cheaper synthetic alternatives. Small producers feel this pressure more intensely, often facing operational constraints as ingredient prices fluctuate. Complicating matters, packaging, transportation, and cold-chain requirements add further expenses.

At the same time, funding patterns highlight how certain beverage innovations are attracting capital that might otherwise support ingredient technologies. For example, Jubel, a fruit-lager company, raised £2.7 million, showing investor interest shifting toward finished products rather than raw-material suppliers, indirectly tightening financial flexibility for essence producers.

Growth Opportunity

Expanding applications in functional nutrition products

Expanding applications in functional nutrition products open meaningful opportunities in the Food-Based Essence Market, especially as consumers embrace wellness-focused beverages, fortified snacks, and specialized nutrition blends. Natural essences help enhance taste without sugar or artificial additives, making them ideal for protein shakes, meal replacements, and dietary supplements. This segment benefits significantly from rising interest in personalized nutrition and plant-based lifestyles.

Additional momentum comes from active investment in nutritional innovation. Elo Life Systems raised $20.5 million to accelerate its natural sweetener development for 2026, while David closed a $75 million round supporting broader food-tech progress. These advancements create fertile ground for essence makers to supply clean flavor solutions tailored to next-generation nutrition products.

Latest Trends

Increasing use of botanical extract essences

Increasing use of botanical extract essences has become a leading trend as consumers gravitate toward floral, herbal, and earthy notes in beverages, desserts, and wellness products. These extracts offer authenticity and complexity, giving brands room to explore unique combinations like lavender citrus, hibiscus berry, and rosemary mint. The trend aligns closely with preferences for natural aromas and minimally processed ingredients.

Shoppers also show stronger interest in products supporting calmness, digestion, or immunity, making botanical essences more relevant. Innovation is further encouraged by startup activity; FoodNerd raised $7.5 million in seed funding to reinvent toddler snacks using nutrient-dense, plant-based ingredients, highlighting a broader industry shift toward natural, botanical-forward food concepts.

Regional Analysis

North America led the Food-Based Essence Market with 37.5%, reaching USD 6.3 Bn.

In the Food-Based Essence Market, North America emerged as the dominant region, accounting for a substantial 37.5% share, valued at USD 6.3 Bn. This leadership reflects the region’s strong processed food sector, advanced flavor manufacturing capabilities, and high consumer demand for clean-label and natural essence formulations.

Europe follows with a mature market structure supported by steady use of botanical and fruit-based essences across beverages, bakery, and nutraceutical categories. The Asia Pacific region continues to expand rapidly as growing urban populations and evolving food preferences drive wider adoption of natural essences in mainstream food products.

Meanwhile, the Middle East & Africa market shows stable uptake, supported by rising interest in flavored beverages and convenience foods. Latin America also contributes meaningfully, driven by increasing product innovation in fruit-based essences aligned with regional taste preferences.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Givaudan continued to play a defining role in the global Food-Based Essence Market, driven by its strong focus on natural flavor development and long-standing expertise in sensory innovation. The company’s strategic emphasis on clean-label solutions and plant-based formulations helped it align with evolving consumer expectations worldwide. Givaudan’s ability to integrate advanced extraction techniques with sustainable sourcing positioned it as a reliable partner for food and beverage manufacturers seeking consistency, authenticity, and premium essence quality across diverse product lines.

International Flavors & Fragrances (IFF) strengthened its market presence through a broad portfolio of food essences designed to support global brands in achieving precise flavor profiles. Its deep technical experience and application-oriented approach allowed IFF to deliver tailored solutions for beverages, dairy, confectionery, and wellness products. The company’s collaborative development models, working closely with formulators, supported faster product launches in competitive categories where taste accuracy and natural ingredients remain critical success factors.

Symrise maintained a firm competitive edge by expanding its capability in natural extractions, botanical essences, and flavor modulation systems. The company’s global sourcing network and technology-driven processing methods enabled it to produce stable, high-impact essences suited for modern clean-label requirements. Symrise’s agility in adapting to regional taste preferences and supporting innovation pipelines kept it influential in shaping the direction of the Food-Based Essence Market in 2024.

Top Key Players in the Market

- Givaudan

- International Flavors & Fragrances

- Symrise

- Firmenich

- Kerry Group

- Sensient Technologies

- Takasago

- Mane

- Robertet Group

- Döhler Group

Recent Developments

- In September 2025, Kerry launched Smart Taste™, a new suite of taste solutions combining flavor expertise and food science. These solutions help food and beverage makers maintain great taste while addressing nutrition, cost, supply, and sustainability challenges.

- In March 2024, DSM-Firmenich opened a state-of-the-art pilot plant in Plainsboro, New Jersey, to help food and beverage customers scale up new products faster with flavor and texture solutions. This facility supports the development and testing of innovative food essences and formulations.

Report Scope

Report Features Description Market Value (2024) USD 16.8 Billion Forecast Revenue (2034) USD 27.9 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Fruit-Based Essences (Apple, Grape, Banana, Others), Vegetable-Based Essences (Cucumber, Tomato, Celery, Others)), By Form (Liquid, Powder), By Application (Beverages, Bakery and Confectionery, Dairy and Frozen Desserts, Savory and Snacks, Processed and Convenience Foods, Specialty and Functional Nutrition, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Givaudan, International Flavors & Fragrances, Symrise, Firmenich, Kerry Group, Sensient Technologies, Takasago, Mane, Robertet Group, Döhler Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food-Based Essence MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Food-Based Essence MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Givaudan

- International Flavors & Fragrances

- Symrise

- Firmenich

- Kerry Group

- Sensient Technologies

- Takasago

- Mane

- Robertet Group

- Döhler Group