Global Floating Liquefied Natural Gas Market By Capacity (Small-Scale, Mid-Scale, And Large-Scale), By Deployment (Offshore, And Near Shore), By Application (Production/Liquefaction, Storage And Transportation, and Regasification), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161004

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

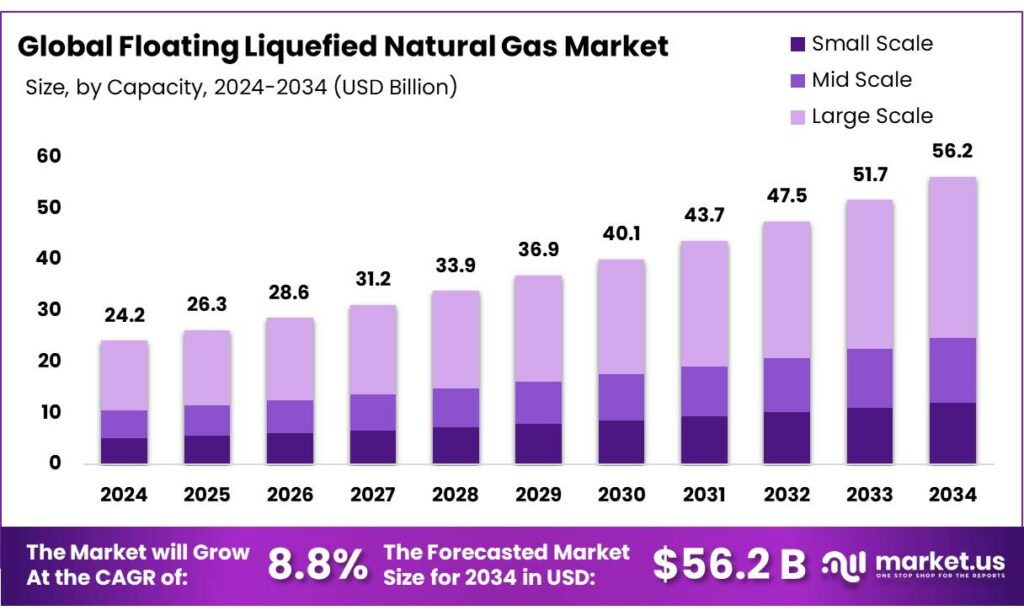

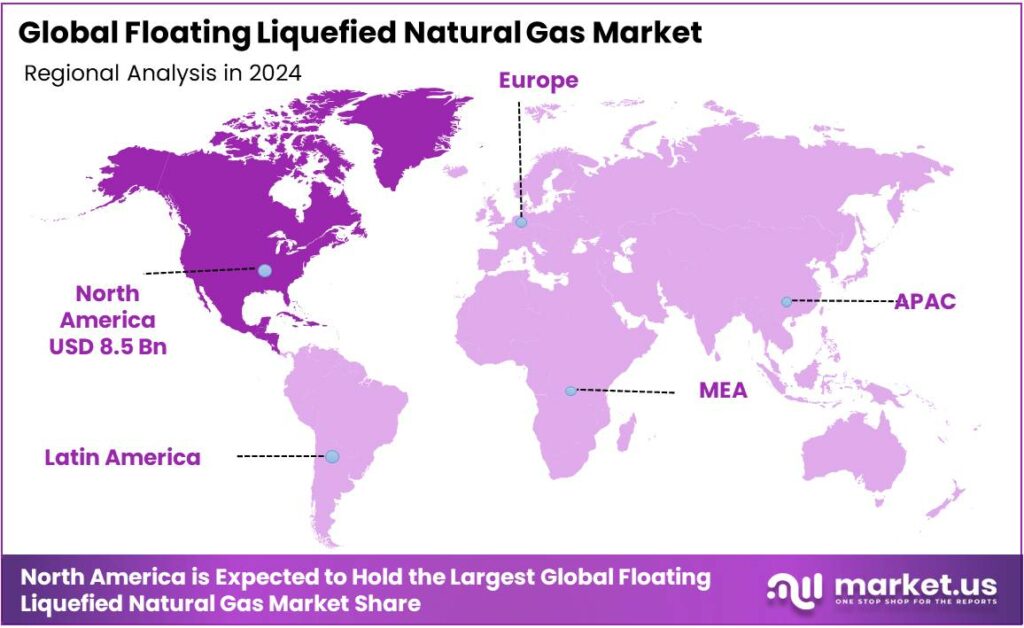

The Global Floating Liquefied Natural Gas Market size is expected to be worth around USD 56.2 Billion by 2034, from USD 24.2 Billion in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 35.1% share, holding USD 8.5 Billion in revenue.

Floating liquefied natural gas (FLNG) is an offshore technology that uses a ship-like vessel to produce, liquefy, and store natural gas directly from subsea fields. This approach allows developers to monetize deepwater or previously uneconomical gas resources without building costly pipelines to shore, as the liquefied natural gas (LNG) is stored on the vessel and transferred to other ships for delivery.

FLNG facilities offer advantages like mobility to different gas fields, lower capital and operational costs compared to onshore plants, and reduced environmental impact by minimizing the need for large onshore infrastructure. Lower environmental footprint is one of the major drivers of the market. In addition, previously inaccessible gas fields may offer many opportunities in the market. However, the space limitation of floating vessels might pose a challenge for the floating liquefied natural gas market.

- Global trade in LNG reached 407 million tonnes in 2024, an increase of just 3 million tonnes from 2023, the lowest annual supply addition for 10 years.

Key Takeaways

- The global floating liquefied natural gas market was valued at USD 24.2 billion in 2024.

- The global floating liquefied natural gas market is projected to grow at a CAGR of 8.8% and is estimated to reach USD 56.2 billion by 2034.

- Based on the capacities of floating liquefied natural gas, large-scale capacities dominated the market in 2024, comprising about 56.1% share of the total global market.

- Based on the deployment of FLNG, offshore deployment was at the forefront of the market in 2024, accounting for a 64.5% share of the total global market.

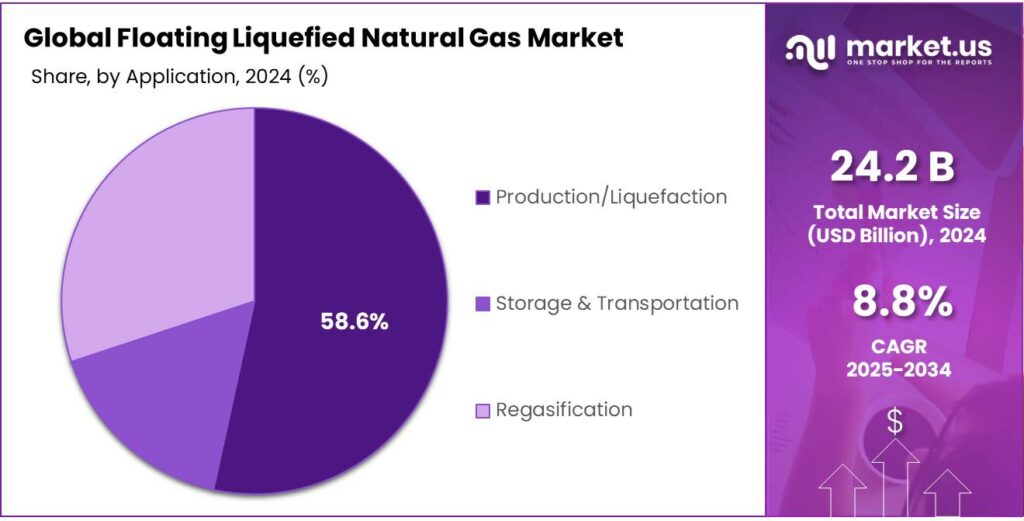

- Among the applications of the FLNG, the production/liquefaction application dominated the market in 2024, accounting for around 58.6% of the market share.

- North America was the largest market for floating liquefied natural gas in 2024, accounting for around 35.1% of the total global consumption.

Capacity Analysis

Large-scale Liquefied Natural Gas Capacities were the Leading Segment in the Market.

On the basis of capacity, the market is segmented into small-scale, mid-scale, and large-scale. Large-scale floating liquefied natural gas capacities dominated the market in 2024 with a market share of 56.1%. Floating liquefied natural gas projects are mostly large-scale, as the high costs and technical complexity of building and operating offshore liquefaction facilities are more economically justified at larger capacities. Liquefaction, storage, and offloading equipment require substantial investment, and spreading these costs over higher production volumes improves overall project efficiency and returns.

Additionally, large gas reserves, such as those of offshore Australia or Mozambique, necessitate high-capacity infrastructure to fully exploit their potential. In addition, engineering constraints make it more practical to consolidate operations into a single, large facility rather than multiple small units. Larger FLNG vessels can store more LNG, reducing the frequency of offloading and improving operational continuity in remote offshore environments.

Deployment Analysis

Offshore Deployment of Facilities Dominated the Floating Liquefied Natural Gas Market in 2024.

Based on the deployment of the capacities, the market is segmented into offshore and near-shore. The offshore deployment dominated the market in 2024 with a market share of 64.5%. Floating liquefied natural gas units are mostly deployed offshore as they are specifically designed to process gas directly at the source, which is often located far from the coastline. Deploying FLNG offshore eliminates the need for long and expensive subsea pipelines to transport gas to onshore facilities, reducing both infrastructure costs and environmental impact.

Offshore deployment also avoids many of the regulatory, land use, and social challenges associated with coastal development, such as displacement, land acquisition, and environmental permitting. Additionally, by processing gas at sea, countries can access remote or deep-water gas fields that would otherwise be uneconomical to develop. This offshore positioning enhances flexibility and responsiveness to global LNG demand.

Application Analysis

Production/Liquefaction Application of Floating Liquefied Natural Gas Dominated the Market.

Based on the application, the market is segmented into production/liquefaction, storage & transportation, and regasification. The production/liquefaction application dominated the market in 2024 with a market share of 58.6%. Floating liquefied natural gas is mostly used for production and liquefaction, as its primary purpose is to process natural gas directly at offshore fields, where onshore infrastructure is not practical or economical.

The goal is to convert natural gas into liquid form at sea, reducing its volume for easier export. Storage and transportation are typically handled by LNG carriers, which are more specialized and cost-effective for long-distance shipping. Similarly, regasification is usually done near consumption centers onshore or at floating storage regasification units (FSRUs), which are optimized for that specific function. FLNG focuses on upstream operations, making it most valuable at the production source rather than in the downstream supply chain.

Key Market Segments

By Capacity

- Small Scale

- Mid-Scale

- Large Scale

By Deployment

- Offshore

- Near Shore

By Application

- Production/Liquefaction

- Storage & Transportation

- Regasification

Drivers

Lower Environmental Footprint Drives the Floating Liquefied Natural Gas Market.

The floating liquefied natural gas market is gaining momentum largely due to its lower environmental footprint compared to traditional onshore processing methods. FLNG units carry out all gas processing, liquefaction, and storage operations offshore, eliminating the need for extensive seabed pipelines and reducing ecological disruption to marine and coastal environments.

- For instance, Shell’s Prelude FLNG facility off the coast of Australia processes up to 3.6 million tonnes of LNG, 1.3 mtpa (million tonnes per annum) of condensate, and 0.4 mtpa of LPG, annually entirely at sea, avoiding the construction and emissions associated with land-based infrastructure.

Moreover, natural gas emits approximately 50-60% less CO₂ than coal when used for electricity generation, making it one of the cleanest-burning fossil fuels. In addition, FLNG offers strategic advantages in terms of safety and stability, especially in remote or geopolitically sensitive regions where onshore facilities may pose higher risks. This offshore approach minimizes environmental impact and allows nations to tap into stranded gas fields that would otherwise be uneconomical to develop.

Restraints

Space Limitation of Floating Vessels Poses a Challenge for the Floating Liquefied Natural Gas.

One of the key challenges facing floating liquefied natural gas technology is the limited space available on floating vessels, which constrains the scale and complexity of operations compared to onshore LNG facilities. FLNG units must accommodate all critical processes, such as gas treatment, liquefaction, storage, and offloading, within a compact footprint. This spatial constraint often requires advanced engineering solutions and compromises on storage capacity or redundancy systems.

- For instance, Shell’s Prelude FLNG, one of the largest in the world at 488 meters long, still holds less LNG than a typical onshore plant due to space and weight limitations.

Additionally, the confined layout can increase operational risks, as equipment is densely packed and harder to access for maintenance or emergency response. In addition, these spatial challenges limit scalability as expanding capacity requires new vessels rather than modular expansion, as is possible on land. The efficient design and compact, high-performance technologies are critical to overcoming these limitations in FLNG development.

Opportunity

Previously Inaccessible Gas Fields Offer Many New Economic Opportunities in the Floating Liquefied Natural Gas Market.

Floating liquefied natural gas technology enables the exploitation of previously inaccessible or stranded offshore gas fields, unlocking significant economic potential for resource-rich nations. Traditional onshore LNG infrastructure is often not feasible for remote fields due to the high costs and logistical challenges of pipeline construction. FLNG bypasses these limitations by operating directly at the gas source.

For instance, Malaysia’s PFLNG Satu became the world’s first operational FLNG unit in 2016, allowing PETRONAS to monetize smaller gas reserves that would not have justified full-scale onshore development. In Africa, Mozambique and Senegal are turning to FLNG to tap into offshore reserves, with expectations to support local industries, create jobs, and generate export revenue.

According to the International Energy Agency, natural gas demand in emerging economies is expected to grow by over 40% by 2040, suggesting that countries investing in FLNG today are positioning themselves as future energy suppliers, spurring long-term economic development.

Trends

Rise of Small-Scale Floating Liquefied Natural Gas.

The rise of small-scale floating liquefied natural gas units is an increasingly important trend in the global energy landscape, offering a flexible solution for monetizing smaller or remote gas reserves. Unlike large-scale FLNG facilities, small-scale units are quicker to deploy, require lower capital investment, and are ideal for countries or companies targeting modest production volumes or serving regional demand.

- For instance, Wärtsilä’s floating storage and regasification barge (FSRB), which stores significantly less LNG than large floating storage and regasification units (FSRUs), typically 7,500 to 30,000 cubic meters (m³).

These compact units also support energy access in island nations or isolated coastal regions, where infrastructure development is limited. Furthermore, small-scale FLNG reduces environmental and social disruption compared to large onshore terminals. With natural gas producing up to 40% less CO₂ than oil and about 50% less than coal, small-scale FLNG offers a cleaner, scalable option for meeting rising global energy needs.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Floating Liquefied Natural Gas Market.

The geopolitical tensions are significantly influencing the floating liquefied natural gas market, as countries seek to diversify energy sources and reduce dependence on politically unstable regions. For instance, the Russia-Ukraine conflict has disrupted traditional gas supply routes to Europe, prompting a shift toward alternative sources like LNG.

The European nations have accelerated the deployment of small-scale FLNG terminals to secure energy imports from more politically stable suppliers such as the United States, Qatar, and West Africa. Germany, which previously relied heavily on Russian pipeline gas, commissioned its first floating LNG terminal in Wilhelmshaven in 2022, with several more planned to enhance energy security.

Similarly, Asia-Pacific countries such as Japan and South Korea are exploring FLNG as a buffer against regional tensions in the South China Sea, where maritime disputes could threaten traditional shipping routes.

- According to the International Energy Agency, LNG trade is estimated to grow by over 5% in the last quarter of 2025, much of it driven by geopolitical disruptions and the need for flexible, mobile infrastructure like FLNG.

These floating units allow countries to adapt quickly to changing political climates without the long lead times associated with onshore terminals. As energy supply becomes increasingly weaponized in global politics, FLNG provides a strategic solution for nations prioritizing energy independence and resilience.

Regional Analysis

North America is the Largest Market for Floating Liquefied Natural Gas.

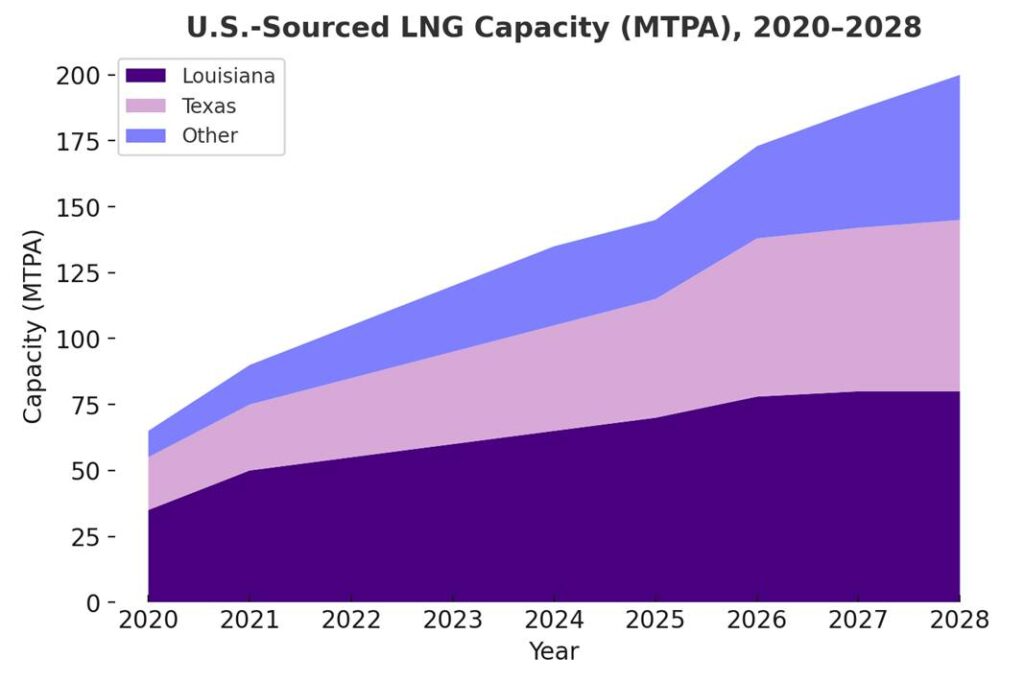

North America held the major share of the global floating liquefied natural gas market, valued at around US$8.5 billion, commanding an estimated 35.1% of the total revenue share. The region has emerged as the largest market for floating liquefied natural gas, driven by its vast natural gas reserves, advanced offshore infrastructure, and strong export capabilities.

The United States, in particular, has become a global leader in LNG production, with the Gulf of Mexico serving as a strategic hub for offshore energy operations. The region’s shale gas boom has resulted in an abundant supply, and FLNG offers a flexible solution for exporting gas from fields that are not easily connected to existing onshore terminals.

Similarly, Canada’s Pacific coast is exploring FLNG options to access Asian markets more efficiently. With North America accounting for over 26% of global natural gas production in 2024, its investment in FLNG infrastructure positions the region as a key player in the evolving global energy trade.

Source: IEEFA

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The key global companies in the floating liquefied natural gas market, such as Shell, Petronas, Golar LNG, ExxonMobil, Eni SpA, Hoegh LNG, Technip Energies, Samsung Heavy Industries, Hyundai Heavy Industries, KBR, JGC Corporation, SBM Offshore, BW Offshore, MODEC, and TotalEnergies, engage in strategic activities such as product development and partnerships to differentiate themselves in the market. In this sector, there are several companies that partner with other companies for research and development on the product, and for the audit of the vessel before signing off on a project. One of the major strategies in the market is the expansion through building new vessels.

Shell is a major global energy company and an early pioneer in floating liquefied natural gas (FLNG) technology, having developed the world’s largest FLNG facility, Prelude FLNG, off the coast of Australia.

Samsung Heavy Industries’ FLNG expertise includes developing and constructing standard models, such as the deepwater MLF-O and nearshore MLF-N, to serve global gas field development projects.

Petronas holds the distinction of being the first energy company to own and produce from two FLNG facilities simultaneously.

ExxonMobil is a leading private oil and gas company with significant involvement in floating Liquefied Natural Gas (LNG) projects, leveraging its extensive experience across the entire LNG value chain to meet global energy demand.

The following are some of the major players in the industry

- Shell

- Petronas

- Golar LNG

- ExxonMobil

- Eni SpA

- Hoegh LNG

- Technip Energies

- Samsung Heavy Industries

- Hyundai Heavy Industries

- KBR

- JGC Corporation

- SBM Offshore

- BW Offshore

- MODEC

- TotalEnergies

- Other Players

Key Developments

- In April 2024, Petronas, the Malaysian national oil and gas company, announced the construction of a 2 Mt/year (2.7 bcm/year) FLNG export vessel to be moored at the Sipitang Oil and Gas Industrial Park (SOGIP) in Malaysia.

- In July 2025, Samsung Heavy Industries, one of South Korea’s largest shipyards, announced the signing of a contract worth US$637 million (40.8 billion meticais) for the construction of a floating liquefied natural gas (LNG) production unit off the coast of Mozambique.

Report Scope

Report Features Description Market Value (2024) USD 24.2 Bn Forecast Revenue (2034) USD 56.2 Bn CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Capacity (Small Scale, Mid Scale, Large Scale), By Deployment (Offshore, Near Shore), By Application (Production/Liquefaction, Storage & Transportation, Regasification) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Shell, Petronas, Golar LNG, ExxonMobil, Eni SpA, Hoegh LNG, Technip Energies, Samsung Heavy Industries, Hyundai Heavy Industries, KBR, JGC Corporation, SBM Offshore, BW Offshore, MODEC, TotalEnergies, Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Floating Liquefied Natural Gas MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Floating Liquefied Natural Gas MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Shell

- Petronas

- Golar LNG

- ExxonMobil

- Eni SpA

- Hoegh LNG

- Technip Energies

- Samsung Heavy Industries

- Hyundai Heavy Industries

- KBR

- JGC Corporation

- SBM Offshore

- BW Offshore

- MODEC

- TotalEnergies

- Other Players