Global Feed Phosphate Market Size, Share, And Business Benefit By Form (Powder, Granule), By Feed Type (Dicalcium Phosphate, Monocalcium Phosphate, Mono-Dicalcium Phosphate, Tricalcium Phosphate, Defluorinated Phosphate, Others), By Livestock Type (Poultry, Swine, Cattle, Aquatic Animals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161731

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

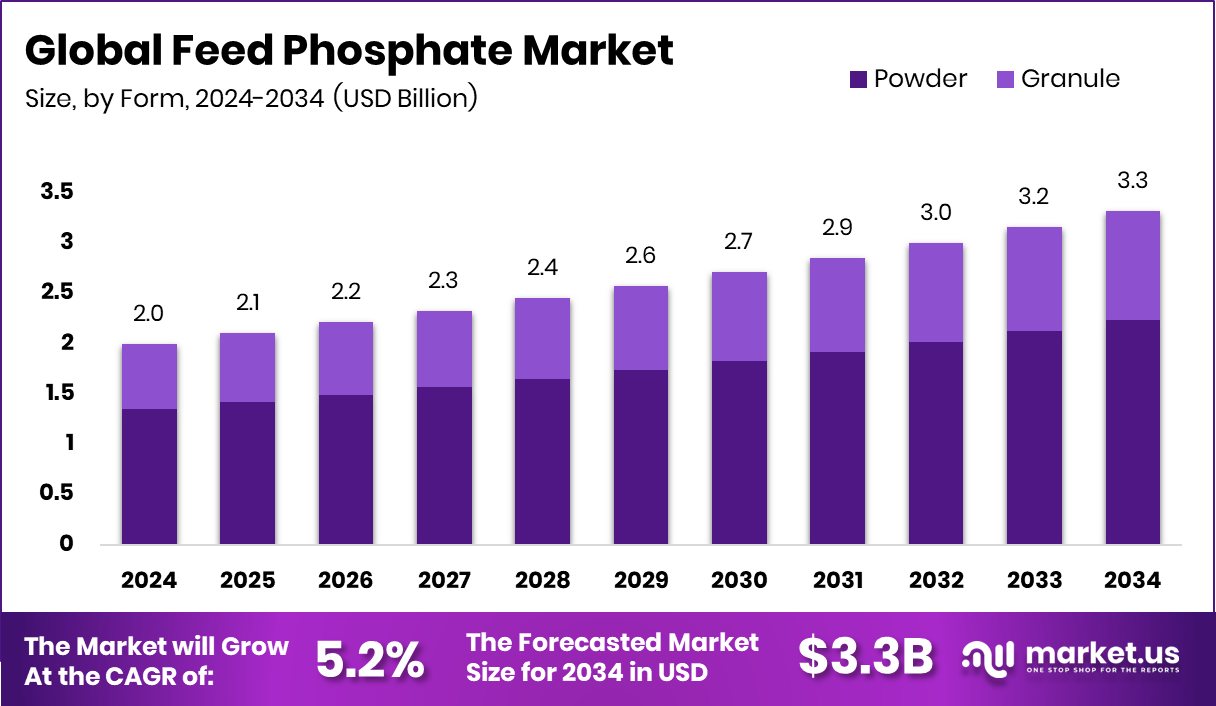

The Global Feed Phosphate Market is expected to be worth around USD 3.3 billion by 2034, up from USD 2.0 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. Growing poultry and aquaculture production across the Asia-Pacific, 34.8% continues driving steady feed phosphate demand.

Feed phosphate refers to inorganic phosphate compounds (such as monocalcium phosphate, dicalcium phosphate, etc.) that are added to animal feed to supply phosphorus, an essential mineral for growth, bone formation, energy metabolism, reproduction, and general health in livestock and poultry. Without adequate bioavailable phosphorus, animals suffer from poor growth, skeletal disorders, reduced fertility, and lower productivity.

The feed phosphate market encompasses the production, distribution, and application of these phosphate additives in animal nutrition across livestock, poultry, aquaculture, and other segments. It involves mining or chemical sourcing of phosphate rock, conversion into feed-grade phosphates, formulation into feed blends, and selling to feed mills and farms. Its scale and dynamics are shaped by global livestock demand, the regulatory environment, raw material availability, and innovations in feed technologies.

One major growth factor is the rising global demand for meat, dairy, and aquaculture products, which drives feed consumption and compels farmers to use balanced, nutrient-rich feed formulations. A second factor is the growing awareness of animal health and productivity: farmers increasingly adopt feed phosphates as a way to enhance feed conversion efficiency, reduce disease risk, and improve yield. Third, policies and funding support strengthen demand — for example, the US Senate approving $1 million for a poultry diagnostics lab, or the USDA offering $1 billion for poultry farmers in disease-stricken regions, all boost the underlying livestock sector and thus feed additive usage.

Opportunities lie in emerging and developing markets where per capita meat consumption is rising fastest and where feed modernization is underway. Novel feed formulations, more digestible phosphate variants, and sustainable phosphate sources are promising growth areas. Additional catalysts include large-scale investments: a German poultry giant backing a mycelium meat startup in a €3 M funding round reflects shifting protein trends that may spur feed innovation; meanwhile, a government creating a P20 million fund for livestock and poultry sectors gives a direct push to sector development. All of these together suggest that feed phosphate demand has a strong runway ahead, especially in regions with expanding livestock production and seeking higher feed efficiency and better returns.

Key Takeaways

- The Global Feed Phosphate Market is expected to be worth around USD 3.3 billion by 2034, up from USD 2.0 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In 2024, the Feed Phosphate Market saw powder form dominate, holding a 67.3% share.

- The Feed Phosphate Market was led by dicalcium phosphate, accounting for 39.4% of the total share.

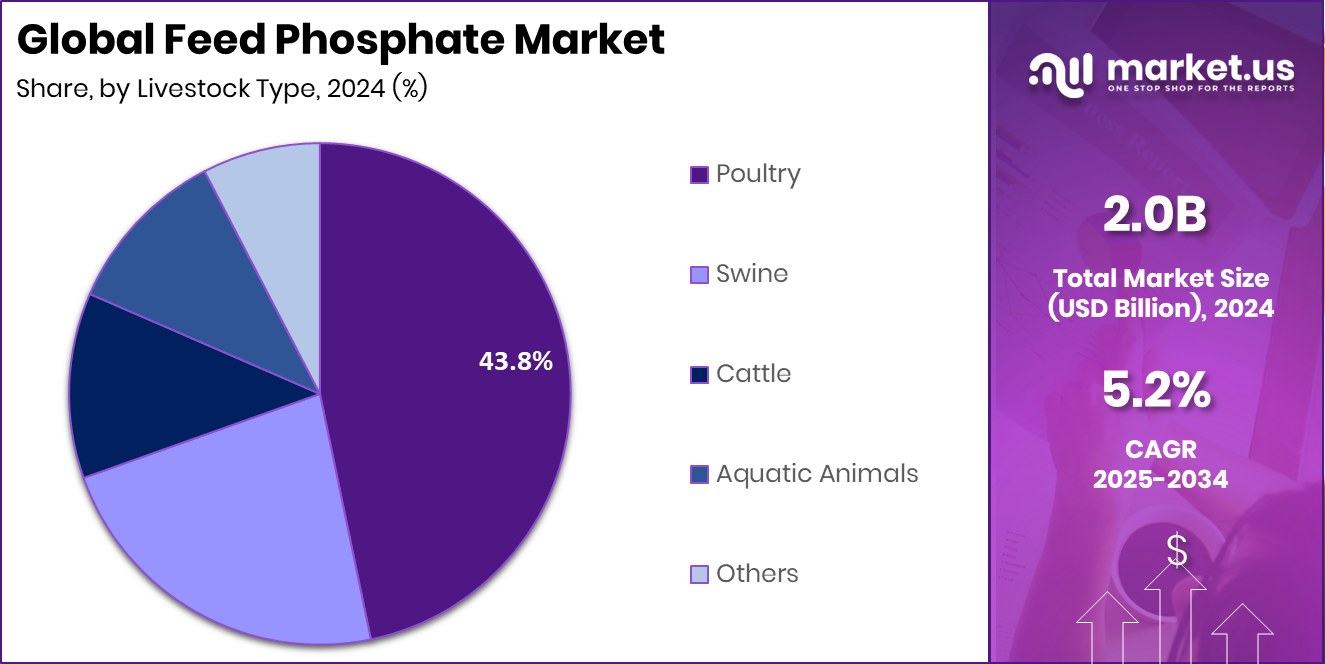

- Poultry dominated the Feed Phosphate Market with a 43.8% share during the assessment year.

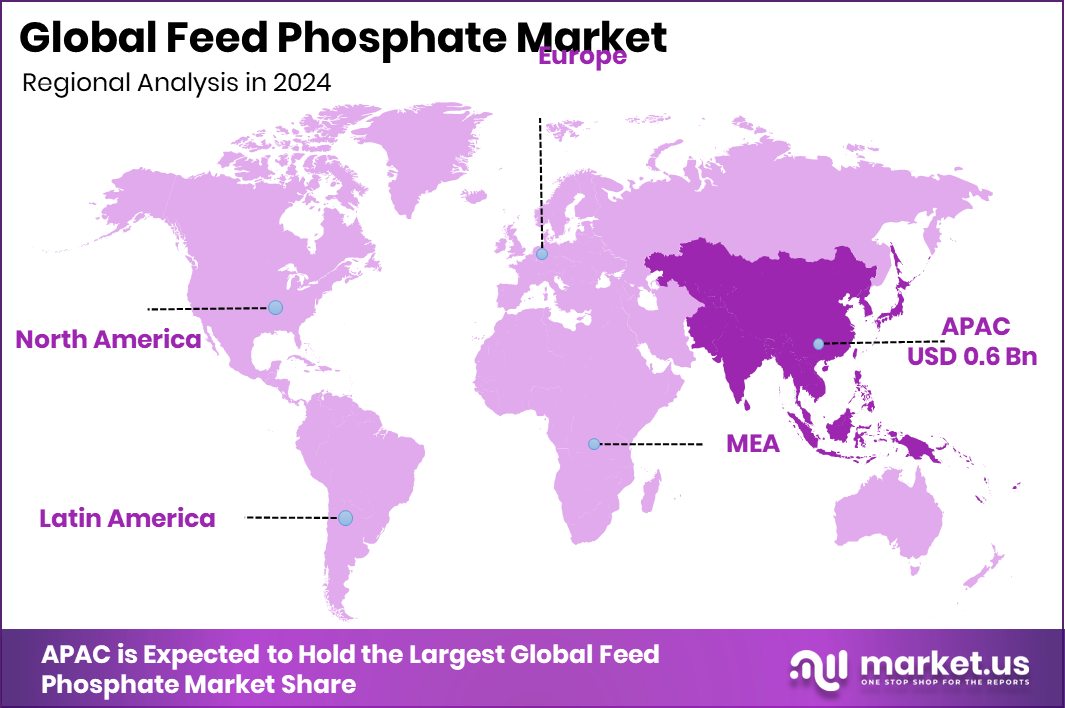

- The Asia-Pacific market value reached around USD 0.6 billion, reflecting strong livestock expansion.

By Form Analysis

In 2024, the Feed Phosphate Market saw Powder holding 67.3%.

In 2024, Powder held a dominant market position in the By Form segment of the Feed Phosphate Market, with a 67.3% share. The powder form is widely preferred due to its easy mixing capability in compound feeds and better nutrient uniformity, ensuring efficient phosphorus delivery to livestock and poultry. Its fine consistency allows improved digestibility and feed conversion efficiency, which supports animal growth and bone development.

The form also offers longer shelf life and convenient storage, making it highly suitable for large-scale feed producers. As livestock and poultry production expand globally, the powder form continues to be the most used format for feed phosphate applications, strengthening its leading position in the market.

By Feed Type Analysis

The Feed Phosphate Market recorded Dicalcium Phosphate leading with 39.4%.

In 2024, Dicalcium Phosphate held a dominant market position in the By Feed Type segment of the Feed Phosphate Market, with a 39.4% share. Its dominance is attributed to its high phosphorus and calcium content, which are essential for bone strength, metabolism, and animal growth. Dicalcium phosphate is widely used in poultry, cattle, and swine feed due to its excellent bioavailability and compatibility with other feed ingredients.

It enhances feed efficiency, improves fertility rates, and supports faster weight gain in livestock. The product’s stability and low reactivity make it suitable for mass feed production, sustaining its preference among feed manufacturers and reinforcing its strong position in the global feed phosphate market.

By Livestock Type Analysis

The Feed Phosphate Market was dominated by Poultry at 43.8%.

In 2024, poultry held a dominant market position in the By Livestock Type segment of the feed phosphate market, with a 43.8% share. This dominance is primarily driven by the increasing global demand for poultry meat and eggs, which has boosted feed consumption. Poultry requires balanced phosphorus nutrition for bone health, eggshell formation, and growth efficiency, making feed phosphates an essential additive.

The poultry industry’s expansion, supported by government funding and disease control programs, further sustains steady phosphate usage. With continuous investments in poultry health and productivity improvement, the segment maintains its strong foothold, highlighting its crucial role in enhancing feed quality and supporting overall production performance in the feed phosphate market.

Key Market Segments

By Form

- Powder

- Granule

By Feed Type

- Dicalcium Phosphate

- Monocalcium Phosphate

- Mono-Dicalcium Phosphate

- Tricalcium Phosphate

- Defluorinated Phosphate

- Others

By Livestock Type

- Poultry

- Swine

- Cattle

- Aquatic Animals

- Others

Driving Factors

Rising Aquaculture and Livestock Nutrition Investments Drive Growth

A key driving factor for the Feed Phosphate Market is the growing investment in animal nutrition, especially within aquaculture and livestock sectors. The demand for phosphorus-rich feed continues to rise as farmers focus on improving animal health, growth, and production efficiency. Global initiatives are strengthening this trend — for example, the University of Stirling secured a £2 million grant to support an aquaculture welfare project in Asia, enhancing feed and health standards for farmed fish.

Similarly, Fyto raised $15 million to develop aquatic “superplants” for animal feed, promoting sustainable nutrient sources. Such funding efforts boost innovation in feed formulations and create long-term opportunities for phosphate-based feed solutions across livestock and aquaculture industries.

Restraining Factors

Environmental Concerns and Plastic Pollution Limit Market Growth

A major restraining factor for the Feed Phosphate Market is growing environmental concern over water pollution and waste from animal farming. Excessive phosphate discharge from feed use can cause nutrient runoff, leading to water eutrophication and ecological imbalance. Recent research highlights these challenges — for instance, Oregon State University (OSU) researchers received a $3.3 million NSF grant to study the effects of tiny plastics on aquatic life.

This project underlines how feed additives and pollutants together can impact aquatic ecosystems. As awareness of such environmental risks rises, stricter regulations on phosphate levels in feed are being introduced, making compliance more costly for producers and restraining overall market expansion in some regions.

Growth Opportunity

Innovative Research and Ocean Science Create New Opportunities

A major growth opportunity for the feed phosphate market lies in expanding research and innovation in sustainable feed and ocean science. The federal government’s $34.4 million investment in Dalhousie University research is driving breakthroughs in clean technology, heart health, and marine studies—all of which indirectly support better aquaculture feed systems and nutrient efficiency.

Likewise, the €1.6 million project tracking aquatic life in the Northeast Atlantic helps improve understanding of marine ecosystems, ensuring more balanced and eco-friendly feed practices. These initiatives promote cleaner, smarter aquaculture and livestock feeding methods. As sustainability and innovation become global priorities, such scientific funding opens new doors for advanced, environmentally responsible phosphate feed applications.

Latest Trends

Sustainable Marine Protection Shapes Future Feed Trends

One of the latest trends in the Feed Phosphate Market is the growing focus on sustainability and marine protection. Governments and institutions are increasingly investing in cleaner, eco-friendly practices to safeguard aquatic ecosystems linked to feed production. A strong example is the £7 million extra funding under the “Britannia Protects the Waves” initiative, aimed at protecting UK marine life and improving ocean health.

Such actions encourage feed producers to adopt responsible sourcing and phosphate management methods to prevent water pollution and maintain marine balance. This shift toward environmentally conscious feed formulations reflects a broader movement in the market, where sustainability and ocean conservation are now guiding the next wave of feed phosphate innovations.

Regional Analysis

In 2024, the Asia-Pacific dominated the Feed Phosphate Market with a 34.8% share.

In 2024, Asia-Pacific held a dominant position in the Feed Phosphate Market, accounting for a 34.8% share valued at USD 0.6 billion. The region’s leadership is supported by its vast livestock and poultry production base, particularly in countries like China, India, and Indonesia, where animal nutrition enhancement remains a key focus. Rapid urbanization and growing meat consumption continue to drive feed phosphate demand across this region.

North America shows steady growth due to the adoption of advanced feed formulations and animal health programs. Europe follows with a balanced expansion, supported by sustainable livestock farming initiatives.

Meanwhile, the Middle East & Africa and Latin America are emerging markets, gradually improving their feed infrastructure. Overall, Asia-Pacific’s dominance is expected to continue, driven by rising livestock output and consistent investments in feed quality improvement.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, OCP Group maintained a leading role in the global feed phosphate market through its strong presence in phosphate mining, fertilizer production, and animal nutrition solutions. The company’s vertically integrated operations, from phosphate extraction to finished feed-grade products, provide it with cost and supply advantages. OCP has continued investing in sustainability and value-added phosphate products that enhance livestock health and productivity. Its efforts toward green ammonia and renewable-powered production processes also align with global sustainability goals, positioning the company as a forward-looking supplier in the animal feed phosphate space.

The Mosaic Company remained a key player with a balanced portfolio of phosphate and potash products. In 2024, Mosaic focused on optimizing feed phosphate formulations that improve nutrient absorption and support animal growth efficiency. The company’s innovation-driven approach, coupled with strong logistics and distribution capabilities across the Americas, helped strengthen its customer reach. Mosaic has also made notable progress in integrating circular economy practices—reducing emissions and improving resource recovery within its phosphate operations—which enhances its environmental stewardship in feed-grade phosphates.

PhosAgro, one of the world’s largest producers of high-grade phosphate rock, continued its focus on supplying environmentally friendly and nutrient-rich phosphate products for the feed industry. In 2024, the company expanded its presence in Europe and Asia through new export agreements, emphasizing product purity and sustainability. PhosAgro’s commitment to low-cadmium phosphate production and innovation in bioavailable feed-grade compounds reflects its strategic focus on safe, efficient, and eco-responsible nutrition solutions for global livestock sectors.

Top Key Players in the Market

- OCP Group

- The Mosaic Company

- PhosAgro

- Yara International ASA

- Phosphea

- J.R. Simplot Company

- Israel Chemicals Ltd.

- Innophos Holdings Inc.

- Lomon Billions Group Co., Ltd.

Recent Developments

- In April 2025, JSC Apatit (a part of PhosAgro) announced plans to invest 60 billion rubles into expanding its resource base at its Kirovsky branch in the Murmansk region by 2028.

- In September 2024, OCP invested about USD 33 million into weir technology to boost its phosphate production efficiency and throughput.

- In September 2024, Mosaic announced that its phosphate operations were impacted by extreme weather (Hurricane Francine) and other operational challenges, causing reduced volumes by an estimated 80-110 thousand tonnes in that quarter.

Report Scope

Report Features Description Market Value (2024) USD 2.0 Billion Forecast Revenue (2034) USD 3.3 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Granule), By Feed Type (Dicalcium Phosphate, Monocalcium Phosphate, Mono-Dicalcium Phosphate, Tricalcium Phosphate, Defluorinated Phosphate, Others), By Livestock Type (Poultry, Swine, Cattle, Aquatic Animals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape OCP Group, The Mosaic Company, PhosAgro , Yara International ASA, Phosphea, J.R. Simplot Company, Israel Chemicals Ltd., Innophos Holdings Inc. , Lomon Billions Group Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- OCP Group

- The Mosaic Company

- PhosAgro

- Yara International ASA

- Phosphea

- J.R. Simplot Company

- Israel Chemicals Ltd.

- Innophos Holdings Inc.

- Lomon Billions Group Co., Ltd.