Global Environmental Control Systems Market Size, Share, And Enhanced Productivity By Component (Sensors, Controllers, Air Purification and Filtration Systems, Actuators, HVAC Systems, Thermostats, Others), By Product (Air Quality Control Systems, Water Treatment Systems, Waste Management Systems, Energy Management Systems, Others), By End Use (Aerospace, Automotive, Marine, Agriculture, Manufacturing, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174473

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

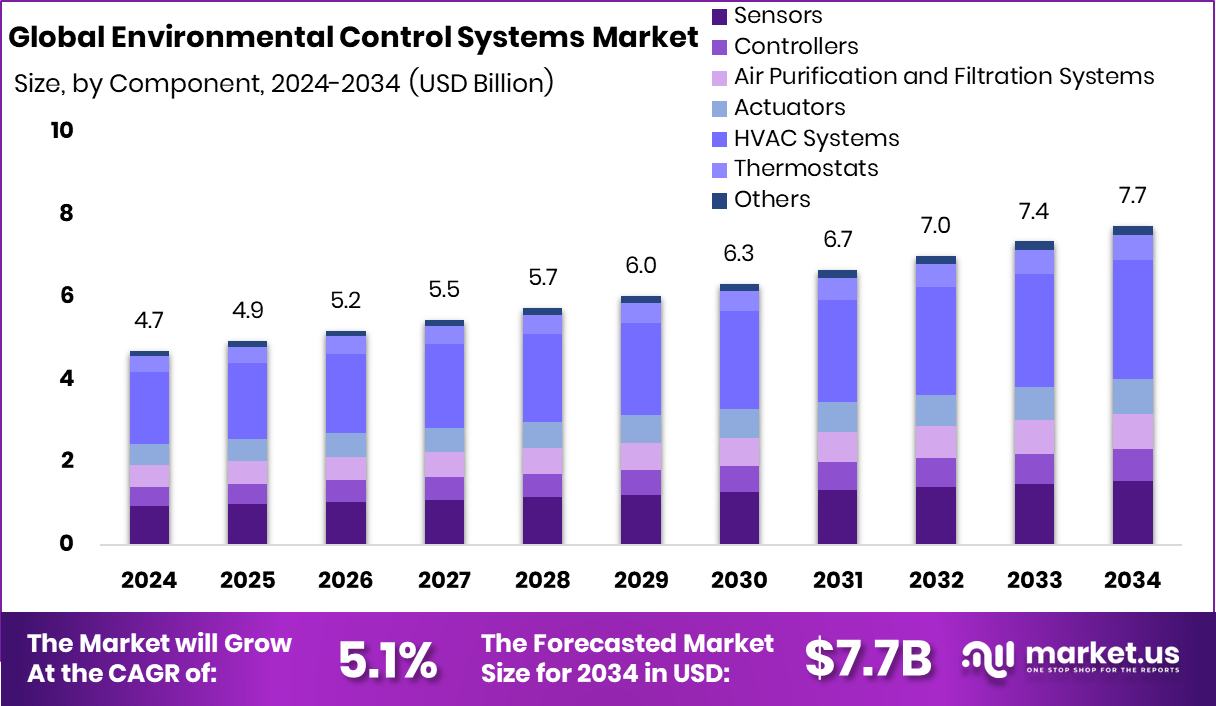

The Global Environmental Control Systems Market is expected to be worth around USD 7.7 billion by 2034, up from USD 4.7 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034. North America shows strong industrial adoption, contributing 34.6% share and reaching USD 1.62 Bn in size.

Environmental Control Systems are integrated technologies used to manage air quality, temperature, humidity, ventilation, and sometimes water and emissions within enclosed or industrial environments. These systems help maintain safe, comfortable, and compliant conditions for people, equipment, and processes. They are commonly used in buildings, factories, schools, healthcare facilities, and public infrastructure to ensure stable environmental conditions while reducing health risks and operational disruptions.

The Environmental Control Systems Market refers to the demand and deployment of these solutions across residential, commercial, institutional, and industrial settings. The market covers systems such as HVAC, air filtration, ventilation, and energy-efficient environmental management tools. Growing attention to indoor air quality, climate resilience, and energy efficiency has made these systems essential rather than optional, especially in public buildings and large facilities.

Growth in this market is strongly supported by public investment in infrastructure upgrades. Springfield schools are moving forward with $18.5 million in upgrades, including HVAC replacements, highlighting how aging facilities are being modernized. Similarly, the U.S. Department of Energy has unveiled $180 million dedicated to energy efficiency and air quality improvements in K-12 schools, accelerating large-scale system adoption.

Demand is rising as extreme heat and poor ventilation disrupt daily operations. After Portland-area schools canceled classes due to overheating, six districts requested up to $100 million in clean-energy funding for HVAC projects. In parallel, $1.2 million in ARPA funds were approved for an HVAC system at the Folsom Senior Center, reflecting growing demand in community facilities.

The market opportunity lies in clean, efficient, and long-term solutions. Oak Park and River Forest High School receiving a $3.5 million grant for a geothermal HVAC system shows how advanced environmental control technologies are gaining traction. These projects signal sustained opportunities driven by public funding, climate adaptation, and long-term energy savings.

Key Takeaways

- The Global Environmental Control Systems Market is expected to be worth around USD 7.7 billion by 2034, up from USD 4.7 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034.

- HVAC systems lead the Environmental Control Systems Market with 37.3%, driven by strict indoor air quality regulations worldwide.

- Water treatment systems hold 34.1% share, supported by rising industrial wastewater reuse and environmental compliance needs.

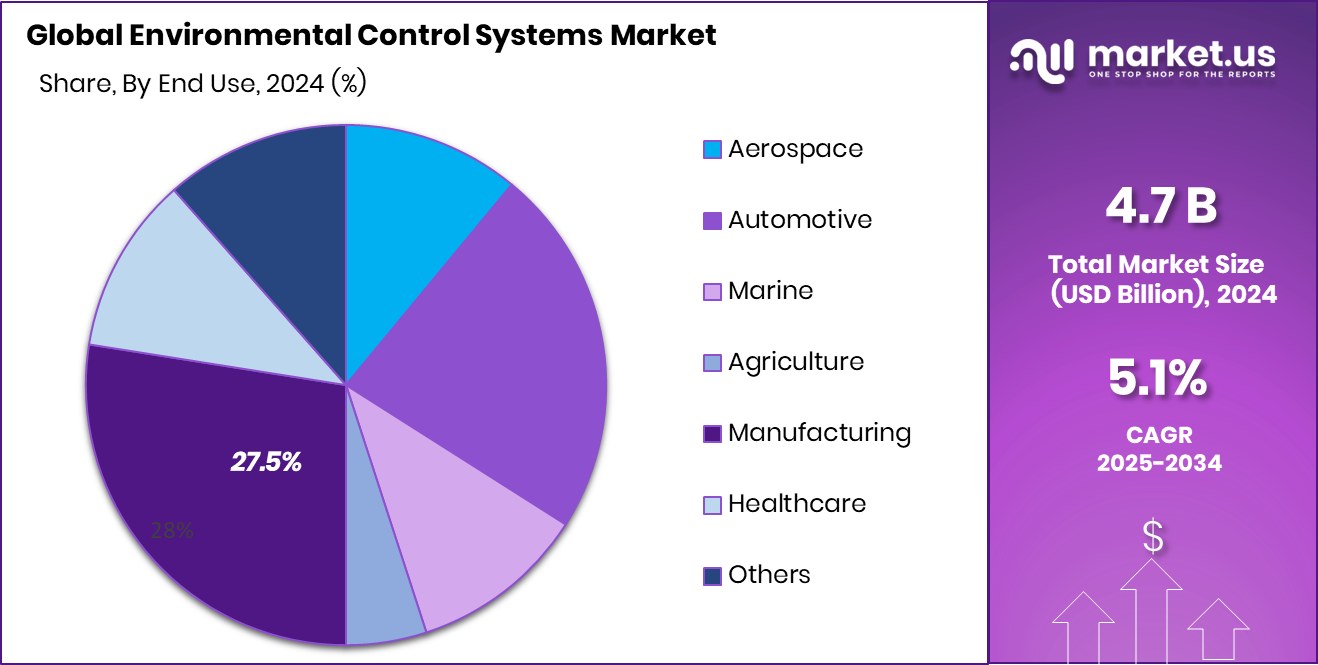

- Manufacturing accounts for 27.5% share as factories adopt environmental control systems to meet emission standards.

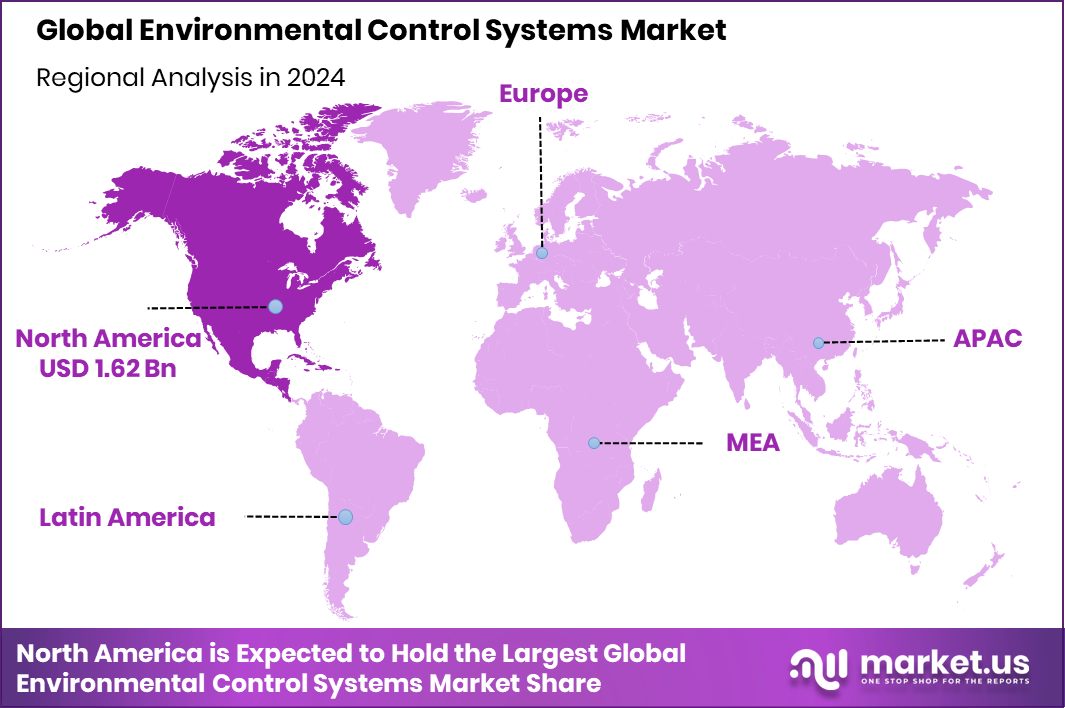

- North America benefits from strict environmental regulations, supporting 34.6% share and USD 1.62 Bn market value.

By Component Analysis

HVAC systems lead the Environmental Control Systems Market by component, holding a 37.3% share.

In 2024, HVAC systems held a 37.3% share within the Environmental Control Systems Market by component, reflecting their central role in maintaining indoor air quality, temperature stability, and humidity control. Industries increasingly relied on advanced HVAC solutions to meet stricter workplace safety norms and energy-efficiency targets. Manufacturing plants, commercial buildings, and data centers adopted smart HVAC systems with sensors and automation to reduce energy consumption while improving environmental performance.

Rising awareness about employee health, especially air filtration and ventilation, further supported demand. Additionally, climate variability pushed facilities to invest in reliable heating and cooling infrastructure. As a result, HVAC systems remained the backbone of environmental control strategies across industrial and commercial settings.

By Product Analysis

Water treatment systems dominate the environmental control systems market by product, with 34.1%.

In 2024, water treatment systems accounted for a 34.1% share of the Environmental Control Systems Market by product, driven by growing concerns over water scarcity and pollution. Industries focused on treating wastewater and reusing process water to comply with environmental regulations and reduce freshwater dependence. Advanced filtration, membrane technologies, and chemical treatment solutions were widely adopted to manage industrial effluents safely.

Governments also enforced stricter discharge standards, encouraging companies to upgrade outdated treatment facilities. The push toward sustainable manufacturing and circular water use strengthened investments in modern water treatment systems. These systems became essential for controlling environmental impact while ensuring operational continuity and regulatory compliance.

By End Use Analysis

Manufacturing end-use drives the Environmental Control Systems Market demand, accounting for 27.5%.

In 2024, the manufacturing sector represented a 27.5% share of the Environmental Control Systems Market by end use, highlighting its strong dependence on controlled environments. Manufacturing operations require stable air quality, temperature, and water management to maintain product quality and worker safety. Sectors such as chemicals, electronics, food processing, and pharmaceuticals invested heavily in integrated environmental control solutions.

Increasing automation and high-precision production further raised the need for consistent environmental conditions. At the same time, manufacturers faced pressure to lower emissions and resource waste. This combination of operational and regulatory needs positioned manufacturing as a key driver of demand for environmental control systems globally.

Key Market Segments

By Component

- Sensors

- Controllers

- Air Purification and Filtration Systems

- Actuators

- HVAC Systems

- Thermostats

- Others

By Product

- Air Quality Control Systems

- Water Treatment Systems

- Waste Management Systems

- Energy Management Systems

- Others

By End Use

- Aerospace

- Automotive

- Marine

- Agriculture

- Manufacturing

- Healthcare

- Others

Driving Factors

Smart Thermostat Funding Accelerates System Adoption

In 2024, strong investment activity became a major driving factor for the Environmental Control Systems Market, especially in smart temperature management. European smart thermostat startup tado secured €12 million in funding to expand its intelligent heating and cooling solutions, showing rising confidence in energy-efficient controls.

In addition, tado raised $46.9 million after its IPO plans faltered, signaling investor belief in long-term demand despite market uncertainty. These investments help improve system accuracy, automation, and user comfort while lowering energy waste. As buildings focus more on reducing energy bills and emissions, funded innovation supports faster product development and wider adoption. This steady flow of capital directly drives market growth by making advanced environmental control systems more accessible and reliable.

Restraining Factors

High Costs And Integration Complexity Limit Adoption

Despite growing interest, cost and complexity remain key restraining factors in the Environmental Control Systems Market. Amazon’s participation in a $50 million funding round for German smart thermostat startup tado highlights how significant capital is often required just to scale solutions. Smaller organizations may struggle to afford such systems without strong backing.

Similarly, Comfy raised $12 million for its workplace temperature control app, showing demand but also emphasizing the resources needed to refine and integrate user-centric platforms. Installation costs, system compatibility issues, and the need for skilled maintenance slow adoption, especially in older buildings. These barriers can delay purchasing decisions, particularly for budget-constrained users, limiting short-term market expansion.

Growth Opportunity

Energy Storage Incentives Create New Growth Pathways

Rising support for energy storage and smart controls is creating strong growth opportunities in the Environmental Control Systems Market. Arizona Public Service’s plan to boost customer storage incentive funding by 50% encourages households and businesses to combine environmental control systems with energy storage for better efficiency. This move supports smarter load management and more resilient building operations.

At the same time, Mysa raised $2 million to develop smart home thermostats, focusing on affordable, user-friendly solutions. These developments open opportunities for integrated systems that manage temperature, energy use, and storage together. Such combinations make environmental control systems more valuable, driving future demand across residential and small commercial segments.

Latest Trends

Circular Systems And Data Platforms Shape Market Trends

Sustainability-focused technologies are emerging as a key trend in the Environmental Control Systems Market. SuperCircle raised $24 million in Series A funding to scale its textile waste management system, reflecting growing interest in circular environmental solutions linked to controlled facilities. These systems help buildings manage waste, emissions, and resource efficiency together.

Meanwhile, Downstream secured $8 million in Series A funding to expand its data platform, enabling better tracking of environmental performance across assets. Together, these developments show a shift toward smarter, data-driven, and circular environmental control approaches. This trend supports long-term efficiency goals and aligns environmental control systems with broader sustainability strategies.

Regional Analysis

North America leads the Environmental Control Systems Market with a 34.6% share, valued at USD 1.62 Bn.

North America dominates the Environmental Control Systems Market, holding a 34.6% share and valued at USD 1.62 Bn, supported by mature industrial infrastructure, strict environmental regulations, and widespread adoption of advanced control technologies across manufacturing, commercial buildings, and utilities. The region emphasizes air quality management, energy efficiency, and water treatment compliance, which strengthens consistent demand.

Europe follows as a steady market, driven by strong environmental compliance frameworks, sustainability-focused industrial practices, and long-term adoption of environmental monitoring and control solutions across multiple sectors.

Asia Pacific represents a fast-expanding regional market, supported by rapid industrialization, urban growth, and increasing focus on pollution control and workplace safety across manufacturing-intensive economies. The Middle East & Africa market shows gradual development, shaped by industrial diversification efforts, infrastructure modernization, and growing awareness of environmental management in energy, utilities, and large commercial facilities.

Latin America contributes steadily, supported by industrial operations, environmental policy alignment, and rising investments in air, water, and emission control systems. Together, these regions reflect balanced global demand dynamics, with North America maintaining leadership due to its scale, regulatory strength, and advanced technology integration.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Honeywell International continues to play a strategic role in the Environmental Control Systems Market through its strong focus on automation, sensing technologies, and integrated control platforms. In 2024, the company’s expertise in building management systems, industrial controls, and environmental monitoring supports demand from manufacturing, commercial infrastructure, and critical facilities. Honeywell’s ability to combine software, analytics, and hardware enables customers to manage air quality, energy efficiency, and operational safety within a single ecosystem, reinforcing its long-term relevance in environmental control applications.

Siemens AG remains a key player by leveraging its deep capabilities in digital industries and smart infrastructure. The company’s environmental control offerings align closely with industrial automation, smart buildings, and process optimization needs. In 2024, Siemens benefits from its strength in integrating environmental controls with energy management and industrial digitalization. Its solutions support consistent environmental conditions, regulatory compliance, and operational efficiency, making Siemens a preferred partner for large-scale industrial and infrastructure projects requiring reliable control systems.

Thermo Fisher Scientific Inc. contributes to the Environmental Control Systems Market through its specialization in analytical instruments, monitoring solutions, and laboratory environments. In 2024, the company’s systems support precise control and measurement of environmental parameters, particularly in manufacturing, life sciences, and industrial testing settings. Thermo Fisher’s strong focus on accuracy, compliance, and data reliability positions it as a critical supplier for applications where environmental stability directly impacts quality, safety, and regulatory adherence.

Top Key Players in the Market

- Honeywell International

- Siemens AG

- Thermo Fisher Scientific Inc.

- Danaher

- 3M

- Liebherr International AG

- Meggitt PLC

- Curtiss-Wright Corporation

- Mecaer Aviation Group

Recent Developments

- In December 2025, 3M announced it would debut an AI-powered innovation tool at CES 2026 to help customers create and test materials faster. While broader than environmental systems, this tool supports 3M’s work in advanced materials and energy-efficient technologies.

- In February 2024, Danaher publicly committed to setting science-based greenhouse gas (GHG) emission reduction targets, aiming to reach net-zero emissions across its value chain by 2050. This pledge covers Scope 1, 2, and 3 emissions and builds on its existing plan to cut Scope 1 and 2 emissions by 50.4% by 2032, underlining the company’s focus on environmental responsibility and sustainability.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Billion Forecast Revenue (2034) USD 7.7 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Sensors, Controllers, Air Purification and Filtration Systems, Actuators, HVAC Systems, Thermostats, Others), By Product (Air Quality Control Systems, Water Treatment Systems, Waste Management Systems, Energy Management Systems, Others), By End Use (Aerospace, Automotive, Marine, Agriculture, Manufacturing, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Honeywell International, Siemens AG, Thermo Fisher Scientific Inc., Danaher, 3M, Liebherr International AG, Meggitt PLC, Curtiss-Wright Corporation, Mecaer Aviation Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Environmental Control Systems MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Environmental Control Systems MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Honeywell International

- Siemens AG

- Thermo Fisher Scientific Inc.

- Danaher

- 3M

- Liebherr International AG

- Meggitt PLC

- Curtiss-Wright Corporation

- Mecaer Aviation Group