Global Envelope Tracking Chips Market Size, Share, Industry Analysis Report By Technology(Cellular Communications, Wireless Communications, Satellite Communications), By Application (Smartphones & Tablets, IoT & Wearable Devices, Others), By End-User (Consumer Electronics, Space and Aviation, Automotive, Telecommunications, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158531

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

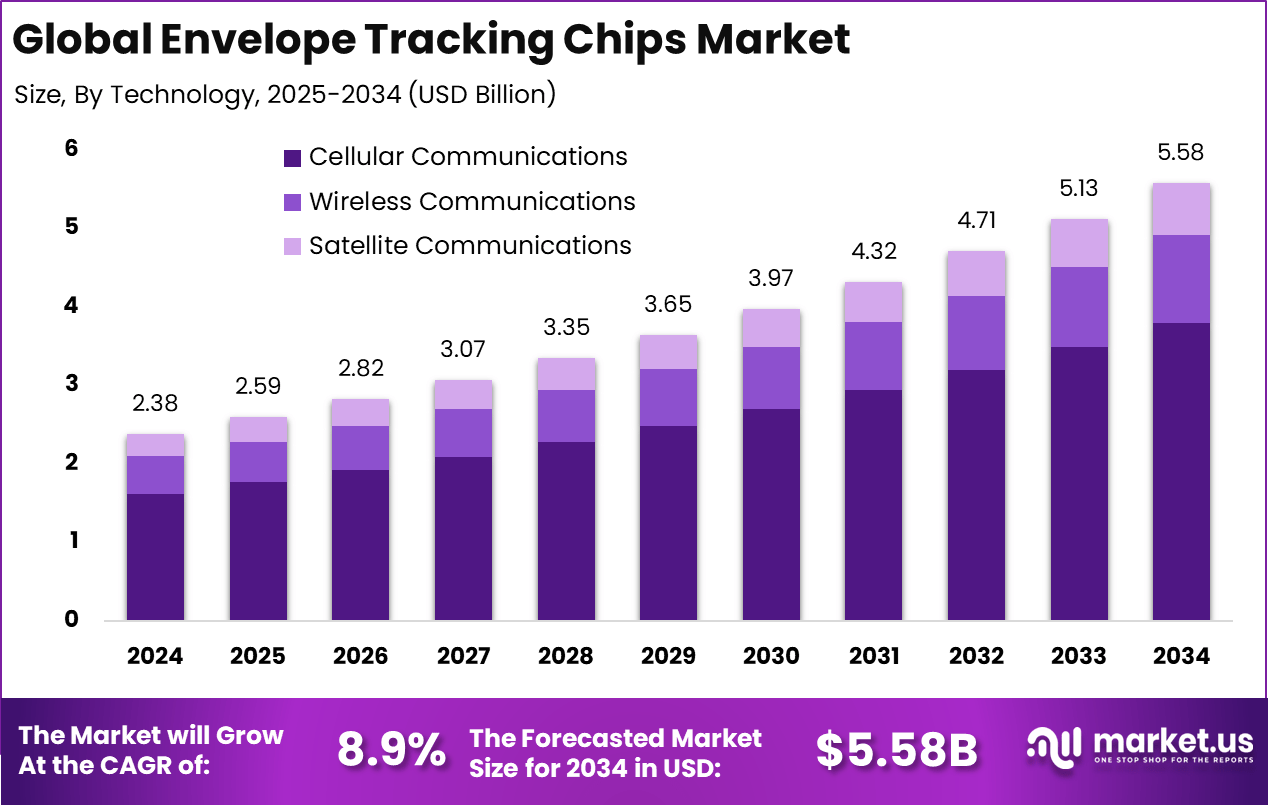

The Global Envelope Tracking Chips Market size is expected to be worth around USD 5.58 billion by 2034, from USD 2.38 billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 46% share, holding USD 1.0 billion in revenue.

The Envelope Tracking Chips Market refers to semiconductor components designed to improve power efficiency in radio frequency (RF) power amplifiers. These chips dynamically adjust the supply voltage to match the instantaneous power requirements of transmitted signals, reducing energy loss and heat generation.

Envelope tracking chips are widely used in smartphones, tablets, base stations, wireless communication systems, and IoT devices to enhance battery life and ensure higher performance in mobile networks. The market is driven by the rapid growth of mobile data traffic and increasing demand for energy-efficient communication devices.

The rollout of 4G LTE and 5G networks requires advanced RF power management, which supports the adoption of envelope tracking chips. Rising smartphone penetration, coupled with consumer expectations for longer battery life, further accelerates demand. The growing use of connected devices and IoT applications is also contributing to market expansion.

For instance, in March 2025, Murata Manufacturing and Rohde & Schwarz jointly announced an initiative to enhance the power efficiency of 5G and 6G devices through Digital Envelope Tracking technology. This collaboration focuses on optimizing the power consumption of RF front-end modules, crucial for next-generation communication systems.

Key Takeaway

- By communication type, the Cellular Communications segment dominated with 68% share, highlighting its central role in enabling efficient power usage in mobile networks.

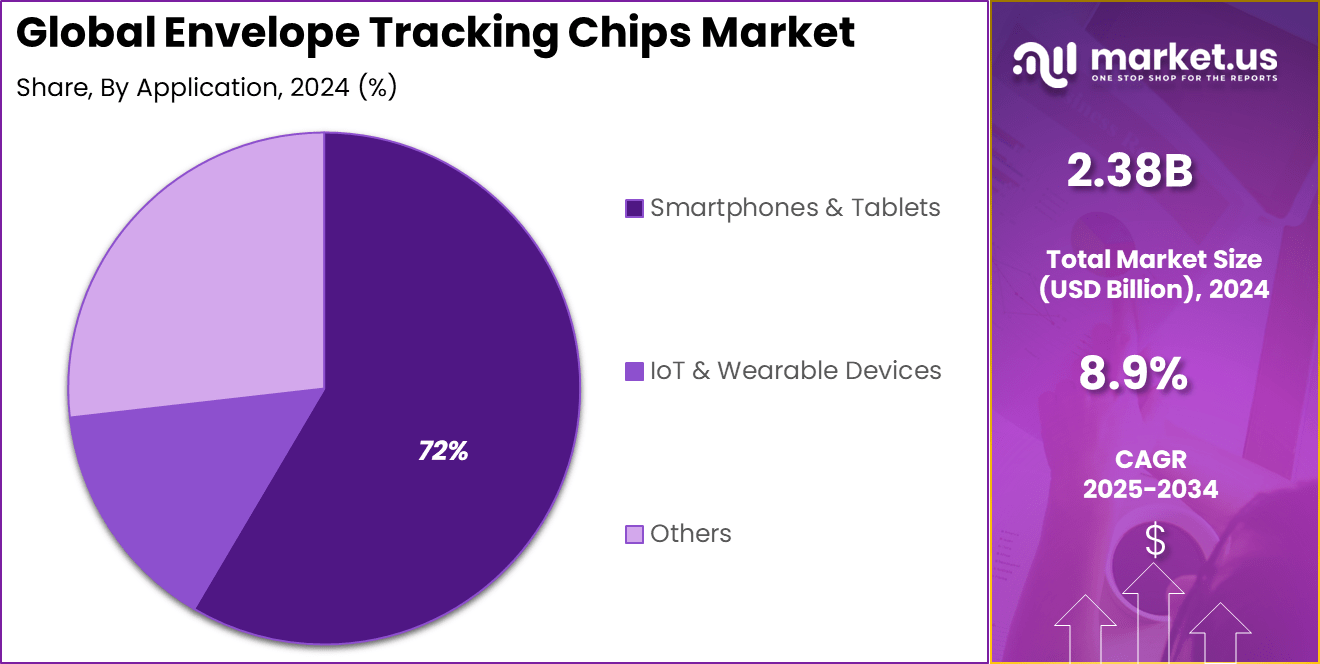

- By device category, Smartphones & Tablets led the market with a commanding 72% share, reflecting strong integration of envelope tracking chips in handheld consumer devices.

- By end-use industry, Consumer Electronics captured 66% share, underlining widespread adoption across connected devices.

- Regionally, Asia Pacific held a leading position with 46% share of the global market in 2024.

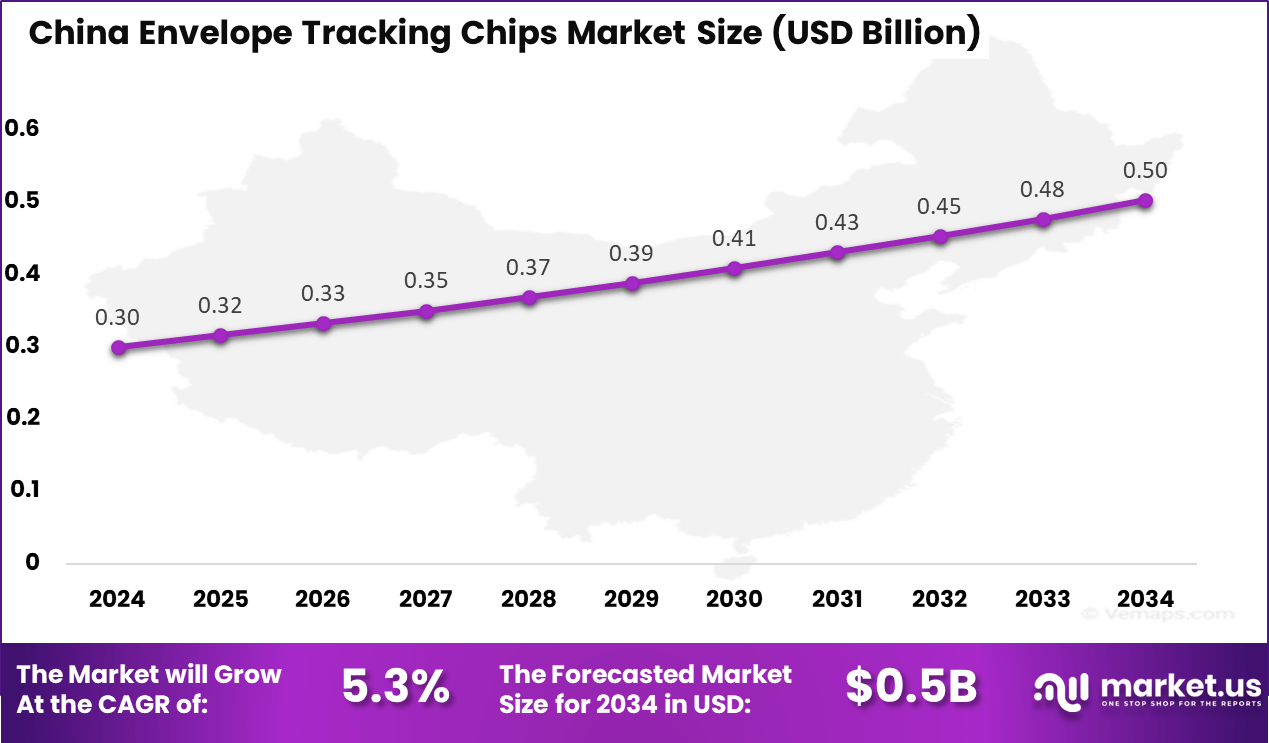

- Within the region, the China market was valued at USD 0.3 Billion in 2024, expanding steadily at a CAGR of 5.3%.

Analysts’ Viewpoint

The increasing adoption of envelope tracking technologies is attributed to their proven benefits in reducing power consumption, lowering heat generation, and extending battery life in mobile and wireless applications. These chips are critical in realizing the full potential of 5G by enabling efficient handling of high-frequency signals and complex modulation schemes.

Investment opportunities in the envelope tracking chips market are highlighted by the push towards domestic semiconductor manufacturing driven by geopolitical factors and supply chain resilience efforts. For instance, the ongoing US tariff policies in 2025 have accelerated investments in local fabrication and packaging facilities to reduce dependency on imports.

From a business benefits standpoint, envelope tracking chips allow manufacturers to deliver products with superior battery life, better thermal management, and improved wireless performance – features highly valued by end-users. These advantages help device makers differentiate their products in a crowded market. The technology helps telecom operators cut energy costs in network infrastructure while improving service quality, supporting cost efficiency and sustainability goals.

China Market Size

The market for Envelope Tracking Chips within China is growing tremendously and is currently valued at USD 0.3 billion, the market has a projected CAGR of 5.3%. The market is growing tremendously due to the country’s rapid adoption of 5G technology and the increasing demand for energy-efficient communication systems.

As China leads the rollout of 5G infrastructure, the demand for energy-efficient, high-performance communication systems rises. Additionally, China’s strong focus on advanced semiconductor manufacturing and the push for smart technologies in sectors like automotive, IoT, and consumer electronics contribute to the market’s expansion.

In 2024, Asia Pacific held a dominant market position in the Global Envelope Tracking Chips Market, capturing more than a 46% share, holding USD 1.0 billion in revenue. This dominance is due to its leadership in 5G deployment and the rapid expansion of mobile and IoT applications.

Countries like China, South Korea, and Japan are at the forefront of 5G infrastructure development, driving high demand for energy-efficient communication solutions. The region’s strong semiconductor manufacturing capabilities, combined with significant investments in wireless technologies, further fuel the growth.

For instance, In November 2022, MediaTek launched its T800 5G modem with advanced Envelope Tracking technology to improve power efficiency and performance, reinforcing Asia Pacific’s strong position in the Envelope Tracking Chips market.

Technology Analysis

In 2024, the Cellular Communications segment held a dominant market position, capturing a 68% share of the Global Envelope Tracking Chips Market. This dominance is due to the rapid expansion of 5G networks, which require more efficient power management for higher frequency and data-intensive communication.

Envelope tracking chips play a crucial role in optimizing power usage in mobile devices, base stations, and wireless infrastructure, ensuring enhanced performance and longer battery life. The growing demand for smartphones and connected devices further drives this market segment’s growth.

For Instance, in October 2023, Qualcomm unveiled its most powerful flagship chipset, featuring improved AI capabilities, enhanced power efficiency, and better performance. This new chipset is designed to support next-generation cellular communications, including 5G and beyond, where Envelope Tracking (ET) chips play a critical role.

Application Analysis

In 2024, the Smartphones & Tablets segment held a dominant market position, capturing a 72% share of the Global Envelope Tracking Chips Market. This dominance is due to the increasing demand for energy-efficient, high-performance devices that support advanced features like 5G connectivity, longer battery life, and faster data speeds.

Envelope tracking chips optimize power usage in power amplifiers, reducing energy consumption while maintaining peak performance in mobile devices. The widespread adoption of 5G smartphones and tablets further accelerates the growth of this segment.

For instance, in August 2022, TechInsights conducted a teardown of the Samsung Galaxy Tab S8 Ultra 5G, revealing the advanced components integrated into the device. The tablet, designed for high-performance tasks, benefits from Envelope Tracking (ET) chips to optimize power consumption and enhance 5G connectivity.

End-User Analysis

In 2024, the Consumer Electronics segment held a dominant market position, capturing a 66% share of the Global Envelope Tracking Chips Market. This dominance is due to the growing demand for power-efficient solutions in various consumer devices, including smartphones, tablets, wearables, and smart home devices.

Envelope tracking chips help optimize battery life and enhance performance, especially in energy-hungry applications like 5G and IoT. As consumers increasingly prioritize longer battery life and faster connectivity, the demand for ET chips continues to rise.

For Instance, in November 2022, MediaTek unveiled its 4nm T800 chipset, designed to deliver high-speed, power-efficient 5G connectivity. The T800 integrates cutting-edge technologies, including an advanced Envelope Tracking system, to optimize power efficiency and support ultra-fast 5G speeds.

Emerging Trends

The market is witnessing a rise in gallium nitride (GaN)-based envelope tracking chips that offer higher power density and efficiency compared to traditional designs. Compact, lightweight chip designs targeting wearable and IoT devices are expanding adoption. There is a growing focus on integrating envelope tracking technology within 5G base stations, Open RAN architectures, and automotive 5G telematics, especially for connected and autonomous vehicles.

The use of AI-based signal processing for real-time power management is becoming standard, alongside advancements in multi-band and mmWave frequency support. These trends reflect a movement toward more energy-efficient and performance-oriented RF front-end solutions.

Growth Factors

Widespread 5G rollout drives demand for envelope tracking chips due to the need for efficient power use in multiband RF frontends. Increasing mobile device usage, IoT proliferation, and consumer demand for longer battery life are key growth drivers. Additionally, regulatory mandates on automotive V2X communication and industrial IoT systems push adoption.

Defense and satellite communications also contribute to growth with high-efficiency requirements. Government initiatives to boost domestic semiconductor manufacturing capacity are increasing availability and lowering supply risks. Overall, growth is strongly tied to power efficiency challenges in modern wireless communication and connected devices.

Key Market Segments

By Technology

- Cellular Communications

- Wireless Communications

- Satellite Communications

By Application

- Smartphones & Tablets

- IoT & Wearable Devices

- Others

By End-User

- Consumer Electronics

- Space and Aviation

- Automotive

- Telecommunications

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for 5G and Mobile Device Efficiency

One key driver for the envelope tracking chip market is the widespread expansion of 5G networks and the increasing number of mobile devices worldwide. These chips are essential to improve power efficiency in mobile devices by optimizing the voltage supply to power amplifiers.

This helps extend battery life and maintain better signal quality, which consumers expect from modern smartphones and wireless devices. For example, as 5G connections increase rapidly, devices require more efficient power management to handle higher data rates and reduce heat generation, pushing the demand for envelope tracking technology.

For instance, in November 2022, MediaTek unveiled its ultra-fast and power-efficient 5G thin modem solution, specifically designed to deliver unparalleled 5G experiences beyond smartphones. This innovation emphasizes the growing importance of efficient power management in 5G networks.

Restraint

Semiconductor Supply Chain Challenges

A significant restraint facing the envelope tracking chip market is the ongoing global semiconductor shortage. The demand for advanced electronic components, including envelope tracking chips, has surged sharply due to growth in telecom infrastructure, automotive systems, and consumer devices.

However, supply constraints have caused production delays and longer lead times. This restricts the ability of manufacturers to meet rising market needs on time, impacting growth potential. Additionally, supply chain disruptions create cost pressures and increase complexity in managing inventory and production schedules.

High dependency on a limited number of suppliers puts risks on the continuity of production. Firms are trying to mitigate this by expanding manufacturing capacities and diversifying suppliers, but these efforts need time to stabilize supply. Thus, semiconductor shortages slow market momentum despite strong demand.

Opportunities

Expanding Automotive and IoT Sectors

The growing automotive industry, especially with the rise of connected vehicles and autonomous driving, presents a promising opportunity for envelope tracking chips. These chips are increasingly used in automotive radar and telematics systems to optimize power usage during vehicle communication and sensor operation. Regulatory mandates on vehicle-to-everything (V2X) communication in regions like Europe and China drive adoption of these energy-efficient chips in next-generation vehicles.

Furthermore, the expansion of IoT ecosystems across smart homes, industries, and cities also creates new use cases. Envelope tracking technology helps manage power consumption in many wireless IoT devices, fostering better performance and battery longevity. As these sectors grow, chip makers have multiple avenues for market expansion beyond mobile devices, leveraging advances in chip efficiency, AI integration, and miniaturization.

For instance, in March 2025, the introduction of the first digital envelope tracking solutions is expected to further boost the efficiency of 5G and upcoming 6G devices. These innovations focus on replacing traditional analog systems with digital implementations, which can provide more precise control over power usage.

Challenges

Thermal Management and Miniaturization

A key technical challenge in the envelope tracking chip market is effective thermal management alongside ongoing miniaturization. As envelope tracking chips operate at high frequencies and power levels, controlling the generated heat becomes critical to maintain performance and reliability. Efficient cooling solutions must be integrated without adding bulk, especially as consumer devices demand smaller form factors.

At the same time, reducing chip size while maintaining or improving functionality requires advanced semiconductor design and manufacturing techniques. Balancing energy efficiency, thermal performance, and compactness demands continuous innovation. Failure to solve these issues may limit chip adoption in space-constrained devices or high-power applications. Firms must invest in R&D to overcome these challenges and stay competitive.

For instance, in March 2022, Qualcomm’s Snapdragon X65 and X62 modem-RF systems powered Telit’s new 5G M.2 module, showcasing a significant innovation in power efficiency for advanced communication systems. The integration of 7th-gen Qualcomm® Wideband Envelope Tracking, along with AI-Enhanced Signal Boost and 5G PowerSave 2.0, addresses the continuous need for innovation in envelope tracking chips.

Key Players Analysis

In the envelope tracking chips market, Qualcomm, Samsung Electronics, MediaTek, and Broadcom are leading players. Their dominance comes from strong positions in the smartphone and wireless communication sectors, where efficient power management for RF amplifiers is essential. These companies integrate envelope tracking solutions into mobile platforms to extend battery life and improve performance in 4G and 5G devices.

One of the leading players in the market, in June 2025, Qualcomm announced its agreement to acquire UK-based Alphawave Semi for $2.4 bn. This strategic acquisition aims to strengthen Qualcomm’s capabilities in high-speed connectivity, particularly in data center infrastructure and advanced communication systems. By integrating Alphawave’s expertise in silicon technology, Qualcomm is poised to enhance its solutions for power-efficient communication systems.

Semiconductor specialists such as Analog Devices, Texas Instruments, Qorvo, and Skyworks Solutions strengthen the market with high-performance RF components. Their chips are widely used in mobile devices, base stations, and IoT applications. With a focus on reducing power consumption and improving signal quality, these firms play an important role in advancing connectivity.

Other contributors including Efficient Power Conversion, Keysight Technologies, R2 Semiconductor, and Rohde & Schwarz add value with niche technologies and testing capabilities. Their work focuses on improving efficiency in RF systems, providing design support, and offering solutions for specialized applications.

Top Key Players in the Market

- Analog Devices Inc.

- Broadcom Inc.

- Efficient Power Conversion Corporation

- Keysight Technologies Inc.

- MediaTek Inc.

- Qorvo Inc.

- Qualcomm Incorporated

- R2 Semiconductor Inc.

- Rohde & Schwarz GmbH & Co KG

- Samsung Electronics Co. Ltd.

- Skyworks Solutions Inc.

- Texas Instruments Incorporated

- Other Key Players

Recent Developments

- In February 2024, Qorvo Inc. announced its acquisition of Anokiwave Inc., a leader in high-performance silicon integrated circuits for intelligent active array antennas used in 5G, SATCOM, and defense applications. The combination of Anokiwave’s expertise in high-frequency beamforming and Qorvo’s RF front-end portfolio will drive further innovation in Envelope Tracking (ET) technology, particularly for defense, aerospace, and 5G network infrastructure.

- In September 2021, Murata Manufacturing completed the acquisition of Eta Wireless Inc., a developer of Digital Envelope Tracking (ET) technology. This acquisition allows Murata to integrate Eta Wireless’s proprietary power management technology into its RF circuit solutions, enhancing power efficiency in broadband signals like 5G.

Report Scope

Report Features Description Market Value (2024) USD 2.38 Bn Forecast Revenue (2034) USD 5.58 Bn CAGR(2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology(Cellular Communications, Wireless Communications, Satellite Communications), By Application (Smartphones & Tablets, IoT & Wearable Devices, Others), By End-User (Consumer Electronics, Space and Aviation, Automotive, Telecommunications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Analog Devices Inc., Broadcom Inc., Efficient Power Conversion Corporation, Keysight Technologies Inc., MediaTek Inc., Qorvo Inc., Qualcomm Incorporated, R2 Semiconductor Inc., Rohde & Schwarz GmbH & Co KG, Samsung Electronics Co. Ltd., Skyworks Solutions Inc., Texas Instruments Incorporated, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Envelope Tracking Chips MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Envelope Tracking Chips MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Analog Devices Inc.

- Broadcom Inc.

- Efficient Power Conversion Corporation

- Keysight Technologies Inc.

- MediaTek Inc.

- Qorvo Inc.

- Qualcomm Incorporated

- R2 Semiconductor Inc.

- Rohde & Schwarz GmbH & Co KG

- Samsung Electronics Co. Ltd.

- Skyworks Solutions Inc.

- Texas Instruments Incorporated

- Other Key Players