Global Enterprise Network Equipment Market Size, Share and Analysis Report By Type (Switches, Routers, WLAN, Network Security, Access Points and Controllers, Others), By Deployment Model (On-Premises, Cloud-Managed, Hybrid), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By End-User Vertical (IT and Telecom, BFSI, Healthcare, Manufacturing, Government, Retail and E-commerce, Other End-User Verticals), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 178501

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

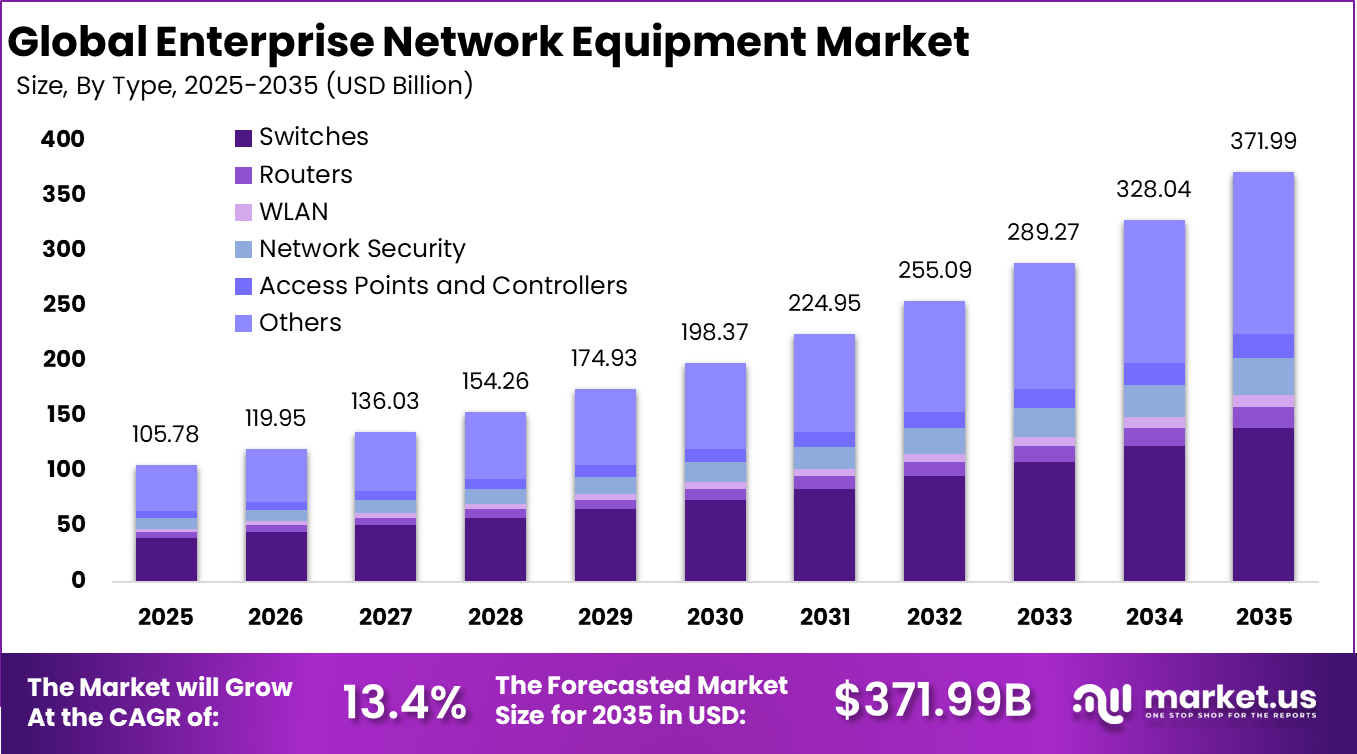

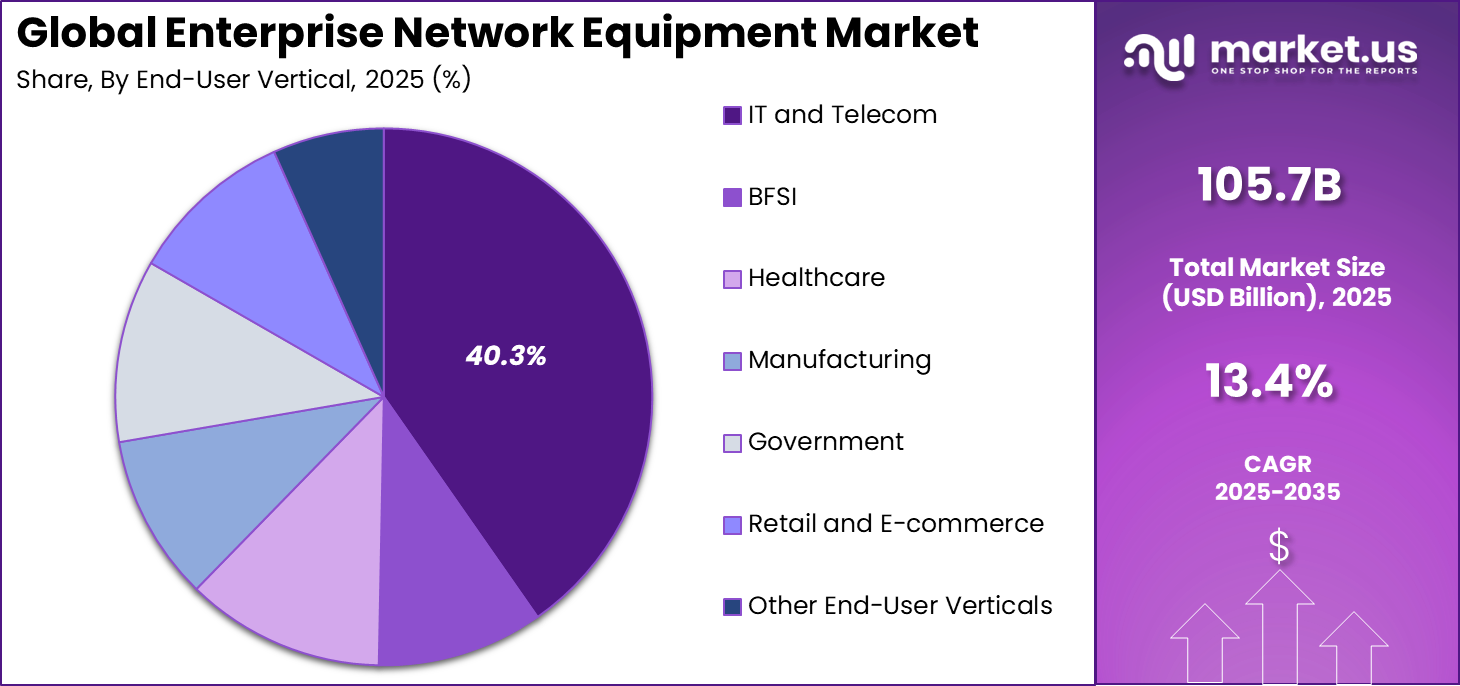

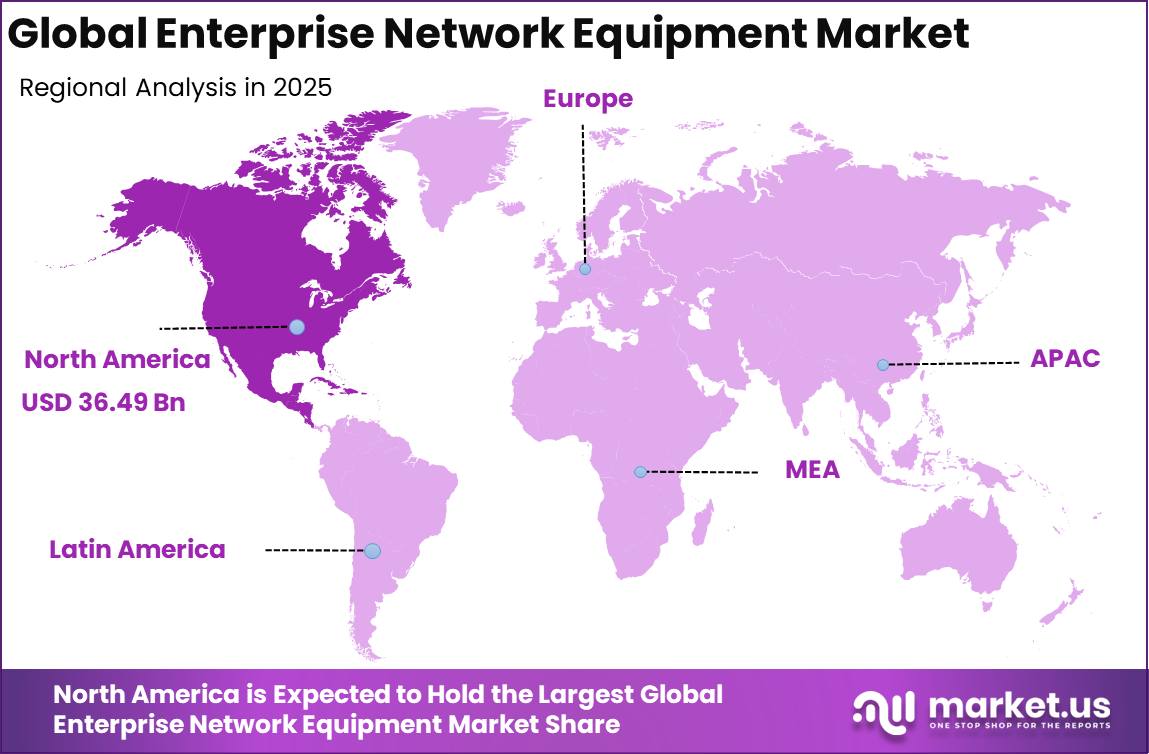

The Global Enterprise Network Equipment Market size is expected to be worth around USD 371.99 billion by 2035, from USD 105.78 billion in 2025, growing at a CAGR of 13.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 34.5% share, holding USD 36.49 billion in revenue.

The enterprise network equipment market comprises hardware and software tools that enable data communication and connectivity within organizations. These components include routers, switches, wireless access points, network security appliances, and related infrastructure. The market is fundamental to supporting digital operations by enabling fast, reliable, and secure data transfer. As enterprises expand their digital footprint, investment in network equipment becomes essential for business continuity and performance.

Enterprise network equipment supports internal and external connectivity across office locations, data centers, and cloud environments. These solutions play a critical role in enabling employees to access applications and data with minimal delay. The market is shaped by the need for resilient network infrastructure that can support increasing data volumes and complex communication requirements. Demand for network equipment has continued to rise as enterprises adopt new digital technologies and hybrid work models.

One of the key driving factors in the enterprise network equipment market is the growth of data traffic within organizations. Businesses increasingly rely on digital services, video communication, and cloud applications that generate significant network load. This trend requires enterprises to upgrade legacy equipment and adopt modern, high-capacity solutions. The shift toward digital services and applications makes robust network infrastructure a priority for enterprise IT budgets.

Demand for enterprise network equipment is influenced by the increasing adoption of cloud computing services. As businesses migrate applications to the cloud, they require network solutions capable of managing traffic between on-premises infrastructure and cloud platforms. Network equipment that supports high bandwidth and low latency is in strong demand to ensure application performance. Organizations are evaluating equipment based on performance, scalability, and integration capabilities.

For instance, in January 2026, Dell Technologies Inc. boosted its Infrastructure Solutions Group with $12.3B AI server orders and PowerStore/PowerMax expansions, leveraging partner networks for rapid AI rack deployments. Dell’s storage-networking combo keeps it central to enterprise AI builds.

Key Takeaway

- Switches accounted for 37.5% share, reflecting strong demand for high performance data routing and traffic management within enterprise networks.

- On premises deployment represented 54.8% of installations, supported by greater control over security, data privacy, and network customization.

- Large enterprises contributed 72.6% of overall demand, driven by extensive IT infrastructure and high bandwidth requirements.

- The IT and telecom vertical held 40.3% share, supported by continuous upgrades in network capacity and cloud connectivity expansion.

- North America captured 34.5% of the global market, supported by advanced digital infrastructure and early technology adoption.

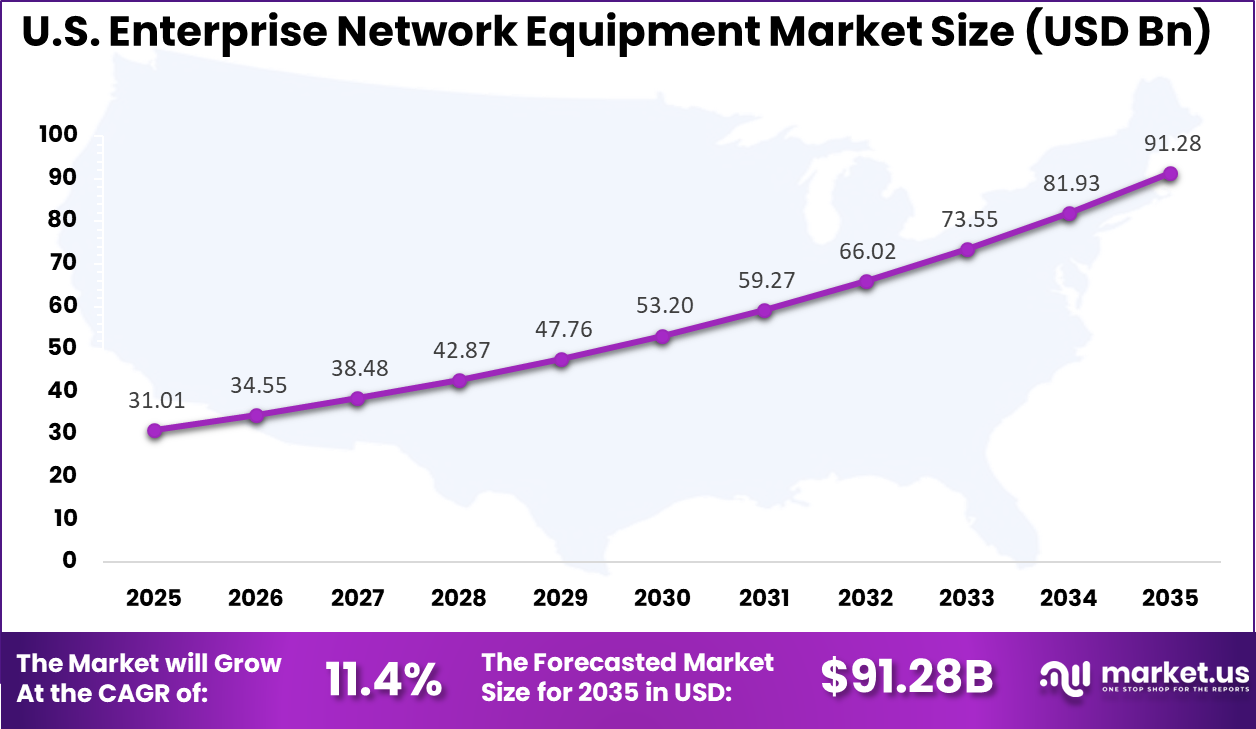

- The United States generated USD 31.01 billion in revenue and is expanding at a 11.4% CAGR, driven by enterprise modernization and data center expansion initiatives.

By Type: Switches

Switches account for 37.5% of the enterprise network equipment market, reflecting their central role in managing internal data traffic. These devices enable communication between computers, servers, and storage systems within enterprise networks. As organizations expand digital operations, the volume of data transmitted across internal systems continues to increase. This sustained data movement supports steady demand for high-performance switching solutions.

Modern enterprise environments require switches that can handle high bandwidth, low latency, and advanced security configurations. The growth of cloud computing, video collaboration, and connected devices has further strengthened the need for scalable switching infrastructure. Enterprises are also upgrading legacy systems to support higher speeds and software-defined networking capabilities. As digital workloads grow, switching equipment remains foundational to network stability and performance.

For Instance, in December 2025, HPE introduced the HPE Juniper Networking QFX5250 switch, the first OEM model with Broadcom Tomahawk 6 silicon. Delivering 102.4 Tbps bandwidth for GPU connections in data centers, it supports AI-native operations with liquid cooling and Junos OS. This boosts performance for scale-out AI inference while cutting power use.

By Deployment Model: On-Premises

On-premises deployment holds 54.8% share, indicating that many enterprises continue to prioritize direct control over network infrastructure. Organizations in regulated sectors often prefer on-site equipment to maintain data governance and security oversight. On-premises systems allow full customization of hardware configurations and security protocols. This level of control remains important for enterprises handling sensitive operational data.

Despite the rise of cloud-managed networking, many companies operate hybrid IT environments that rely on physical infrastructure within corporate facilities. Large data centers, manufacturing plants, and financial institutions frequently depend on locally managed network equipment. On-premises deployment also supports predictable performance and minimal external dependency. As digital transformation progresses, physical network infrastructure continues to serve as a critical backbone.

For instance, in July 2025, Arista Networks acquired VeloCloud for SD-WAN, enhancing on-premises branch setups with secure firewalls and Wi-Fi. The deal expands Arista’s edge routers for hybrid networks, linking data centers to offices reliably. Customers like Broadcom use it for a scalable WAN without full cloud shifts.

By Enterprise Size: Large Enterprises

Large enterprises represent 72.6% of total demand, reflecting the scale and complexity of their network environments. Multinational corporations operate multiple data centers, branch offices, and distributed teams. Such expansive infrastructure requires high-capacity routers, switches, and security appliances. The operational demands of these organizations create sustained investment in enterprise-grade networking equipment.

These enterprises often integrate advanced technologies such as network automation, software-defined networking, and AI-driven traffic management. As digital workloads expand across cloud, edge, and on-premises systems, network reliability becomes essential for business continuity. Large organizations also prioritize redundancy and cybersecurity measures to minimize operational risk. The dominance of this segment highlights the strategic importance of resilient network architecture.

For Instance, in January 2025, HPE Aruba Networking unveiled a retail-ready portfolio for large chains, bundling Wi-Fi 7, private 5G, and edge computing via the Central platform. New 100 Series Cellular Bridge offers resilient WAN backup for POS during outages. This modernizes distributed locations from warehouses to curbside with AI insights for optimization.

By End-User Vertical: IT and Telecom

The IT and telecom sector accounts for 40.3% of market adoption, driven by continuous expansion of data traffic and connectivity services. Telecom operators manage vast network infrastructures that support broadband, mobile, and enterprise connectivity solutions. IT service providers also require advanced networking systems to host applications, cloud platforms, and managed services. This vertical depends heavily on high-performance and scalable network equipment.

Rapid growth in 5G, fiber deployments, and data center expansion further strengthens equipment demand in this segment. IT and telecom companies continuously upgrade infrastructure to support increasing bandwidth requirements and digital service delivery. Network equipment forms the operational core of communication services. As global data consumption rises, this sector remains a primary driver of enterprise network equipment adoption.

For Instance, in October 2025, Fortinet dominated IT/telecom RFPs with bundled NGFW and switches, hitting 19% share alongside Palo Alto. Telecoms pick them for perimeter security in data-heavy ops. All-in-one setups cut complexity for verticals facing cyber threats and bandwidth spikes.

By Geography: North America

North America holds 34.5% of the enterprise network equipment market, reflecting strong digital infrastructure investment across industries. Enterprises in the region prioritize modernization of data centers and campus networks. High adoption of cloud services and advanced connectivity solutions supports consistent demand for network hardware. The region benefits from mature IT ecosystems and widespread enterprise digitization.

The United States market contributes significantly, with a recorded value of USD 31.01 Bn and a CAGR of 11.4%. Growth is supported by ongoing enterprise digital transformation and increasing deployment of advanced networking technologies. Investments in cybersecurity and high-speed connectivity infrastructure further sustain equipment demand. The regional outlook remains stable as enterprises continue upgrading network performance and resilience.

Emerging Trends Analysis

One emerging trend within the enterprise network equipment market is the increasing integration of software-defined and AI-driven networking capabilities into traditional hardware platforms. Enterprises are prioritizing solutions that offer automation, real-time performance monitoring, and predictive analytics alongside core routers and switches to support complex, high-performance environments.

This trend reflects the broader market shift toward dynamic network operations that can adapt to cloud, hybrid workforce, and IoT demands. As a result, networking equipment is no longer viewed solely as hardware but as part of intelligent infrastructure that can optimize traffic and enhance security. Additionally, the demand for cloud-managed and hybrid network deployments is gaining prominence as enterprises seek greater scalability and operational flexibility.

Cloud-managed networking solutions reduce on-premise complexity and enable centralized visibility across distributed sites, a critical capability in geographically diverse organizations. This aligns with broader enterprise digital transformation strategies, where agility and rapid service delivery are priorities. Continued adoption of technologies such as SD-WAN and SASE further exemplifies this trend toward hybrid networking models that balance performance with centralized control.

Opportunity Analysis

A significant opportunity within the enterprise network equipment market lies in expanding demand for edge computing solutions. Edge computing requires distributed networking hardware that can process data closer to its source, reducing latency and improving real-time decision-making. Enterprise network equipment vendors can benefit as manufacturing, healthcare, and logistics adopt edge architectures for automation and mission critical operations.

Furthermore, growing markets in Asia-Pacific and other developing regions present substantial opportunity due to rapid digital infrastructure investments and expanding enterprise IT environments. These regions are witnessing accelerated adoption of 5G, cloud services, and IoT applications, driving the need for robust network infrastructure. Vendors that tailor solutions to meet regional scalability, cost, and compliance requirements are well positioned to capture incremental growth across diverse enterprise segments.

Key Market Segments

By Type

- Switches

- Routers

- WLAN

- Network Security

- Access Points and Controllers

- Others

By Deployment Model

- On-Premises

- Cloud-Managed

- Hybrid

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By End-User Vertical

- IT and Telecom

- BFSI

- Healthcare

- Manufacturing

- Government

- Retail and E-commerce

- Other End-User Verticals

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Established networking infrastructure leaders such as Cisco Systems Inc., Huawei Technologies Co., Ltd., Hewlett Packard Enterprise Company, Juniper Networks Inc., and Arista Networks Inc. dominate the enterprise network equipment market. Their portfolios include switches, routers, wireless access points, and network management software. These vendors emphasize high-speed connectivity, software-defined networking, and cloud-managed architectures.

Security-focused networking providers such as Fortinet Inc., Palo Alto Networks Inc., Check Point Software Technologies Ltd., F5 Inc., and VMware LLC integrate security within network infrastructure. Broadcom Inc. supports hardware performance through advanced chipsets. Adoption is strong in enterprises prioritizing secure access and zero trust frameworks.

Regional and diversified infrastructure vendors such as Dell Technologies Inc., Nokia Corporation, ZTE Corporation, New H3C Technologies Co., Ltd., Ubiquiti Inc., Alcatel-Lucent Enterprise, NETSCOUT Systems Inc., A10 Networks Inc., and TP-Link Technologies Co., Ltd. expand market reach across segments. Other vendors enhance competition and innovation, supporting steady growth in enterprise network equipment globally.

Top Key Players in the Market

- Cisco Systems Inc.

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise Company

- Aruba Networks LLC

- Juniper Networks Inc.

- Arista Networks Inc.

- Extreme Networks Inc.

- Dell Technologies Inc.

- Broadcom Inc.

- Fortinet Inc.

- Palo Alto Networks Inc.

- Check Point Software Technologies Ltd.

- F5 Inc.

- VMware LLC

- New H3C Technologies Co., Ltd.

- Nokia Corporation

- ZTE Corporation

- Ubiquiti Inc.

- Alcatel-Lucent Enterprise

- NETSCOUT Systems Inc.

- A10 Networks Inc.

- TP-Link Technologies Co., Ltd.

- Others

Recent Developments

- In December 2025, Hewlett Packard Enterprise accelerated post-Juniper acquisition integration by unveiling the first combined HPE Aruba-Juniper Wi-Fi 7 access point, blending Mist AI and Aruba Central for self-driving networks. This $14B deal enables HPE to challenge Cisco in AI-native enterprise networking with unified edge-to-core solutions.

- In June 2025, at Cisco Live 2025, Cisco launched next-gen Nexus 9000 switches with Silicon One ASICs and 400 GbE optics. These innovations boost data center scalability and security integration, keeping Cisco at the forefront of AI-ready infrastructure for enterprises.

Report Scope

Report Features Description Market Value (2025) USD 105.7 Billion Forecast Revenue (2035) USD 371.9 Billion CAGR(2025-2035) 13.4% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Switches, Routers, WLAN, Network Security, Access Points and Controllers, Others), By Deployment Model (On-Premises, Cloud-Managed, Hybrid), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By End-User Vertical (IT and Telecom, BFSI, Healthcare, Manufacturing, Government, Retail and E-commerce, Other End-User Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems Inc., Huawei Technologies Co. Ltd., Hewlett Packard Enterprise Company, Aruba Networks LLC, Juniper Networks Inc., Arista Networks Inc., Extreme Networks Inc., Dell Technologies Inc., Broadcom Inc., Fortinet Inc., Palo Alto Networks Inc., Check Point Software Technologies Ltd., F5 Inc., VMware LLC, New H3C Technologies Co. Ltd., Nokia Corporation, ZTE Corporation, Ubiquiti Inc., Alcatel-Lucent Enterprise, NETSCOUT Systems Inc., A10 Networks Inc., TP-Link Technologies Co. Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enterprise Network Equipment MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Enterprise Network Equipment MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems Inc.

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise Company

- Aruba Networks LLC

- Juniper Networks Inc.

- Arista Networks Inc.

- Extreme Networks Inc.

- Dell Technologies Inc.

- Broadcom Inc.

- Fortinet Inc.

- Palo Alto Networks Inc.

- Check Point Software Technologies Ltd.

- F5 Inc.

- VMware LLC

- New H3C Technologies Co., Ltd.

- Nokia Corporation

- ZTE Corporation

- Ubiquiti Inc.

- Alcatel-Lucent Enterprise

- NETSCOUT Systems Inc.

- A10 Networks Inc.

- TP-Link Technologies Co., Ltd.

- Others