Global Energy Supplement Market Size, Share, And Enhanced Productivity By Nature (Stimulant-Based, Stimulant-Free), By Product Type (Drinks, Powders, Gels, Capsules, Tablet, Gummies, others), By End-user (Kids, Adults, Old Age), By Distribution Channel (Hypermarkets/Supermarkets, Pharmacies Stores, Grocery Stores, Specialty Stores, Discount Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169416

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

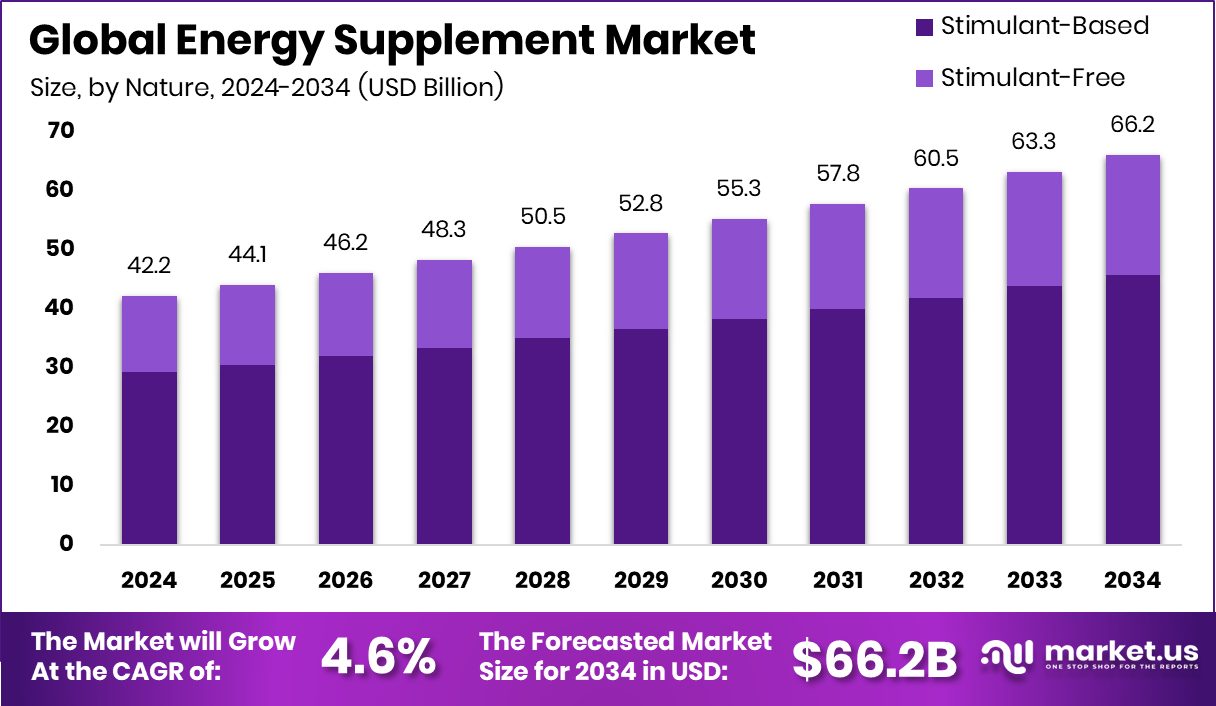

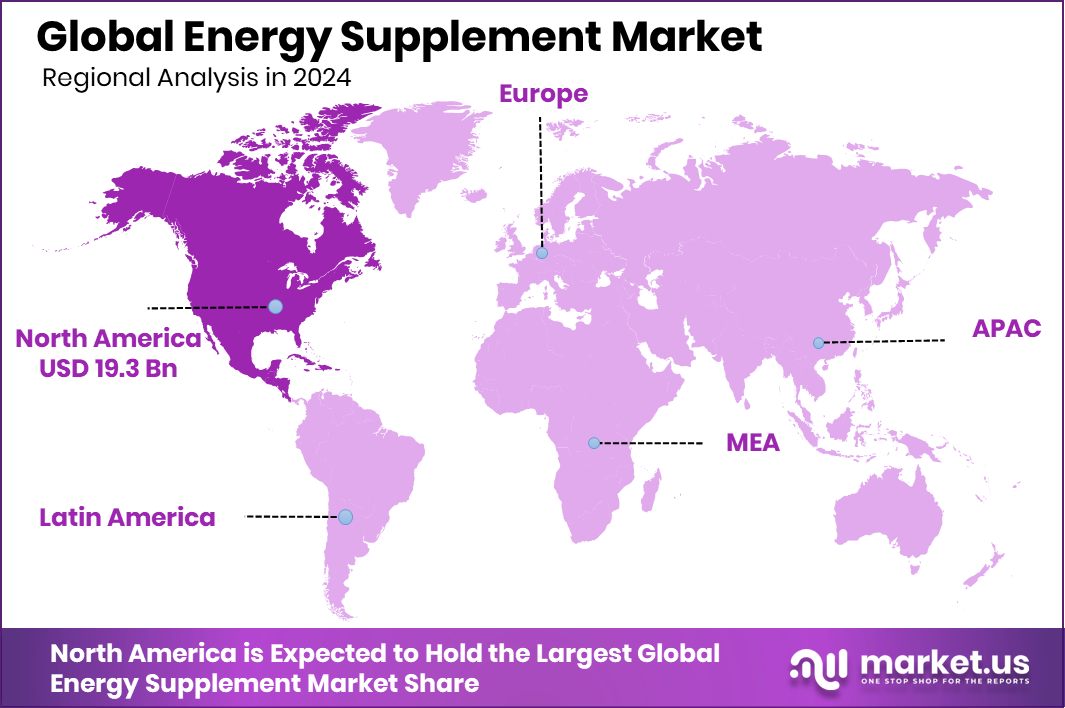

The Global Energy Supplement Market is expected to be worth around USD 66.2 billion by 2034, up from USD 42.2 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034. North America’s dominance reflects 45.80% Energy Supplement Market share, generating USD 19.3 Bn.

An energy supplement is a product designed to support physical and mental energy. It usually contains ingredients such as caffeine, vitamins, minerals, amino acids, or plant extracts that help reduce tiredness, improve focus, and support daily performance without acting as a medical product.

The energy supplement market represents the commercial ecosystem around these products, including powders, capsules, shots, and functional beverages. It serves consumers looking for quick energy support for work, fitness, travel, and active lifestyles, reflecting shifting habits toward convenience and on-the-go nutrition.

Growth in this market is driven by urban lifestyles, longer working hours, and rising interest in preventive wellness. Public and private investments are also shaping momentum, highlighted by Purdue receiving additional funding to expand a $3.5 million smart-city energy research program focused on efficient energy use.

Demand is rising as consumers seek cleaner labels, better taste, and functional benefits beyond simple stimulants. This is supported by strong funding confidence, such as Lucky Energy securing $25 million for nationwide expansion and a new consumer energy drink brand raising $24.5 million to scale awareness.

Opportunities ahead include product diversification and regional expansion. An example is a Pune-based beverage startup raising ₹10 crore to reach one lakh outlets, showing how local innovation and retail reach can unlock new consumer segments in energy supplements.

Key Takeaways

- The Global Energy Supplement Market is expected to be worth around USD 66.2 billion by 2034, up from USD 42.2 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034.

- Stimulant-based products dominate the energy supplement market, holding a 69.3% share due to quick energy and alertness benefits.

- Drinks lead the energy supplement market by product type with a 38.4% share from convenience and fast consumption.

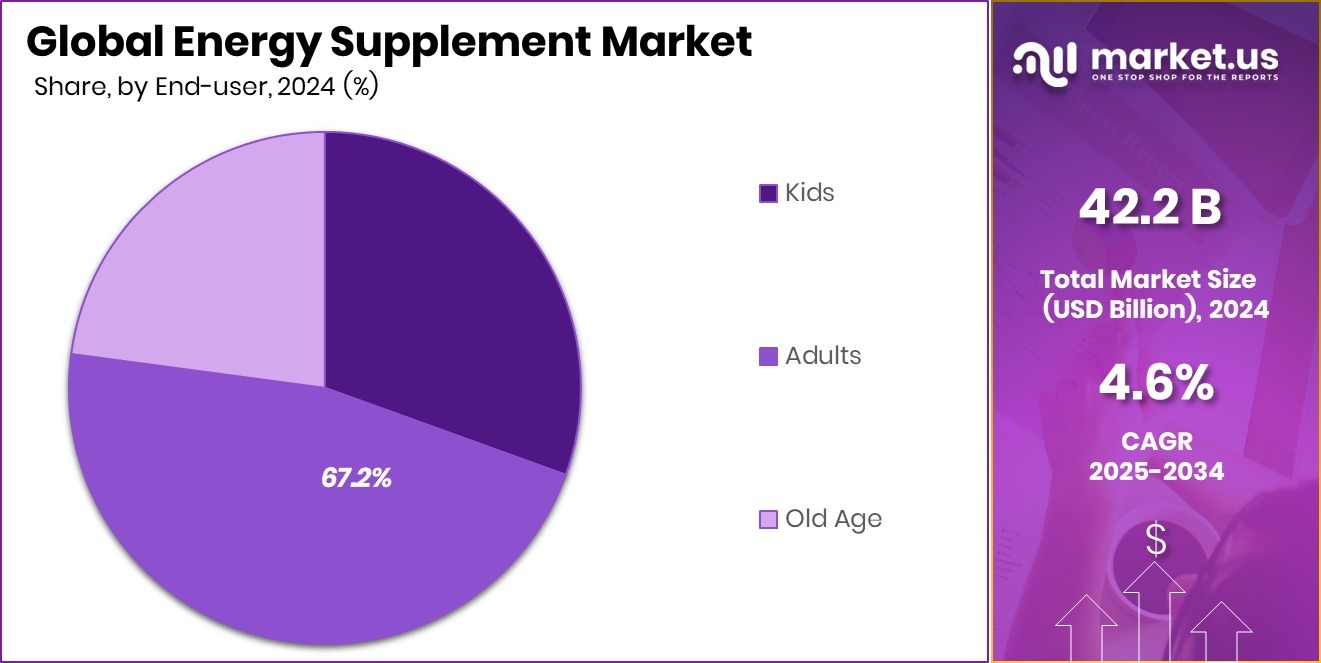

- Adults represent the largest end-user group in the energy supplement market, accounting for 67.2%, driven by active lifestyles.

- Hypermarkets and supermarkets lead distribution in the energy supplement market with a 34.8% share due to wide availability.

- Energy Supplement Market in North America reached USD 19.3 Bn, with a 45.80% share.

By Nature Analysis

The energy supplement market shows stimulant-based products dominating by nature, with a 69.3% share.

In 2024, Stimulant-Based held a dominant market position in the By Nature segment of the Energy Supplement Market, with a 69.3% share. This leadership reflects the strong consumer preference for products that deliver fast and noticeable energy enhancement, particularly for work, fitness, and active daily routines.

Stimulant-based formulations are widely recognised for their immediate impact on alertness, focus, and physical readiness, making them the first choice for users seeking quick results. Their dominance is further supported by broad availability across multiple formats, including drinks, powders, and capsules, which improves accessibility and usage frequency.

Consistent demand from working professionals, athletes, and young consumers continues to reinforce this segment’s relevance. As energy needs become more immediate and performance-oriented, stimulant-based energy supplements maintain their strong market presence by meeting expectations for reliability, speed, and effectiveness.

By Product Type Analysis

The energy supplement market sees drinks as the leading product type, accounting for 38.4% of consumption.

In 2024, Drinks held a dominant market position in the By Product Type segment of the Energy Supplement Market, with a 38.4% share. This dominance is closely linked to the convenience and instant consumption benefits offered by energy drinks, which align well with fast-paced lifestyles.

Consumers favor drink-based formats for their ease of use, ready availability, and ability to deliver quick energy without additional preparation. The liquid format also allows efficient absorption, making it suitable for immediate performance support during work, travel, or physical activity.

Strong visibility in retail outlets and on-the-go consumption habits have further strengthened this segment’s position. As consumer routines increasingly prioritise convenience and speed, drinks continue to remain a preferred product type within the energy supplement market.

By End-user Analysis

Energy Supplement Market demand remains adult-driven, with adults representing 67.2% of the end-user share.

In 2024, Adults held a dominant market position in the end-user segment of the Energy Supplement Market, with a 67.2% share. This dominance reflects the high reliance of the adult population on energy supplements to manage demanding work schedules, physical exertion, and daily stress levels.

Adults increasingly use energy supplements to maintain focus, endurance, and productivity across professional and personal activities. Regular exposure to long screen hours, commuting, and fitness routines has made energy support products a routine part of adult consumption patterns.

The strong share also indicates established purchasing power and consistent usage behaviour within this group. As lifestyles remain busy and performance-driven, adults continue to represent the primary end-user base for energy supplements.

By Distribution Channel Analysis

Energy supplement market sales favour hypermarkets and supermarkets, contributing to a 34.8% distribution share.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the By Distribution Channel segment of the Energy Supplement Market, with a 34.8% share. This dominance is largely supported by strong in-store visibility and easy accessibility, allowing consumers to encounter energy supplements during regular shopping trips.

Extensive shelf space, promotional displays, and the ability to compare multiple options on the spot play an important role in influencing purchase decisions. Many shoppers view energy supplements as convenient add-on products when buying daily essentials from large retail stores.

In addition, the credibility of organised retail and the assurance of immediate product availability strengthen consumer confidence. As buyers increasingly prioritise convenience and consolidated shopping experiences, hypermarkets and supermarkets continue to hold a strong position within the energy supplement distribution landscape.

Key Market Segments

By Nature

- Stimulant-Based

- Stimulant-Free

By Product Type

- Drinks

- Powders

- Gels

- Capsules

- Tablet

- Gummies

- others

By End-user

- Kids

- Adults

- Old Age

By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies Stores

- Grocery Stores

- Specialty Stores

- Discount Stores

- Others

Driving Factors

Rising Demand for Clean and Convenient Energy Solutions

One of the key driving factors of the Energy Supplement Market is the growing demand for clean, reliable, and easy-to-consume energy products. Consumers today want quick energy support that fits into busy routines without complicated preparation. This shift favours ready-to-drink formats and simple ingredient profiles that feel lighter and more trustworthy.

People are paying closer attention to what fuels their bodies, preferring energy options that support focus and stamina while aligning with daily wellness habits. This demand is also encouraging innovation and early-stage investment across the market.

For example, a clean-caffeine energy drink brand recently closed a $1.2M seed funding round, highlighting strong confidence in next-generation energy concepts. Such funding reflects rising belief in cleaner energy alternatives and supports product development, wider availability, and growing consumer acceptance in the energy supplement space.

Restraining Factors

Rising Consumer Concerns Over Ingredient Safety Claims

A major restraining factor in the Energy Supplement Market is growing consumer concern around ingredient safety and transparency. Many buyers have become cautious about high stimulant levels, artificial additives, and unclear labelling, which can create hesitation before purchase. This scrutiny often slows decision-making and encourages consumers to limit usage or switch to alternatives perceived as safer.

Regulatory attention and public discussions around health impact also add pressure on brands to reformulate and clearly communicate benefits. While innovation continues, trust remains a key challenge. Even newer concepts require strong validation, as shown by former Coke and Pepsi executives raising $4 million to build a clean energy drink brand.

Such funding reflects the effort needed to overcome scepticism, reassure consumers, and address restraint factors tied to health perception and ingredient confidence within the market.

Growth Opportunity

Expanding Functional Energy Products Beyond Traditional Use

One strong growth opportunity in the Energy Supplement Market lies in expanding functional energy products beyond basic stimulation. Consumers are increasingly interested in energy solutions that also support focus, endurance, and daily performance without feeling heavy. This opens space for new formulations that fit workdays, fitness routines, and lifestyle wellness needs.

Many buyers now view energy supplements as part of regular nutrition rather than occasional boosters. This shift supports product trials, repeat usage, and broader retail placement. Innovation at the launch stage highlights this opportunity, seen in a ketone-based energy drink entering the market with $4 million in initial funding.

Such financial backing signals confidence in alternative energy formats and shows how differentiated products can attract attention. As consumer understanding grows, functional energy positioning creates long-term growth paths for the market.

Latest Trends

Growing Popularity of Natural Functional Energy Ingredients

A key latest trend in the Energy Supplement Market is the rising use of natural and functional ingredients to deliver energy in a smoother way. Consumers are moving away from harsh stimulants and are showing interest in plant-based, fermentation-derived, and adaptogenic components that support steady energy. This trend reflects a broader lifestyle shift toward balance, mental clarity, and everyday wellness rather than short energy spikes.

Energy supplements are increasingly positioned as daily health-support products instead of occasional boosters. New product launches are following this direction, supported by strong investment activity.

For example, a mushroom-infused energy drink brand recently secured $6 million in funding, highlighting growing confidence in alternative energy ingredients. This trend is expected to reshape product innovation, especially as consumers continue searching for cleaner, functional energy experiences.

Regional Analysis

North America led the Energy Supplement Market with 45.80% share, at USD 19.3 Bn.

In 2024, North America remained the dominating region in the Energy Supplement Market, holding a 45.80% share and generating USD 19.3 Bn in market value. This leadership reflects well-established consumption habits, high awareness of functional beverages and supplements, and strong retail penetration across urban and suburban areas. Busy lifestyles, fitness culture, and demand for convenient energy solutions continue to support sustained market strength across the region.

Europe represents a mature and steadily expanding market for energy supplements, driven by increasing focus on active living and wellness-oriented consumption. Consumers across the region show growing acceptance of energy products as part of daily routines, particularly in professional and lifestyle-based usage. Regulatory oversight and preference for clearly positioned functional products shape regional market behaviour.

The Asia Pacific region shows strong momentum supported by urbanisation, working-age population growth, and rising disposable income. Energy supplements are increasingly adopted to support long workdays, travel, and fitness activities. Rapid expansion of organised retail and digital commerce also enhances product reach.

In the Middle East & Africa, market growth is supported by a young population and gradually rising awareness of performance nutrition. Adoption is strongest in metropolitan areas where modern retail channels are developing.

Latin America demonstrates emerging potential as lifestyle changes, fitness engagement, and urban consumption patterns create opportunities for wider energy supplement adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amway Corporation continues to hold a strong position in the global energy supplement space through its deep-rooted direct selling model and global wellness focus. In 2024, the company benefits from long-standing consumer trust and a strong distributor network that supports repeat usage and education-driven adoption. Its emphasis on lifestyle nutrition and daily energy support aligns well with consumers seeking consistent performance rather than short-term stimulation.

Herbalife Nutrition Ltd. remains a key force in the energy supplement market due to its science-backed formulation approach and strong engagement with active and fitness-oriented consumers. The company’s focus on weight management, performance nutrition, and everyday energy positions it well across multiple consumer age groups. In 2024, its community-based distribution model and continued focus on personalisation will enhance brand loyalty and sustained demand.

Glanbia Nutritionals Inc. stands out for its ingredient expertise and innovation-driven strategy. As a supplier and formulator, the company supports energy supplement development through functional ingredients designed for performance and endurance. In 2024, Glanbia’s strength lies in formulation science, clean-label positioning, and its ability to meet evolving consumer expectations, making it a strategic player shaping product innovation within the energy supplement ecosystem.

Top Key Players in the Market

- Amway Corporation

- Herbalife Nutrition Ltd.

- Glanbia Nutritionals Inc.

- PepsiCo Holdings

- Red Bull GmbH

- Herbaland

- Rockstar, Inc.

- CELSIUS

- Lonza Group

- GU Energy Labs

Recent Developments

- In July 2024, Amway expanded its flagship brand Nutrilite to include products focused on longevity, gut health, and “health span.” The company introduced a gut-health-oriented “gut primer” powdered drink under a new product line (launched in parts of Asia) designed to support digestion and nutrient absorption.

- In February 2024, Herbalife launched the GLP-1 Nutrition Companion product combos targeted at individuals using GLP-1 weight-loss medications. These combos include nutrition shakes, protein and fibre support, aiming to help maintain energy, muscle mass, and nutritional balance for people on diet-related medications.

Report Scope

Report Features Description Market Value (2024) USD 42.2 Billion Forecast Revenue (2034) USD 66.2 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Stimulant-Based, Stimulant-Free), By Product Type (Drinks, Powders, Gels, Capsules, Tablet, Gummies, others), By End-user (Kids, Adults, Old Age), By Distribution Channel (Hypermarkets/Supermarkets, Pharmacies Stores, Grocery Stores, Specialty Stores, Discount Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amway Corporation, Herbalife Nutrition Ltd., Glanbia Nutritionals Inc., PepsiCo Holdings, Red Bull GmbH, Herbaland, Rockstar, Inc., CELSIUS, Lonza Group, GU Energy Labs Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Energy Supplement MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Energy Supplement MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amway Corporation

- Herbalife Nutrition Ltd.

- Glanbia Nutritionals Inc.

- PepsiCo Holdings

- Red Bull GmbH

- Herbaland

- Rockstar, Inc.

- CELSIUS

- Lonza Group

- GU Energy Labs