Global Energy Storage for Satellites Market Size, Share, Growth Analysis By Technology (Batteries, Fuel Cells, Supercapacitors, Others), By Component (Battery Cells, Battery Management Systems, Power Conditioning Systems, Others), By Application (Communication Satellites, Earth Observation Satellites, Navigation Satellites, Others), By End-User (Commercial, Military) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167748

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

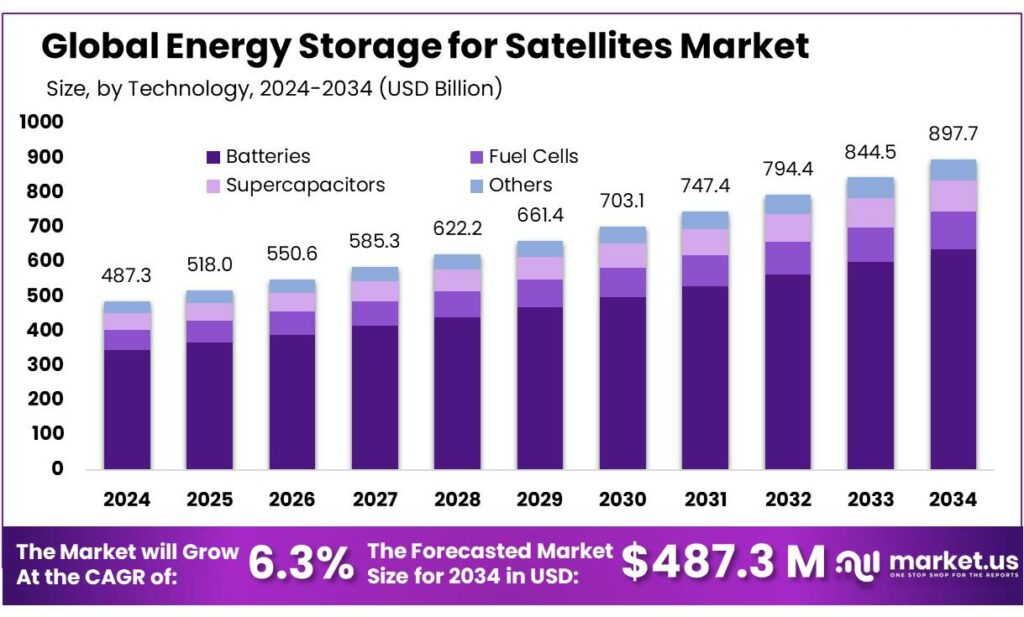

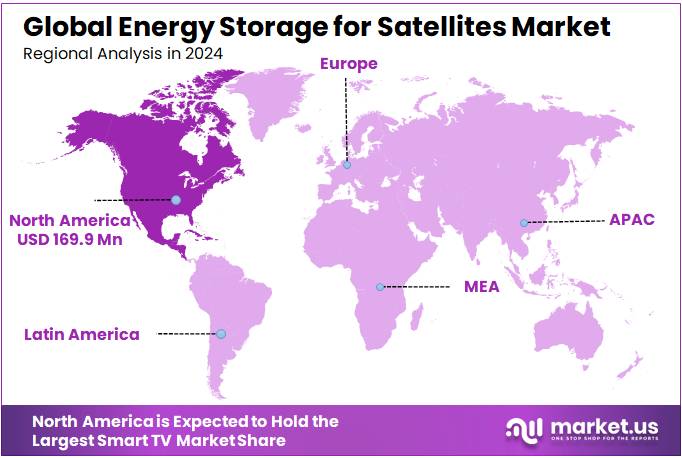

The Global Energy Storage for Satellites Market size is expected to be worth around USD 897.7 Million by 2034, from USD 487.3 Million in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 34.70% share, holding USD 169.0 Million revenue.

Energy storage for satellites sits at the centre of the modern space economy. Satellite payloads rely on batteries to bridge long eclipse periods, smooth power from solar arrays and support peak loads for propulsion, communications and payload operations. NASA notes that current state-of-the-art lithium-ion cells for space applications reach around 270 Wh/kg at cell level, while future exploration missions are targeting specific energies above 300 Wh/kg with discharge durations exceeding 10 hours. NREL and NASA research already demonstrate commercial Li-ion cells with specific energy above 280 Wh/kg, underlining how terrestrial battery R&D feeds directly into satellite platforms.

On the industrial side, satellite energy storage is now a distinct niche within the wider space power ecosystem, linking cell suppliers, battery integrators, satellite OEMs and launch providers. In 2024, 2,963 objects were placed into orbit, including 2,578 operational satellites from 261 launch attempts, of which 254 succeeded, underlining the robust cadence of missions that require qualified batteries and power systems. Industry analysis indicates that satellites account for close to 70% of the entire space battery market, making satellite platforms the dominant application for specialized rechargeable packs.

Government policy and public investment are important demand anchors. NASA, ESA and other agencies fund long-term battery R&D for exploration missions, while national industrial strategies increasingly view satellite manufacturing and power systems as strategic capabilities. For example, India aims to grow its space economy more than five-fold to $44 billion by 2033, with a strong emphasis on satellite-based navigation, remote sensing and communications — all of which rely on robust space-qualified batteries.

At the technology level, lithium-ion has become the workhorse of satellite energy storage, displacing older nickel-cadmium and nickel-hydrogen systems. NASA’s Advanced Energy Storage Systems (AESS) program targets lightweight Li-ion batteries with specific energy above 300 Wh/kg, and test cells have demonstrated around 340 Wh/kg while still meeting ≥200 cycle life targets under mission-relevant conditions. Operational satellites are expected to remain functional for long periods — industry sources cite average lifetimes of roughly 15 years, while the Hubble Space Telescope, launched in 1990 with six 88 Ah nickel-hydrogen batteries, is expected to stay operational until about 2035.

Key Takeaways

North America currently stands as the dominant regional market for Energy Storage for Satellites, accounting for around 34.70% of global revenues, equivalent to USD 169.0 million.

By Technology Analysis

Batteries dominate the Energy Storage for Satellites Market with a 71.9% share due to proven reliability and long mission life

In 2024, Batteries held a dominant market position, capturing more than a 71.9% share in the Energy Storage for Satellites Market, mainly because satellites need a trusted and maintenance-free power source once they are launched. Batteries remain essential for keeping satellites operational during eclipse periods, when solar panels cannot generate electricity. In both low Earth orbit and geostationary orbit missions, battery systems are responsible for uninterrupted power during every orbit cycle, making them the backbone of satellite energy storage in 2024 and continuing into 2025.

The dominance of batteries is closely linked to their long operational track record in space missions. Satellite operators prefer battery-based storage because these systems are compact, lightweight, and already certified for long-duration missions that often last more than a decade. In 2024, most newly launched communication, navigation, and Earth-observation satellites relied on battery systems as their primary secondary power source, as alternatives such as fuel cells or experimental storage technologies are still limited to research or special missions. This widespread adoption supports the technology’s leading position without adding operational risk.

By Component Analysis

Battery Cells lead the Energy Storage for Satellites Market with a 57.2% share due to their central role in power reliability

In 2024, Battery Cells held a dominant market position, capturing more than a 57.2% share in the Energy Storage for Satellites Market, as they form the core building block of all satellite battery systems. Every satellite mission depends on the performance, safety, and longevity of the individual cells, making them the most value-critical component in space energy storage. In 2024, satellite manufacturers continued to prioritize high-quality battery cells because any degradation at cell level directly affects mission life and power availability.

The strong position of battery cells is driven by strict space qualification requirements. In 2024, most new satellite platforms were designed around proven cell formats that have a long flight heritage, reducing technical risk. Cell selection plays a key role in managing frequent charge-discharge cycles, thermal stability, and radiation exposure in orbit. As satellite operators aim for missions lasting well beyond a decade, the reliability of battery cells remains a top design priority.

By Application Analysis

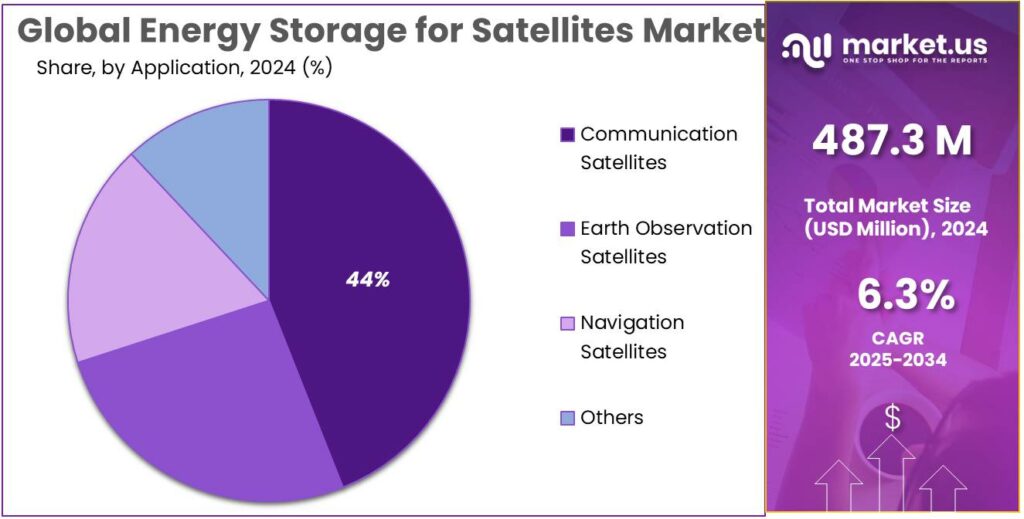

Communication Satellites dominate the market with a 44.5% share due to rising bandwidth needs and continuous power demand

In 2024, Communication Satellites held a dominant market position, capturing more than a 44.5% share in the Energy Storage for Satellites Market. Their strong lead comes from the growing global need for high-speed connectivity, direct-to-device communication, and secure data links. Communication satellites require stable onboard energy storage to power large antennas, transponders, and high-throughput payloads, especially during eclipse periods when solar panels cannot generate electricity. As a result, they rely heavily on advanced batteries to support uninterrupted service across multiple time zones.

In 2024, the expansion of commercial broadband constellations significantly strengthened the demand for energy storage within this segment. Each new satellite added to these networks needs lightweight and long-life batteries capable of handling frequent charge-discharge cycles. The rise of GEO high-throughput satellites also supported higher demand for powerful energy storage systems, as these platforms often operate for more than 15 years, making battery performance a crucial factor for mission reliability.

By End-User Analysis

Commercial end users lead the market with a 72.4% share driven by large-scale satellite deployments

In 2024, Commercial held a dominant market position, capturing more than a 72.4% share in the Energy Storage for Satellites Market. This dominance is mainly due to the rapid expansion of privately operated communication, Earth-observation, and broadband satellite fleets. Commercial operators focus heavily on cost efficiency, launch cadence, and long-term reliability, making advanced energy storage systems a critical part of their satellite designs. Batteries are essential for ensuring uninterrupted service during orbital eclipses, which directly affects service quality and customer experience.

During 2024, commercial satellite programs continued to prioritize scalable and standardized energy storage solutions. Many private operators preferred proven battery architectures that can be produced more efficiently and integrated across multiple satellite units. This approach helps reduce manufacturing time and improve consistency across large constellations. As a result, battery demand from commercial customers rose faster than from defense or purely scientific missions, strengthening their leading market position.

Key Market Segments

By Technology

- Batteries

- Fuel Cells

- Supercapacitors

- Others

By Component

- Battery Cells

- Battery Management Systems

- Power Conditioning Systems

- Others

By Application

- Communication Satellites

- Earth Observation Satellites

- Navigation Satellites

- Others

By End-User

- Commercial

- Military

Emerging Trends

Shift Toward High-Energy Lithium-Ion and Next-Gen Chemistries Is Reshaping Satellite Batteries

A clear latest trend in energy storage for satellites is the move toward higher-energy lithium-ion and experimental next-generation chemistries, driven by the need to power more capable payloads without increasing satellite mass. Space agencies and manufacturers are pushing their battery designs far beyond older nickel-cadmium and nickel-hydrogen systems, which typically offered well under 150 Wh/kg at cell level in earlier missions, limiting how much power could be carried on board.

NASA’s current Advanced Energy Storage Systems work now targets lithium-ion cells above 300 Wh/kg, and development cells have already demonstrated around 340 Wh/kg while still meeting mission-relevant cycle life requirements.

This shift is closely linked to the rise of low Earth orbit constellations and high-throughput communications satellites. The Union of Concerned Scientists notes that the number of operational satellites increased from 3,371 in 2019 to 7,560 in 2023, more than doubling in just four years, with communications satellites making up about 73% of that total.

Governments are actively nurturing this technology transition. NASA’s battery roadmaps explicitly call for space-qualified storage above 400 Wh/kg in future phases to support deep-space exploration and more demanding Earth-orbiting missions, framing high-energy batteries as a “mission-enabling” technology rather than a simple support system.

Radiation-tolerant lithium-ion designs are another part of this trend. The European Space Agency highlights that satellites in low Earth orbit can experience thousands of eclipse cycles and significant radiation doses throughout their lifetimes, often above 10 krad(Si) total ionizing dose for long missions.

Drivers

Rapid Growth in Satellite Launches Is Driving Demand for Advanced Energy Storage

The scale of satellite deployment has increased at an unprecedented pace. According to the Union of Concerned Scientists, the number of operational satellites worldwide rose from 3,371 in 2019 to 7,560 in 2023, more than doubling in just four years. Communication satellites alone accounted for over 73% of this total, showing how data-intensive services are driving capacity expansion. Each of these satellites requires high-performance batteries designed to function reliably for 10–15 years in extreme radiation and temperature conditions.

This growth is reinforced by the expanding low Earth orbit (LEO) satellite ecosystem. Data from the European Space Agency (ESA) shows that more than 90% of satellites launched since 2020 operate in LEO, where frequent eclipses require batteries to cycle thousands of times over their lifetime. ESA notes that typical LEO satellites experience up to 5,500 charge–discharge cycles per year, far higher than most terrestrial energy storage systems. This cycling intensity is a key reason satellite batteries must be lightweight, safe, and extremely durable.

Government initiatives further strengthen this demand. NASA continues to invest heavily in satellite and space power technologies through programs such as its Advanced Energy Storage Systems (AESS) project. NASA reports that modern lithium-ion batteries used in space missions can now exceed 300 Wh/kg in specific energy, compared to less than 150 Wh/kg two decades ago. These advances allow satellites to carry heavier payloads or extend mission lifetimes without increasing launch mass, making advanced energy storage a strategic enabler rather than a supporting component.

National space policies are also pushing satellite deployment. The Indian Space Research Organisation (ISRO) has stated that India plans to expand its satellite-based services significantly as part of its goal to grow the national space economy to USD 44 billion by 2033. Navigation, broadband connectivity, and Earth observation are core priorities under this vision, all of which depend on reliable onboard energy storage for continuous operation.

Restraints

High Reliability Requirements and Radiation Risks Limit Battery Design Flexibility

One of the biggest restraining factors for energy storage for satellites is the extreme reliability demanded by the space environment, combined with constant exposure to radiation. Unlike batteries used on Earth, satellite batteries cannot be repaired or replaced once the satellite is launched. A single battery failure can shorten a mission worth hundreds of millions of dollars. This makes satellite energy storage one of the most conservative and risk-averse battery applications in the world, slowing innovation and increasing development time.

- According to NASA, radiation exposure in low Earth orbit (LEO) can exceed 10–50 krad(Si) per year, while satellites in geostationary orbit (GEO) may experience even higher cumulative doses over long missions. These radiation levels gradually degrade battery electrodes and electronic control systems, reducing usable capacity and increasing failure risk.

Long mission lifetimes further complicate battery design. The European Space Agency (ESA) states that most commercial and government satellites are required to operate continuously for 12 to 15 years without maintenance. In LEO, satellites may undergo up to 60,000 charge–discharge cycles over their full operational life due to frequent eclipses. Designing batteries that can survive this cycling load while maintaining safety margins significantly limits the choice of materials and chemistries.

Safety considerations act as another major restraint. Lithium-ion batteries, while widely used, carry known risks of thermal runaway. NASA reports that even minor internal shorts in space-grade lithium-ion cells can lead to rapid temperature spikes beyond 200°C, posing catastrophic risks to spacecraft electronics. As a result, space agencies often require extensive qualification testing that can last 5–7 years, adding cost, time, and uncertainty to new battery technologies.

Opportunity

LEO Constellations and New Space Programs Open Big Battery Growth Opportunities

A major growth opportunity for energy storage in satellites comes from the surge in low Earth orbit (LEO) constellations and new national space programs. The number of operational satellites has already climbed to 7,560 as of May 2023, according to the Union of Concerned Scientists, and that figure has been rising steadily as more broadband, Earth-observation, and navigation fleets go up.

This expansion sits inside a fast-growing space economy. The Space Foundation reports that the global space economy reached about USD 613 billion in 2024, up 7.8% from 2023, with nearly 80% coming from commercial revenues such as satellite communications and downstream services. A joint World Economic Forum–McKinsey analysis goes further, suggesting space activity could reach USD 1.8 trillion by 2035, compared with USD 630 billion in 2023. Much of that growth is tied to satellite-enabled services, which directly translate into long-term demand for advanced battery systems.

Government-backed constellations are a clear signal of future demand. In Europe, the IRIS² secure connectivity program plans a constellation of 290 satellites, backed by about EUR 10.6 billion, with service targeted around 2030. This single initiative locks in a decade of work for power-system suppliers, including manufacturers of space-qualified batteries and power-management electronics. A briefing for the European Parliament also highlights how LEO systems will be central to secure communications and resilient connectivity in the EU, reinforcing political support for these infrastructures.

Similar dynamics are visible in emerging space nations. In India, government projections aim to grow the national space economy to roughly USD 44 billion by 2033, with a strong focus on satellite communication, navigation, and remote-sensing services. Even when venture funding cycles soften, public programs and dedicated space funds help keep satellite projects moving, which in turn sustains demand for high-reliability batteries designed for long missions.

Regional Insights

North America Dominates the Energy Storage for Satellites Market with 34.70% Share, Valued at USD 169.0 Million

North America currently stands as the dominant regional market for Energy Storage for Satellites, accounting for around 34.70% of global revenues, equivalent to USD 169.0 million in 2024. This leadership reflects the region’s dense satellite base, strong federal space budgets, and a deep ecosystem of prime contractors, battery suppliers, and launch providers. The United States alone operates 5,184 of the world’s 7,560 active satellites – roughly 69% of the total – according to the Union of Concerned Scientists satellite database.

This overwhelming ownership of in-orbit assets naturally concentrates demand for high-reliability satellite batteries in North America. Launch activity further underpins the region’s strength. Our World in Data reports that 2,664 objects were launched into space in 2023, and US agencies and companies were responsible for 2,166 of these – around 81% of the global total.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Lockheed Martin’s spacecraft power architecture has been applied across commercial and defence satellites, with electrical power subsystems and integrated battery assemblies delivered for large GEO platforms and specialized missions. Flight heritage for A2100 and other buses has been documented through in-orbit performance reports and supplier contracts for high-energy lithium-ion cells. Energy resilience capabilities have also been adapted for terrestrial and defence energy storage applications, reinforcing systems engineering and battery qualification competencies.

Northrop Grumman Corporation — Northrop Grumman supplies commercial and defense satellites (GEOStar platforms) and is advancing on-orbit sustainment capabilities including mission extension and refuelling interfaces that alter lifecycle energy strategies. The company’s focus on satellite-services and extension technologies affects battery lifecycle planning, enabling deferred replacement and service-based revenue models; recent multi-satellite contracts have reinforced demand for qualified power systems compatible with long operational service windows.

Thales Alenia Space — Thales Alenia Space is positioned as a major prime contractor for orbital infrastructures and telecom platforms (Spacebus, Space Inspire), integrating proprietary and supplier-sourced energy-storage subsystems to satisfy performance and reliability objectives. The firm’s exhibition of satellite power innovations at recent industry events and participation in feasibility studies underscores emphasis on scalable battery architectures, digitalized power control and lifecycle services for both GEO and constellation markets. Programmatic consolidation in Europe is influencing competitive dynamics.

Top Key Players Outlook

- Airbus Defence and Space

- Boeing

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Thales Alenia Space

- Ball Aerospace & Technologies Corp.

- OHB SE

- Honeywell Aerospace

- L3Harris Technologies

- Raytheon Technologies

Recent Industry Developments

In 2024, Airbus Defence and Space reported revenues of € 12.1 billion, reflecting a modest 5% increase year-on-year. Over the first half of 2025, that growth has accelerated: the division’s revenue rose 17% to € 5.8 billion, compared to the same period in 2024.

In 2024, Lockheed Martin’s Space segment generated about USD 12.5 billion in net sales with operating profit of roughly USD 1.2 billion and a 9.8% margin, indicating a healthy budget for satellite power and battery technology development.

Report Scope

Report Features Description Market Value (2024) USD {{val1}} Forecast Revenue (2034) USD {{val2}} CAGR (2025-2034) {{cagr}}% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Batteries, Fuel Cells, Supercapacitors, Others), By Component (Battery Cells, Battery Management Systems, Power Conditioning Systems, Others), By Application (Communication Satellites, Earth Observation Satellites, Navigation Satellites, Others), By End-User (Commercial, Military) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Airbus Defence and Space, Boeing, Lockheed Martin Corporation, Northrop Grumman Corporation, Thales Alenia Space, Ball Aerospace & Technologies Corp., OHB SE, Honeywell Aerospace, L3Harris Technologies, Raytheon Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Energy Storage for Satellites MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Energy Storage for Satellites MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Airbus Defence and Space

- Boeing

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Thales Alenia Space

- Ball Aerospace & Technologies Corp.

- OHB SE

- Honeywell Aerospace

- L3Harris Technologies

- Raytheon Technologies