Global Electronic Nose Market Size, Share Analysis Report By Product Type (Portable Electronic Noses, Fixed Electronic Noses, & Handheld Electronic Noses), By Application (Food & Beverage Industry, Medical & Healthcare Industry, Environmental Monitoring, Defense and Security, & Industrial Manufacturing), By Sensor Technology (Metal Oxide Semiconductor (MOS) Sensors, Polymer Sensors, Conductive Polymer Sensors, Surface Acoustic Wave (SAW) Sensors, & Piezoelectric Sensors), By Form Factor (Compact, Modular, & Integrated), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153002

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

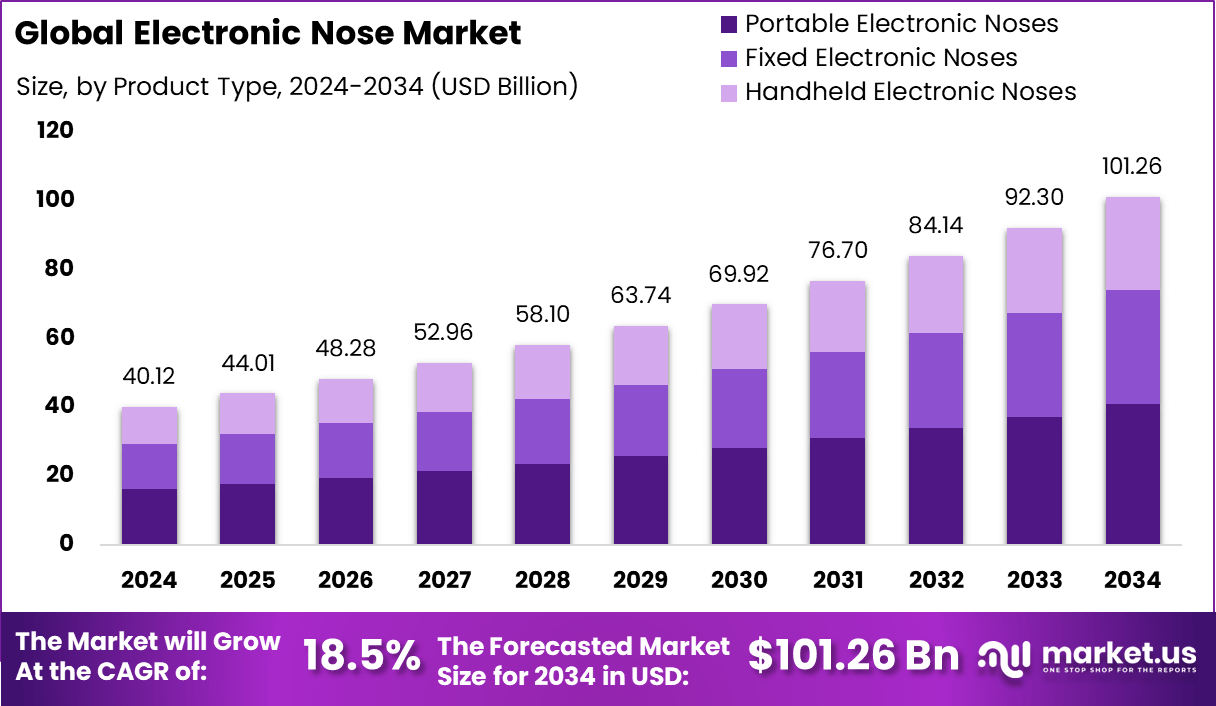

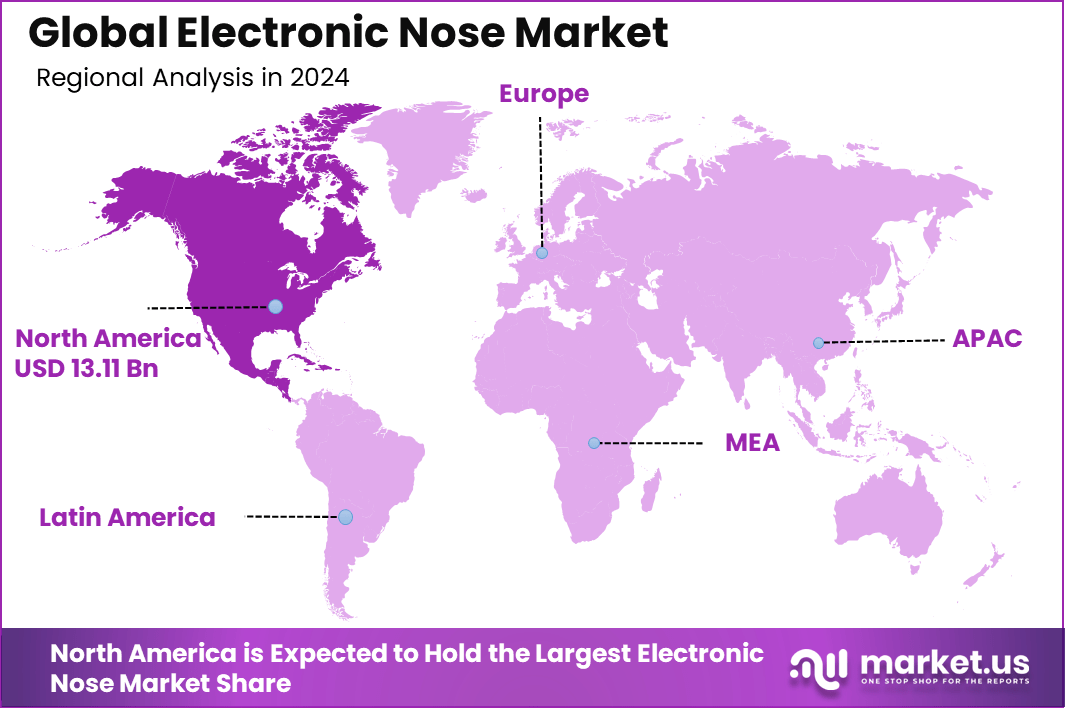

The global Electronic Nose market size accounted for USD 40.12 billion in 2024 and is predicted to increase from USD 44.01 billion in 2025 to approximately USD 101.26 billion by 2034, expanding at a CAGR of 18.5% from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.7% share, holding USD 13.11 Billion revenue.

The electronic nose market is gaining strong global attention as businesses look for advanced solutions to monitor and analyze odors and volatile organic compounds. These intelligent sensing devices, inspired by the human sense of smell, are creating a shift in quality control, environmental monitoring, and healthcare diagnostics. More industries now view electronic noses as essential for ensuring product consistency, safety, and environmental compliance, which fuels widespread adoption across various sectors.

The primary push behind the electronic nose market comes from the need for precise, real-time monitoring of products and environments. Industries such as food and beverage, healthcare, and environmental science demand higher quality standards, prompting them to seek more sophisticated detection tools.

Regulatory bodies are also tightening guidelines on product safety and emissions, driving companies to implement advanced odor analysis solutions to meet these new requirements. As a result, the technology continues evolving, making accurate and automated odor detection possible for both large-scale and niche applications.

For instance, In July 2023, around 400 AI-powered early-detection sensors were deployed across Germany’s Eberswalde forest. These advanced devices act like electronic noses, trained to detect subtle changes in air composition. By analyzing smoke types and fire signatures, the system helps identify forest fires in their earliest stages. This proactive technology ensures faster alerts and quicker response times, minimizing damage.

Scope and Forecast

Report Features Description Market Value (2024) USD 40.12 Bn Forecast Revenue (2034) USD 101.26 Bn CAGR (2025-2034) 18.5% Largest market in 2024 North America [32.7% market share] Demand for electronic noses is climbing as organizations prioritize early detection of spoilage, contamination, and hazardous substances. In the food industry, for example, businesses use electronic noses to minimize recalls and waste. In healthcare, the non-invasive nature of electronic noses allows for early disease diagnosis by detecting specific biomarkers in breath and fluids.

The push for safer workspaces and consumer goods is further intensifying the call for these devices, reflecting a clear trend toward proactive rather than reactive quality assurance. Recent technological innovations are reshaping the electronic nose market. The introduction of artificial intelligence, machine learning, and neuromorphic computing has substantially improved odor recognition and classification.

These advancements enable sensors to process and analyze complex chemical data with greater accuracy and speed. Miniaturization has also led to the emergence of portable e-nose devices, expanding usage in mobile scenarios and wearables. IoT integration is another driver: e-noses can now transmit data wirelessly for real-time analysis and remote monitoring, fitting seamlessly into smart systems.

Key Takeaways

- The global Electronic Nose market was valued at USD 40.12 billion in 2024.

- It is projected to reach around USD 101.26 billion by 2034, growing at a CAGR of 18.5% from 2025 to 2034.

- In 2024, North America led the global market with a 32.7% share, generating USD 13.11 billion in revenue.

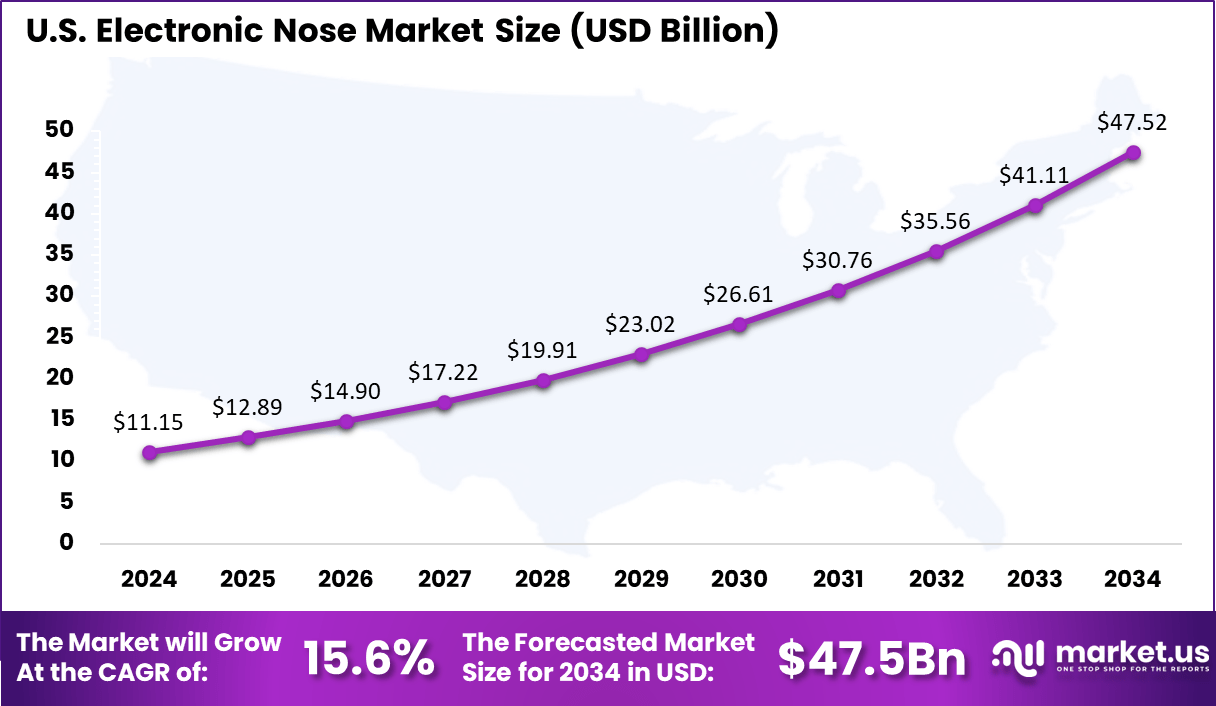

- The United States alone contributed USD 11.15 billion, supported by a CAGR of 15.6%.

- Portable electronic noses held the highest market share of 40.4% due to their flexibility and ease of use.

- The food and beverage industry emerged as the top application area, accounting for 32.6% of total demand.

- Metal oxide semiconductor (MOS) sensors captured a leading share of 25.7% because of their cost-effectiveness and sensitivity.

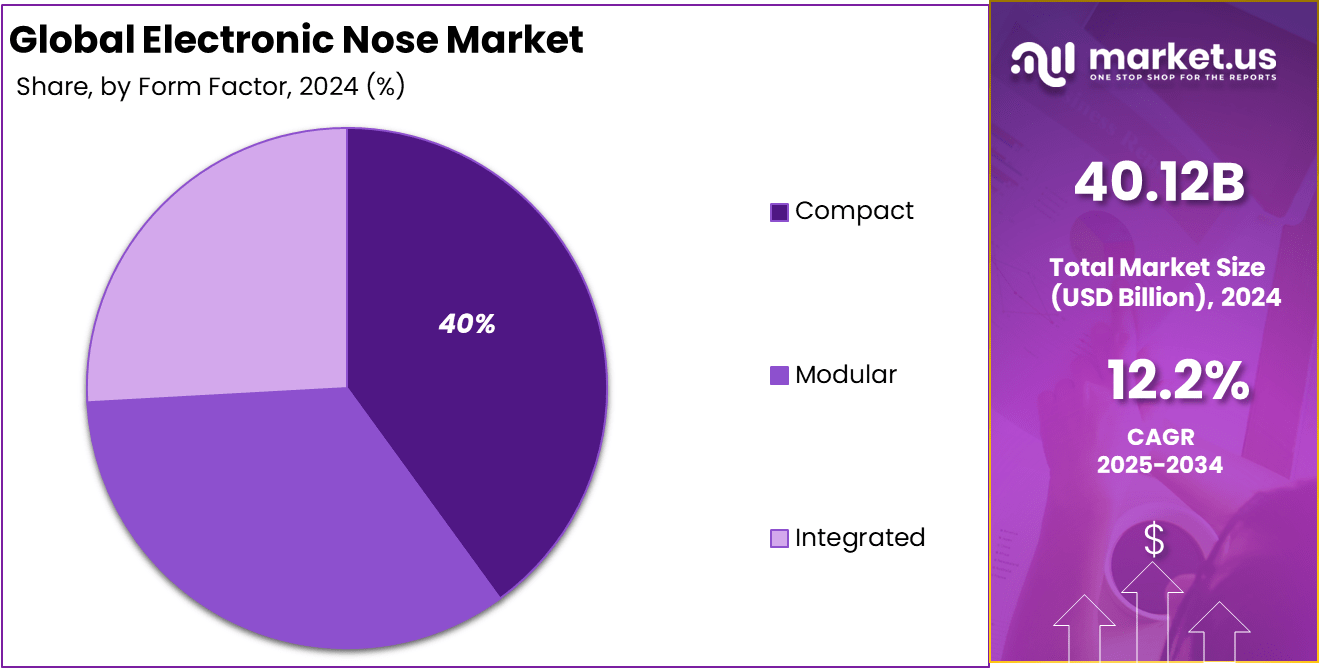

- Compact devices dominated the form factor category with a 40.2% share, driven by rising use in embedded and mobile systems.

U.S. Electronic Nose Market Size

The U.S. Electronic Nose Market was valued at USD 11.15 Billion in 2024 and is anticipated to reach approximately USD 47.52 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 15.6% during the forecast period from 2025 to 2034.

The United States, in particular, has seen rapid advancements in AI-powered sensor technology, which has expanded the applications of electronic noses in various sectors. The increasing focus on environmental protection and food quality control, coupled with the region’s focus on innovations in sensor technologies, has contributed to North America’s leading market position.

In 2024, North America held a dominant market position in the Electronic Nose market, capturing more than a 32.7% share, generating USD 13.11 billion in revenue. This leadership can be attributed to the region’s strong adoption of advanced technologies, high investments in research and development, and a well-established manufacturing base.

The growing demand for electronic noses in industries such as food and beverage, healthcare, and environmental monitoring has been a key driver of this growth. Additionally, the presence of major players in the region, along with significant government and private sector investments, has further solidified North America’s market dominance.

By Product Type

Portable Electronic Noses (40.4%)

Portable electronic noses have emerged as a game-changer in the electronic nose market, comprising the leading segment by product type with a market share of 40.4%. The main reason behind their popularity stems from their convenience and flexibility. Unlike bulky stationary systems, portable e-noses are lightweight, easy to transport, and suitable for on-site evaluations – perfect for industries where immediate or field testing is crucial.

This portability is particularly important for sectors like food safety, environmental monitoring, and emergency response, where quick decision-making directly impacts outcomes. These devices are not only convenient but also empower professionals to conduct complex odor analyses without specialized laboratory settings.

The ability to carry out diagnostics or quality checks directly at the source saves both time and resources, making portable e-noses an attractive investment. Ultimately, their growing adoption signals a broader trend towards mobility and adaptability in scientific instruments, reflecting the shifting needs of today’s fast-paced industries.

By Application

Food & Beverage Industry (32.6%)

The food and beverage industry stands out as the primary application area for electronic noses, securing a 32.6% market share. This is largely because companies in this sector are under constant pressure to guarantee product quality, maintain freshness, and detect contamination before products reach consumers.

Electronic noses serve as vital tools for these tasks, whether it’s checking the ripeness of fruit, ensuring the consistency of flavors, or detecting spoilage earlier than traditional methods can. Moreover, as consumer expectations for quality rise and regulatory standards become stricter, the reliance on objective, rapid-testing solutions like e-noses increases.

These devices help manufacturers maintain high standards, reduce product recalls, and foster a reputation for reliability. Their role is only expected to expand as the food industry increasingly turns to automation and technology-based quality control for a competitive edge.

By Sensor Technology

Metal Oxide Semiconductor (MOS) Sensors (25.7%)

Metal Oxide Semiconductor (MOS) sensors represent the leading sensor technology in the electronic nose market, holding a 25.7% share. The reason for their dominance is twofold: MOS sensors are both highly sensitive to a wide range of volatile compounds and cost-effective to produce. This makes them suitable for a diverse array of applications – from detecting gases in industrial processes to identifying spoilage in food products.

Furthermore, MOS sensors are appreciated for their robustness and relatively simple design, which translates to reliable performance even in challenging environments. Their widespread adoption is a testament to their adaptability and effectiveness, qualities that manufacturers prioritize as they strive for higher accuracy and reliability in odor detection technology.

By Form Factor

Compact (40.2%)

The preference for compact electronic noses is evident with this form factor leading at 40.2% market share. The appeal lies in their ability to provide advanced functionality while occupying minimal space – a factor that benefits laboratories, processing facilities, and portable field operations. Compact e-noses integrate seamlessly into existing workflows without requiring substantial modifications or new infrastructure.

Additionally, this trend towards compactness aligns with the broader miniaturization observed in today’s tech landscape. As scientific instruments become smaller yet more powerful, the demand for space-saving solutions grows. Compact e-noses enable businesses to deploy sophisticated sensing technology in areas previously constrained by space or budget, thus widening access and driving market expansion.

Key Market Segments

By Product Type

- Portable Electronic Noses

- Fixed Electronic Noses

- Handheld Electronic Noses

By Application

- Food & Beverage Industry

- Medical & Healthcare Industry

- Environmental Monitoring

- Defense and Security

- Industrial Manufacturing

By Sensor Technology

- Metal Oxide Semiconductor (MOS) Sensors

- Polymer Sensors

- Conductive Polymer Sensors

- Surface Acoustic Wave (SAW) Sensors

- Piezoelectric Sensors

By Form Factor

- Compact

- Modular

- Integrated

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Adoption of Electric Vehicles (EVs)

Growing consumer demand for food quality control is one of the major drivers behind the rapid adoption of electronic nose technology in the food and beverage industry. With increasing consumer expectations about safety, freshness and quality of food products, businesses are moving towards electronic nose for precise and non-invasive quality control.

For instance, Alpha MOS, a leader in electronic nose technology, has developed innovative sensor solutions that help food manufacturers to continuously monitor and maintain product quality. Their system is used extensively in the food industry for taste and aroma profiles, as well as to detect unwanted chemicals or deteriorating agents, thus ensures the product integrity.

Restraint

Limited Sensor Accuracy and Sensitivity

The limited sensor accuracy and sensitivity to the electronic nose presents a significant challenge for their widespread adoption and application in various industries. These devices, while revolutionary, often struggle to achieve high levels of accuracy required for some complex functions, such as medical diagnosis and food quality control.

For instance, in healthcare applications, electronic nose is being detected to detect the disease through respiratory analysis. However, breathing samples can be challenging to receive frequent accuracy in identifying biomarkers, especially when various compounds overlap or are present in low concentrations.

In the food and beverage industry, a highly sensitive sensor is required to detect a subtle gap in aroma and taste. Unfortunately, many electronic nose currently encounter issues with time flow, which reduces sensitivity, which compromises their credibility.

Opportunities

Integration with IoT and Smart Devices

Electronic nose integration with IOT and smart devices is one of the most exciting opportunities for the global electronic nose market. This synergy enables real -time data collection, analysis and monitoring in various applications, including environmental detection to healthcare diagnostics.

For instance, in smart homes, electronic nose can be used to detect harmful gases such as carbon monoxide or even to analyze air quality, which warns residents about potential hazards. As IOT systems are rapidly connected, these devices can send immediate alert to users’ smartphones or other smart devices, making homes safe and more efficient.

In agriculture, IOT-integrated electronic can monitor the condition of nose crops, detect early signs of the disease or deteriorate through smell analysis. By connecting these systems with smart sensors, farmers can take action in real time, reduce waste and improve crop yields.

Growth Factors

- Technological Advancements: The continuous evolution of sensor technology, in association with Artificial Intelligence (AI) and machine learning, is improving the accuracy and reliability of electronic nose. As the sensors become more sensitive and AI algorithms are more sophisticated, this equipment are able to detect and analyze more accurately, providing their adoption in various industries including healthcare, food security and environmental monitoring.

- Growing Demand in Healthcare: The healthcare industry presents an important development opportunity for the electronic nose market. Electronic nose can detect the disease biomarker in the human breath, which can enable non-invasive and initial stage diagnosis for diseases such as cancer, diabetes and respiratory disorders. As the healthcare provider wants innovative ways to improve the care of the patient, the demand for these clinical equipment is expected to increase.

- Rising Focus on Food Safety and Quality Control: Electronic nose is rapidly used for quality control in the food and beverage industry, with consumers being more health-conscious and high standards of food security. These devices help deteriorate, detection of contamination and ensure stability in taste and aroma, which are essential for brand reputation and consumer trust.

- Increasing Environmental Concerns: Growing global focus on environmental stability has promoted the demand for electronic nose under air quality supervision. These devices can detect pollutants, dangerous gases and chemicals in the air, supporting environmental protection efforts. As governments and organizations increase the rules to reduce pollution, the use of electronic nose for environmental monitoring is expected to expand.

Key Players Analysis

WAGEM Monitoring Systems, Tiger Nose Associates, and Cyranose are key players in the Electronic Nose market. WAGEM focuses on odor monitoring for industrial air quality, while Tiger Nose develops sensor arrays for detecting volatile compounds. Cyranose stands out for its portable e-nose devices used in real-time chemical detection, offering reliable field diagnostics across multiple sectors.

SPEC Sensors, Odotech, and Owlstone Medical contribute to medical and environmental advancements. SPEC Sensors creates compact gas sensors, Odotech delivers odor monitoring for waste management, and Owlstone leads in breath-based diagnostics. Bedfont further supports non-invasive medical testing through its breath analysis instruments.

Aryballe Technologies, Alpha MOS, and Ionicon Analytik are advancing digital scent detection. Aryballe uses biosensors and AI for food and fragrance testing. Alpha MOS offers e-nose systems for quality control, and Ionicon provides high-precision gas analyzers. Players like Cambridge Sensotecs, Smiths Detection, and Airsense Analytics also play critical roles in expanding e-nose applications across safety, food, and healthcare domains.

Top Key Players in the Market

- WAGEM Monitoring Systems

- Tiger Nose Associates

- Cyranose

- SPEC Sensors

- Odotech

- Owlstone Medical

- Bedfont

- eNose Company

- Aryballe Technologies

- Cambridge Sensotecs

- Delphian Corporation

- Aethon

- Airsense Analytics

- Alpha MOS

- Smiths Detection

- Ionicon Analytik

- Others

Recent Developments

- In November 2024, a study in Science Advances revealed an electronic nose capable of detecting odors at speeds similar to a mouse’s olfactory system. It distinguishes scents by analyzing the unique patterns they form on the sensor over time. This development marks a major step in mimicking biological scent recognition through artificial means.

- In February 2024, Ariese introduced the PEN, a portable electronic nose designed to identify gases and gas mixtures. It uses a wide range of sensors and is applicable in environmental monitoring, industrial safety, and healthcare diagnostics.

- By April 2024, engineers at Princess Sumaya University for Technology (PSUT) built a prototype e-nose to detect bacteria and microbes in food. This device aims to improve food safety in public venues such as malls, schools, and airports, particularly protecting vulnerable groups like children and travelers.

- In January 2024, researchers in Taiwan developed an AI-based e-nose that identifies different types of coffee with 98% accuracy. Created at the National Kaohsiung University of Science and Technology, the device leverages machine learning algorithms to recognize complex aroma profiles.

- In August 2023, Odotech launched an enhanced version of its odor monitoring technology, which expands the potential for real-time tracking of odor emissions in waste management. This innovation aims to help municipalities manage odor emissions more efficiently.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Portable Electronic Noses, Fixed Electronic Noses, & Handheld Electronic Noses), By Application (Food & Beverage Industry, Medical & Healthcare Industry, Environmental Monitoring, Defense and Security, & Industrial Manufacturing), By Sensor Technology (Metal Oxide Semiconductor (MOS) Sensors, Polymer Sensors, Conductive Polymer Sensors, Surface Acoustic Wave (SAW) Sensors, & Piezoelectric Sensors), By Form Factor (Compact, Modular, & Integrated) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape WAGEM Monitoring Systems, Tiger Nose Associates, Cyranose, SPEC Sensors, Odotech, Owlstone Medical, Bedfont, eNose Company, Aryballe Technologies, Cambridge Sensotecs, Delphian Corporation, Aethon, Airsense Analytics, Alpha MOS, Smiths Detection, Ionicon Analytik, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- WAGEM Monitoring Systems

- Tiger Nose Associates

- Cyranose

- SPEC Sensors

- Odotech

- Owlstone Medical

- Bedfont

- eNose Company

- Aryballe Technologies

- Cambridge Sensotecs

- Delphian Corporation

- Aethon

- Airsense Analytics

- Alpha MOS

- Smiths Detection

- Ionicon Analytik

- Others