Global Electric Bicycle Batteries Market Size, Share Analysis Report By Capacity (36V, 48V, Others), By Batteries (Lithium Ion Battery, Lead-acid Battery) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170530

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

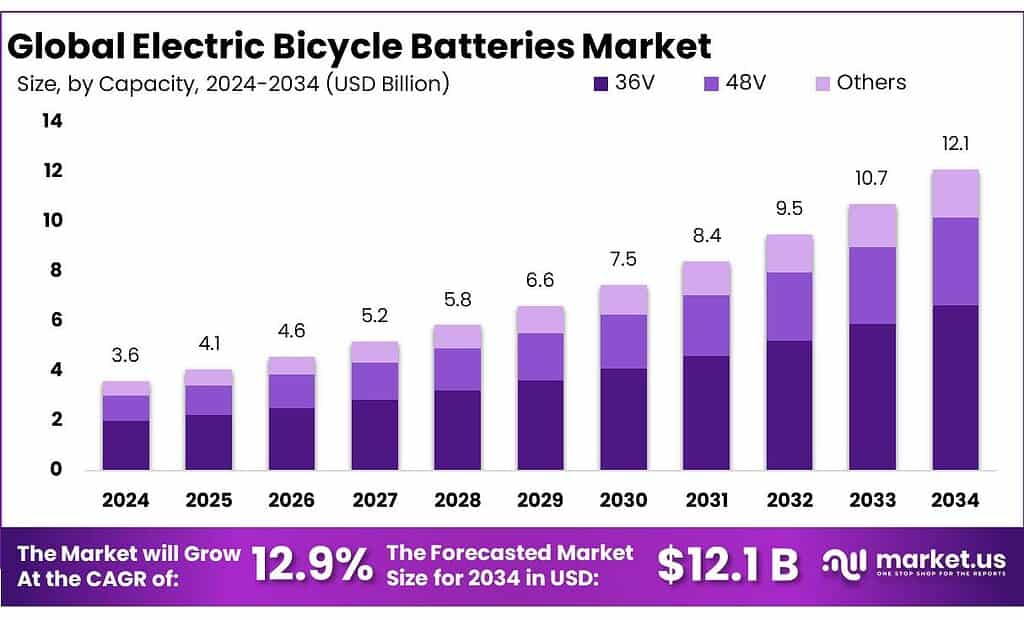

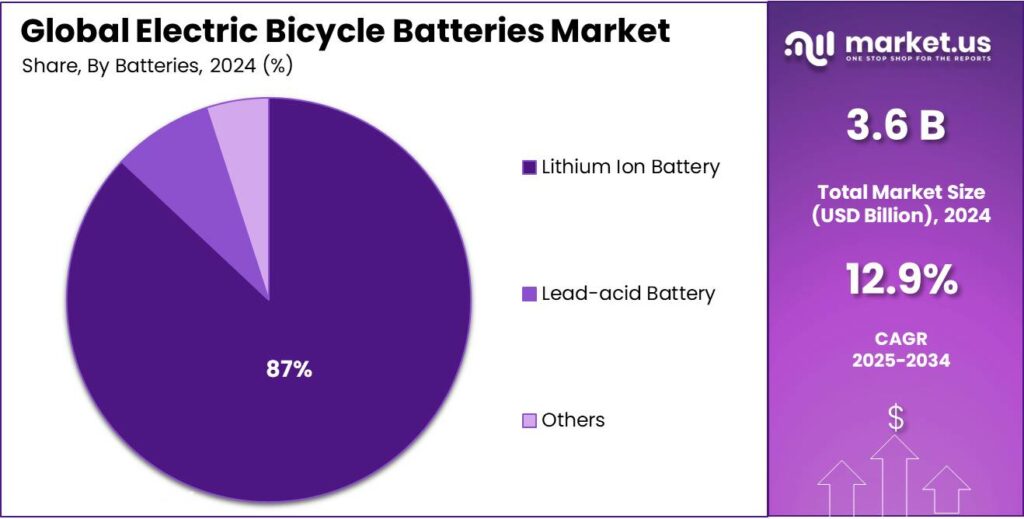

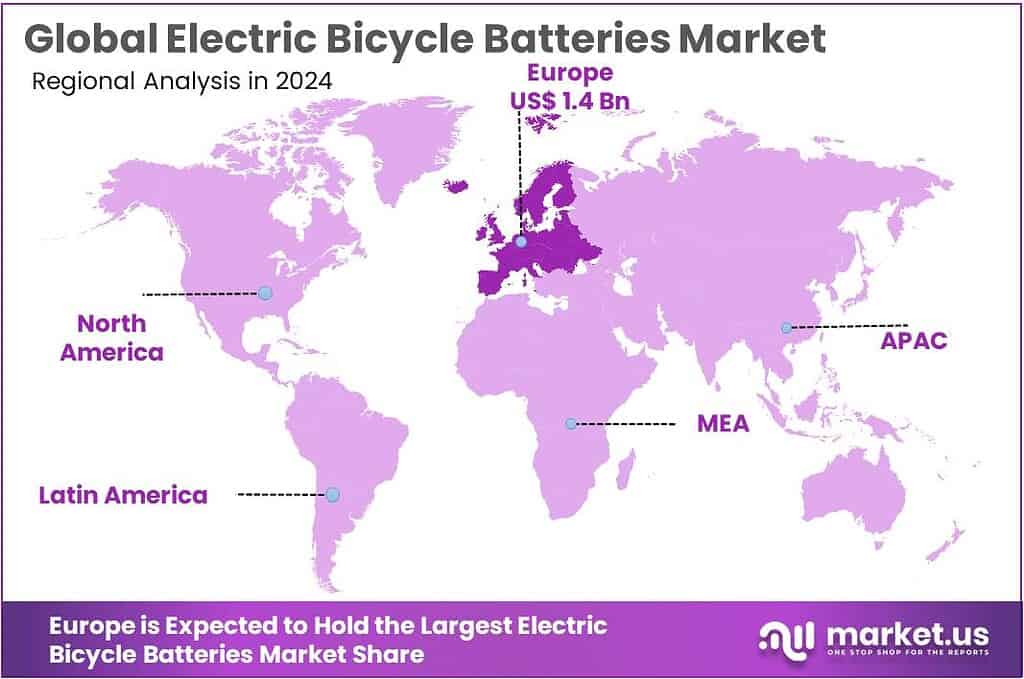

The Global Electric Bicycle Batteries Market size is expected to be worth around USD 12.1 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 12.9% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 39.10% share, holding USD 1.4 Billion revenue.

The electric bicycle battery industry is a critical sub-segment of the broader electric mobility ecosystem, providing power solutions that enable e-bikes to deliver assisted propulsion with greater range and efficiency compared to conventional human-powered bicycles. E-bike batteries are predominantly lithium-ion (Li-ion) chemistries due to their high energy density, longer life cycles, and declining costs, making them the preferred choice in modern electric bicycles. These batteries typically range from 0.3 kWh to over 1 kWh capacity depending on design and application, directly influencing both cost and range performance.

In Europe alone, 5.1 million e-bikes were sold across the EU27+UK in 2023, while the wider bicycle/e-bike ecosystem reported €19.3 billion in turnover and around 170,000 direct/indirect manufacturing jobs—evidence of a deep supply base for components and assembly. Globally, the “light EV” segment is already heavily electrified: the IEA notes that two- and three-wheelers remain the most electrified road segment in 2024, with ~15% electric sales share and about 10 million electric model sales, and >9% of the global 2/3W fleet now electric—supporting scale benefits for cells, BMS electronics, and pack manufacturing.

Key driving factors are converging. First, affordability and adoption are being improved through public programs that indirectly strengthen battery demand and localization: India’s Ministry of Heavy Industries confirms FAME-II had an outlay of ₹10,000 crore and targeted support for up to 10 lakh electric two-wheelers, and the same ministry’s portal states the PM E-DRIVE scheme runs from 1 Oct 2024 to 31 Mar 2026—signals that policy is still steering the light-EV ecosystem that shares suppliers and standards with e-bikes/e-cycles.

Second, safety and compliance are rising as decisive purchase gates after battery-fire headlines; for example, U.S. reporting cited 31 battery-related incidents and >$700,000 in property damage tied to certain models, pushing OEMs toward stronger cell qualification, pack protections, and certified servicing networks.

- Government initiatives and public policies are accelerating this transition. In India, the central PM E-DRIVE scheme under the Ministry of Heavy Industries provides direct incentives for electric two-wheelers and related battery systems, supplementing state programs offering subsidies of ₹5,000-₹30,000 per kWh of battery capacity on electric bikes and waivers on registration fees.

Key Takeaways

- Electric Bicycle Batteries Market size is expected to be worth around USD 12.1 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 12.9%.

- 36V held a dominant market position, capturing more than a 54.9% share.

- Lithium Ion Battery held a dominant market position, capturing more than a 87.3% share.

- Europe held a leading position in the electric bicycle batteries market, representing 39.10% of regional share and an estimated US$1.4 billion.

By Capacity Analysis

36V batteries dominate with a 54.9% share, favored for balanced power and everyday riding needs

In 2024, 36V held a dominant market position, capturing more than a 54.9% share. This dominance was supported by its balanced performance between power output, riding range, and cost, making it the most widely used battery capacity in electric bicycles. The 36V format was commonly adopted in commuter and city e-bikes, where moderate speed and efficiency were prioritized over high torque.

During 2024, rising urban mobility demand and increasing preference for lightweight e-bikes strengthened adoption of 36V batteries. In 2025, the segment continued to see steady demand as manufacturers focused on standardization, improved battery management systems, and wider compatibility across mid-range electric bicycle models, sustaining its leading position in the market.

By Batteries Analysis

Lithium-ion batteries lead with an 87.3% share, driven by high energy density and longer life

In 2024, Lithium Ion Battery held a dominant market position, capturing more than a 87.3% share. This strong position was supported by its high energy density, lighter weight, and longer charging cycle compared to traditional battery types, making it the preferred choice for modern electric bicycles. Lithium-ion batteries enabled longer riding range and faster charging, which directly improved user convenience and performance.

During 2024, declining battery costs and improved safety features increased adoption across entry-level to premium e-bikes. In 2025, demand remained robust as manufacturers continued to focus on efficiency, compact battery design, and better thermal management, reinforcing lithium-ion technology as the standard battery solution in the electric bicycle batteries market.

Key Market Segments

By Capacity

- 36V

- 48V

- Others

By Batteries

- Lithium Ion Battery

- Lead-acid Battery

Emerging Trends

Certified, safer batteries become the new normal

One clear latest trend in electric bicycle batteries is the fast move toward certified, safety-tested battery systems—and away from cheap, unverified packs. This shift is being pushed by real-world fire incidents, new city rules, and pressure from delivery platforms that don’t want riders charging risky batteries in homes or shared buildings. When safety becomes a daily topic, buyers start asking “Is this certified?” before asking “How many kilometers will it run”

On the standards side, the market is increasingly shaped by certifications like UL 2849 and related battery standards. UL explains that UL 2849 was developed with industry involvement to assess electrical and fire safety for e-bikes by examining the drivetrain, battery system, and charger as a combined system. As cities tighten safety expectations, this “system-level” certification matters more than ever because many fires are linked to mismatched chargers, modified packs, or low-quality cells rather than the bike frame itself.

Governments and public bodies are also creating a tailwind for higher-quality batteries. At EU level, the European Declaration on Cycling encourages employers and institutions to promote cycling through measures like cycle-to-work incentives, provision of company (e-)bikes, and even the use of bike-based delivery services. The more cycling becomes “officially supported transport,” the more pressure there is for batteries to be safe, standardized, and easy to inspect—especially in apartments, offices, and public parking areas.

Drivers

Last-mile food delivery and city incentives push e-bike battery demand

One major driver for electric bicycle batteries is the fast shift of short urban trips—especially food and grocery delivery—from cars and scooters to e-bikes. Delivery riders need reliable range, quick charging, and low downtime, so battery upgrades directly translate into more orders per shift. DoorDash, for example, says the share of deliveries made on two-wheeled devices across its U.S. and Canada markets has tripled since 2022, which signals a real operational pivot toward battery-powered mobility in dense cities.

The U.S. Department of Energy reports lithium-ion battery pack costs for light-duty vehicles fell about 90% from 2008 to 2023, reaching about $139 per kWh in 2023—a long-term cost slide that supports smaller packs like e-bike batteries too, because cells, manufacturing learning, and supply chains overlap. When battery costs fall, brands can offer higher-capacity packs or better safety features without pushing the bike price out of reach—important for delivery riders who often pay weekly or monthly for a vehicle.

Public policy is another accelerant because it reduces upfront cost and normalizes e-bikes as “everyday transport,” not a niche hobby. In India, the Ministry of Heavy Industries’ PM E-DRIVE program aims to incentivize about 24.79 lakh electric two-wheelers, and it explicitly states that only e-2Ws equipped with advanced batteries qualify for demand incentives—an approach that pushes the market toward better battery chemistry, safer pack design, and improved lifecycle performance. In the EU, the European Declaration on Cycling encourages measures such as “cycle-to-work incentives” and provision of company (e-)bikes—exactly the kind of institutional support that expands daily usage and battery wear cycles.

Restraints

Battery fire risk and tougher safety rules slow adoption

One major restraining factor for electric bicycle batteries is safety risk from poor-quality or mishandled lithium-ion packs, which has triggered stricter rules, tougher enforcement, and higher compliance costs. When a battery overheats or goes into thermal runaway, it can spread fast and produce heavy smoke. That fear is not theoretical anymore. In the UK, the Office for Product Safety and Standards (OPSS) recorded 211 fires involving e-bikes or e-scooters in 2024, with 175 of those reports coming from the London Fire Brigade.

New York City shows how fire statistics quickly turn into regulation. FDNY reported 277 fires started by lithium-ion batteries in 2024 (up from 268 in 2023), and it also noted increased inspections of e-bike shops. In response to safety concerns, NYC’s Local Law 39 requires devices and batteries sold, leased, or rented in the city to meet specific UL certification standards. This kind of rule is good for safety, but it can slow the market in the short term because low-cost, uncertified packs get pushed out, and certified batteries are usually more expensive.

The pressure is especially strong in the food delivery economy, where riders often charge at home, in shared housing, or in small commercial spaces. Delivery platforms are now being pulled into safety campaigns because their riders are frequent users. Deliveroo, for instance, says it partnered with the London Fire Brigade on the ChargeSafe campaign in 2024 to share e-bike battery safety information, and it also ran 30 face-to-face rider engagement events across the UK and Ireland that year.

Finally, battery risk affects logistics and transport too, which can squeeze supply and raise costs. The FAA’s incident tracking shows 89 verified lithium battery incidents on aircraft in 2024 involving smoke, fire, or extreme heat. Even though e-bike batteries usually move by ground or regulated cargo channels, rising incident counts increase scrutiny across shipping, packaging, and handling—adding friction for distributors and importers.

Opportunity

Battery-as-a-service for food delivery fleets

A big growth opportunity for electric bicycle batteries is building “battery-as-a-service” models for food and grocery delivery riders—think certified batteries, simple weekly plans, and convenient charging or swap points. Delivery work is intense: riders do many short trips, stop-and-go riding, and charge more than once a day. That creates a clear need for batteries that are safe, predictable, and always available. DoorDash has already seen the share of deliveries made on two-wheeled devices across its U.S. and Canada markets triple since 2022.

This is where subscriptions and managed fleets open a real door for battery makers. Just Eat, for example, promotes options that let restaurant partners subscribe from only £45 per week for electric pedal bikes. A battery-focused version of this idea—bundling the pack, charger, maintenance checks, and end-of-life takeback into one plan—can solve two headaches at once: high upfront cost and safety worries. Instead of riders buying unknown batteries, they can use verified packs that are tracked, tested, and replaced before they become risky. That kind of trust matters in apartment-heavy cities where indoor charging rules are getting stricter.

Government direction is also lining up behind “better batteries,” which supports premium and service-based offerings. In India, the PM E-DRIVE program aims to incentivize about 24.79 lakh electric two-wheelers, and it clearly says only e-2Ws with advanced batteries qualify for demand incentives. That policy signal helps the market move away from cheap, low-quality packs and toward higher-standard designs—exactly what battery-as-a-service providers want, because fewer failures mean lower service cost.

Cost trends make this opportunity even more practical. The U.S. Department of Energy estimates lithium-ion battery pack costs fell about 90% between 2008 and 2023, with a 2023 estimate around $139 per kWh.

Regional Insights

Europe accounts for 39.1% (US$1.4 Bn) of the e-bicycle battery market in 2024, led by strong policy support and urban demand

In 2024, Europe held a leading position in the electric bicycle batteries market, representing 39.10% of regional share and an estimated US$1.4 billion in value; this dominance was supported by mature cycling infrastructure, consumer preference for micromobility, and government incentives that favoured low-emission urban transport. Demand in Western Europe—notably Germany, France and the Netherlands—was driven by high per-capita e-bike ownership and expanding last-mile logistics use, which increased need for durable, higher-energy batteries for cargo and commuter models.

In 2024, product trends emphasised lithium-ion chemistries for higher energy density and lighter weight, and improvements in battery management systems were noted to extend cycle life and safety performance. Policy levers such as purchase incentives, urban low-emission zones, and support for micromobility pilots were observed to accelerate replacement cycles and fleet electrification among commercial operators, lifting total addressable demand for replacement and OEM batteries.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Samsung SDI is a major supplier of lithium-ion cells used in premium electric bicycles. In 2024, its battery business operated at multi-GWh scale, with cylindrical and prismatic cells supporting 36V and 48V e-bike systems. Energy density levels exceeded 250 Wh/kg, enabling longer range and improved durability for high-end models.

ChaoWei is a leading battery supplier for electric bicycles, particularly in Asia. In 2024, the company produced batteries for more than 20 million electric two-wheelers annually. Its portfolio included lithium-ion and advanced lead-acid batteries, with growing focus on 36V lithium packs for urban and commuter e-bikes.

Panasonic is a well-established battery manufacturer supplying lithium-ion cells for electric mobility. In 2024, Panasonic’s energy segment operated above 50 GWh capacity, with e-bike batteries benefiting from high safety standards and long cycle life. The company’s cells were widely used in mid- to premium-range electric bicycles.

Top Key Players Outlook

- Samsung SDI

- BYD

- ChaoWei

- Panasonic

- GS Battery

- Exide Technologies

- SBS Battery

- Fiamm

- Power Sonic Europe

- Yamaha Motor Co. Ltd.

Recent Industry Developments

In 2024, Samsung SDI continued to support the electric bicycle batteries sector through its strong portfolio of cylindrical lithium-ion cells designed for micromobility applications, including e-bikes. At the China Cycle 2024 fair, the company showcased its 21700 cylindrical cells with around 20 Wh capacity and extended life beyond 4,000 cycles, reflecting enhancements in capacity and durability tailored for longer range riding.

In 2024, GS Battery—operating under the GS Yuasa Corporation umbrella—continued to contribute to the broader electric battery landscape with its range of lithium‑ion and lead‑acid technologies that support mobility applications, including components of electric bicycle battery systems through OEM and aftermarket supply channels. GS Yuasa has over 65 subsidiaries and 33 affiliates globally, demonstrating extensive scale in battery manufacturing and distribution across Europe and Asia.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Bn Forecast Revenue (2034) USD 12.1 Bn CAGR (2025-2034) 12.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Capacity (36V, 48V, Others), By Batteries (Lithium Ion Battery, Lead-acid Battery) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Samsung SDI, BYD, ChaoWei, Panasonic, GS Battery, Exide Technologies, SBS Battery, Fiamm, Power Sonic Europe, Yamaha Motor Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electric Bicycle Batteries MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Electric Bicycle Batteries MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung SDI

- BYD

- ChaoWei

- Panasonic

- GS Battery

- Exide Technologies

- SBS Battery

- Fiamm

- Power Sonic Europe

- Yamaha Motor Co. Ltd.