Global Eco Cable Market Size, Share, And Enhanced Productivity By Type (Polyethylene Based, Polypropylene Based, Others), By Application (Communication, Petrochemicals, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171435

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

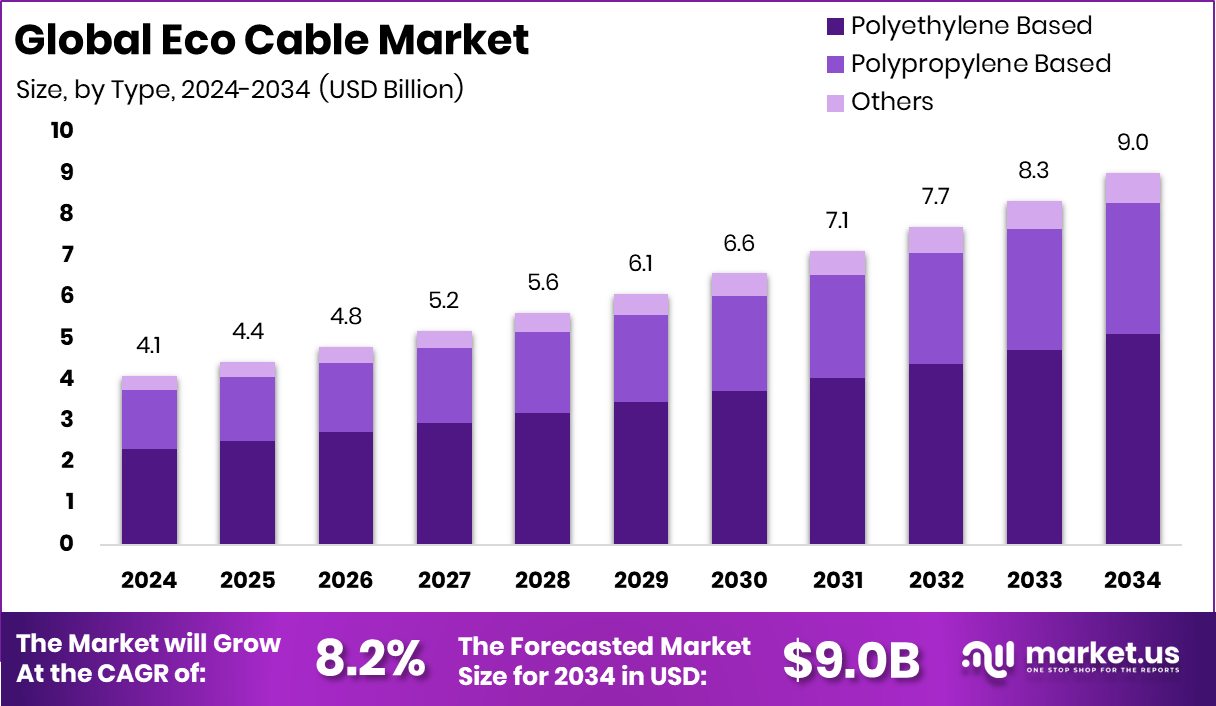

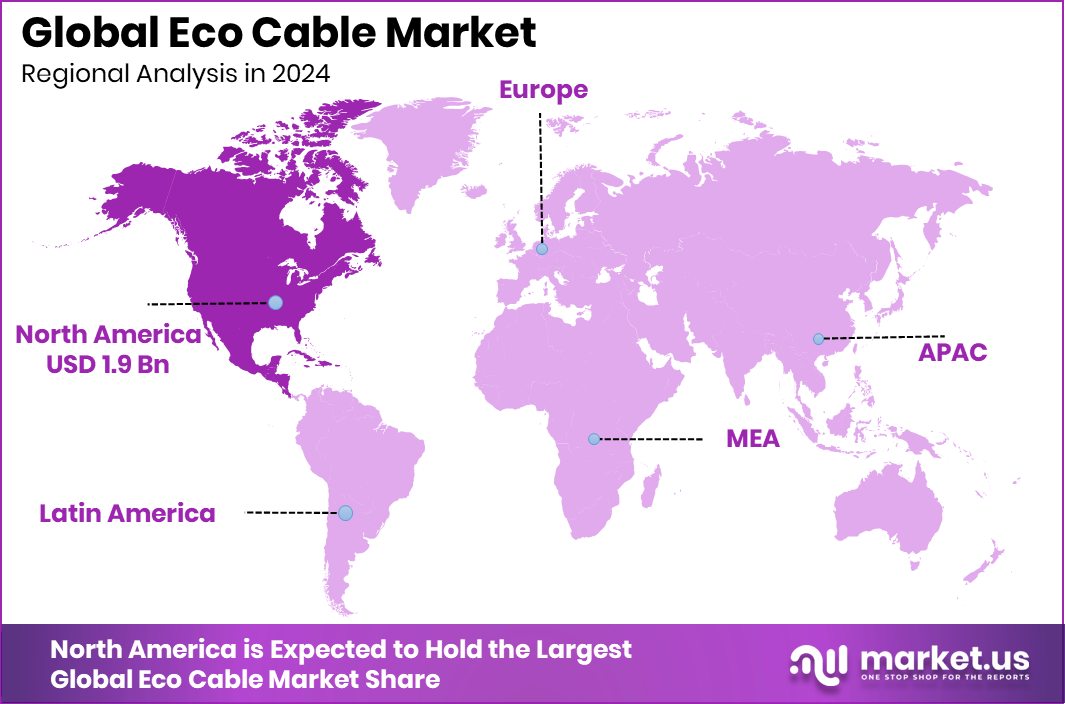

The Global Eco Cable Market is expected to be worth around USD 9.0 billion by 2034, up from USD 4.1 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034. The North America Eco Cable Market commands a 48.20% share, generating USD 1.9 Bn

Eco cable refers to environmentally responsible electrical and communication cables designed to reduce environmental impact across their lifecycle. These cables use safer insulation materials, lower-toxicity compounds, and recyclable components while maintaining reliable electrical and data transmission performance. Eco cables are widely used in power distribution, communication networks, electric vehicles, and digital infrastructure, where sustainability and long-term safety are priorities.

The Eco Cable Market represents the global industry focused on manufacturing, supplying, and deploying eco-friendly cables across infrastructure, energy, transport, and digital connectivity systems. The market is shaped by rising sustainability standards, infrastructure modernization, and growing demand for low-impact materials in both public and private projects.

Market growth is supported by large-scale infrastructure and connectivity investments. Google announced a $1 billion investment in digital connectivity to Japan, expanding the Pacific Connect initiative with new subsea cables, Proa, and Taihei. Nigeria approved the deployment of 90,000 km of fiber optic cable to transform national communication networks, reinforcing demand for sustainable cabling solutions.

Demand is accelerating from energy transition and urban development projects. Houston received a $15 million federal grant to expand EV charging infrastructure, increasing the need for eco-compliant power cables. In parallel, Danang Ba Na Hills raised $1.7 billion for large-scale infrastructure development, supporting sustained cable consumption.

Innovation and digital platforms create new opportunities across connected systems. Cosmic Wire raised $30 million to expand its cross-chain Web3 platform, indirectly increasing demand for efficient and sustainable data-transmission infrastructure.

Key Takeaways

- The Global Eco Cable Market is expected to be worth around USD 9.0 billion by 2034, up from USD 4.1 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034.

- In the Eco Cable Market, polyethylene-based cables dominate with 56.8% share due to flexibility benefits.

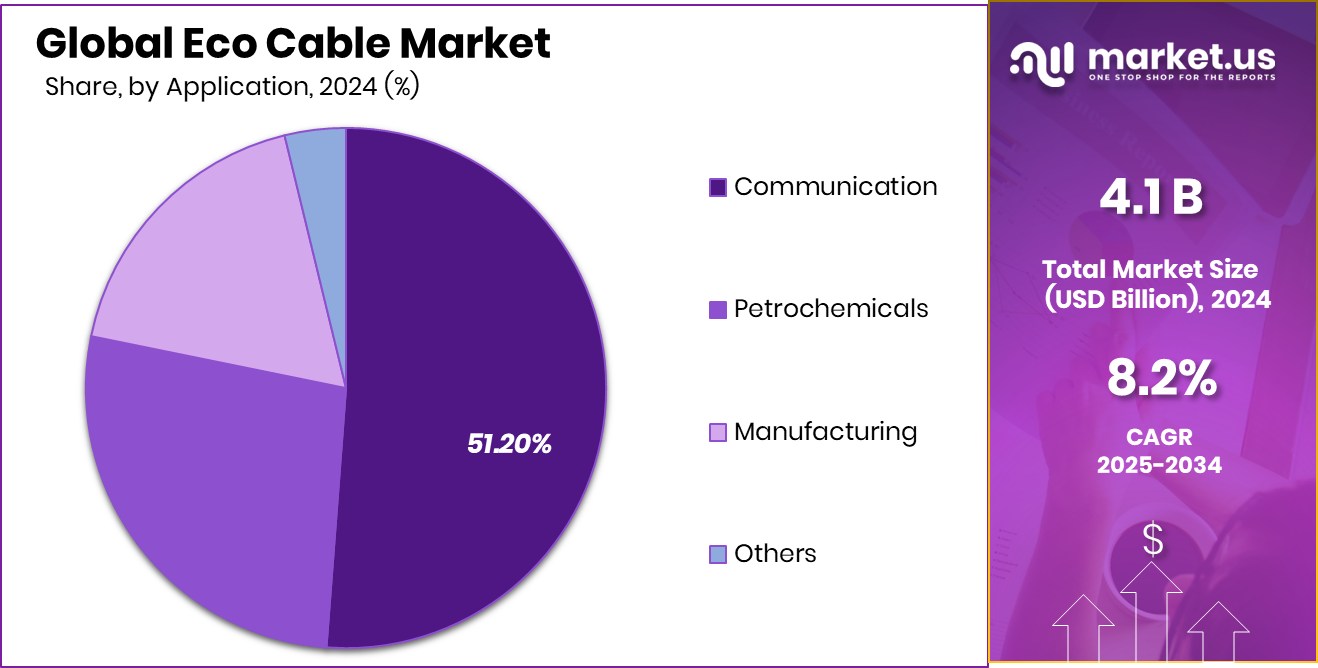

- In the Eco Cable Market, communication applications lead with a 51.20% share, driven by digital connectivity needs.

- In North America, the Eco Cable Market holds a 48.20% share, totaling USD 1.9 Bn.

By Type Analysis

In Eco Cable Market, polyethylene-based type dominates with 56.8% share globally.

In 2024, Polyethylene-Based held a dominant market position in the By Type segment of the Eco Cable Market, with a 56.8% share. This dominance reflects the strong suitability of polyethylene materials for eco-cable manufacturing, particularly where durability, insulation performance, and environmental compliance are required together. Polyethylene-based eco cables are widely preferred because they balance mechanical strength with flexibility, making them reliable across varied installation conditions while supporting reduced environmental impact objectives.

The 56.8% share also indicates consistent adoption across infrastructure and industrial wiring systems, where long service life and stable electrical performance are critical. Manufacturers continue to rely on polyethylene formulations as they enable efficient processing and support eco-design standards. As sustainability expectations rise, polyethylene-based eco cables remain positioned as a practical and trusted solution within the market.

By Application Analysis

Within the Eco Cable Market, communication applications lead demand, holding 51.20% market share.

In 2024, Communication held a dominant market position in By Application segment of the Eco Cable Market, with a 51.20% share. This leading share highlights the growing use of eco cables in communication networks, where performance reliability and environmental responsibility are increasingly interconnected. Communication systems demand stable signal transmission and long-term operational safety, making eco-friendly cable solutions a preferred choice.

The 51.20% share reflects the steady deployment of eco cables across data transmission, telecom networks, and connected infrastructure. As digital connectivity expands, communication applications continue to prioritize materials that support efficiency while reducing environmental burden. This dominance shows that eco cables have moved beyond niche adoption and are now a core component in modern communication infrastructure planning.

Key Market Segments

By Type

- Polyethylene Based

- Polypropylene Based

- Others

By Application

- Communication

- Petrochemicals

- Manufacturing

- Others

Driving Factors

Industrial Investment Accelerates Sustainable Cable Material Supply

A major driving factor for the Eco Cable Market is rising investment in petrochemicals and sustainable materials that support cleaner cable production. Petronet LNG secured a ₹12,000 crore term loan to fund its Gujarat PDH-PP project at Dahej, boosting 750 KTPA propane dehydrogenation and 500 KTPA polypropylene capacity. This expansion strengthens the supply of advanced polymers used in durable and eco-friendly cable insulation, supporting long-term material availability for sustainable cabling.

At the same time, global capital is moving into petrochemical and bio-based material platforms. Berkshire Hathaway’s near $10 billion deal for Occidental’s petrochemical unit reflects confidence in essential downstream materials that feed wire and cable manufacturing. In parallel, Origin. Bio raised $15 million to help manufacturers develop more sustainable materials, encouraging lower-impact alternatives for cable components.

Restraining Factors

Financial Volatility Slows Sustainable Cable Material Investments

A key restraining factor for the Eco Cable Market is financial uncertainty across upstream petrochemical and material supply chains. Petronet is seeking a $1.4 bn loan to fund a petrochemical plant and LNG terminal, showing that large capital requirements can delay project execution and material availability. Such financing pressure often slows decisions related to capacity expansion for polymers and compounds used in eco cable insulation and jacketing.

Market instability further adds risk. Shares of Mangalore Refinery and Petrochemicals fell 2.01% in a single session, reflecting investor concerns around profitability and operational performance. In addition, SCG Chemicals reported a loss of $87 mln from its Vietnam-based Long Son Petrochemicals unit in Q1, highlighting cost overruns and margin pressure. These financial setbacks reduce confidence in new investments, limiting steady raw material supply for eco cable manufacturing.

Growth Opportunity

Low-Carbon Petrochemical Investments Unlock Eco Cable Growth

A major growth opportunity for the Eco Cable Market is the rising flow of funding into cleaner petrochemical production. Inter Pipeline was awarded a $408 million grant under Alberta’s Petrochemicals Incentive Program, supporting advanced facilities that improve the supply of polymers with lower environmental impact. These materials are essential for producing eco-friendly cable insulation and sheathing used in power and communication networks.

At the same time, innovation-focused funding is helping reduce emissions across the petrochemical value chain. Copenhagen-based Again secured €39M to decarbonise the petrochemical industry, enabling cleaner processing methods and reduced carbon intensity of base materials. As cable manufacturers increasingly prioritize sustainability, access to low-carbon polymers creates a clear pathway for eco cable adoption across infrastructure projects.

Latest Trends

Shifting Petrochemical Commitments Reshape Eco Cable Strategies

A key latest trend in the Eco Cable Market is the growing uncertainty around petrochemical investments, which is reshaping material sourcing and planning strategies. South Korea’s Hyundai E&C cancelled a $521 million petrochemicals deal after financing issues linked to Iran. Such cancellations highlight rising geopolitical and funding risks in traditional petrochemical supply chains, pushing cable manufacturers to rethink long-term sourcing and prioritize flexibility, regional diversification, and alternative materials that support eco cable production.

Policy-related investment delays are also influencing market direction. Union officials have criticized the failure to deliver £200 million in promised investment to protect the future of Grangemouth, raising concerns about continuity in domestic petrochemical capacity. These developments are encouraging eco cable stakeholders to focus more on resilient supply models and sustainable inputs rather than relying on uncertain large-scale projects.

Regional Analysis

North America Eco Cable Market reached 48.20% share, valued at USD 1.9 Bn.

.The Eco Cable Market shows varied regional performance, with North America emerging as the dominating region. In 2024, North America accounted for 48.20% of the global Eco Cable Market, valued at USD 1.9 Bn, reflecting strong demand from power, communication, and infrastructure upgrades that prioritize environmentally compliant cabling solutions. The region’s leadership is supported by early adoption of sustainable materials and structured replacement of conventional cables across utilities and commercial networks.

Europe represents a mature and regulation-driven market, where eco cables are increasingly embedded in grid modernization and urban infrastructure projects, supported by strong environmental standards and long-term asset planning.

Asia Pacific continues to expand steadily, driven by rapid urbanization, expanding communication networks, and rising awareness of sustainable electrical components across developing economies.

In the Middle East & Africa, eco cable adoption is gaining traction through infrastructure development and gradual alignment with global sustainability practices. Latin America shows consistent progress, supported by improving power distribution systems and growing emphasis on environmentally responsible construction materials across regional markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Fujikura continues to be a strong force in the Eco Cable Market through its long-standing expertise in cable engineering and materials innovation. In 2024, the company’s focus remains on reducing environmental impact while maintaining high performance standards across power and communication cables. Its approach reflects disciplined manufacturing practices, efficient material use, and steady alignment with sustainability expectations from infrastructure and utility customers.

Hitachi brings a systems-oriented perspective to eco cables, integrating them within broader energy, digital, and infrastructure solutions. During 2024, Hitachi’s strength lies in combining cable technologies with smart energy and industrial applications. This integration supports lower lifecycle impact and improved operational efficiency, reinforcing the company’s relevance as sustainability becomes a core procurement criterion.

Furukawa Electric maintains a solid position in the eco-cable landscape by emphasizing material efficiency and advanced cable designs. In 2024, its eco cable offerings benefit from strong R&D capabilities and manufacturing precision. The company’s consistent focus on environmentally responsible products positions it well for long-term demand driven by infrastructure upgrades and cleaner energy networks.

Top Key Players in the Market

- Fujikura

- Hitachi

- Furukawa Electric

- Nexans

- Prysmian Group

- Alpha Wire

- Oki Electric Cable

- Kuramo Electric

- Shikoku Cable

Recent Developments

- In July 2025, Fujikura began the world’s first sale of its 13,824-fiber SWR™/WTC™ cable designed for hyperscale data center networks. This product delivers very high fiber density in a compact design, helping customers manage larger data loads with fewer ducts and easier installation.

- In November 2024, Furukawa Electric concluded an agreement to acquire 67% of the shares of Hakusan Inc.. This move aims to strengthen its connector business, especially for optical connectors used in high-density cable systems. The acquisition enhances Furukawa’s manufacturing capacity and product development in optical connectivity.

- In May 2024, Hitachi Energy was selected to supply a ±800 kV, 950-km high-voltage direct current (HVDC) system to connect renewable energy in Bhadla, Rajasthan to Fatehpur, Uttar Pradesh, India. This large transmission project uses efficient cable and converter technology to move clean energy over long distances and support the country’s renewable grid expansion.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Billion Forecast Revenue (2034) USD 9.0 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polyethylene Based, Polypropylene Based, Others), By Application (Communication, Petrochemicals, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Fujikura, Hitachi, Furukawa Electric, Nexans, Prysmian Group, Alpha Wire, Oki Electric Cable, Kuramo Electric, Shikoku Cable Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Fujikura

- Hitachi

- Furukawa Electric

- Nexans

- Prysmian Group

- Alpha Wire

- Oki Electric Cable

- Kuramo Electric

- Shikoku Cable