The Global Dodecanedioic Acid Market Size, Share, And Business Benefits By Purity (Upto to 99%, More than 99%), By Manufacturing Process (Synthetic Process, Biological Process), By Application (Nylon, Corrosion Inhibitor, Engine Coolant, Epoxy Resin, Powder Coating, Tooth Brush Bristles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153605

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

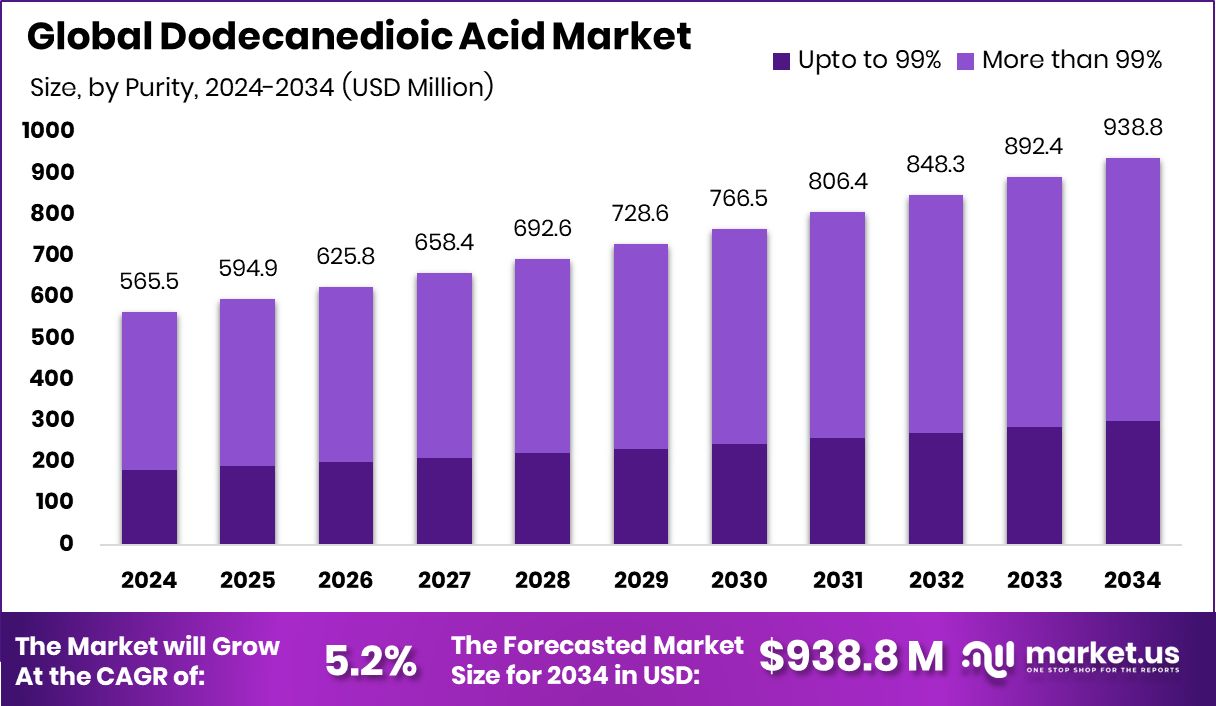

The Global Dodecanedioic Acid Market is expected to be worth around USD 938.8 million by 2034, up from USD 565.5 million in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. Strong industrial demand across Asia-Pacific supported its dominant 36.7% market position.

Dodecanedioic Acid (DDDA) is a 12-carbon, long-chain dicarboxylic acid primarily derived from petrochemical processes or through biological fermentation using renewable feedstocks. It is a white crystalline powder known for its high stability and corrosion resistance. DDDA is widely used in producing high-performance polymers such as nylon 612, adhesives, resins, lubricants, and powder coatings.

The Dodecanedioic Acid market refers to the global trade and production network that supplies DDDA to various industrial sectors such as automotive, electronics, construction, and consumer goods. This market is shaped by the demand for durable polymers, especially in high-temperature and chemically exposed environments. The market includes synthetic and bio-based production methods, with growing interest in sustainable processes influencing its future direction.

The market growth is being driven by the increasing demand for high-performance nylons and polymers used in automotive components, electrical insulation, and industrial machinery. The superior strength, flexibility, and heat resistance of nylon 612, which is synthesized using DDDA, make it highly preferred in demanding industrial applications.

Rising emphasis on lightweight, fuel-efficient vehicles has led to increased adoption of engineering plastics, boosting demand for DDDA-based materials. Additionally, sectors like electronics and powder coatings are expanding rapidly, further driving consistent consumption of DDDA in resin formulations.

Key Takeaways

- The Global Dodecanedioic Acid Market is expected to be worth around USD 938.8 million by 2034, up from USD 565.5 million in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In 2024, the more than 99% purity grade dominated, with 68.3% due to superior polymer compatibility.

- Synthetic process accounted for 87.4% and was favored for its scalability, consistency, and established industrial infrastructure.

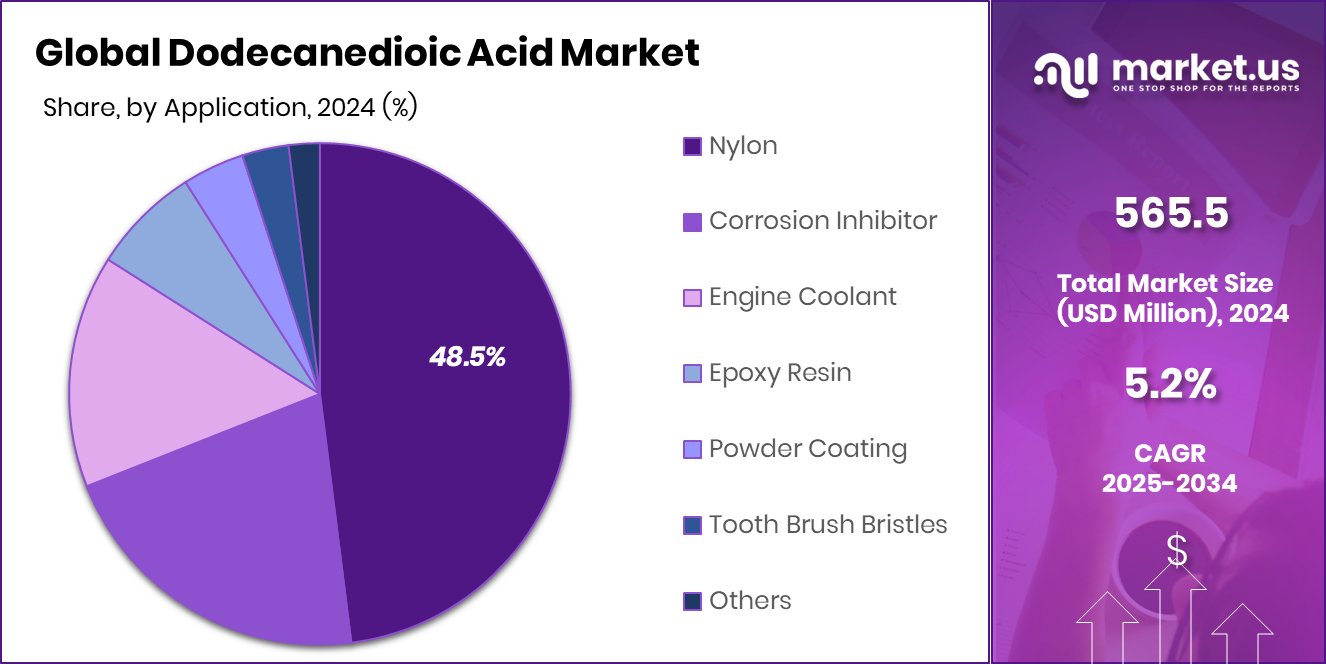

- Nylon led with 48.5%, driven by rising demand for durable, lightweight polymers in automotive and electronics.

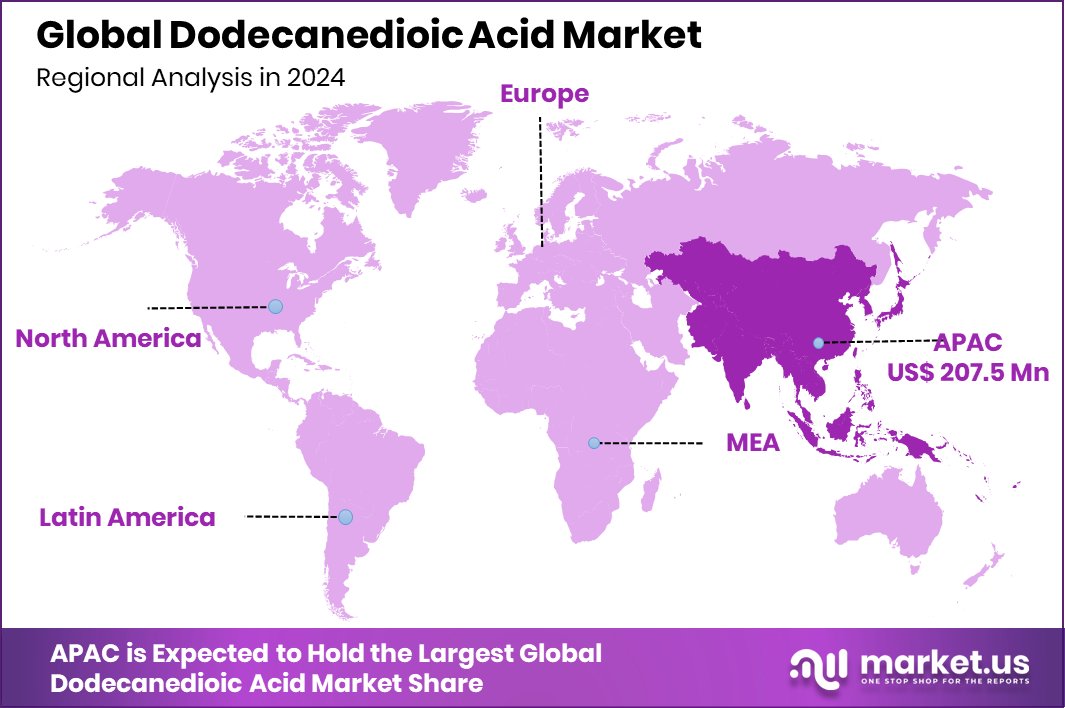

- The Asia-Pacific market size reached USD 207.5 million during the same year.

By Purity Analysis

More than 99% purity dominates with 68.3% market share globally.

In 2024, More than 99% held a dominant market position in the By Purity segment of the Dodecanedioic Acid Market, with a 68.3% share. This high-purity grade is primarily preferred across applications where chemical consistency, superior quality, and reliability are crucial—especially in the production of high-performance polymers, specialty coatings, and advanced adhesives.

Industries such as automotive, electronics, and industrial manufacturing increasingly rely on high-purity DDDA to ensure enhanced mechanical strength, corrosion resistance, and thermal endurance in their end products. Additionally, stringent quality standards in end-use sectors have further supported the uptake of more than 99% purity grade material. The widespread preference for this grade also reflects growing industrial awareness regarding the long-term functional benefits it offers over lower-purity alternatives.

The segment’s lead is reinforced by advancements in purification technologies and process control that have made the consistent production of high-purity DDDA more feasible at scale. As end-users continue to prioritize performance and durability, the demand for high-purity Dodecanedioic Acid is expected to remain strong, supporting its continued dominance in the purity-based segmentation.

By Manufacturing Process Analysis

Synthetic processes account for 87.4%, indicating industrial preference for consistency.

In 2024, Synthetic Process held a dominant market position in the By Manufacturing Process segment of the Dodecanedioic Acid Market, with an 87.4% share. This dominance reflects the widespread industrial reliance on well-established petrochemical routes for DDDA production, offering cost efficiency, process consistency, and scalability. The synthetic method is preferred for its ability to yield high-purity output that meets the stringent specifications required in sectors such as polymers, coatings, and adhesives.

The substantial share of the synthetic process is supported by mature infrastructure and raw material availability, enabling continuous production with predictable outcomes. Additionally, its proven compatibility with current industrial systems makes it a practical choice for large-scale operations where performance reliability is critical.

Despite increasing global attention on sustainability, industries continue to favor the synthetic route due to its technical robustness, lower production variability, and broad acceptance in downstream applications. The ability to maintain uniform molecular structure and purity across batches further strengthens the synthetic process’s role in meeting market expectations.

By Application Analysis

Nylon application leads usage with 48.5%, driven by strong demand.

In 2024, Nylon held a dominant market position in the By Application segment of the Dodecanedioic Acid Market, with a 48.5% share. This significant share highlights the critical role of DDDA in the production of specialty nylons, particularly nylon 612, which is valued for its excellent mechanical strength, heat resistance, and chemical stability. These properties make nylon a preferred material in demanding applications where performance and durability are essential.

The dominance of the nylon segment is largely driven by its widespread use in sectors that require lightweight yet strong engineering plastics. Dodecanedioic acid serves as a key monomer in the nylon formulation, allowing for improved flexibility and resistance to wear and abrasion. This enhances the overall functional characteristics of the final product.

Industries using nylon benefit from the consistent performance of DDDA-based polymers, especially in high-stress environments. The market’s preference for nylon is also supported by its adaptability in design, molding ease, and long service life, all of which are critical for industrial and technical uses.

Key Market Segments

By Purity

- Upto to 99%

- More than 99%

By Manufacturing Process

- Synthetic Process

- Biological Process

By Application

- Nylon

- Corrosion Inhibitor

- Engine Coolant

- Epoxy Resin

- Powder Coating

- Tooth Brush Bristles

- Others

Driving Factors

Rising Demand for High-Performance Nylon Materials

One of the main driving factors for the Dodecanedioic Acid (DDDA) market is the rising demand for high-performance nylon materials, especially nylon 612. This type of nylon is made using DDDA and is widely used in industries like automotive, electronics, and machinery. Nylon 612 offers excellent strength, resistance to heat, and durability, making it suitable for parts that need to handle stress, heat, or chemicals.

As more industries focus on creating lightweight, strong, and long-lasting components, the use of DDDA in nylon production continues to grow. This trend is especially strong in sectors aiming to improve product performance and reduce weight without compromising quality or safety, making it a key growth driver for the DDDA market.

Restraining Factors

Environmental Concerns Over Petrochemical-Based Production Methods

A major restraining factor for the Dodecanedioic Acid (DDDA) market is the environmental impact of its synthetic production. Most of the DDDA used today is produced through petrochemical-based methods, which rely heavily on fossil fuels. This process generates greenhouse gas emissions and contributes to environmental pollution. As governments and industries move toward greener production standards and carbon reduction targets, pressure is increasing to shift away from conventional chemical processes.

Additionally, consumers and manufacturers are becoming more aware of sustainability, which may reduce demand for DDDA made through traditional methods. These environmental concerns and the growing regulatory focus on cleaner production may limit the expansion of the synthetic DDDA market unless cleaner, bio-based alternatives become more widely adopted.

Growth Opportunity

Growth Opportunity: Expansion in Bio‑Based DDDA Production

A major growth opportunity for the Dodecanedioic Acid (DDDA) market lies in the expansion of bio‑based production methods. Unlike traditional petrochemical approaches, bio‑based processes use renewable feedstocks such as plant oils or agricultural residues, which lowers greenhouse gas emissions and reduces dependence on fossil fuels. These eco‑friendly routes align well with increasing global emphasis on sustainable chemistry and circular economies.

As manufacturers and policymakers focus more on reducing carbon footprints, demand for bio‑based DDDA is expected to rise. Moreover, advancements in biotechnology and fermentation techniques are improving yields and reducing costs, making bio‑based DDDA more competitive.

Latest Trends

Trend Highlight: Shift Toward Bio‑Sourced Dodecanedioic Acid

A key trend emerging in the Dodecanedioic Acid (DDDA) market is the growing shift toward bio‑sourced production. Instead of using petroleum-based chemicals, companies are beginning to explore renewable feedstocks like plant oils, sugars, and agricultural waste. This move is driven by increasing concern for the environment and the desire to reduce carbon emissions.

Bio‑based DDDA offers a greener alternative, with potentially lower energy use and less pollution. As biotechnology improves, these sustainable methods are becoming more efficient and affordable. Producers and end-users are increasingly interested in products that deliver similar performance while addressing environmental concerns. This trend reflects a broader industry shift toward eco-friendly solutions and could reshape the future direction of the DDDA market.

Regional Analysis

In 2024, the Asia-Pacific held a 36.7% share of the Dodecanedioic Acid Market.

In 2024, Asia-Pacific emerged as the leading region in the Dodecanedioic Acid Market, capturing a significant 36.7% share and reaching a market value of USD 207.5 million. This dominance is attributed to the region’s expanding industrial base, rising demand for high-performance polymers, and strong presence of chemical manufacturing infrastructure. Countries such as China, India, and South Korea are key contributors, supported by increased production activities and favorable government policies aimed at industrial development.

North America and Europe followed as prominent regions, benefiting from steady consumption of specialty chemicals in automotive and engineering applications. While both regions demonstrate consistent demand, their market share remains below that of Asia-Pacific. The Middle East & Africa and Latin America represented smaller portions of the global market, driven by gradual growth in industrial and construction sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continues to leverage its deep technological expertise and integrated supply chain capabilities in petrochemical-derived DDDA. The company’s strong vertical integration and process optimization efforts have enabled efficient production and consistent output quality. As a result, BASF has maintained robust supply relationships with major polymer and specialty chemical manufacturers.

Cathay Industrial Biotech represents a growing force in bio-based DDDA production. The firm’s investments in fermentation technologies have demonstrated potential to shift market preferences toward renewable feedstocks. Its approach addresses both performance requirements and sustainability concerns, appealing to environmentally conscious end users and markets with stringent regulatory frameworks.

UBE Industries has remained a key participant by balancing traditional chemical synthesis and innovation. The company’s focus on quality control and product consistency has solidified its reputation across automotive, electronics, and specialty materials sectors. By aligning its capacity with demand intrinsically tied to high-performance applications, UBE has upheld a steady market share.

Santa Cruz Biotechnology, primarily recognized in the biochemical research domain, has ventured into DDDA supply tailored for research and niche industrial applications. Their targeted positioning enables responsiveness to specialized customer needs, though their overall market footprint remains smaller compared to larger industrial players.

Top Key Players in the Market

- BASF SE

- Cathay Industrial Biotech

- UBE Industries

- Santa Cruz Biotechnology

- Catha

- Evonik

- Chemceed

Recent Developments

- In November 2024, BASF’s Care Chemicals division partnered with Acies Bio to scale up its “OneCarbonBio” synthetic biology platform. The collaboration focuses on converting renewable methanol—derived from captured CO₂—into fatty acids and derivatives, which are important building blocks for chemicals like DDDA. This partnership highlights BASF’s commitment to integrating biotechnology and reducing reliance on fossil-based feedstocks.

- In March 2024, Cathay Biotech announced the successful industrial-scale production of 100% bio-based DDDA using biomass feedstock. This milestone moves DDDA production away from fossil-based sources and demonstrates that green manufacturing can meet industrial supply demands. The development promises lower carbon emissions and stable raw material sourcing for bio-nylon production.

Report Scope

Report Features Description Market Value (2024) USD 565.5 Million Forecast Revenue (2034) USD 938.8 Million CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Upto to 99%, More than 99%), By Manufacturing Process (Synthetic Process, Biological Process), By Application (Nylon, Corrosion Inhibitor, Engine Coolant, Epoxy Resin, Powder Coating, Tooth Brush Bristles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Cathay Industrial Biotech, UBE Industries, Santa Cruz Biotechnology, Catha, Evonik, Chemceed Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Cathay Industrial Biotech

- UBE Industries

- Santa Cruz Biotechnology

- Catha

- Evonik

- Chemceed