Global Dioctyl Maleate Market By Purity ( Less-than 96%, 96% to 98 %, Greater-than 98%), By Application (Paints and Coatings, Architectural, Industrial, Adhesives and Sealants, Plasticizers, Surfactants, Chemical Intermediate, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149555

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

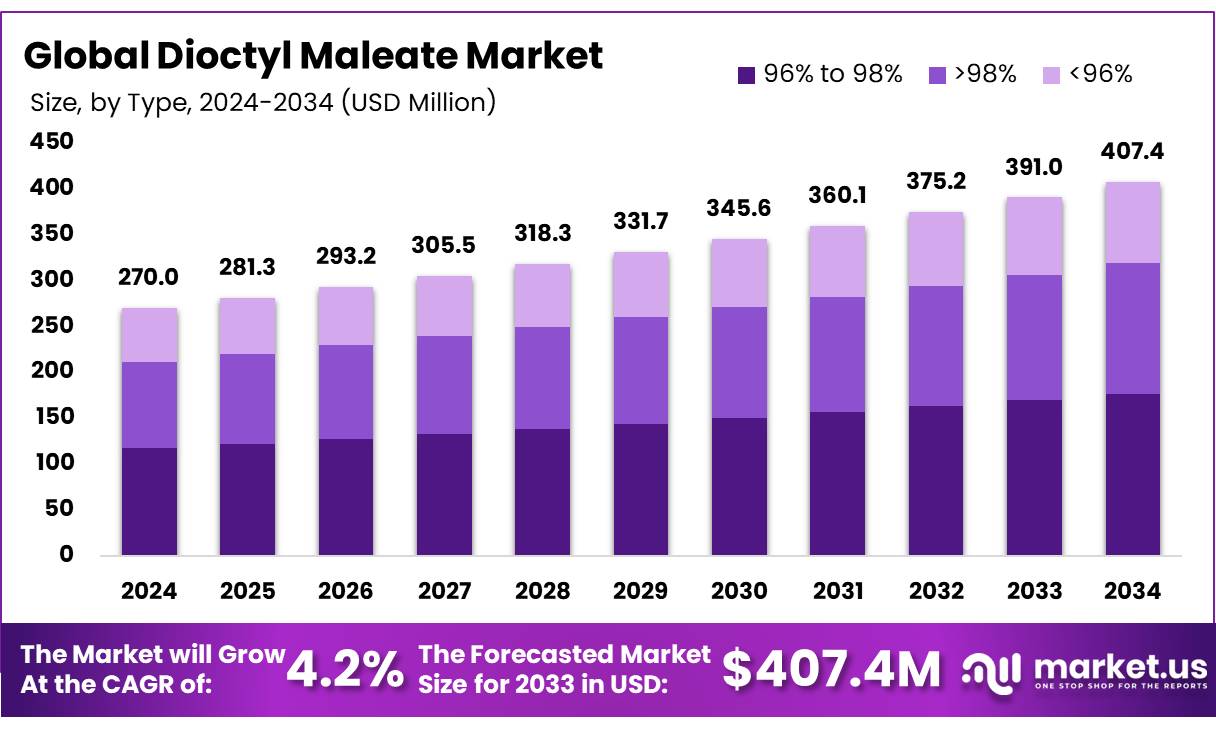

The Global Dioctyl Maleate Market size is expected to be worth around USD 407.4 Million by 2034, from USD 270.0 Million in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

Dioctyl Maleate is a specialty chemical compound widely recognized for its role as a plasticizer and functional monomer in various polymerization processes. As a di-ester of maleic acid, Dioctyl Maleate is primarily used in the production of vinyl and acrylic emulsions, especially in paints, adhesives, and coatings where it imparts flexibility, softness, and improved resistance to humidity and UV exposure. Its compatibility with vinyl acetate, vinyl chloride, and acrylates makes it an ideal co-monomer for high-performance formulations.

Additionally, Dioctyl Maleate is valued for being a phthalate-free alternative, aligning with increasing regulatory pressure on traditional phthalate-based plasticizers. Its low volatility and chemical stability make it suitable for use in textile coatings, surfactants, and certain cosmetic and personal care applications.

The global market for Dioctyl Maleate is experiencing steady growth, driven by expanding demand in the construction, automotive, packaging, and textile industries. With increasing focus on environmental safety and regulatory compliance, especially in Europe and North America, shifting industries toward phthalate-free and eco-friendly plasticizers creates a favorable environment for Dioctyl Maleate.

Furthermore, the rise of water-based formulations and advanced coating technologies is contributing to increased Dioctyl Maleate usage in emulsion polymer systems. The Asia-Pacific region, particularly China and India, continues to lead demand growth due to robust industrial expansion and investments in downstream chemical manufacturing.

Key Takeaways

- The global Dioctyl Maleate market was valued at USD 270.0 million in 2024.

- The global Dioctyl Maleate market is projected to grow at a CAGR of 4.2% and is estimated to reach USD 407.4 million by 2034.

- Among purity, 96% to 98% accounted for the largest market share of 43.4%. Due to its balanced performance, cost-efficiency, and broad industrial applicability.

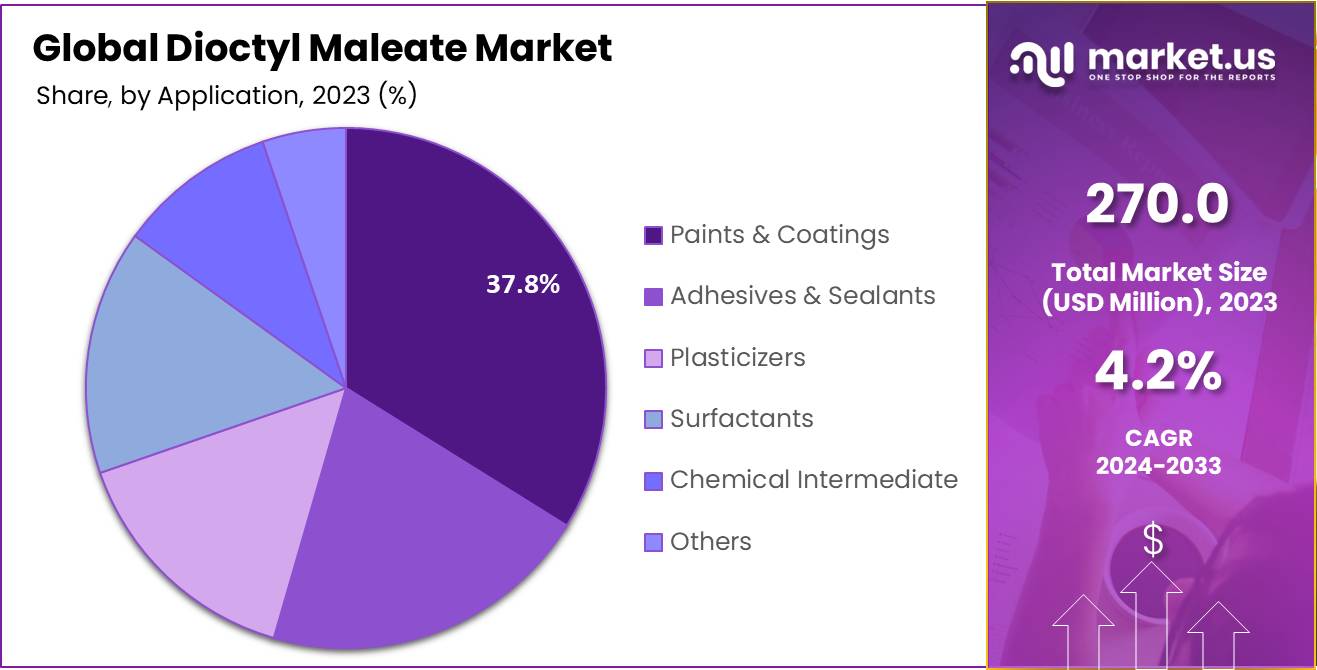

- Among applications, paints & coatings accounted for the majority of the market share at 37.8%. Driven by rising demand for flexible, UV-resistant, and phthalate-free formulations in architectural and industrial applications.

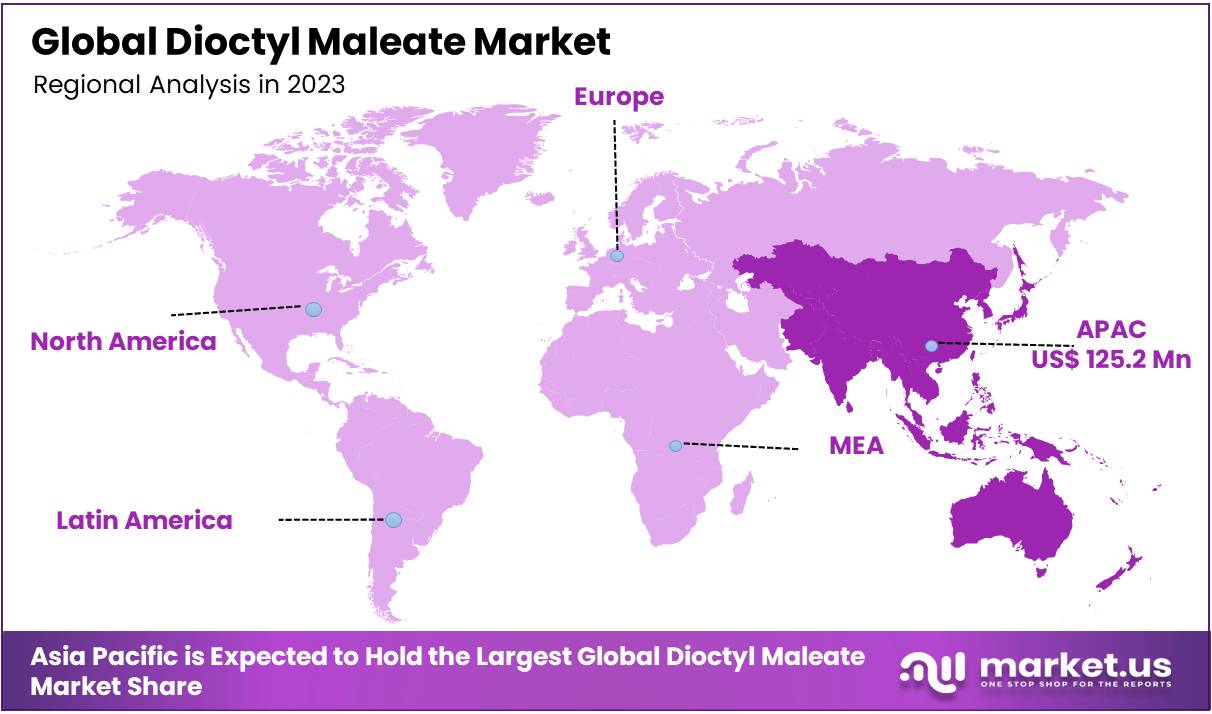

- Asia Pacific is estimated as the largest market for Dioctyl Maleate with a share of 46.4% of the market share. Due to robust industrial expansion and investments in downstream chemical manufacturing.

Purity Analysis

Purity Segment Led The Dioctyl Maleate Market Share Due To Its Balanced Performance, Cost-Efficiency, And Broad Industrial Applicability.

The Dioctyl Maleate market is segmented based on purity into <96%, 96% to 98 %, and > 98%,. In 2024, the 96% to 98 % segment held a significant revenue share of 43.4%. Due to its ideal purity level, which offers a strong combination of performance and cost-effectiveness. It is widely preferred in applications such as adhesives, coatings, and emulsion polymerization due to its consistent quality and compatibility with various monomers. Additionally, their usage in phthalate-free formulation aligns with increasing regulatory and environmental demands across industries like construction, automotive, and packaging.

Application Analysis

The Paints & Coatings Segment Dominated The Dioctyl Maleate Market Driven By Rising Demand For Flexible, UV-resistant, And Phthalate-Free Formulations In Industrial Applications.

Based on application, the market is further divided into paints & coatings, architectural, industrial, adhesives & sealants, plasticizers, surfactants, chemical intermediates, and others. The predominance of the paints & coatings, commanding a substantial 37.8% market share in 2024. This dominance is attributed to increasing demand for high-performance, weather-resistant, and low-VOC formulations in both architectural and industrial sectors. Dioctyl Maleate’s ability to enhance flexibility, adhesion, and UV resistance makes it ideal for modern coatings. Additionally, the shift towards phthalate-free and environmentally friendly materials has further fueled its adoption.

Key Market Segments

By Purity

- <96%

- 96% to 98%

- >98%

By Application

- Paints & Coatings

- Architectural

- Industrial

- Adhesives & Sealants

- Plasticizers

- Surfactants

- Chemical Intermediate

- Others

Drivers

Adoption of High Temperature Coating and Adhesives.

The growing demand for high-temperature coatings and adhesives is significantly driving the global market for Dioctyl Maleate. As industries across construction, automotive, energy, and electronics continue to advance, they seek materials that can withstand extreme temperatures and harsh environmental conditions. Dioctyl Maleate plays a vital role in enhancing the performance of high-temperature coatings and adhesives by improving their heat resistance, adhesion strength, flexibility, gloss, and overall durability. This has made it an essential component in the formulation of materials used in high-heat applications, such as exhaust systems, engines, and aerospace components.

- For instance, according report of European Adhesive and Sealant Industry Association (FEICA) reports that the European adhesives and sealants market reached €19 billion in 2022, with high-temperature applications representing a significant and growing segment, particularly in automotive and construction.

Furthermore, another key factor driving market growth is the versatility of Dioctyl Maleate in improving the properties of high-temperature adhesives. These adhesives are increasingly used in industries like automotive and construction, where they offer a lighter, more efficient alternative to traditional mechanical fasteners. By enabling uniform distribution of joining forces across substrates, Dioctyl Maleate enhances the structural integrity and lifespan of components exposed to extreme heat. Furthermore, its ability to support adhesives that are electrically conductive or insulative has expanded its application into electronics and energy sectors, including photovoltaic cells and motors.

- For instance to International Organization of Motor Vehicle Manufacturers (OICA) reports that global vehicle production reached 93.5 million units in 2023, up from 85 million in 2022, reflecting increased demand for lightweight, high-performance coating materials in automotive manufacturing.

- According to the European Commission, the global electronics market is expected to grow at a CAGR of 5–6% through 2025, with increasing demand for materials that can withstand high temperatures and harsh environments, especially in electric vehicles, consumer electronics, and industrial automation.

Additionally, high-temperature coatings, enhance the heat and chemical resistance of phthalate-based coatings. These coatings are crucial for protecting components like exhaust systems, mufflers, and industrial equipment from corrosion and degradation caused by high operating temperatures. This makes them ideal for environments that involve constant thermal cycling or exposure to harsh chemicals, ensuring long-term durability and performance. The ability to create lightweight, efficient, and durable solutions with high-temperature coatings and adhesives ensures that Dioctyl Maleate will remain a key player in the growing market for advanced materials.

Restraints

Stringent environmental Regulation on plasticizers used

Stringent environmental regulations on plasticizers, particularly phthalate-based compounds, have emerged as a significant restraint on the growth of the global Dioctyl Maleate (DOM) market. Governments worldwide have implemented a variety of regulations concerning the use of plasticizers due to increasing scientific evidence linking them to adverse health and environmental impacts. Plasticizers, including many phthalates, have been subjected to extensive toxicological testing and risk assessments with reproductive toxicity, endocrine disruption, developmental disorders, and chronic illnesses such as cancer and diabetes. These risks are especially pronounced in vulnerable populations such as children and pregnant women.

Moreover, the potential for plasticizers to leach from finished products into air, water, and soil contributes to widespread environmental contamination. These substances can accumulate in living organisms, posing a long-term risk to both human health and ecosystems. As these compounds are widely used in consumer goods, food packaging, toys, and medical devices, to mitigate these challenges, many countries have imposed strict regulations or outright bans on hazardous phthalates, placing pressure on Dioctyl Maleate producers to innovate and meet evolving regulatory standards pose a significant constraint on the market expansion of conventional DOM-based formulations.

- For instance, the European Union’s REACH Regulation (EC) 1907/2006 restricts the use of four key phthalates—DEHP, DBP, BBP, and DIBP—to less than 0.1% by weight in toys, childcare articles, adhesives, sealants, paints, and inks, either individually or in combination.

- In the United States, the Environmental Protection Agency (EPA) evaluates phthalates under the Toxic Substances Control Act (TSCA). In its 2025 risk evaluation, the EPA concluded that Dioctyl phthalate (DIDP) poses an unreasonable risk to human health, particularly for workers exposed to products such as adhesives, sealants, paints, and coatings.

These regulations are forcing manufacturers to phase out traditional phthalates and seek safer, compliant alternatives. While this presents a barrier to conventional plasticizer demand, it simultaneously creates a compelling opportunity for phthalate-free compounds like Dioctyl Maleate, which offer similar performance with reduced regulatory risk.

Opportunity

Increasing Adoption Of Water-Based Formulation.

The rising adoption of water-based coatings across various industries presents a significant growth opportunity for the global Dioctyl Maleate (DOM) market. Waterborne formulations are gaining widespread preference due to their superior environmental and safety profiles compared to solvent-based alternatives. These coatings contribute to sustainability goals by reducing VOC emissions, lowering raw material consumption, and minimizing fire and health hazards associated with toxic solvents. Furthermore, Dioctyl Maleate plays a key role in water-based formulations by enhancing properties such as flexibility, adhesion, weather resistance, and film formation, making it a valuable co-monomer and plasticizer in acrylic emulsions and resins. As industries like automotive, aerospace, electronics, pharmaceuticals, publishing, and luxury packaging increasingly turn to low-VOC, high-performance coatings, the demand for DOM as a functional additive continues to grow.

Moreover, the simplified cleanup, reduced hazardous waste, and regulatory compliance advantages of water-based systems further drive their market penetration. This shift toward greener, safer coating technologies positions Dioctyl Maleate as a critical ingredient in next-generation formulations, supporting both performance excellence and environmental responsibility.

Trend

Integration with Smart Coating And Nanotech Material

The integration of nanotechnology and smart coating technologies is emerging as a transformative trend in advanced materials, opening new avenues for growth in the global Dioctyl Maleate (DOM) market. As industries such as automotive, aerospace, electronics, and healthcare increasingly adopt multifunctional and intelligent surface solutions, the demand for high-performance, flexible, and durable coating formulations continues to rise.

Additionally, Smart coatings enhanced with nanofillers provide superior mechanical strength, thermal stability, and self-sensing capabilities while enabling real-time performance monitoring and predictive maintenance. Dioctyl Maleate, as a reactive plasticizer and co-monomer, plays a vital role in optimizing the flexibility, adhesion, and processability of these next-generation coatings. Its chemical properties support the development of advanced acrylic and vinyl-based emulsions that serve as the foundation for nanocomposite coatings.

Furthermore, smart coatings offer a lightweight and customizable solution for structural applications with complex geometries, reducing the reliance on traditional sensors and mechanical fasteners. As innovation in sensor-embedded materials advances, DOM is positioned to benefit from its compatibility with flexible and adaptive polymer systems, reinforcing its importance in the formulation of next-generation, nanotechnology-enabled coating systems.

Geopolitical Impact Analysis

Geopolitical tariffs may Affect the Dioctyl Maleate Market Growth By Raising Production Costs And Disrupting Supply Chains.

Geopolitical tariffs implemented by the US president pose a significant challenge to the growth of the global Dioctyl Maleate market by increasing production costs and disrupting supply chains. The tariff measures introduced—such as a 10% universal tariff and higher rates on imports from key trading partners—have adversely affected industries that rely heavily on Dioctyl Maleate, including paints, coatings, adhesives, and sealants. These tariffs raise the cost of essential raw materials like vinyl acetate, vinyl chloride, and acrylates, thereby limiting the use of DOM-based materials in automotive, construction, and chemical applications.

- For instance, the 10% baseline tariff, combined with increased rates on imports from over 60 trading partners, adds pressure on global production costs and raw material availability.

- A 34% tariff on Chinese imports disrupts the supply of vital coating materials, while a 20% tariff on EU imports affects European manufacturers that depend on Dioctyl Maleate.

These measures may lead to higher manufacturing costs, delay product innovation, and force companies to restructure supply chains, ultimately slowing down the growth trajectory of the Dioctyl Maleate market.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Dioctyl Maleate Market

In 2024, Asia Pacific dominated the global Dioctyl Maleate market, accounting for 46.4% of the total market share, Asia Pacific region emerging as the fastest growing region in the Dioctyl Maleate market. Countries such as Japan, China, India, and South Korea continue contributing growth due to the developing automotive, healthcare, and construction sectors rapidly growing in these regions has exceptionally increased demand for Dioctyl Maleate in the overall region.

- For instance, according to the China Association of Automobile Manufacturers (CAAM), China produced 27.02 million vehicles in 2022, up by 3.4% year on year, while sales rose by 2.1% to 26.86 million units. This growth significantly boosted demand for DOM-based emulsions, widely used in scratch-resistant automotive coatings, UV-stable interiors, and phthalate-free plastic components.

Furthermore region’s rapid industrialization, urban development, and expanding manufacturing sectors. Countries such as China, India, Japan, and South Korea are at the forefront of demand due to their large-scale production in industries like paints and coatings, adhesives, textiles, plastics, and automotive. The region’s growing middle-class population, rising disposable income, and increasing investment in infrastructure have led to a surge in demand for high-performance materials, including those containing plasticizers such as DOM.

- In China, around 26 million light vehicles were locally produced in 2022. According to BASF estimates, this level of production required approximately 400,000 tons of automotive coatings—including e-coat, primer, basecoat, clearcoat, and hardener—highlighting the substantial demand for advanced materials like DOM-based emulsions in high-performance automotive applications.

Additionally, the shift toward eco-friendly and water-based formulations—particularly in China and Japan—has created new opportunities for DOM as a non-phthalate additive in environmentally compliant products. Government policies promoting local manufacturing, foreign direct investment(FDI), and sustainable chemical practices are further accelerating market adoption. Moreover, the strong presence of raw material suppliers and low production costs in Asia-Pacific makes it a favorable hub for both domestic use and export-oriented manufacturing, reinforcing the region’s role as a significant contributor to the global growth of the Dioctyl Maleate market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the Dioctyl Maleate market dominate the market through strategic innovation, premium positioning, and global reach.

In 2024 global Dioctyl Maleate market dominated by key players such as Celanese Corporation, Eastman Chemical Company, Merck Group, Sinocure Chemical Group, along with smaller but significant producers like Prakash Chemicals International Private Limited (PCIPL), and OAN Industries. Each leverages its unique strengths to navigate evolving industrial preferences and market dynamics.

Celanese Corporation – Celanese is a prominent supplier with a global footprint and strong product portfolio, but it operates in a competitive landscape with multiple established manufacturers. Eastman Chemical Company – Eastman Chemical Company is a major player in the DMT market, combining traditional manufacturing with cutting-edge recycling technologies to meet the growing demand for sustainable polyester feedstocks globally.

The following are some of the major players in the industry

- Celanese Corporation

- Polynt S.p.A.

- Nayakem

- Hallstar

- Henan Niujiao Industrial Co., Ltd

- KLJ Group

- Prakash Chemicals International Private Limited (PCIPL)

- OAN Industries

- YUANLI CHEMICAL GROUP CO., LTD

- Eastman Chemical Company

- Hangzhou Qianyang Technology Co., Ltd

- Matrix Scientific

- Dahison PolyChem Private Limited

- Sinocure Chemical Group Co., Ltd.

- Merck Group

- Other Key Players

Recent Development

- In March 2025 – Eastman Chemical Company announced a price increase of USD 0.05/lb for its plasticizers, including Eastman™ DOM Plasticizer, across all grades and packages. This move reflects rising production costs and market demand, reinforcing Eastman’s focus on maintaining value in specialty materials.

- In February 2024 – Vikas Ecotech Ltd. acquired a 100% stake in Polymeric Plasticizer Manufacturing Company Vikas Organics Pvt. Ltd. expanding its plasticizer portfolio to include Dioctyl Maleate (DOM) and other key additives. The company committed a total of ₹75 crore for facility expansion, working capital, and the development of phthalate-free and food-grade plasticizers, strengthening its position in sustainable vinyl applications.

Report Scope

Report Features Description Market Value (2024) USD 270.0 Mn Forecast Revenue (2034) USD 407.4 Mn CAGR (2025-2034) 4.2 % Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (<96%, 96% to 98 %,> 98%), By Application (Paints & Coatings, Architectural, Industrial, Adhesives & Sealants, Plasticizers, Surfactants, Chemical Intermediate, Others), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Celanese Corporation, Polynt S.p.A., Nayakem, Hallstar, Henan Niujiao Industrial Co., Ltd, KLJ Group, Prakash Chemicals International Private Limited (PCIPL), OAN Industries, YUANLI CHEMICAL GROUP CO., LTD, Eastman Chemical Company, Hangzhou Qianyang Technology Co., Ltd, Matrix Scientific, Dahison PolyChem Private Limited, Sinocure Chemical Group Co., Ltd., Merck Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Celanese Corporation

- Polynt S.p.A.

- Nayakem

- Hallstar

- Henan Niujiao Industrial Co., Ltd

- KLJ Group

- Prakash Chemicals International Private Limited (PCIPL)

- OAN Industries

- YUANLI CHEMICAL GROUP CO., LTD

- Eastman Chemical Company

- Hangzhou Qianyang Technology Co., Ltd

- Matrix Scientific

- Dahison PolyChem Private Limited

- Sinocure Chemical Group Co., Ltd.

- Merck Group

- Other Key Players