Global Dimethyl Amine Market Size, Share, And Business Benefit By Type (40% Solution, 50% Solution, 60% Solution), By Production Process (Catalytic Synthesis, Sustainable Production), By Application (Agriculture, Chemicals, Pharmaceuticals, Textiles, Water Treatment, Electronics, Personal Care, Rubber, Paints and Coatings, Others), By Sales Channel (Direct Sales, Distributor, Online Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164707

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

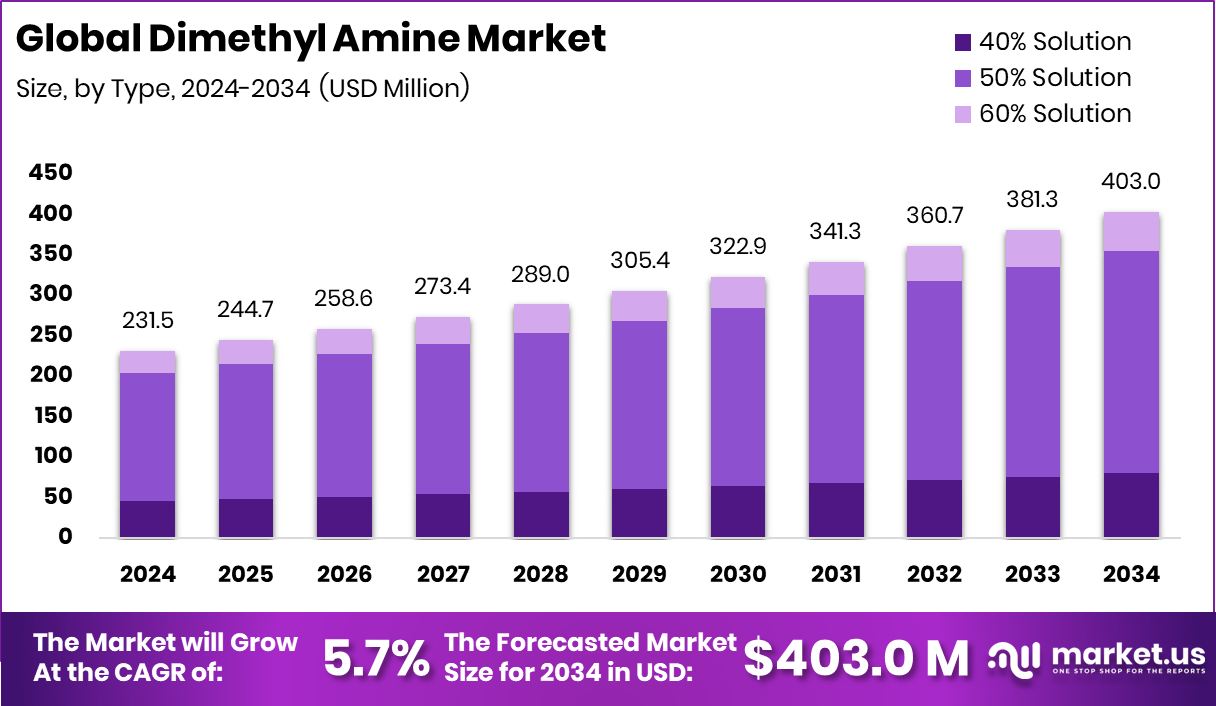

The Global Dimethyl Amine Market is expected to be worth around USD 403.0 million by 2034, up from USD 231.5 million in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034. Expanding chemical and agricultural sectors across Asia Pacific 45.90% continue driving Dimethylamine consumption upward.

Dimethylamine is a colorless, flammable gas with a strong ammonia-like odor. It easily dissolves in water and serves as a key intermediate in manufacturing pharmaceuticals, pesticides, surfactants, and rubber-processing chemicals. Due to its high reactivity, it is often used in producing solvents, corrosion inhibitors, and other chemical intermediates that support large industrial processes across multiple sectors.

The growth of the dimethylamine market is strongly driven by its expanding use in chemical synthesis, especially in pharmaceuticals and agrochemicals. Rapid industrialization and the demand for high-performance materials have also widened its scope in coatings, cleaning agents, and specialty chemicals. Sustainability investments are strengthening this growth path—for instance, Ecoat secured €21 million to reinvent sustainable paint, while JSW obtained ₹9,300 crore financing for the Akzo Nobel acquisition. These developments indirectly push demand for amine intermediates used in coatings and performance materials.

Demand for dimethylamine is increasing as industries seek efficient and versatile chemical building blocks. It plays a vital role in producing active ingredients for drugs, fungicides, and textile finishes. The ongoing race for innovation in the coatings sector—including the $2.5 billion competition involving Pidilite, JSW, and Indigo Paints—reflects rising downstream chemical demand that supports steady consumption of dimethylamine in formulation processes.

A key opportunity lies in producing greener and purer grades of dimethylamine for eco-friendly industrial applications. With sustainability becoming central to manufacturing, producers can gain an advantage by focusing on low-emission synthesis and renewable feedstocks. Expanding industries in Asia-Pacific and Latin America also present lucrative prospects, as the demand for paints, textiles, and pharmaceuticals continues to accelerate in these fast-growing regions.

Key Takeaways

- The Global Dimethyl Amine Market is expected to be worth around USD 403.0 million by 2034, up from USD 231.5 million in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034.

- In the Dimethyl Amine Market, the 50% solution type dominates, holding a strong 48.2% share globally.

- Catalytic synthesis leads production in the Dimethyl Amine Market, contributing an impressive 89.1% to total output volumes.

- Within applications, agriculture remains the key sector for the Dimethyl Amine Market, accounting for 29.3% share.

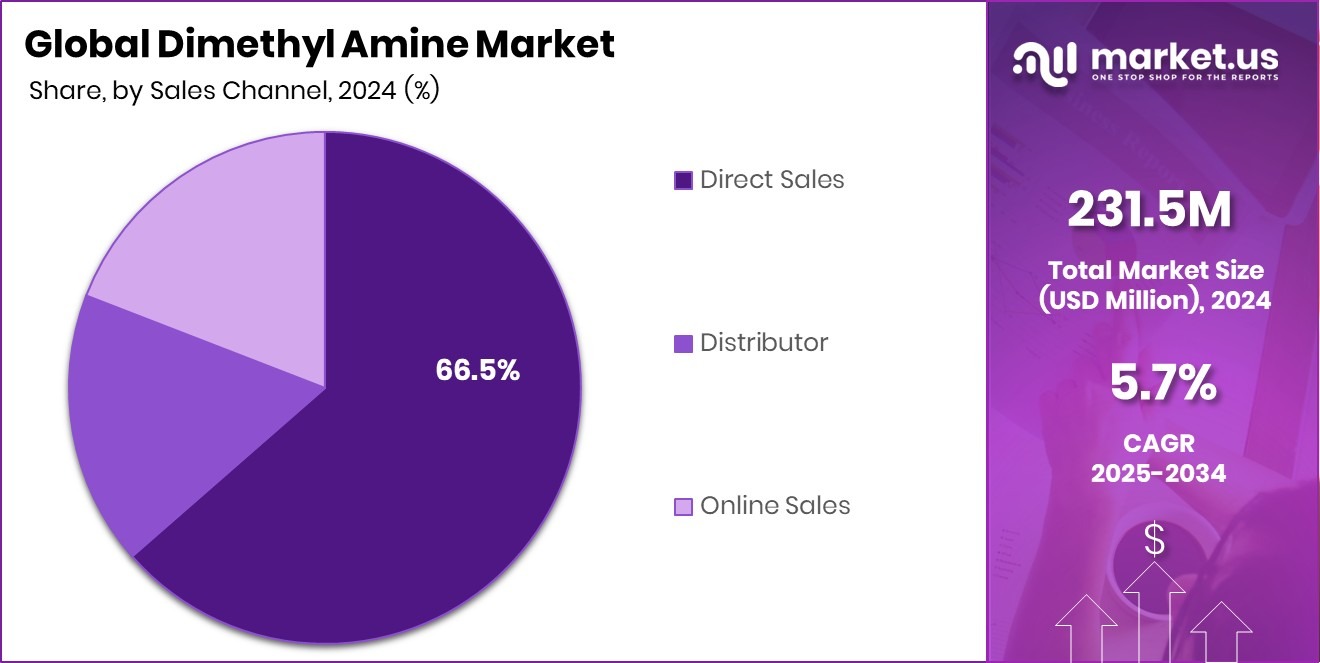

- Direct sales channels dominate the Dimethyl Amine Market distribution landscape, capturing a substantial 66.5% of total sales.

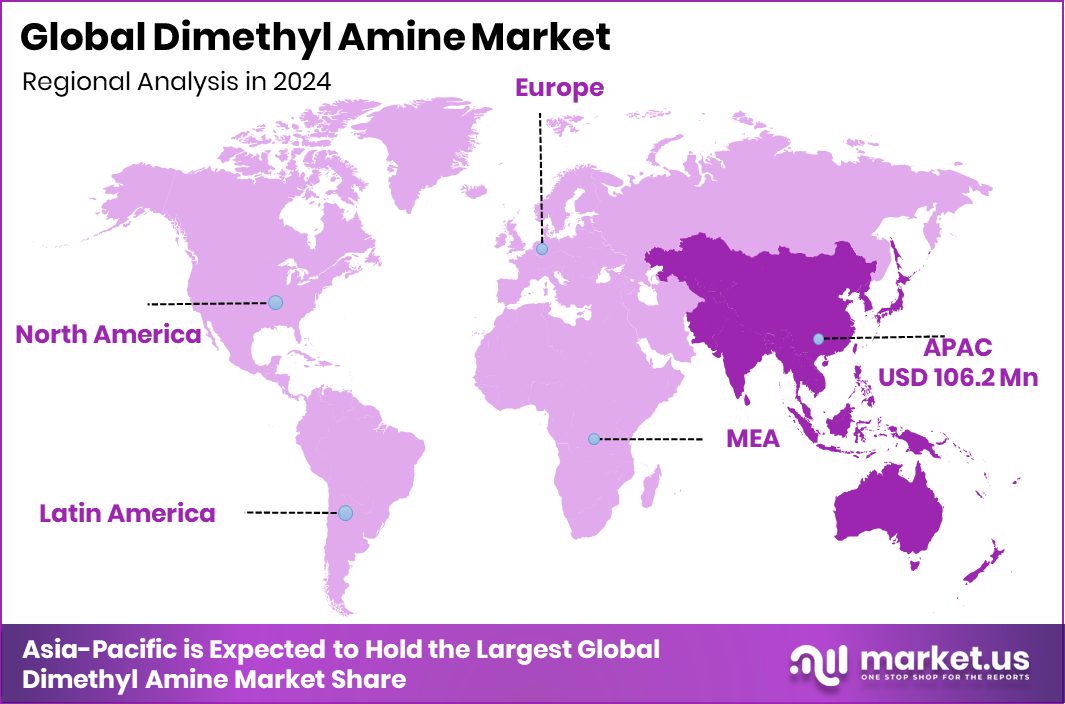

- The Asia Pacific market value reached approximately USD 106.2 million, highlighting strong industrial growth.

By Type Analysis

The Dimethyl Amine Market 50% Solution segment holds 48.2% share.

In 2024, 50% Solution held a dominant market position in the By Type segment of the Dimethylamine Market, with a 48.2% share. This concentration level is widely preferred due to its balance between reactivity and handling safety, making it suitable for large-scale industrial use. Industries such as pharmaceuticals, agrochemicals, and rubber manufacturing rely on the 50% solution form for its efficiency in blending and consistency in chemical reactions.

Its compatibility with various synthesis processes enhances production quality while maintaining operational stability. The demand for this type remains strong, driven by its reliability, cost-effectiveness, and ability to meet the technical requirements of diverse downstream applications in both bulk and specialty chemical formulations.

By Production Process Analysis

Catalytic Synthesis dominates the Dimethyl Amine Market with an 89.1% production share.

In 2024, Catalytic Synthesis held a dominant market position in the By Production Process segment of the Dimethylamine Market, with an 89.1% share. This process remains the preferred method due to its high efficiency, consistent product quality, and cost-effectiveness in large-scale operations. The catalytic route allows precise control over reaction conditions, leading to improved yield and purity of Dimethylamine.

Its ability to utilize readily available raw materials further strengthens its adoption across industrial producers. Moreover, the process supports continuous manufacturing, reducing energy consumption and waste generation. The dominance of catalytic synthesis highlights its critical role in meeting global demand while ensuring operational reliability and environmental compliance in chemical production systems.

By Application Analysis

Agriculture applications lead the Dimethyl Amine Market, accounting for 29.3% share.

In 2024, Agriculture held a dominant market position in the By Application segment of the Dimethylamine Market, with a 29.3% share. The segment’s leadership stems from the compound’s extensive use in producing agrochemicals such as herbicides, fungicides, and insecticides.

Dimethylamine serves as a vital intermediate in formulating dimethylammonium salts and related products that enhance crop yield and pest control efficiency. With the rising global emphasis on improving agricultural productivity, demand for such intermediates remains strong.

Its chemical stability and compatibility with large-scale fertilizer and pesticide production processes further reinforce its dominance. The agriculture segment continues to benefit from consistent use in high-volume formulations supporting modern farming and sustainable crop management practices.

By Sales Channel Analysis

Direct Sales channel drives the Dimethyl Amine Market with 66.5% contribution.

In 2024, Direct Sales held a dominant market position in the By Sales Channel segment of the Dimethylamine Market, with a 66.5% share. This strong presence reflects the industry’s preference for direct supplier-to-customer relationships that ensure consistent product quality, customized supply agreements, and timely deliveries.

Manufacturers benefit from better control over pricing and logistics, while buyers gain technical support and stable sourcing of high-purity Dimethylamine. Direct sales channels also help maintain long-term contracts with key industrial users in sectors such as chemicals, pharmaceuticals, and agriculture.

The reliability and transparency of this distribution approach continue to make it the most trusted and efficient channel in the global Dimethylamine supply network.

Key Market Segments

By Type

- 40% Solution

- 50% Solution

- 60% Solution

By Production Process

- Catalytic Synthesis

- Sustainable Production

By Application

- Agriculture

- Chemicals

- Pharmaceuticals

- Textiles

- Water Treatment

- Electronics

- Personal Care

- Rubber

- Paints and Coatings

- Others

By Sales Channel

- Direct Sales

- Distributor

- Online Sales

Driving Factors

Rising Agricultural Demand Driving Dimethylamine Growth

One of the strongest driving factors for the Dimethylamine market is its growing application in the agriculture sector. Dimethylamine is a key intermediate used in the production of herbicides and pesticides that support large-scale farming efficiency. With rising global population and increasing food demand, the need for crop protection chemicals continues to expand. Governments and private investors are focusing on sustainable agricultural innovations to ensure productivity and climate resilience.

A recent boost came from Novastar allocating USD 50 million to support Egypt’s agriculture climate-tech startups, emphasizing sustainable inputs and smarter farming solutions. Such funding enhances the demand for Dimethylamine-based intermediates essential in modern agrochemical production, aligning chemical innovation with future-ready, sustainable agricultural practices.

Restraining Factors

Supply-Chain Pressure and Raw Material Volatility Hindering Growth

A significant restraining factor for the Dimethylamine market is the instability of key feedstocks and the complexity of maintaining secure production chains. Inputs such as ammonia and methanol can experience sharp price swings or availability bottlenecks, disrupting production planning and squeezing margins.

At the same time, heavy investment is shifting into adjacent sectors—for example, New York State Energy Research and Development Authority (NYSERDA) recently granted US$7 million to co-locate solar and agriculture throughout New York—which implies industry focus is moving toward renewable energy and farm innovation, not directly chemical raw-materials.

This diversion of attention and capital means chemical supply chains may face less priority. The net effect is increased cost risk and supply uncertainty for dimethylamine producers, which slows investment decisions, reduces agility in serving downstream users, and ultimately restrains market-expansion potential

Growth Opportunity

Expanding Agricultural Innovation Creates New Market Opportunity

A major growth opportunity for the Dimethylamine market lies in the increasing focus on agricultural innovation and workforce development. Dimethylamine plays a vital role in producing agrochemicals that improve crop yield and soil health. As global farming systems move toward efficiency and sustainability, the need for advanced chemical intermediates like Dimethylamine continues to rise.

Recent initiatives, such as the $1 million grant supporting Tulare County farmworkers to pursue advanced careers in agriculture, reflect a growing commitment to modernizing the sector.

These programs foster skilled labor and encourage the adoption of improved agricultural inputs, creating a stronger market for Dimethylamine-based products. This alignment of education, technology, and sustainable farming practices unlocks promising expansion opportunities for future growth.

Latest Trends

Sustainable Farming Practices Shaping Dimethylamine Utilization Trends

One of the latest trends in the Dimethylamine market is the growing shift toward sustainable and resilient agricultural practices. Dimethylamine is widely used in producing eco-friendly agrochemicals that help farmers reduce crop losses while minimizing environmental impact. Governments and institutions are increasingly supporting such sustainability efforts through targeted funding.

Recently, the USDA announced $531 million in grant agreements to cover agricultural losses in Georgia, reinforcing its commitment to protecting farmers and promoting sustainable recovery. This funding encourages the use of advanced, efficient chemical solutions like Dimethylamine-based formulations in modern farming.

As agriculture moves toward greener production and recovery systems, Dimethylamine demand is set to rise in step with sustainable chemical innovation and responsible land management.

Regional Analysis

In 2024, Asia Pacific dominated the Dimethylamine Market with 45.90% share.

In 2024, Asia Pacific held a dominant position in the Dimethylamine Market, accounting for 45.90% of the global share, valued at USD 106.2 million. The region’s leadership is supported by strong industrial growth in China, India, and Japan, where Dimethylamine is widely used in agrochemicals, pharmaceuticals, and rubber processing.

Rapid agricultural development and expanding manufacturing capabilities continue to strengthen demand, with regional producers focusing on efficient synthesis routes to meet large-scale requirements. North America follows with consistent demand from established pharmaceutical and chemical industries, while Europe maintains steady growth driven by stringent quality standards and industrial modernization.

The Middle East & Africa and Latin America represent emerging markets, showing gradual adoption in agricultural and industrial applications. Overall, Asia Pacific remains the key growth hub due to its expanding industrial base, high agricultural activity, and increased chemical production capacity, positioning the region as the most influential contributor to the global Dimethylamine landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Suqian Xinya Technology plays a strong role in the global Dimethylamine market through its focus on amine-based chemical production. The company is known for its broad portfolio, including dimethylamine and related amine derivatives used across agrochemical, pharmaceutical, and industrial applications. Its advanced production facilities and proximity to major Asian demand centers enable efficient supply and cost competitiveness. Suqian Xinya emphasizes consistent product quality and tailored chemical solutions, supporting long-term partnerships with manufacturers that rely on stable amine inputs.

Nanjing Qinzuofu Chemical is an established producer of dimethylamine and various organic amines. The company’s strategy focuses on flexibility and precision in meeting diverse industrial requirements, particularly in agriculture and specialty chemical manufacturing. Its integration within key industrial clusters provides logistics and sourcing advantages. By maintaining high production standards and versatile product options, the firm successfully serves both domestic and international markets.

Mitsubishi Gas Chemical Company holds a reputable position in the dimethylamine market through its technological expertise and quality-driven production systems. The company’s dimethylamine output supports applications in surfactants, textile processing, and specialty polymers. With advanced facilities and a focus on safety and innovation, it ensures high purity and consistent supply to global customers. Its international network and strong research capabilities help align production with evolving industrial standards and sustainability goals.

Top Key Players in the Market

- Suqian Xinya Technology

- Nanjing Qinzuofu Chemical

- MITSUBISHI GAS CHEMICAL COMPANY

- Hualu Hengsheng

- Feicheng Acid Chemical

- Eastman Chemical

- Celanese

- BASF

- Balaji Amines

- Alkyl Amines Chemicals

Recent Developments

- In June 2024, MGC announced that its Niigata Plant began producing bio-methanol from digester gas—marking Japan’s first such facility—and obtained ISCC PLUS certification for both the bio-methanol and its derivative dimethyl ether (DME). This move signals MGC’s push into renewable feedstocks and sustainability-certified chemical production.

- In February 2024, BASF strengthened its collaboration with OQEMA GmbH in the UK and Ireland for its standard amines portfolio (excluding ethanolamines). The expanded distribution and sales network aims to offer BASF’s amines more widely via OQEMA’s local market capabilities.

Report Scope

Report Features Description Market Value (2024) USD 231.5 Million Forecast Revenue (2034) USD 403.0 Million CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (40% Solution, 50% Solution, 60% Solution), By Production Process (Catalytic Synthesis, Sustainable Production), By Application (Agriculture, Chemicals, Pharmaceuticals, Textiles, Water Treatment, Electronics, Personal Care, Rubber, Paints and Coatings, Others), By Sales Channel (Direct Sales, Distributor, Online Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Suqian Xinya Technology, Nanjing Qinzuofu Chemical, MITSUBISHI GAS CHEMICAL COMPANY, Hualu Hengsheng, Feicheng Acid Chemical, Eastman Chemical, Celanese, BASF, Balaji Amines, Alkyl Amines Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Suqian Xinya Technology

- Nanjing Qinzuofu Chemical

- MITSUBISHI GAS CHEMICAL COMPANY

- Hualu Hengsheng

- Feicheng Acid Chemical

- Eastman Chemical

- Celanese

- BASF

- Balaji Amines

- Alkyl Amines Chemicals