Global Dietary Fiber Beverage Market Size, Share, And Business Benefit By Type (Shakes/Smoothies, Tea/Coffee, Carbonated Drinks, Others), By Form (Ready to Drink (RTD), Ready to Mix (RTM)), By Fiber Type (Inulin, FOS, GOS, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retails, Specialty Stores, Pharmacies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165772

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

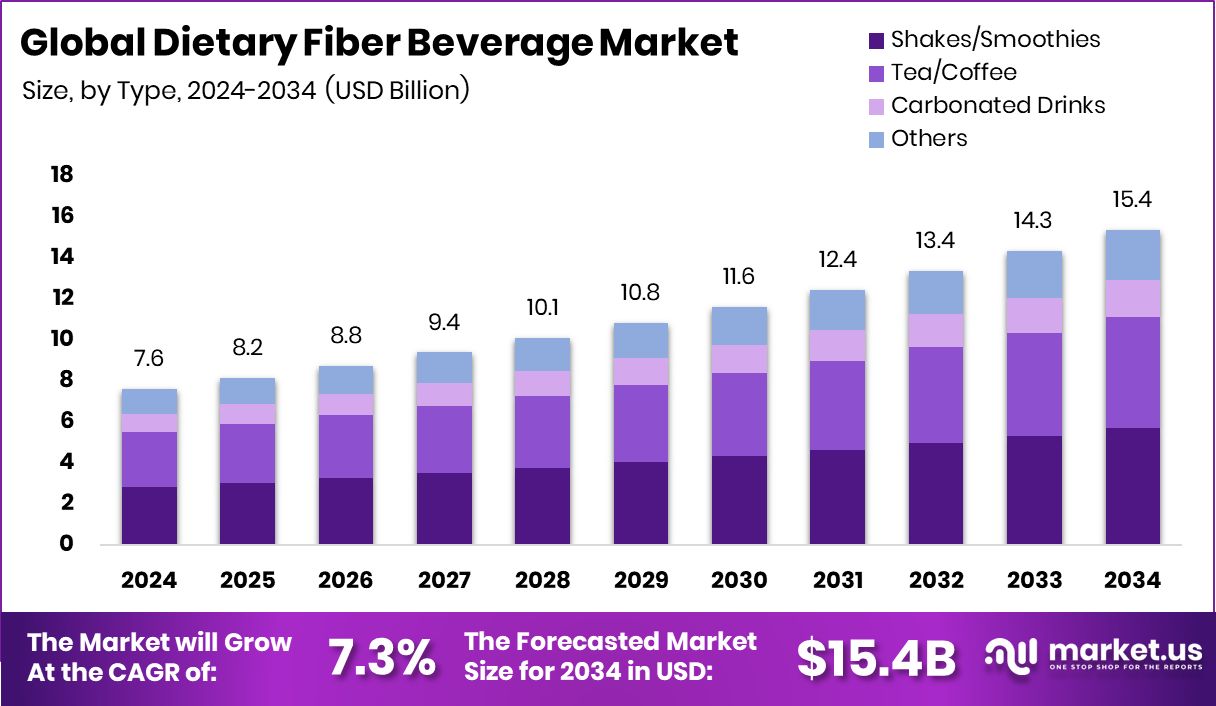

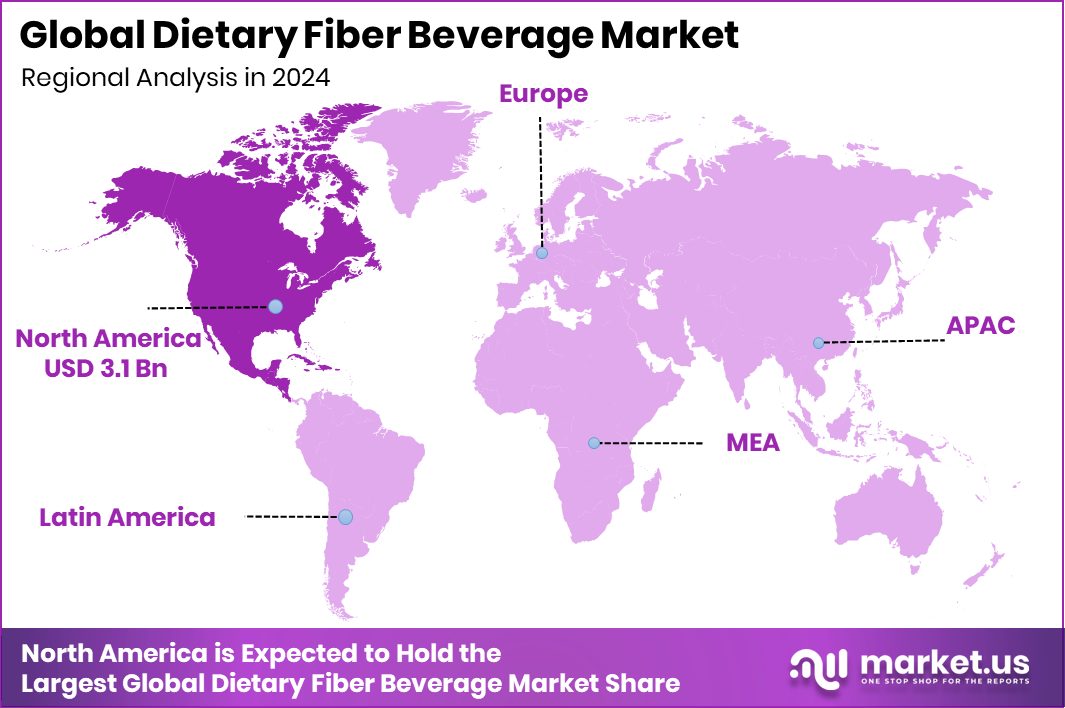

The Global Dietary Fiber Beverage Market is expected to be worth around USD 15.4 billion by 2034, up from USD 7.6 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034. North America leads with 41.90% share, generating USD 3.1 Bn demand.

Dietary fiber beverages are drinks enriched with soluble or insoluble fibers that support gut health, help improve digestion, and promote a feeling of fullness. These beverages often use natural fiber sources such as oats, fruits, or plant extracts, making them an easy way for consumers to increase daily fiber intake without changing their eating habits. As digestive wellness becomes a mainstream priority, these beverages are gaining attention among both health-focused consumers and everyday drinkers looking for simple nutrition.

The Dietary Fiber Beverage Market reflects this rising interest, driven by growing awareness around gut health, weight management, and clean-label ingredients. Brands are developing fiber-rich drinks that appeal to modern lifestyles—convenient, tasty, and functional. The category benefits from stronger demand for beverages that combine hydration and nutrition, making fiber drinks a natural fit for busy consumers.

Growth factors remain strong as consumers shift toward healthier beverages and actively seek products that support digestion, immunity, and satiety. Rising investments across the wider beverage and café ecosystem also create a supportive environment. Recent funding, such as First Coffee raising $1.2 million, Chelvies Coffee securing $1 million, and Fore Coffee raising US$8.5 million, shows growing investor confidence in beverage-driven formats that can integrate functional drink lines.

Demand is also lifting as more brands explore fiber-fortified drinks across cafés and retail shelves. Funding rounds—Blue Tokai’s $25 million bridge round, Third Wave Coffee’s $35 million Series C, abCoffee’s $3.4 million round, and Flash Coffee’s $3 million infusion—signal rapid expansion of beverage chains where dietary fiber drinks can become key menu additions.

Opportunity continues to widen as global interest in plant-based, fiber-rich, and wellness-oriented beverages grows. Investments like Preferred’s $4.2 million and repeated funding for First Coffee ($1.2 million) show a strong push toward innovative beverage formats. As cafés and ready-to-drink brands scale up, fiber beverages can ride this momentum, offering new flavors, formats, and health-driven product lines for expanding consumer needs.

Key Takeaways

- The Global Dietary Fiber Beverage Market is expected to be worth around USD 15.4 billion by 2034, up from USD 7.6 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034.

- The dietary fiber beverage market sees shakes and smoothies leading strongly with 37.2% share.

- The Dietary Fiber Beverage Market is driven by convenient RTD options, holding a 72.5% share.

- Inulin captures a 44.7% share, shaping innovation across the evolving dietary fiber beverage market globally.

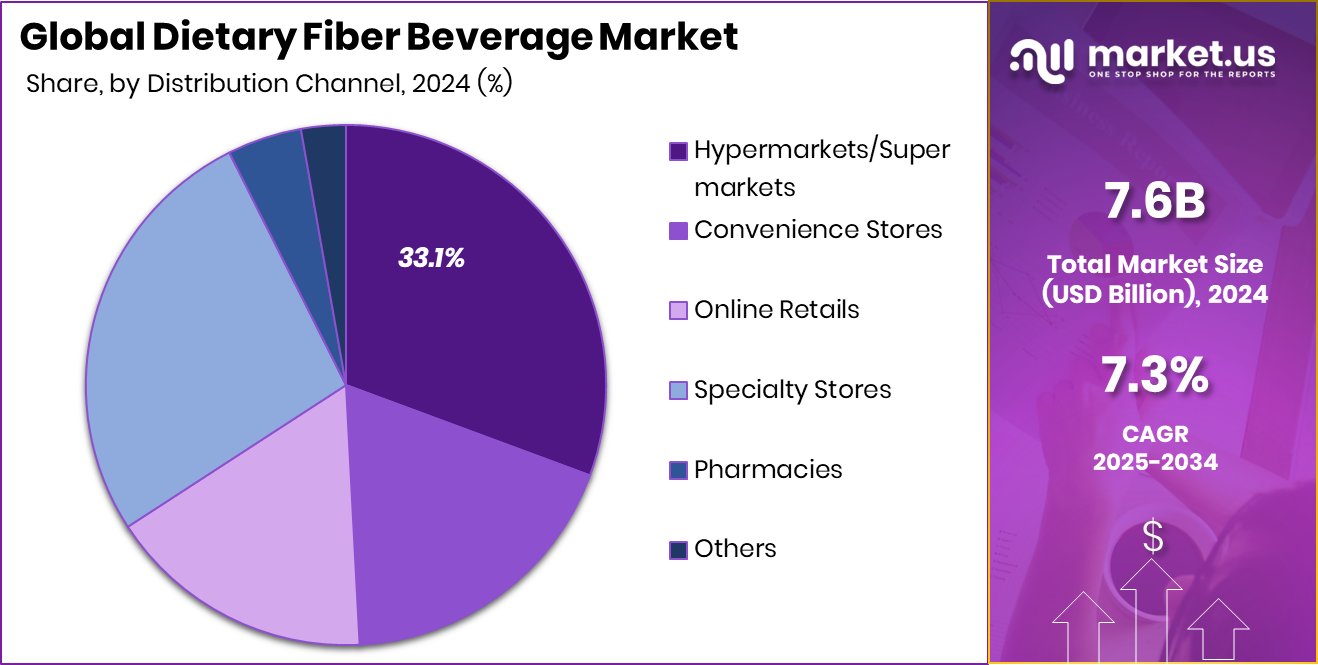

- Hypermarkets and supermarkets hold a 33.1% share, guiding retail growth in the dietary fiber beverage market.

- The North America 41.90% share reflects strong consumer interest worth USD 3.1 Bn.

By Type Analysis

Shakes dominate the category with a 37.2% share, driving consistent consumer interest across markets.

In 2024, Shakes/Smoothies held a dominant market position in the By Type segment of the Dietary Fiber Beverage Market, with a 37.2% share, reflecting strong consumer preference for fiber-rich drinks that feel familiar, convenient, and enjoyable. This segment benefits from its versatility, as shakes and smoothies easily blend fruits, plant fibers, and natural ingredients into a format consumers already trust for daily nutrition. Their thicker texture and satiety appeal make them popular among health-conscious buyers seeking digestive support and balanced energy throughout the day.

The rising adoption of functional beverages also strengthens this segment, as consumers increasingly look for beverages that combine taste, fiber content, and convenience, helping Shakes/Smoothies maintain their leading position.

By Form Analysis

RTD products hold a 72.5% share, boosting convenience-driven market adoption rates among consumers.

In 2024, Ready to Drink (RTD) held a dominant market position in the By Form segment of the Dietary Fiber Beverage Market, with a 72.5% share, driven by strong consumer preference for convenience and immediate consumption. RTD products fit naturally into fast-paced lifestyles, offering fiber enrichment without preparation, mixing, or additional steps. Their portability and consistent taste make them appealing for on-the-go consumers seeking digestive support and daily wellness benefits.

The segment also benefits from broader retail availability, as RTD fiber beverages are increasingly stocked across supermarkets, cafés, and quick-service outlets. This ease of access, combined with rising interest in functional drinks, supports the strong leadership of RTD formats within the Dietary Fiber Beverage Market.

By Fiber Type Analysis

Inulin leads the dietary fiber beverage market with 44.7% due to its functionality benefits.

In 2024, Inulin held a dominant market position in the By Fiber Type segment of the Dietary Fiber Beverage Market, with a 44.7% share, supported by its strong functional benefits and easy incorporation into beverages. Inulin’s natural solubility, mild taste, and prebiotic properties make it a preferred choice for brands aiming to enhance digestive wellness and improve product texture.

Its ability to support gut-friendly formulations without altering flavor profiles strengthens its acceptance in fiber-focused drinks. Consumers seeking smoother, lighter beverages also respond well to inulin-based formulations, reinforcing its leadership. The segment’s position is further supported by rising interest in plant-derived fibers, allowing inulin to maintain significant influence within the Dietary Fiber Beverage Market.

By Distribution Channel Analysis

Hypermarkets and supermarkets capture a 33.1% share in the dietary fiber beverage market.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the By Distribution Channel segment of the Dietary Fiber Beverage Market, with a 33.1% share, supported by wide product visibility and strong consumer footfall. These retail formats offer extensive shelf space, allowing shoppers to compare different fiber beverage options in one place. Their role in weekly household shopping also makes them a primary point of purchase for functional drinks.

Clear labeling, promotional displays, and frequent discounting further encourage consumers to try fiber-enriched beverages. With their ability to offer variety and convenience together, hypermarkets and supermarkets remain the most trusted and accessible channels for buyers, reinforcing their leading position in the overall market.

Key Market Segments

By Type

- Shakes/Smoothies

- Tea/Coffee

- Carbonated Drinks

- Others

By Form

- Ready to Drink (RTD)

- Ready to Mix (RTM)

By Fiber Type

- Inulin

- FOS

- GOS

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Retails

- Specialty Stores

- Pharmacies

- Others

Driving Factors

Growing Shift Toward Functional Healthy Beverages

A major driving factor for the Dietary Fiber Beverage Market is the fast-rising consumer shift toward functional beverages that support digestion, gut health, and everyday wellness. People are choosing drinks that offer real benefits, not just hydration, and fiber-based beverages fit naturally into this trend. The market gains even stronger momentum as investors actively back functional drink brands, showing clear confidence in this category.

A key example is Olipop securing $50 million in Series C funding, aimed at expanding its functional soda offerings and strengthening fiber-focused beverages in the mainstream. This rising flow of investment encourages more innovation, new flavor development, and wider retail reach, allowing fiber beverages to grow faster and reach more health-conscious consumers.

Restraining Factors

Limited Consumer Awareness Slows Market Expansion

One key restraining factor for the Dietary Fiber Beverage Market is the limited awareness many consumers still have about the benefits of fiber-enriched drinks. While interest in health beverages is rising, many people remain unsure about how fiber supports digestion, gut balance, and overall wellness. This lack of understanding slows adoption and makes it harder for new products to gain quick acceptance.

Even with growing innovation in the functional beverage space, companies must still invest heavily in education and clear communication. The challenge becomes more visible as new players enter the market, such as a functional probiotic soda startup raising $15 million, showing strong investor interest but also highlighting the need for greater consumer clarity. Better awareness is essential for broader market growth and long-term demand.

Growth Opportunity

Rising Demand for Prebiotic and Gut-Friendly Drinks

A major growth opportunity in the Dietary Fiber Beverage Market comes from the fast-expanding demand for prebiotic and gut-supporting drinks. Consumers are now more open to beverages that help digestion, improve gut balance, and offer natural fiber without changing daily routines. This shift opens space for new flavors, lighter textures, and creative plant-fiber combinations. Strong investor enthusiasm also supports this opportunity, giving brands the confidence to scale faster.

Recent funding highlights the momentum, with Culture Pop Soda raising $15 million in equity funding and prebiotic soda brand Olipop reaching a $1.85 billion valuation in its latest funding round. These investments signal a strong future for fiber-focused beverages and encourage more innovation in this growing wellness category.

Latest Trends

Growing Preference for Fiber-Rich Functional Refreshments

A key trend in the Dietary Fiber Beverage Market is the rising consumer preference for functional refreshments that blend taste with digestive support. People are choosing beverages that do more than hydrate, and fiber-added drinks fit perfectly into this lifestyle shift. Brands are also experimenting with lighter textures, fruit-based blends, and clean-label ingredients to match modern wellness habits. Market enthusiasm is further strengthened by strong financial activity across the functional beverage space.

Storia Foods reporting a 51% revenue spike to Rs 169 crore in FY24 shows how well health-focused drinks are performing. In addition, Cove Soda raising $15 million in Series A funding highlights expanding investor confidence in functional, fiber-linked beverages. This trend is shaping the next wave of smart, gut-friendly drink choices.

Regional Analysis

North America held a 41.90% share, valued at USD 3.1 Bn in 2024.

In 2024, North America dominated the Dietary Fiber Beverage Market with a 41.90% share valued at USD 3.1 Bn, reflecting strong adoption of functional and fiber-focused beverages driven by rising demand for gut-health solutions and ready-to-drink nutrition. The region’s mature retail networks and growing interest in wellness beverages further support this leadership.

Europe follows with steady uptake as consumers continue embracing healthier beverage choices and fiber-enriched formulations across daily diets. Asia Pacific shows expanding potential, supported by increasing awareness of digestive wellness and a fast-growing young population that prefers convenient, functional drinks.

The Middle East & Africa region is gradually building traction as urban consumers explore fortified beverage options. Latin America continues to gain momentum with improving retail availability and a growing shift toward health-oriented drinks. Each region contributes uniquely, but North America remains the strongest force in shaping the overall market direction.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Coca-Cola Company continues to strengthen its position in the Dietary Fiber Beverage Market by gradually expanding its functional drink portfolio and leveraging its strong global distribution network. The company’s ability to integrate fiber-fortified options into familiar beverage formats helps it stay relevant among consumers seeking everyday wellness. Its brand strength, supply chain scale, and marketing capabilities allow it to promote digestive-support beverages with wider visibility.

PepsiCo, Inc. also plays an influential role as it focuses on aligning its beverage offerings with rising health and nutrition trends. The company’s ongoing shift toward better-for-you drinks supports the growth of fiber-enhanced beverages within its portfolio. PepsiCo’s innovation capabilities and broad retail reach position it well to respond to the growing demand for functional hydration and digestive wellness.

Abbott Laboratories contributes from a nutrition-driven standpoint, using its strong expertise in dietary products and health-focused formulations. The company’s experience in developing clinically backed nutritional beverages gives it an advantage in crafting fiber-rich options aimed at digestive health, satiety, and overall wellness. Its credibility in the nutritional sector helps build consumer trust, making Abbott an important participant in advancing fiber-based beverage development.

Top Key Players in the Market

- The Coca-Cola Company

- PepsiCo, Inc.

- Abbott Laboratories.

- Meiji Holdings Co., Ltd.

- Califia Farms, LLC.

- Nestlé S.A.

- Danone S.A

Recent Developments

- In March 2025, PepsiCo announced it would acquire the prebiotic-soda brand Poppi for approximately US $1.95 billion, enhancing its portfolio of functional beverages focused on gut health.

- In February 2025, Coca-Cola launched Simply® Pop, its first prebiotic soda made with real fruit juice, no added sugar, and 6 g of prebiotic fiber per can (along with vitamin C & zinc for immune support).

Report Scope

Report Features Description Market Value (2024) USD 7.6 Billion Forecast Revenue (2034) USD 15.4 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Shakes/Smoothies, Tea/Coffee, Carbonated Drinks, Others), By Form (Ready to Drink (RTD), Ready to Mix (RTM)), By Fiber Type (Inulin, FOS, GOS, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retails, Specialty Stores, Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Coca-Cola Company, PepsiCo, Inc., Abbott Laboratories, Meiji Holdings Co., Ltd., Califia Farms, LLC., Nestlé S.A., Danone S.A Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dietary Fiber Beverage MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Dietary Fiber Beverage MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Coca-Cola Company

- PepsiCo, Inc.

- Abbott Laboratories.

- Meiji Holdings Co., Ltd.

- Califia Farms, LLC.

- Nestlé S.A.

- Danone S.A