Global Diamond Coatings Market Size, Share, And Business Benefits By Technology (Chemical Vapour Deposition (CVD), Physical Vapour Deposition (PVD)), By Substrate (Metal, Ceramic, Composite, Others), By End Use (Electrical and Electronics, Medical, Industrial, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153887

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

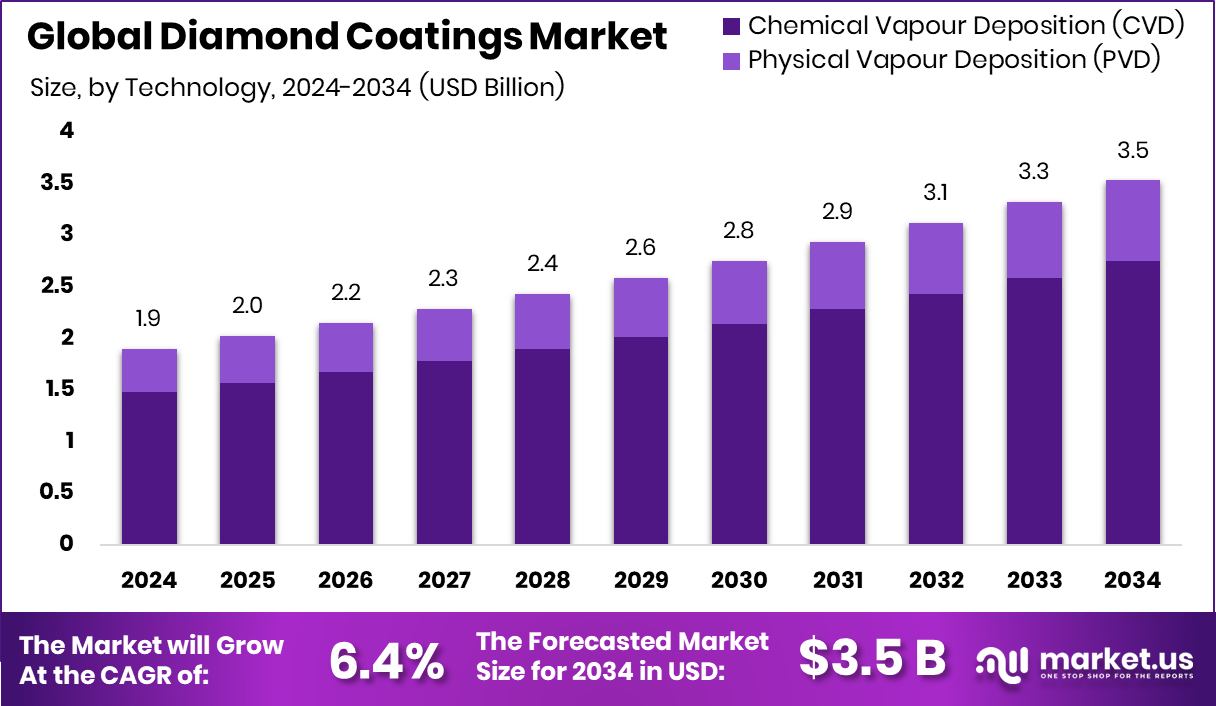

The Global Diamond Coatings Market is expected to be worth around USD 3.5 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034. Strong demand from electronics and aerospace drives North America’s USD 0.8 billion market.

Diamond coatings refer to thin films of diamond material applied to surfaces such as metals, ceramics, or glass to enhance their physical properties. These coatings are typically produced through chemical vapor deposition (CVD) techniques and are prized for their extreme hardness, high thermal conductivity, excellent wear resistance, and chemical inertness. Owing to these properties, diamond coatings are used in a wide range of applications, including cutting tools, optical lenses, electronic devices, and biomedical implants, where durability and performance are critical.

The diamond coatings market encompasses the global production, distribution, and application of synthetic diamond films across various industries. It involves manufacturers of diamond-coated tools, equipment providers, end-users from electronics to automotive sectors, and technology developers focused on improving coating efficiency and performance.

The market is primarily driven by the demand for high-performance coatings that reduce wear and extend equipment life. Sectors like electronics and aerospace are increasingly adopting diamond coatings for their superior heat dissipation and structural integrity. In addition, the shift toward precision manufacturing in the medical and automotive industries further supports market expansion.

Growing reliance on high-speed machining and miniaturized electronic components has led to greater adoption of diamond-coated tools and surfaces. The need for surfaces that resist corrosion, friction, and extreme temperatures is fueling demand across industrial sectors. Moreover, the surge in renewable energy installations, especially solar panels, is also contributing to the uptake of diamond-coated parts.

Key Takeaways

- The Global Diamond Coatings Market is expected to be worth around USD 3.5 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- In the Diamond Coatings Market, Chemical Vapour Deposition (CVD) dominates with a 77.8% technology share.

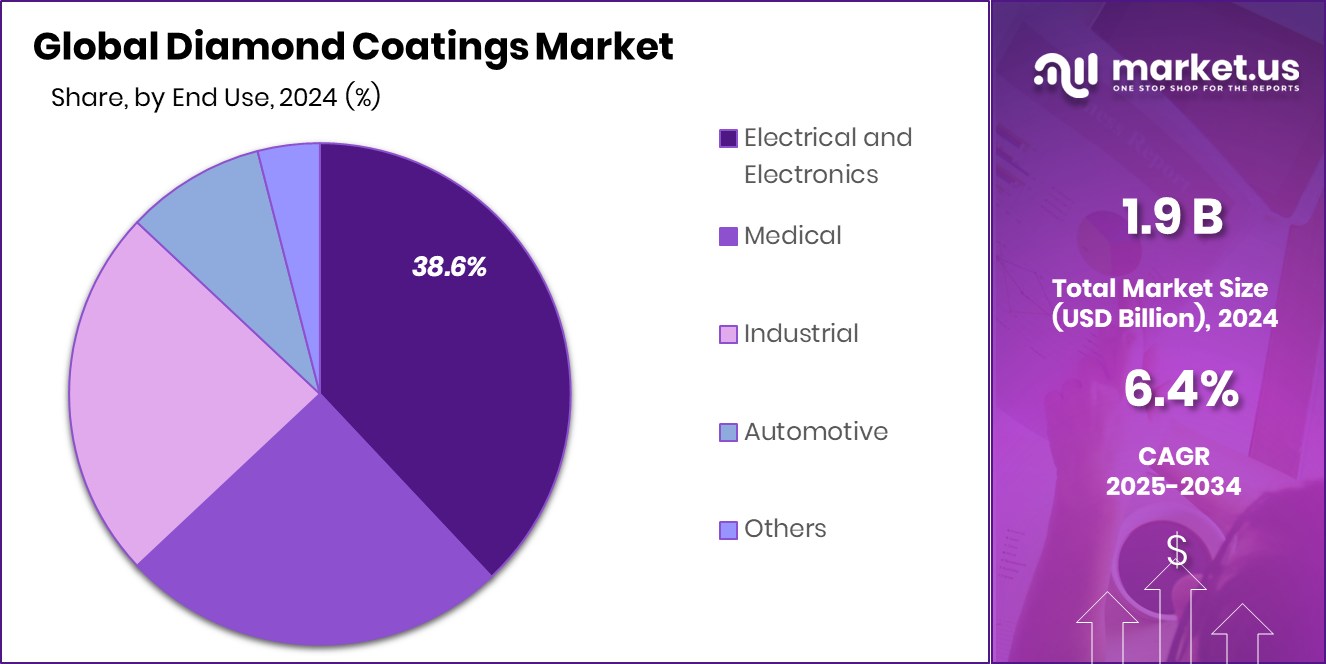

Metal substrates lead the Diamond Coatings Market by substrate, accounting for 48.2% of total usage. - The Electrical and Electronics end-use sector holds the largest share in the Diamond Coatings Market at 38.6%.

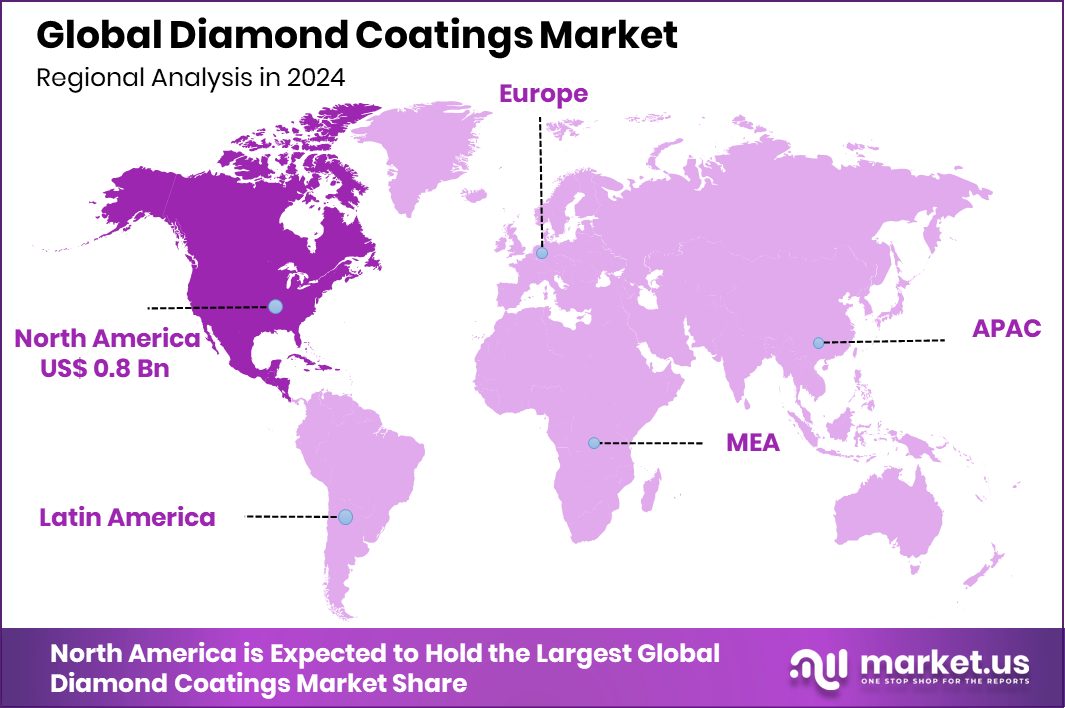

- The North American market reached a value of USD 0.8 billion in 2024.

By Technology Analysis

Chemical Vapour Deposition dominates the diamond coatings market with a 77.8% share.

In 2024, Chemical Vapour Deposition (CVD) held a dominant market position in the By Technology segment of the Diamond Coatings Market, with a 77.8% share. This leading position is attributed to the widespread adoption of CVD due to its ability to produce high-purity, uniform, and strongly adherent diamond films on various substrates. Industries such as electronics, optics, and cutting tools continue to favor CVD technology for its effectiveness in enhancing surface hardness, thermal conductivity, and wear resistance without compromising the integrity of the base material.

The process is especially valued for its precision and ability to coat complex geometries, making it suitable for both large-scale industrial components and small high-precision parts. The strong presence of CVD in research and industrial applications further reinforces its dominance, supported by technological advancements that have improved process efficiency and lowered operational costs over time.

As the demand for high-performance coatings rises across advanced manufacturing and thermal management sectors, CVD remains the preferred method, offering a combination of performance, reliability, and scalability. Its well-established infrastructure and compatibility with various materials position it as the backbone of diamond coating production in 2024, maintaining its significant share in the global market.

By Substrate Analysis

Metal substrates lead the Diamond Coatings Market, accounting for 48.2% share.

In 2024, Metal held a dominant market position in the By Substrate segment of the Diamond Coatings Market, with a 48.2% share. This dominance can be attributed to the high compatibility of diamond coatings with various metal substrates, which are commonly used in industries requiring enhanced wear resistance, thermal stability, and surface hardness. Metals such as steel, titanium, and tungsten are frequently coated with diamond films to extend the service life of cutting tools, medical instruments, and mechanical components exposed to extreme operating conditions.

The superior adhesion of diamond coatings on metal surfaces ensures durability in high-speed machining and precision manufacturing applications. Additionally, the thermal conductivity of diamond complements the heat-intensive operations of metal-based tools, making it a preferred choice for industries such as aerospace, automotive, and heavy engineering.

The widespread use of metal components across diverse sectors, combined with the operational benefits of diamond coatings, has played a significant role in securing the segment’s leading position. The ongoing emphasis on reducing downtime and maintenance costs further supports the growing preference for coated metal substrates, reinforcing their 48.2% share in the diamond coatings market’s substrate segment in 2024.

By End Use Analysis

The Electrical and Electronics sector drives the Diamond Coatings Market, contributing 38.6%.

In 2024, Electrical and Electronics held a dominant market position in the By End Use segment of the Diamond Coatings Market, with a 38.6% share. This significant share is primarily driven by the growing demand for high-performance materials in electronic devices that require exceptional thermal conductivity, electrical insulation, and durability. Diamond coatings are extensively applied to semiconductor components, heat sinks, circuit boards, and optical windows to improve device efficiency and lifespan.

As miniaturization continues in the electronics industry, managing heat dissipation has become increasingly critical, positioning diamond coatings as a reliable solution. Their ability to enhance performance while maintaining compact form factors supports their growing adoption in advanced consumer electronics and communication devices. Additionally, the robustness of diamond-coated components contributes to greater reliability and reduced failure rates in sensitive electronic assemblies.

The steady growth in global electronics production, particularly in regions focused on innovation and automation, has further reinforced the dominance of this segment. With continued investment in microelectronics and thermal management technologies, the electrical and electronics sector maintained its leading position in 2024, accounting for 38.6% of the total diamond coatings market by end use.

Key Market Segments

By Technology

- Chemical Vapour Deposition (CVD)

- Physical Vapour Deposition (PVD)

By Substrate

- Metal

- Ceramic

- Composite

- Others

By End Use

- Electrical and Electronics

- Medical

- Industrial

- Automotive

- Others

Driving Factors

High-End Manufacturing Needs Boost Diamond Coatings Demand

The main driving factor for the diamond coatings market is the rising need for durable and high-performance materials in advanced manufacturing. Industries such as electronics, aerospace, and medical devices are increasingly using components that require protection from wear, heat, and corrosion.

Diamond coatings offer exceptional hardness, chemical resistance, and thermal conductivity, making them ideal for tools, semiconductors, and precision instruments. As production processes become more demanding and miniaturized, the need for surfaces that can endure extreme conditions without failure has become more critical.

This trend is pushing manufacturers to adopt diamond-coated parts to improve product quality and reliability. The result is a steady increase in demand for diamond coatings across both established and emerging industrial applications.

Restraining Factors

High Production Costs Limit Market Growth Potential

One of the main restraining factors for the diamond coatings market is the high cost of production. The process of applying diamond coatings—especially through chemical vapor deposition (CVD)—requires specialized equipment, high energy input, and controlled environments, which lead to significant operational expenses.

These costs make diamond coatings less accessible for small- and medium-sized manufacturers who operate under tight budgets. Additionally, the time-consuming nature of the process further increases production costs and limits scalability.

In price-sensitive markets, alternatives such as ceramic or carbide coatings are often preferred despite their lower performance. As a result, the high cost remains a barrier, slowing down widespread adoption of diamond coatings, particularly in cost-driven industries or developing regions.

Growth Opportunity

Expansion in Electric Vehicle Thermal Management Applications

A significant growth opportunity in the diamond coatings market lies in the expanding use of coatings for thermal management in electric vehicles (EVs). With the increasing adoption of EVs worldwide, manufacturers are seeking effective ways to manage heat in battery packs, power electronics, and charging systems.

Diamond coatings offer exceptional thermal conductivity and electrical insulation, which enhance heat dissipation while protecting sensitive components from wear and corrosion. This makes them especially valuable for improving the efficiency and longevity of EV systems. As the EV sector grows, demand for materials that can efficiently handle heat and extend component lifetime is rising.

Therefore, diamond coatings are positioned to benefit from this trend. The automotive industry’s emphasis on performance, reliability, and sustainability further supports the uptake of diamond-coated parts, representing a promising expansion path for market players.

Latest Trends

Growing Use of Diamond Coatings in Electronics

One of the most noticeable trends in the diamond coatings market is the growing use of these coatings in the electronics sector. With the demand for smaller, faster, and more durable electronic devices increasing, manufacturers are turning to diamond coatings for their excellent thermal conductivity, electrical insulation, and resistance to wear.

These coatings help protect sensitive electronic parts from overheating and damage, especially in high-performance devices like smartphones, semiconductor tools, and microelectromechanical systems (MEMS).

As industries such as consumer electronics and advanced computing expand, the integration of diamond coatings into circuit boards and semiconductor components is expected to rise steadily. This trend reflects a shift toward more efficient and long-lasting electronic components across global markets.

Regional Analysis

North America dominated the diamond coatings market with a 45.7% share in 2024.

In 2024, North America held a dominant position in the global diamond coatings market, accounting for 45.7% of the total market share and reaching a value of approximately USD 0.8 billion. This strong regional performance can be attributed to the robust presence of high-end manufacturing sectors such as aerospace, electronics, and automotive, which rely heavily on advanced surface coatings for durability and precision.

Europe followed as a significant contributor to the market, supported by the region’s advanced industrial base and growing adoption of diamond coatings in precision engineering and medical tools. The Asia Pacific region exhibited steady growth due to increasing investments in semiconductor manufacturing and industrial tooling, particularly in countries such as China, Japan, and South Korea.

The Middle East & Africa and Latin America regions are still emerging markets in this sector, with limited but growing application in oilfield drilling equipment and industrial wear protection. Despite these developments, North America remained the leading region in 2024, driven by consistent technological advancements, strong industrial demand, and high-value end-use applications, securing its position as the core hub for diamond coating innovations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Crystallume Corp. continues to be recognized for its pioneering efforts in chemical vapor deposition (CVD) diamond coating technologies. The company’s strategic focus on manufacturing high-quality polycrystalline diamond films has enabled its coatings to be widely used in cutting tools, electronics, and biomedical devices. Crystallume’s competitive edge lies in its ability to deliver uniform, adherent, and durable diamond layers that extend the lifespan of industrial components, particularly in high-precision applications.

Diamond Materials GmbH and Co. KG, headquartered in Germany, plays a significant role in advancing diamond coating technologies across Europe. The company has gained prominence through its tailored coating solutions for optics, semiconductors, and thermal management applications. Its expertise in producing nanocrystalline and microcrystalline diamond coatings through advanced plasma-assisted techniques has positioned it as a trusted supplier for research institutions and industrial clients requiring highly reliable and application-specific coatings.

Element Six UK Ltd., a subsidiary of De Beers Group, remains a dominant force in the synthetic diamond industry. In 2024, the company continues leveraging its decades of R&D in synthetic diamond innovation to support industries such as aerospace, electronics, and automotive. With a strong portfolio in CVD and PCD (polycrystalline diamond) technologies, Element Six maintains a competitive advantage in high-performance industrial applications.

Top Key Players in the Market

- Anglo American plc

- Blue Wave Semiconductors Inc.

- Calico Coatings

- CemeCon AG

- Creating Nano Technologies Inc.

- Crystallume Corp.

- Diamond Materials GmbH and Co. KG

- Element Six UK Ltd.

- Endura Coatings LLC

- IBC Coatings Technologies Inc.

- JCS Technologies Pte Ltd

- NeoCoat SA

- OC Oerlikon Corp. AG

- RobbJack Corporation

- Sandvik AB

Recent Developments

- In February 2025, Anglo American booked a further $2.9 billion impairment on the De Beers diamond unit, after a prior write‑down of $1.6 billion. These substantial writedowns were intended to prepare the diamond business for sale or demerger. The total impairment of $3.8 billion significantly affected Anglo’s full‑year results for 2024

- In July 2024, Element Six and Lummus Technology form an exclusive partnership to develop diamond-enabled electrochemical solutions for the destruction of PFAS (per‑ and polyfluoroalkyl substances) in water. The project uses Element Six’s boron-doped diamond electrodes in combination with Lummus’ electro-oxidation systems to offer scalable water treatment technology targeting “forever chemicals”.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 3.5 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Chemical Vapour Deposition (CVD), Physical Vapour Deposition (PVD)), By Substrate (Metal, Ceramic, Composite, Others), By End Use (Electrical and Electronics, Medical, Industrial, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anglo American plc, Blue Wave Semiconductors Inc., Calico Coatings, CemeCon AG, Creating Nano Technologies Inc., Crystallume Corp., Diamond Materials GmbH and Co. KG, Element Six UK Ltd., Endura Coatings LLC, IBC Coatings Technologies Inc., JCS Technologies Pte Ltd, NeoCoat SA, OC Oerlikon Corp. AG, RobbJack Corporation, Sandvik AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anglo American plc

- Blue Wave Semiconductors Inc.

- Calico Coatings

- CemeCon AG

- Creating Nano Technologies Inc.

- Crystallume Corp.

- Diamond Materials GmbH and Co. KG

- Element Six UK Ltd.

- Endura Coatings LLC

- IBC Coatings Technologies Inc.

- JCS Technologies Pte Ltd

- NeoCoat SA

- OC Oerlikon Corp. AG

- RobbJack Corporation

- Sandvik AB