Global Detergent Alcohols Market Size, Share, And Business Benefit By Source (Natural, Synthetic), By Application (Laundry Detergents, Dishwashing Detergents, Personal Care and Cosmetics, Industrial Cleaners, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163504

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

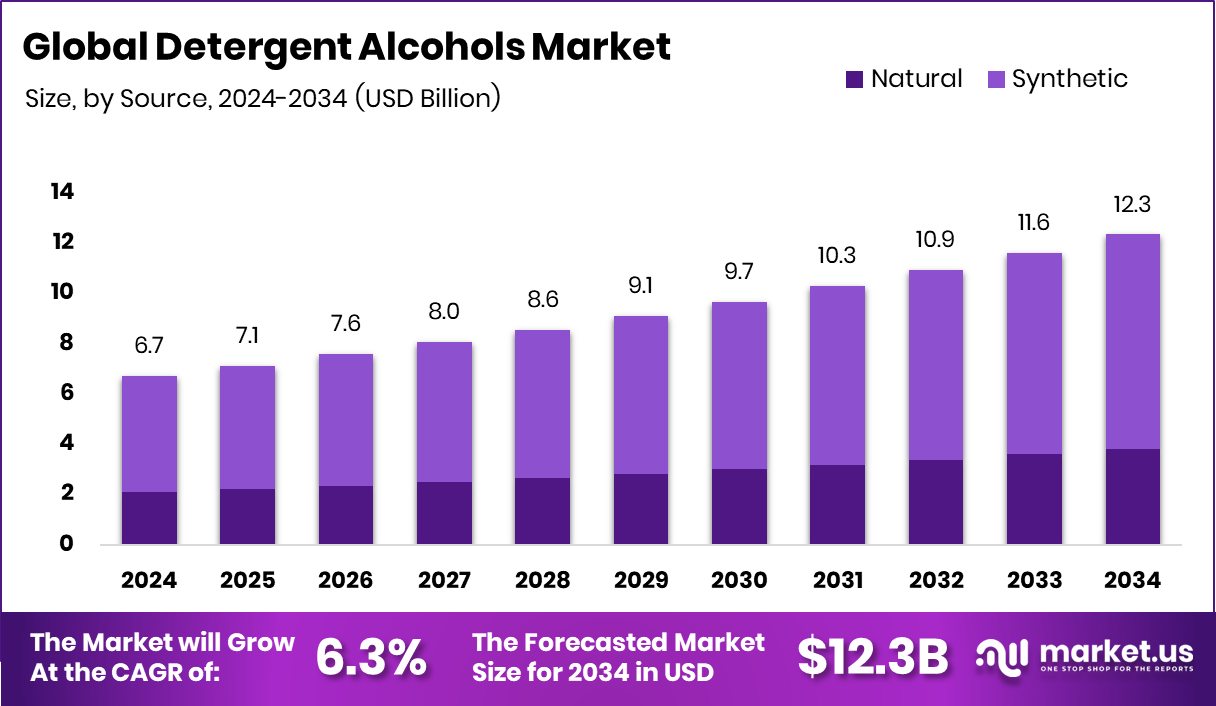

The Global Detergent Alcohols Market is expected to be worth around USD 12.3 billion by 2034, up from USD 6.7 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. Rapid urbanization and growing detergent consumption continue to boost the Asia-Pacific’s 47.90% market leadership.

Detergent alcohols are long-chain primary alcohols, generally ranging from C12 to C18, used as raw materials in producing surfactants for detergents, cleaning agents, and personal care products. They are derived from natural fats and oils or synthetic petrochemical processes. These alcohols play a vital role in improving foaming, wetting, and cleaning efficiency. Their biodegradability and compatibility with eco-friendly surfactant systems make them essential in developing sustainable and high-performance cleaning formulations across home care, industrial, and personal-care applications.

The detergent alcohols market represents the global ecosystem of producers, suppliers, and end users involved in manufacturing and using fatty alcohols for surfactants. It covers both natural and synthetic feedstocks and their conversion into ethoxylates and sulfates for detergents. This market is closely linked to trends in consumer hygiene, sustainability, and industrial cleaning innovation. The steady shift toward bio-based materials and new detergent formats is shaping the industry, with producers focusing on technology efficiency, waste reduction, and expanding capacity to meet diverse regional demands.

One major growth driver is the rising need for sustainable cleaning and laundry solutions. The household and industrial cleaning sectors are rapidly expanding due to hygiene awareness and eco-friendly preferences. USC Sea Grant receiving nearly $2 million from NOAA to turn marine debris into laundry detergent and sustainable dyes reflects growing innovation in green surfactant production. Advancements in hydrogenation and fatty alcohol recovery also enhance output efficiency.

Global demand for detergent alcohols is being strengthened by the increasing consumption of natural and plant-derived cleaning ingredients. Consumers are shifting toward safe, skin-friendly, and environmentally sound cleaning products. The rise of direct-to-consumer brands illustrates this change—D2C home cleaning brand Koparo raised Rs 14.5 crore in funding to expand eco-friendly product lines.

The detergent alcohols market holds strong opportunities for innovation in product format and raw material sourcing. The introduction of dissolvable cleaning tablets and refillable solutions, as shown by Everdrop raising $21.8 million in Series A funding, showcases the potential for customized surfactant systems. Meanwhile, The Laundress’s $100 million acquisition and Dropps’ $10 million fundraising emphasize the economic potential of sustainable laundry products.

Key Takeaways

- The Global Detergent Alcohols Market is expected to be worth around USD 12.3 billion by 2034, up from USD 6.7 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- In 2024, synthetic detergent alcohols held a 69.4% share, driving efficiency and scalability in production processes.

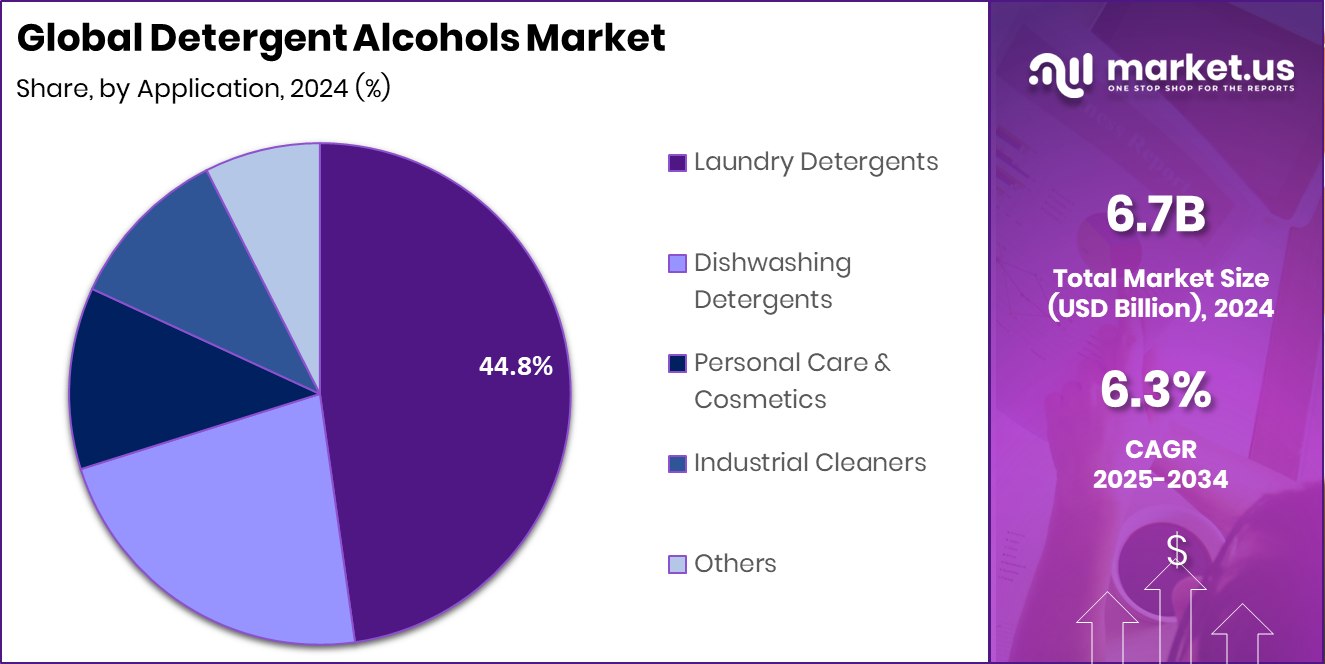

- Laundry detergents accounted for 44.8% of the detergent alcohols market, supported by strong global cleaning product demand.

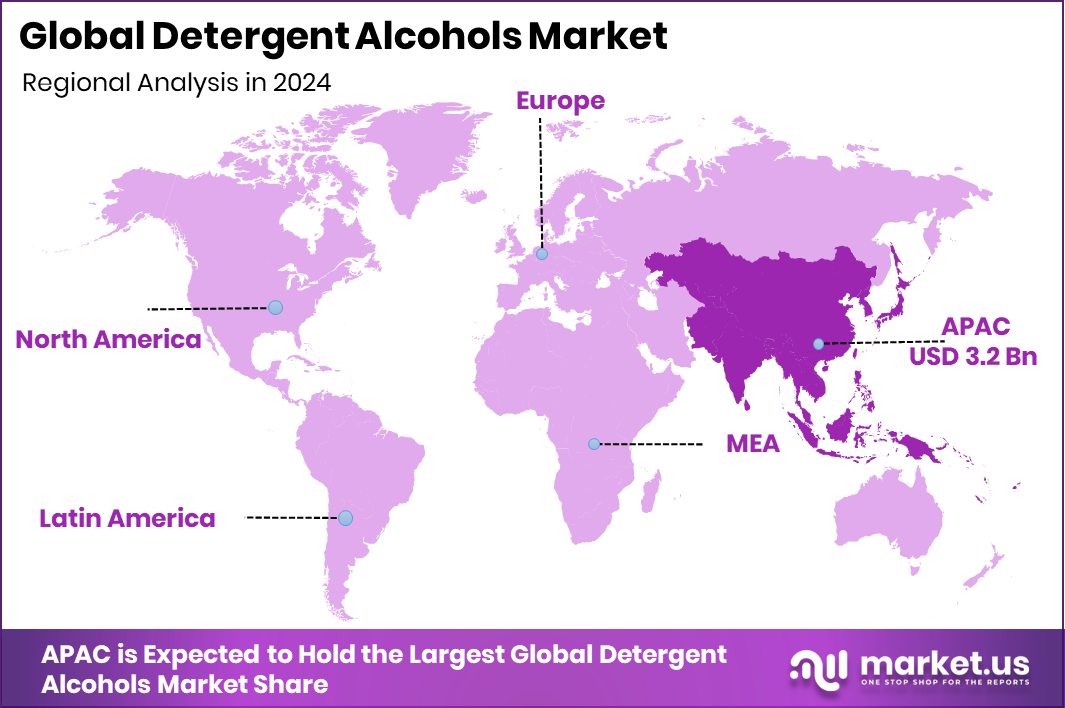

- The Asia-Pacific market value reached approximately USD 3.2 billion, driven by strong industrial demand.

By Source Analysis

In 2024, synthetic detergent alcohols held a 69.4% share, driving efficiency and scalability in production processes.

In 2024, Synthetic held a dominant market position in the By Source segment of the Detergent Alcohols Market, with a 69.4% share. The dominance of synthetic detergent alcohols is attributed to their consistent quality, large-scale availability, and cost-effectiveness in surfactant manufacturing. These alcohols are widely used in producing industrial and household cleaning products due to their stable performance and chemical uniformity.

Synthetic routes enable manufacturers to achieve controlled carbon chain lengths and purity levels, enhancing formulation efficiency. Their compatibility with various detergent types makes them a preferred choice among large-scale producers, particularly in applications requiring high-performance and cost-stable raw materials. This strong industrial demand has reinforced synthetic detergent alcohols’ leadership in the global market.

By Application Analysis

Laundry detergents accounted for 44.8% of the detergent alcohols market, supported by strong global cleaning product demand.

In 2024, Laundry Detergents held a dominant market position in the By Application segment of the Detergent Alcohols Market, with a 44.8% share. This dominance is driven by the extensive use of detergent alcohols as key surfactant ingredients in both liquid and powder formulations. Their excellent emulsifying, foaming, and cleaning properties make them essential for producing effective and biodegradable laundry solutions.

The growing consumer preference for high-efficiency detergents and sustainable washing products has further supported this segment’s strength. Additionally, the expanding household care sector and advancements in concentrated detergent formulations continue to increase detergent alcohol utilization in laundry applications, ensuring its sustained leadership and vital contribution to overall market growth.

Key Market Segments

By Source

- Natural

- Synthetic

By Application

- Laundry Detergents

- Dishwashing Detergents

- Personal Care and Cosmetics

- Industrial Cleaners

- Others

Driving Factors

Rising Demand for Eco-Friendly Cleaning Solutions

A major driving factor for the Detergent Alcohols Market is the growing global shift toward eco-friendly and sustainable cleaning products. Consumers today are more aware of the environmental effects of conventional detergents and prefer biodegradable alternatives made from renewable sources.

Detergent alcohols play a key role as primary ingredients in these formulations due to their excellent cleaning and foaming properties. The rapid growth of eco-conscious direct-to-consumer brands further highlights this trend.

For instance, Koparo secured Rs 14.5 crore in an extended pre-Series A round led by Saama Capital to expand its range of sustainable cleaning products. Such developments underline how rising environmental awareness and green innovation are driving long-term demand for detergent alcohols across home and industrial cleaning applications.

Restraining Factors

High Production Costs and Feedstock Price Volatility

A key restraining factor for the Detergent Alcohols Market is the high production cost linked to fluctuating raw material prices. Detergent alcohols are primarily derived from natural oils or petrochemical feedstocks, both of which face strong price volatility due to changing global energy and agricultural markets.

The cost of raw materials such as palm oil or ethylene directly impacts production margins and product pricing. Moreover, manufacturing processes like hydrogenation and distillation require significant energy input, further increasing operational expenses.

This cost pressure limits profit flexibility for producers and makes it difficult for smaller companies to compete. As a result, unstable feedstock availability and high input costs can slow the market’s overall growth momentum.

Growth Opportunity

Expanding Scope of Sustainable Home Care Products

A major growth opportunity for the Detergent Alcohols Market lies in the expanding demand for sustainable home and personal care products. Consumers are increasingly shifting toward eco-friendly cleaning solutions that are safe for health and the environment.

Detergent alcohols, being key raw materials in biodegradable surfactants, are benefiting from this green transformation. Their use in producing natural laundry detergents, dishwashing liquids, and personal hygiene products continues to rise globally.

The trend is further strengthened by new funding in sustainable brands, such as Beco, raising $10 million from Tanglin Venture Partners to expand its eco-conscious home care range. This momentum highlights how growing sustainability investments are opening strong opportunities for detergent alcohol suppliers worldwide.

Latest Trends

Smart Retail Integration Boosting Sustainable Detergent Sales

A key trend in the Detergent Alcohols Market is the integration of smart retail and digital convenience in promoting sustainable cleaning products. Modern consumers prefer on-demand and contactless access to eco-friendly home care items, including detergents made with detergent alcohols.

This shift is driving companies to adopt technology-based retail formats and subscription models. For example, Bodega raised $2.5 million to build smart store kiosks in apartment buildings, offering instant access to everyday essentials like cleaning products.

Such innovations are redefining how consumers purchase sustainable detergents, reducing packaging waste and encouraging local supply chains. The trend highlights how technology and sustainability are merging to create a more efficient and accessible market for alcohol-based detergent formulations.

Regional Analysis

In 2024, the Asia-Pacific dominated the Detergent Alcohols Market with a 47.90% share.

In 2024, the Asia-Pacific region held a dominant position in the global Detergent Alcohols Market, accounting for 47.90% of the total share and valued at around USD 3.2 billion. This strong regional presence is supported by rapid industrialization, growing urban populations, and expanding demand for cleaning and personal care products across major economies such as China, India, and Japan.

Rising awareness of hygiene standards and the availability of cost-effective raw materials, particularly natural fatty alcohols, have strengthened the region’s manufacturing capabilities. North America follows closely with its well-established household cleaning sector and technological advancements in surfactant production.

Europe remains a key market driven by sustainable formulation trends and environmental regulations. Meanwhile, Latin America and the Middle East & Africa are witnessing steady growth due to increasing urbanization and improving consumer lifestyles.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Sasol Ltd., BASF SE, and KLK OLEO played a crucial role in shaping the global Detergent Alcohols Market through their innovation, technological expansion, and sustainable product development.

Sasol Ltd. strengthened its market presence by enhancing its synthetic detergent alcohol production capacity and optimizing feedstock efficiency to meet growing global detergent demand.

BASF SE focused on advancing its chemical processes and integrating renewable feedstock technologies to produce high-quality fatty alcohols suitable for eco-friendly cleaning and personal care products.

Meanwhile, KLK OLEO expanded its bio-based detergent alcohol portfolio, leveraging its strong palm-based oleochemical foundation to cater to the rising demand for biodegradable and sustainable surfactants.

Top Key Players in the Market

- Sasol Ltd.

- BASF SE

- KLK OLEO

- Wilmar International

- Godrej Industries

- Procter & Gamble Chemicals

- Emery Oleochemicals

- Ecogreen Oleochemicals

- Kao Corporation

- VVF Ltd

Recent Developments

- In February 2025, BASF announced an investment of a mid-double-digit million-euro amount to build a new alcoholates plant at its Ludwigshafen, Germany, site. While not strictly fatty alcohols for detergents, this investment in alcoholate production underlines BASF’s broader commitment to alcohol-based chemistries and securing high-value global supply chains.

- In December 2024, Sasol Chemicals (a unit of Sasol Ltd.) introduced a new stearyl alcohol product called NACOL 18-98, made exclusively from segregated rapeseed oil and designed as a palm oil-free, bio-based solution for the personal care industry. The launch supports regulations such as the EU deforestation regulation and offers formulators an alternative to traditional fatty alcohols derived from palm.

Report Scope

Report Features Description Market Value (2024) USD 6.7 Billion Forecast Revenue (2034) USD 12.3 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Natural, Synthetic), By Application (Laundry Detergents, Dishwashing Detergents, Personal Care and Cosmetics, Industrial Cleaners, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sasol Ltd., BASF SE, KLK OLEO, Wilmar International, Godrej Industries, Procter & Gamble Chemicals, Emery Oleochemicals, Ecogreen Oleochemicals, Kao Corporation, VVF Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Detergent Alcohols MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Detergent Alcohols MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sasol Ltd.

- BASF SE

- KLK OLEO

- Wilmar International

- Godrej Industries

- Procter & Gamble Chemicals

- Emery Oleochemicals

- Ecogreen Oleochemicals

- Kao Corporation

- VVF Ltd