Dermatological Drugs Market By Product Type (Prescription and OTC), By Route of Administration (Topical (Creams & Lotions, Ointments, Gels, Sprays, and Foams), Oral (Tablets/Capsules and Syrups), Injectables, and Transdermal), By Application (Acne, Psoriasis, Rosacea, Alopecia, and Others), By Distribution Channel (Hospital & Clinic Pharmacies, Retail Pharmacies, and Online Pharmacies), By Drug Class (Corticosteroids, Retinoids, Antibiotics, Antifungals, Calcineurin Inhibitors, Antihistamines, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150898

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Route of Administration Analysis

- Application Analysis

- Distribution Channel Analysis

- Drug Class Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

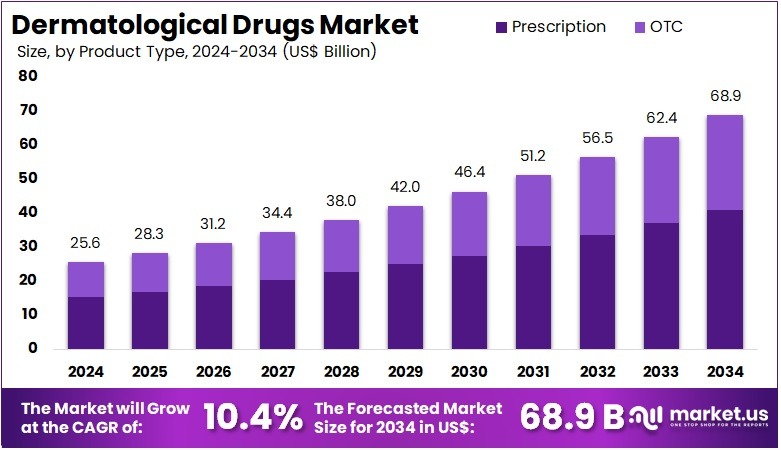

The Global Dermatological Drugs Market Size is expected to be worth around US$ 68.9 Billion by 2034, from US$ 25.6 Billion in 2024, growing at a CAGR of 10.4% during the forecast period from 2025 to 2034.

Rising demand for effective treatments for various skin conditions and the increasing awareness of dermatological health drive the growth of the dermatological drugs market. Dermatological drugs address a wide range of conditions, including acne, psoriasis, eczema, and fungal infections, offering both therapeutic and cosmetic benefits. The market has seen significant innovation in drug formulations, with new therapies targeting complex skin conditions more effectively and with fewer side effects.

Recent trends, such as the growing preference for biologic drugs and topical formulations, highlight the shift towards more targeted, patient-specific treatments. In March 2022, Accord BioPharma’s launch of CAMCEVITM (leuprolide) 42mg injectable emulsion, although primarily an oncology treatment, exemplifies the broader trend of introducing innovative, long-acting therapies across various therapeutic areas. This innovation reflects a broader market move toward improving patient compliance and outcomes.

Additionally, the rise in conditions such as atopic dermatitis, acne vulgaris, and skin cancer, coupled with the aging population, creates an expanding market opportunity. The increasing use of telemedicine in dermatology also presents a unique opportunity to integrate digital tools with drug treatments. With ongoing advancements in personalized medicine and the growing prevalence of chronic skin disorders, the dermatological drugs market is poised for continued growth.

Key Takeaways

- In 2024, the market for Dermatological Drugs generated a revenue of US$ 25.6 billion, with a CAGR of 10.4%, and is expected to reach US$ 68.9 billion by the year 2034.

- The product type segment is divided into prescription and OTC, with prescription taking the lead in 2024 with a market share of 59.3%.

- Considering route of administration, the market is divided into topical, oral, injectables, and transdermal. Among these, topical held a significant share of 58.8%.

- Furthermore, concerning the application segment, the market is segregated into acne, psoriasis, rosacea, alopecia, and others. The psoriasis sector stands out as the dominant player, holding the largest revenue share of 41.2% in the Dermatological Drugs market.

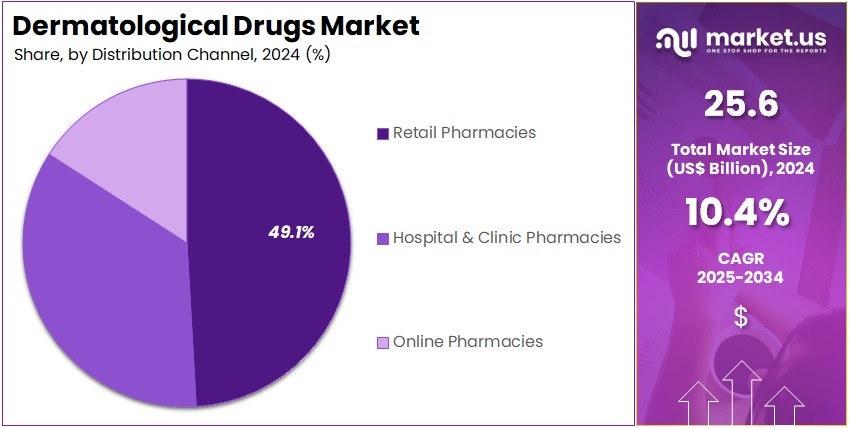

- The distribution channel segment is segregated into hospital & clinic pharmacies, retail pharmacies, and online pharmacies, with the retail pharmacies segment leading the market, holding a revenue share of 49.1%.

- Considering drug class, the market is divided into corticosteroids, retinoids, antibiotics, antifungals, calcineurin inhibitors, antihistamines, and others. Among these, corticosteroids held a significant share of 26.5%.

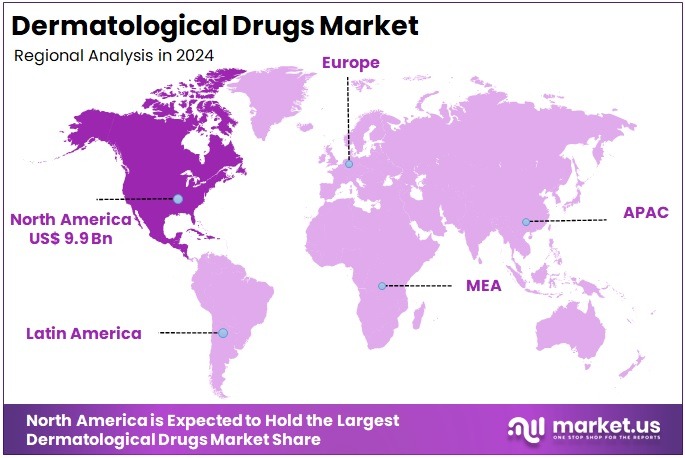

- North America led the market by securing a market share of 38.5% in 2024.

Product Type Analysis

The prescription segment claimed a market share of 59.3% owing to the increasing prevalence of skin conditions such as eczema, psoriasis, and acne that require medical intervention. Patients are likely to seek out prescription-based solutions as they offer more effective treatments compared to over-the-counter options.

The growth of this segment is anticipated to be fueled by the rising awareness of the risks associated with self-medication and the growing reliance on healthcare providers for proper diagnoses and treatment plans. Additionally, advancements in the development of targeted therapies and biologics are expected to further propel the demand for prescription dermatological drugs, especially for chronic conditions requiring specialized care.

Route of Administration Analysis

The topical held a significant share of 58.8% due to its effectiveness in treating localized skin conditions. Topical treatments, such as creams, ointments, and gels, are anticipated to remain the preferred option for treating conditions like acne, eczema, and psoriasis, as they allow for direct application to affected areas, leading to faster and more effective results.

The convenience of self-administration and minimal side effects compared to systemic treatments are expected to drive the segment’s expansion. Additionally, innovations in drug formulations that enhance skin absorption and improve efficacy are likely to increase the popularity of topical dermatological treatments in the market.

Application Analysis

The psoriasis segment had a tremendous growth rate, with a revenue share of 41.2% as the prevalence of psoriasis continues to rise globally. This segment is likely to expand due to the increasing demand for effective treatments to manage symptoms, reduce flare-ups, and improve the quality of life for patients.

The market for psoriasis treatments is anticipated to be fueled by the development of biologics and other advanced therapies that offer better outcomes compared to traditional treatments. The rising awareness of the condition, coupled with improved diagnostic tools, is expected to result in more patients seeking medical intervention for psoriasis, thereby driving the growth of this segment.

Distribution Channel Analysis

The retail pharmacies segment grew at a substantial rate, generating a revenue portion of 49.1% due to increased consumer preference for convenient, over-the-counter dermatological treatments. Retail pharmacies are expected to benefit from the growing trend of self-medication, as patients increasingly seek solutions for common skin conditions like acne, fungal infections, and dry skin without needing a prescription.

Moreover, the expansion of pharmacy chains and the increasing availability of dermatological products in easily accessible locations are anticipated to further support this segment’s growth. The rise of health-conscious consumers and a greater focus on skincare is likely to continue driving demand for retail-based dermatological solutions.

Drug Class Analysis

The corticosteroids held a significant share of 26.5% due to the widespread use of corticosteroids in treating a variety of skin conditions, including eczema, psoriasis, and allergic dermatitis. Corticosteroids are expected to remain a primary treatment option because of their potent anti-inflammatory effects, which help reduce swelling, redness, and irritation.

This segment’s growth is anticipated to be further supported by ongoing advancements in corticosteroid formulations that minimize side effects, such as skin thinning, while enhancing therapeutic outcomes. As a result, corticosteroids are expected to remain a dominant class of dermatological drugs, with increasing demand for both topical and systemic applications.

Key Market Segments

By Product Type

- Prescription

- OTC

By Route of Administration

- Topical

- Creams & Lotions

- Ointments

- Gels

- Sprays

- Foams

- Oral

- Tablets/Capsules

- Syrups

- Injectables

- Transdermal

By Application

- Acne

- Psoriasis

- Rosacea

- Alopecia

- Others

By Distribution Channel

- Hospital & Clinic Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Drug Class

- Corticosteroids

- Retinoids

- Antibiotics

- Antifungals

- Calcineurin Inhibitors

- Antihistamines

- Others

Drivers

Rising Prevalence of Skin Disorders is Driving the Market

The increasing global prevalence of various skin disorders, ranging from common conditions like acne and eczema to more severe ones like psoriasis and skin cancer, is a primary driver for the dermatological drugs market. Factors such as environmental pollutants, lifestyle changes, genetic predispositions, and an aging global population contribute to the growing burden of these conditions.

For instance, the International Agency for Research on Cancer (IARC) estimated that in 2022, over 1.5 million new cases of skin cancers were diagnosed worldwide, with approximately 330,000 new cases of melanoma. Furthermore, the International Eczema Council’s “Global Report on Atopic Dermatitis 2022” stated that about 223 million people globally were living with atopic dermatitis in 2022. This widespread and increasing patient population necessitates effective pharmaceutical interventions, thus directly fueling the demand for various dermatological drugs, including topical, oral, and injectable formulations.

Restraints

High Cost of Novel Therapies and Adherence Challenges are Restraining the Market

The dermatological drugs market faces significant restraint due to the high cost associated with novel biological and targeted therapies and the persistent challenges in patient adherence to treatment regimens. Newer drugs for severe conditions like psoriasis or atopic dermatitis, while highly effective, often come with a substantial price tag, which can create financial barriers for patients and strain healthcare systems.

A cross-sectional study analyzing data from 2007 to 2021, referenced by EMJ (European Medical Journal) in 2024, highlighted a sharp rise in the cost of biologic treatments for plaque psoriasis, with the average annual net treatment cost for first-line biologics increasing significantly. Moreover, adherence to long-term dermatological treatments, particularly topical medications, can be challenging for patients, impacting treatment efficacy and increasing the risk of disease flares.

A review published in PMC (PubMed Central, a free full-text archive of biomedical and life sciences journal literature at the US National Institutes of Health’s National Library of Medicine) in 2024 emphasized that inadequate adherence to dermatological treatments is a common issue that can lead to unfavorable outcomes, necessitating more aggressive and potentially more expensive medications.

Opportunities

Emergence of Novel Biologics and Small Molecule Inhibitors Creates Growth Opportunities

The continuous development and approval of novel biologics and small molecule inhibitors present significant growth opportunities in the dermatological drugs market. These advanced therapies offer highly targeted mechanisms of action, leading to improved efficacy and better safety profiles for patients with moderate-to-severe dermatological conditions that do not respond adequately to conventional treatments.

For example, the US Food and Drug Administration (FDA) in 2024 approved numerous new dermatologic therapies and expanded indications for existing treatments, demonstrating ongoing innovation in areas like atopic dermatitis, hidradenitis suppurativa, and alopecia areata. This robust pipeline of innovative drugs addresses previously unmet medical needs and provides dermatologists with more effective tools to manage complex skin diseases, driving the expansion of therapeutic options. Pharmaceutical companies consistently invest in research and development, aiming to bring more targeted therapies to market, which contributes significantly to this growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors play a critical role in shaping the dermatological drugs market. Changes in healthcare spending, insurance coverage, and patient disposable income directly influence access to treatment. Economic prosperity often leads to higher investments in research and development. This results in the creation of advanced dermatological therapies and broader patient access to costly treatments. However, during economic downturns, budget constraints may limit reimbursements for expensive drugs. Patients may also face increased out-of-pocket expenses, which can impact their ability to start or continue prescribed therapies.

According to the U.S. Bureau of Economic Analysis, healthcare spending in the United States rose by 7.5% in 2023, reaching US$4.9 trillion. This marked an acceleration from a 4.6% increase in 2022. Rising healthcare expenditure during strong economic periods supports the launch and uptake of high-cost dermatological drugs, including biologics. In contrast, inflation and slowed economic growth can force payers to reassess their reimbursement policies. This could delay the approval of new treatments or increase the burden on patients, especially in countries with private or hybrid insurance systems.

Geopolitical stability also affects the dermatology drugs market through trade and supply chain reliability. The production of active pharmaceutical ingredients (APIs) often relies on international supply chains. Geopolitical disruptions can lead to shortages or rising costs of raw materials. This may reduce production efficiency or increase prices of finished dermatological products. Despite such challenges, many skin conditions are chronic, painful, or visible. As a result, patient demand tends to remain stable, making the market relatively resilient to broader political and economic instability.

Current U.S. tariff policies may significantly affect the dermatological drugs market. Tariffs on imported active pharmaceutical ingredients (APIs) or finished dermatology products—especially from key suppliers such as China—can raise production costs for pharmaceutical companies. Between 2020 and 2022, the U.S. doubled its medication imports from China, according to the U.S. Census Bureau. A May 2025 article in the Journal of Managed Care & Specialty Pharmacy estimated that a 25% tariff could raise medication costs by about US$ 600 per household annually, impacting affordability and patient access.

Higher prices could particularly affect patients with chronic dermatological conditions. However, these tariff policies may also prompt pharmaceutical companies to shift API and drug manufacturing back to the United States. This move could help reduce reliance on international suppliers and build a more secure domestic supply chain. While the short-term effect may be increased costs, the long-term result might be greater pharmaceutical resilience. Domestic production could stabilize supply, enhance quality oversight, and support national drug security strategies.

Trends

Increasing Adoption of Personalized and Precision Dermatology is a Recent Trend

A prominent recent trend in the dermatological drugs market is the increasing adoption of personalized and precision dermatology approaches. This involves tailoring treatment strategies based on an individual patient’s genetic makeup, biomarkers, and specific disease characteristics, aiming to optimize drug efficacy and minimize side effects. Advances in understanding disease pathophysiology and the development of targeted therapies are enabling this shift.

The US FDA’s consistent approvals for novel dermatologic treatments in 2024 reflect a move towards more targeted interventions with specific patient populations in mind. This approach also extends to optimizing dosing and selection of specific biologics for individual patients. The continued exploration of biomarkers for predicting treatment response in conditions like psoriasis and atopic dermatitis is driving this trend, leading to more customized and effective patient care.

Regional Analysis

North America is leading the Dermatological Drugs Market

North America led the dermatological therapeutics market with a 38.5% revenue share. This dominance is driven by the high prevalence of skin conditions and the regular introduction of advanced treatments. In the United States, more than 8 million individuals suffer from psoriasis, while approximately 31.6 million people have eczema. These statistics, provided by the National Psoriasis Foundation and the National Eczema Association, reflect a large patient base. Such widespread occurrence of skin disorders continues to create strong demand for effective and long-term therapeutic solutions across the region.

The U.S. Food and Drug Administration (FDA) plays a vital role by consistently approving new therapies, including innovative small molecules and biologics. These developments provide dermatologists with more targeted and efficient treatment options for managing chronic skin diseases. Pharmaceutical companies continue to invest in this space. For instance, AbbVie generated US$11.718 billion in global revenue from Skyrizi in 2024. This drug is part of AbbVie’s immunology portfolio, which includes treatments for various dermatological conditions. These figures reflect the growing commercial potential of dermatology-focused biologics.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is projected to experience the fastest compound annual growth rate (CAGR) due to the rising prevalence of skin diseases and enhanced access to healthcare services. In 2021, East Asian countries reported around 15.78 million cases of viral skin diseases. This points to a significant treatment need. Improvements in healthcare infrastructure and increasing awareness are supporting this growth. The availability of more dermatological services and public health campaigns across developing economies in the region are expected to improve early diagnosis and treatment outcomes.

Increased government healthcare spending is also driving market growth. In 2024, China’s expenditure on health and family planning reached RMB 2,034.8 billion (approximately US$280 billion). This reflects a strong focus on expanding medical infrastructure. In addition, the growing middle-class population in Asia Pacific is increasingly willing to pay for modern treatments. As a result, demand for innovative skin health products is expected to rise significantly across urban centers. This trend will support the broader growth of the dermatological care market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the dermatological drug market employ strategies such as expanding their product portfolios, focusing on niche therapeutic areas, and forming collaborations with healthcare providers to enhance patient outcomes. Companies prioritize the development of innovative, targeted therapies for skin conditions, including acne, psoriasis, and eczema, to cater to specific patient needs. They invest in research and development to explore new delivery methods and improve the effectiveness of treatments.

Additionally, firms expand their market presence through strategic acquisitions, geographic expansion, and by capitalizing on the growing demand for personalized skincare solutions. Johnson & Johnson is a leading global healthcare company headquartered in New Brunswick, New Jersey. The company operates through three primary segments: pharmaceuticals, medical devices, and consumer health products.

Johnson & Johnson is a major player in the dermatological market, offering a range of topical treatments for various skin conditions, including acne and psoriasis. The company’s commitment to innovation, robust R&D pipeline, and strong market presence allow it to maintain its leadership in the dermatological sector.

Top Key Players in the Dermatological Drugs Market

- Sun Pharmaceutical Industries Ltd

- Pfizer Inc

- Novartis AG

- Lupin

- Leo Pharma A/S

- Johnson & Johnson Services, Inc

- GSK plc

- GALDERMA

- Daewoong Pharmaceutical Co. Ltd

- Cipla Limited

Recent Developments

- In December 2023: Daewoong Pharmaceutical Co. Ltd. from South Korea and Zydus Lifesciences Ltd. formed a licensing agreement to jointly develop and market a generic version of leuprolide acetate for depot suspension, targeting treatments for endometriosis, advanced prostate cancer, and uterine fibroids. This partnership is expected to enhance the market for leuprolide acetate by offering an affordable, accessible treatment alternative, helping to increase the drug’s availability and usage across diverse patient groups.

- In November 2022: Cipla Limited and its wholly owned subsidiary, Cipla USA Inc., introduced Leuprolide Acetate Injection Depot 22.5mg, approved by the US Food and Drug Administration (FDA) through the 505(b)(2) regulatory pathway. This approval represents a major step forward for the leuprolide acetate market, delivering a convenient and effective treatment option for patients with hormone-related conditions, including advanced prostate cancer, which is likely to drive further demand for the drug.

Report Scope

Report Features Description Market Value (2024) US$ 25.6 billion Forecast Revenue (2034) US$ 68.9 billion CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Prescription and OTC), By Route of Administration (Topical (Creams & Lotions, Ointments, Gels, Sprays, and Foams), Oral (Tablets/Capsules and Syrups), Injectables, and Transdermal), By Application (Acne, Psoriasis, Rosacea, Alopecia, and Others), By Distribution Channel (Hospital & Clinic Pharmacies, Retail Pharmacies, and Online Pharmacies), By Drug Class (Corticosteroids, Retinoids, Antibiotics, Antifungals, Calcineurin Inhibitors, Antihistamines, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sun Pharmaceutical Industries Ltd, Pfizer Inc, Novartis AG, Lupin, Leo Pharma A/S, Johnson & Johnson Services, Inc, GSK plc, GALDERMA, Daewoong Pharmaceutical Co. Ltd, Cipla Limited. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dermatological Drugs MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Dermatological Drugs MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sun Pharmaceutical Industries Ltd

- Pfizer Inc

- Novartis AG

- Lupin

- Leo Pharma A/S

- Johnson & Johnson Services, Inc

- GSK plc

- GALDERMA

- Daewoong Pharmaceutical Co. Ltd

- Cipla Limited