Global Dermal Fillers Market Analysis By Material Type (Hyaluronic acid (HA)-based, Calcium hydroxylapatite (CaHA)-based, Poly-L-lactic acid (PLLA), Poly(methyl methacrylate) (PMMA) microspheres, Collagen-based fillers, Others), By Application (Wrinkle and fold correction, Lip enhancement, Face volume restoration & contouring, Scar treatment, Skin Rejuvenation, Others), By Longevity (Temporary (Biodegradable) < 1 Year, Semi-Permanent (Biodegradable) 1-2 Years, (Non-Biodegradable) >2Years), By Gender (Women, Men), By Age Group (18-30 Years, 31-45 Years, 46-60 Years, 60+ Years), By End-User (Dermatology clinics, Cosmetic surgery/Plastic surgery clinics, Medical spas, Hospitals) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166617

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

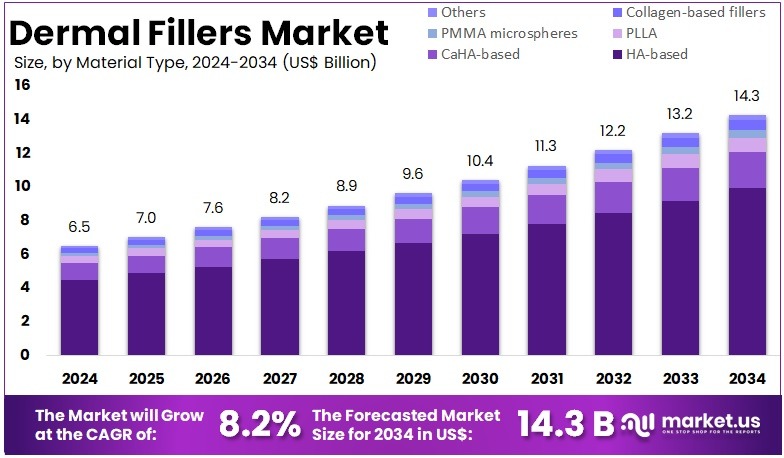

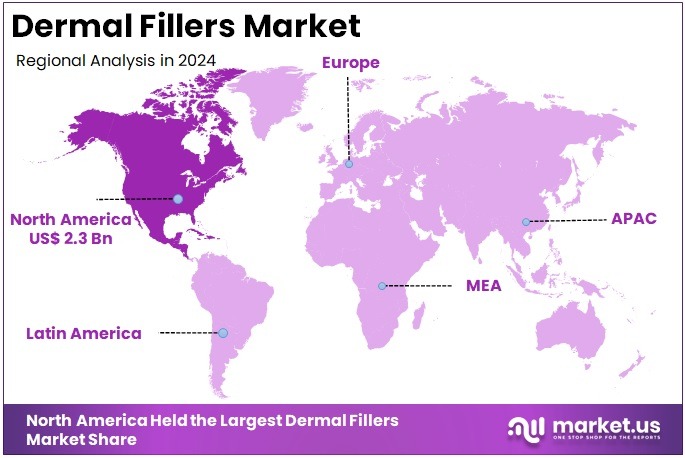

The Global Dermal Fillers Market Size is expected to be worth around US$ 14.3 Billion by 2034, from US$ 6.5 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 35.8% share and holds US$ 2.3 Billion market value for the year.

Demand for dermal fillers is being shaped by strong demographic and clinical trends. Ageing populations across all major regions are increasing the need for non-surgical rejuvenation. According to the World Health Organization, around 1 billion people aged 60 years and above were recorded in 2019. This figure is projected to reach 1.4 billion by 2030 as longevity improves worldwide. These demographic shifts expand the pool of individuals experiencing age-related volume loss, which strengthens demand for filler-based facial restoration.

The preference for minimally invasive procedures is also contributing to sector growth. Study by the International Society of Aesthetic Plastic Surgery noted that 34.9 million aesthetic procedures were performed globally in 2023. Within this total, more than 19.1 million were non-surgical, reflecting a steady structural shift. For instance, global procedure volume increased by 3.4% year-on-year, and expanded by nearly 40% in four years, illustrating robust long-term momentum. As injectable treatments require less downtime and lower risk, dermal fillers remain central to this rising preference.

Hyaluronic acid (HA) fillers have emerged as a dominant category in this nonsurgical landscape. According to ISAPS, HA filler procedures rose by almost 29% in 2023, reaching 5.5 million treatments worldwide. In the United States alone, around 5.33 million patients received HA fillers in 2024, and about 1.59 million of these were lip-specific. These figures reflect both broader aesthetic adoption and growing interest in targeted contouring.

Product characteristics are also reinforcing adoption. According to clinical sources such as Johns Hopkins Medicine, HA fillers offer biocompatibility, predictable results, and reversibility. For example, unwanted outcomes can be corrected through dissolution, which lowers the barrier for first-time patients. This ease of correction, combined with short treatment duration, continues to strengthen confidence among both patients and clinicians.

Market-Supportive Conditions and Innovation Landscape

Industry growth is being further supported by clear regulatory pathways. According to the U.S. Food and Drug Administration, dermal fillers are approved only after controlled clinical studies confirm safety and performance in defined anatomical areas. The agency has authorised several materials, including hyaluronic acid, calcium hydroxylapatite, poly-L-lactic acid, and polymethylmethacrylate. For example, each material is assigned specific indications and duration profiles, which improves practitioner confidence and encourages manufacturer investment.

Innovation in filler engineering and injection methodology is also enhancing clinical outcomes. Study by medical institutions notes that HA gels are formulated with varied particle sizes and crosslinking densities to match different aesthetic needs. For instance, newer techniques involving blunt cannulas, layered injections, and multimodal protocols allow more natural contouring and better facial harmonization. These innovations support repeat use and encourage younger adults to adopt early “pre-juvenation” approaches.

Shifting social attitudes are also expanding the addressable patient base. ISAPS data indicate rising participation among men, who now represent a meaningful share of global procedure volume. Increased public visibility on digital platforms and wider acceptance among younger demographics are accelerating consideration of fillers for preventive or maintenance purposes. This behavioural evolution creates longer treatment lifecycles and sustained clinic revenues.

The growth of aesthetic service infrastructure and medical tourism adds another layer of support. According to ISAPS, high-volume markets such as the United States and Brazil conduct millions of procedures annually. For example, destinations like Türkiye, Mexico, Colombia, and Thailand attract significant foreign-patient inflows. As access expands and pricing becomes more competitive, demand for approved fillers and trained injectors strengthens. Combined with ongoing regulatory warnings against unapproved products, these factors reinforce a stable and safety-driven growth outlook for the dermal fillers market.

Key Takeaways

- The global dermal fillers market is projected to reach about US$ 14.3 billion by 2034, rising from US$ 6.5 billion in 2024 with an 8.2% CAGR.

- The hyaluronic acid–based category was described as leading the material segment in 2024, accounting for over 69.4% of total market share.

- Wrinkle and fold correction was highlighted as the foremost application area in 2024, securing more than 34.6% share in the overall market.

- Temporary biodegradable fillers lasting under one year were noted as the top longevity segment in 2024, representing more than 45.7% market share.

- Women were identified as the dominant consumer group in 2024, contributing over 63.5% to total dermal filler demand worldwide.

- Individuals aged 18–30 years were recognized as the primary age group in 2024, holding more than 34.3% share of procedures.

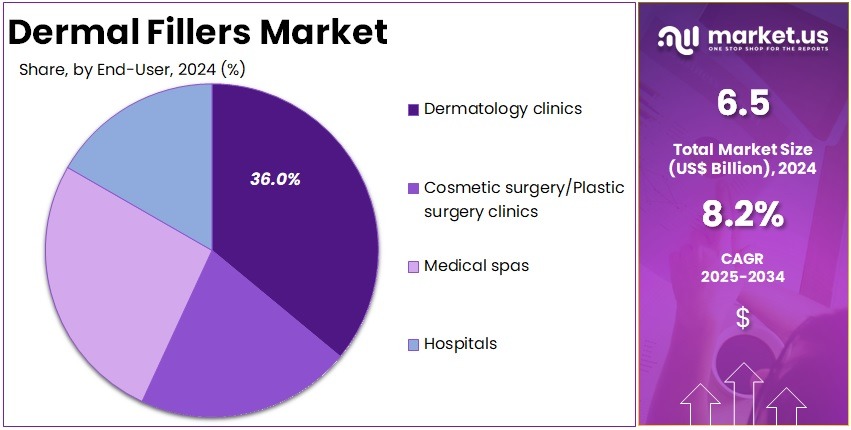

- Dermatology clinics were observed as the leading end-user segment in 2024, accounting for over 36.0% of the global procedure volume.

- North America was reported as the largest regional market in 2024, capturing more than 35.8% share and generating roughly US$ 2.3 billion.

Material Type Analysis

In 2024, the Hyaluronic acid (HA)-based segment held a dominant market position in the Material Type Segment of the Dermal Fillers Market, and captured more than a 69.4% share. Its strong lead was supported by high biocompatibility and consistent clinical results. Demand increased as patients preferred safe and minimally invasive procedures. The reversible nature of HA fillers also strengthened adoption. Wider usage across facial areas further reinforced segment expansion. Clinics continued to rely on HA-based options for predictable outcomes.

Calcium hydroxylapatite (CaHA)-based fillers held a notable position due to long-lasting effects. Their ability to stimulate collagen improved acceptance in deeper correction treatments. Poly-L-lactic acid (PLLA) fillers showed steady growth as gradual volume restoration remained important. Longer durability supported wider use. PMMA microspheres retained a smaller share. Their permanent nature created niche demand. Clinical caution around irreversible materials limited faster growth. Still, these products remained relevant for specific facial enhancement needs.

Collagen-based fillers recorded slow growth because of shorter durability. Yet, they maintained use in selected applications. Their natural composition supported patient acceptance. The Others segment included emerging biomaterials with rising research interest. Innovation in regenerative treatments supported gradual progress. Adoption remained modest but showed potential for future expansion. Overall, material choices continued to shift toward safer and minimally invasive solutions. HA-based fillers shaped market behaviour and remained central to aesthetic treatment trends.

Application Analysis

In 2024, the ‘Wrinkle and fold correction’ held a dominant market position in the Application Segment of the Dermal Fillers Market, and captured more than a 34.6% share. Demand grew due to rising age-related concerns. The preference for minimally invasive procedures also supported this lead. Improved filler durability strengthened adoption. Lip enhancement followed with steady uptake. Social media trends influenced younger users. Quick recovery options further expanded the segment. Acceptance of cosmetic treatments increased across diverse groups.

Face volume restoration and contouring recorded notable progress. Aging-related volume loss created stable demand. New filler technologies improved treatment results. Interest in facial harmonization supported consistent use. Scar treatment showed moderate but rising uptake. Acne scars remained a major concern. Safe and adaptable fillers expanded clinical use. Combined methods, such as fillers with energy-based systems, enhanced outcomes. Growing awareness of aesthetic scar solutions encouraged more procedures among various age groups.

Skin rejuvenation continued to gain traction. Patients preferred natural-looking improvements. Deep hydration fillers improved skin quality. Preventive aesthetic care attracted younger consumers. Regenerative fillers stimulated segment growth. Other niche applications added incremental value. These uses grew through tailored treatment plans. Practitioners adopted new methods and product types. Diversified filler portfolios supported broader adoption. Overall application demand increased as non-surgical aesthetic procedures became more accessible and widely accepted in clinical and consumer settings.

Longevity Analysis

In 2024, the “Temporary (Biodegradable) < 1 Year” segment held a dominant market position in the Longevity Segment of the Dermal Fillers Market and captured more than a 45.7% share. The segment gained strong traction due to high patient acceptance and predictable outcomes. Short recovery times also supported its use. Growing demand for safe procedures increased adoption. Reversible effects encouraged first-time users. Broader consumer awareness strengthened its position across major aesthetic treatment categories.

The Semi-Permanent (Biodegradable) 1–2 Years segment showed steady growth in 2024. Its expansion was driven by longer-lasting outcomes and balanced safety. The segment gained traction in mid-depth correction procedures. Rising use in repeat treatments supported consistent demand. Product improvements enhanced stability. Practitioners adopted these fillers for predictable performance.

The segment benefited from broader patient willingness to choose options that offered extended effects while maintaining controlled biodegradation and reduced long-term risk. The Non-Biodegradable (>2 Years) segment maintained a smaller share in 2024. Its adoption was limited due to long-term safety concerns and irreversible outcomes. Regulatory caution further restricted use.

Demand continued in niche applications that required durable volume restoration. Some patients preferred long-lasting effects despite higher risk. Clinical usage patterns remained stable. The segment experienced controlled growth. Market performance reflected a selective approach, where practitioners used these fillers only when extended correction was necessary and patient expectations were well aligned.

Gender Analysis

In 2024, the ‘Women’ segment held a dominant market position in the Gender Segment of the Dermal Fillers Market, and captured more than a 63.5% share. This leadership was driven by strong demand for non-invasive aesthetic procedures. Women showed higher adoption of fillers for facial contouring and anti-aging needs. Social media influence also increased interest in subtle enhancements. Rising awareness of safe treatment options supported steady segment growth across major markets.

The segment’s growth was further supported by increasing disposable income among working women. Demand expanded in developed and emerging countries as treatment accessibility improved. Clinics promoted personalized filler solutions, which encouraged repeat procedures. Awareness campaigns highlighted long-lasting results and minimal downtime. These factors strengthened women’s preference for dermal fillers. The trend is expected to continue as consumers seek natural-looking improvements and greater facial symmetry through minimally invasive methods worldwide today.

The men segment recorded gradual growth as aesthetic awareness increased. Men opted for fillers to enhance jawline definition and reduce signs of aging. Discreet procedures with short recovery times supported wider acceptance. Product innovations tailored for male facial structure also encouraged uptake. Although the male share remained smaller, steady adoption was observed across urban markets. Positive perception shifts are expected to sustain future growth. This development indicates broader engagement in cosmetic treatments across gender groups.

Age Group Analysis

In 2024, the “18–30 Years” segment held a dominant market position in the Age Group Segment of the Dermal Fillers Market, and captured more than a 34.3% share. This group showed strong interest in early enhancement. Demand rose due to preventive aesthetic care. Social media shaped treatment choices. Hyaluronic acid fillers gained acceptance. Facial contouring procedures increased. Awareness of minimally invasive options improved. Stable adoption supported consistent market growth.

The 31–45 Years segment recorded strong participation in dermal filler treatments. Demand rose due to early signs of aging. Consumers in this group sought solutions for fine lines and volume loss. Higher incomes supported wider adoption. Combination procedures became common. Interest in mid-face correction increased steadily. Professional and social pressures influenced treatment uptake. The segment showed stable expansion due to repeat sessions and rising awareness of non-surgical rejuvenation options.

The 46–60 Years and 60+ Years segments displayed steady but varied growth. Demand increased as aging concerns intensified. Individuals pursued fillers to restore facial structure and manage deep wrinkles. Long-lasting formulations gained attention. Confidence in non-invasive procedures improved. Safety advancements supported mature skin treatments. Life expectancy trends encouraged continued adoption. Natural-looking outcomes remained the primary goal. These segments contributed stable volume and maintained a positive outlook for long-term market expansion.

End-User Analysis

In 2024, the ‘Dermatology clinics’ held a dominant market position in the End-User Segment of the Dermal Fillers Market and captured more than a 36.0% share. Their lead was supported by strong patient preference for minimally invasive aesthetic procedures. Demand increased due to skilled dermatologists and reliable treatment outcomes. Clinics also adopted modern injection techniques. These factors improved safety and precision. Rising patient visits for routine cosmetic enhancements further strengthened the overall share of dermatology clinics in the market.

Cosmetic and plastic surgery clinics recorded notable demand for dermal fillers. Their growth was influenced by rising interest in facial contouring and volume restoration. These clinics offered advanced treatment options. A high level of customization improved patient satisfaction. Medical spas also contributed significantly. These centers attracted consumers seeking simple and affordable aesthetic services. Easy access to consultations supported higher footfall. Their focus on non-surgical wellness solutions increased adoption. This trend positioned medical spas as an important segment within the market.

Hospitals held a moderate share within the dermal fillers market. Their participation was driven by the presence of qualified specialists and advanced medical support. Hospitals often managed complex or high-risk cases. This increased patient trust. However, lower demand for routine cosmetic procedures in hospital settings limited higher growth. Many patients preferred clinics or medical spas for convenience. Even so, hospitals remained essential for specific treatments that required medical supervision. Their role ensured balanced growth across the end-user landscape.

Key Market Segments

By Material Type

- Hyaluronic acid (HA)-based

- Calcium hydroxylapatite (CaHA)-based

- Poly-L-lactic acid (PLLA)

- Poly(methyl methacrylate) (PMMA) microspheres

- Collagen-based fillers

- Others

By Application

- Wrinkle and fold correction

- Lip enhancement

- Face volume restoration & contouring

- Scar treatment

- Skin Rejuvenation

- Others

By Longevity

- Temporary (Biodegradable) < 1 Year

- Semi-Permanent (Biodegradable) 1-2 Years

- (Non-Biodegradable) >2Years

By Gender

- Women

- Men

By Age Group

- 18-30 Years

- 31-45 Years

- 46-60 Years

- 60+ Years

By End-User

- Dermatology clinics

- Cosmetic surgery/Plastic surgery clinics

- Medical spas

- Hospitals

Drivers

Rising Procedure Volumes And Strong Consumer Intent For Minimally Invasive Injectables

The growth of dermal fillers is being driven by a steady rise in minimally invasive aesthetic procedures. Demand is supported by strong consumer interest in treatments that provide visible results with limited downtime. The market has been shaped by a shift toward non-surgical solutions, as patients increasingly prefer procedures that are quick, safe, and predictable. This pattern reflects a structural change in aesthetic preferences, where injectables such as hyaluronic-acid fillers are now regarded as routine interventions rather than niche cosmetic options.

The expansion of procedure volumes has reinforced this trend. According to global industry observations, minimally invasive injectables are being chosen more frequently as alternatives to surgical procedures. The rising popularity of dermal fillers reflects improvements in product safety, formulation diversity, and practitioner expertise. This environment has encouraged both first-time and repeat users, strengthening long-term market potential. The consistent adoption of fillers across age groups suggests that the category will maintain its upward trajectory during the coming years.

A strong evidence base further supports this outlook. According to the International Society of Aesthetic Plastic Surgery, 6.3 million hyaluronic-acid filler procedures were performed worldwide in 2024. This represented a 5.2 percent increase over the previous year. For instance, this sustained momentum indicates that fillers remain one of the most preferred non-surgical treatments globally. The volume growth highlights continued acceptance of injectable aesthetics, driven by evolving beauty standards and rising awareness of minimally invasive solutions.

National data provides additional confirmation. According to the American Society of Plastic Surgeons, the United States recorded 3.44 million dermal filler procedures in 2023, marking a four percent year-on-year rise. Study by the American Society for Dermatologic Surgery showed that around 70 percent of consumers are considering cosmetic procedures, with injectables among the most frequently contemplated. For example, this consumer openness demonstrates that the underlying demand drivers remain strong, reinforcing the positive outlook for the dermal fillers market.

Restraints

Safety Concerns Around Vascular And Delayed Complications

The market has been affected by growing concerns about vascular and delayed complications associated with dermal fillers. This restraint has emerged because adverse events, though uncommon, can lead to severe outcomes that require urgent intervention. The rising awareness of these risks has encouraged practitioners to adopt more conservative approaches. It has also encouraged tighter oversight across clinical settings. As a result, market expansion has been moderated by the need for improved procedural standards and stronger safety protocols that reassure both providers and patients.

Clinical literature has reinforced these concerns by highlighting the seriousness of potential vascular events. According to recent research, complications such as ischemia, tissue necrosis and, in extreme cases, irreversible blindness can occur when arterial occlusion develops. Study by PubMed Central indicated that these events, while rare, remain clinically significant and demand high caution during practice. This evidence has strengthened the perception that dermal fillers require advanced training and careful injection techniques to mitigate the risks associated with their use.

Regulatory reviews have also contributed to the growing focus on safety outcomes. For instance, a US FDA assessment of 28 cases linked to HA fillers reported that 42.9% involved nodularity or palpable masses, while 35.7% showed inflammatory symptoms such as swelling or redness. The same report noted that 10.7% of cases resulted in tissue necrosis and 10.7% in dyspigmentation. These documented complications have increased the pressure on clinics and manufacturers to support stricter guidelines and enhanced practitioner competencies.

Consumer sentiment has further intensified the restraint on market growth. For example, the ASDS 2023 survey found that concerns about side effects and overall safety were leading reasons why many individuals delayed cosmetic treatments. According to the survey, perceived risks have become an important factor shaping the decision-making process among potential clients. This shift in perception has encouraged providers to strengthen patient education, promote realistic expectations and demonstrate adherence to high safety standards to maintain trust and sustain demand within the dermal fillers market.

Opportunities

Next-Generation, Better-Characterised Ha Fillers And Long-Lasting Formulations

The expanding scientific landscape around hyaluronic acid (HA) fillers has created notable opportunities for product differentiation, yet these same advancements introduce restraints for the dermal fillers market. The rapid introduction of new crosslinking technologies and diverse formulations requires manufacturers to maintain higher levels of evidence, which increases development costs. The market is also pressured by the need for standardised characterisation, as the performance expectations for fillers continue to rise. This environment limits the ability of smaller players to compete, which restrains broader market expansion.

Growing awareness of product heterogeneity further contributes to regulatory caution. According to a 2025 MDPI “Gels” study, over 140 HA injectables in Europe and more than 20 FDA-approved fillers in the US demonstrate a large and varied product base. For instance, this diversity has encouraged regulatory bodies to intensify oversight to ensure safety and consistency. These developments have slowed approval timelines and raised compliance burdens, which restrict the pace of innovation and commercial rollouts.

Longevity-related findings also act as a restraint due to heightened scrutiny. A 2024 systematic review on HA filler persistence reported that imaging often detects residual material beyond 12 months, and in some MRI studies, HA remained for several years. For example, such data has increased concerns about long-term tissue interactions, delayed reactions, and cumulative effects. These uncertainties have encouraged more conservative clinical use, which limits procedure frequency and constrains market growth despite demand for longer-lasting outcomes.

Emerging regenerative technologies are creating further regulatory and clinical hesitations. Study by researchers in 2025 on HA–silk fibroin hydrogels showed enhanced adhesion and type III collagen regeneration, indicating a shift toward bioactive fillers. For example, while these advances offer promising benefits, they introduce new safety considerations related to tissue remodeling. This has led to calls for stricter practitioner training and more cautious injection protocols. Consequently, these evolving clinical risks and patient perceptions function as restraints that temper rapid commercial adoption across the dermal fillers market.

Trends

Shift toward “prejuvenation” and preventive, natural-looking aesthetic use

A shift toward preventive and natural-looking aesthetic use is reshaping the demand for dermal fillers. Younger consumers now pursue subtle enhancements rather than corrective procedures. This shift is creating pressure on manufacturers and practitioners to adapt to evolving expectations. The trend emphasizes long-term appearance management, which encourages careful product selection and conservative usage patterns. As a result, the market is experiencing a restraint because patient priorities are moving toward minimal interventions and safer protocols, reducing high-volume, correction-focused filler consumption traditionally observed in older age groups.

The concept of “prejuvenation” has strengthened this restraint. According to recent clinical discussions on proactive cosmetic care, Millennials and Gen Z undertake treatments earlier to delay visible aging. Study by experts in a 2025 preprint described dermal fillers as components of broader skin health strategies rather than standalone corrective tools. This orientation reduces the intensity of single-session procedures and encourages slower, incremental treatments. The shift limits rapid filler uptake and redirects patient interest toward balanced regimens that prioritize prevention and risk reduction.

For instance, insights presented in the Aesthetic Surgery Journal Open Forum highlighted that preventive interventions are preferred over extensive correction in aging patients. This behavioral shift supports a conservative mindset among practitioners who focus on natural outcomes. For example, Aesthetic Medicine India noted that young adults influenced by social media prefer subtle changes. This sentiment reinforces cautious dosing and careful technique, which directly moderates filler usage. The trend thereby acts as a restraint on aggressive procedure volumes within clinical practice.

The broader utilization landscape reinforces this restraint. According to ISAPS, non-surgical procedures reached 20.5 million in 2024, with hyaluronic-acid fillers among the leading treatments. Although uptake remains high, increased awareness of complications has encouraged stricter regulation and better training. Study by various clinical bodies indicates rising patient concern over safety, prompting practitioners to follow conservative protocols. These shifts reduce excessive or frequent filler use, creating a structural restraint on overall market expansion despite ongoing interest in minimally invasive aesthetics.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 35.8% share and holds US$ 2.3 Billion market value for the year. The region’s lead was driven by strong interest in aesthetic enhancement. Demand for non-surgical facial procedures grew at a steady pace. Advanced clinical settings improved access to dermal filler treatments. High consumer awareness also supported growth. The presence of skilled professionals further strengthened procedure adoption across major urban markets.

The market expansion in North America was supported by a rising preference for hyaluronic acid-based fillers. These products gained traction due to favorable safety outcomes. Their predictable performance encouraged repeat procedures. Continuous improvements in filler formulations further boosted acceptance. The regulatory environment also played a key role. Clear approval pathways helped maintain user confidence. This structure ensured access to safe and innovative products across dermatology clinics and medical spas.

Demographic trends also shaped regional demand. The aging population showed increasing interest in facial rejuvenation. Consumers sought procedures that required minimal downtime. This preference encouraged strong uptake of injectable fillers. Higher disposable incomes supported spending on elective aesthetic care. Out-of-pocket payment remained common, yet demand stayed resilient. Stable economic conditions improved consumer confidence. These factors allowed the market to maintain steady procedure volumes throughout the region.

Digital influence contributed to deeper market penetration. Social media exposure increased awareness of treatment outcomes. This visibility motivated first-time users to explore dermal fillers. Educational content shared by practitioners improved patient understanding. As a result, trust in aesthetic procedures continued to rise. The combination of innovation, consumer interest, and strong clinical capabilities positioned the region for sustained growth. These conditions ensured that North America continued to lead the global dermal fillers landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global dermal fillers market has been shaped by strong innovation and established aesthetic brands. The market has been influenced by continuous shifts in consumer demand and the steady uptake of minimally invasive procedures. AbbVie Inc. has strengthened its position through the Juvéderm portfolio, which remains a leading hyaluronic acid option. Galderma S.A. has advanced its Restylane and Sculptra lines, supported by clinical evidence. Merz Pharma GmbH & Co. KGaA has expanded its Belotero and Radiesse platforms, reinforcing its role in collagen-stimulating solutions.

Competitive momentum has been driven by companies that invest in science-based technologies and broad treatment capabilities. Sinclair Pharma has gained recognition through Ellansé and MaiLi, which focus on regeneration and elasticity. LG Chem Ltd. has improved global reach with its YVOIRE fillers, supported by quality-controlled manufacturing. These players have expanded access in Asia, Europe and Middle Eastern markets. The growth of these portfolios has been supported by improved cross-linking technologies and rising interest in natural-looking aesthetic outcomes.

Market development has also been influenced by specialized brands that offer differentiated or long-lasting solutions. Suneva Medical, Inc. has positioned Bellafill as a semi-permanent option for acne scars and folds. Medytox Inc. has advanced the Neuramis line, serving expanding Asian demand. Revance Therapeutics Inc. and Teoxane SA have strengthened the dynamic filler segment through the RHA Collection. IBSA Institut Biochimique SA has expanded adoption of Profhilo, which supports bio-remodelling and improved skin quality in combination treatment protocols.

Additional players have supported wider market penetration through focused product portfolios and regional strengths. Croma Pharma GmbH has increased visibility with its Saypha range of hyaluronic acid fillers. Prollenium Medical Technologies has seen steady growth with its Revanesse products in North America. Bioplus Co. Ltd. and Bioaxis Pharmaceuticals have enhanced global supply through technology-driven HA solutions. Brands such as Cutera Aesthetics and Evolus have expanded adjacent offerings, which indirectly support dermal filler demand through complementary aesthetic treatments.

Market Key Players

- AbbVie Inc.

- Galderma S.A.

- Merz Pharma GmbH & Co. KGaA

- Sinclair Pharma

- LG Chem Ltd.

- Suneva Medical, Inc.

- Medytox Inc.

- Revance Therapeutics Inc.

- Bioplus Co. Ltd.

- Teoxane SA

- IBSA Institut Biochimique SA

- Croma Pharma GmbH

- Prollenium Medical Technologies

- Bioaxis Pharmaceuticals

- Cutera Aesthetics

- Evolus

Recent Developments

- In May 2023: SKINVIVE™ by JUVÉDERM® received U.S. FDA approval as the first and only hyaluronic acid intradermal microdroplet injection indicated to improve skin smoothness of the cheeks in adults ≥21 years. The product is positioned as a “skin-quality” dermal filler that increases dermal hydration and provides a visible glow with results lasting up to six months with optimal treatment.

- In June 2023: Galderma received U.S. FDA approval for Restylane® Eyelight™, an undereye hyaluronic acid dermal filler formulated with NASHA® Technology, indicated to treat infraorbital hollowing (undereye hollows) in adults over 21 years. It is described as the first and only U.S. product using this technology specifically for undereye volume loss, with effect duration reported up to 18 months.

- In October 2024: A clinical study in the Journal of Cosmetic Dermatology reported long-term duration and safety data for RADIESSE® (+) used for jawline contouring. The CaHA-CMC (+) formulation produced clinically meaningful and long-lasting improvements in jawline contour, with effects maintained through 60 weeks and a favorable tolerability profile, thereby reinforcing the product’s clinical evidence base for lower-face contouring.

- In July 2024: Sinclair announced the launch of MaiLi® in Singapore, positioning it as a “breakthrough” premium hyaluronic acid filler line that leverages OxiFree™ technology to preserve HA chains and deliver a supple, spring-like gel with high projection power and longevity. This expansion into Southeast Asia was framed as part of Sinclair’s broader strategy to grow its global injectable aesthetics footprint.

Report Scope

Report Features Description Market Value (2024) US$ 6.5 Billion Forecast Revenue (2034) US$ 14.3 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material Type (Hyaluronic acid (HA)-based, Calcium hydroxylapatite (CaHA)-based, Poly-L-lactic acid (PLLA), Poly(methyl methacrylate) (PMMA) microspheres, Collagen-based fillers, Others), By Application (Wrinkle and fold correction, Lip enhancement, Face volume restoration & contouring, Scar treatment, Skin Rejuvenation, Others), By Longevity (Temporary (Biodegradable) < 1 Year, Semi-Permanent (Biodegradable) 1-2 Years, (Non-Biodegradable) >2Years), By Gender (Women, Men), By Age Group (18-30 Years, 31-45 Years, 46-60 Years, 60+ Years), By End-User (Dermatology clinics, Cosmetic surgery/Plastic surgery clinics, Medical spas, Hospitals) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AbbVie Inc., Galderma S.A., Merz Pharma GmbH & Co. KGaA, Sinclair Pharma, LG Chem Ltd., Suneva Medical, Inc., Medytox Inc., Revance Therapeutics Inc., Bioplus Co. Ltd., Teoxane SA, IBSA Institut Biochimique SA, Croma Pharma GmbH, Prollenium Medical Technologies, Bioaxis Pharmaceuticals, Cutera Aesthetics, Evolus Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AbbVie Inc.

- Galderma S.A.

- Merz Pharma GmbH & Co. KGaA

- Sinclair Pharma

- LG Chem Ltd.

- Suneva Medical, Inc.

- Medytox Inc.

- Revance Therapeutics Inc.

- Bioplus Co. Ltd.

- Teoxane SA

- IBSA Institut Biochimique SA

- Croma Pharma GmbH

- Prollenium Medical Technologies

- Bioaxis Pharmaceuticals

- Cutera Aesthetics

- Evolus