Global Dengue Testing Market By Product Type (ELISA-based Tests, RT-PCR Tests, Rapid Diagnostic Tests, NS1 Antigen Detection Kits, Lateral Flow Immunoassay, and Dengue IgG/IgM Detection Kits), By Service Type (Centralized Service and Point-of-Care (POC) Service), By End-user (Clinical Labs, Home Healthcare, and Hospitals/Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154926

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

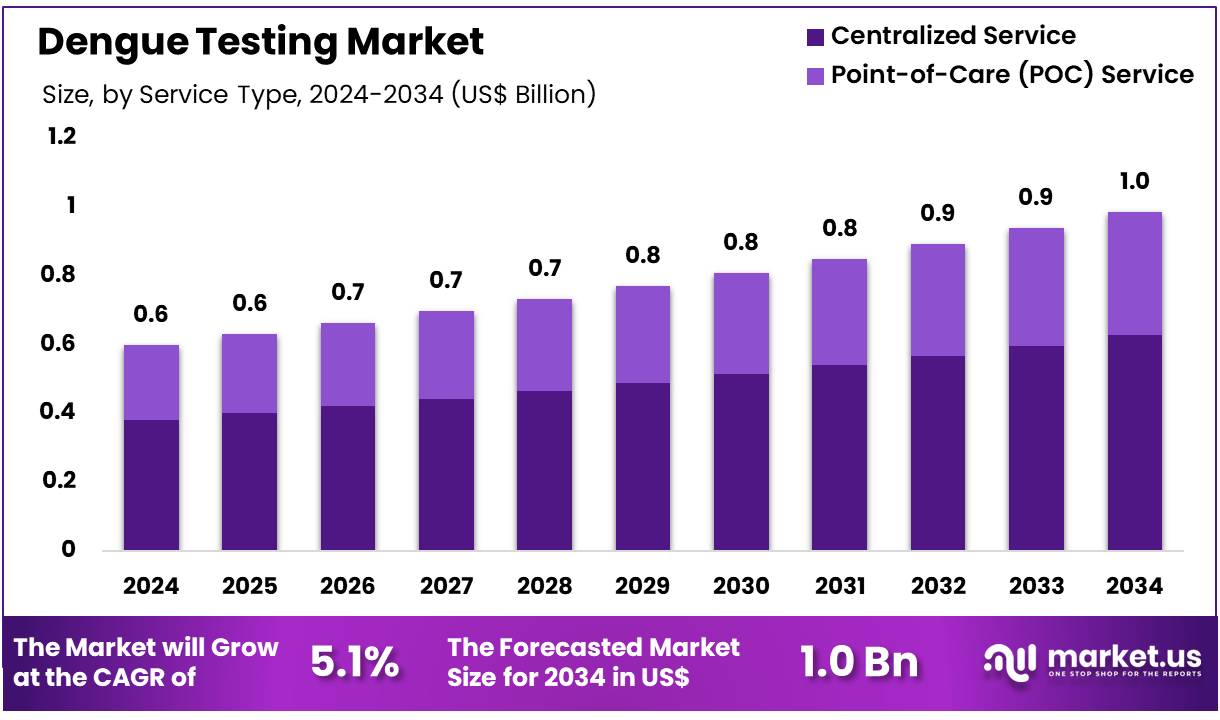

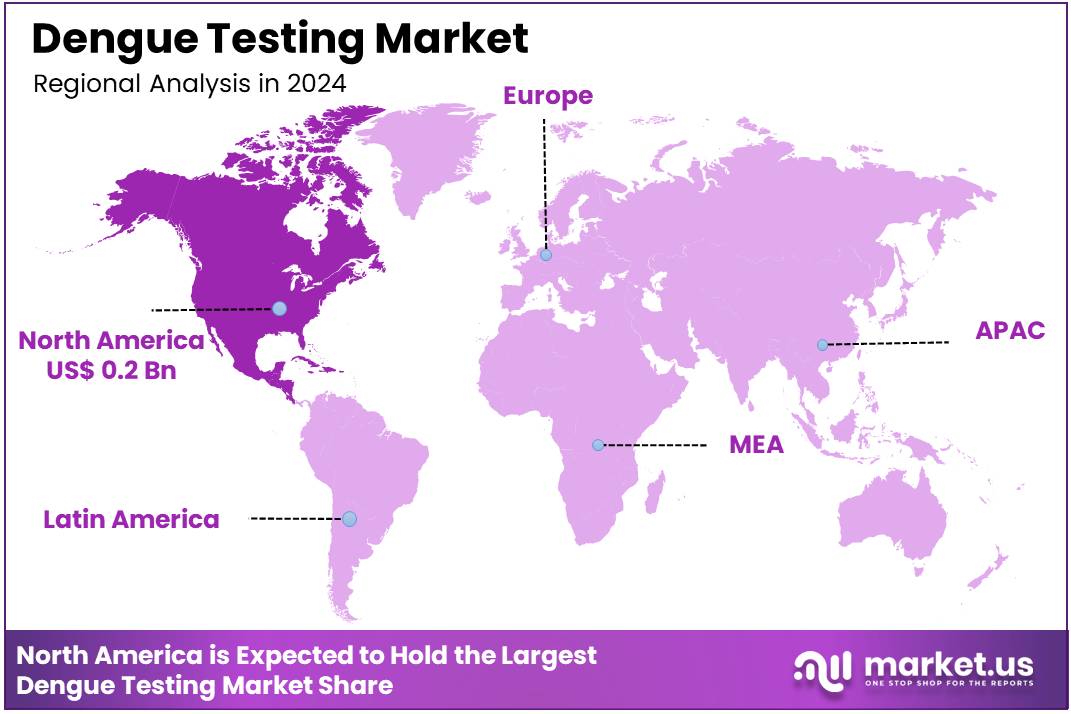

Global Dengue Testing Market size is expected to be worth around US$ 1.0 Billion by 2034 from US$ 0.6 Billion in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.9% share with a revenue of US$ 0.2 Billion.

Increasing global dengue incidence is rapidly expanding the dengue testing market, driven by a confluence of factors. The escalating number of cases, with over 5 million cases reported from 80 countries in 2023, is significantly propelled by climate change and urbanization, which create favorable conditions for mosquito breeding and viral transmission. Climate change, for example, could expose an additional 4.7 billion people to dengue globally by the end of this century. Furthermore, rising public awareness campaigns emphasizing early detection and treatment critically drive market expansion.

Opportunities in the market stem from technological advancements, particularly in point-of-care testing (POCT) devices, offering rapid and user-friendly diagnostics crucial in resource-limited settings. The development of multiplex assays also presents significant opportunities, allowing for differentiation between dengue and other arboviral infections like Zika and chikungunya, thereby improving diagnostic accuracy and patient management.

Recent trends demonstrate a shift towards more precise and comprehensive testing solutions across various applications. For instance, diagnostic applications include acute phase detection through nucleic acid amplification tests (NAATs) and NS1 antigen tests, while serological assays like IgM and IgG ELISAs aid in identifying recent and past infections for surveillance and epidemiological studies.

In June 2024, QIAGEN launched the QIAcuity digital PCR assays, designed for microbial diagnostics, and the addition of assays targeting Dengue virus serotypes 1-4 enhances the company’s commitment to advancing research and surveillance of infectious diseases, providing a powerful tool for more precise detection and monitoring. These advancements significantly improve turnaround times and accessibility, fostering more effective outbreak control and clinical management of dengue fever.

Key Takeaways

- In 2024, the market for dengue testing generated a revenue of US$ 0.6 billion, with a CAGR of 5.1%, and is expected to reach US$ 1.0 billion by the year 2034.

- The product type segment is divided into ELISA-based tests, RT-PCR tests, rapid diagnostic tests, NS1 antigen detection kits, lateral flow immunoassay, and dengue IgG/IgM detection kits, with ELISA-based tests taking the lead in 2023 with a market share of 41.8%.

- Considering service type, the market is divided into centralized service and point-of-care (POC) service. Among these, centralized service held a significant share of 63.5%.

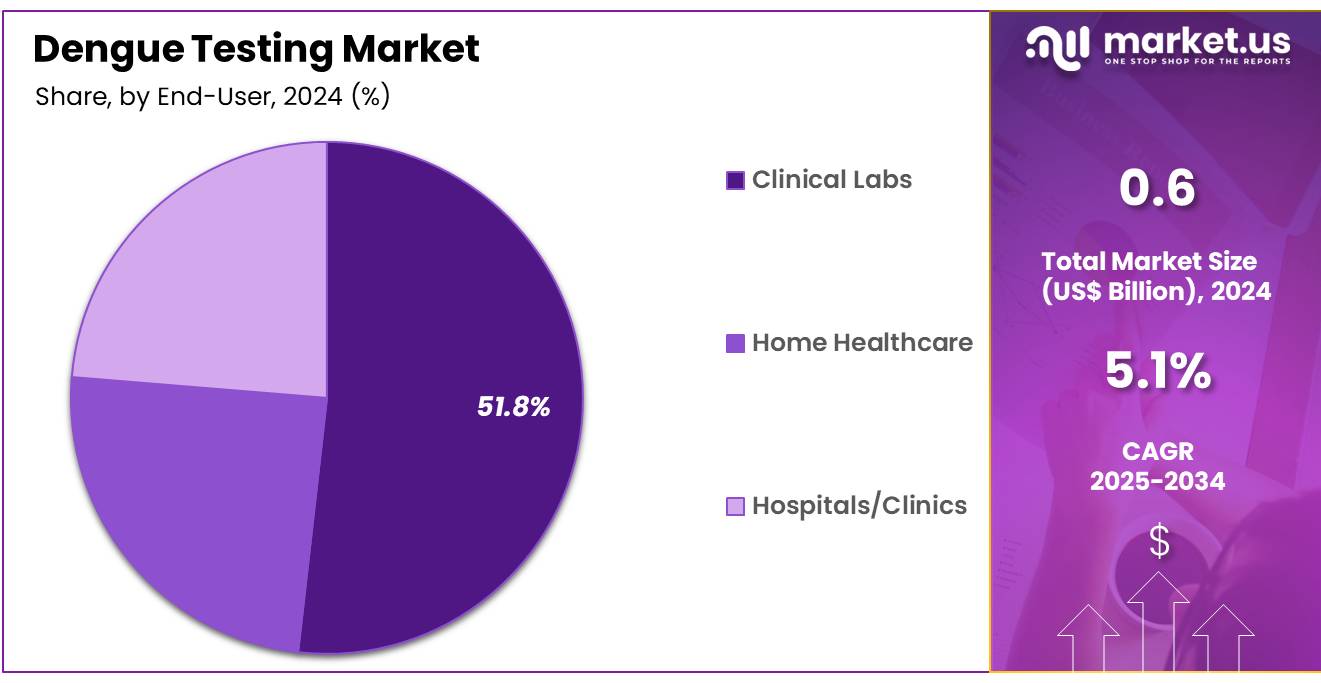

- Furthermore, concerning the end-user segment, the market is segregated into clinical labs, home healthcare, and hospitals/clinics. The clinical labs sector stands out as the dominant player, holding the largest revenue share of 51.8% in the dengue testing market.

- North America led the market by securing a market share of 38.9% in 2024.

Product Type Analysis

ELISA-based tests represent the largest share in the dengue testing market, accounting for 41.8%. The growth of this segment is expected to be driven by the widespread recognition of ELISA as an efficient and cost-effective diagnostic tool. ELISA tests are preferred in many settings for detecting both IgG and IgM antibodies, providing crucial diagnostic information for detecting both current and past dengue infections. The increasing prevalence of dengue in tropical regions and the rise in public health initiatives aimed at early detection and prevention are expected to boost demand for ELISA tests.

Additionally, advancements in the automation and reliability of ELISA platforms are likely to further fuel their adoption in clinical settings. Given their cost-effectiveness, ELISA-based tests remain a cornerstone in dengue diagnostics, particularly in resource-constrained regions where affordability and accessibility are key concerns. As the healthcare sector continues to invest in scalable diagnostic solutions, the ELISA-based tests segment is poised for sustained growth.

Service Type Analysis

Centralized service accounts for 63.5% of the service type segment in the dengue testing market. This dominance is anticipated to continue as centralized laboratories offer the advantage of high-throughput testing and streamlined processes, making them ideal for managing large volumes of dengue tests, particularly during outbreaks. Centralized services allow for the deployment of advanced diagnostic technologies, improving the accuracy and speed of test results.

These facilities are expected to become more critical as the demand for efficient and reliable testing continues to rise globally. The integration of automated systems and improved workflows in centralized laboratories will likely lead to enhanced diagnostic capabilities, ensuring faster turnaround times for test results. Furthermore, as healthcare systems increasingly prioritize accuracy and efficiency in disease surveillance, centralized services are expected to remain a pivotal component in the management of dengue and other infectious diseases.

End-User Analysis

Clinical labs hold a dominant share of 51.8% in the dengue testing market, and their importance is expected to grow due to their central role in diagnosing infectious diseases like dengue. The rising number of cases globally, particularly in regions with endemic dengue, is driving demand for reliable diagnostic solutions in clinical labs. These labs are well-positioned to offer a variety of testing methods, including ELISA, RT-PCR, and rapid diagnostic tests, to meet the diverse needs of healthcare providers.

As public health concerns related to dengue intensify, clinical labs are increasingly relied upon for timely and accurate diagnosis, which is critical for effective disease management and containment. The ongoing development of more efficient diagnostic platforms and the growing integration of digital technologies to streamline laboratory processes are projected to further boost the role of clinical labs in the dengue testing market. As healthcare continues to focus on improving diagnostic precision and patient outcomes, the demand for clinical labs to handle complex diagnostic needs will likely increase.

Key Market Segments

By Product Type

- ELISA-based Tests

- RT-PCR Tests

- Rapid Diagnostic Tests

- NS1 Antigen Detection Kits

- Lateral Flow Immunoassay

- Dengue IgG/IgM Detection Kits

By Service Type

- Centralized Service

- Point-of-Care (POC) Service

By End-user

- Clinical Labs

- Home Healthcare

- Hospitals/Clinics

Drivers

Escalating Global Incidence is driving the market

The escalating global incidence of dengue fever represents a significant driver for the dengue testing market. The disease, transmitted by Aedes mosquitoes, continues to expand its geographical reach and intensify in endemic areas, leading to a pressing need for accurate and timely diagnosis. According to the World Health Organization (WHO), over 7.6 million dengue cases were reported globally as of April 30, 2024, including 3.4 million confirmed cases, significantly surpassing the 4.6 million cases reported in 2023.

The Americas region, in particular, has seen a dramatic rise, with cases exceeding seven million by the end of April 2024. This increase in case numbers directly translates into a higher demand for diagnostic kits and services, as healthcare systems worldwide grapple with identifying infections, particularly in the early stages, to prevent severe outcomes.

The high number of cases reported, such as over 13 million suspected cases in Latin America and the Caribbean in 2024, further underscores the urgent need for effective diagnostic solutions. This continuous surge in outbreaks fuels investments in diagnostic research and development, driving the introduction of novel testing methodologies and expanding the overall market size.

Restraints

High Cost of Advanced Diagnostics is restraining the market

The high cost associated with advanced dengue diagnostic technologies acts as a significant restraint on market growth, particularly in resource-limited settings where the disease burden is often highest. While highly accurate methods like RT-PCR offer superior sensitivity and specificity for early detection, their expensive equipment, specialized reagents, and the need for trained personnel limit their widespread adoption in many endemic regions. This economic barrier often forces public health systems and individual patients to rely on less sensitive, albeit more affordable, rapid diagnostic tests (RDTs), which can sometimes lead to false-negative or false-positive results, delaying appropriate treatment.

For instance, while ELISA-based tests and rapid diagnostic tests remain widely used due to their cost-effectiveness, their limitations in early infection detection or differentiation of serotypes can impact patient management. The substantial investment required for high-throughput laboratory automation and RT-PCR platforms, although beneficial for same-day turnaround in clinical labs, presents a considerable hurdle for healthcare facilities with constrained budgets.

Opportunities

Emergence of Point-of-Care (POC) Testing is creating growth opportunities

The emergence and increasing adoption of Point-of-Care (POC) testing solutions are creating significant growth opportunities in the dengue testing market. These rapid, portable, and user-friendly diagnostic devices enable immediate testing and results outside traditional laboratory settings, such as in clinics, remote areas, and even at home. This accessibility is crucial for early detection in areas with limited healthcare infrastructure, allowing for prompt clinical management and improved patient outcomes.

For example, the increasing traction of lateral flow immunoassay (LFIA) kits like SD BIOLINE Dengue Duo and Panbio Dengue Rapid Tests, particularly during the 2024 dengue surges in Latin America and Southeast Asia, highlights the growing demand for quick diagnostics. The focus on expanding point-of-care testing adoption, particularly in regions like North America with robust public health surveillance, further signifies this trend. The ability of POC tests to reduce turnaround times and facilitate rapid intervention makes them an attractive solution for managing dengue outbreaks efficiently and effectively.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly shape the dengue testing market. Economic downturns and inflation directly affect healthcare budgets, limiting public health spending on surveillance programs and the procurement of diagnostic tools, particularly advanced and more expensive ones. Countries experiencing economic instability often face reduced foreign aid and investment in healthcare infrastructure, hindering the widespread adoption of effective testing strategies.

Conversely, periods of economic growth can lead to increased government allocation for public health initiatives, research and development in diagnostics, and improved access to testing services. Geopolitical tensions, such as trade disputes or regional conflicts, disrupt global supply chains for raw materials and finished diagnostic products. These disruptions cause delays, increase transportation costs, and potentially lead to shortages of essential testing components, impacting product availability and pricing in affected regions. However, these challenges also spur innovation, encouraging domestic manufacturing and regional collaborations to secure supply chains and foster self-sufficiency in diagnostic production, ultimately strengthening regional market resilience.

Current US tariffs on imported goods, particularly those impacting the medical device and pharmaceutical sectors, directly influence the dengue testing market. The imposition of tariffs on materials and components sourced from certain countries, predominantly China, increases the manufacturing costs for diagnostic kit producers. These elevated costs are often passed on to consumers, leading to higher prices for dengue tests and potentially limiting accessibility, especially in a market where cost-effectiveness is a critical factor for adoption in endemic regions.

For example, recent announcements in May 2024 indicated increased tariffs on items like syringes and medical masks from China, with some taking effect in August 2024. While specific tariffs on dengue test kits may vary or be subject to exclusions, the broader impact on the medical supply chain, which saw a $6.6 billion increase in supply expenses from 2022 to 2023 for US hospitals, inevitably affects related diagnostic products. Such tariffs can also incentivize domestic manufacturing, fostering local production capabilities and reducing reliance on external supply chains, thereby stimulating innovation and investment within the United States for diagnostic solutions.

Latest Trends

Integration of Multiplex and AI-powered Diagnostics is a recent trend

A recent and significant trend in the dengue diagnostics market is the increasing integration of multiplex testing technologies and the advent of AI-powered diagnostic platforms. Multiplex assays allow for the simultaneous detection of multiple dengue serotypes or even co-circulating arboviruses like chikungunya and Zika from a single sample, providing a comprehensive and efficient diagnostic solution. This trend is driven by the need for faster and more accurate differential diagnoses, especially given the re-emergence of certain serotypes, such as DENV-3 in the Americas in 2024-2025.

For instance, the CDC’s use of the CDC DENV-1-4 real-time reverse transcriptase PCR assay highlights the move towards serotype-specific detection. Complementing this, AI and machine learning are being increasingly explored to enhance diagnostic accuracy, interpret complex test results, and even predict outbreak patterns, streamlining the diagnostic workflow. Although still in nascent stages, the development of biosensor-based diagnostics and advanced multiplexing technologies for simultaneous pathogen detection are indicative of this forward-looking trend, aiming to improve speed, accuracy, and comprehensiveness in dengue diagnosis.

Regional Analysis

North America is leading the Dengue Testing Market

The dengue testing market in North America, representing 38.9% of the global market, experienced substantial growth in 2024, primarily driven by a significant increase in reported dengue cases and heightened public health initiatives. For instance, in Puerto Rico, a US territory, a public health emergency was declared in March 2024 due to rising dengue cases, with a total of 6,291 confirmed cases reported in 2024. This surge necessitated increased diagnostic testing to monitor the outbreak and manage patient care effectively.

The overall Region of the Americas, which includes North America, witnessed an alarming increase in dengue incidence, with over 7.6 million cases reported to WHO globally by April 30, 2024, surpassing the annual high of 4.6 million cases in 2023. This widespread increase across the Americas directly fueled the demand for accurate and rapid dengue diagnostics in North America.

Advancements in diagnostic technologies, such as the development of rapid NS1 antigen assays and multiplex PCR platforms, played a crucial role. These innovations provided faster and more reliable testing solutions, supporting early detection and improving patient outcomes, thereby driving market expansion. The continuous threat of imported cases due to increased global travel also spurred investments in laboratory upgrades and expanded point-of-care testing adoption, particularly in the US and Canada, bolstering the growth of the dengue testing sector.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The dengue testing market in Asia Pacific is anticipated to exhibit robust growth during the forecast period, propelled by the high endemicity of dengue, increasing urbanization, and expanding public health programs. Countries like India, Indonesia, and Thailand consistently report a substantial burden of dengue cases.

For example, India reported 289,235 dengue cases in 2023, the highest in the last 5 years, according to the National Centre for Vector Borne Diseases Control, underscoring the pressing need for extensive testing. Furthermore, as of August 2, 2024, India has already reported over 32,000 dengue cases, with 18,391 cases in the corresponding period of 2023, as stated by the Minister of State for Health and Family Welfare Prataprao Jadhav in the Lok Sabha. In addition, Karnataka reported 32,886 cases in 2024 (as of July 19, 2025 data), a significant increase from 19,300 cases in 2023.

Similarly, Malaysia, a part of the Western Pacific region, reported 17,497 cases in 2022, a 57.6% increase compared to the same period in the previous year, highlighting the escalating demand for diagnostics. Governments across the region are implementing national vector control programs, which frequently fund the deployment of ELISA and RT-PCR tests in regional laboratories and point-of-care NS1 rapid tests in community health centers.

Ongoing technological advancements, including the development of rapid diagnostic tests (RDTs) and molecular diagnostics, are expected to enhance testing accessibility and efficiency. Innovations like the introduction of portable RT-PCR molecular tests, such as one launched by Anitoa System in May 2022, and the development of high-accuracy dry luminescence assay tests, are further projected to drive market expansion by offering faster and more accurate diagnostic solutions in resource-constrained settings. These factors collectively indicate a strong growth trajectory for the dengue testing sector in Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the dengue testing market implement a combination of strategies to drive sustained growth and enhance their competitive edge. They focus on expanding product portfolios by developing rapid, accurate, and cost-effective diagnostic solutions that cater to diverse market needs. Innovation plays a crucial role, as companies invest in advanced testing technologies, such as molecular and antigen-based methods, to improve diagnostic accuracy and efficiency.

Strategic partnerships with research institutions, healthcare providers, and governments enable players to strengthen their market position and facilitate quicker adaptation to regional needs. Furthermore, expanding distribution networks into emerging markets experiencing a higher incidence of dengue proves vital for revenue growth. Companies also capitalize on public health initiatives and educational campaigns to enhance awareness, ensuring greater market penetration and customer trust.

Abbott Laboratories, a global leader in healthcare and diagnostics, exemplifies a key player in this space. The company has developed cutting-edge dengue diagnostic solutions that provide fast and reliable results, making them a valuable tool for healthcare professionals worldwide. Abbott’s strategic focus on technological innovation, combined with its global reach, enables it to address the growing demand for effective diagnostic tools, ensuring its leadership in the market.

Top Key Players

- Thermo Fisher Scientific Inc

- Quest Diagnostics Incorporated

- PerkinElmer Inc. (Euroimmun AG)

- NovaTec Immundiagnostica GmbH

- InBios International, Inc

- Hoffmann‑La Roche Ltd

- DiaSorin S.p.A.

- Certest Biotec

- Abnova Corporation

- Abbott

Recent Developments

- In December 2024, bioMérieux revealed that the BIOFIRE FILMARRAY Tropical Fever (TF) Panel earned Special 510(k) clearance from the US FDA. This advanced PCR-based diagnostic tool offers quick and accurate pathogen detection in patients with unexplained fever, including dengue, enabling healthcare professionals to make timely and informed treatment choices.

- In August 2024, J Mitra & Company unveiled the Dengue NS1 Antigen self-test kit, a groundbreaking diagnostic tool for home use in India. This kit empowers individuals to test for dengue independently, providing results in as little as 20 minutes with easy-to-read visual indicators, making it an accessible solution for timely detection.

Report Scope

Report Features Description Market Value (2024) US$ 0.6 Billion Forecast Revenue (2034) US$ 1.0 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (ELISA-based Tests, RT-PCR Tests, Rapid Diagnostic Tests, NS1 Antigen Detection Kits, Lateral Flow Immunoassay, and Dengue IgG/IgM Detection Kits), By Service Type (Centralized Service and Point-of-Care (POC) Service), By End-user (Clinical Labs, Home Healthcare, and Hospitals/Clinics) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc, Quest Diagnostics Incorporated, PerkinElmer Inc. (Euroimmun AG), NovaTec Immundiagnostica GmbH, InBios International, Inc, F. Hoffmann‑La Roche Ltd, DiaSorin S.p.A., Certest Biotec, Abnova Corporation, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc

- Quest Diagnostics Incorporated

- PerkinElmer Inc. (Euroimmun AG)

- NovaTec Immundiagnostica GmbH

- InBios International, Inc

- Hoffmann‑La Roche Ltd

- DiaSorin S.p.A.

- Certest Biotec

- Abnova Corporation

- Abbott