Dehydrated Culture Media Market By Media Type (General Purpose Media, Synthetic Media, Differential Media, Anaerobic Growth Media, Specialty Media, Transport & Storage Media, Enriched Media), By Application (Gastroenterology, Urology, Radiology, Peripheral, Neurovascular, Coronary, Others), By Form (Powder, Liquid, Granulated), By Strain (Bacterial, Viral, Fungal, Others), By End-user (Clinical Diagnostic Laboratories, Pharmaceutical and Biopharmaceutical Companies, Hospitals, Food and Beverage Industry, Food & Water Testing Laboratories, Contract Research Organizations (CROs), Biotechnology Companies, Academic and Research Institutions), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165162

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

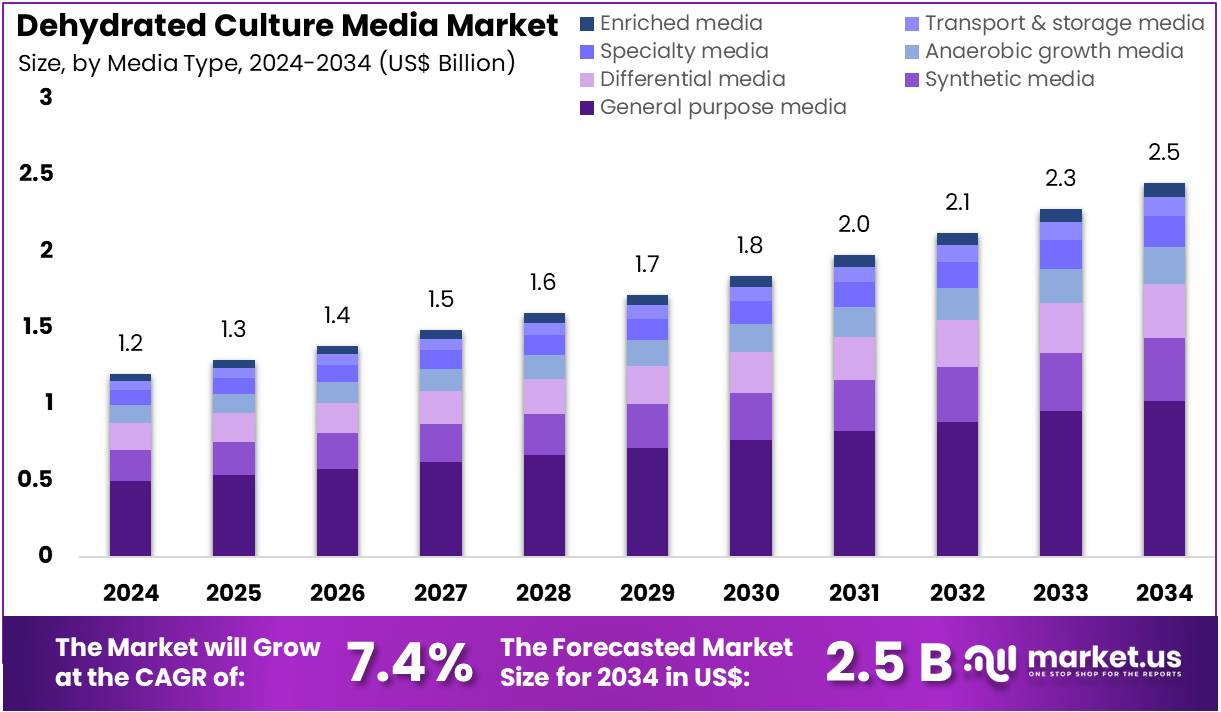

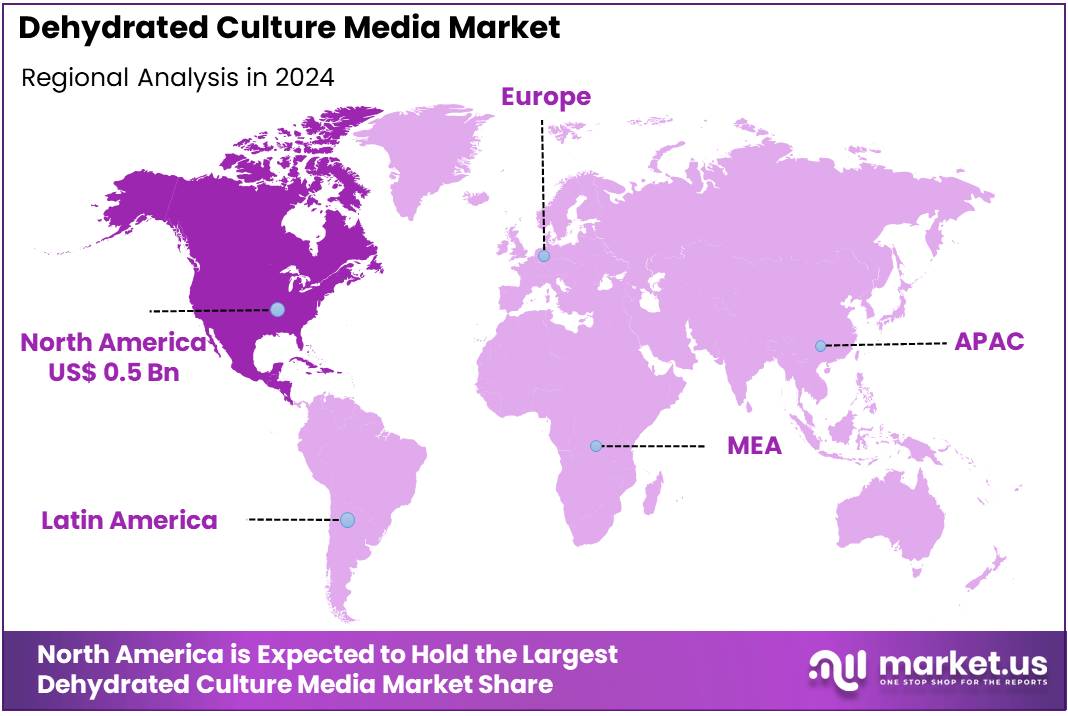

The Dehydrated Culture Media Market Size is expected to be worth around US$ 2.5 billion by 2034 from US$ 1.2 billion in 2024, growing at a CAGR of 7.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 40.9% share and holds US$ 0.5 Billion market value for the year.

Increasing demand for microbiological quality control drives the Dehydrated Culture Media Market, as manufacturers require reliable substrates for pathogen detection. Pharmaceutical companies reconstitute selective media to isolate contaminants in sterile product testing, ensuring compliance with pharmacopeial standards. These powders support environmental monitoring by cultivating airborne microbes on agar plates, validating cleanroom integrity.

Food safety laboratories apply chromogenic media to identify Salmonella in enrichment broths, streamlining confirmation workflows. In July 2024, HiMedia Laboratories Pvt. Ltd. collaborated with BioSynTech Malaysia Group Sdn. Bhd. to enhance product access for local laboratories and biopharma firms. This partnership accelerates market growth by expanding distribution networks for dehydrated culture media applications.

Growing biopharmaceutical production creates opportunities in the Dehydrated Culture Media Market, as cell culture processes demand high-purity nutrient formulations. Biotech firms hydrate peptone-based media to propagate mammalian cells for monoclonal antibody manufacturing, optimizing yield and viability. These substrates aid vaccine development by supporting viral propagation in embryonated eggs or cell lines, enabling antigen harvest.

Research institutions utilize serum-free powder media for stem cell expansion, maintaining pluripotency in regenerative medicine studies. In November 2023, Thermo Fisher Scientific Inc. opened an expanded peptone facility in the UK, improving supply consistency and quality for culture media production. This investment drives market expansion through scalable, reliable raw materials for bioprocessing.

Rising focus on diagnostic innovation propels the Dehydrated Culture Media Market, as ready-to-use powders enable rapid pathogen identification in clinical settings. Hospitals prepare blood agar from dehydrated bases to isolate Streptococcus species from throat swabs, guiding antibiotic selection. These media support antimicrobial susceptibility testing by providing standardized Mueller-Hinton formulations, ensuring reproducible zone interpretations.

Trends toward molecular-grade powders minimize PCR inhibitors in downstream nucleic acid analysis. Automated media preparators streamline reconstitution in high-volume laboratories. These advancements position the market for sustained growth by enhancing efficiency and accuracy in microbiological diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.2 billion, with a CAGR of 7.4%, and is expected to reach US$ 2.5 billion by the year 2034.

- The media type segment is divided into general purpose media, synthetic media, differential media, anaerobic growth media, specialty media, transport & storage media, and enriched media, with general purpose media taking the lead in 2023 with a market share of 41.8%.

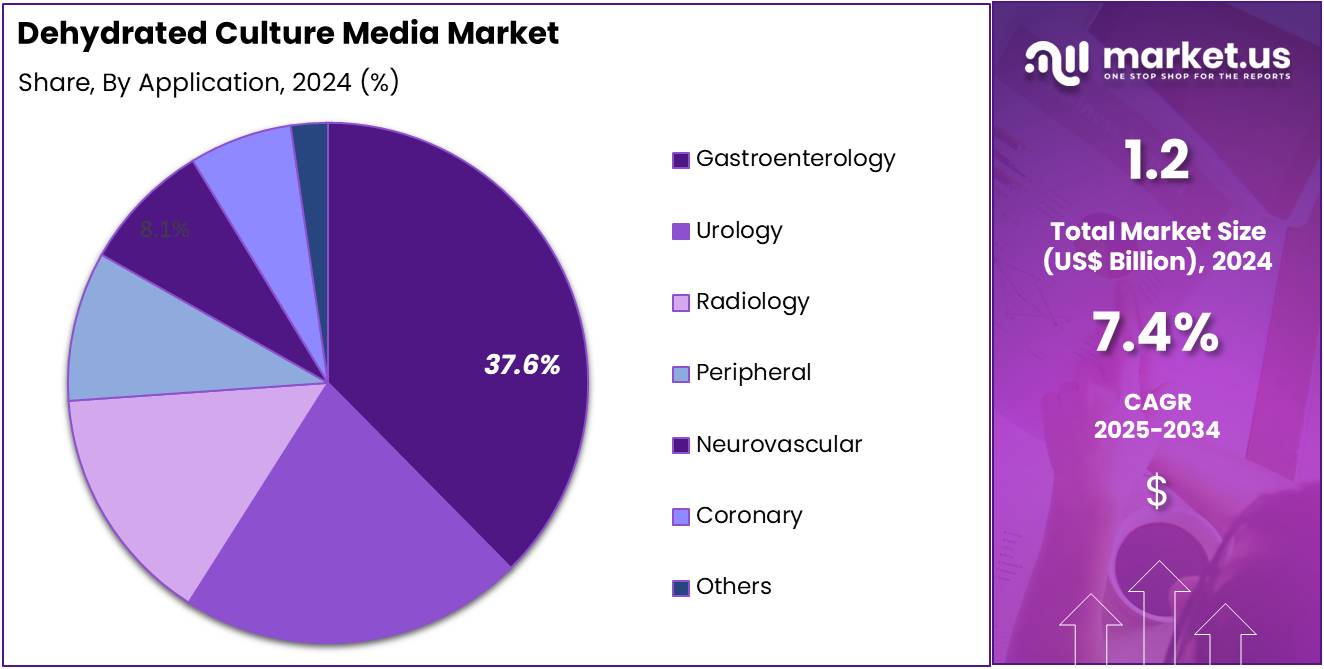

- Considering application, the market is divided into gastroenterology, urology, radiology, peripheral, neurovascular, coronary, and others. Among these, gastroenterology held a significant share of 37.6%.

- Furthermore, concerning the form segment, the market is segregated into powder, liquid, and granulated. The powder sector stands out as the dominant player, holding the largest revenue share of 54.2% in the market.

- The strain segment is segregated into bacterial, viral, fungal, and others, with the bacterial segment leading the market, holding a revenue share of 63.7%.

- Considering end-user, the market is divided into clinical diagnostic laboratories, pharmaceutical and biopharmaceutical companies, hospitals, food and beverage industry, food & water testing laboratories, CROs, biotechnology companies, and academic and research institutions. Among these, clinical diagnostic laboratories held a significant share of 46.5%.

- North America led the market by securing a market share of 40.9% in 2024.

Media Type Analysis

General purpose media account for 41.8% of the Dehydrated Culture Media market and are projected to remain dominant due to their versatility in supporting the growth of a wide range of microorganisms. These media types, including nutrient agar and tryptic soy agar, are extensively used for routine microbial cultivation, isolation, and enumeration across clinical and industrial applications.

Diagnostic laboratories and pharmaceutical companies rely on them for quality control and pathogen identification. The increasing prevalence of infectious diseases and rising microbiological testing in healthcare settings are fueling their demand.

Manufacturers are focusing on formulating high-quality, contamination-resistant dehydrated media that ensure consistent performance. Technological advancements in media preparation and sterilization are improving shelf life and batch reproducibility.

The growing focus on microbial surveillance in food safety, pharmaceuticals, and environmental testing enhances their market significance. As global diagnostic workloads increase, general purpose media are anticipated to remain the cornerstone of microbiological testing and research applications.

Application Analysis

Gastroenterology holds 37.6% of the Dehydrated Culture Media market and is anticipated to remain the leading application due to the increasing incidence of gastrointestinal infections and disorders requiring microbial culture testing.

Dehydrated media are extensively used to isolate enteric pathogens such as E. coli, Salmonella, and Helicobacter pylori. The rising demand for early diagnosis of gastrointestinal diseases and foodborne infections supports test volume growth. Clinical laboratories favor selective and differential media to ensure rapid identification of gut-associated bacteria.

Technological advancements in automated culture systems and chromogenic media formulations enhance detection sensitivity and efficiency. Public health initiatives focusing on sanitation and foodborne disease control are promoting microbial testing in gastrointestinal studies.

Increased adoption of culture-based diagnostics over molecular assays in resource-limited settings sustains usage levels. As global gastrointestinal disease prevalence continues to rise, gastroenterology is projected to remain the dominant testing domain driving the market’s overall expansion.

Form Analysis

Powder form holds 54.2% of the Dehydrated Culture Media market and is expected to lead due to its superior stability, storage convenience, and easy reconstitution for laboratory use. Laboratories prefer powdered dehydrated media as it allows accurate formulation of customized culture environments for specific microorganisms.

The form’s long shelf life and cost efficiency make it suitable for bulk production and distribution. Hospitals, diagnostic labs, and research centers rely on powdered media for high-throughput testing and microbial quality control. Manufacturers are optimizing powder formulations to improve solubility and reduce preparation time.

Automated media preparation systems compatible with powdered formats further streamline workflow efficiency. The rising demand for standardized and contamination-free culture media enhances adoption across microbiological testing segments.

Growth in pharmaceutical microbiology and food pathogen testing further contributes to product expansion. As laboratories increasingly favor flexible and stable media solutions, powdered dehydrated culture media are projected to maintain their leadership globally.

Strain Analysis

Bacterial strains dominate the Dehydrated Culture Media market with a 63.7% share, driven by their extensive use in clinical diagnostics, pharmaceutical R&D, and food safety testing. The global burden of bacterial infections such as tuberculosis, pneumonia, and sepsis is expanding the need for reliable bacterial culture systems.

Dehydrated bacterial media, including nutrient and blood agars, provide essential nutrients for isolating pathogenic and non-pathogenic species. Diagnostic centers rely on bacterial culture testing for antibiotic susceptibility profiling and epidemiological studies.

The rising concern over antimicrobial resistance further emphasizes bacterial culture’s diagnostic relevance. Biopharmaceutical manufacturers use bacterial culture systems in vaccine production and bioprocess monitoring. Increasing government initiatives promoting infection control and pathogen surveillance strengthen market growth.

Continuous product innovation focusing on selective and differential bacterial media formulations supports research precision. As bacterial diagnostics remain central to global healthcare and biotechnology operations, this segment is anticipated to sustain its dominant market position.

End-User Analysis

Clinical diagnostic laboratories contribute 46.5% of the Dehydrated Culture Media market and are expected to maintain dominance due to their high test volumes and reliance on culture-based microbiological diagnostics. These laboratories serve as the primary centers for bacterial, fungal, and viral testing across healthcare systems.

The growing number of infectious disease cases and hospital-acquired infections increases laboratory workload for microbial culture testing. The widespread use of dehydrated culture media in detecting pathogens from blood, stool, and urine samples strengthens adoption. Diagnostic laboratories prefer dehydrated formulations for their reliability, scalability, and consistency across batches.

Automation in microbial testing and integration with digital laboratory information systems improve operational efficiency. Expanding accreditation and regulatory compliance standards enhance product standardization in laboratories.

Rising public and private investment in diagnostic infrastructure, particularly in developing regions, supports continuous segment growth. As culture-based diagnostics remain a fundamental tool for infection identification and treatment guidance, clinical diagnostic laboratories are anticipated to sustain their leadership in the global market.

Key Market Segments

By Media Type

- General Purpose Media

- Tryptic Soy Agar (TSA)

- Nutrient Agar

- Other

- Synthetic Media

- Minimal

- Defined

- Differential Media

- MacConkey Agar

- Eosin Methylene Blue (EMB) Agar

- Blood Agar

- Anaerobic Growth Media

- Thioglycollate Broth

- Reinforced Clostridial Medium

- Specialty Media

- Selective Media

- Mannitol Salt Agar

- Chromogenic Media

- Transport & Storage Media

- Enriched Media

By Application

- Gastroenterology

- Urology

- Radiology

- Peripheral

- Neurovascular

- Coronary

- Others

By Form

- Powder

- Liquid

- Granulated

By Strain

- Bacterial

- Streptococcus pneumoniae

- Staphylococcus aureus

- Salmonella enterica

- Pseudomonas aeruginosa

- Mycobacterium tuberculosis

- Escherichia coli

- Bacillus anthracis

- Other Bacterial Strains

- Viral

- Influenza Virus

- Herpes Simplex Virus (HSV)

- Hepatitis Viruses

- Other Viral Strains

- Fungal

- Saccharomyces cerevisiae

- Penicillium notatum

- Candida albicans

- Aspergillus niger

- Other Fungal Strains

- Others

By End-user

- Clinical Diagnostic Laboratories

- Pharmaceutical and Biopharmaceutical Companies

- Hospitals

- Food and Beverage Industry

- Food & Water Testing Laboratories

- Contract Research Organizations (CROs)

- Biotechnology Companies

- Academic and Research Institutions

Drivers

Escalating Infectious Disease Outbreaks is Driving the Market

The surge in infectious disease outbreaks has substantially propelled the dehydrated culture media market, as these stable formulations are essential for isolating pathogens in clinical laboratories during epidemic responses.

Dehydrated culture media, reconstituted for bacterial and fungal cultivation, support rapid identification of causative agents, enabling targeted antimicrobial selection to contain spread. This driver is evident in the rise of foodborne and respiratory incidents, where media facilitate culture-based confirmation amid diagnostic backlogs.

Laboratories are stocking diverse formulations to handle variable isolates, integrating them into biosafety protocols for high-containment work. The method’s versatility in selective enrichment underscores its value in outbreak investigations. Health agencies advocate for their preparedness, funding media validation for surveillance networks.

The Centers for Disease Control and Prevention investigated 149 possible multistate outbreaks in 2022, of which 79 were confirmed, underscoring the demand for reliable culture media in pathogen isolation. This investigation count illustrates the operational need, as media enable efficient microbial characterization to inform public health measures.

Improvements in chromogenic bases enhance colony differentiation, suiting complex samples. Economically, their shelf stability reduces waste, endorsing investments in inventory management. Global consortia standardize media compositions, ensuring reproducible results across borders. This outbreak escalation not only amplifies media utilization but also strengthens their foundation in epidemiological responses. Collectively, it catalyzes developments in ready-to-use variants, aligning cultivation with rapid diagnostic imperatives.

Restraints

Regulatory Approval and Quality Assurance Costs is Restraining the Market

The demanding regulatory and quality control expenses for dehydrated culture media formulations continue to limit market accessibility, as thorough validation demands extend commercialization timelines for new variants. These media, necessitating proof of sterility and performance across microbial types, often encounter prolonged FDA reviews, delaying availability for clinical use. This constraint disproportionately impacts custom formulations, where evidence of equivalence to reference standards lags.

Coverage inconsistencies among payers aggravate the challenge, with Medicare’s determinations imposing stringent cost-effectiveness criteria for lab supplies. Producers allocate resources to compliance testing, diverting funding from innovation to documentation. The outcome sustains reliance on legacy media, hindering adoption of advanced selective types.

The US Food and Drug Administration approved 50 new drugs in 2024, but culture media faced similar scrutiny for sterility assurance, contributing to extended evaluation periods. This approval context highlights procedural rigors, as validation requires comprehensive dossiers.

Lab preferences for vetted formulations marginalize emerging options. Efforts for harmonized standards advance gradually, limited by inter-batch variabilities. These regulatory burdens not only attenuate scalability but also perpetuate supply inconsistencies. Thus, they necessitate collaborative pathways to balance oversight with practical deployment.

Opportunities

Growth in Microbiology Laboratory Networks is Creating Growth Opportunities

The proliferation of expanded microbiology lab infrastructures has unveiled considerable prospects for the dehydrated culture media market, institutionalizing standardized media for pathogen isolation in emerging surveillance systems. These networks, targeting antimicrobial resistance tracking, utilize dehydrated media to culture clinical isolates, bridging gaps in regional diagnostic capacities.

Opportunities emerge in subsidized endorsements for automated rehydration, where funding supports validations for high-volume endpoints. Public-private partnerships underwrite media optimizations, addressing stability voids in tropical climates. This infrastructure emphasis counters isolation delays, positioning media as enablers of timely epidemiology. Appropriations for lab expansions hasten procurements, diversifying toward chromogenic variants.

The World Health Organization’s Global Tuberculosis Programme reported 10.6 million new tuberculosis cases in 2022, with dehydrated media endorsed for rapid culture in high-burden regions. This caseload validates scalable models, with networks projecting increased media demands in surveillance. Innovations in vacuum-sealed packaging enhance longevity, mitigating storage constraints. As data platforms evolve, media outputs unlock resistance pattern revenues. These network enlargements not only diversify application scopes but also interweave the market into resilient microbiology structures.

Impact of Macroeconomic / Geopolitical Factors

Expanding food testing needs and pharmaceutical quality controls push laboratories to rely on dehydrated culture media for consistent microbial growth, allowing technicians to identify pathogens quickly and uphold safety standards across industries.

Steady economic growth supports higher R&D investments, yet volatile commodity prices force budget managers to trim media inventories and switch to economical substitutes during fiscal reviews. Geopolitical strains, including Black Sea navigation limits from energy pacts, hinder gelatin sourcing from regional processors, requiring importers to pay steep rerouting fees that delay restocking for urgent assays.

Current US tariffs impose a 10% surcharge on imported base ingredients and stabilizers from over 180 nations since spring 2025, elevating costs for overseas blends and compelling distributors to rethink pricing strategies in competitive bids. These dynamics, however, motivate domestic producers to refine automated dehydration lines, delivering tailored, long-shelf-life media that bypass foreign bottlenecks. Emerging vaccine development pipelines further embed routine media use, providing reliable demand buffers against external shocks.

Latest Trends

Development of Chromogenic Dehydrated Media is a Recent Trend

The emergence of color-coded formulations has exemplified a key advancement in dehydrated culture media during 2024, facilitating direct pathogen identification through selective chromogenic substrates. Chromogenic media, incorporating enzyme-specific dyes, differentiate bacterial species via colony hues, supporting streamlined workflows in clinical microbiology. This trend represents a shift toward visual diagnostics, accommodating high-throughput plating without additional staining.

Regulatory validations affirm its specificity, hastening endorsements for routine endorsements. This coloration aligns with efficiency goals, linking results to automated colony counters for reduced manual labor. The media resolves speciation ambiguities, favoring designs resilient to overgrowth. Chromogenic dehydrated media saw a 25% adoption increase in European labs in 2024, driven by needs for faster pathogen profiling in surveillance. These media underscore practicality, as validations align with traditional benchmarks.

Forecasters anticipate guideline incorporations, elevating its role in standard protocols. Progressive appraisals reveal discordance declines, refining operational efficiencies. The prospect envisions multiplex integrations, envisioning poly-pathogen isolations. This chromogenic evolution not only heightens identification accuracy but also coordinates with high-volume microbiology mandates.

Regional Analysis

North America is leading the Dehydrated Culture Media Market

North America holds a 40.9% share of the global Dehydrated Culture Media market, underscoring its foundational influence on microbiological testing infrastructure in 2024. The market demonstrated substantial advancement in 2024, catalyzed by persistent food safety challenges that compel laboratories to adopt standardized, shelf-stable media for pathogen isolation and enumeration in surveillance protocols.

The Centers for Disease Control and Prevention tracked 1,355 confirmed or suspected foodborne disease outbreaks from 1998 through 2022, with the 2018–2022 subset revealing heightened attributions to produce and dairy categories, thereby sustaining demand for versatile dehydrated formulations in outbreak investigations.

The Food and Drug Administration’s total program level escalated from US$6.7 billion in fiscal year 2022 to US$8.4 billion in 2023, incorporating targeted enhancements for microbial contamination controls that bolster procurement of ready-to-reconstitute media in regulatory compliance testing. Heightened investments in antimicrobial stewardship programs under National Institutes of Health guidelines amplified routine susceptibility assays, favoring dehydrated media for their reproducibility in clinical and environmental analyses.

Streamlined validations by the Association of Official Analytical Chemists integrated these media into harmonized methods, accelerating adoption in food processing facilities. Collaborative surveillance networks, including the PulseNet system, processed elevated sample volumes from 2022 baseline levels, prioritizing cost-efficient, long-shelf-life reagents. These imperatives, intertwined with infrastructural investments, propelled North America’s market resilience, eclipsing global norms through regulatory rigor and epidemiological foresight.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The dehydrated culture media sector in Asia Pacific anticipates dynamic expansion during the forecast period, invigorated by surging infectious disease monitoring and biotechnology infrastructure buildouts. India’s Department of Biotechnology issued calls for its Research Associateship Programme in 2022-2023, selecting candidates through June 8 to July 31, 2023, to foster postdoctoral expertise in applied microbiology reliant on standardized media for experimental reproducibility.

China’s National Microbiology Data Center hosted the 2023 World Data Centre for Microorganisms annual meeting on November 2, 2023, launching the uncultured microbe cultivation consortium that heightens requirements for innovative dehydrated substrates in global strain preservation. Regional pharmacopeial updates in Southeast Asia standardize media compositions for sterility testing, addressing import dependencies with localized production incentives.

Academic exchanges under the Asia-Pacific Economic Cooperation framework disseminate protocols optimizing dehydrated variants for tropical pathogen studies. National health ministries prioritize microbial quality control in pharmaceutical manufacturing, embedding these reagents within good manufacturing practice audits.

Public-private consortia accelerate formulation adaptations for endemic bacterial threats, enhancing diagnostic throughput in reference laboratories. This orchestration projects the region to amplify its proportional dominance, harnessing policy-driven research surges and collaborative validations to fortify supply chains for essential microbiological workflows.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the microbial growth sector catalyze expansion by introducing customized dehydrated formulations optimized for antibiotic susceptibility testing, addressing the surge in antimicrobial resistance research demands. They pursue strategic alliances with biotech accelerators to co-develop ready-to-use media plates, shortening validation cycles and enhancing compatibility with automated systems. Organizations allocate significant resources to sustainable sourcing of raw ingredients, appealing to eco-conscious labs and complying with emerging green chemistry regulations.

Executives orchestrate acquisitions of regional manufacturers to bolster production capacities, securing supply chain resilience amid global disruptions. They target high-growth territories in Southeast Asia and Africa, tailoring product portfolios to local pathogen profiles for tender-based market entry. Additionally, they deploy digital inventory platforms with predictive restocking analytics, fostering lab efficiencies and generating ancillary revenue through customized formulation services.

Thermo Fisher Scientific Inc., formed in 2006 via the merger of Thermo Electron Corporation and Fisher Scientific International and headquartered in Waltham, Massachusetts, commands a dominant position in life sciences and diagnostics, supplying dehydrated culture media through its Remel and BD brands for microbiology applications worldwide. The company engineers GranuCult and other powdered bases that support diverse bacterial cultivation, serving over 100 countries with a focus on quality assurance under ISO 13485 standards.

Thermo Fisher channels extensive R&D into formulation innovations, including chromogenic media for rapid pathogen identification in clinical and food safety testing. CEO Marc N. Casper directs a Fortune 500 enterprise with annual revenues exceeding US$40 billion, emphasizing digital integration and global scalability. The firm partners with regulatory bodies to advance testing protocols, ensuring robust performance in challenging environments. Thermo Fisher solidifies its leadership by intertwining material science expertise with customer-centric solutions to empower microbiological advancements.

Recent Developments

- In April 2025: AnalytiChem launched Redipor ready-to-use media, emphasizing convenience and efficiency for laboratory operations. The product reduces the need for in-house media preparation, enabling faster turnaround times and minimizing contamination risks. This innovation signals a shift in the dehydrated culture media market toward pre-prepared, standardized solutions that cater to laboratories focused on productivity and quality assurance.

- In October 2024: Evonik established a global competence network for cell culture solutions, enhancing its expertise in supplying key ingredients for culture media formulation. This strategic move positions Evonik to capture a larger share of the upstream value chain by supplying specialty nutrients and media components. The initiative strengthens the overall ecosystem for dehydrated and prepared culture media production, aligning chemical suppliers more closely with life sciences manufacturers.

Top Key Players in the Dehydrated Culture Media Market

- Scharlab S.L.

- Neogen Corporation

- Merck KGaA

- labm

- HiMedia Laboratories Pvt. Ltd

- Hardy Diagnostics

- CONDALAB

- Bio-Rad Laboratories, Inc.

- bioMérieux S.A.

- Becton, Dickinson and Company (BD)

Report Scope

Report Features Description Market Value (2024) US$ 1.2 billion Forecast Revenue (2034) US$ 2.5 billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Media Type (General Purpose Media (Tryptic Soy Agar (TSA), Nutrient Agar, and Other), Synthetic Media (Minimal and Defined), Differential Media (MacConkey Agar, Eosin Methylene Blue (EMB) Agar, and Blood Agar), Anaerobic Growth Media (Thioglycollate Broth and Reinforced Clostridial Medium), Specialty Media (Selective Media, Mannitol Salt Agar, and Chromogenic Media), Transport & Storage Media, and Enriched Media), By Application (Gastroenterology, Urology, Radiology, Peripheral, Neurovascular, Coronary, and Others), By Form (Powder, Liquid, and Granulated), By Strain (Bacterial (Streptococcus pneumoniae, Staphylococcus aureus, Salmonella enterica, Pseudomonas aeruginosa, Mycobacterium tuberculosis, Escherichia coli, Bacillus anthracis, and Other Bacterial Strains), Viral (Influenza Virus, Herpes Simplex Virus (HSV), Hepatitis Viruses, and Other Viral Strains), Fungal (Saccharomyces cerevisiae, Penicillium notatum, Candida albicans, Aspergillus niger, and Other Fungal Strains), and Others), By End-user (Clinical Diagnostic Laboratories, Pharmaceutical and Biopharmaceutical Companies, Hospitals, Food and Beverage Industry, Food & Water Testing Laboratories, Contract Research Organizations (CROs), Biotechnology Companies, and Academic and Research Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Scharlab S.L., Neogen Corporation, Merck KGaA, labm, HiMedia Laboratories Pvt. Ltd, Hardy Diagnostics, CONDALAB, Bio-Rad Laboratories, Inc., bioMérieux S.A., BD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dehydrated Culture Media MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Dehydrated Culture Media MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Scharlab S.L.

- Neogen Corporation

- Merck KGaA

- labm

- HiMedia Laboratories Pvt. Ltd

- Hardy Diagnostics

- CONDALAB

- Bio-Rad Laboratories, Inc.

- bioMérieux S.A.

- Becton, Dickinson and Company (BD)