Global Crop Insurance Market Size, Share Analysis By Coverage (Multi Peril Crop Insurance (MPCI), Crop Hail Insurance, Others), By Type (Crop Yield Insurance, Crop Revenue Insurance), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Commercial Crops (Cotton, Sugarcane, etc.), Other Crops), By Farm Size (Smallholder (Less Than 2 ha), Medium (2-10 ha), Large (Greater Than 10 ha)), By Distribution Channel (Banks, Insurance Companies, Brokers/Agents, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155109

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Role of AI

- US Market Size

- Top 5 Trends and Innovations

- Top 5 Growth Factors

- By Coverage

- By Type

- By Crop Type

- By Farm Size

- By Distribution Channel

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

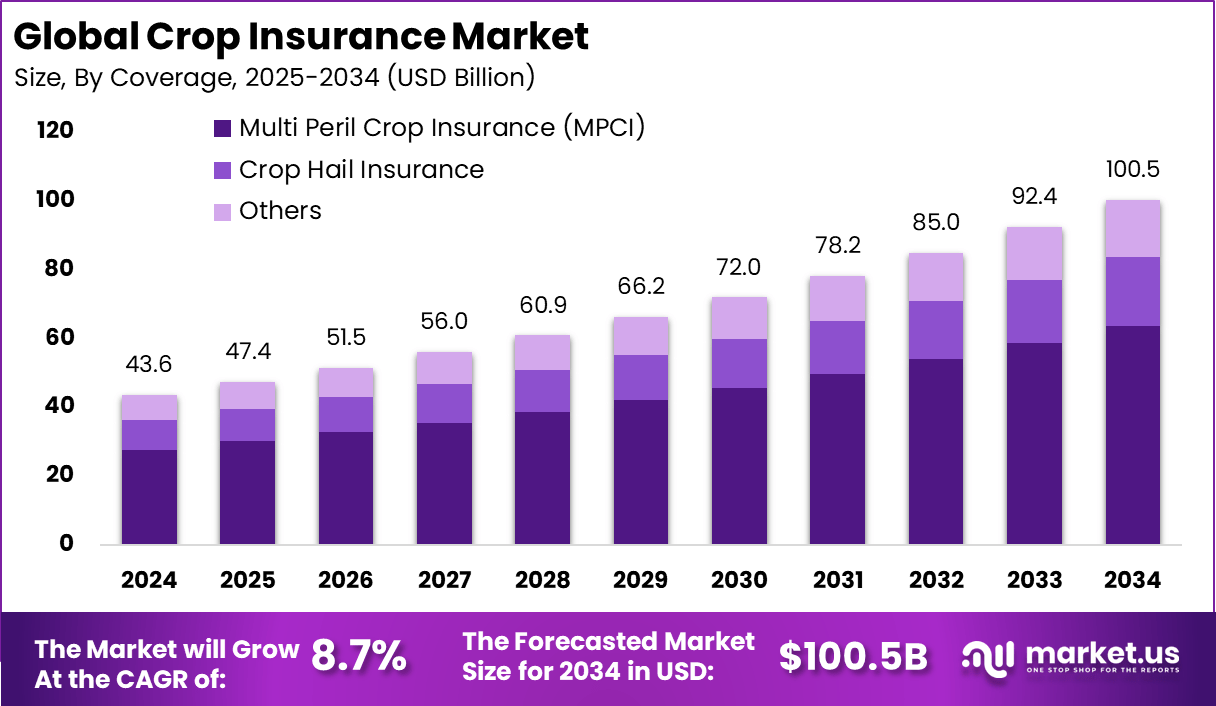

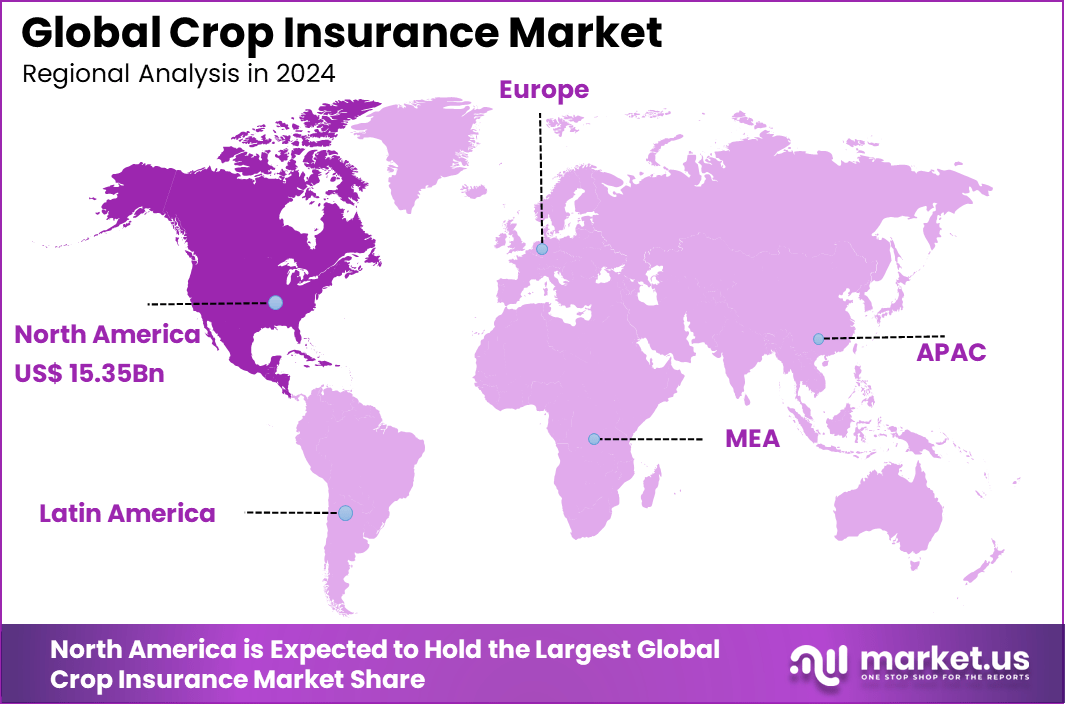

The Global Crop Insurance Market size is expected to be worth around USD 100.5 Billion By 2034, from USD 43.6 billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 35.2% share, holding USD 15.35 Billion revenue.

The crop insurance market serves as a critical financial safeguard for farmers globally, addressing the escalating risks posed by climate variability and unpredictable weather events such as droughts, floods, and storms. These risks threaten crop yields and farmers’ incomes, making crop insurance an essential tool for financial protection. Increasingly, farmers recognize this need as a way to stabilize their operations and secure their livelihoods despite the inherent uncertainties of agriculture.

Top driving factors are being shaped by climate stress, public policy, and technology maturity. Droughts account for more than 65% of agriculture sector disaster losses in global post disaster assessments, which has elevated demand for formal risk transfer instead of ad hoc disaster aid. Policy initiatives that co finance premiums and standardize program rules have accelerated adoption and stabilized participation through direct income support and structured risk tools.

According to Market.us, The global online insurance market is projected to grow from USD 95.6 billion in 2024 to approximately USD 681.2 billion by 2034, registering a CAGR of 21.7% between 2025 and 2034. Growth is being driven by rising digital adoption, improved online platforms, and increasing consumer preference for convenient, paperless insurance solutions.

Investment opportunities are emerging in insurtech platforms, geospatial analytics, and public private partnerships. Venture flows into insurtech are stabilizing after a correction, creating room for disciplined capital deployment in underwriting support tools and distribution channels. Partnerships that combine government premium support with private delivery are being encouraged to accelerate diffusion of innovation and to leverage scarce public budgets

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 43.6 Bn Forecast Revenue (2034) USD 100.5 Bn CAGR(2025-2034) 8.7% Leading Segment By Coverage – Multi-Peril Crop Insurance (MPCI): 63.4% Leading Region Share North America [35.2% Market Share] Largest Country U.S. [USD 14.52 Bn Market Revenue], CAGR: 6.16% Key Insight Summary

- The market is projected to grow from USD 43.6 billion in 2024 to approximately USD 100.5 billion by 2034, recording a CAGR of 8.7%, driven by climate change risks, rising agricultural investments, and increasing government support programs.

- North America led globally with a 35.2% share, generating USD 15.35 billion in revenue in 2024, supported by strong federal subsidy programs and advanced risk assessment models.

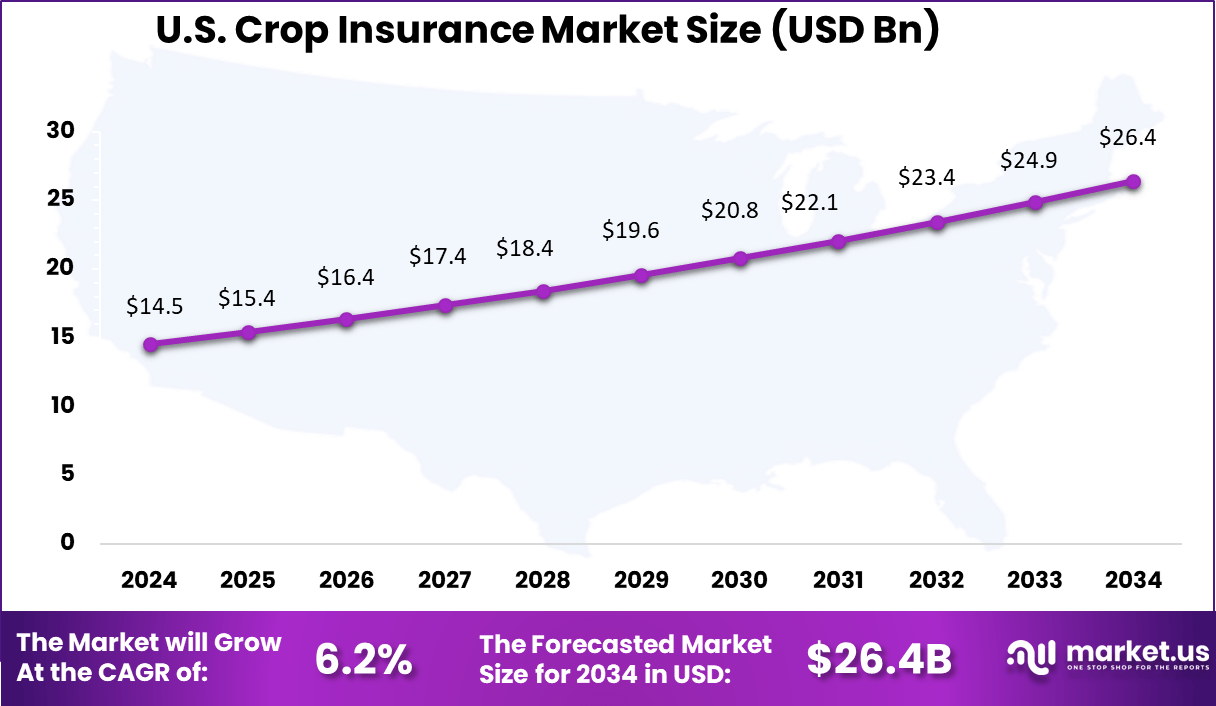

- The U.S. market alone contributed USD 14.52 billion and is expected to grow at a CAGR of 6.16%, reflecting steady farmer participation and policy renewals.

- By coverage, Multi-Peril Crop Insurance (MPCI) dominated with a 63.4% share, providing protection against a wide range of natural disasters and yield losses.

- Crop Yield Insurance led by type with a 57.3% share, as farmers seek guaranteed income protection against unpredictable seasonal productivity.

- Cereals & Grains represented the largest crop category at 38.2%, driven by their economic importance and high cultivation acreage.

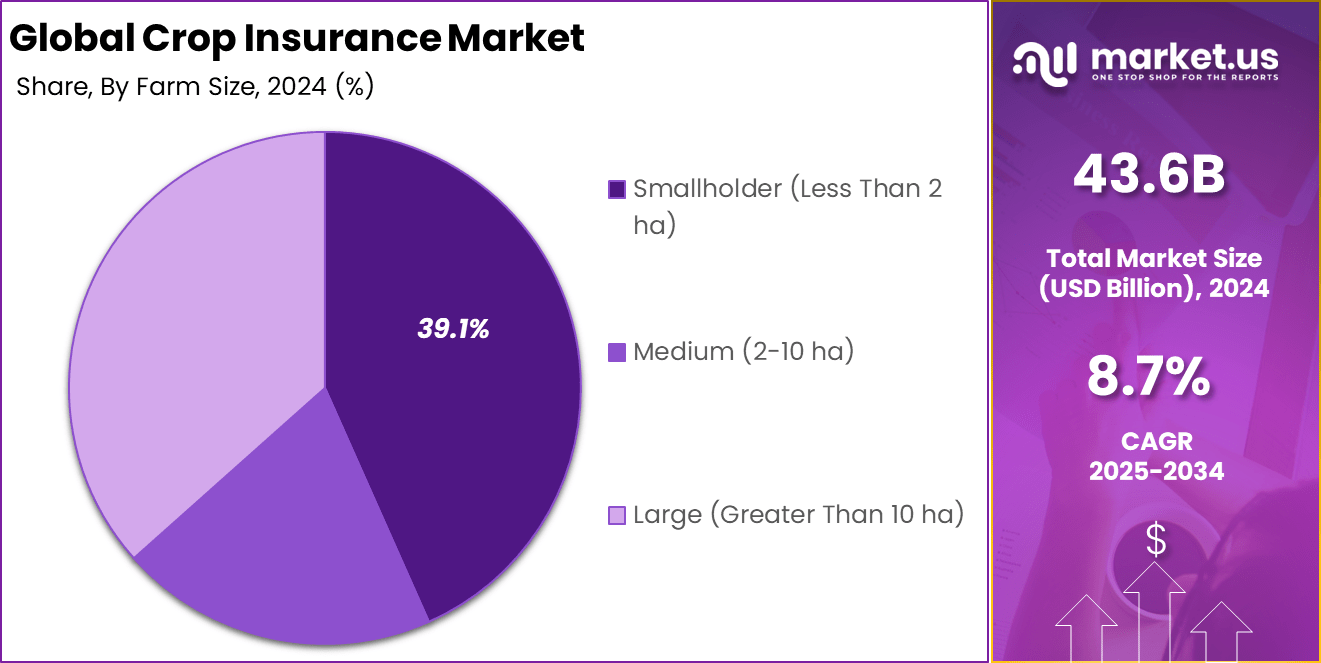

- Smallholder farms (less than 2 hectares) accounted for 39.1%, reflecting growing adoption of microinsurance schemes in developing and emerging economies.

- Banks were the leading distribution channel with a 33.9% share, leveraging existing rural networks and credit-linked insurance offerings.

Role of AI

Role/Function Description Remote Sensing & Satellite Data Use of satellite imagery (NDVI, SAR) and IoT sensors for accurate, real-time crop and weather monitoring. AI-Driven Risk Assessment Machine learning models enhance underwriting accuracy by analyzing weather, crop health, and historical data. Automated Claims Processing AI and parametric insurance enable fast settlements by triggered payouts based on pre-defined weather or vegetation indices. Predictive Analytics & Data Modeling AI predicts crop losses, pricing risks, and claims probability to optimize premium setting and underwriting. Blockchain & Transparency Use of blockchain for transparent, fraud-resistant policy administration and claims processing. Mobile & Digital Platforms Mobile enrollment and apps increase farmer access and streamline policy management. US Market Size

The U.S. Crop Insurance Market was valued at USD 14.5 Billion in 2024 and is anticipated to reach approximately USD 26.4 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.2% during the forecast period from 2025 to 2034.

In the United States, insured acreage increased from 206 million acres in 2000 to 494 million acres by the 2022 crop year, supported by program innovation that extended coverage to pasture, rangeland, and forage. Organic producers have also increased participation, with more than 12.9 million acres insured between 2013 and 2022 across 70 plus crops, reflecting broader inclusion beyond staple commodities.

In 2024, North America held a dominant market position, capturing more than a 35.2% share and generating USD 15.35 billion in revenue. This leadership is primarily the result of well-established agricultural insurance frameworks, high government involvement in subsidy programs, and a strong culture of risk management among farmers.

The United States and Canada have long invested in structured crop insurance systems that protect against yield losses caused by weather extremes, pests, and market fluctuations. The region’s mature regulatory environment, coupled with advanced satellite and data analytics integration, has enhanced risk assessment accuracy, making crop insurance more reliable and widely adopted.

North America’s dominance is also reinforced by the scale and diversity of its agricultural sector, which requires comprehensive protection solutions for high-value crops. Climate variability and the increasing frequency of extreme weather events have heightened the need for robust insurance coverage, driving participation rates.

Top 5 Trends and Innovations

Trend/Innovation Description Parametric & Index-Based Insurance Products that pay out based on weather or satellite indices rather than traditional loss assessments. AI & Big Data Integration Combining diverse datasets for more accurate risk evaluation and personalized policies. Mobile & Digital Access Expanding reach through smartphone apps for policy purchase, monitoring, and claims management. Customization & Flexible Policies Tailored insurance products catering to regional crop risks and farmer needs. Blockchain for Claims Transparency Enhanced trust and reduced fraud through distributed Top 5 Growth Factors

Growth Factor Description Increasing Climate-Related Risks More frequent extreme weather events like droughts, floods, and storms drive demand for risk mitigation. Government Subsidies & Support Many countries provide premium subsidies and public insurance programs boosting farmer participation. Technological Innovation Advances in AI, data analytics, remote sensing, and parametric products improve efficiency and reduce costs. Growing Farmer Awareness Education and outreach programs increase adoption among smallholder and commercial farmers. Rising Global Agricultural Trade Market liberalization and commodity price volatility increase farmers’ need to hedge financial risks. By Coverage

In 2024, Multi-Peril Crop Insurance, or MPCI, holds a dominant share of 63.4% in the crop insurance market. This widespread adoption reflects MPCI’s comprehensive coverage against multiple risks such as drought, flood, pests, and disease, which are common threats faced by farmers worldwide. The extensive protection offered by MPCI makes it a preferred choice for managing uncertainties in agricultural production and securing farmer incomes against a broad spectrum of potential losses.

The popularity of MPCI is driven by its ability to mitigate diverse climatic and environmental challenges, providing farmers with financial stability and confidence to invest in crop production. Its broad risk coverage supports agricultural resilience, especially in regions susceptible to unpredictable weather patterns and the increasing impacts of climate change.

By Type

In 2024, Crop yield insurance accounts for 57.3% of the market, emphasizing its significance as a risk management tool focused on protecting farmers against losses in crop yields. This insurance type evaluates actual versus expected production and compensates farmers for shortfalls, helping to offset the financial impacts of reduced harvests caused by factors such as adverse weather or pest infestations.

Yield-based insurance is especially important for ensuring farm-level income stability and enabling continued agricultural activity despite fluctuations in productivity. Its reliance on verifiable yield data and actuarial models makes it a reliable and widely accepted form of crop insurance among producers and policymakers alike.

By Crop Type

In 2024, the cereals and grains segment commands a 38.2% share, reflecting their status as staple crops cultivated extensively across numerous agricultural regions. This category includes vital crops such as wheat, rice, corn, and barley, which form the dietary foundation for large populations globally. Insurance on cereals and grains is critical for safeguarding food security and stabilizing farmer income in the face of yield volatility.

Given their importance in national and global food systems, protecting cereal and grain production through insurance helps moderate supply fluctuations, supports market stability, and incentivizes investment in these essential crops. The high share also aligns with the wide acreage devoted to cereals and grains in farming operations ranging from smallholders to large commercial producers.

By Farm Size

In 2024, Smallholder farms, defined as those with less than 2 hectares of land, constitute 39.1% of the crop insurance market. This reflects growing efforts to extend insurance coverage and financial protection to small-scale farmers, who often face heightened vulnerability due to limited resources and exposure to natural risks.

Protecting smallholders through tailored insurance products is crucial for enhancing rural livelihoods and fostering inclusive agricultural development. Supporting smallholder insurance uptake involves addressing challenges such as affordability, accessibility, and awareness.

Innovative distribution channels and government-backed subsidies frequently play essential roles in expanding insurance penetration among these farmers, who collectively contribute significantly to food production in many developing economies.

By Distribution Channel

In 2024, Banks serve as a key distribution channel for crop insurance, accounting for 33.9% of the market share. Financial institutions facilitate access to insurance by bundling policies with agricultural loans and credit products, enabling farmers to secure coverage as part of broader financial service packages. This channel leverages the banks’ existing customer relationships, outreach capabilities, and understanding of farm credit needs.

Using banks as intermediaries promotes greater insurance uptake by simplifying policy acquisition and reducing transaction costs for farmers. It also allows insurers to effectively manage risks linked to loan portfolios by ensuring borrowers have adequate protection, thereby strengthening the overall agricultural finance ecosystem.

Key Market Segments

By Coverage

- Multi Peril Crop Insurance (MPCI)

- Crop Hail Insurance

- Others

By Type

- Crop Yield Insurance

- Crop Revenue Insurance

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Commercial Crops (Cotton, Sugarcane, etc.)

- Other Crops

By Farm Size

- Smallholder (Less Than 2 ha)

- Medium (2-10 ha)

- Large (Greater Than 10 ha)

By Distribution Channel

- Banks

- Insurance Companies

- Brokers/Agents

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

The primary drivers for the crop insurance market include rising climate change impacts leading to more frequent and severe adverse weather events such as droughts, floods, storms, and unpredictable temperature fluctuations. This growing environmental volatility compels farmers to seek financial protection more urgently.

Government subsidies and support programs worldwide promote wider adoption by making insurance more affordable and accessible, especially in developing economies with large farming populations. The increasing global demand for food security and higher agricultural productivity necessitates effective risk mitigation, driving farmers to invest in crop insurance.

Technological advancements such as precision agriculture, satellite imagery, and AI-powered tools have also enhanced the accuracy of risk assessment and claims adjustment, making crop insurance more attractive and viable for insurers and farmers alike.

Restraint Analysis

Despite growth prospects, the market faces notable restraints including the complexity of insurance policy terms and claim procedures which can deter adoption, particularly among small and marginal farmers who may lack awareness or understanding.

High administrative and operational costs affect premium affordability in many regions. Basis risk – where payout does not perfectly match individual farmer losses due to reliance on area or index-based measurements – remains a challenge, sometimes causing dissatisfaction.

Limited access to information and low insurance literacy restrict market penetration in emerging and rural areas. Moreover, integration challenges between traditional systems and new technologies, regulatory barriers, and concerns about data privacy also hinder rapid expansion.

Opportunity Analysis

There are vast opportunities for growth through the expansion of index-based and weather-index insurance products tailored to local climate risks and crop types. The integration of agtech solutions like drones, IoT devices, and AI-driven predictive analytics offers insurers precise crop and weather monitoring to optimize underwriting and claims management.

Customizable and flexible insurance packages aligned with farmers’ specific needs and cash flow cycles provide an edge. Emerging markets, particularly in Asia-Pacific and parts of Africa, present untapped potential with expansive farming communities and rising government support.

Additionally, the ongoing focus on climate-resilient crop varieties and sustainable farming practices opens avenues for insurance products that incentivize eco-friendly agriculture. Enhanced mobile enrollment and digital platforms serve to improve accessibility and awareness among farmers, further expanding the reach and effectiveness of crop insurance.

Challenge Analysis

Balancing advanced technological adoption while maintaining affordability and ease of use is a major challenge. Ensuring data security and compliance with local regulations amid growing concerns over user privacy is critical. Overcoming adverse selection and moral hazard requires continuous innovation in product design and risk modeling.

The need to educate farmers on the benefits and workings of crop insurance remains urgent to boost adoption. Furthermore, geopolitical and economic instability, fluctuating commodity prices, and varying government policies add layers of complexity to the crop insurance ecosystem.

Insurers must also navigate fragmented agricultural landscapes with heterogenous risk profiles, requiring flexible and regionally adapted solutions. Reliable data collection in remote or underdeveloped areas and integrating these insights into real-time decision-making present operational hurdles.

Competitive Analysis

In the Crop Insurance Market, major global insurers such as PICC, Chubb Ltd., QBE Insurance Group, Tokio Marine HCC, and Zurich Insurance Group hold significant influence. These companies have built strong portfolios through risk diversification, reinsurance capacity, and tailored coverage solutions for varying crop types and climatic conditions.

Regional leaders also play a crucial role in market development. Agriculture Insurance Co. of India (AIC), Fairfax Financial subsidiaries, American Financial Group, and ICICI Lombard are key in Asia-Pacific’s agricultural economies. They focus on government-backed insurance programs, technology-driven claim processing, and affordable premium structures to boost adoption.

Specialized and regional-focused insurers bring niche expertise to the market. Sompo Holdings, Swiss Re Corporate Solutions, AXA XL, Munich Re, and Mapfre are strong in reinsurance and parametric solutions. Companies such as Farmers Mutual Hail Insurance Company, GlobalAg Risk Solutions, and regional providers like Agriculture Insurance Company of Kenya, Agriculture Reinsurance Ltd., and Grupo BrasilSeg focus on local crop patterns and regulatory needs.

Top Key Players in the Market

- PICC

- Chubb Ltd.

- QBE Insurance Group

- Tokio Marine HCC

- Zurich Insurance Group

- Agriculture Insurance Co. of India (AIC)

- Fairfax Financial (Brit, Allied World)

- American Financial Group (Great American)

- ICICI Lombard

- Sompo Holdings

- Swiss Re Corporate Solutions

- AXA XL

- Munich Re

- Mapfre

- Farmers Mutual Hail Insurance Company

- GlobalAg Risk Solutions

- Agriculture Insurance Company of Kenya

- Agriculture Reinsurance Ltd.

- Grupo BrasilSeg

- Others

Recent Developments

- In December 2024, the Agriculture Insurance Company of India Limited introduced ‘Fal Suraksha Bima,’ a specialized insurance product for banana and papaya crops. Launched during the company’s 22nd Foundation Day celebrations, the initiative reflects a focused effort to meet the unique needs of Indian farmers by providing tailored crop protection solutions.

- In September 2024, Alpha Omega secured a major contract with the U.S. Department of Agriculture to strengthen crop insurance programs. The partnership aims to enhance the resilience of American agriculture against growing climate variability by utilizing digital modernization, artificial intelligence, and cybersecurity to improve risk management systems

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage (Multi Peril Crop Insurance (MPCI), Crop Hail Insurance, Others), By Type (Crop Yield Insurance, Crop Revenue Insurance), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Commercial Crops (Cotton, Sugarcane, etc.), Other Crops), By Farm Size (Smallholder (Less Than 2 ha), Medium (2-10 ha), Large (Greater Than 10 ha)), By Distribution Channel (Banks, Insurance Companies, Brokers/Agents, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PICC, Chubb Ltd., QBE Insurance Group, Tokio Marine HCC, Zurich Insurance Group, Agriculture Insurance Co. of India (AIC), Fairfax Financial (Brit, Allied World), American Financial Group (Great American), ICICI Lombard, Sompo Holdings, Swiss Re Corporate Solutions, AXA XL, Munich Re, Mapfre, Farmers Mutual Hail Insurance Company, GlobalAg Risk Solutions, Agriculture Insurance Company of Kenya, Agriculture Reinsurance Ltd., Grupo BrasilSeg, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PICC

- Chubb Ltd.

- QBE Insurance Group

- Tokio Marine HCC

- Zurich Insurance Group

- Agriculture Insurance Co. of India (AIC)

- Fairfax Financial (Brit, Allied World)

- American Financial Group (Great American)

- ICICI Lombard

- Sompo Holdings

- Swiss Re Corporate Solutions

- AXA XL

- Munich Re

- Mapfre

- Farmers Mutual Hail Insurance Company

- GlobalAg Risk Solutions

- Agriculture Insurance Company of Kenya

- Agriculture Reinsurance Ltd.

- Grupo BrasilSeg

- Others