Global Cranial Implants Market By Product Type (Customized and Non-Customized), By Material (Polymer, Metal, Ceramic and Others), By End-User (Hospitals, Neurosurgery Centers, Ambulatory Surgical Centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174328

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

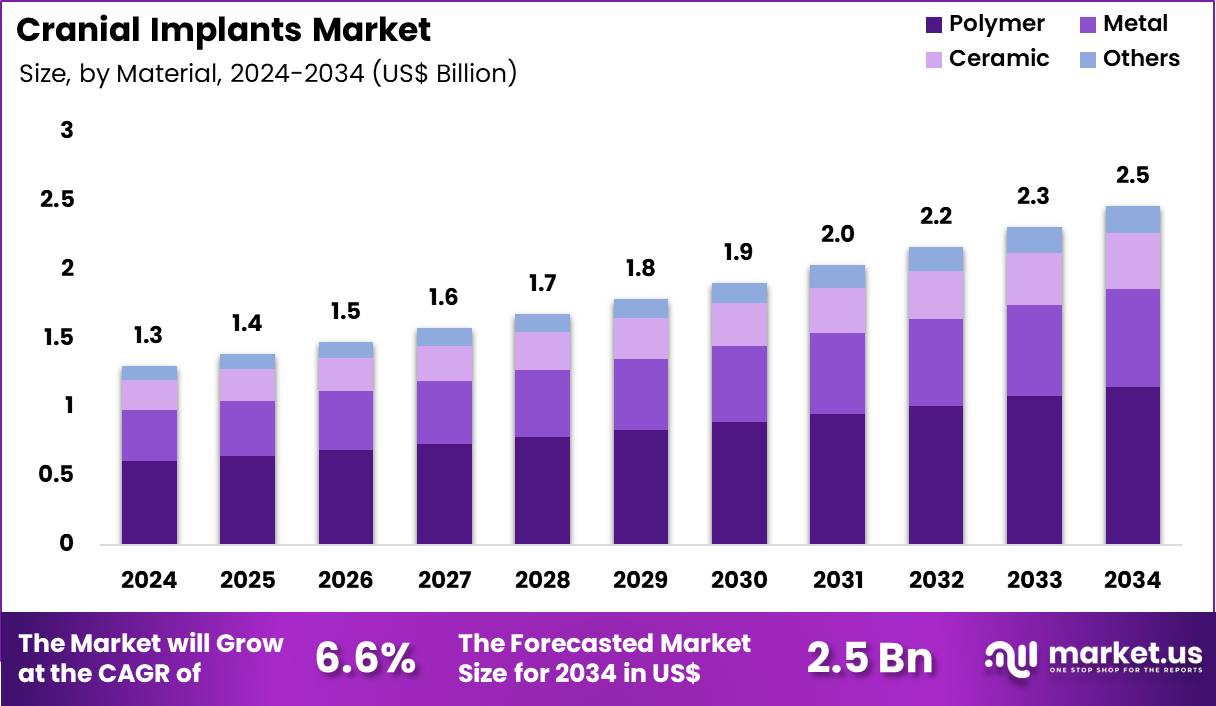

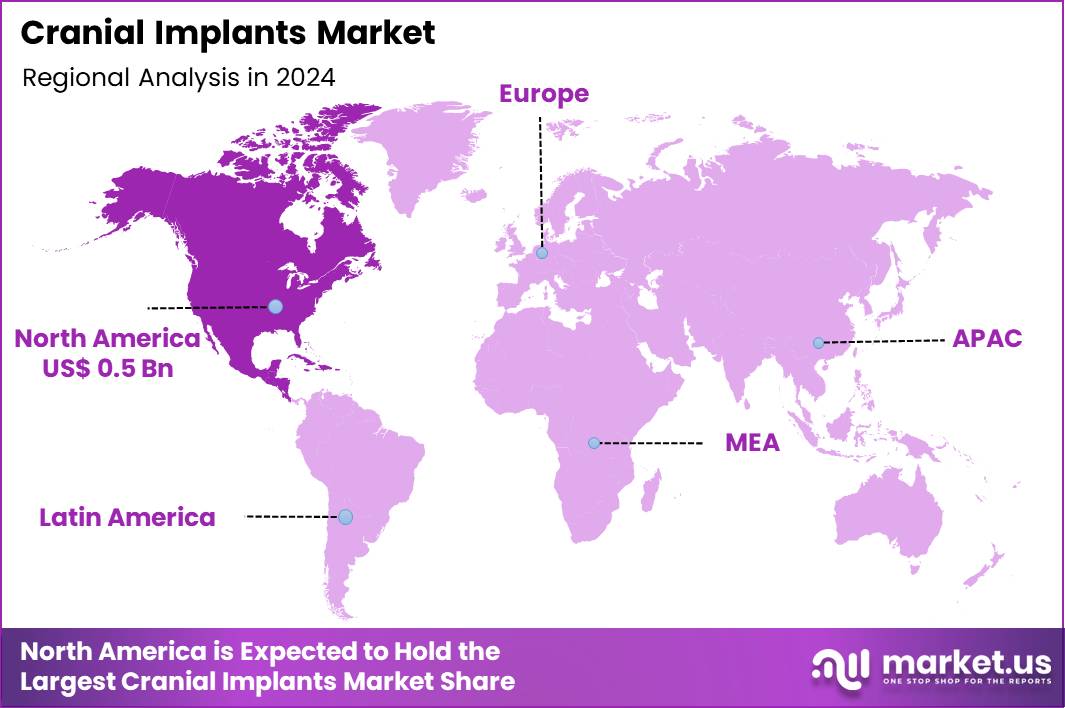

The Global Cranial Implants Market size is expected to be worth around US$ 2.5 Billion by 2034 from US$ 1.3 Billion in 2024, growing at a CAGR of 6.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.7% share with a revenue of US$ 0.5 Billion.

The cranial implants market is expanding as the incidence of traumatic brain injuries, cranial defects, and complex neurosurgical procedures continues to rise. Surgeons rely on cranial implants to restore skull integrity, protect brain tissue, and support functional and aesthetic recovery after procedures such as decompressive craniectomy, tumor resection, and craniofacial trauma repair.

Titanium mesh and patient-specific implants are widely used to stabilize large skull defects, while porous polyethylene materials support aesthetic reconstruction in congenital conditions like craniosynostosis. Cranial implants also play a critical role in orbital and craniofacial repairs, helping preserve ocular function and facial symmetry.

In October 2023, University Hospital Basel successfully produced a patient-specific cranial implant using in-hospital additive manufacturing in collaboration with 3D Systems, demonstrating improved anatomical accuracy and reduced surgical preparation time, highlighting the growing shift toward point-of-care 3D printing.

Opportunities are emerging in bioactive and composite implants that promote bone integration and adapt to pediatric skull growth, reducing long-term complications. Manufacturers are also developing antimicrobial surfaces, modular implant systems, and sensor-integrated designs to improve infection control and postoperative monitoring.

Recent trends emphasize advanced additive manufacturing, lightweight materials, and real-time intraoperative customization, enabling precise fit and fewer revision surgeries. Ongoing innovation in resorbable scaffolds and regenerative materials positions cranial implants as key enablers in the future of personalized and regenerative neurosurgery.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.3 Billion, with a CAGR of 6.6%, and is expected to reach US$ 2.5 Billion by the year 2034.

- The product type segment is divided into customized and non-customized, with customized taking the lead in 2024 with a market share of 61.8%.

- Considering material, the market is divided into polymer, metal, ceramic and others. Among these, polymer held a significant share of 46.7%.

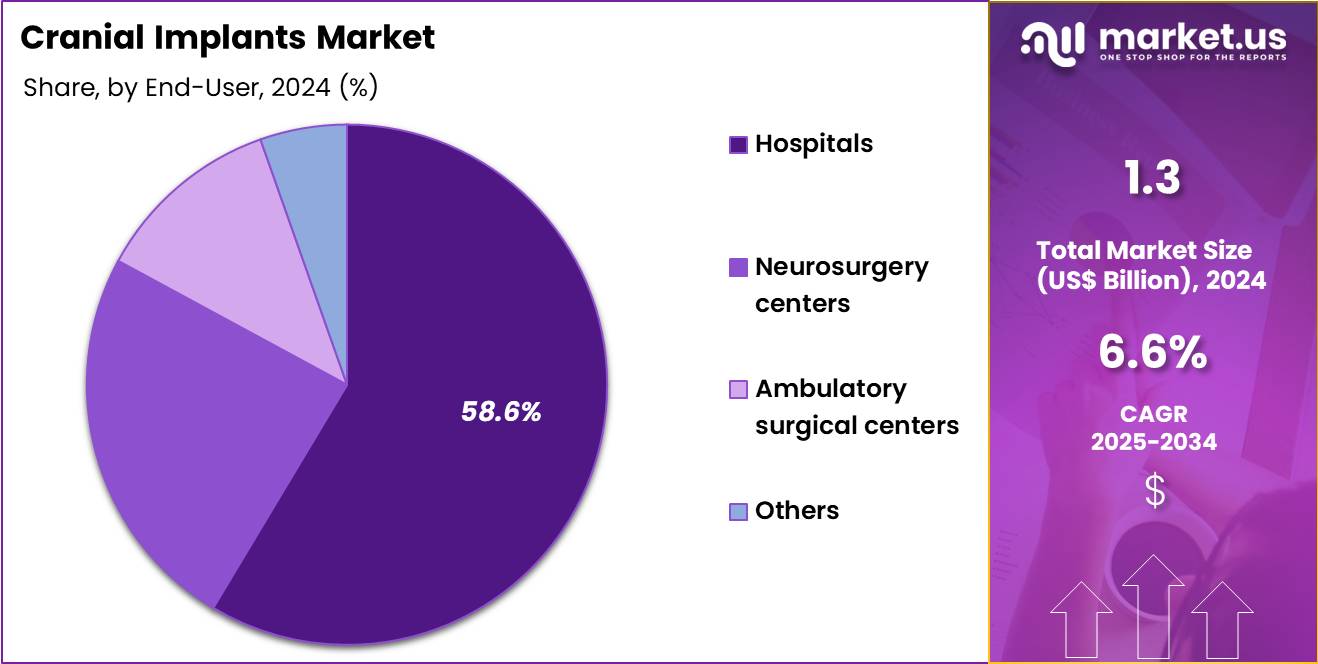

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, neurosurgery centers, ambulatory surgical centers and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 58.6% in the market.

- North America led the market by securing a market share of 37.7% in 2024.

Product Type Analysis

Customized cranial implants accounted for 61.8% of growth within the product type category and represent the most advanced solution in the Cranial Implants market. Surgeons increasingly prefer patient-specific implants due to superior anatomical fit. Customized designs improve aesthetic and functional reconstruction outcomes. Advanced imaging and 3D modeling enable precise implant fabrication. Reduced intraoperative adjustment shortens surgical time.

Improved fit lowers complication and revision rates. Trauma and tumor-related cranioplasty cases drive demand for customization. Customized implants support complex cranial defect geometries. Surgeons value predictable alignment and fixation accuracy. Growing adoption of 3D printing accelerates production timelines. Patient satisfaction improves with personalized reconstruction.

Hospitals prioritize solutions that enhance surgical precision. Customized implants reduce postoperative discomfort and pressure points. Technological maturity increases surgeon confidence. Regulatory acceptance of patient-matched devices supports adoption. Custom workflows integrate seamlessly with preoperative planning.

Rising neurosurgical volumes expand utilization. Improved collaboration between surgeons and manufacturers strengthens demand. Clinical outcomes data reinforce preference for customization. The segment is projected to maintain dominance due to precision and outcome advantages.

Material Analysis

Polymer materials represented 46.7% of growth within the material category and lead the Cranial Implants market. Polymers offer favorable strength-to-weight characteristics for cranial reconstruction. Radiolucency supports postoperative imaging clarity. Surgeons prefer polymers for reduced thermal conductivity. Biocompatibility minimizes inflammatory response risks.

Polymer implants support easy intraoperative handling. Custom shaping capabilities align well with patient-specific designs. Lower artifact interference improves CT and MRI follow-up. Polymer materials reduce stress shielding compared to metals. Growing use of PEEK and similar polymers supports market expansion.

Lightweight properties enhance patient comfort. Polymers demonstrate corrosion resistance in long-term implantation. Manufacturing flexibility supports rapid customization. Cost-effectiveness improves accessibility across healthcare systems. Hospitals favor polymers for predictable performance. Clinical studies support long-term safety profiles.

Polymer implants integrate well with fixation systems. Adoption grows in both trauma and elective cranioplasty. Surgeon training increasingly includes polymer-based solutions. The segment is anticipated to retain leadership due to versatility and imaging compatibility.

End-User Analysis

Hospitals accounted for 58.6% of growth within the end-user category and dominate the Cranial Implants market. Complex cranial surgeries primarily occur in hospital settings. Hospitals manage high volumes of trauma and neurosurgical cases. Availability of advanced imaging supports precise implant planning. Multidisciplinary neurosurgical teams coordinate reconstruction procedures. Hospitals provide intensive perioperative monitoring.

Emergency cranioplasty cases concentrate demand in hospitals. Hospital procurement supports access to customized implant solutions. Teaching hospitals drive adoption through advanced surgical techniques. Integrated operating rooms improve procedural efficiency. Hospitals manage patients with severe comorbidities requiring specialized care. Insurance reimbursement frameworks favor hospital-based neurosurgery.

Postoperative follow-up occurs predominantly in hospitals. Infrastructure investments support advanced cranial reconstruction. Hospitals maintain sterile processing and implant inventory management. Referral networks channel complex cases to tertiary hospitals.

Clinical research activities expand implant usage. Patient safety standards align with hospital governance. Expansion of neurosurgical departments increases procedure volumes. The segment is expected to retain dominance due to infrastructure strength and case complexity.

Key Market Segments

By Product Type

- Customized

- Non-customized

By Material

- Polymer

- Metal

- Ceramic

- Others

By End-User

- Hospitals

- Neurosurgery centers

- Ambulatory surgical centers

- Others

Drivers

Rising incidence of traumatic brain injuries is driving the market

The cranial implants market is significantly driven by the rising incidence of traumatic brain injuries, which often require reconstructive cranioplasty to restore skull protection and improve patient outcomes. Neurosurgeons increasingly utilize implants to repair defects caused by falls, motor vehicle accidents, and assaults, particularly in younger and working-age populations.

Regulatory bodies recognize the importance of timely intervention in trauma cases, supporting the use of advanced implants in emergency and elective procedures. Medical device manufacturers focus on developing durable materials to withstand the mechanical demands of cranial reconstruction. Clinical protocols emphasize the role of implants in preventing secondary brain injury and promoting neurological recovery.

Global epidemiological data indicate a consistent upward trend in head trauma cases due to urbanization and road traffic accidents. Academic studies demonstrate improved functional outcomes with modern implant designs in trauma patients. Patient rehabilitation programs incorporate implants to facilitate earlier return to daily activities.

Economic analyses highlight the long-term cost savings from reduced complications associated with proper cranial repair. According to the Centers for Disease Control and Prevention, an estimated 223,050 traumatic brain injury-related hospitalizations occurred in the United States in 2020, with high rates persisting through the 2022-2024 period.

Restraints

High costs of patient-specific implants are restraining the market

The cranial implants market is restrained by the high costs of patient-specific implants, which involve advanced imaging, design software, and customized manufacturing processes. Hospitals and surgical centers often face budget limitations when considering tailored implants over standard options. Manufacturers incur substantial expenses in 3D modeling and additive manufacturing, leading to elevated pricing for end-users.

Regulatory requirements for validation of custom devices further increase development and approval costs. Clinical practices in resource-constrained facilities tend to rely on off-the-shelf implants, limiting the use of personalized solutions. Global disparities in healthcare funding exacerbate challenges in adopting high-cost technologies.

Academic evaluations point to the financial barrier as a key factor in unequal access to optimal reconstructive outcomes. Patient treatment decisions are influenced by cost considerations, reducing demand for premium implants. Economic pressures on public health systems prioritize more affordable alternatives. These constraints collectively slow broader adoption of advanced cranial implant technologies across diverse healthcare settings.

Opportunities

Advancements in bioresorbable cranial implants are creating growth opportunities

The cranial implants market presents growth opportunities through advancements in bioresorbable cranial implants, which gradually degrade and allow natural bone regeneration without the need for secondary removal surgery. Developers can innovate with materials that provide temporary structural support while promoting osteogenesis in pediatric and adult patients.

Regulatory pathways are facilitating approvals for resorbable designs that demonstrate safe degradation profiles. Healthcare providers gain alternatives that reduce long-term complications associated with permanent foreign bodies. Pharmaceutical partnerships are exploring combinations of resorbable implants with growth factors for enhanced bone healing. Clinical research is evaluating resorbable systems in trauma and congenital defect cases for broader indications.

Global adoption is expanding in pediatric neurosurgery, where growth accommodation is essential. Academic collaborations are refining degradation kinetics to optimize implant performance. Patient outcomes improve with reduced revision surgeries and better cosmetic results. These developments position the market for diversification into regenerative and minimally invasive reconstructive solutions.

Impact of Macroeconomic / Geopolitical Factors

Global economic expansions allocate substantial funds to neurosurgical advancements, boosting the cranial implants market through greater demand for titanium and polymer-based reconstructions in trauma care. Executives leverage demographic shifts like increasing geriatric populations to innovate custom 3D-printed implants, securing steady revenue in mature economies.

Nonetheless, persistent international inflation escalates metal and fabrication expenses, compelling suppliers to navigate squeezed margins in emerging territories. Heightened superpower rivalries in resource-heavy zones impede alloy shipments, disrupting timelines for implant production among reliant multinationals.

Managers tackle these issues by redirecting to geopolitically neutral sourcing hubs, which streamlines operations and reveals cost-optimization synergies. Current US tariffs, imposing a 10% baseline with potential escalations up to 50% on imported medical devices from key Asian suppliers, amplify financial pressures for external providers.

American firms capitalize on this backdrop by scaling up native manufacturing sites, which ignites R&D investments and reinforces supply resilience. Progressive developments in biocompatible materials continually invigorate the sector, promising enhanced durability and expansive market opportunities ahead.

Latest Trends

Increasing use of 3D printing for custom cranial implants is a recent trend

In 2024, the cranial implants market has exhibited a prominent trend toward the increasing use of 3D printing for custom cranial implants, which enables precise replication of patient anatomy for optimal fit and functional restoration. Manufacturers are adopting additive manufacturing to produce patient-specific devices with complex geometries and porous structures.

Healthcare professionals are incorporating 3D-printed implants in cranioplasty for trauma, tumor resection, and congenital deformities. Regulatory agencies are reviewing 3D-printed devices under established pathways, with several clearances granted in recent years. Clinical case series demonstrate reduced operative times and improved aesthetic outcomes with printed implants.

Academic publications are evaluating the long-term performance of 3D-printed materials in cranial reconstruction. Global distribution is expanding access to custom implants in specialized neurosurgical centers. Patient satisfaction is rising due to better contouring and reduced donor-site morbidity. Ethical considerations are guiding the use of patient-derived data in design processes. The trend reflects broader adoption of additive technologies in neurosurgical reconstruction.

Regional Analysis

North America is leading the Cranial Implants Market

In 2024, North America secured a 37.7% share of the global cranial implants market, propelled by surging demands for reconstructive neurosurgery following traumatic brain injuries and strokes, where 3D-printed titanium and bioresorbable implants offer customized fits for skull defects to restore structural integrity and protect brain tissue.

Neurosurgeons expanded adoption of patient-specific designs in cranioplasty procedures, supported by FDA clearances that emphasize biocompatibility and reduced infection risks in high-volume trauma centers. Innovations in porous scaffolds enhanced osseointegration, aligning with clinical protocols for post-tumor resection reconstructions amid rising oncology caseloads.

Demographic trends toward contact sports and vehicular accidents amplified procedural volumes for protective implants, prompting integrated care models with imaging guidance. Biotechnology firms refined additive manufacturing techniques for lightweight alloys, facilitating broader integrations in pediatric congenital repairs.

Collaborative registries tracked implant longevity, fostering confidence in long-term outcomes for elderly patients. Supply adaptations ensured sterile, pre-fabricated options compliant with biosafety norms in specialty hospitals. The Centers for Disease Control and Prevention reported 69,473 traumatic brain injury-related deaths in the United States in 2021, underscoring the ongoing burden driving surgical interventions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders project vigorous escalation in cranial implant solutions across Asia Pacific throughout the forecast period, as road traffic accidents and industrial mishaps intensify skull fracture incidences amid rapid urbanization. Specialists incorporate customized titanium meshes into emergency craniotomies, optimizing restoration for young adults vulnerable to high-impact traumas.

National health bodies allocate budgets for bioresorbable variants in public facilities, equipping them to manage post-stroke deformities in aging rural populations. Biotech developers tailor porous alloys with enhanced durability, suiting humid climates prone to corrosion. Cross-national consortia evaluate implant efficacy through population studies, fostering safety for tumor excision reconstructions in diverse ethnic groups.

Pharmaceutical alliances adapt 3D-printing technologies through local ventures, ensuring affordability for congenital defect corrections. Community outreach trains surgeons on minimally invasive insertions, extending coverage to peripheral clinics facing diagnostic delays. The World Health Organization estimates that road traffic injuries cause 1.19 million deaths annually, with 92% occurring in low- and middle-income countries including those in Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Cranial Implants market drive growth by advancing patient-specific designs that leverage digital imaging, CAD modeling, and precision manufacturing to improve surgical fit and aesthetic outcomes. Companies expand adoption through close collaboration with neurosurgeons and maxillofacial specialists to integrate customized solutions into trauma, tumor, and reconstructive pathways.

Commercial strategies emphasize rapid turnaround times, sterilization-ready delivery, and streamlined ordering platforms that reduce operating room delays. Innovation priorities include lightweight biocompatible materials, porous structures for osseointegration, and additive manufacturing that enhances durability and long-term performance.

Market expansion targets regions with rising neurosurgical volumes and improving access to advanced reconstructive care. Kelyniam operates as a key participant, combining expertise in patient-matched cranial reconstruction, strong clinical partnerships, and scalable manufacturing to support reliable outcomes in complex cranial procedures.

Top Key Players

- Stryker Corporation

- Zimmer Biomet

- DePuy Synthes (Johnson & Johnson)

- Medtronic plc

- Integra LifeSciences

- KLS Martin Group

- Exactech, Inc.

- Acumed LLC

- Orthofix Holdings Inc.

- Biomet (Zimmer Biomet)

Recent Developments

- In August 2024, a neurotechnology firm based in Maryland, Longeviti Neuro Solutions, obtained US patent protection for a newly developed cranial implant with optical transparency. Unlike conventional implants, this design permits ongoing visualization of the brain surface and supports external signal interfacing after surgery. The innovation reduces the need for repeated diagnostic procedures, helping clinicians monitor neurological conditions more efficiently while lowering follow up complexity and costs.

- In April 2024, FDA 510(k) clearance was granted to Fin ceramica Faenza s.p.a. and Kelyniam Global for a cranial fixation solution known as the NEOS Surgery Cranial LOOP system. Intended for use with patient specific hydroxyapatite skull implants, the polymer based device enables quick and stable repositioning of bone segments after cranial surgery. Its imaging compatibility and low infection risk allow safe use across both adult and pediatric neurosurgical cases.

Report Scope

Report Features Description Market Value (2024) US$ 1.3 Billion Forecast Revenue (2034) US$ 2.5 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Customized and Non-Customized), By Material (Polymer, Metal, Ceramic and Others), By End-User (Hospitals, Neurosurgery Centers, Ambulatory Surgical Centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stryker Corporation, Zimmer Biomet, DePuy Synthes (Johnson & Johnson), Medtronic plc, Integra LifeSciences, KLS Martin Group, Exactech, Inc., Acumed LLC, Orthofix Holdings Inc., Biomet (Zimmer Biomet) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Stryker Corporation

- Zimmer Biomet

- DePuy Synthes (Johnson & Johnson)

- Medtronic plc

- Integra LifeSciences

- KLS Martin Group

- Exactech, Inc.

- Acumed LLC

- Orthofix Holdings Inc.

- Biomet (Zimmer Biomet)