Global Cranberry Extracts Market Size, Share Report By Form (Liquid, Powder, Capsules, Tablets), By Application (Dietary Supplements, Functional Foods, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Online Retail, Supermarkets, Health Stores, Pharmacies, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154141

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

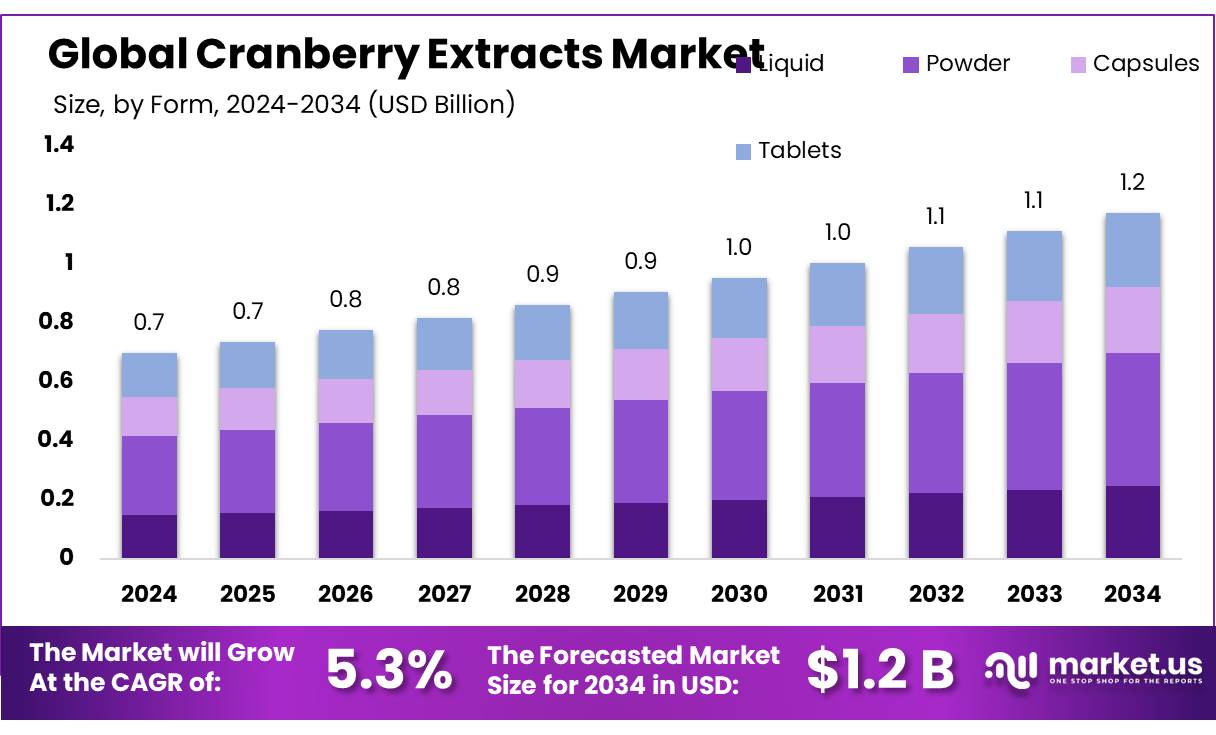

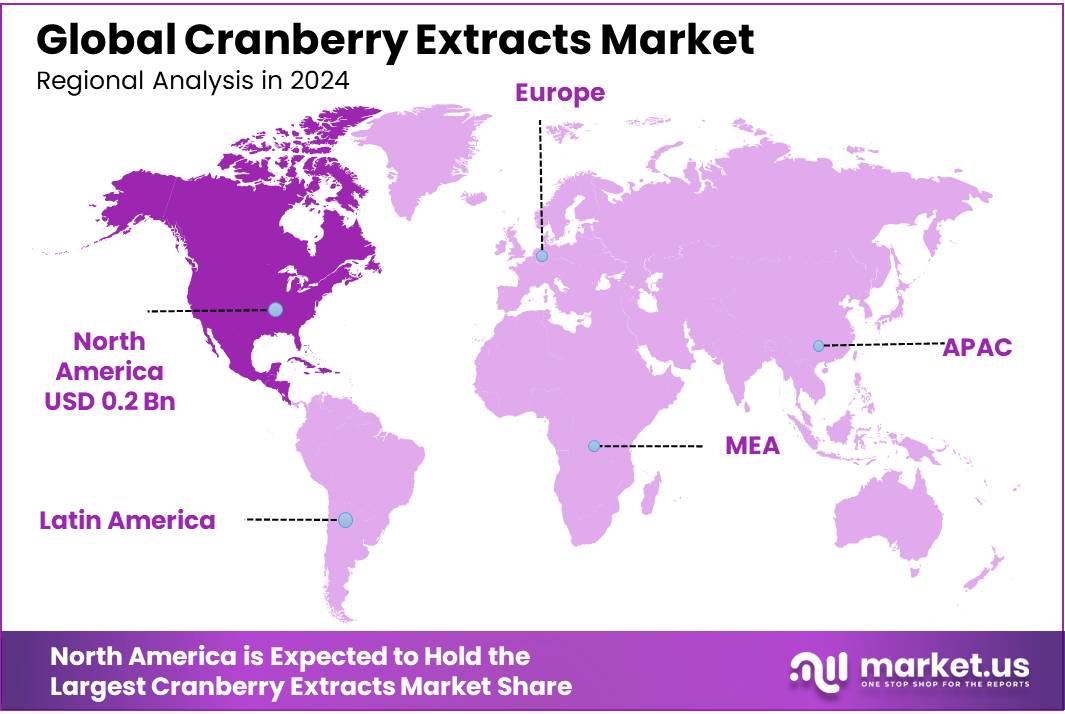

The Global Cranberry Extracts Market size is expected to be worth around USD 1.2 Billion by 2034, from USD 0.7 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.8% share, holding USD 0.2 Billion in revenue.

Cranberry extract concentrates have emerged as a significant component in the global food and nutraceutical industries, driven by their health benefits and versatile applications. Rich in antioxidants, particularly proanthocyanidins, cranberry extracts are recognized for their potential in promoting urinary tract health and offering anti-inflammatory properties.

Government initiatives have played a pivotal role in supporting the cranberry extract industry. In the U.S., the Food and Drug Administration (FDA) announced a qualified health claim for cranberry juice beverages and dietary supplements, stating that consuming one serving (8 oz) each day of a cranberry juice beverage containing at least 27% cranberry juice may help reduce the risk of recurrent urinary tract infections in healthy women. Additionally, the U.S. Department of Agriculture (USDA) has authorized the use of specific standards for cranberry juice products, ensuring quality and consistency in the market.

In the United States, the cranberry industry plays a vital economic role. For instance, the economic impact of producing an additional 2,500 acres of cranberries is estimated to be USD 29.67 million annually, with the creation of 383 jobs. This underscores the industry’s contribution to employment and economic activity, particularly in regions like Wisconsin and Massachusetts, which are major producers.

The North American region, particularly the United States and Canada, dominates the cranberry extract concentrate market. These countries account for approximately 97% of global cranberry production, with Wisconsin and Quebec being the leading producing regions. The robust infrastructure, advanced processing technologies, and established export channels contribute to their market leadership. For instance, in 2024, Canada exported prepared/preserved cranberries worth $124 million and cranberry juice valued at $92 million.

The industry’s expansion is also evident in trade dynamics. In 2024, exports of U.S. cranberry juice to South Africa increased by over 40%, with projections indicating steady growth in the coming years. This surge is attributed to growing consumer awareness of the health benefits of cranberries, particularly among middle-income, health-conscious consumers.

The United States and Canada are the leading producers of cranberries, accounting for nearly 99% of global production. In 2022, the U.S. produced approximately 790 million pounds of cranberries, with Wisconsin being the largest producer, contributing 59% of the total . These regions have well-established infrastructure for cranberry cultivation and processing, ensuring a steady supply of raw materials for the extract concentrate industry.

Key Takeaways

- Cranberry Extracts Market size is expected to be worth around USD 1.2 Billion by 2034, from USD 0.7 Billion in 2024, growing at a CAGR of 5.3%.

- Powder held a dominant market position, capturing more than a 38.5% share in the Cranberry Extracts Market.

- Dietary Supplements held a dominant market position, capturing more than a 44.2% share in the Cranberry Extracts Market.

- Online Retail held a dominant market position, capturing more than a 31.9% share in the Cranberry Extracts Market.

- North America held a dominant position in the global cranberry extracts market, accounting for more than 42.8% of the total market share, with an estimated value of USD 0.2 billion.

By Form Analysis

Powder Form Leads with 38.5% Share Due to Long Shelf Life and Easy Use

In 2024, Powder held a dominant market position, capturing more than a 38.5% share in the Cranberry Extracts Market by form. The powdered form has gained strong preference across dietary supplements, functional foods, and pharmaceutical applications due to its longer shelf life, ease of storage, and compatibility with various formulations. This form allows for convenient integration into capsules, tablets, drink mixes, and health bars, which aligns well with rising consumer demand for easy-to-use wellness products.

In 2025, the share of powder form is expected to grow steadily, supported by ongoing innovation in clean-label health supplements and increasing demand in regions like North America and Asia-Pacific. The powder’s ability to retain the cranberry’s natural antioxidant properties without the use of synthetic preservatives has further boosted its adoption in the nutraceutical industry. This consistent growth trend reflects a clear shift toward health-conscious consumption supported by stable industrial processing and distribution advantages.

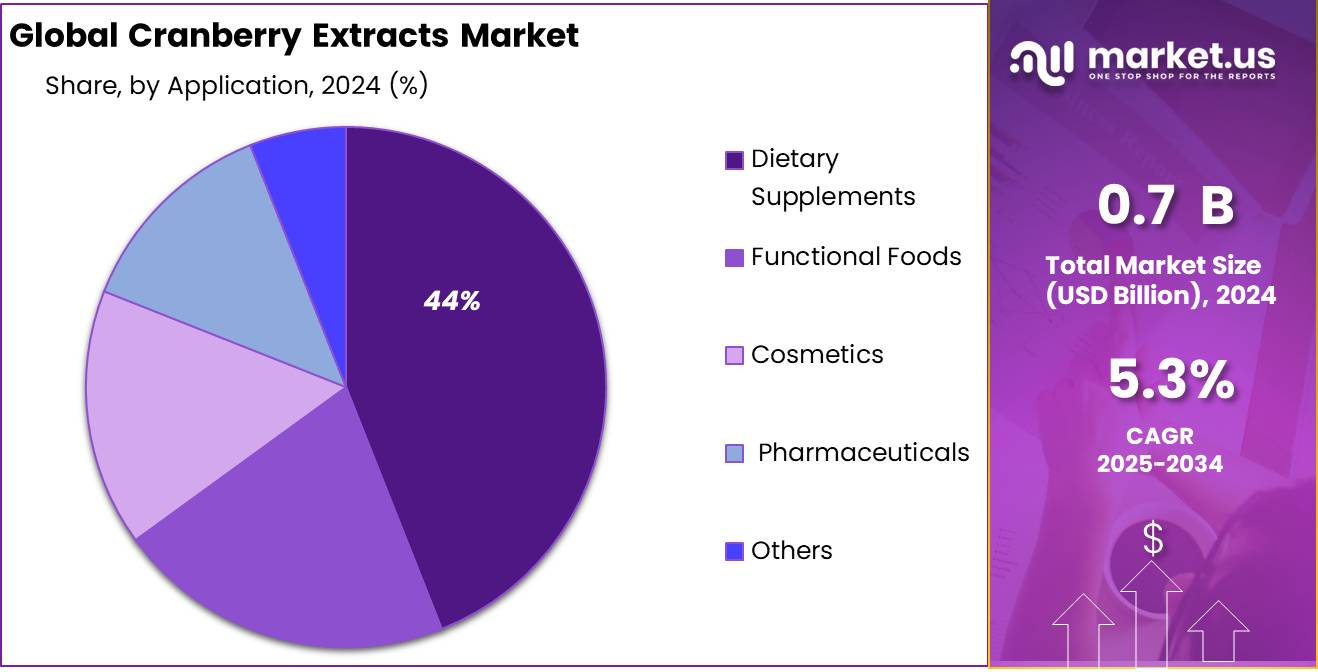

By Application Analysis

Dietary Supplements Dominate with 44.2% Share Due to Rising Health Awareness

In 2024, Dietary Supplements held a dominant market position, capturing more than a 44.2% share in the Cranberry Extracts Market by application. This segment’s growth is largely driven by increasing consumer focus on preventive healthcare and the growing popularity of natural remedies for urinary tract and immune system support. The convenience of capsules, gummies, and tablets made with cranberry extract has contributed to steady demand, especially among adult and elderly populations.

In 2025, the dietary supplements segment is expected to maintain its lead, with rising adoption in both developed and emerging markets. This sustained momentum is further supported by growing retail presence of plant-based nutraceuticals and greater awareness of cranberry’s antioxidant and anti-inflammatory benefits. The segment’s strength lies in its ability to address health needs while fitting easily into daily wellness routines.

By Distribution Channel Analysis

Online Retail Leads with 31.9% Share Owing to Easy Product Access and Wider Reach

In 2024, Online Retail held a dominant market position, capturing more than a 31.9% share in the Cranberry Extracts Market by distribution channel. The growing shift toward e-commerce platforms has made it easier for consumers to access a wide range of cranberry-based supplements and wellness products. Factors such as doorstep delivery, availability of multiple brands, user reviews, and attractive discounts have fueled this trend.

In 2025, the online retail segment is expected to expand further, especially as digital literacy and smartphone usage rise across both urban and semi-urban regions. Many health-conscious buyers are now turning to online stores for reliable access to clean-label and plant-based products. The convenience of browsing, comparing, and purchasing without visiting physical stores has made online platforms a key channel for nutraceutical distribution, particularly in the post-pandemic health-driven landscape.

Key Market Segments

By Form

- Liquid

- Powder

- Capsules

- Tablets

By Application

- Dietary Supplements

- Functional Foods

- Cosmetics

- Pharmaceuticals

- Others

By Distribution Channel

- Online Retail

- Supermarkets

- Health Stores

- Pharmacies

- Others

Emerging Trends

Rising Demand for Natural Ingredients and Clean-Label Products

A significant trend shaping the cranberry extract industry is the growing consumer preference for natural ingredients and clean-label products. Consumers are increasingly seeking products with transparent labeling, minimal processing, and natural sourcing, driven by a heightened awareness of health and environmental concerns. This shift is particularly evident in the food and beverage sector, where cranberry extracts are valued for their antioxidant properties and functional benefits.

The demand for clean-label products is further supported by consumer willingness to pay a premium for natural and organic ingredients. Reports indicate that around 75% of consumers are willing to pay more for products with natural and clean-label attributes . This trend is prompting manufacturers to innovate and develop cranberry-based products that align with consumer preferences for transparency and natural sourcing.

Government initiatives also play a role in promoting the use of natural ingredients. For instance, the U.S. Department of Agriculture (USDA) supports cranberry producers through various programs aimed at enhancing the sustainability and competitiveness of U.S. agriculture, including the cranberry sector.

Drivers

Impact of Cranberry Extracts on Urinary Tract Health

One of the primary drivers behind the growing demand for cranberry extract concentrates is their potential role in supporting urinary tract health. Urinary tract infections (UTIs) are common, particularly among women, with nearly one in three developing a UTI before age 24 and 25% experiencing repeat infections within a year. This high prevalence has led to increased consumer interest in preventive measures, including the use of cranberry-based products.

Cranberries contain proanthocyanidins (PACs), compounds believed to inhibit the adhesion of certain bacteria, such as E. coli, to the walls of the urinary tract. A Cochrane systematic review of 50 studies concluded that consuming cranberry products (such as juice or capsules) is effective for reducing the risk of UTIs in women with recurrent UTIs, in children, and in people susceptible to UTIs following clinical interventions. This evidence has bolstered the popularity of cranberry extracts as a natural alternative to antibiotics for UTI prevention.

- Government initiatives have further supported the use of cranberry products. For instance, the U.S. Food and Drug Administration (FDA) has authorized a qualified health claim for cranberry juice beverages and dietary supplements, indicating that consuming one serving (8 oz) each day may help reduce the risk of recurrent UTIs in healthy women. This endorsement has enhanced consumer confidence and spurred demand for cranberry-based products.

The growing recognition of cranberry extracts’ potential benefits for urinary tract health, supported by scientific research and government endorsements, has significantly contributed to the expansion of the cranberry extract concentrate market. As consumer awareness continues to rise, the demand for cranberry-based products is expected to further increase, presenting opportunities for market growth and innovation.

Restraints

Challenges in Standardization and Quality Control

A significant challenge facing the cranberry extract industry is the inconsistency in product quality and the lack of standardized extraction methods. Cranberry extracts, particularly those rich in proanthocyanidins (PACs), are often evaluated using various analytical techniques, such as liquid chromatography-mass spectrometry or colorimetric methods. These differing methodologies can lead to variations in the reported PAC content, making it difficult for consumers and manufacturers to assess the potency and efficacy of the products reliably .

This variability in product quality can result from several factors, including differences in the cranberry cultivars used, the ripeness of the fruit at harvest, and the processing methods employed. For instance, cranberries harvested at different times or grown in varying climatic conditions may yield extracts with differing concentrations of active compounds. Additionally, post-harvest handling and storage practices can affect the stability and bioavailability of these compounds .

The lack of standardization poses challenges not only for consumers seeking consistent health benefits but also for manufacturers aiming to produce reliable and effective products. Without standardized methods, it becomes challenging to ensure uniformity across batches, leading to potential discrepancies in product performance and consumer trust. This inconsistency can also hinder regulatory bodies from establishing clear guidelines and health claims, further complicating market dynamics.

Addressing these challenges requires concerted efforts from industry stakeholders to develop and adopt standardized extraction and quality assessment protocols. Such initiatives would enhance product consistency, bolster consumer confidence, and facilitate regulatory approvals, ultimately supporting the sustainable growth of the cranberry extract market.

Opportunity

Expansion into Emerging Markets

In South Africa, a market traditionally not associated with cranberry consumption, imports of U.S. cranberry juice saw a remarkable 42% increase in 2024, with expectations of continued growth at an annual rate of 7% over the next five years . This trend underscores the potential for cranberry products to penetrate new markets through targeted marketing and distribution strategies.

Government initiatives play a crucial role in facilitating this expansion. For example, the U.S. Department of Agriculture (USDA) has been instrumental in promoting American agricultural exports, including cranberries, through various programs and trade agreements. Such support not only aids in market entry but also enhances the competitiveness of U.S. cranberry products on the global stage .

To capitalize on these opportunities, stakeholders in the cranberry extract industry should focus on adapting their products to meet the specific preferences and dietary habits of consumers in emerging markets. This may involve developing new product formats, such as ready-to-drink beverages or functional snacks, and ensuring compliance with local regulations and standards. By aligning product offerings with market demands and leveraging government support, the cranberry extract industry can achieve sustained growth and increased global market share.

Regional Insights

North America Leads with 42.8% Share Valued at USD 0.2 Billion

In 2024, North America held a dominant position in the global cranberry extracts market, accounting for more than 42.8% of the total market share, with an estimated value of USD 0.2 billion. This dominance is primarily supported by the region’s strong agricultural base, particularly in the United States and Canada, which together contribute over 95% of the world’s cranberry production.

The growing focus on preventive health, rising geriatric population, and increasing awareness of natural ingredients have boosted the demand for cranberry-based supplements, particularly those targeting urinary tract health and immune support. In addition, regulatory support for nutraceutical products and clean-label ingredients has created a favorable environment for industry growth. Online retail penetration in North America has also significantly contributed to the easy availability and awareness of cranberry extract formulations.

By 2025, North America is projected to retain its leadership in the global market, supported by innovations in product formulations, higher healthcare expenditure, and strong distribution networks. The presence of leading nutraceutical brands and strategic investments in natural product development further solidify the region’s prominent position in the cranberry extracts industry.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

NutraGreen Biotechnology is a China-based company specializing in the research, development, and manufacturing of natural plant extracts, including cranberry extracts. They offer a range of cranberry products, focusing on quality and sustainability. Their cranberry extracts are utilized in various applications, including dietary supplements and functional foods, catering to the growing demand for natural health products.

Naturex, a global leader in specialty plant-based natural ingredients, offers a range of cranberry extracts, including their patented Pacran® Organic. Pacran Organic is a clinically proven ingredient that helps support urinary tract health. Naturex controls the production of its plant extracts at its 16 industrial sites worldwide, ensuring high-quality standards and sustainability in its cranberry extract offerings.

Ocean Spray Cranberries, Inc., established in 1930, is an American agricultural cooperative owned by over 700 cranberry farmers across the United States, Canada, and Chile. They are the world’s leading producer of cranberry juices, juice drinks, and dried cranberries. Ocean Spray’s products, including cranberry extracts, are widely recognized for their quality and health benefits, making them a significant player in the cranberry extract market.

Top Key Players Outlook

- NutraGreen Biotechnology

- Naturex

- BioCare Copenhagen Cranberry Sweets

- Ocean Spray Cranberries

- RFI Ingredients

- Fruit d’Or

- Starwest Botanicals

- Herbalife Nutrition

- Mountain Rose Herbs

- The Green Labs

Recent Industry Developments

In 2024, the cooperative harvested approximately 2.2 million barrels of cranberries, with about 80% of these berries directed to Ocean Spray for processing into products such as juice, sauce, and dried fruit.

NutraGreen has invested in a 1,000-mu organic planting base in Xiaoxingan, China, renowned for its rare medicinal plants, to secure high-quality botanical raw materials.

Report Scope

Report Features Description Market Value (2024) USD 0.7 Bn Forecast Revenue (2034) USD 1.2 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder, Capsules, Tablets), By Application (Dietary Supplements, Functional Foods, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Online Retail, Supermarkets, Health Stores, Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape NutraGreen Biotechnology, Naturex, BioCare Copenhagen Cranberry Sweets, Ocean Spray Cranberries, RFI Ingredients, Fruit d’Or, Starwest Botanicals, Herbalife Nutrition, Mountain Rose Herbs, The Green Labs Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- NutraGreen Biotechnology

- Naturex

- BioCare Copenhagen Cranberry Sweets

- Ocean Spray Cranberries

- RFI Ingredients

- Fruit d'Or

- Starwest Botanicals

- Herbalife Nutrition

- Mountain Rose Herbs

- The Green Labs