Global Countertops Market Size, Share, Growth Analysis Product (Granite, Solid Surface, Engineered Quartz, Laminate, Marble, Others), Application (Kitchen, Bathroom, Others), End Use (Residential, Commercial), Installation Type (New Construction, Renovation / Retrofit), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177258

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

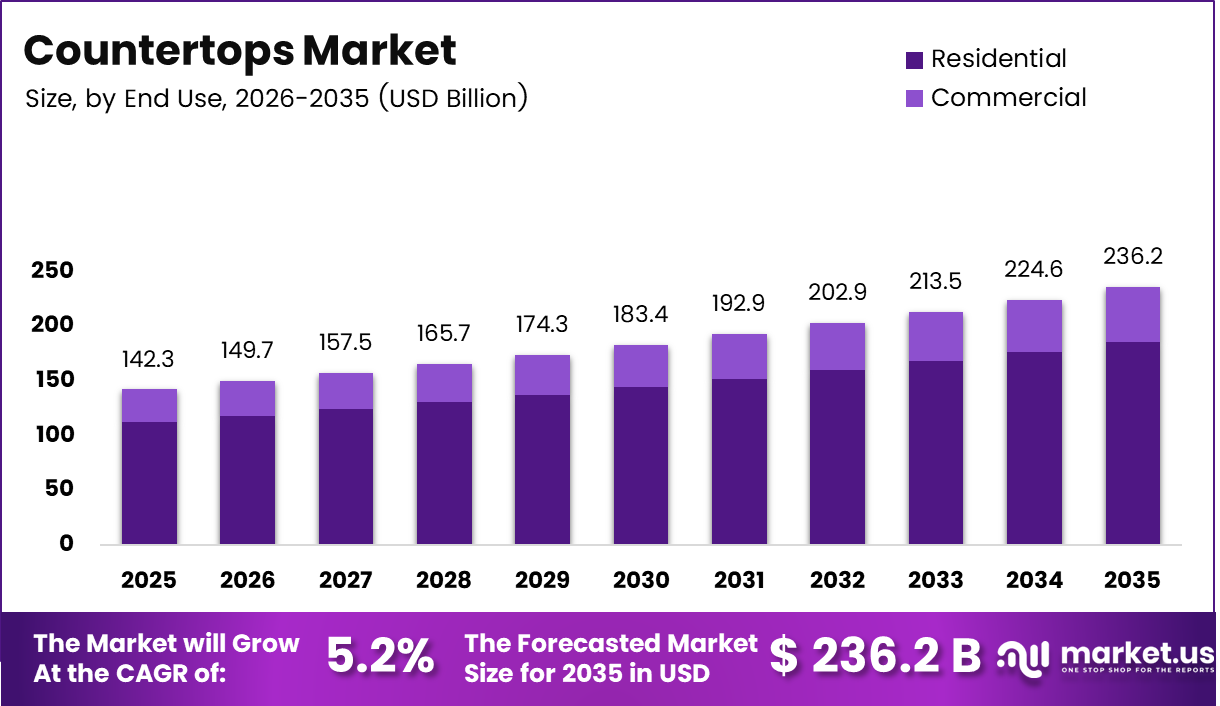

Global Countertops Market size is expected to be worth around USD 236.2 Billion by 2035 from USD 142.3 Billion in 2025, growing at a CAGR of 5.2% during the forecast period 2026 to 2035.

The countertops market encompasses surface materials installed in kitchens, bathrooms, and commercial spaces. These products include granite, quartz, marble, laminate, and Acrylic solid surfaces. Countertops serve both functional and aesthetic purposes in residential and commercial applications.

Market growth is driven by increasing residential renovation activities and rising demand for premium interior solutions. Moreover, expansion of real estate developments and smart housing projects globally contributes to market acceleration. Consumer preference for durable and low-maintenance surface materials further strengthens market potential.

The industry benefits from technological advancements in surface finishing and custom fabrication techniques. Additionally, growing urbanization drives modular kitchen installations across developing regions. Commercial sectors including hospitality and retail increasingly adopt premium countertop solutions for enhanced aesthetics and functionality.

Government initiatives promoting sustainable construction materials create new opportunities for eco-friendly countertop manufacturers. Furthermore, investment in green building certifications encourages adoption of recycled and composite materials. Regulatory standards for antimicrobial and heat-resistant surfaces also influence product development and market dynamics.

According to MSI, the granite countertop collection offers over 80 colors, representing the most comprehensive slab selection in the market. This diversity enables consumers to choose customized patterns and edge profiles matching their design preferences and functional requirements.

According to Caesarstone US, standard kitchen countertop depth measures 25.5 inches, while island countertops range from 27 to 28 inches deep. Breakfast bar areas require at least 30 inches depth to provide adequate knee room and safety for seating arrangements.

The market experiences consolidation through strategic acquisitions strengthening distribution networks and manufacturing capabilities. Consequently, leading players expand their geographic presence and product portfolios. Premium segment growth reflects increasing consumer spending on quality interior design solutions across residential and commercial sectors.

Key Takeaways

- Global Countertops Market projected to reach USD 236.2 Billion by 2035 from USD 142.3 Billion in 2025

- Market expected to grow at a CAGR of 5.2% during forecast period 2026-2035

- Granite segment dominates Product category with 32.5% market share in 2025

- Kitchen application holds leading position with 69.3% share of total market

- Residential end use segment accounts for 78.8% of market demand

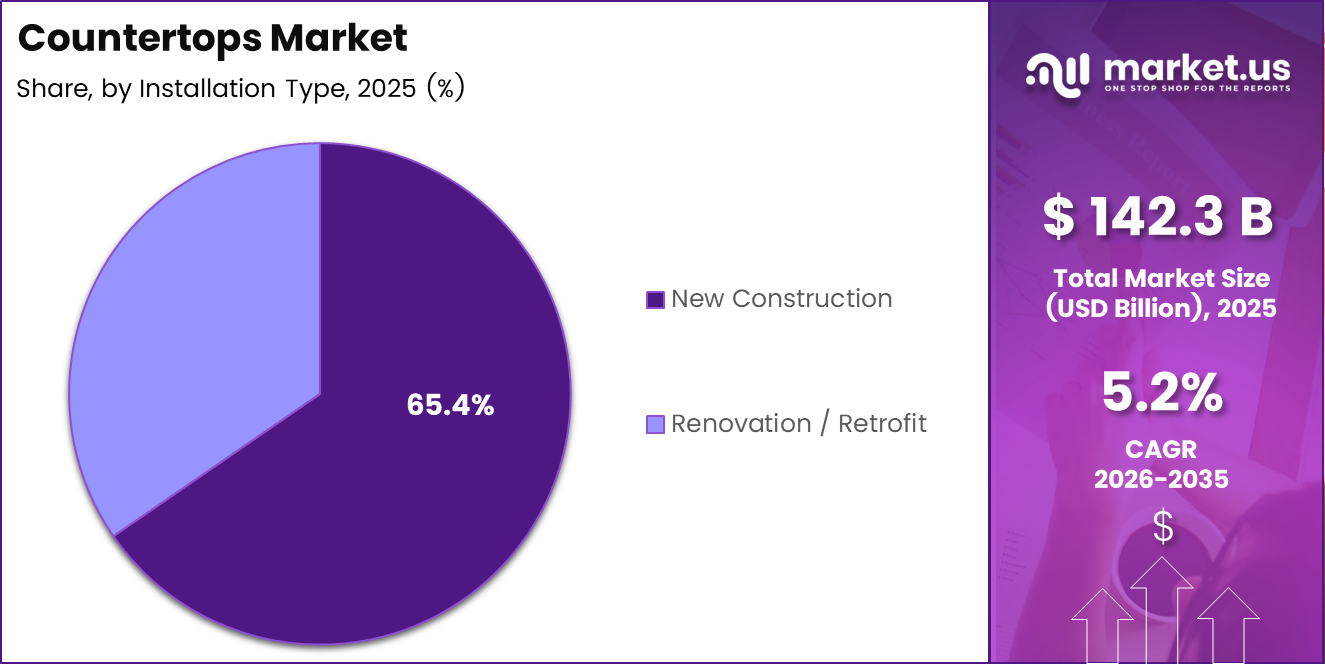

- New Construction installation type leads with 65.4% market share

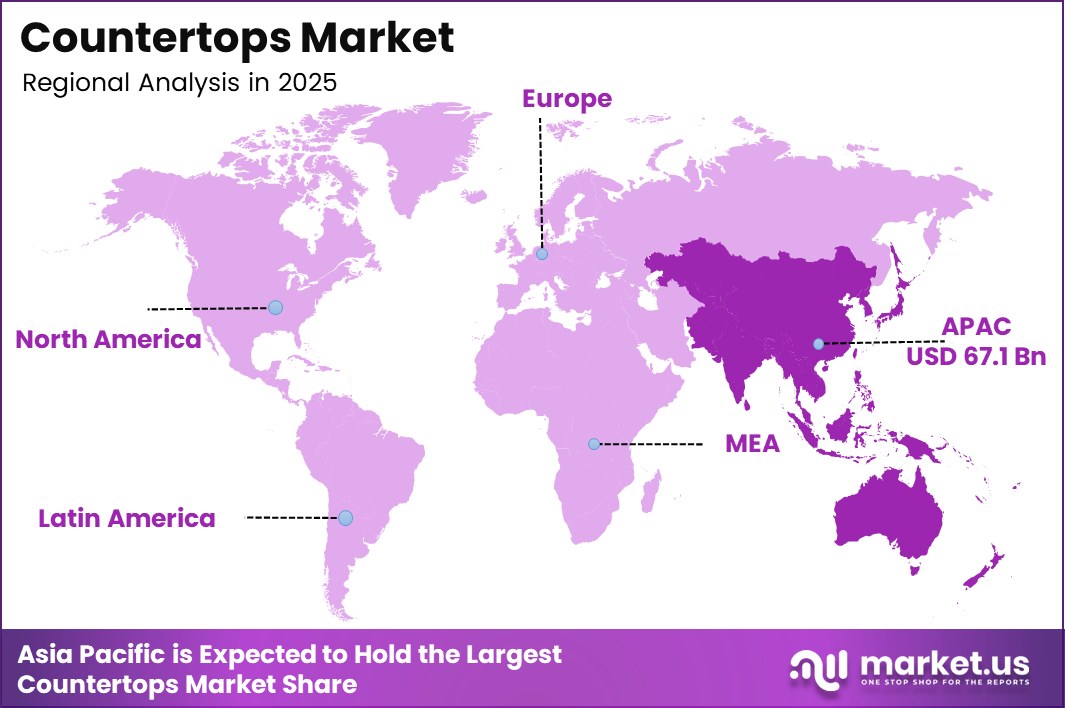

- Asia-Pacific region dominates with 47.20% share, valued at USD 67.1 Billion

Product Analysis

Granite dominates with 32.5% due to superior durability, heat resistance, and timeless aesthetic appeal.

In 2025, Granite held a dominant market position in the Product segment of Countertops Market, with a 32.5% share. Granite offers exceptional durability, scratch resistance, and heat tolerance making it ideal for high-traffic kitchen environments. Moreover, natural stone variations provide unique patterns ensuring each installation remains distinctive and visually appealing.

Solid Surface materials gain traction due to seamless installation capabilities and easy repairability. These non-porous surfaces resist staining and bacterial growth, meeting hygiene standards for residential and commercial applications. Additionally, solid surfaces offer extensive color customization options enabling cohesive interior design schemes across multiple spaces.

Engineered Quartz experiences rapid growth driven by consistent patterning and superior stain resistance compared to natural stone. This manufactured material combines natural quartz with resins creating highly durable surfaces requiring minimal maintenance. Furthermore, engineered quartz provides uniform appearance eliminating natural stone’s unpredictability while maintaining premium aesthetics.

Laminate serves budget-conscious consumers seeking cost-effective countertop solutions without compromising basic functionality. Modern laminate technologies deliver improved durability and realistic stone or wood appearances. However, laminate remains susceptible to heat damage and scratching compared to premium alternatives.

Marble maintains popularity in luxury segments due to elegant veining patterns and sophisticated appearance. Despite requiring regular sealing and maintenance, marble countertops enhance property value and visual appeal. Consequently, high-end residential and hospitality projects continue specifying marble for statement installations.

Others category includes concrete, butcher block, recycled glass, and emerging sustainable materials. These alternative surfaces cater to niche markets emphasizing unique aesthetics or environmental consciousness. Innovations in composite materials expand options for consumers seeking distinctive design solutions.

Application Analysis

Kitchen dominates with 69.3% due to essential food preparation requirements and central role in home design.

In 2025, Kitchen held a dominant market position in the Application segment of Countertops Market, with a 69.3% share. Kitchen countertops endure heavy daily use requiring durable, heat-resistant, and hygienic surfaces. Moreover, kitchen renovations rank among highest priority home improvement projects driving consistent countertop replacement and upgrade demand.

Bathroom applications represent significant market share driven by vanity installations and shower surrounds. Waterproof and stain-resistant properties become critical selection factors for bathroom countertop materials. Additionally, smaller surface areas in bathrooms enable premium material adoption at lower total costs compared to kitchen installations.

Others applications include laundry rooms, outdoor kitchens, bar areas, and commercial workspaces. These specialized installations often require specific performance characteristics such as weather resistance or chemical durability. Furthermore, commercial applications in retail, hospitality, and healthcare sectors demand surfaces meeting stringent hygiene and aesthetic standards.

End Use Analysis

Residential dominates with 78.8% due to widespread home construction, renovation activities, and personal design preferences.

In 2025, Residential held a dominant market position in the End Use segment of Countertops Market, with a 78.8% share. Homeowners prioritize kitchen and bathroom upgrades as primary value-adding renovations. Moreover, increasing disposable incomes enable consumers to invest in premium countertop materials enhancing living spaces.

Commercial segment encompasses hospitality, retail, healthcare, and office applications requiring durable high-performance surfaces. Commercial installations prioritize easy maintenance, hygiene compliance, and brand-aligned aesthetics. Additionally, commercial projects typically involve larger-scale installations creating substantial order volumes despite representing smaller market share compared to residential applications.

Installation Type Analysis

New Construction dominates with 65.4% due to global urbanization and expanding residential and commercial development projects.

In 2025, New Construction held a dominant market position in the Installation Type segment of Countertops Market, with a 65.4% share. New building projects integrate countertop specifications during initial design phases enabling coordinated material selection. Moreover, builders and developers purchase countertops in bulk volumes for multiple units creating economies of scale.

Renovation / Retrofit activities drive replacement demand as homeowners update aging kitchens and bathrooms. Remodeling projects often upgrade from basic laminate to premium granite or quartz surfaces. Additionally, commercial renovations refresh retail and hospitality spaces maintaining competitive appeal and meeting contemporary design standards.

Key Market Segments

Product

- Granite

- Solid Surface

- Engineered Quartz

- Laminate

- Marble

- Others

Application

- Kitchen

- Bathroom

- Others

End Use

- Residential

- Commercial

Installation Type

- New Construction

- Renovation / Retrofit

Drivers

Rapid Growth in Residential Renovation and Kitchen Remodeling Activities Drives Market Expansion

Homeowners increasingly invest in kitchen and bathroom renovations to enhance property values and improve living experiences. Rising disposable incomes enable consumers to allocate substantial budgets toward premium countertop materials. Moreover, aging housing stock in developed markets creates consistent replacement demand for outdated surfaces.

Remodeling activities focus on modernizing aesthetics and improving functionality through durable low-maintenance materials. Therefore, granite, quartz, and solid surface countertops replace traditional laminate installations. Additionally, open-concept floor plans emphasize kitchen visibility making countertop selection a critical design element.

Consumer preference shifts toward seamless installations and integrated appliances driving demand for custom-fabricated countertops. Furthermore, DIY renovation trends supported by online resources increase countertop replacement frequency. Consequently, residential remodeling sector sustains strong market growth through consistent upgrade cycles.

Restraints

High Material and Installation Costs for Premium Countertop Surfaces Limit Market Adoption

Natural stone and engineered quartz countertops require significant upfront investment deterring budget-conscious consumers. Installation complexity necessitates professional fabrication and fitting increasing total project costs. Moreover, custom edge profiles and integrated features further elevate expenses beyond standard configurations.

Premium materials like marble and exotic granite command substantial price premiums limiting accessibility for middle-income households. Consequently, price-sensitive markets continue relying on affordable laminate alternatives despite inferior durability. Additionally, economic uncertainties and housing market fluctuations reduce discretionary spending on non-essential home improvements.

Supply chain volatility affecting natural stone quarrying and engineered material production creates pricing unpredictability. Transportation costs for heavy stone slabs contribute to regional price variations. Furthermore, skilled labor shortages in fabrication and installation sectors increase service costs limiting market penetration.

Growth Factors

Rising Adoption of Engineered Quartz and Sustainable Composite Countertops Accelerates Market Growth

Engineered quartz combines natural stone aesthetics with superior performance characteristics including stain resistance and uniform patterning. Manufacturers develop innovative composite materials incorporating recycled glass and sustainable components appealing to environmentally conscious consumers. Moreover, consistent quality and reduced maintenance requirements position engineered surfaces as practical alternatives.

Commercial sector demand from hospitality, retail, and healthcare facilities drives bulk countertop installations requiring durable hygienic surfaces. Hotels and restaurants prioritize easy-clean materials withstanding heavy use while maintaining visual appeal. Additionally, medical facilities specify antimicrobial surfaces meeting stringent infection control standards.

Technological advancements in surface finishing enable realistic stone textures, matte finishes, and customized color matching. Digital fabrication tools improve precision reducing material waste and installation time. Furthermore, modular kitchen systems integrate countertops as essential components driving coordinated purchasing in urbanizing markets.

Emerging Trends

Surge in Preference for Eco-Friendly and Recycled Countertop Materials Reshapes Market Landscape

Environmental consciousness drives consumer demand for countertops manufactured from recycled materials and sustainable sourcing practices. Manufacturers develop products incorporating reclaimed stone, recycled glass, and bio-based resins reducing environmental impact. Moreover, green building certifications incentivize specification of eco-friendly countertop materials in construction projects.

Aesthetic preferences shift toward seamless matte and textured surface finishes departing from traditional high-gloss appearances. Consumers seek natural understated elegance aligning with minimalist interior design trends. Additionally, textured surfaces provide enhanced slip resistance and hide fingerprints improving practical functionality.

Integration of antimicrobial and heat-resistant technologies addresses hygiene concerns and performance requirements in residential and commercial applications. Surfaces incorporating silver ions or copper compounds actively inhibit bacterial growth maintaining sanitary conditions. Furthermore, advanced resin formulations improve heat tolerance protecting countertops from cookware damage.

Customization demand increases as consumers request unique colors, patterns, and edge profiles reflecting personal design preferences. Digital visualization tools enable customers to preview installations before purchase reducing decision anxiety. Consequently, fabricators invest in flexible production capabilities accommodating bespoke specifications.

Regional Analysis

Asia-Pacific Dominates the Countertops Market with a Market Share of 47.20%, Valued at USD 67.1 Billion

Asia-Pacific leads global countertops market driven by rapid urbanization, expanding middle class, and extensive residential construction activities. China and India represent major growth engines with massive housing development programs and rising consumer spending on interior upgrades. Moreover, 47.20% market share reflects the region’s dominant position valued at USD 67.1 Billion, supported by local manufacturing capabilities and cost-competitive production.

North America Countertops Market Trends

North America demonstrates strong demand fueled by active residential renovation sector and preference for premium countertop materials. United States leads regional consumption with established distribution networks and high homeownership rates. Additionally, kitchen remodeling remains top home improvement priority sustaining consistent replacement demand across suburban markets.

Europe Countertops Market Trends

Europe exhibits mature market characteristics with emphasis on sustainable materials and design innovation. Germany, Italy, and United Kingdom drive regional demand through luxury residential projects and commercial hospitality developments. Furthermore, stringent environmental regulations promote adoption of eco-friendly countertop solutions.

Latin America Countertops Market Trends

Latin America experiences growth through expanding urban construction and increasing middle-class housing investments. Brazil and Mexico represent primary markets with developing infrastructure and rising consumer aspirations for modern kitchen amenities. However, economic volatility and import dependencies create pricing challenges.

Middle East & Africa Countertops Market Trends

Middle East and Africa show growth potential driven by luxury real estate developments and hospitality sector expansion. GCC countries invest heavily in premium residential and commercial projects specifying high-end countertop materials. Nevertheless, market penetration remains limited in developing African regions due to affordability constraints.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Cosentino maintains global leadership through innovative surface solutions including Silestone quartz and Dekton ultra-compact materials. The company operates integrated production facilities and extensive distribution networks across multiple continents. Moreover, Cosentino invests heavily in sustainable manufacturing processes and recycled material technologies. Their architectural and design partnerships strengthen brand positioning in premium residential and commercial segments globally.

Levantina leverages vertical integration from quarry ownership through fabrication and distribution delivering natural stone excellence. The Spanish company supplies granite, marble, and limestone to international markets emphasizing quality and consistency. Additionally, Levantina’s heritage in stone craftsmanship spans over fifty years establishing strong industry credibility. Their global presence supports major construction and renovation projects worldwide.

LX Hausys combines advanced engineering with aesthetic innovation producing HI-MACS solid surfaces and engineered stone products. The South Korean manufacturer emphasizes thermoformability enabling complex curved installations and seamless designs. Furthermore, LX Hausys expands manufacturing capacity meeting growing Asian demand while penetrating Western markets. Their commitment to sustainability includes eco-friendly production certifications.

Corian pioneered solid surface category and maintains premium positioning through continuous product innovation and design collaboration. DuPont’s legacy brand offers unmatched fabrication flexibility and repair capabilities distinguishing it from stone alternatives. Moreover, Corian’s non-porous surfaces meet healthcare and food service hygiene requirements. Strategic partnerships with architects and designers sustain specification momentum.

Key players

- Cosentino

- Levantina

- LX Hausys

- Corian

- Cambria

- LG Hausys

- Wilsonart

- EGGER

- Polycor

- Antolini

Recent Developments

- October 2025 – Borgman Capital acquired K.G. Stevens, Milwaukee-based countertop fabricator and installer, marking the largest countertop fabrication operation in Wisconsin. The acquisition strengthens Borgman Capital’s building materials portfolio while expanding K.G. Stevens’ market reach through enhanced capital resources and operational support.

- July 2024 – Cutting Edge Countertops acquired L.E. Smith Company expanding fabrication capacity and geographic coverage, in competitive regional markets. This strategic consolidation enables operational synergies and improved service delivery capabilities for residential and commercial customers.

Report Scope

Report Features Description Market Value (2025) USD 142.3 Billion Forecast Revenue (2035) USD 236.2 Billion CAGR (2026-2035) 5.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product (Granite, Solid Surface, Engineered Quartz, Laminate, Marble, Others), Application (Kitchen, Bathroom, Others), End Use (Residential, Commercial), Installation Type (New Construction, Renovation / Retrofit) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cosentino, Levantina, LX Hausys, Corian, Cambria, LG Hausys, Wilsonart, EGGER, Polycor, Antolini Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cosentino

- Levantina

- LX Hausys

- Corian

- Cambria

- LG Hausys

- Wilsonart

- EGGER

- Polycor

- Antolini