Global Conversational Commerce Market By Type (Chatbots, Intelligent Virtual Assistants), By Component (Software / Solutions, Services), By Deployment Mode (Cloud, On-Premises), By Organisation Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By End-user Industry (Banking, Financial Services and Insurance (BFSI), Information Technology and Telecom, Other End-user Industries), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170916

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Type Analysis

- Component Analysis

- Deployment Mode Analysis

- Organisation Size Analysis

- End-User Industry Analysis

- Increasing Adoption of Technologies

- Benefits

- Usage

- How It Works

- Leading Industry Examples

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Opportunities & Thrests

- Key Challenges

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

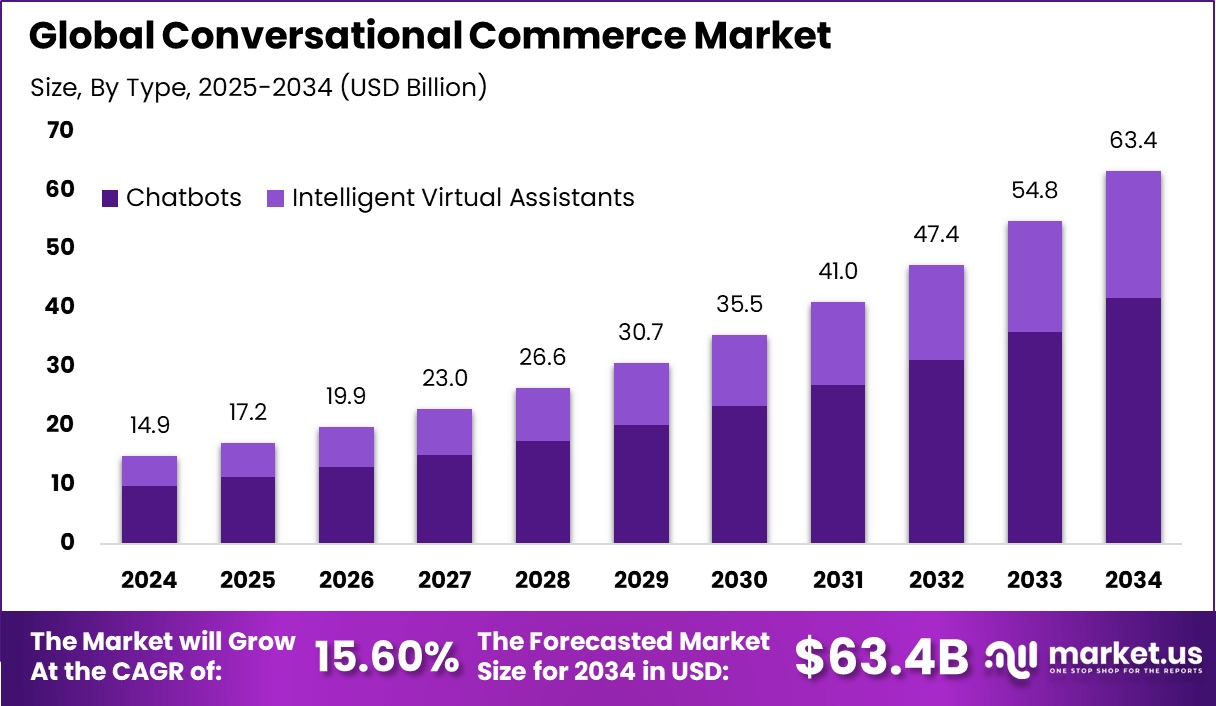

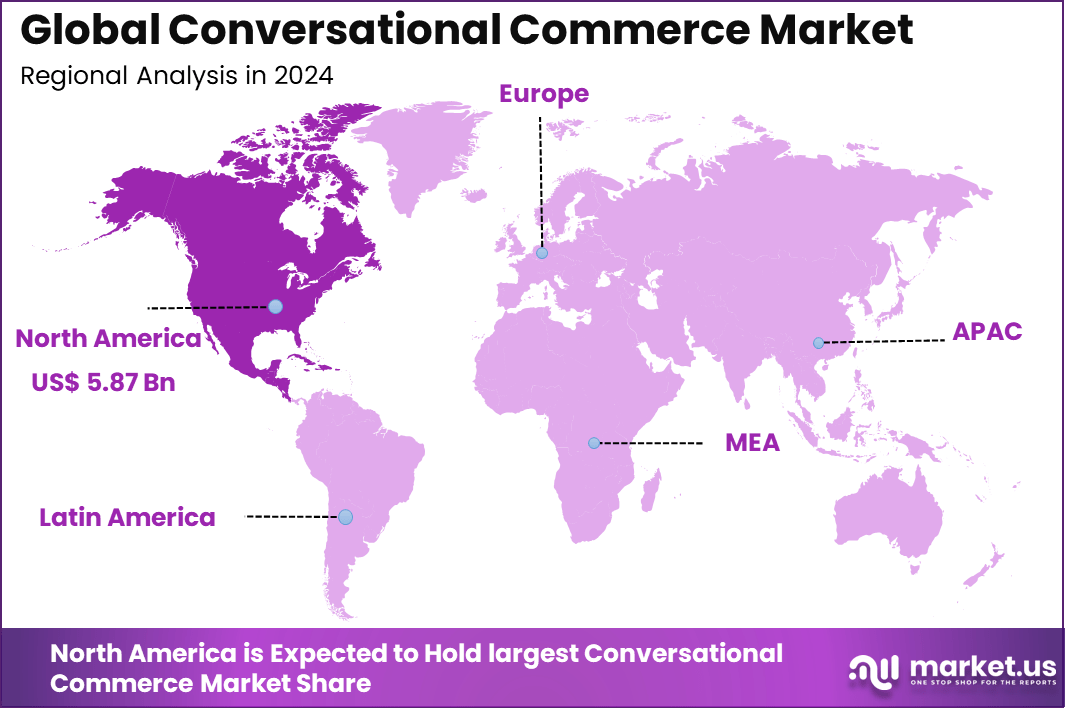

The Global Conversational Commerce Market generated USD 14.9 billion in 2024 and is predicted to register growth from USD 17.2 billion in 2025 to about USD 63.4 billion by 2034, recording a CAGR of 15.60% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.5% share, holding USD 5.87 Billion revenue.

Conversational commerce refers to the use of messaging platforms, chat interfaces, and voice assistants to enable buying, selling, and customer interaction. It allows businesses to communicate with customers in real time through channels such as chat apps, websites, and social platforms. The approach focuses on natural conversations rather than traditional website navigation. This model improves engagement by meeting customers where they already spend their time.

The market includes chatbots, live chat systems, voice assistants, and AI-powered messaging tools used across retail, banking, travel, and service industries. Businesses use conversational commerce to answer queries, guide purchases, and complete transactions. The model supports both automated and human-assisted interactions. As digital communication habits evolve, conversational commerce is becoming a standard customer interface.

According to experro, interest in Gen AI powered conversational commerce is growing, with 66% of consumers willing to try AI driven shopping interactions. About 34% of retail customers are already comfortable chatting with AI chatbots or virtual assistants, reflecting increasing trust in automated customer engagement during the buying journey.

This adoption is translating into measurable business outcomes. Chatbot enabled retail websites recorded a 23% increase in conversion rates, while brands that launched AI focused shopping subdomains experienced a 1200% surge in site traffic between mid 2024 and early 2025, demonstrating the strong impact of conversational AI on customer acquisition and sales performance.

One major driving factor is the shift in consumer behavior toward instant and conversational interactions. Customers increasingly expect quick responses and personalized communication when making purchase decisions. Traditional email or form-based systems often fail to meet these expectations. Conversational tools provide immediate and interactive engagement.

Another key factor is the growing use of mobile messaging applications. Messaging platforms have become primary communication channels for many users worldwide. Businesses see these platforms as effective touchpoints for customer interaction and conversion. This trend continues to push adoption across industries.

Top Market Takeaways

- By type, chatbots accounted for 65.8% of the conversational commerce market, as they handle customer queries and sales through natural chat.

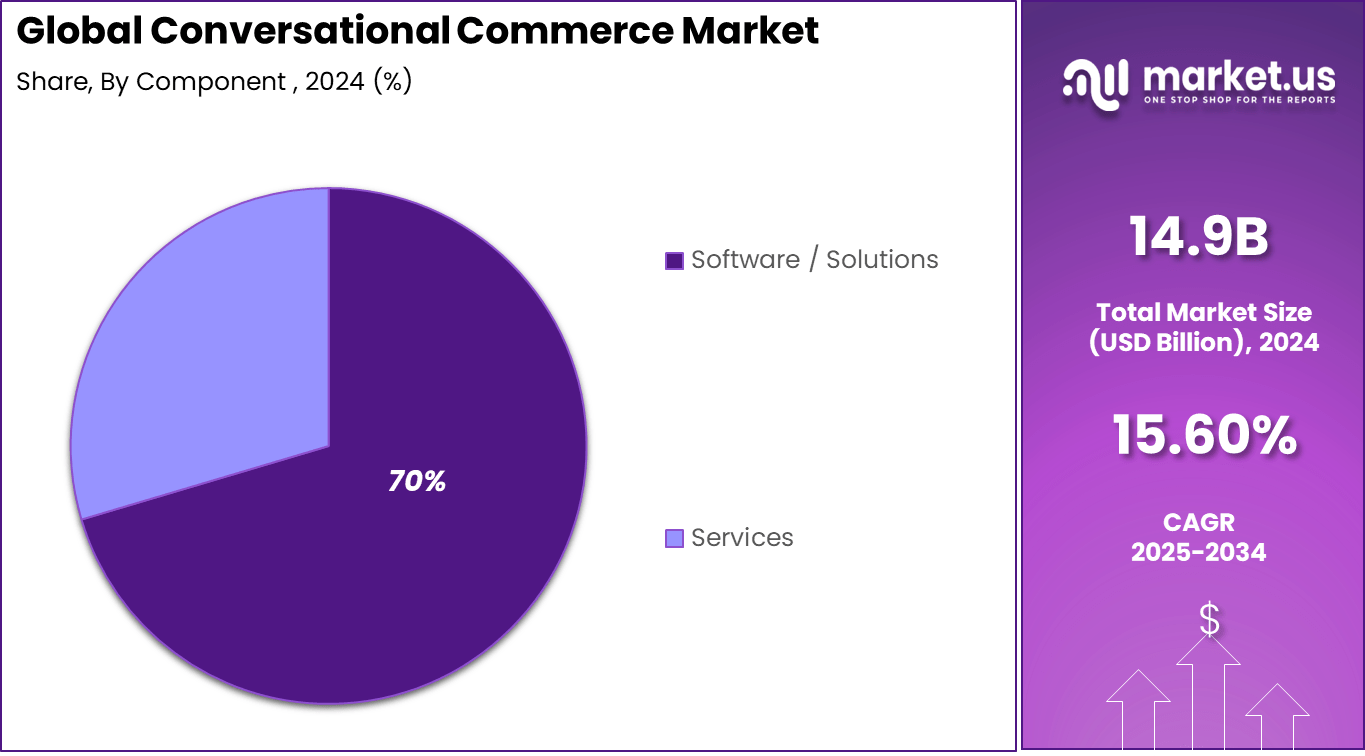

- By component, software and solutions held 70.4% share, providing the core tools for building and running chat systems.

- By deployment mode, on-premises solutions captured 58.7%, chosen by firms for better data control and security.

- By organisation size, large enterprises took 76.8%, using advanced chat platforms to serve millions of customers.

- By end-user industry, banking, financial services and insurance led with 40.8%, applying chatbots for account help and transactions.

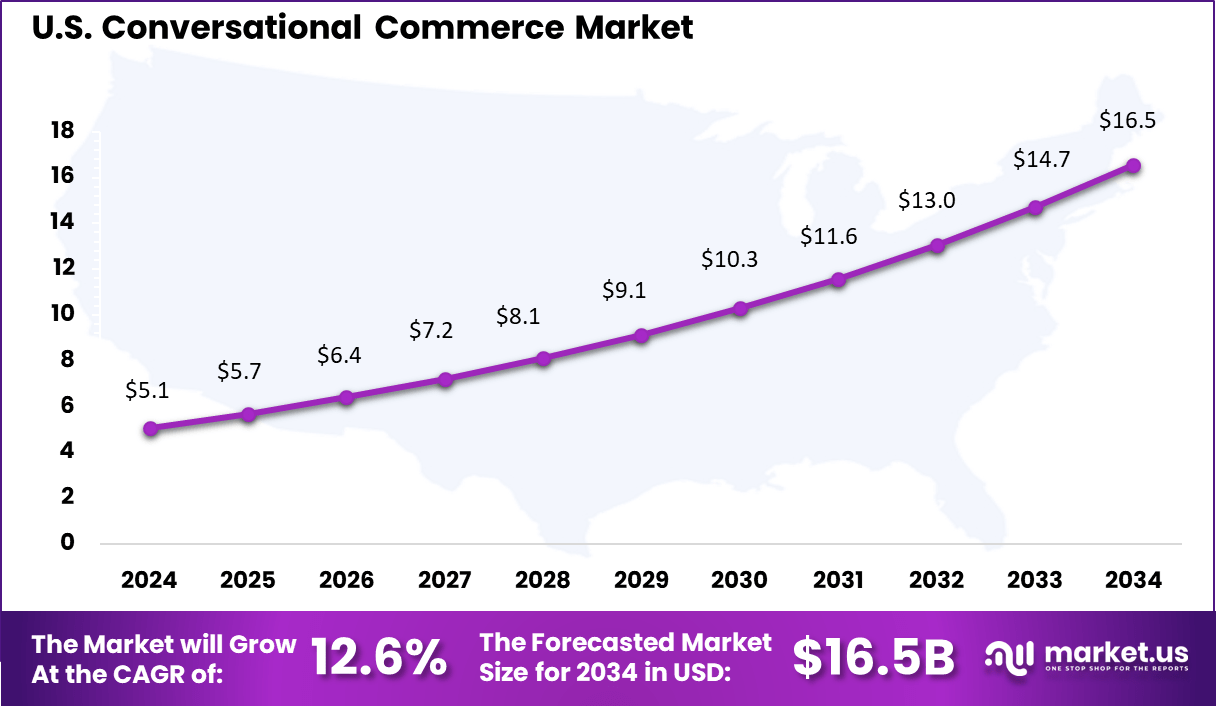

- North America had 39.5% of the global market, with the U.S. at USD 5.05 billion in 2025 and growing at a CAGR of 12.6%.

Quick Market Facts

Business Impact and Benefits

- Conversational commerce solutions are delivering measurable commercial value by improving sales performance and operational efficiency.

- AI-powered chat interactions have increased conversion rates by up to 23%, as guided assistance reduces buyer hesitation.

- Proactive conversational prompts help recover nearly 35% of abandoned carts by addressing concerns in real time.

- Businesses report average cost savings of 30% in customer service operations, alongside faster issue resolution.

- Customer satisfaction levels have improved significantly, with many organizations reporting up to 80% improvement in CSAT scores after chatbot adoption.

Consumer Behavior and Preferences

- Messaging-based brand interaction is strongly preferred, with 67% of consumers valuing mobile messaging and 62% favoring chatbots over waiting for human agents.

- Personalization remains a key expectation, as 90% of consumers seek tailored recommendations and 78% show higher repeat purchase intent with personalized experiences.

- Interest in AI-led commerce is growing, with 66% of consumers open to Gen AI-driven interactions, while still valuing empathy and human fallback options.

- Voice commerce adoption is increasing, with 17% of consumers already using voice assistants for reordering and 60% making daily or weekly purchases through smart voice devices.

Type Analysis

Chatbots account for 65.8%, showing that automated conversational tools dominate conversational commerce adoption. Businesses use chatbots to handle customer inquiries, product recommendations, and order support across digital channels. Chatbots provide quick responses and operate continuously. This improves customer engagement and service availability.

The strong adoption of chatbots is driven by cost efficiency and scalability. Organizations use them to manage high volumes of customer interactions without increasing staffing levels. Chatbots also help reduce response time and improve consistency. These benefits support widespread deployment.

Component Analysis

Software and solutions represent 70.4%, indicating that conversational commerce relies mainly on integrated platforms. These solutions support chatbot development, conversation management, and integration with payment and customer systems. Centralized software allows better control over conversation flows. It also supports analytics and performance tracking.

Growth in this segment is driven by demand for end-to-end conversational systems. Businesses prefer ready-to-use platforms that reduce development complexity. Software solutions also support customization across different business needs. This strengthens adoption across industries.

Deployment Mode Analysis

On-premises deployment holds 58.7%, reflecting preference for internal control over conversational data. Organizations handling sensitive customer information rely on local systems to manage conversations securely. On-site deployment supports stricter data governance. This approach reduces external data exposure.

Adoption of on-premises solutions is supported by regulatory and security requirements. Enterprises benefit from greater system customization and direct oversight. Integration with existing internal systems is easier. These factors continue to support this deployment model.

Organisation Size Analysis

Large enterprises account for 76.8%, highlighting their dominant role in conversational commerce adoption. These organizations manage large customer bases and complex service operations. Conversational platforms help handle high interaction volumes efficiently. Centralized systems support enterprise-wide consistency.

Adoption among large enterprises is driven by digital transformation initiatives. Conversational commerce improves customer experience and operational efficiency. Large enterprises also invest in advanced integration and analytics. This sustains strong demand in this segment.

End-User Industry Analysis

The BFSI sector holds 40.8%, making it the leading end-user industry. Financial institutions use conversational commerce for account support, transaction assistance, and customer queries. Secure and accurate communication is critical in this sector. Conversational tools help maintain service continuity.

Demand in BFSI is driven by rising digital banking adoption. Conversational platforms improve customer accessibility and reduce service delays. They also support compliance through controlled interaction flows. These needs support continued adoption.

Increasing Adoption of Technologies

The adoption of artificial intelligence and natural language processing is accelerating the use of conversational commerce. These technologies enable systems to understand customer intent and respond accurately. Machine learning improves performance over time by analyzing interaction data. This makes conversations more natural and effective.

Integration with payment systems, customer databases, and order management platforms is also increasing. These integrations allow conversations to move seamlessly from inquiry to transaction. Cloud deployment supports scalability and remote access. Together, these technologies strengthen the reliability and reach of conversational commerce solutions.

One key reason for adoption is improved customer engagement. Conversational interfaces create a more personal and interactive experience compared to static websites. Customers are more likely to complete purchases when guided through conversations. This directly supports higher conversion rates.

Another reason is operational efficiency. Automated chat systems reduce the workload on customer support teams. Businesses can handle more interactions without proportional cost increases. This balance of cost control and service quality drives long-term adoption.

Benefits

- Customer engagement improves as responses are instant and interactive.

- Sales conversion rates increase due to real time guidance during purchase decisions.

- Operating costs are reduced by limiting dependence on large support teams.

- Brand presence becomes stronger through consistent and always available communication.

- Customer satisfaction rises because issues are resolved faster within a single conversation.

Usage

- Used by online retailers to answer product questions and complete purchases in chat.

- Adopted by banks to assist customers with account services and transaction queries.

- Applied in travel and hospitality to manage bookings and service requests.

- Used by food delivery and quick service brands for order placement and tracking.

- Utilized by service providers to handle support tickets and follow ups efficiently.

How It Works

- Customer Starts the Conversation: A customer asks a question through chat or voice, such as asking for blue running shoes.

- System Understands the Request: The system understands what the customer wants by reading the meaning and context of the question.

- Personalized Response: Suitable products are shown, questions about size or price are answered, and the customer is guided step by step.

- Easy Purchase: The customer can add items to the cart and complete the payment without leaving the chat.

Leading Industry Examples

- Starbucks: Uses a Barista Bot in its mobile app that lets customers place orders by voice and pay directly within the chat.

- H&M: Runs a chatbot that suggests outfits based on customer style and occasion, with the option to buy immediately in the same chat.

- Four Seasons: Uses a chat based concierge that helps guests request room service, room upgrades, and local travel suggestions in one conversation.

- Domino’s: Lets customers order a pizza by sending a pizza emoji through text message or Facebook Messenger.

Emerging Trends

Key Trend Description Voice Shopping Rise Voice based AI allows users to shop by speaking to smart devices and assistants. AI Personal Help Chatbots provide personalized product suggestions using past chats and behavior. Pay in Chat Payments are completed directly inside messaging apps for faster purchases. Multi Channel Talk Users switch easily between chat, voice, and apps during one shopping journey. Emotion Smart Bots AI systems detect user mood to offer suitable help, offers, or responses. Growth Factors

Key Factors Description Messaging Apps Boom Widespread use of messaging platforms supports chat based customer interaction. AI Chatbot Spread Businesses deploy AI chatbots to offer round the clock support and drive sales. Shoppers Want Fast Consumers expect quick answers and instant buying within a single chat flow. Mobile Shop Jump Rising mobile shopping increases demand for conversational buying tools. Small Biz Tools Low cost platforms help small businesses add chat based sales features. Key Market Segments

By Type

- Chatbots

- Intelligent Virtual Assistants

By Component

- Software / Solutions

- Services

By Deployment Mode

- Cloud

- On-Premises

By Organisation Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-user Industry

- Banking, Financial Services and Insurance (BFSI)

- Information Technology and Telecom

- Healthcare

- Travel and Hospitality

- Retail and E-commerce

- Other End-user Industries

Regional Analysis

North America accounted for 39.5% share, supported by high digital maturity and strong penetration of messaging platforms, mobile commerce, and voice based interfaces. Enterprises across retail, banking, travel, and telecommunications have adopted conversational commerce to improve customer engagement and reduce service costs.

Demand has been driven by consumer preference for instant responses and seamless interaction across chat, voice, and social channels. Businesses have increasingly used conversational tools to manage inquiries, recommend products, and complete transactions within a single conversation flow.

The U.S. market reached USD 5.05 Bn and is projected to grow at a 12.6% CAGR, reflecting broad adoption across large enterprises and fast growing digital brands. Companies have deployed conversational commerce solutions to support sales, customer service, and post purchase engagement, particularly in e commerce and financial services. The ability to handle high interaction volumes while maintaining consistent service quality has been a key driver for adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Opportunities & Thrests

The Conversational Commerce market presents strong opportunities as consumers increasingly prefer quick and direct communication with brands. Chat based shopping through messaging apps, websites, and voice assistants allows businesses to guide customers in real time, answer questions, and support purchase decisions within a single conversation.

This improves customer convenience and increases the chance of completing a sale. Growth is also supported by the widespread use of smartphones and social messaging platforms, which makes conversational channels easy to access for a broad user base.

The market faces threats related to trust, data privacy, and customer experience quality. Poorly designed chatbots or inaccurate responses can frustrate users and damage brand reputation. Concerns around personal data usage and secure payment handling may limit adoption, especially in regions with strict data protection rules. If customers feel that conversations are not secure or transparent, they may avoid completing transactions through chat channels.

Key Challenges

- Maintaining accurate and natural conversation quality

- Protecting customer data and payment information

- Integrating chat systems with existing sales and support platforms

- Balancing automation with timely human assistance

- Measuring performance and return on conversational interactions

Competitive Analysis

Amazon Web Services, Meta Platforms, Google, Microsoft, and IBM lead the conversational commerce market by providing AI and cloud platforms that enable chat based interactions across messaging apps, websites, and voice channels. Their technologies support chatbots, virtual assistants, and automated customer journeys at scale. These companies focus on natural language understanding, personalization, and secure data handling.

LivePerson, Jio Haptik, Quiq, Attentive Mobile, Octane AI, SleekFlow, Charles, and Connectly strengthen the market with commerce focused messaging solutions for sales, marketing, and customer support. Their platforms help brands drive conversions through SMS, WhatsApp, and in app chat. These providers emphasize automation, omnichannel orchestration, and measurable ROI.

Glia, Conversation24, Webio, Respond.io, Yalo, Boost AI, Sprinklr, Invoca, Inbenta, CogniCor, SalesLoft, Wizard Commerce, and other players expand the landscape with specialized conversational AI and engagement tools. Their offerings support customer service automation, lead qualification, and post purchase support. These companies focus on integration flexibility and industry specific use cases.

Top Key Players in the Market

- Amazon Web Services, Inc.

- Meta Platforms, Inc.

- Google LLC

- Microsoft Corporation

- IBM Corporation

- LivePerson, Inc.

- Jio Haptik Technologies Limited

- Quiq, Inc.

- Attentive Mobile, Inc.

- Octane AI, Inc.

- SleekFlow Technologies Limited

- Charles GmbH

- Connectly, Inc.

- Glia Technologies, Inc.

- Conversation24 Ltd.

- Webio Ltd.

- Respond.io Ltd.

- Yalo, Inc.

- Boost AI AS

- Sprinklr, Inc.

- Invoca, Inc.

- Inbenta Holdings Inc.

- CogniCor Technologies, Inc.

- SalesLoft, Inc.

- Wizard Commerce, Inc.

- Others

Future Outlook

The future outlook for the Conversational Commerce market is expected to remain positive as businesses focus on more direct and personalized digital interactions with customers. Chat and voice based shopping is being adopted across retail, banking, travel, and food services to support faster responses and smoother purchase journeys.

Improvements in natural language understanding and integration with payment, CRM, and order management systems are helping conversations move from simple support to complete transactions. Over time, higher consumer comfort with messaging platforms and voice assistants is likely to make conversational channels a standard part of online commerce strategies, supporting stronger engagement and repeat purchases.

Recent Developments

- December, 2025 – AWS launched UST Conversational Commerce on its marketplace, an AI platform for retailers that handles product recommendations, order tracking and payments in-chat across social channels, integrating with Shopify and CRMs for higher AOV and seamless handoffs to humans.

- June, 2025 – Meta rolled out WhatsApp status ads and business voice calling at Conversations 2025, enabling live shopping on Messenger and centralized campaigns with AI budget optimization to turn messaging into direct commerce channels.

Report Scope

Report Features Description Market Value (2024) USD 14.9 Bn Forecast Revenue (2034) USD 63.4 Bn CAGR(2025-2034) 15.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Chatbots, Intelligent Virtual Assistants), By Component (Software / Solutions, Services), By Deployment Mode (Cloud, On-Premises), By Organisation Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By End-user Industry (Banking, Financial Services and Insurance (BFSI), Information Technology and Telecom, Other End-user Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services, Inc., Meta Platforms, Inc., Google LLC, Microsoft Corporation, IBM Corporation, LivePerson, Inc., Jio Haptik Technologies Limited, Quiq, Inc., Attentive Mobile, Inc., Octane AI, Inc., SleekFlow Technologies Limited, Charles GmbH, Connectly, Inc., Glia Technologies, Inc., Conversation24 Ltd., Webio Ltd., Respond.Io Ltd., Yalo, Inc., Boost AI AS, Sprinklr, Inc., Invoca, Inc., Inbenta Holdings Inc., CogniCor Technologies, Inc., SalesLoft, Inc., Wizard Commerce, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Conversational Commerce MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Conversational Commerce MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services, Inc.

- Meta Platforms, Inc.

- Google LLC

- Microsoft Corporation

- IBM Corporation

- LivePerson, Inc.

- Jio Haptik Technologies Limited

- Quiq, Inc.

- Attentive Mobile, Inc.

- Octane AI, Inc.

- SleekFlow Technologies Limited

- Charles GmbH

- Connectly, Inc.

- Glia Technologies, Inc.

- Conversation24 Ltd.

- Webio Ltd.

- Respond.Io Ltd.

- Yalo, Inc.

- Boost AI AS

- Sprinklr, Inc.

- Invoca, Inc.

- Inbenta Holdings Inc.

- CogniCor Technologies, Inc.

- SalesLoft, Inc.

- Wizard Commerce, Inc.

- Others