Global Content Security Gateway Market Size, Share, Industry Analysis Report By Component (Solutions (URL Filtering, Malware Detection, Application Control, DLP, SSL/TLS Inspection), Services (Professional Services, Managed Services)), By Deployment (Cloud-based, On-Premises), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Industry Vertical (BFSI, Healthcare, Government and Defense, IT & Telecom, Retail & Ecommerce, Education, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162439

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Role of Generative AI

- Threat-Related Statistics

- Internal and Human-Related Statistics

- US Market Size

- Emerging Trends

- Growth Factors

- By Component

- By Deployment

- By Organization Size

- By Industry Vertical

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

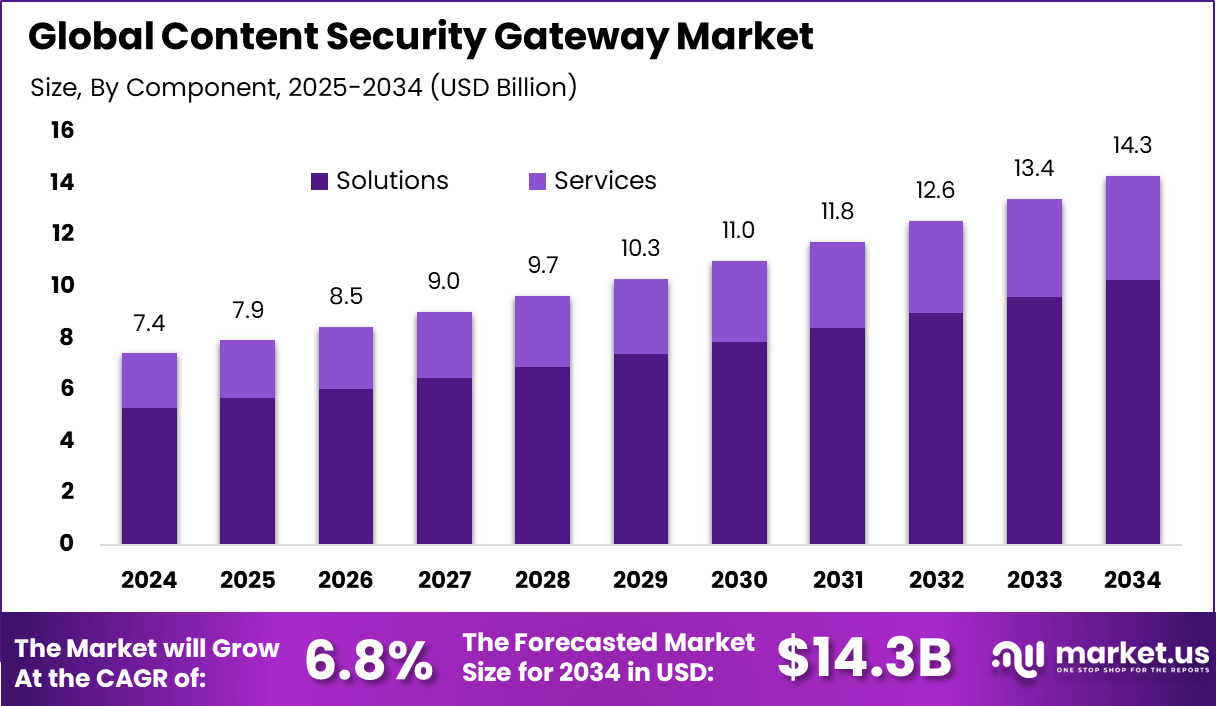

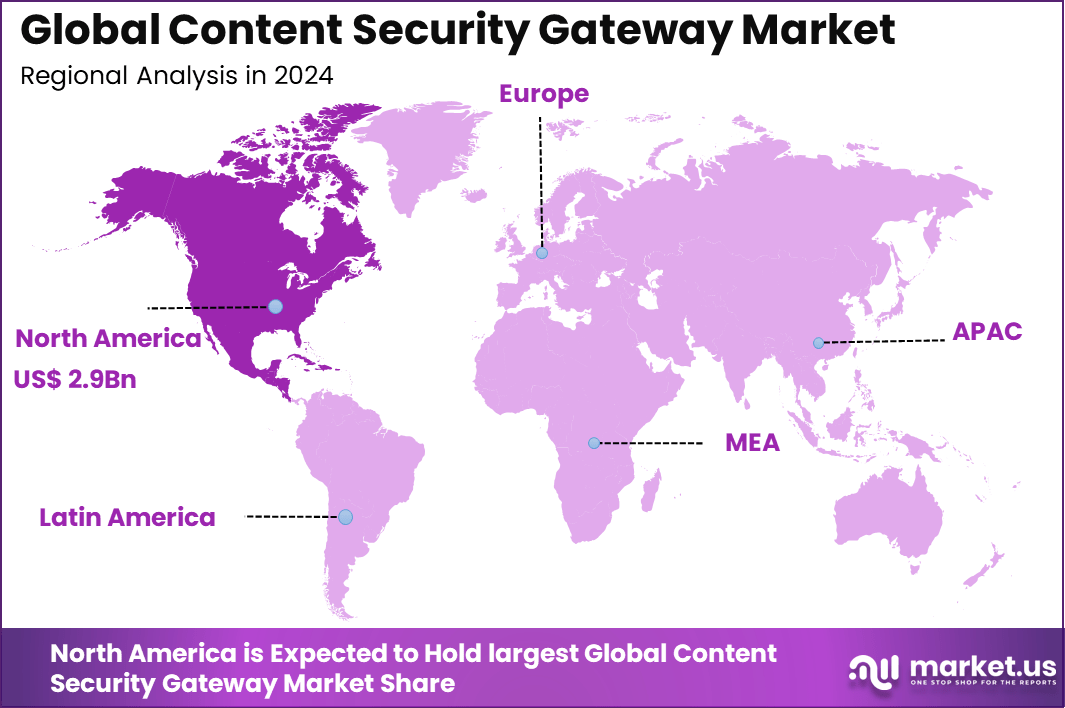

The Global Content Security Gateway Market generated USD 7.4 billion in 2024 and is predicted to register growth from USD 7.9 billion in 2025 to about USD 14.3 billion by 2034, recording a CAGR of 6.8% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.4% share, holding USD 2.9 Billion revenue.

The Content Security Gateway (CSG) market is growing rapidly as organizations face increasing cyber risks and demand stronger control over digital threats. CSG solutions act as gatekeepers by filtering and blocking harmful or unauthorized content from networks. They combine antivirus, antispam, web filtering, and data loss prevention to protect enterprises’ digital assets.

Key driving factors include the rise in sophisticated cyber threats and the shift toward cloud-based environments. With more employees working remotely and accessing corporate resources from various devices, the demand for secure gateways that provide secure remote access has increased significantly. According to the FBI’s 2021 report, internet crimes led to reported losses exceeding $6.9 billion, highlighting the urgent need for robust security frameworks.

Technological advancements are reshaping how content security gateways operate. The integration of artificial intelligence (AI) and machine learning (ML) has enhanced threat detection accuracy and enabled faster response times. Cloud-based CSG solutions offer scalability, cost-efficiency, and easier management compared to traditional on-premises setups.

Unified threat management platforms that combine firewalls, intrusion prevention, and filtering functions in one solution are gaining popularity for their simplicity and cost benefits. Many organizations are embracing the zero-trust security model, which continuously verifies the users and devices accessing information, further boosting gateway adoption.

Investment opportunities are strong in cloud-delivered security platforms that support hybrid and remote workforce environments. Businesses benefit from reduced infrastructure costs, flexible scaling, and improved threat intelligence sharing through cloud-based services. Regulatory compliance requirements also create a growing market for specialized CSG tools that help organizations meet data privacy laws like GDPR and CCPA.

Top Market Takeaways

- The Solutions segment led with 71.6%, reflecting strong adoption of integrated platforms for email, web, and data protection.

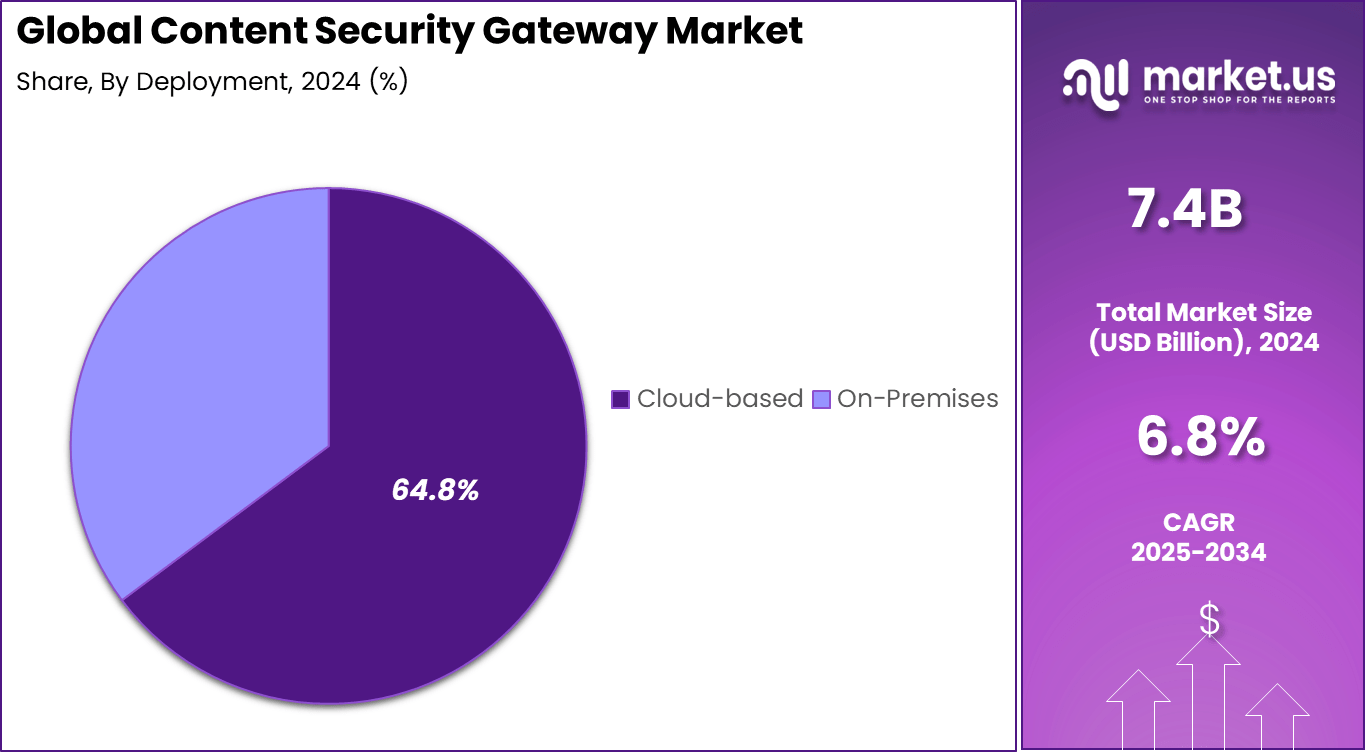

- Cloud-based deployment accounted for 64.8%, driven by growing demand for scalable, flexible, and remotely managed security systems.

- Large Enterprises dominated with 67.5%, supported by increased investments in cybersecurity to safeguard complex digital infrastructures.

- The BFSI sector held 22.3%, highlighting stringent compliance requirements and the need for advanced content filtering in financial institutions.

- North America captured 39.4% of the global market, benefiting from mature IT ecosystems and high awareness of data breach prevention.

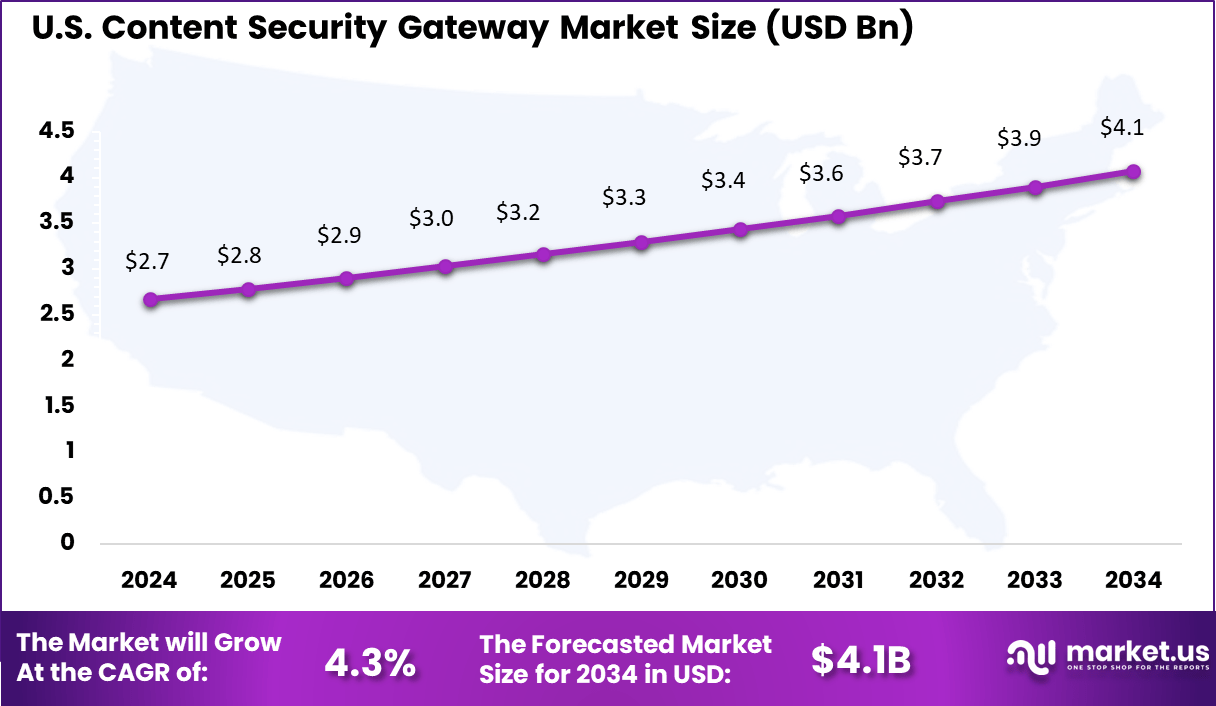

- The US market reached USD 2.67 Billion in 2024, registering a steady 4.3% CAGR, driven by continuous modernization of enterprise cybersecurity frameworks.

Role of Generative AI

Generative AI has become a crucial component in enhancing content security gateways by improving threat detection and response capabilities. Around 66% of organizations expect AI to reshape cybersecurity by 2025, highlighting its growing influence in identifying and mitigating cyber threats. However, only 37% of these organizations have deployed adequate safeguards, showing a gap between adoption and security preparedness.

Generative AI helps analyze vast amounts of data automatically, detecting unusual patterns such as phishing or data breaches, thereby reducing the risk exposure in enterprise environments. Such AI-driven security tools also help cut down incident response times substantially, making defenses more proactive and effective in stopping attacks early.

Despite the rise in AI-powered security, vulnerabilities remain prominent. For example, over 20% of files uploaded for AI processing have contained sensitive corporate data, requiring specialized AI controls to avoid data leaks. Additionally, adversarial AI attacks, including sophisticated phishing tactics enhanced by Generative AI, surged by 146%, indicating the dual-edged nature of this technology.

Threat-Related Statistics

- Cybercrime costs: Global cybercrime is projected to cost businesses up to $10.5 trillion by the end of 2025, underscoring the financial scale of the threat.

- Phishing: This remains the most prevalent attack method. An estimated 3.4 billion phishing emails are sent daily, with 90% of cyber incidents beginning from phishing. Research suggests phishing is the initial vector in nearly 30% of global breaches.

- Ransomware: One of the costliest threats, ransomware accounted for 59% of all cyberattacks in 2024. The average ransom payment reached $2 million, while global ransomware costs are expected to hit $265 billion annually by 2031.

- AI-powered attacks: The misuse of generative AI is intensifying cyber risks. In 2025, 97% of companies reported security issues linked to AI misuse, particularly in generating realistic phishing campaigns and deepfakes.

- Other threats:

- Data breaches: The global average cost reached $4.88 million in 2024.

- Malware: More than 560,000 new malware samples are detected each day.

- Web application attacks: Roughly 75% of attacks target websites and custom-built web apps.

- Cloud threats: At least 61% of companies experience one or more cloud-based attacks per year, with over half linked to human error.

Internal and Human-Related Statistics

- Human error: Mistakes by employees remain a major vulnerability, contributing to 68% of data breaches, as reported in 2024.

- Insider threats: In 2024, 83% of organizations experienced at least one insider-driven attack, reflecting growing risks from within.

- Security preparedness: Many organizations, especially small and medium-sized businesses (SMBs), lack sufficient safeguards. Around 20% of SMBs report having no cybersecurity technology in place, often relying on untrained in-house teams.

- Cyber insurance: Coverage gaps persist, with only 74% of companies carrying dedicated cybercrime insurance to mitigate financial losses.

US Market Size

The United States alone contributes around USD 2.67 billion, expanding at a 4.3% CAGR. Growth stems from stricter data protection laws and the widespread adoption of remote and multi‑cloud operations. U.S. enterprises invest heavily in AI‑powered security analytics that strengthen defense against zero‑day threats. The region’s dynamic regulatory landscape ensures steady innovation in content inspection, encryption monitoring, and adaptive access controls.

North America leads with 39.4% of the global share, reflecting the region’s strong cybersecurity infrastructure maturity and early technology adoption. Enterprises across the United States and Canada continue modernizing legacy systems to address increasingly complex threat environments. Continuous collaboration between technology providers and government initiatives reinforces the region’s leadership in compliance-driven deployments.

Emerging Trends

The shift toward cloud-native security solutions is a dominant trend in the content security gateway space, with around 60% of enterprises preferring cloud deployments for their scalability and cost efficiency. Cloud-based gateways facilitate seamless protection for remote workforces and mobile users, meeting the demands of modern hybrid work environments.

Another key development is the integration of zero-trust architecture models, which verify every user and device continuously to prevent insider threats. Governments and large organizations have reported internal threat reductions by up to 40% after adopting zero-trust measures, proving its effectiveness. Mobile-centric security is gaining momentum as mobile device usage rises sharply, requiring gateways to prioritize protecting mobile applications and data.

In 2025, some enterprises already prevented hundreds of malware attacks on employee mobile devices through enhanced mobile threat protection. Alongside, behavioral analytics and AI-powered detection are becoming standard features, enabling gateways to identify novel and zero-day threats faster. The demand for comprehensive security platforms that integrate these trends is shaping the future of content security gateways to be smarter, more adaptive, and user-aware.

Growth Factors

The primary growth driver is the escalating frequency and complexity of cyberattacks, which forces organizations to adopt advanced content security gateways to safeguard sensitive data. For instance, cybercrime reports grew by 13% year-over-year in Australia alone, reflecting a global pattern of rising threats.

Additionally, evolving data privacy regulations worldwide increase pressure on companies to comply by deploying robust security gateways that filter harmful content proactively and help avoid costly breaches. The widespread adoption of BYOD (Bring Your Own Device) policies also fuels demand, as gateways need to secure diverse endpoints accessing corporate networks.

Moreover, the proliferation of cloud computing and remote workforces creates a strong need for cloud-based security gateways that offer flexible protection outside traditional network perimeters. This shift is accompanied by an increase in AI integration within gateways to automate threat detection and response. Investments in AI-driven security rose by over 15%, keeping pace with application and data security spending.

By Component

In 2024, Solutions dominate the content security gateway market with 71.6%, reflecting enterprises’ growing need for unified platforms that secure data and digital communications. These solutions integrate malware detection, data loss prevention, and web filtering features under one control layer. Their strength lies in offering centralized oversight across endpoints, email systems, and cloud applications.

The demand for comprehensive security suites reflects a shift from stand‑alone tools to integrated frameworks. Businesses prioritize simplified management and real‑time analytics, enabling faster detection of suspicious activity. Vendors are expanding their platforms with AI‑driven threat analysis that adapts to evolving risks.

By Deployment

In 2024, Cloud‑based deployment leads with 64.8%, driven by rising adoption of SaaS and remote work models. These systems allow organizations to secure data flow across distributed teams without heavy hardware investment. They offer faster configuration, automatic updates, and elastic scalability that on‑premises systems often lack.

The preference for cloud versions also reflects the need for secure access to web and email traffic from mobile and geographically dispersed networks. Enterprises are prioritizing flexible security measures that grow with their expanding cloud ecosystem. Cloud gateways support machine‑learning detection and zero‑trust access models, improving visibility into data movement.

Their integration with identity management platforms further boosts security posture in hybrid infrastructures. The continuous evolution of APIs, microservices, and cloud‑native workloads ensures this deployment type remains central to future cyber defense strategies.

By Organization Size

In 2024, Large enterprises account for 67.5% of the market, as they handle vast data volumes and complex digital ecosystems. These organizations invest heavily in advanced threat protection and compliance management due to their exposure to multi‑vector cyber threats. Their large-scale IT infrastructures demand high reliability and integration with other cybersecurity tools.

Continuous network monitoring and encryption enforcement remain core requirements, driving steady investment in robust gateway platforms. Moreover, large enterprises are adopting multi‑layered defense strategies combining gateways with email filters, endpoint protection, and real‑time traffic analysis.

Budget allocations for cybersecurity continue to rise, reflecting greater regulatory scrutiny and reputational risk concerns. The segment’s focus on centralized management and automated threat response fuels demand for sophisticated content gateways that support secure data operations at scale.

By Industry Vertical

In 2024, The BFSI sector leads with 22.3%, reflecting its stringent regulatory requirements and sensitivity to data breaches. Financial institutions depend on content security gateways to prevent unauthorized transmissions and detect insider or external data theft.

The segment’s high transaction frequency and confidential communications make real‑time inspection essential. Encryption inspection, digital rights management, and adaptive filtering are key capabilities driving adoption in banking and insurance sectors.

As BFSI networks move toward cloud banking and mobile transaction platforms, the need for dynamic, policy‑driven content security reinforces market growth. Institutions are investing in systems that integrate directly with fraud analytics and secure access services. The broader goal remains reducing operational risk while preserving customer trust, especially in cross‑border data exchange environments.

Key Market Segments

By Component

- Solutions

- URL Filtering

- Malware Detection

- Application Control

- DLP

- SSL/TLS inspection

- Services

- Professional Services

- Managed Services

By Deployment

- Cloud-based

- On-Premises

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Industry Vertical

- BFSI

- Healthcare

- Government and Defense

- IT & Telecom

- Retail & Ecommerce

- Education

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Cybersecurity Threats and Cloud Adoption

The growing sophistication and volume of cyberattacks are major drivers for the Content Security Gateway (CSG) market. As businesses rely increasingly on digital platforms for communication and commerce, the risk of malware, ransomware, phishing, and data breaches rises sharply.

CSG solutions become critical to filter malicious content, protect networks, and maintain regulatory compliance, making them indispensable for modern enterprises. This need drives strong demand across sectors such as BFSI, healthcare, government, and IT. Cloud adoption further fuels market growth as organizations migrate applications and data to cloud environments.

Cloud-based CSGs offer scalability, flexibility, and remote management capabilities, aligning well with hybrid and distributed IT infrastructures. This combination of heightened threat landscape and cloud reliance pushes enterprises to invest heavily in advanced CSG technologies integrated with AI and machine learning for proactive threat detection.

Restraint

High Deployment Costs and Complexity

One key restraint is the high cost of deploying and maintaining content security gateways, especially for smaller organizations. These solutions often require significant upfront investments in hardware, software licenses, and skilled personnel to manage complex environments. Organizations face challenges in budgeting for initial and ongoing expenses, which can limit wider adoption among SMEs.

Additionally, the complexity of operating CSGs across hybrid and multi-cloud environments poses operational difficulties. Consistently managing security policies, monitoring threats, and preventing misconfigurations demands specialized skills. This complexity may lead to security gaps and increase the risk exposure, thereby restraining some businesses from fully embracing CSG solutions.

Opportunity

AI-Driven Integrated Security Platforms

The integration of artificial intelligence and machine learning into content security gateways presents a strong opportunity. AI-driven analytics enable real-time threat detection, behavioral analysis, and rapid response to complex cyberattacks. These features enhance the efficacy of CSGs, helping reduce false positives and automate routine tasks, which lowers the burden on security teams.

Furthermore, the market is shifting towards integrated security platforms that combine endpoint, network, and cloud security with content filtering. This convergence allows organizations to adopt zero-trust models and automated workflows for comprehensive protection. Increasing demand for cloud-native and SaaS-based CSG solutions also opens new avenues for vendors to innovate and capture emerging market segments.

Challenge

Managing Evolving Threat Landscape and Skilled Workforce Shortage

The constantly evolving nature of cyber threats requires content security gateways to be continuously updated and adapted. Sophisticated attacks like advanced persistent threats and insider threats challenge traditional security measures, demanding ongoing innovation and vigilance. Keeping up with these changes is costly and resource-intensive for organizations and vendors alike.

Moreover, there is a shortage of skilled cybersecurity professionals capable of deploying, managing, and optimizing CSG solutions. This workforce gap hinders efficient implementation and may lead to vulnerabilities if security tools are not properly configured or monitored. Addressing this talent deficit is critical to maximizing the potential of content security gateways in safeguarding digital assets.

Competitive Analysis

The Content Security Gateway Market is led by global cybersecurity providers such as Cisco Systems Inc., Broadcom Inc., Fortinet Inc., Palo Alto Networks Inc., and Trend Micro Inc. These companies offer advanced content filtering, threat detection, and secure web gateway solutions to protect enterprises from malware, phishing, and data leakage.

Prominent players including McAfee Corp., Barracuda Networks Inc., Check Point Software Technologies Ltd., Zscaler Inc., Proofpoint Inc., and Microsoft Corporation deliver unified threat management and email security solutions that safeguard enterprise communications and content workflows. Their focus on zero-trust security, endpoint integration, and real-time threat intelligence enhances visibility and compliance across organizational networks.

Additional participants such as F5 Inc., Sophos Group PLC, Mimecast Services Limited, WatchGuard Technologies Inc., Comodo Security Solutions Inc., iboss Inc., Menlo Security Inc., Trustwave Holdings Inc., AO Kaspersky Lab, Cato Networks Ltd., FirstWave Cloud Technology Limited, Smoothwall Limited, and Planet Technology Corporation, along with other market contributors, strengthen the market through secure web gateways, sandboxing, and cloud-delivered content security.

Top Key Players in the Market

- Barracuda Networks Inc.

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- F5 Inc.

- FirstWave Cloud Technology Limited

- McAfee Corp.

- Planet Technology Corporation

- Proofpoint Inc.

- Trustwave Holdings Inc.

- Microsoft Corporation

- Palo Alto Networks Inc.

- Juniper Networks Inc.

- Fortinet Inc.

- Trend Micro Inc.

- Zscaler Inc.

- Fortra LLC

- AO Kaspersky Lab

- Cato Networks Ltd.

- Mimecast Services Limited

- SonicWall Inc.

- Comodo Security Solutions Inc.

- WatchGuard Technologies Inc.

- Sophos Group PLC

- iboss Inc.

- Cyren Inc.

- Smoothwall Limited

- Menlo Security Inc.

- Others

Recent Developments

- October 2025: Barracuda Networks is set to accelerate growth with new investment from KKR, following KKR’s acquisition deal valued at about $4 billion. Barracuda will focus on expanding its managed detection and response (MDR), extended detection and response (XDR), and secure access service edge (SASE) technologies, aiming to help channel partners build stronger security practices with enhanced opportunities.

- October 2025: Broadcom unveiled major advancements in AI infrastructure networking solutions at the 2025 Open Compute Project Global Summit. New product launches include the Tomahawk 6 Ethernet switches and third-generation TH6-Davisson Co-packaged Optics, designed to deliver scalable, power-efficient network architectures tailored for AI workloads’ growing bandwidth demands.

- October 2025: Check Point Software Technologies reported strong partner ecosystem growth with over 2,000 new partners added since January 2024. The company’s GenAI Protect solution inventories AI use within enterprises to prevent data loss, and Check Point is pursuing broader strategic partnerships like its recent go-to-market collaboration with Wiz to enhance cloud security offerings.

- October 2025: Cisco Systems delivered robust Q4 FY 2025 results with AI infrastructure orders surpassing $800 million in the quarter. Cisco is capitalizing on AI-driven networking innovation, integrating NVIDIA Spectrum-X, and advancing Secure AI Factory solutions, while expanding collaborations with key cloud clients globally including in the Middle East.

Report Scope

Report Features Description Market Value (2024) USD 7.4 Bn Forecast Revenue (2034) USD 14.3 Bn CAGR(2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions (URL Filtering, Malware Detection, Application Control, DLP, SSL/TLS Inspection), Services (Professional Services, Managed Services)), By Deployment (Cloud-based, On-Premises), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Industry Vertical (BFSI, Healthcare, Government and Defense, IT & Telecom, Retail & Ecommerce, Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Barracuda Networks Inc., Broadcom Inc., Check Point Software Technologies Ltd., Cisco Systems Inc., F5 Inc., FirstWave Cloud Technology Limited, McAfee Corp., Planet Technology Corporation, Proofpoint Inc., Trustwave Holdings Inc., Microsoft Corporation, Palo Alto Networks Inc., Juniper Networks Inc., Fortinet Inc., Trend Micro Inc., Zscaler Inc., Fortra LLC, AO Kaspersky Lab, Cato Networks Ltd., Mimecast Services Limited, SonicWall Inc., Comodo Security Solutions Inc., WatchGuard Technologies Inc., Sophos Group PLC, iboss Inc., Cyren Inc., Smoothwall Limited, Menlo Security Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Content Security Gateway MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Content Security Gateway MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Barracuda Networks Inc.

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- F5 Inc.

- FirstWave Cloud Technology Limited

- McAfee Corp.

- Planet Technology Corporation

- Proofpoint Inc.

- Trustwave Holdings Inc.

- Microsoft Corporation

- Palo Alto Networks Inc.

- Juniper Networks Inc.

- Fortinet Inc.

- Trend Micro Inc.

- Zscaler Inc.

- Fortra LLC

- AO Kaspersky Lab

- Cato Networks Ltd.

- Mimecast Services Limited

- SonicWall Inc.

- Comodo Security Solutions Inc.

- WatchGuard Technologies Inc.

- Sophos Group PLC

- iboss Inc.

- Cyren Inc.

- Smoothwall Limited

- Menlo Security Inc.

- Others