Global Content Disarm and Reconstruction Market Size, Share, Industry Analysis Report By Component (Solutions, Services), By Deployment (On-Premises, Cloud-based), By Application (Email, Web/Browser Isolation, File Transfer Protocol (FTP/SFTP), Removable Media and Kiosk Imports, APIs and Content Collaboration), By Organization Size (Small and Medium-sized Enterprises (SME), Large Enterprises), By Industry Vertical (BFSI, IT and Telecom, Government and Defense, Manufacturing, Healthcare and Life Sciences, Energy and Utilities, Other End-user Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157548

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI in CDR

- Emerging Trends

- U.S. CDR Market Size

- Component Analysis

- Deployment Analysis

- Application Analysis

- Organization Size Analysis

- Industry Vertical Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

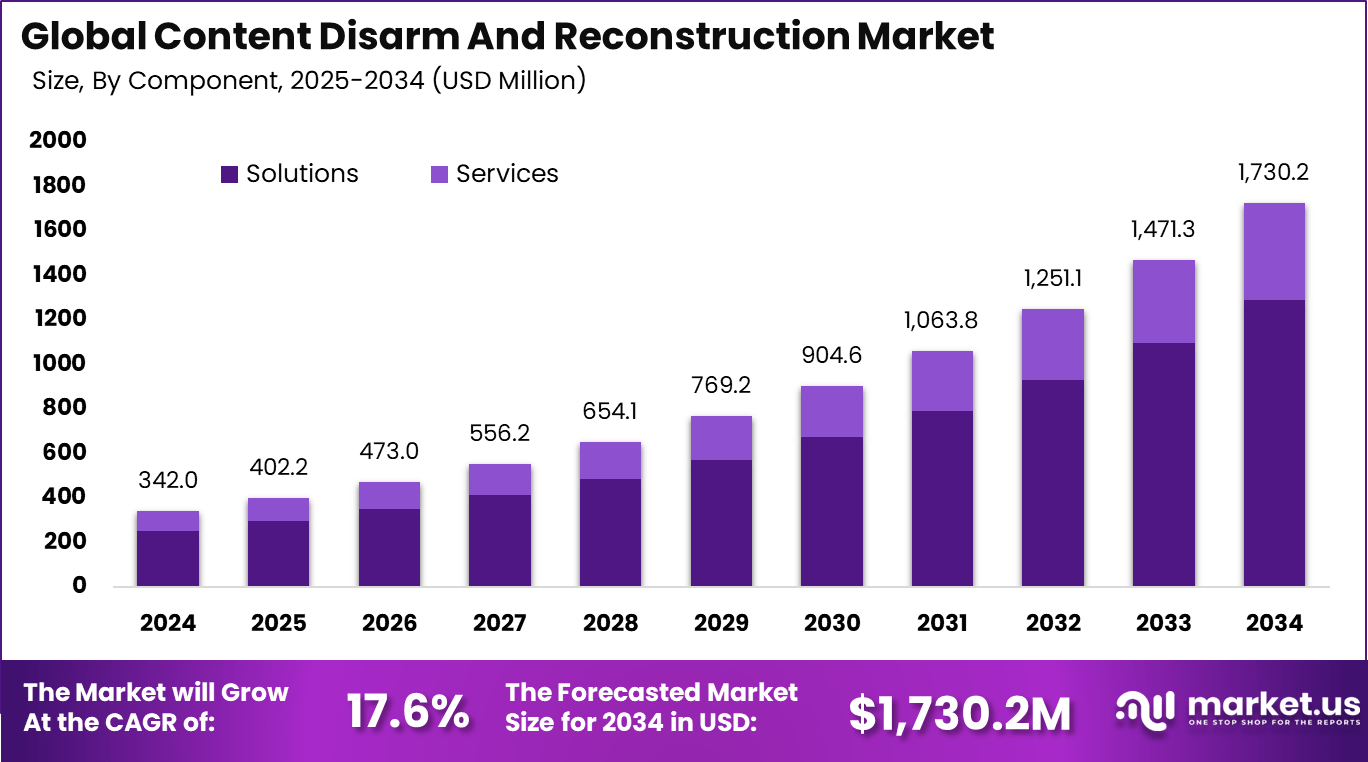

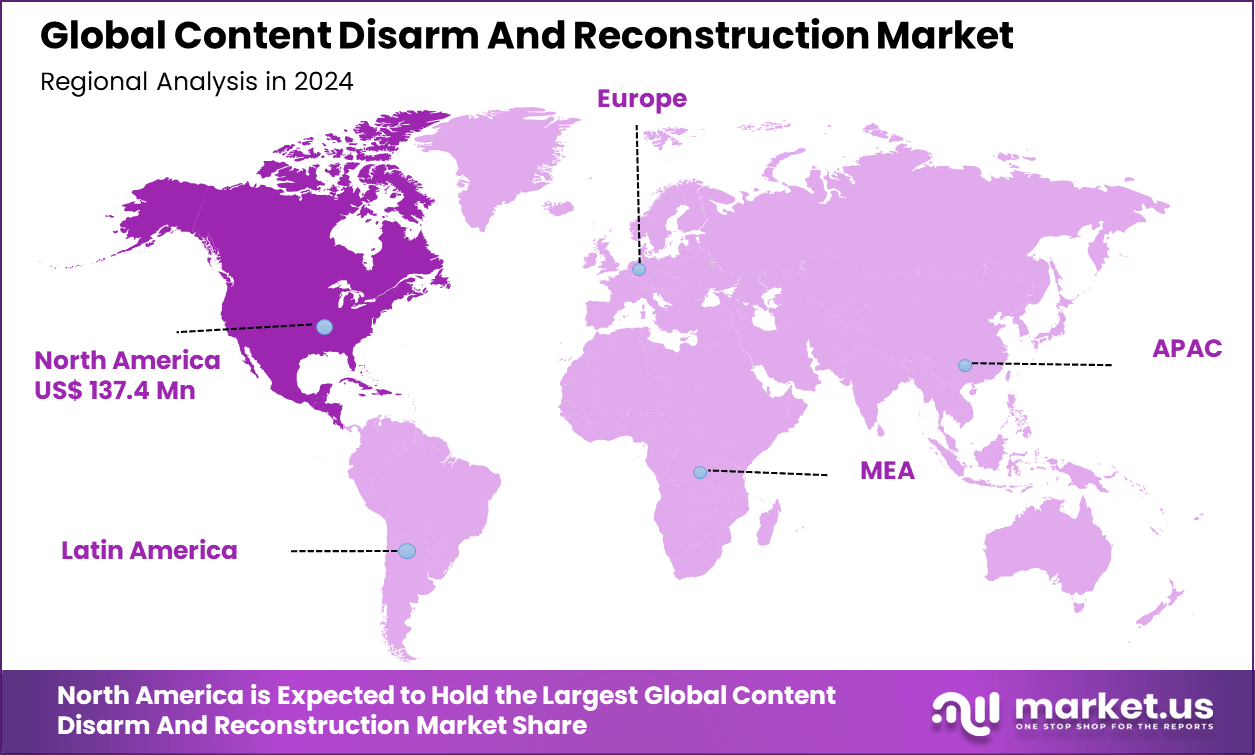

The Global Content Disarm And Reconstruction Market size is expected to be worth around USD 1,730.2 million by 2034, from USD 342.0 million in 2024, growing at a CAGR of 17.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.2% share, holding USD 137.4 million in revenue.

The Content Disarm and Reconstruction (CDR) Market includes technologies designed to detect, neutralize, and reconstruct potentially harmful or malicious content in files, emails, and web traffic. These solutions ensure that incoming files, such as documents, images, or email attachments, are free from malware, viruses, or other security threats before they enter a network.

The primary factors driving the growth of the CDR market are the increasing number of cyber threats such as ransomware, phishing, and advanced persistent threats (APTs). As more businesses adopt digital transformation and cloud-based applications, new vulnerabilities are created, raising the need for effective content security.

For instance, in March 2023, Votiro, a leader in CDR technology, raised $11.5 million in Series A funding. This funding round is aimed at enhancing Votiro’s solutions for file sanitization and threat prevention. The investment will allow Votiro to scale its CDR offerings, providing businesses with advanced protection against file-based threats like malware and ransomware.

Key Takeaway

- In 2024, the Solutions segment dominated the market, holding 74.6% share.

- The On-Premises deployment model led with 56.3% share in 2024.

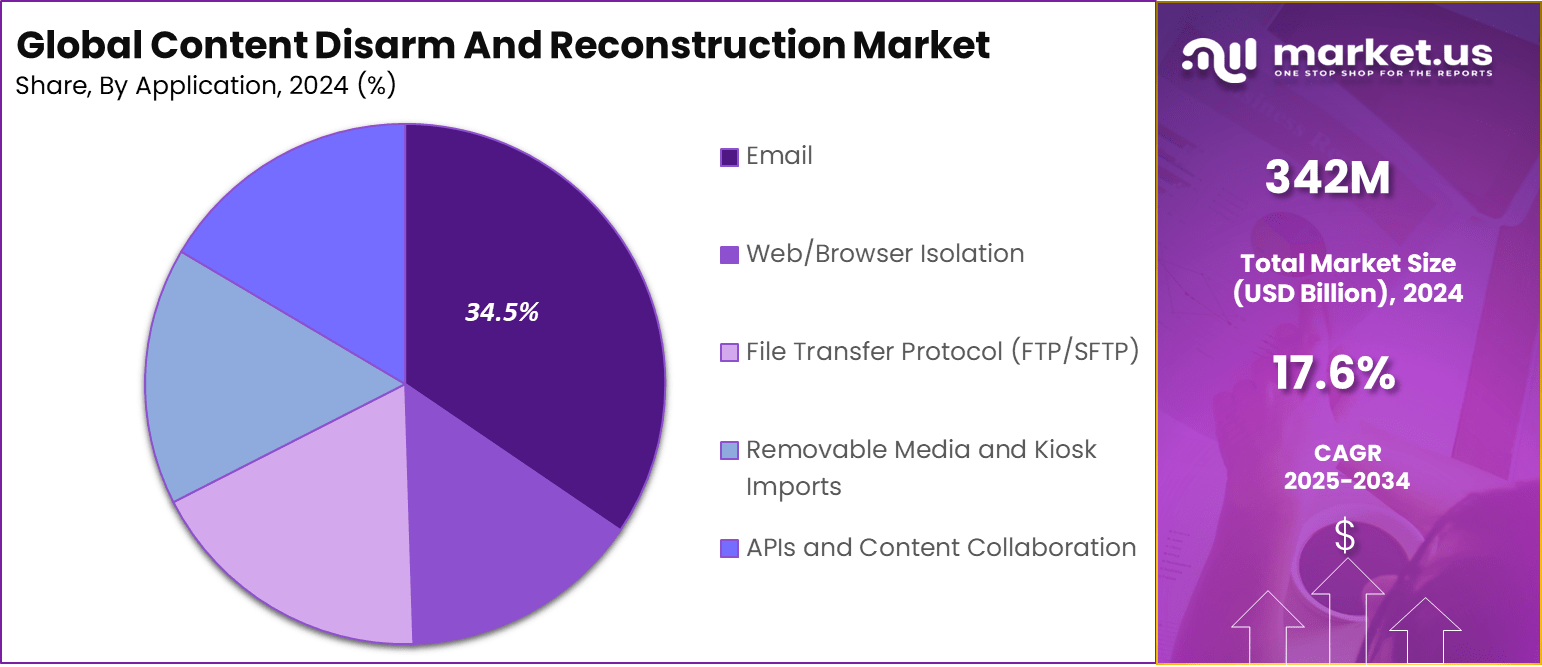

- By channel, Email security accounted for the largest portion, capturing 34.5% share.

- Large Enterprises were the primary adopters, representing 65.7% share of the market.

- By vertical, Government and Defense held the top position with 23.6% share.

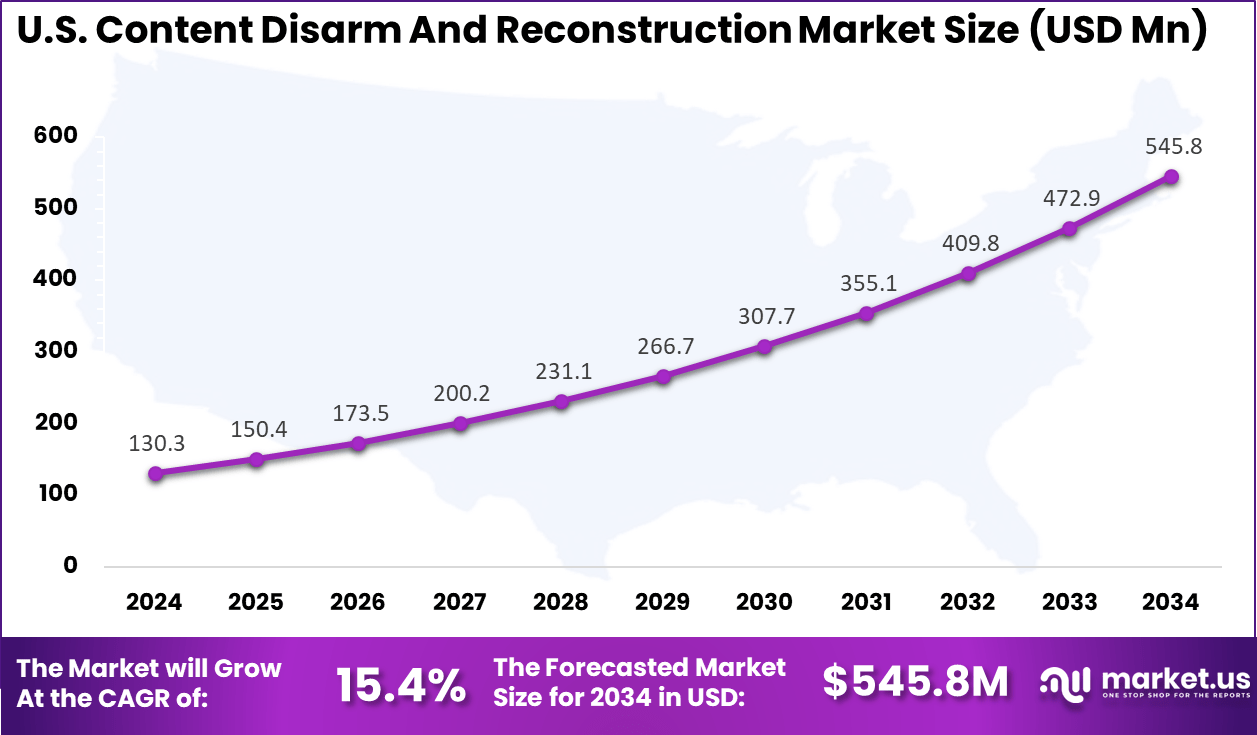

- The U.S. market reached USD 130.3 Million in 2024, growing at a strong 15.4% CAGR.

- North America remained the leading region, securing 40.2% share of the global market.

Role of Generative AI in CDR

Key Points Description AI-enhanced threat detection Generative AI helps analyze file components with advanced pattern recognition to identify suspicious content beyond traditional signatures. Real-time file sanitization AI accelerates the disassembly and reconstruction process by automating threat removal with minimal delay. Adaptive policy enforcement AI models customize sanitization based on contextual understanding of file types and organizational risk policies. Zero-day attack prevention AI identifies novel malicious elements and removes them before execution, protecting against unknown threats. Integration with threat intelligence Generative AI combines multiple security sources to predict and neutralize malicious payloads during reconstruction. Emerging Trends

Key Trends Description Increasing cloud-based CDR adoption More organizations leverage cloud for scalable, centralized file sanitization services. Integration with zero trust frameworks CDR complements zero trust policies by ensuring file content safety before endpoint delivery. Use of AI and machine learning Incorporating AI for predictive threat detection and behavior analytics is growing rapidly. Expansion into remote work security CDR adoption rises due to increased file sharing risks from remote and hybrid workforce models. API-based microservices deployment Flexible and scalable integration of CDR into enterprise SaaS and security platforms via APIs. U.S. CDR Market Size

The market for Content Disarm And Reconstruction within the U.S. is growing tremendously and is currently valued at USD 130.3 million, the market has a projected CAGR of 40.2%. The market is growing due to the increasing number of cyber threats targeting organizations across various industries.

As digital transformation accelerates, businesses are handling more sensitive data, making them prime targets for cyberattacks. Stringent data protection regulations further drive the adoption of CDR solutions to ensure compliance and secure digital content. Additionally, the rise of remote work and cloud computing is increasing the need for robust content security measures in the U.S.

In 2024, North America held a dominant market position in the Global Content Disarm And Reconstruction Market, capturing more than a 40.2% share, holding USD 137.4 million in revenue. This dominance is due to the region’s advanced technological infrastructure and high adoption of cybersecurity solutions.

The growing frequency of sophisticated cyberattacks, coupled with strict data protection regulations, has driven businesses to invest in CDR solutions for enhanced content security. Additionally, the presence of key cybersecurity players and rising adoption of cloud-based security services, along with the region’s focus on digital transformation, have further fueled the demand for robust, scalable CDR technologies.

For instance, in April 2025, Glasswall announced a strategic investment from PSG Equity to further expand its Content Disarm and Reconstruction (CDR) solutions. This move underscores the growing dominance of North America in the CDR market, as Glasswall strengthens its position in the region, especially within government, defense, and enterprise sectors.

Component Analysis

In 2024, The Solutions segment held a dominant market position, capturing a 74.6% share of the Global Content Disarm And Reconstruction Market. This dominance is due to the increasing need for advanced, automated tools to protect organizations from evolving cyber threats.

As businesses prioritize securing digital content, CDR solutions offer real-time protection by neutralizing malware, ransomware, and other malicious content. The growing adoption of digital communication and cloud-based systems further drives the demand for comprehensive, efficient CDR solutions across industries.

For Instance, in January 2024, Vertosoft was appointed as the official distributor for OPSWAT, a company that provides advanced Content Disarm and Reconstruction (CDR) technologies. OPSWAT’s solutions focus on protecting organizations from malware and cyber threats by sanitizing files and ensuring safe content.

Deployment Analysis

In 2024, the On-Premises segment held a dominant market position, capturing a 56.3% share of the Global Content Disarm And Reconstruction Market. This dominance is due to organizations seeking greater control over their cybersecurity infrastructure and sensitive data.

On-premises solutions provide enhanced security and compliance, particularly for industries with strict regulatory requirements, such as healthcare and finance. Additionally, organizations with complex, customized IT environments prefer on-premises CDR solutions for tailored integration and data privacy.

For instance, in June 2020, OPSWAT offered a Deep CDR solution that can be deployed on-premises to protect critical infrastructure from zero-day and advanced malware attacks. This solution disarms and regenerates files, ensuring that only safe, clean, and usable content reaches your systems. It supports over 200 file types and can process files in milliseconds, providing robust protection against file-based threats.

Application Analysis

In 2024, The Email segment held a dominant market position, capturing a 34.5% share of the Global Content Disarm And Reconstruction Market. This dominance is due to the increasing use of email as a primary communication channel for both business and personal exchanges, making it a prime target for cyberattacks, such as phishing and malware. CDR solutions for email provide robust protection by sanitizing attachments and links, ensuring that malicious content is neutralized before reaching the end user, thereby safeguarding sensitive information and preventing data breaches.

For Instance, in August 2025, SentinelOne’s partnership with Mimecast aims to integrate advanced CDR technologies into its broader email security solutions. This collaboration is designed to provide organizations with enhanced protection against email-based threats, such as malware, ransomware, and phishing.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 65.7% share of the Global Content Disarm And Reconstruction Market. This dominance is due to large organizations’ increased need to protect vast amounts of sensitive data and defend against advanced cyber threats.

These enterprises are increasingly adopting CDR solutions to secure critical communication and ensure compliance with data protection regulations. Additionally, their greater financial resources and more complex IT infrastructures drive the demand for advanced, scalable CDR solutions.

For Instance, in April 2025, Glasswall announced a strategic investment from PSG Equity to accelerate innovation and expand its product offerings in the CDR market. Glasswall’s zero-trust file protection solutions are utilized by government intelligence, defense, critical infrastructure, and financial services clients worldwide.

Industry Vertical Analysis

In 2024, The Government and Defense segment held a dominant market position, capturing a 23.6% share of the Global Content Disarm And Reconstruction Market. This dominance is due to the critical need for robust cybersecurity measures in safeguarding national security and sensitive governmental data.

As cyberattacks become more sophisticated, government agencies and defense sectors face high risks of data breaches and cyber espionage. CDR solutions are essential in ensuring secure communication, preventing malware, and maintaining the integrity of sensitive files exchanged within these sectors.

For Instance, in June 2021, Forcepoint acquired UK-based Deep Secure to enhance its portfolio of cybersecurity offerings for governments, critical infrastructure, and enterprises worldwide. This acquisition integrates Deep Secure’s defense-grade CDR capabilities within Forcepoint’s Data-first SASE architecture.

Key Market Segments

By Component

- Solutions

- Services

- Consulting

- Integration & Implementation

- Training, Support, & Maintenance

By Deployment

- On-Premises

- Cloud-based

By Application

- Web/Browser Isolation

- File Transfer Protocol (FTP/SFTP)

- Removable Media and Kiosk Imports

- APIs and Content Collaboration

By Organization Size

- Small and Medium-sized Enterprises (SME)

- Large Enterprises

By Industry Vertical

- BFSI

- IT and Telecom

- Government and Defense

- Manufacturing

- Healthcare and Life Sciences

- Energy and Utilities

- Other End-user Verticals

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Cybersecurity Threats

As cyberattacks become increasingly sophisticated, organizations face growing threats from malicious files like malware, ransomware, and viruses. These types of cyber threats can infiltrate through seemingly harmless files, making it essential to have secure methods for handling documents.

Content Disarm and Reconstruction (CDR) solutions provide an effective safeguard by sanitizing files and removing potential dangers while maintaining the integrity of the content. The rise in these cyber risks is driving greater demand for CDR solutions across various industries.

For instance, in February 2025, the World Economic Forum highlighted key cybersecurity threats expected to escalate, including more sophisticated ransomware attacks, targeted phishing campaigns, and the rise of AI-powered cyberattacks. As these threats evolve, businesses and organizations must adopt advanced solutions like Content Disarm and Reconstruction (CDR) to proactively protect against malicious content.

Restraint

Complexity and Cost of Implementation

One major restraint on CDR market growth is the increasing complexity of cyber threats which often evolve faster than existing disarm and reconstruction techniques can keep up. These advancements require continuous innovation and updates in CDR technologies, which can be costly in terms of research, development, and deployment.

Organizations might hesitate to implement or upgrade CDR solutions frequently, especially due to budget constraints and the high cost of integration. Moreover, implementing effective CDR solutions demands highly skilled cybersecurity professionals knowledgeable in cloud computing and advanced analytics.

The shortage of such skilled professionals worldwide limits companies’ ability to fully leverage CDR technology, which slows down large-scale adoption. These challenges around cost and expertise present significant barriers to growth, especially for smaller organizations.

Opportunities

Increasing Demand from High-Risk Industries

Industries with high exposure to cyber threats, such as finance, healthcare, and government, represent a significant growth opportunity for the Content Disarm and Reconstruction market. These sectors are not only prime targets for cyberattacks but also face strict regulatory requirements for data security and privacy.

As the risk of data breaches and cyber incidents grows, these industries are increasingly adopting CDR solutions to protect sensitive information. This demand is driving innovation and expanding the market for CDR technologies tailored to their needs.

For instance, in February 2025, Glasswall enhanced its Zero Trust Content Disarm and Reconstruction (CDR) file protection solution by integrating advanced threat intelligence from ReversingLabs. This strategic move strengthens the ability to detect and mitigate sophisticated threats, providing an added layer of security for organizations handling sensitive data.

Challenges

Evolving Threat Landscape

The rapid evolution of cyberattacks presents a significant challenge for CDR solutions. As hackers develop more sophisticated methods to bypass security measures, CDR technologies must adapt to neutralize emerging threats in real time.

Malware, ransomware, and other advanced threats are constantly evolving, requiring vendors to update their systems to recognize and handle new attack vectors. Staying ahead of these dynamic threats is crucial for the continued effectiveness of CDR solutions and requires ongoing innovation and agility from vendors in the market.

For instance, In February 2025, Menlo Security acquired Votiro, a leader in content disarm and reconstruction (CDR). This acquisition enhances Menlo’s secure browsing capabilities by integrating Votiro’s advanced threat isolation solutions. The combined technologies aim to strengthen protection against sophisticated cyber threats like zero-day malware and ransomware.

Key Players Analysis

The Content Disarm and Reconstruction (CDR) market is highly competitive, with several key players dominating the landscape. Check Point Software Technologies Ltd., Fortinet, Inc., and OPSWAT, Inc. are among the leading companies offering advanced CDR solutions. These firms provide robust products designed to protect organizations from malicious content in digital files, enhancing overall cybersecurity defenses.

Other significant players include Deep Secure Ltd., Votiro Inc., and ReSec Technologies Ltd., who offer innovative CDR solutions to mitigate risks posed by cyber threats. These companies utilize sophisticated technology to ensure safe file transfers and protect against malware, ransomware, and other cyberattacks.

Additionally, emerging companies like Kasm Technologies, Clearswift (Fortra), and Nexor Limited are making notable strides in the CDR space. With a growing demand for data security and content protection, companies such as Zscaler, Inc., Menlo Security, Inc., and Forcepoint LLC continue to refine their technologies.

Top Key Players in the Market

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- OPSWAT, Inc.

- Broadcom Inc. (Symantec)

- Glasswall Solutions Limited

- Deep Secure Ltd.

- Votiro Inc.

- ReSec Technologies Ltd.

- SoftCamp Co., Ltd.

- Sasa Software (CAS) Ltd.

- Cybace Solutions

- YazamTech Inc.

- Peraton Corporation

- Jiransecurity Co., Ltd.

- Mimecast Services Limited

- Solebit Labs Ltd.

- Kasm Technologies

- odix Ltd.

- Clearswift (Fortra)

- Nexor Limited

- Advenica AB

- Zscaler, Inc.

- Menlo Security, Inc.

- Forcepoint LLC

- Virtru Inc.

- Others

Recent Developments

- In May 2025, Palo Alto Networks introduced advanced granular file-transfer controls within its Remote Browser Isolation, aimed at providing more detailed and secure management of file transfers. This move aligns with growing concerns over cyber threats, particularly in environments where sensitive data exchanges are frequent.

- In April 2025, PSG Equity made a strategic investment in Glasswall, with the goal of accelerating innovation and expanding its reach globally. This investment highlights the increasing importance of Content Disarm and Reconstruction (CDR) solutions as the cybersecurity landscape evolves, with a growing need for more robust protection mechanisms against emerging threats.

- Earlier in February 2025, ReversingLabs and Glasswall formed a partnership to combine their expertise in threat intelligence and deterministic file reconstruction. This collaboration aims to offer enhanced capabilities in identifying and neutralizing cyber threats.

- In March 2024, OPSWAT achieved a 100% Protection and Accuracy Score in SE Labs’ Content Disarm & Reconstruction Test, setting a new standard in cybersecurity. This accomplishment validates OPSWAT’s effectiveness in protecting against file-based threats.

- In March 2024, Broadcom introduced VMware VeloCloud SASE secured by Symantec, integrating SD-WAN and Security Service Edge capabilities into a unified solution for advanced security and network management.

Report Scope

Report Features Description Market Value (2024) USD 342 Mn Forecast Revenue (2034) USD 1,730.2 Mn CAGR(2025-2034) 17.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Deployment (On-Premises, Cloud-based), By Application (Email, Web/Browser Isolation, File Transfer Protocol (FTP/SFTP), Removable Media and Kiosk Imports, APIs and Content Collaboration), By Organization Size (Small and Medium-sized Enterprises (SME), Large Enterprises), By Industry Vertical (BFSI, IT and Telecom, Government and Defense, Manufacturing, Healthcare and Life Sciences, Energy and Utilities, Other End-user Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Check Point Software Technologies Ltd., Fortinet, Inc., OPSWAT, Inc., Broadcom Inc. (Symantec), Glasswall Solutions Limited, Deep Secure Ltd., Votiro Inc., ReSec Technologies Ltd., SoftCamp Co., Ltd., Sasa Software (CAS) Ltd., Cybace Solutions, YazamTech Inc., Peraton Corporation, Jiransecurity Co., Ltd., Mimecast Services Limited, Solebit Labs Ltd., Kasm Technologies, odix Ltd., Clearswift (Fortra), Nexor Limited, Advenica AB, Zscaler, Inc., Menlo Security, Inc., Forcepoint LLC, Virtru Inc., Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Content Disarm and Reconstruction MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Content Disarm and Reconstruction MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- OPSWAT, Inc.

- Broadcom Inc. (Symantec)

- Glasswall Solutions Limited

- Deep Secure Ltd.

- Votiro Inc.

- ReSec Technologies Ltd.

- SoftCamp Co., Ltd.

- Sasa Software (CAS) Ltd.

- Cybace Solutions

- YazamTech Inc.

- Peraton Corporation

- Jiransecurity Co., Ltd.

- Mimecast Services Limited

- Solebit Labs Ltd.

- Kasm Technologies

- odix Ltd.

- Clearswift (Fortra)

- Nexor Limited

- Advenica AB

- Zscaler, Inc.

- Menlo Security, Inc.

- Forcepoint LLC

- Virtru Inc.

- Others