Global Container Ship Market Size, Share, Growth Analysis By Fuel Type (Diesel and Gasoline, Electric, LNG, LPG, Others), By Deadweight (Below 75,000 DWT, 75,000–2,00,000 DWT, Above 2,00,000 DWT), By Container Type (General, Reefer), By Service (Full-Container-Load (FCL), Less-Than-Container-Load (LCL)), By End-User (FMCG and Retail, Manufacturing and Automotive, Healthcare and Pharmaceuticals, Electronics and Electrical Equipment, Industrial Chemicals and Raw Materials, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171257

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

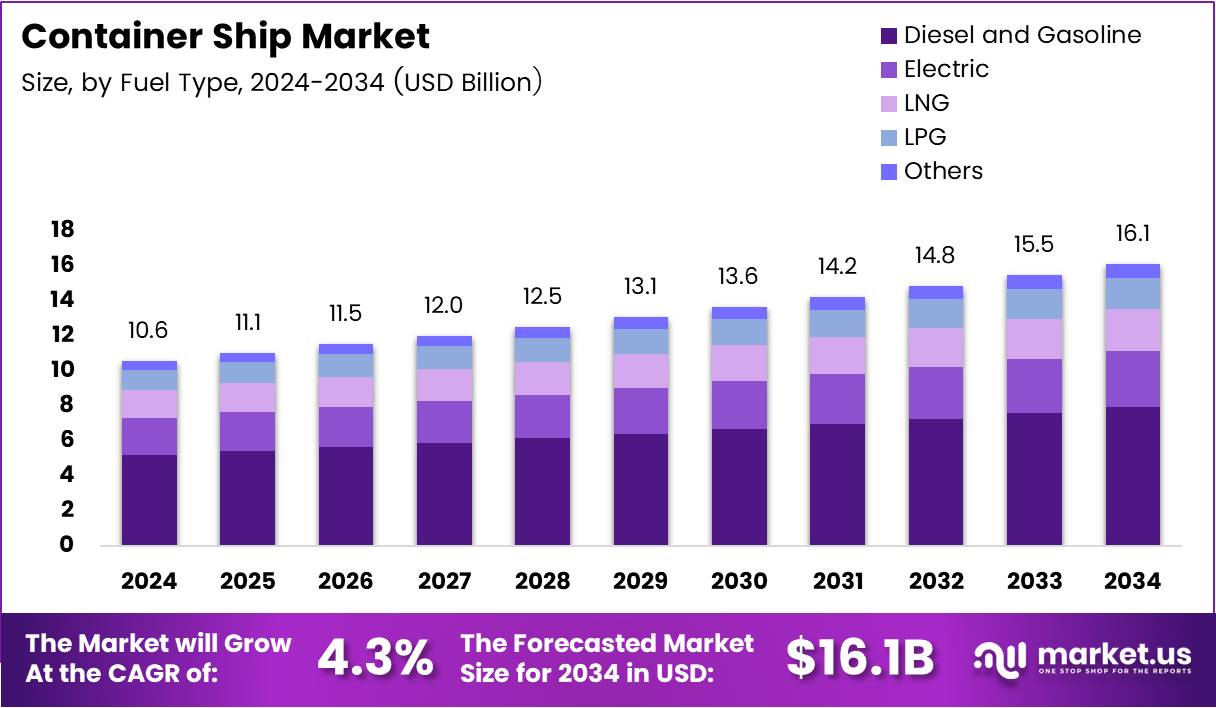

The global Container Ship Market size is expected to reach approximately USD 16.1 Billion by 2034, up from USD 10.6 Billion in 2024, expanding at a CAGR of 4.3% during the forecast period from 2025 to 2034.

Container ships are specialized maritime vessels engineered to transport standardized cargo containers across international trade routes. These vessels serve as critical infrastructure enabling global commerce and supply chain connectivity. The container ship market encompasses vessel manufacturing, chartering services, and fleet management operations worldwide.

Global trade dynamics continue driving robust demand for container shipping capacity across major maritime corridors. E-commerce expansion has fundamentally transformed logistics requirements, necessitating enhanced vessel availability and operational efficiency. Consequently, shipping operators are accelerating fleet modernization initiatives to address evolving market demands effectively.

Cross-border manufacturing networks rely extensively on dependable container shipping services for component sourcing and distribution. Production fragmentation across multiple continents amplifies containerized cargo volumes substantially. Therefore, sustained investment in vessel capacity remains essential for supporting international manufacturing ecosystems.

According to UNCTAD, approximately 80% of international trade goods volume moves via sea transport. This statistic underscores maritime shipping’s dominant role in global commerce infrastructure. Container vessels specifically facilitate efficient, cost-effective cargo movement across transcontinental distances reliably.

Data from Container Trade Statistics indicates global container trade reached about 183.2 million TEUs in 2024, representing an approximately 8% increase since 2019. This growth trajectory demonstrates persistent demand resilience despite periodic economic uncertainties and market fluctuations. Rising containerized trade volumes reflect expanding international commerce and supply chain globalization trends.

Government initiatives worldwide are driving substantial port infrastructure expansion and modernization programs across strategic locations. Regulatory frameworks increasingly mandate stricter environmental compliance standards and emission reduction targets for maritime operations. These policy developments are accelerating industry transition toward cleaner propulsion technologies and sustainable operational practices.

Fleet renewal programs focus predominantly on acquiring fuel-efficient, high-capacity vessels incorporating advanced environmental technologies. Ultra-large container vessels deliver significant economies of scale on major trunk routes between economic regions. Additionally, dual-fuel propulsion systems enable operational flexibility while meeting evolving regulatory requirements effectively.

Long-term charter agreements provide shipping operators with capacity stability amid volatile freight rate environments. These arrangements enable predictable operational planning and risk mitigation for both vessel owners and operators. Furthermore, expansion of transshipment hubs and mega-port facilities accommodates increasingly larger vessel classes efficiently.

Regional trade corridors across Southeast Asia, Africa, and Latin America present substantial growth opportunities beyond traditional routes. Intra-regional containerized trade continues expanding driven by local manufacturing development and economic integration initiatives. Investment in specialized vessel designs and alternative fuel technologies reflects industry commitment to sustainability objectives.

Key Takeaways

- Global Container Ship Market valued at USD 10.6 Billion in 2024, projected to reach USD 16.1 Billion by 2034 at 4.3% CAGR.

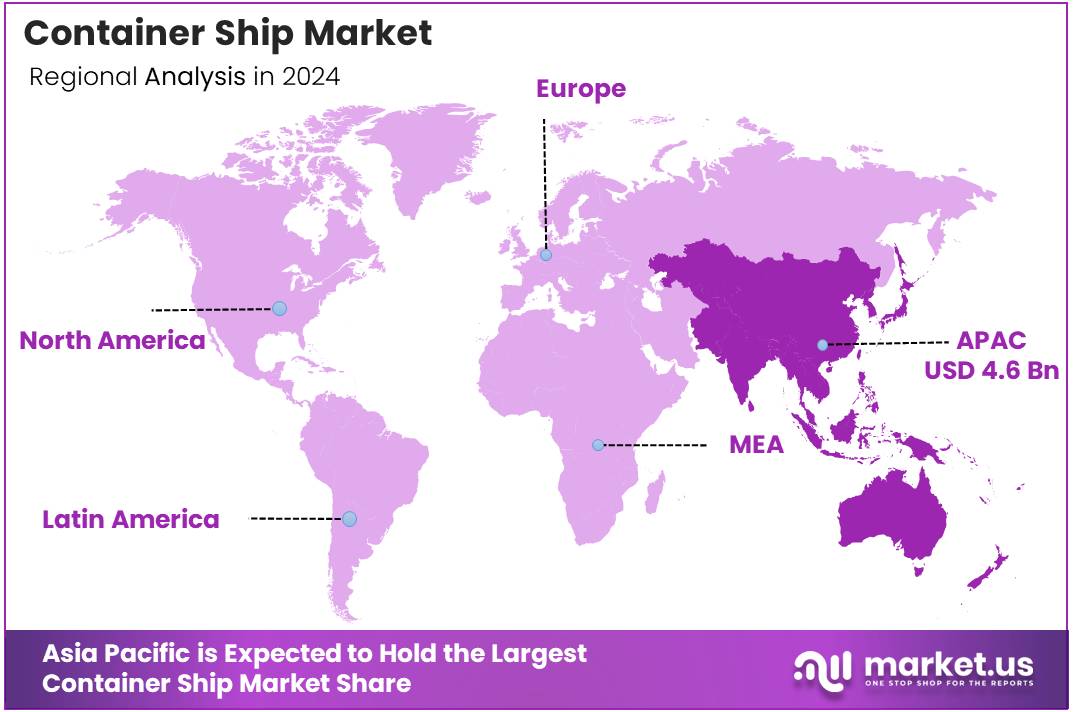

- Asia Pacific dominates with 43.8% market share, valued at USD 4.6 Billion.

- Diesel and Gasoline fuel type leads with 61.8% market share.

- Below 75,000 DWT segment holds 37.2% share in deadweight category.

- General container type accounts for 79.6% of the market.

- Full-Container-Load (FCL) service dominates with 71.4% share.

By Fuel Type

Diesel and Gasoline dominate with 61.8% due to established infrastructure and operational reliability.

In 2024, Diesel and Gasoline held a dominant market position in the By Fuel Type segment of Container Ship Market, with a 61.8% share. These conventional fuel systems offer proven performance and widespread availability across global bunkering networks. Shipping operators rely on diesel engines for their durability and cost-effectiveness. Existing fleet infrastructure predominantly supports these traditional propulsion systems, ensuring minimal conversion requirements.

Electric propulsion systems are gaining traction as zero-emission alternatives for short-haul container routes. Battery technology advancements enable practical implementation in coastal and feeder services. However, limited range capabilities restrict application to longer transoceanic voyages. Port electrification infrastructure development remains critical for broader adoption across maritime operations.

LNG-powered vessels represent a significant transition toward cleaner fuel alternatives in container shipping. This fuel type reduces sulfur emissions substantially compared to conventional marine fuels. Major shipping lines are investing in dual-fuel engines capable of operating on LNG. Infrastructure development at key ports supports the growing LNG bunkering network worldwide.

LPG propulsion offers another intermediate solution balancing environmental performance with operational feasibility. This fuel type provides lower carbon intensity than traditional diesel options. Adoption remains limited due to infrastructure constraints and vessel conversion costs. Nevertheless, regulatory pressures are encouraging exploration of diverse fuel alternatives across the industry.

Other emerging fuel technologies include methanol, ammonia, and hydrogen-based propulsion systems. These alternatives align with long-term decarbonization targets set by international maritime organizations. Research and pilot programs are evaluating technical viability and economic feasibility. Industry stakeholders recognize that multiple fuel pathways will likely coexist throughout the transition period.

By Deadweight

Below 75,000 DWT dominates with 37.2% due to versatility in regional and feeder services.

In 2024, Below 75,000 DWT held a dominant market position in the By Deadweight segment of Container Ship Market, with a 37.2% share. These smaller vessels excel in regional trade routes and feeder operations connecting secondary ports. Their size allows access to ports with draft and infrastructure limitations. Operators value the flexibility these vessels provide in serving diverse market segments efficiently.

The 75,000-200,000 DWT category represents the workhorses of mainline container shipping operations. These mid-sized vessels balance capacity with operational flexibility across major trade lanes. They serve primary routes between major economic regions while maintaining acceptable port compatibility. Investment in this segment reflects steady demand for reliable capacity on established shipping routes.

Above 200,000 DWT vessels comprise ultra-large container vessels (ULCVs) designed for high-volume trunk routes. According to industry sources, vessels like MSC Irina reach capacities around 24,346 TEU. These mega-ships deliver significant economies of scale on Asia-Europe and transpacific routes. However, their deployment requires substantial port infrastructure investments and strategic route optimization.

By Container Type

General containers dominate with 79.6% due to universal applicability across diverse cargo types.

In 2024, General containers held a dominant market position in the By Container Type segment of Container Ship Market, with a 79.6% share. These standardized units accommodate the majority of manufactured goods, consumer products, and dry cargo. Their versatility supports efficient intermodal transportation across multiple logistics networks. Global standardization enables seamless cargo handling procedures at ports worldwide.

Reefer containers serve specialized markets requiring temperature-controlled transportation for perishable goods. This segment supports pharmaceutical, food, and agricultural product distribution globally. Technological advancements enhance refrigeration efficiency and monitoring capabilities throughout transit. Growing international trade in fresh produce and vaccines drives steady demand for reefer capacity.

By Service

Full-Container-Load (FCL) dominates with 71.4% due to cost efficiency for large shipments.

In 2024, Full-Container-Load (FCL) held a dominant market position in the By Service segment of Container Ship Market, with a 71.4% share. This service model provides exclusive container usage for single shipper cargo volumes. FCL shipments offer faster transit times and reduced handling compared to consolidated options. Large manufacturers and retailers prefer FCL for predictable scheduling and cargo security benefits.

Less-Than-Container-Load (LCL) services cater to small and medium enterprises requiring partial container space. This consolidation model enables cost-effective international shipping for smaller cargo volumes. Freight forwarders aggregate multiple shippers’ goods into shared containers for economic efficiency. LCL services provide essential access to global markets for businesses with limited shipping volumes.

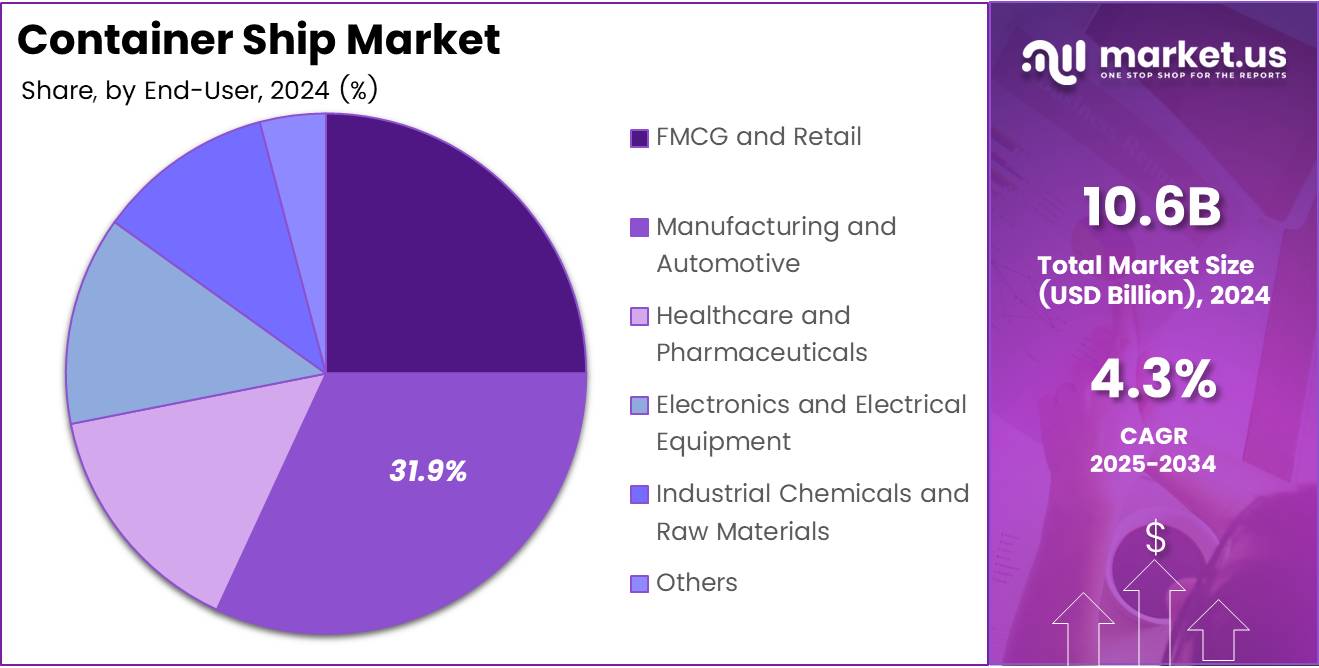

By End-User

Manufacturing and Automotive leads with 31.9% driven by global production networks and supply chains.

FMCG and Retail sectors generate substantial containerized cargo volumes through consumer goods distribution networks. These industries depend on reliable maritime logistics for inventory replenishment across global markets. E-commerce growth amplifies demand for consistent container shipping capacity. Fast-moving consumer goods require efficient supply chain coordination to meet market demands.

In 2024, Manufacturing and Automotive held a dominant market position in the By End-User segment of Container Ship Market, with a 31.9% share. This sector relies extensively on international component sourcing and finished vehicle exports. Just-in-time manufacturing principles necessitate dependable container shipping services worldwide. Automotive supply chains span multiple continents, requiring sophisticated logistics coordination and capacity management.

Healthcare and Pharmaceuticals represent high-value cargo requiring specialized handling and transportation conditions. Temperature-sensitive medications and medical equipment demand reliable reefer container services. Regulatory compliance adds complexity to pharmaceutical logistics operations globally. Growing international healthcare trade supports steady expansion of specialized container shipping services.

Electronics and Electrical Equipment industries generate significant container traffic through global manufacturing networks. High-value consumer electronics require secure and efficient maritime transportation solutions. Component sourcing and finished product distribution span multiple geographic regions. This sector’s growth correlates directly with technological advancement and consumer demand patterns.

Industrial Chemicals and Raw Materials utilize container shipping for safe transportation of packaged chemicals. Specialized container types accommodate hazardous materials with appropriate safety features. Global manufacturing processes depend on reliable chemical supply chains across continents. This segment requires strict regulatory compliance and specialized handling protocols throughout transportation.

Other end-users encompass diverse industries including agriculture, textiles, and construction materials. These sectors contribute to overall container shipping demand through varied cargo types. Emerging markets expand the breadth of industries utilizing containerized maritime transportation. Specialized cargo requirements continue diversifying container shipping service offerings globally.

Key Market Segments

By Fuel Type

- Diesel and Gasoline

- Electric

- LNG

- LPG

- Others

By Deadweight

- Below 75,000 DWT

- 75,000-2,00,000 DWT

- Above 2,00,000 DWT

By Container Type

- General

- Reefer

By Service

- Full-Container-Load (FCL)

- Less-Than-Container-Load (LCL)

By End-User

- FMCG and Retail

- Manufacturing and Automotive

- Healthcare and Pharmaceuticals

- Electronics and Electrical Equipment

- Industrial Chemicals and Raw Materials

- Others

Drivers

Sustained Growth in Global Containerized Trade Volumes Drives Market Expansion

E-commerce proliferation continues transforming international shipping demand patterns across consumer markets. Online retail growth necessitates robust container shipping capacity for cross-border fulfillment operations. Digital marketplaces connect global suppliers with consumers, increasing containerized cargo volumes substantially.

Cross-border manufacturing networks require efficient maritime logistics for component sourcing and distribution. Production fragmentation across multiple countries amplifies container shipping requirements significantly. Supply chain globalization drives consistent demand for reliable container vessel capacity worldwide.

Transshipment hub expansion accommodates larger vessel classes and enhances network connectivity efficiently. Mega-port development enables economies of scale through increased handling capacity and automation. Strategic port investments improve operational efficiency and reduce vessel turnaround times considerably.

Fleet renewal programs prioritize fuel-efficient designs addressing rising operational cost pressures. High-capacity container ships deliver improved economies of scale on major trade routes. Operators replace aging vessels with modern designs incorporating advanced propulsion and efficiency technologies.

Long-term charter demand provides capacity stability amid volatile freight rate environments. Liner operators secure vessel availability through extended chartering arrangements with shipowners. This model ensures predictable capacity access while mitigating short-term market fluctuations effectively.

Restraints

Freight Rate Volatility Creates Investment Uncertainty in Container Shipping Markets

Extreme cyclicality characterizes container shipping freight rates, complicating investment planning for stakeholders. Rate fluctuations create uncertainty regarding return on investment for new vessel orders. Operators face challenges timing capital expenditures amid unpredictable market conditions.

Historical boom-bust cycles demonstrate the market’s susceptibility to rapid demand shifts. Overcapacity periods severely depress freight rates, impacting shipowner profitability significantly. These patterns discourage consistent investment flows into new vessel construction programs.

Tightening environmental regulations substantially increase capital requirements for compliant vessel designs. Emission reduction mandates necessitate investment in advanced propulsion systems and fuel technologies. Retrofit costs for existing fleets add significant financial burdens on vessel operators.

Compliance costs extend beyond initial capital expenditure to include ongoing operational expenses. Monitoring systems, alternative fuels, and carbon offset programs increase operational complexity. Smaller operators particularly struggle meeting evolving regulatory requirements due to resource constraints.

Growth Factors

Ultra-Large Container Vessel Demand Accelerates on Major Trade Routes

Rising demand for ULCVs transforms capacity deployment strategies on Asia-Europe routes. These mega-ships deliver unparalleled economies of scale, reducing per-unit transportation costs significantly. Transpacific routes similarly benefit from ULCV deployment amid growing trans-Pacific trade volumes.

Accelerated fleet replacement addresses aging vessel profiles while incorporating environmental compliance features. Eco-designed newbuilds offer superior fuel efficiency and reduced emission profiles simultaneously. Operators recognize long-term economic advantages outweigh higher initial capital investment requirements.

Intra-regional container shipping expands rapidly across Southeast Asia, Africa, and Latin America. Regional economic development drives local manufacturing growth and intra-continental trade expansion. These emerging corridors present substantial growth opportunities beyond traditional mainline routes.

Long-term leasing and chartering models gain popularity among major shipping lines. These arrangements provide financial flexibility while ensuring capacity availability during demand peaks. Asset-light strategies enable operators to scale operations without direct vessel ownership burdens.

Emerging Trends

Dual-Fuel and LNG Propulsion Technologies Transform Container Ship Designs

Rapid adoption of dual-fuel engines enables operational flexibility across diverse fuel types. LNG-powered designs substantially reduce sulfur emissions while meeting stringent environmental regulations. Major shipbuilders now offer standardized dual-fuel propulsion options for new container vessels.

Fleet digitalization leverages AI-based voyage optimization tools enhancing operational efficiency significantly. Predictive maintenance systems reduce unplanned downtime and extend equipment operational lifespans. Real-time monitoring platforms enable proactive decision-making throughout vessel operations globally.

Strategic alliances among container carriers facilitate capacity-sharing arrangements on major routes. These partnerships optimize vessel utilization while reducing operational redundancy across networks. Collaborative frameworks enable smaller operators to participate in global shipping networks effectively.

Design optimization for slow steaming practices reduces fuel consumption and emission outputs. Vessels engineered for lower operating speeds maintain schedule reliability while improving environmental performance. This approach aligns operational practices with decarbonization targets established by international maritime authorities.

Regional Analysis

Asia Pacific Dominates Container Ship Market with 43.8% Share, Valued at USD 4.6 Billion

Asia Pacific commands the largest market position with 43.8% share, valued at approximately USD 4.6 Billion. The region benefits from extensive manufacturing bases and major port infrastructure networks. China, Japan, and South Korea host leading shipbuilding facilities producing majority of global container vessels. Strategic positioning along critical trade routes enhances the region’s maritime dominance substantially.

North America Container Ship Market Trends

North America maintains significant container shipping activity through major West and East Coast ports. The region serves as a critical node connecting Asian manufacturing with American consumer markets. Infrastructure modernization programs enhance port capacity and efficiency across gateway terminals. Growing nearshoring trends may reshape container shipping patterns within the region.

Europe Container Ship Market Trends

Europe represents a mature market with established container shipping networks and port infrastructure. Major North European ports serve as transshipment hubs for intra-European and global trade. Environmental regulations drive rapid adoption of cleaner vessel technologies throughout European waters. Regional shipping operators lead sustainability initiatives within the global container shipping industry.

Middle East and Africa Container Ship Market Trends

Middle East and Africa show promising growth potential driven by infrastructure development initiatives. Strategic transshipment hubs position the region as critical connectors between Asian and European markets. Port expansion projects enhance cargo handling capabilities across key maritime corridors. African intra-regional trade development creates new container shipping opportunities continent-wide.

Latin America Container Ship Market Trends

Latin America experiences steady container shipping growth supporting regional economic development. Major ports facilitate trade connections with North America, Europe, and Asia. Infrastructure investments improve port efficiency and accommodate larger vessel classes progressively. Regional manufacturing growth and agricultural exports sustain consistent container shipping demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Container Ship Company Insights

The container ship market in 2024 features established shipbuilders and operators competing through technological innovation and sustainability initiatives. Market leaders focus on delivering advanced vessel designs incorporating fuel-efficient propulsion systems and environmental compliance features. Strategic positioning relies on operational excellence, long-term customer relationships, and capacity to meet evolving regulatory requirements effectively.

Damen Shipyards Group maintains a competitive position through innovative modular vessel designs and flexible construction methodologies. The company delivers customized container ship solutions emphasizing operational efficiency and environmental performance across diverse market segments.

COSCO SHIPPING LINES CO., LTD operates one of the world’s largest container vessel fleets with comprehensive global route coverage. The company continues expanding its modern, fuel-efficient fleet supporting international trade infrastructure and supply chain connectivity.

Hanwha Ocean leverages advanced shipbuilding capabilities and technological expertise delivering high-capacity container vessels to major shipping operators. The company prioritizes incorporating next-generation propulsion technologies and emission reduction systems into new vessel construction programs.

Hyundai Heavy Industries remains a leading global shipbuilder with extensive experience producing large-scale container vessels for international carriers. The company emphasizes construction efficiency, quality assurance, and integration of advanced maritime technologies throughout vessel development processes.

Industry consolidation trends and strategic alliances shape competitive dynamics within the container shipping sector. Companies investing in dual-fuel technologies and digitalization platforms establish advantageous market positions. Furthermore, environmental compliance capabilities increasingly differentiate market participants amid tightening regulatory frameworks. Operators prioritizing long-term sustainability objectives while maintaining operational cost competitiveness position themselves favorably for future growth opportunities.

Key Companies

- Damen Shipyards Group

- COSCO SHIPPING LINES CO., LTD

- Hanwha Ocean

- Hyundai Heavy Industries

- Japan Marine United Corporation

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries

Recent Developments

- In December 2024, AP Moller-Maersk completed the order of 20 dual-fuel container vessels totaling 300,000 TEU as part of its fleet renewal program. Deliveries are scheduled from 2028 to 2030, reflecting commitment to sustainable maritime operations.

- In November 2024, Hapag-Lloyd signed contracts with Chinese shipyards for 24 new low-emission, dual-fuel container ships. Deliveries expected between 2027 and 2029 represent approximately USD 4 billion in investment toward fleet modernization.

- In April 2025, Orient Overseas International ordered 14 new container vessels worth USD 3.08 billion, equipped with methanol dual-fuel engines. Deliveries planned from Q3 2028 to Q3 2029 demonstrate commitment to alternative fuel adoption.

- In December 2025, Hapag-Lloyd and North Sea Container Line won a tender through the Zero Emission Maritime Buyers Alliance. The agreement powers container ships with low-emission e-fuels including e-methanol and e-ammonia from 2027 for at least three years.

- In December 2025, Hapag-Lloyd confirmed an order for eight dual-fuel vessels from Chinese shipbuilder CIMC Raffles. Deliveries scheduled for 2028 and 2029 support ongoing fleet modernization and carbon-reduction strategy implementation.

Report Scope

Report Features Description Market Value (2024) USD 10.6 Billion Forecast Revenue (2034) USD 16.1 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fuel Type (Diesel and Gasoline, Electric, LNG, LPG, Others), By Deadweight (Below 75,000 DWT, 75,000–2,00,000 DWT, Above 2,00,000 DWT), By Container Type (General, Reefer), By Service (Full-Container-Load (FCL), Less-Than-Container-Load (LCL)), By End-User (FMCG and Retail, Manufacturing and Automotive, Healthcare and Pharmaceuticals, Electronics and Electrical Equipment, Industrial Chemicals and Raw Materials, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Damen Shipyards Group, COSCO SHIPPING LINES CO., LTD, Hanwha Ocean, Hyundai Heavy Industries, Japan Marine United Corporation, Kawasaki Heavy Industries, Mitsubishi Heavy Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Damen Shipyards Group

- COSCO SHIPPING LINES CO., LTD

- Hanwha Ocean

- Hyundai Heavy Industries

- Japan Marine United Corporation

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries