Global Container Fleet Market Size, Share, Growth Analysis By Type (Dry Container, Special Container, Tank Container, Reefer Container), By Application (Automotive, Mining and Minerals, Oil and Gas, Agriculture, Food, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153123

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

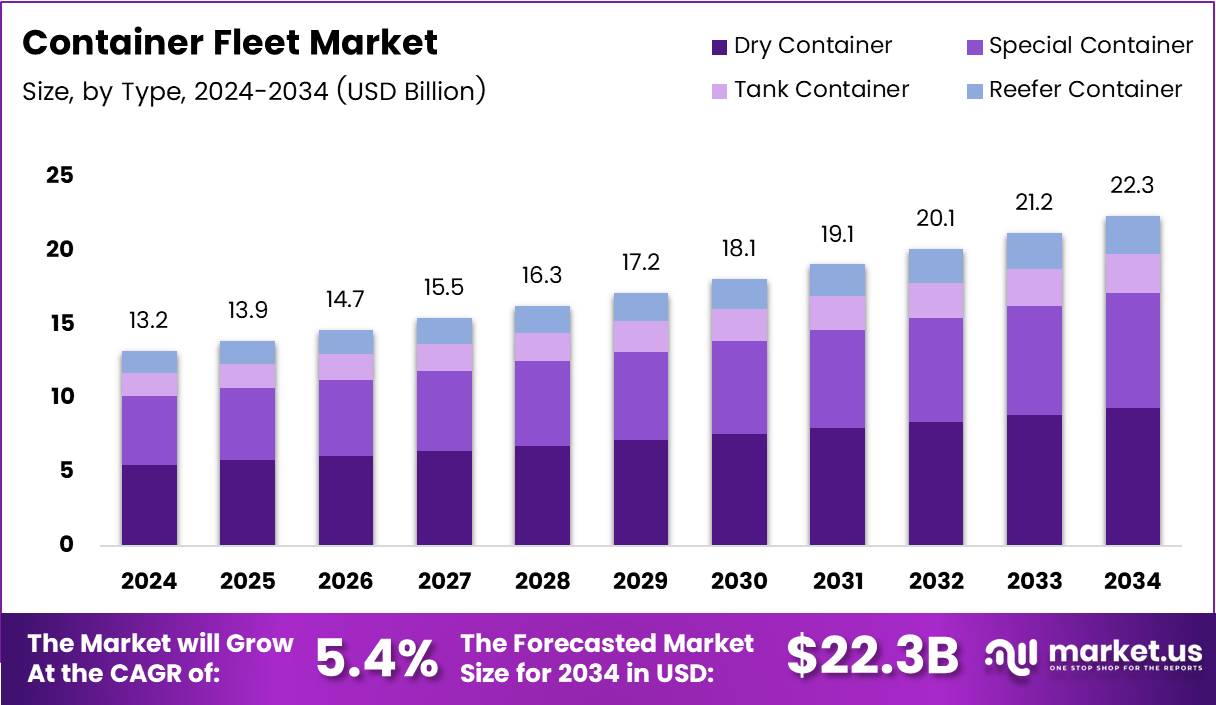

The Global Container Fleet Market size is expected to be worth around USD 22.3 Billion by 2034, from USD 13.2 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The Container Fleet Market represents a critical segment within the global maritime logistics ecosystem, consisting of vessels designed specifically to carry containerized cargo. These fleets facilitate international trade by transporting goods efficiently across major shipping routes. The market has seen significant consolidation in recent years, with dominance by a few major players.

As of June 2025, the global container fleet is operating at near-full capacity, with only 0.5% of vessels idle, according to Mfame Guru. This indicates heightened demand, optimized operations, and tighter capacity management across routes. High utilization also hints at fewer market inefficiencies and greater operational discipline among fleet operators.

Moreover, Contimod reports that the top 10 ocean carriers control around 85% of the global container fleet. This growing consolidation reflects intense competition, economies of scale, and strategic mergers, especially following pandemic-related disruptions. Notably, the largest container ship now boasts a staggering 24,000 TEU capacity, reflecting technological evolution in vessel design.

The global trade rebound is pushing volume expansion. According to Kuehne + Nagel, Container Trades Statistics recorded 15.6 million TEU in a recent month, representing a 5.8% increase from April 2024. This uptick confirms stronger port activity, rising demand from Asia-Pacific, and improving economic sentiment post-COVID recovery.

Additionally, sustainability is emerging as a key theme. As per ScienceDirect, container fleets burned 117.8 million tonnes of fuel in 2018, releasing over 367.2 million tonnes of CO₂ emissions. These figures underscore urgent calls for decarbonization and compliance with IMO 2030/2050 targets to mitigate the sector’s environmental footprint.

Government investments are intensifying across port infrastructure and clean shipping initiatives. Regulatory pressures, including carbon taxes and fuel mandates, are pushing fleet owners to adopt LNG-powered or hybrid propulsion systems, driving innovations in fleet management.

Opportunities are expanding in AI-powered route optimization, autonomous vessel monitoring, and digitized freight platforms. These innovations help reduce fuel usage and increase turnaround time, especially vital amid congested global trade lanes.

With maritime trade expected to rise further, the container fleet market is poised for strategic fleet expansions and equipment upgrades. Investors are closely monitoring container leasing trends, vessel turnaround rates, and geopolitical shifts influencing route dynamics and fleet capacity planning.

Key Takeaways

- The Global Container Fleet Market is projected to reach USD 22.3 Billion by 2034, up from USD 13.2 Billion in 2024, at a CAGR of 5.4% from 2025 to 2034.

- In 2024, Dry Containers held a dominant share of 58.7% in the market by type due to their versatility, cost-efficiency, and widespread usage.

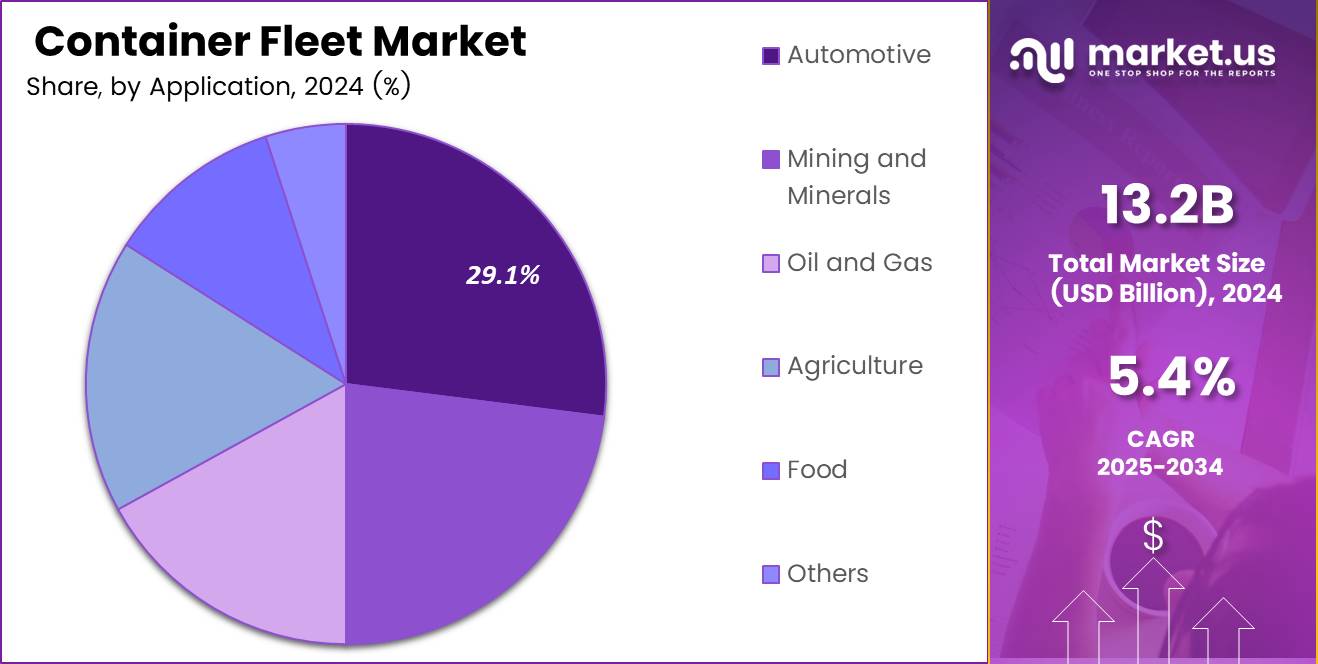

- The Automotive sector led the market by application in 2024 with a 29.1% share, driven by global shipping of vehicle parts and assemblies.

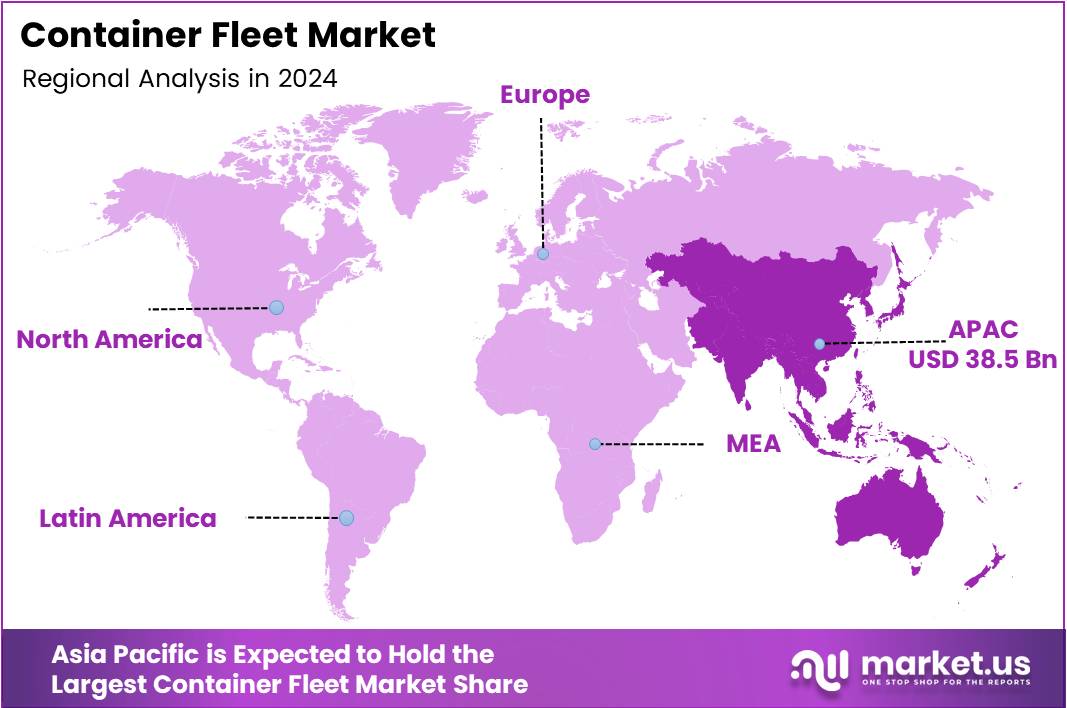

- Asia Pacific was the top regional market in 2024, holding a 38.5% share and generating USD 5.1 Billion, supported by a robust manufacturing base and expanding port infrastructure.

Type Analysis

Dry Container dominates with 58.7% due to its extensive use in global trade and standard freight logistics.

In 2024, Dry Container held a dominant market position in the By Type Analysis segment of the Container Fleet Market, with a 58.7% share. Its widespread adoption stems from its versatility, cost-efficiency, and suitability for transporting a vast range of general cargo. These containers are integral to global supply chains and are commonly used across various industries, driving their consistent market demand.

Special Containers, including open-top, flat-rack, and platform variants, are used for transporting oversized or project cargo. While they cater to niche shipping requirements, their application is steadily rising in construction and machinery transport.

Tank Containers are specifically designed for bulk liquid transport, including chemicals and food-grade liquids. Their adoption continues to rise due to enhanced safety standards and growing global chemical trade.

Reefer Containers are essential in the cold chain logistics segment, catering to the transport of temperature-sensitive goods such as pharmaceuticals and perishable food items. The demand for reefer containers is growing in tandem with the global rise in food exports and healthcare logistics.

Application Analysis

Automotive dominates with 29.1% due to its high-volume export needs and globalized supply chains.

In 2024, Automotive held a dominant market position in the By Application Analysis segment of the Container Fleet Market, with a 29.1% share. The automotive sector relies heavily on containerized shipping to manage a steady flow of parts, assemblies, and finished vehicles across continents, particularly between Asia, Europe, and North America.

Mining and Minerals followed, leveraging containers for secure and efficient transport of ores and raw materials. The industry’s growing demand for remote site logistics boosts its usage of container fleets.

Oil and Gas applications make strategic use of containers for transporting drilling equipment, tools, and chemicals, especially in offshore and cross-border operations, where mobility and protection are crucial.

Agriculture is an expanding segment due to increased global trade in grains, pulses, and agro-products. Containers support bulk exports while ensuring product safety and compliance with international standards.

Food, particularly processed and perishable goods, sees consistent reliance on container fleets, especially refrigerated variants, to maintain quality and shelf-life across long shipping routes.

Others comprise textiles, electronics, and general merchandise, which continue to contribute to container usage across global trade corridors, supporting a balanced market landscape.

Key Market Segments

By Type

- Dry Container

- Special Container

- Tank Container

- Reefer Container

By Application

- Automotive

- Mining and Minerals

- Oil and Gas

- Agriculture

- Food

- Others

Drivers

Surge in Containerized Cargo for E-commerce Fulfillment Accelerates Market Demand

The rapid growth of global trade and the expansion of intermodal logistics networks have significantly increased the need for container fleets. Businesses are shipping goods across continents with greater frequency, and this globalization is boosting long-distance cargo movement. As a result, fleets are being optimized to handle multi-modal transport efficiently.

A key factor driving this market is the explosive rise of e-commerce. With millions of parcels being shipped daily, there is a strong reliance on containerized cargo solutions for timely and secure deliveries. Fleet operators are adapting to smaller, faster shipments to meet online retail expectations.

Additionally, the growth of cold chain logistics in developing countries is fueling the adoption of reefer containers. Nations in Asia, Africa, and Latin America are investing heavily in cold storage infrastructure, driving demand for temperature-controlled fleets to transport food, pharmaceuticals, and other sensitive goods.

Furthermore, smart technology is transforming how fleet operations are managed. Container tracking, remote diagnostics, and automated systems are being integrated to reduce downtime and increase transparency. Companies adopting digital fleet management systems gain a competitive advantage through optimized routes and asset utilization.

Restraints

Port Congestion and Inefficiencies Slowing Turnaround Times Restrain Market Growth

One of the significant barriers in the container fleet market is the unpredictability of steel prices. As steel is the primary material used in container production, its price volatility directly affects manufacturing costs, leading to uncertain capital planning for fleet expansion.

Congested ports and inefficient terminal operations are another major issue. Ships often face long waiting times to load or unload containers, especially in high-traffic regions. These delays not only increase operational costs but also reduce overall container turnaround efficiency.

Environmental regulations around aging fleets pose further challenges. Many older containers do not comply with modern sustainability mandates, forcing operators to upgrade or retire existing units. Compliance costs are high, and retrofitting is not always feasible, especially for smaller operators.

Lastly, the shift towards smart fleet maintenance is being hampered by a shortage of skilled technicians. Maintaining digital systems, sensors, and AI-driven diagnostics requires specialized training, and the current workforce shortage is limiting the full adoption of smart technologies.

Growth Factors

Adoption of AI-Based Predictive Maintenance in Fleet Operations Creates New Opportunities

The adoption of AI-based predictive maintenance is reshaping fleet operations. By using real-time data, operators can now identify wear and tear before it becomes a problem. This proactive approach reduces downtime and extends container life, ultimately improving cost-efficiency.

Strategic partnerships between shipping companies and logistics technology firms are also opening up new growth avenues. These alliances promote innovation in fleet tracking, route optimization, and digital documentation—enhancing operational transparency and efficiency across the supply chain.

There’s also growing interest in modular and multi-purpose containers. These adaptable units are designed to serve multiple cargo types, allowing companies to consolidate shipments and maximize container usage. This is especially useful in regions with diverse export profiles.

Emerging economies are witnessing increased penetration of container leasing services. Many small- to mid-sized firms in these markets prefer leasing over owning containers to reduce upfront investment. This model provides flexibility and makes container fleet access more inclusive for businesses of all sizes.

Emerging Trends

Integration of IoT and Telematics in Maritime Containers Shapes Market Trends

Decarbonization is a leading trend influencing the container fleet market. Shipping lines are under increasing pressure to reduce their carbon footprint, and fleet operators are investing in eco-friendly containers and optimized logistics to meet net-zero targets.

Another strong trend is the growing use of blockchain in the supply chain. By improving container tracking and providing secure, tamper-proof data records, blockchain enhances trust and efficiency between stakeholders involved in global shipping.

Real-time visibility of container movements is becoming a necessity rather than a luxury. Fleet operators are leveraging smart systems to monitor container location, condition, and delays. This transparency helps reduce risk and improves client confidence.

IoT and telematics are also transforming the container landscape. Smart containers equipped with sensors offer insights into temperature, pressure, and movement, allowing for better decision-making and alert systems throughout the shipping process. This tech-driven shift is redefining modern container management.

Regional Analysis

Asia Pacific Dominates the Container Fleet Market with a Market Share of 38.5%, Valued at USD 5.1 Billion

In 2024, Asia Pacific emerged as the leading region in the global Container Fleet Market, accounting for a substantial 38.5% market share and generating revenue worth USD 5.1 Billion. The dominance is attributed to the region’s strong manufacturing base, rising seaborne trade, and rapid infrastructural developments in ports across countries like China, India, and Japan. Additionally, the increasing reliance on intermodal freight and growing investments in container tracking systems further elevate the market growth in this region.

North America Container Fleet Market Trends

North America holds a significant position in the global container fleet ecosystem, driven by robust logistics infrastructure and high container traffic on transpacific trade routes. The U.S. remains a vital contributor with its advanced fleet management systems and integration of digital solutions. The region also benefits from strong demand in retail, automotive, and e-commerce sectors that rely on efficient containerized cargo movement.

Europe Container Fleet Market Trends

Europe exhibits steady growth in the container fleet market, fueled by its well-established port infrastructure and commitment to decarbonizing maritime transport. Northern and Western Europe, in particular, are witnessing increased adoption of sustainable fleet technologies. The European Union’s emphasis on cross-border trade facilitation continues to support container fleet expansion.

Middle East and Africa Container Fleet Market Trends

The Middle East and Africa region is experiencing gradual growth in container fleet deployment due to the development of free trade zones and expansion of port capacities in countries like UAE and South Africa. Strategic investments in logistics corridors and increased trade links with Asia and Europe are acting as growth enablers in the region.

Latin America Container Fleet Market Trends

Latin America is witnessing moderate growth in the container fleet market, driven by improvements in port infrastructure and the expansion of regional trade agreements. Brazil and Mexico are key markets showing signs of increasing container traffic, supported by rising exports and modernization of logistics networks.

Regional Mentions:

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Container Fleet Company Insights

In 2024, the global Container Fleet Market continues to evolve, shaped significantly by the strategies and expansions of its leading players.

China COSCO Shipping Corporation Limited remains a dominant force in the market, leveraging its vast fleet and state-backed support to solidify its presence across key global trade lanes. Its continued investment in digitalization and green shipping technologies underpins its strategic direction.

CMA CGM S.A. is focused on strengthening its integrated logistics capabilities, expanding beyond traditional shipping services. The company’s efforts to reduce emissions and enhance end-to-end supply chain efficiency have positioned it as a forward-thinking leader in the sector.

Hapag-Lloyd AG has maintained steady growth through strategic acquisitions and fleet modernization. Its focus on sustainability and digital customer experience solutions continues to resonate with global shippers navigating supply chain challenges.

Matson Inc. plays a crucial role in the transpacific trade, particularly in serving U.S. domestic and Pacific island markets. Its agile operations and strong customer service make it a competitive player in niche shipping segments.

These companies are reshaping the container fleet landscape, driving efficiency, resilience, and innovation to meet global demand.

Top Key Players in the Market

- China COSCO Shipping Corporation Limited

- CMA CGM S.A.

- Hapag-Lloyd AG

- Matson Inc.

- MSC Mediterranean Shipping Company S.A.

- Ocean Network Express Pte. Ltd.

- Orient Overseas Container Line Limited

- Pacific International Lines Pte. Ltd.

- Unifeeder A/S (DP World)

- Wan Hai Lines Ltd.

- Yang Ming Marine Transport Corporation

- ZIM Integrated Shipping Services Ltd.

- Maersk

- CMA CGM

- Mitsui O.S.K

- Orient Overseas Container Line

- HYUNDAI Merchant Marine Co. Ltd.

- Kawasaki Kisen Kaisha Ltd.

- China COSCO SHIPPING Corp. Ltd.

Recent Developments

- In Jul 2025, Heidmar has entered into an agreement to acquire the C/V A. Obelix, a 1,702 TEU gearless feeder container vessel. Built in 2008 at Wadan/Aker Yards, this acquisition enhances Heidmar’s feeder fleet capabilities.

- In Feb 2025, Hapag-Lloyd finalised a $4 billion green financing package to support the construction of 24 new container ships. These vessels will be LNG and ammonia-ready, aligning with the company’s sustainable fleet strategy.

Report Scope

Report Features Description Market Value (2024) USD 13.2 Billion Forecast Revenue (2034) USD 22.3 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Dry Container, Special Container, Tank Container, Reefer Container), By Application (Automotive, Mining and Minerals, Oil and Gas, Agriculture, Food, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BYD Company Ltd., China COSCO Shipping Corporation Limited, CMA CGM S.A., Hapag-Lloyd AG, Matson Inc., MSC Mediterranean Shipping Company S.A., Ocean Network Express Pte. Ltd., Orient Overseas Container Line Limited, Pacific International Lines Pte. Ltd., Unifeeder A/S (DP World), Wan Hai Lines Ltd., Yang Ming Marine Transport Corporation, ZIM Integrated Shipping Services Ltd., Maersk, CMA CGM, Mitsui O.S.K, Orient Overseas Container Line, HYUNDAI Merchant Marine Co. Ltd., Kawasaki Kisen Kaisha Ltd., China COSCO SHIPPING Corp. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- China COSCO Shipping Corporation Limited

- CMA CGM S.A.

- Hapag-Lloyd AG

- Matson Inc.

- MSC Mediterranean Shipping Company S.A.

- Ocean Network Express Pte. Ltd.

- Orient Overseas Container Line Limited

- Pacific International Lines Pte. Ltd.

- Unifeeder A/S (DP World)

- Wan Hai Lines Ltd.

- Yang Ming Marine Transport Corporation

- ZIM Integrated Shipping Services Ltd.

- Maersk

- CMA CGM

- Mitsui O.S.K

- Orient Overseas Container Line

- HYUNDAI Merchant Marine Co. Ltd.

- Kawasaki Kisen Kaisha Ltd.

- China COSCO SHIPPING Corp. Ltd.