Global Construction Fabrics Market Size, Share Analysis Report By Material (Polyvinyl Chloride (PVC), Polytetrafluoroethylene (PTFE), Ethylene Tetrafluoroethylene (ETFE), Others), By Application (Tensile Architecture, Awnings and Canopies, Facades, Others), By End Use (Non-residential, Residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153902

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

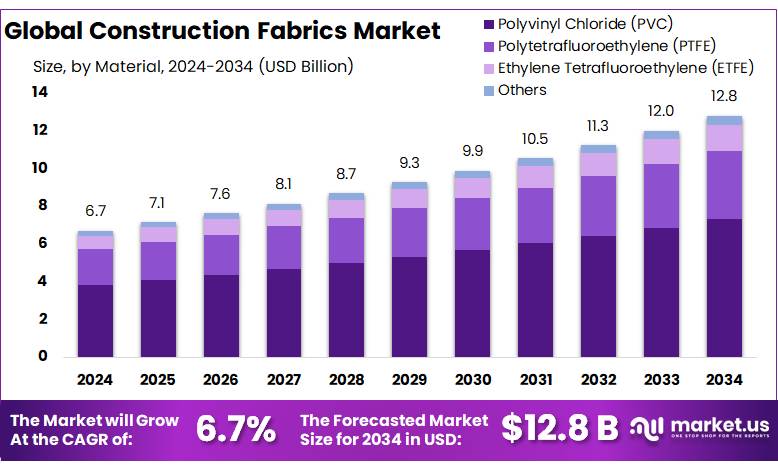

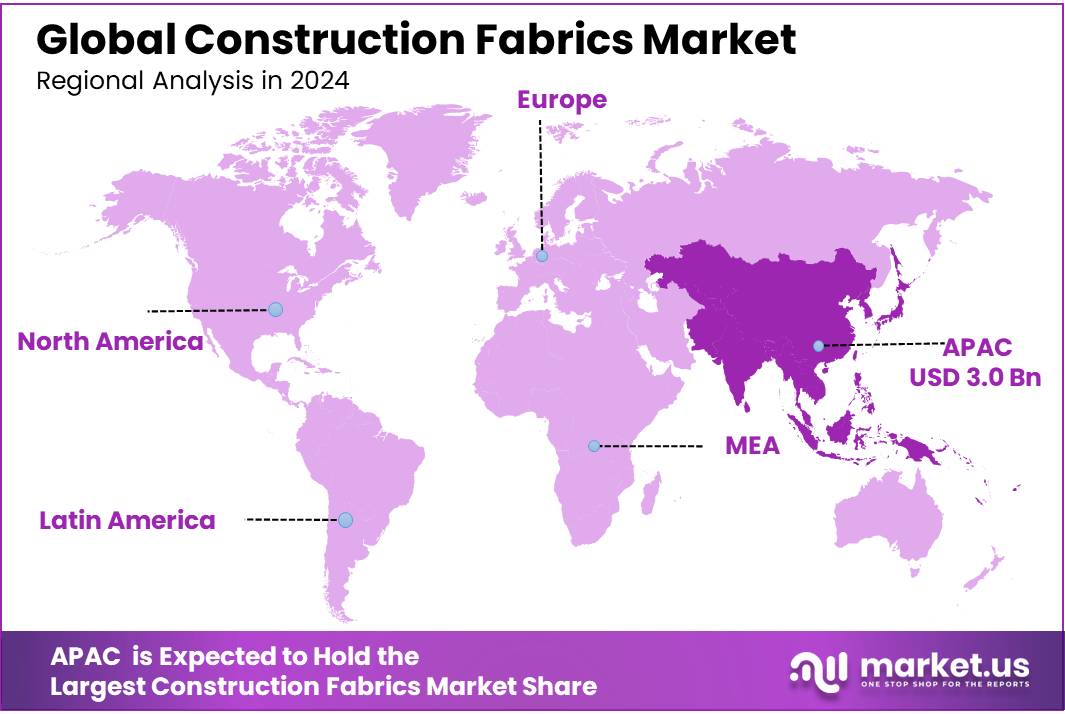

The Global Construction Fabrics Market size is expected to be worth around USD 12.8 Billion by 2034, from USD 6.7 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024, Asia Pacific (APAC) held a dominant market position, capturing more than a 45.8% share, holding USD 3.0 Billion revenue.

The construction fabrics concentrates sector, a pivotal segment within India’s technical textiles industry, has witnessed substantial growth, driven by escalating infrastructural demands and government-backed initiatives. According to the Ministry of Textiles’ Baseline Survey on Technical Textiles, the sector encompasses a diverse range of applications, including geotextiles, protective clothing, and construction fabrics, which are integral to the nation’s infrastructure development. The government’s strategic focus on promoting technical textiles has further bolstered this sector’s expansion.

The Indian technical textiles industry is the second-largest producer of man-made fibre (MMF) after China and the third-largest exporter of textiles globally. In the fiscal year 2022, India’s textile and apparel exports reached approximately USD 44.4 billion, underscoring the sector’s robust performance. The construction fabrics concentrates segment contributes significantly to this export value, reflecting its growing importance in the global market.

Government initiatives have played a crucial role in fostering the growth of this sector. The PM Mega Integrated Textile Region and Apparel (MITRA) scheme, launched in 2021, aims to establish seven mega textile parks with an investment of INR 4,445 crore. These parks are designed to integrate the entire textile value chain, from spinning to garment manufacturing, thereby enhancing efficiency and competitiveness. The establishment of such parks is expected to provide a significant boost to the construction fabrics concentrates sector by facilitating advanced manufacturing capabilities and infrastructure development.

Key Takeaways

- The Construction Fabrics Market is projected to grow from USD 6.7 billion in 2024 to around USD 12.8 billion by 2034, registering a CAGR of 6.7% over the forecast period.

- Polyvinyl Chloride (PVC) dominated the market, accounting for more than 57.2% of the global share.

- Tensile Architecture held a leading position, contributing over 44.9% of the total market share.

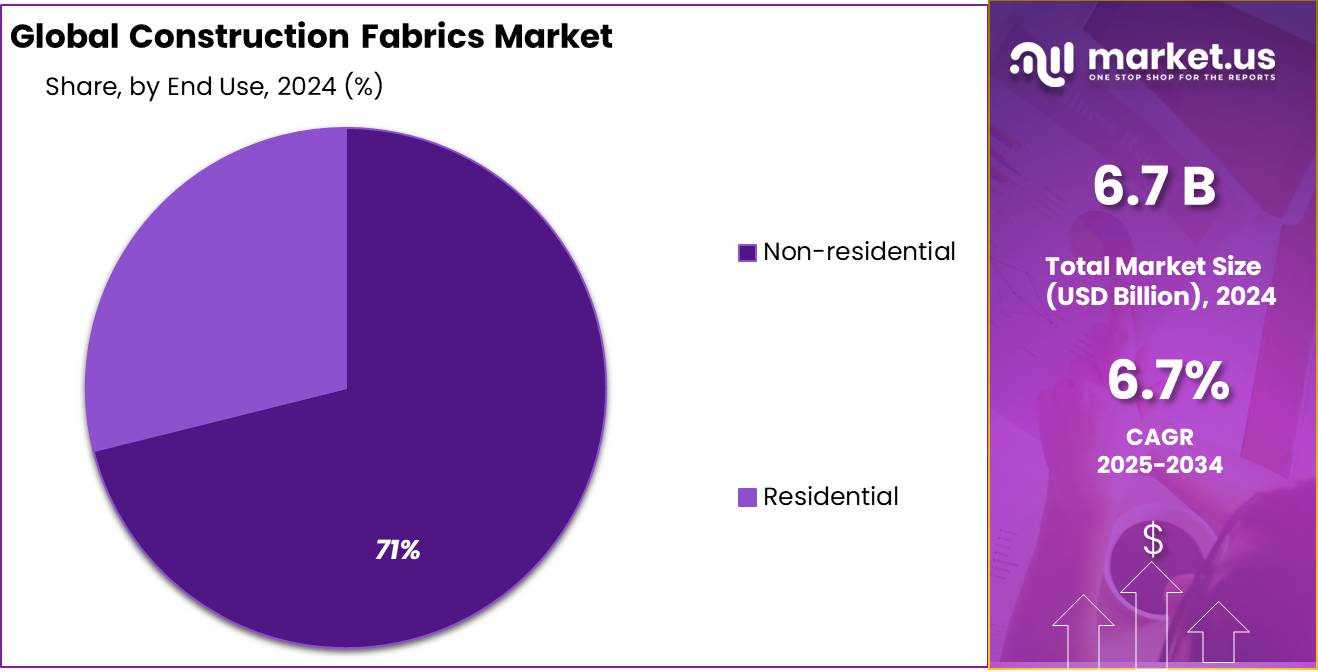

- The Non-residential segment captured a commanding share of more than 71.4% in the global market.

- The Asia Pacific (APAC) region led the market, holding 45.8% of the global share, with an estimated value of approximately USD 3.0 billion in 2024.

By Material Analysis

Polyvinyl Chloride leads with 57.2% due to its durability and low cost.

In 2024, Polyvinyl Chloride (PVC) held a dominant market position, capturing more than a 57.2% share in the construction fabrics market. This strong presence is mainly supported by PVC’s flexibility, weather resistance, and cost-efficiency, making it a preferred material for architectural structures such as canopies, awnings, tensile roofs, and stadium covers.

Its ease of fabrication and ability to be welded or coated enhances its suitability for large-scale installations. The demand for PVC-based construction fabrics continued to grow in 2025 as more infrastructure projects across urban and commercial sectors emphasized durability and affordability. Furthermore, the recyclable nature of PVC and ongoing innovations in UV-resistant and fire-retardant coatings are encouraging wider adoption in sustainable construction applications.

By Application Analysis

Tensile Architecture dominates with 44.9% due to its modern design and structural efficiency.

In 2024, Tensile Architecture held a dominant market position, capturing more than a 44.9% share in the global construction fabrics market. This strong share reflects the growing preference for lightweight, flexible, and visually appealing structures in both commercial and public infrastructure projects. Tensile structures made with high-performance fabrics are increasingly being used in stadiums, airport terminals, exhibition halls, and walkways due to their ability to cover large spans with minimal materials.

The demand remained steady in 2025, as urban development and green building initiatives continued to promote energy-efficient and innovative designs. With advancements in fabric technology offering enhanced strength, weather resistance, and UV protection, tensile architecture is expected to maintain its lead in this segment.

By End Use Analysis

Non-residential sector dominates with 71.4% driven by large-scale infrastructure and commercial use.

In 2024, Non-residential held a dominant market position, capturing more than a 71.4% share in the construction fabrics market. This significant share reflects the widespread use of construction fabrics in commercial buildings, industrial sheds, transportation hubs, sports arenas, and government infrastructure projects. The demand for durable, weather-resistant, and energy-efficient materials has led to the growing adoption of fabric-based solutions for roofs, façades, and temporary structures in non-residential applications.

In 2025, continued investments in urban infrastructure, smart city projects, and public facilities supported the use of high-performance fabrics, particularly in areas requiring lightweight construction and faster installation. The segment’s strong hold is also backed by its compatibility with modern architectural needs and sustainability standards.

Key Market Segments

By Material

- Polyvinyl Chloride (PVC)

- Polytetrafluoroethylene (PTFE)

- Ethylene Tetrafluoroethylene (ETFE)

- Others

By Application

- Tensile Architecture

- Awnings & Canopies

- Facades

- Others

By End Use

- Non-residential

- Residential

Emerging Trends

Government Support for Construction Fabric Innovation

The construction fabric sector is experiencing notable growth, driven by advancements in materials and increased demand for sustainable building solutions. In India, this growth is further supported by government initiatives aimed at fostering innovation and infrastructure development.

The Indian government has introduced several programs to bolster the technical textiles industry, which encompasses construction fabrics. One such initiative is the Pradhan Mantri Mega Integrated Textile Region and Apparel (PM MITRA) scheme, launched in 2021. This program aims to establish seven mega textile parks across the country with an investment of ₹4,445 crore. These parks are designed to provide state-of-the-art infrastructure and promote the integration of the entire textile value chain, including the production of construction fabrics.

Additionally, the government has been actively promoting research and development in technical textiles through various funding schemes. For instance, the Tamil Nadu government announced a ₹1 crore scheme to support R&D in technical textiles, encouraging industries and academic institutions to develop innovative solutions in this field.

Drivers

Government Initiatives Driving Growth in Construction Fabrics Concentrates

One of the primary catalysts for the growth of construction fabrics concentrates in India is the government’s strategic initiatives aimed at enhancing the technical textiles sector. These initiatives not only bolster domestic manufacturing but also position India as a competitive player in the global market.

A significant development in this regard is the establishment of the PM Mega Integrated Textile Region and Apparel (PM MITRA) Parks. The government has approved the creation of seven such parks across various states, with a total outlay of ₹4,445 crore for the period from 2021 to 2027. Each park is expected to generate approximately 3 lakh direct and indirect employment opportunities, thereby strengthening the domestic value chain for technical textiles, including construction fabrics concentrates.

Furthermore, the National Technical Textiles Mission (NTTM), launched in 2020, aims to make India a global leader in technical textiles. With an outlay of ₹1,480 crore until 2025-26, the mission focuses on research, innovation, and market development. It has already approved 168 research projects worth ₹509 crore, fostering advancements in materials and processes pertinent to construction fabrics concentrates.

These government-backed initiatives are complemented by the Union Budget 2025-26, which allocated ₹5,272 crore to the Ministry of Textiles, marking a 19% increase from the previous year. This enhanced funding underscores the government’s commitment to the growth of the textile sector, including the niche of construction fabrics concentrates.

Restraints

Challenges in Scaling Up Domestic Production of Construction Fabrics

A significant challenge hindering the growth of construction fabrics concentrates in India is the limited domestic production capacity for high-performance materials. While the country has made strides in manufacturing basic textiles, advanced materials required for specialized applications in construction are predominantly imported. This dependency on foreign suppliers not only escalates costs but also poses risks related to supply chain disruptions and currency fluctuations.

For instance, products like high-tenacity polyester and geosynthetic materials, essential for reinforcement and erosion control, are largely sourced from countries with established manufacturing capabilities in these domains. The lack of indigenous production facilities for such specialized materials results in increased lead times and higher procurement costs, impacting the overall competitiveness of Indian construction projects.

To address this issue, the Indian government has introduced initiatives like the Production Linked Incentive (PLI) Scheme, aiming to boost domestic manufacturing in sectors including technical textiles. The scheme offers financial incentives to manufacturers based on their incremental sales, thereby encouraging investment in advanced manufacturing technologies and infrastructure.

Additionally, the establishment of Mega Integrated Textile Region and Apparel (PM MITRA) parks is intended to create integrated textile hubs that encompass the entire value chain, from raw material production to finished goods. These parks are expected to foster economies of scale and reduce dependency on imports by promoting domestic production capabilities.

However, the success of these initiatives hinges on timely implementation, adequate infrastructure development, and active participation from private sector players. Without substantial investment in building domestic production capacity for specialized construction fabrics, India may continue to face challenges in meeting the growing demand for such materials in its infrastructure projects.

Opportunity

Government Initiatives Fueling Growth in Construction Fabrics

A significant growth opportunity for construction fabrics in India lies in the government’s strategic initiatives aimed at enhancing the technical textiles sector. These initiatives not only bolster domestic manufacturing but also position India as a competitive player in the global market.

A notable development is the establishment of the PM Mega Integrated Textile Region and Apparel (PM MITRA) Parks. The government has approved the creation of seven such parks across various states, with a total outlay of ₹4,445 crore for the period from 2021 to 2027. Each park is expected to generate approximately 3 lakh direct and indirect employment opportunities, thereby strengthening the domestic value chain for technical textiles, including construction fabrics.

Furthermore, the National Technical Textiles Mission (NTTM), launched in 2020, aims to make India a global leader in technical textiles. With an outlay of ₹1,480 crore until 2025-26, the mission focuses on research, innovation, and market development. It has already approved 168 research projects worth ₹509 crore, fostering advancements in materials and processes pertinent to construction fabrics.

Additionally, the Production Linked Incentive (PLI) Scheme for the textile sector has led to investments amounting to ₹7,343 crore, generated a turnover of ₹4,648 crore, and contributed ₹538 crore in exports. This demonstrates the scheme’s effectiveness in stimulating capital infusion, enhancing production capabilities, and promoting export competitiveness in the textile industry.

Regional Insights

In 2024, the Asia Pacific (APAC) region held a dominant position in the global construction fabrics market, accounting for 45.8% of the total market share and reaching a value of approximately USD 3.0 billion. This leadership is largely supported by rapid urbanization, expanding infrastructure development, and increasing investments in public and private construction projects across countries such as China, India, Japan, and South Korea. The region’s focus on cost-effective and efficient building solutions has significantly contributed to the adoption of advanced construction fabrics in tensile architecture, transportation terminals, commercial roofing, and façade cladding.

China remains the largest contributor within the APAC region, driven by its large-scale infrastructural programs under initiatives like the Belt and Road Initiative and its extensive urban redevelopment plans. India is also showing robust growth with government-supported programs such as Smart Cities Mission and large-scale metro rail and airport expansions, which demand high-performance, durable, and lightweight construction materials such as fabric membranes. Moreover, increasing attention to sustainable construction practices and green buildings is further boosting demand for coated fabrics that offer energy efficiency and weather resistance.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dongwon Industry Co. is a leading South Korean manufacturer of high-performance construction fabrics, specializing in coated textiles used for architectural membranes, tents, and industrial covers. The company is known for its durable PVC-coated and PVDF-laminated products that are widely used in tensile structures and stadium roofing. With strong R&D and continuous investment in eco-friendly production technologies, Dongwon supports large-scale infrastructure and smart city projects across Asia and international markets.

ENDUTEX, based in Portugal, is a globally recognized producer of coated technical textiles, offering PVC, acrylic, and PU-coated fabrics for the construction and architectural sectors. The company provides solutions for awnings, façades, tensile structures, and temporary buildings. Its advanced coating lines and vertically integrated manufacturing allow ENDUTEX to maintain consistent quality and innovation. The company exports to over 50 countries and has expanded operations to meet growing demand in Europe, Latin America, and Asia-Pacific regions.

Hightex Maintenance GmbH, based in Germany, is a pioneer in tensile membrane architecture and technical textile engineering. The company designs, produces, and installs lightweight construction fabric systems for stadiums, transport terminals, and commercial buildings. Hightex is well-regarded for its innovation in PTFE, ETFE, and PVC-coated fabric solutions that combine strength, translucency, and aesthetic appeal. With a portfolio of large-scale international projects, Hightex plays a key role in modern construction using fabric-based architecture.

Top Key Players Outlook

- Dongwon Industry Co.

- ENDUTEX COATED TECHNICAL TEXTILES

- Erez thermoplastic Products

- Hightex Maintenance GmbH

- HIRAOKA & Co., Ltd.

- IASO

- Novum Membranes GmbH

- Saint-Gobain

- Sattler AG

- Seaman Corporation

- Seele

- Sefar AG

- Serge Ferrari

- Sioen Industries Nv

- Structurflex

- Taiyo Kogyo Corporation

- Tensaform

- Verseidag-Indutex GmbH

Recent Industry Developments

In 2024, Endutex produced approximately 20 million square meters of textiles annually, serving over 571 clients across more than 50 countries. The company operates nine manufacturing and distribution centers globally, employing around 250 professionals.

In 2024, HIRAOKA continued to supply its fabric membranes both domestically and to global markets, emphasizing low-cost yet durable solutions that meet international fire-resistance and weatherability standards.

Report Scope

Report Features Description Market Value (2024) USD 6.7 Bn Forecast Revenue (2034) USD 12.8 Bn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polyvinyl Chloride (PVC), Polytetrafluoroethylene (PTFE), Ethylene Tetrafluoroethylene (ETFE), Others), By Application (Tensile Architecture, Awnings and Canopies, Facades, Others), By End Use (Non-residential, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dongwon Industry Co., ENDUTEX COATED TECHNICAL TEXTILES, Erez thermoplastic Products, Hightex Maintenance GmbH, HIRAOKA & Co., Ltd., IASO, Novum Membranes GmbH, Saint-Gobain, Sattler AG, Seaman Corporation, Seele, Sefar AG, Serge Ferrari, Sioen Industries Nv, Structurflex, Taiyo Kogyo Corporation, Tensaform, Verseidag-Indutex GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Construction Fabrics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Construction Fabrics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dongwon Industry Co.

- ENDUTEX COATED TECHNICAL TEXTILES

- Erez thermoplastic Products

- Hightex Maintenance GmbH

- HIRAOKA & Co., Ltd.

- IASO

- Novum Membranes GmbH

- Saint-Gobain

- Sattler AG

- Seaman Corporation

- Seele

- Sefar AG

- Serge Ferrari

- Sioen Industries Nv

- Structurflex

- Taiyo Kogyo Corporation

- Tensaform

- Verseidag-Indutex GmbH