Global Connected Logistics Market Size, Share, Growth Analysis By Component (Software, Hardware, Services), By Platform (Device Management, Application Management, Connectivity Management), By Transportation Mode (Roadways, Railways, Airways, Waterways), By End-User Industry (Retail & E-commerce, Automotive, Aerospace & Defense, Healthcare, Energy, Electronics & Semiconductors, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175935

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

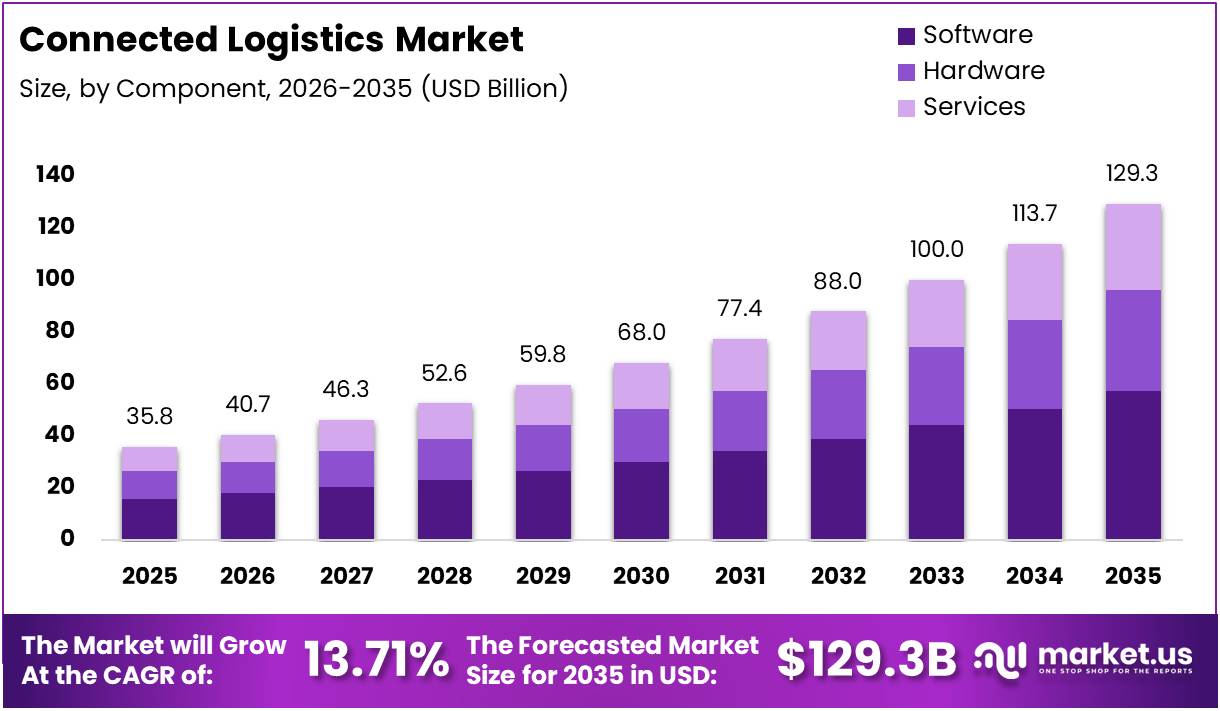

The Global Connected Logistics Market size is expected to be worth around USD 129.3 Billion by 2035 from USD 35.79 Billion in 2025, growing at a CAGR of 13.71% during the forecast period 2026 to 2035.

Connected logistics represents the integration of advanced technologies including Internet of Things, artificial intelligence, and cloud computing into supply chain operations. These solutions enable real-time tracking, automated decision-making, and seamless communication across transportation networks. Moreover, connected logistics transforms traditional supply chains into intelligent, data-driven ecosystems.

The market experiences robust growth driven by increasing demand for operational efficiency and transparency. Companies seek to reduce costs while improving delivery accuracy and customer satisfaction. Additionally, the rise of e-commerce accelerates the need for sophisticated logistics management systems that handle complex, high-volume operations effectively.

Government initiatives worldwide promote digital transformation in logistics infrastructure. Regulatory frameworks increasingly mandate emission reductions and sustainability practices. Consequently, organizations invest in connected solutions to comply with environmental standards while maintaining competitive advantage through technology adoption and innovation.

Technological advancements create significant opportunities across emerging markets and developed economies. The integration of autonomous vehicles, robotics, and predictive analytics reshapes operational capabilities. Furthermore, blockchain technology enhances transparency and security throughout global supply chains, addressing long-standing industry challenges.

According to a research, shipment tracking using IoT sensors is reported at 78% adoption among firms, while warehouse inventory monitoring sees 72% adoption. This demonstrates strong market penetration of connected technologies in core logistics functions.

According to Eseye, 55% of logistics and supply chain firms have deployed between 1,000 and 10,000 connected devices including sensors, trackers, and gateways in their operations, while 38% have 500 to 1,000 devices currently installed. Therefore, widespread device adoption signals market maturity and readiness for advanced solutions.

According to Reuters, AI tools could cut freight logistics carbon footprint by 10 to 15% via optimized operations, load planning, and smart route management. This sustainability benefit drives continued investment in connected logistics platforms across industries seeking environmental compliance and operational excellence.

Key Takeaways

- Global Connected Logistics Market valued at USD 35.79 Billion in 2025, projected to reach USD 129.3 Billion by 2035

- Market growing at CAGR of 13.71% during forecast period 2026-2035

- Software segment dominates by component with 44.37% market share in 2025

- Device Management platform leads with 42.81% share among platform segments

- Roadways transportation mode holds largest share at 65.26% in 2025

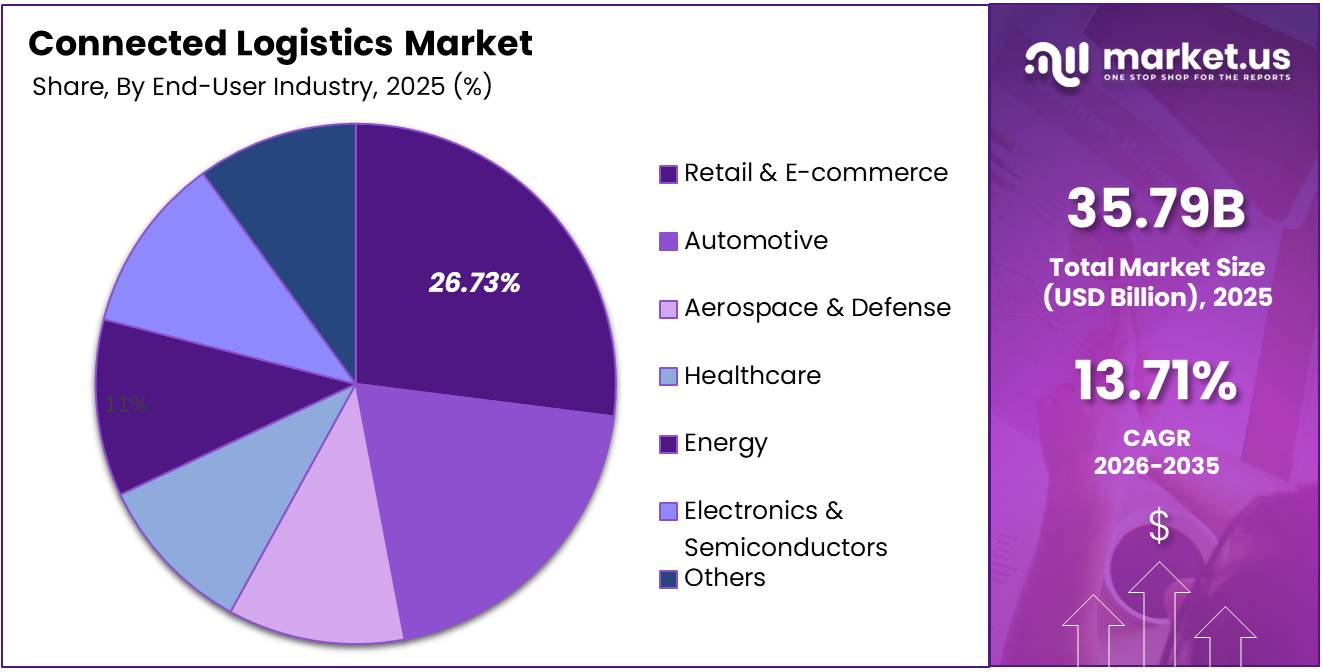

- Retail & E-commerce end-user industry accounts for 26.73% market share

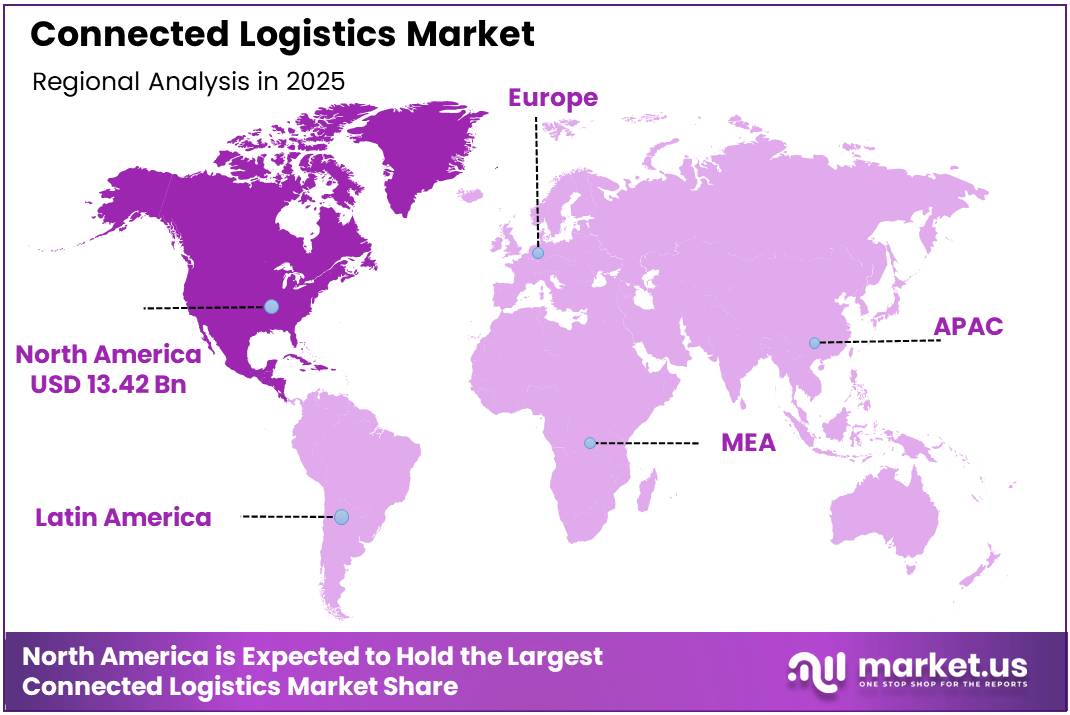

- North America dominates regional market with 37.54% share, valued at USD 13.42 Billion

Component Analysis

Software dominates with 44.37% due to increasing demand for integrated logistics management platforms.

In 2025, Software held a dominant market position in the By Component segment of Connected Logistics Market, with a 44.37% share. Software solutions including warehouse management, fleet management, and freight transportation management deliver comprehensive operational control. Organizations prioritize these platforms for real-time visibility and automated decision-making capabilities that enhance efficiency across supply chains.

Hardware components including RFID tags, sensors, communication devices, and tracking devices form the physical infrastructure of connected logistics. These technologies enable data collection and transmission throughout transportation networks. Moreover, hardware deployment continues expanding as companies implement IoT-enabled tracking systems.

Services encompassing consulting, integration and deployment, support and maintenance, and managed services facilitate successful technology adoption. Professional services help organizations navigate complex implementation processes and maximize return on investment. Additionally, managed services provide ongoing optimization and troubleshooting.

Platform Analysis

Device Management dominates with 42.81% due to critical need for centralized control of connected assets.

In 2025, Device Management held a dominant market position in the By Platform segment of Connected Logistics Market, with a 42.81% share. This platform enables organizations to monitor, configure, and maintain thousands of connected devices across distributed logistics networks. Consequently, companies achieve improved operational efficiency and reduced downtime through centralized management capabilities and automated monitoring systems.

Application Management platforms provide oversight and control of software applications deployed across logistics operations. These solutions ensure application performance, security, and integration with existing enterprise systems. Furthermore, they enable rapid deployment of updates and new features. Organizations leverage application management to maintain consistent service quality and support evolving business requirements effectively.

Connectivity Management platforms handle network communications between devices, applications, and central systems. They optimize data transmission, manage bandwidth allocation, and ensure reliable connectivity across diverse geographic locations. Additionally, connectivity management reduces communication costs while maintaining service quality. .

Transportation Mode Analysis

Roadways dominates with 65.26% due to extensive infrastructure and high-volume freight movement requirements.

In 2025, Roadways held a dominant market position in the By Transportation Mode segment of Connected Logistics Market, with a 65.26% share. Road transportation handles the majority of last-mile deliveries and regional freight operations worldwide. Connected technologies enable real-time route optimization, fleet tracking, and predictive maintenance for trucking operations. Moreover, roadway logistics benefits significantly from IoT sensors and GPS tracking systems.

Railways transportation leverages connected logistics for cargo monitoring, predictive maintenance of rolling stock, and operational scheduling. Rail networks integrate sensors and communication systems to improve safety and efficiency. Additionally, connected solutions help optimize intermodal transfer points and reduce transit times.

Airways transportation utilizes connected logistics for high-value shipments, temperature-sensitive cargo, and real-time tracking across global air freight networks. Airlines and cargo operators deploy IoT sensors to monitor environmental conditions during flight and ground operations.

Waterways transportation implements connected systems for container tracking, vessel monitoring, and port operations management across maritime logistics networks. Shipping companies utilize satellite communication and IoT devices to track cargo throughout ocean transit. Additionally, smart port technologies integrate with vessel tracking systems.

End-User Industry Analysis

Retail & E-commerce dominates with 26.73% due to explosive growth in online shopping and delivery expectations.

In 2025, Retail & E-commerce held a dominant market position in the By End-User Industry segment of Connected Logistics Market, with a 26.73% share. The e-commerce boom drives unprecedented demand for sophisticated logistics tracking and warehouse automation. Retailers require real-time inventory visibility and delivery tracking to meet customer expectations.

Automotive industry implements connected logistics for just-in-time delivery and parts tracking across global production networks. Manufacturers leverage real-time visibility to synchronize component delivery with assembly schedules. Moreover, automotive supply chains require precise coordination among thousands of suppliers.

Aerospace & Defense sector requires secure, traceable logistics for sensitive components and equipment throughout complex supply chains. Military and aviation applications demand highest security standards and chain-of-custody documentation. Additionally, aerospace manufacturers manage high-value parts requiring temperature control and impact monitoring.

Healthcare organizations utilize connected systems for pharmaceutical cold chain management and medical equipment tracking throughout distribution networks. Temperature-sensitive medications require continuous monitoring to maintain efficacy and patient safety. Moreover, medical device tracking ensures regulatory compliance and prevents counterfeit products.

Energy sector logistics handles hazardous materials and specialized equipment requiring precise tracking and environmental monitoring. Oil, gas, and renewable energy operations depend on safe, reliable transportation of critical infrastructure components. Additionally, energy companies manage global supply chains for exploration, production, and distribution activities.

Electronics & Semiconductors manufacturers need visibility across complex global supply chains to manage component availability and production scheduling. Semiconductor production requires precisely timed delivery of materials and equipment to fabrication facilities. Moreover, electronics manufacturers coordinate multiple suppliers across different regions.

Others category encompasses diverse industries including manufacturing, construction, food and beverage, and government sectors adopting connected logistics solutions. Each industry implements tracking, monitoring, and optimization technologies tailored to specific operational requirements. Additionally, cross-industry adoption accelerates as technology costs decrease.

Key Market Segments

By Component

- Software

- Warehouse Management

- Fleet Management

- Freight Transportation Management

- Asset Tracking and Management

- Data Management and Analytics

- Others

- Hardware

- RFID Tags

- Sensors

- Communication Devices

- Tracking Devices

- Others

- Services

- Consulting

- Integration and Deployment

- Support & Maintenance

- Managed Services

By Platform

- Device Management

- Application Management

- Connectivity Management

By Transportation Mode

- Roadways

- Railways

- Airways

- Waterways

By End-User Industry

- Retail & E-commerce

- Automotive

- Aerospace & Defense

- Healthcare

- Energy

- Electronics & Semiconductors

- Others

Drivers

Rapid Adoption of IoT-Enabled Fleet Management Systems Drives Market Growth

Organizations increasingly deploy IoT sensors and GPS tracking across vehicle fleets to optimize operations and reduce costs. Real-time monitoring enables predictive maintenance, fuel efficiency improvements, and driver behavior analysis. Moreover, fleet management systems provide comprehensive visibility into asset utilization and performance metrics that support data-driven decision-making across transportation operations.

The integration of IoT devices with cloud-based analytics platforms transforms traditional fleet management into intelligent, automated systems. Companies achieve significant cost savings through optimized routing, reduced idle time, and improved vehicle lifespan. Additionally, regulatory compliance becomes easier with automated reporting and documentation capabilities that track driver hours and vehicle inspections systematically.

Growing demand for real-time shipment tracking and visibility accelerates connected logistics adoption across industries. Customers expect accurate delivery estimates and proactive communication regarding shipment status throughout transit. Furthermore, AI and machine learning integration enables predictive logistics that anticipates delays and optimizes supply chain operations. Therefore, technological advancement drives continuous market expansion and innovation.

Restraints

Data Privacy and Cybersecurity Concerns Limit Market Adoption

Connected logistics systems generate massive volumes of sensitive operational data vulnerable to cyberattacks and unauthorized access. Organizations face significant risks including data breaches, ransomware attacks, and system disruptions that compromise supply chain integrity. Consequently, companies hesitate to implement connected solutions without robust security frameworks and comprehensive risk management strategies in place.

Regulatory requirements regarding data protection and privacy vary significantly across geographic regions and industries. Compliance with standards like GDPR and industry-specific regulations increases implementation complexity and costs. Moreover, organizations must invest substantially in cybersecurity infrastructure, monitoring systems, and incident response capabilities. Therefore, security concerns create barriers to adoption, particularly among small and medium-sized enterprises.

Limited interoperability between legacy systems and modern connected solutions presents significant technical challenges. Many organizations operate established logistics infrastructure that lacks compatibility with new IoT and cloud-based platforms. Integration requires substantial investment in middleware, custom development, and system upgrades. Additionally, organizations face operational disruptions during migration periods, further slowing adoption rates across the market.

Growth Factors

Expansion into Emerging Markets Accelerates Market Growth

Emerging economies experience rapid e-commerce growth and infrastructure development that drives connected logistics demand. Countries in Asia Pacific, Latin America, and Africa invest heavily in digital transformation and smart city initiatives. Moreover, improving internet connectivity and mobile network coverage enable widespread IoT deployment. Therefore, these markets represent significant untapped opportunities for technology providers and service organizations.

Development of autonomous and connected delivery vehicles transforms last-mile logistics operations and urban distribution networks. Self-driving trucks, delivery drones, and autonomous robots integrate seamlessly with connected logistics platforms. These innovations reduce labor costs, improve delivery speed, and enable 24/7 operations. Additionally, autonomous vehicle technology addresses driver shortages while enhancing safety and operational efficiency across transportation networks.

Integration with smart warehousing and robotics solutions creates comprehensive end-to-end logistics ecosystems. Automated storage and retrieval systems connect with transportation management platforms for seamless inventory flow. Furthermore, collaborative robots and AI-powered picking systems optimize warehouse operations while reducing human error. Consequently, integrated solutions deliver superior performance and return on investment that accelerates market adoption across industries.

Emerging Trends

5G Technology Enhances Real-Time Data Transmission Capabilities

Adoption of 5G networks revolutionizes connected logistics through ultra-low latency and high-bandwidth communication capabilities. Real-time video streaming from vehicles, instant sensor data transmission, and immediate response to changing conditions become possible. Moreover, 5G enables dense IoT device deployments in warehouses and transportation hubs without network congestion. Therefore, next-generation connectivity unlocks advanced applications previously constrained by network limitations.

Blockchain technology implementation creates transparent and secure supply chains with immutable transaction records. Smart contracts automate payment processing, customs clearance, and compliance verification across international shipments. Additionally, blockchain enables trusted data sharing among multiple stakeholders without centralized intermediaries. Consequently, the technology addresses long-standing challenges regarding transparency, fraud prevention, and dispute resolution in global logistics operations.

Shift toward sustainable and green connected logistics solutions reflects growing environmental awareness and regulatory pressure. Companies implement route optimization algorithms that minimize fuel consumption and carbon emissions. Furthermore, electric vehicle integration with charging infrastructure management systems supports fleet electrification initiatives. Organizations leverage connected technologies to measure, report, and reduce environmental impact while maintaining operational efficiency and competitiveness.

Regional Analysis

North America Dominates the Connected Logistics Market with a Market Share of 37.54%, Valued at USD 13.42 Billion

North America leads the global market driven by advanced technology infrastructure and high e-commerce penetration rates. The region hosts major logistics companies and technology providers that pioneer connected solutions. Moreover, strong government support for digital transformation and smart transportation initiatives accelerates adoption. The United States and Canada demonstrate particularly strong demand for IoT-enabled fleet management and warehouse automation systems.

Europe Connected Logistics Market Trends

Europe experiences robust growth fueled by stringent environmental regulations and sustainability commitments across the logistics sector. Countries including Germany, France, and the United Kingdom invest heavily in green logistics and emission reduction technologies. Additionally, European Union initiatives promote digital supply chain transformation and cross-border logistics integration. Therefore, the region represents a significant market for connected logistics solutions.

Asia Pacific Connected Logistics Market Trends

Asia Pacific demonstrates the fastest growth rate driven by rapid e-commerce expansion and manufacturing sector digitalization. China, Japan, South Korea, India, and Australia lead regional adoption with massive logistics networks requiring sophisticated tracking systems. Furthermore, government smart city initiatives and infrastructure investments create favorable conditions. Consequently, Asia Pacific presents substantial opportunities for market participants.

Latin America Connected Logistics Market Trends

Latin America shows increasing adoption as countries modernize logistics infrastructure and expand digital commerce capabilities. Brazil and Mexico lead regional implementation driven by growing consumer demand and cross-border trade requirements. Additionally, improving telecommunications infrastructure enables wider IoT deployment. Organizations increasingly recognize connected logistics as essential for competitive advantage in evolving markets.

Middle East & Africa Connected Logistics Market Trends

Middle East & Africa markets grow steadily with investments in smart ports, logistics hubs, and transportation infrastructure. GCC countries particularly focus on technology adoption to diversify economies beyond traditional sectors. South Africa leads sub-Saharan adoption with established logistics networks. Moreover, regional trade agreements and economic zones drive demand for sophisticated supply chain visibility solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Bosch Service Solutions GmbH leverages its extensive industrial automation expertise to provide comprehensive connected logistics platforms. The company integrates IoT sensors, cloud analytics, and AI-driven optimization across supply chain operations. Moreover, Bosch’s solutions emphasize predictive maintenance and real-time asset tracking for manufacturing and retail sectors. Their established reputation in automotive and industrial markets positions them strategically for logistics technology expansion.

Cisco Systems Inc. delivers enterprise-grade networking infrastructure and IoT connectivity solutions essential for connected logistics ecosystems. The company provides secure, scalable network architecture supporting millions of connected devices across distributed logistics operations. Additionally, Cisco’s cybersecurity expertise addresses critical data protection concerns in supply chain digitalization. Their comprehensive portfolio spans edge computing, cloud connectivity, and analytics platforms that enable intelligent logistics networks.

AT&T Inc. provides cellular connectivity and IoT network services powering connected logistics applications across transportation modes. The company’s nationwide network infrastructure supports real-time tracking, fleet management, and warehouse automation systems. Furthermore, AT&T offers managed services and consulting expertise helping organizations implement and optimize connected solutions. Their 5G network deployment accelerates next-generation logistics applications requiring ultra-low latency and high bandwidth capabilities.

IBM Corporation offers blockchain-based supply chain visibility platforms and AI-powered logistics optimization solutions. The company’s Watson AI technology enables predictive analytics for demand forecasting, route optimization, and inventory management. Moreover, IBM’s blockchain networks facilitate transparent, secure transactions among multiple stakeholders across global supply chains. Their enterprise integration capabilities help organizations connect legacy systems with modern connected logistics platforms effectively.

Key players

- Bosch Service Solutions GmbH

- Cisco Systems Inc.

- AT&T Inc.

- IBM Corporation

- Intel Corporation

- SAP SE

- Oracle Corporation

- Freightgate Inc.

- ORBCOMM Inc.

- HCL Technologies Ltd.

- Honeywell International Inc.

- Microsoft Corporation

- Siemens AG

- Zebra Technologies Corp.

- Trimble Inc.

- Descartes Systems Group

- Sensitech Inc.

- Project44 Inc.

- FourKites Inc.

- Huawei Technologies Co. Ltd.

- JD Logistics

- DHL Supply Chain

- FedEx Corp.

- Others

Recent Developments

- January 2026 – Echo Global Logistics signed a definitive agreement to acquire ITS Logistics, expanding its service capabilities and geographic reach across North American transportation markets to strengthen competitive positioning in connected logistics solutions.

- January 2026 – Lightsmith Group led a $20 million investment in Tive, valuing the shipment-tracking systems developer at slightly more than $500 million and expanding the private-equity firm’s portfolio of businesses that strengthen supply chain resilience and visibility capabilities.

- December 2025 – Connected Logistics acquired a majority stake in One Phoenix Solutions, expanding support in Virginia via SPRUCE with joint venture partner OneGlobe to enhance regional service delivery and technology integration for government and commercial clients.

- May 2025 – WiseTech Global announced plans to acquire e2open in a $2.1 billion deal to expand its global logistics platform, combining complementary technologies to create comprehensive supply chain visibility and management solutions for enterprise customers worldwide.

- March 2025 – Descartes Systems acquired 3GTMS for $115 million, strengthening its transportation management capabilities and expanding its customer base in logistics technology to deliver enhanced route optimization and carrier management solutions.

Report Scope

Report Features Description Market Value (2025) USD 35.79 Billion Forecast Revenue (2035) USD 129.3 Billion CAGR (2026-2035) 13.71% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Hardware, Services), By Platform (Device Management, Application Management, Connectivity Management), By Transportation Mode (Roadways, Railways, Airways, Waterways), By End-User Industry (Retail & E-commerce, Automotive, Aerospace & Defense, Healthcare, Energy, Electronics & Semiconductors, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bosch Service Solutions GmbH, Cisco Systems Inc., AT&T Inc., IBM Corporation, Intel Corporation, SAP SE, Oracle Corporation, Freightgate Inc., ORBCOMM Inc., HCL Technologies Ltd., Honeywell International Inc., Microsoft Corporation, Siemens AG, Zebra Technologies Corp., Trimble Inc., Descartes Systems Group, Sensitech Inc., Project44 Inc., FourKites Inc., Huawei Technologies Co. Ltd., JD Logistics, DHL Supply Chain, FedEx Corp., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bosch Service Solutions GmbH

- Cisco Systems Inc.

- AT&T Inc.

- IBM Corporation

- Intel Corporation

- SAP SE

- Oracle Corporation

- Freightgate Inc.

- ORBCOMM Inc.

- HCL Technologies Ltd.

- Honeywell International Inc.

- Microsoft Corporation

- Siemens AG

- Zebra Technologies Corp.

- Trimble Inc.

- Descartes Systems Group

- Sensitech Inc.

- Project44 Inc.

- FourKites Inc.

- Huawei Technologies Co. Ltd.

- JD Logistics

- DHL Supply Chain

- FedEx Corp.

- Others