Global Condensed Milk Market Size, Share, And Business Benefits By Product Type (Dairy, Non-Dairy/Plant-Based), By Category (Sweetened Condensed Milk, Unsweetened Evaporated Milk), By End User (Confectionery, Infant Food, Dairy Products, Bakeries, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153056

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

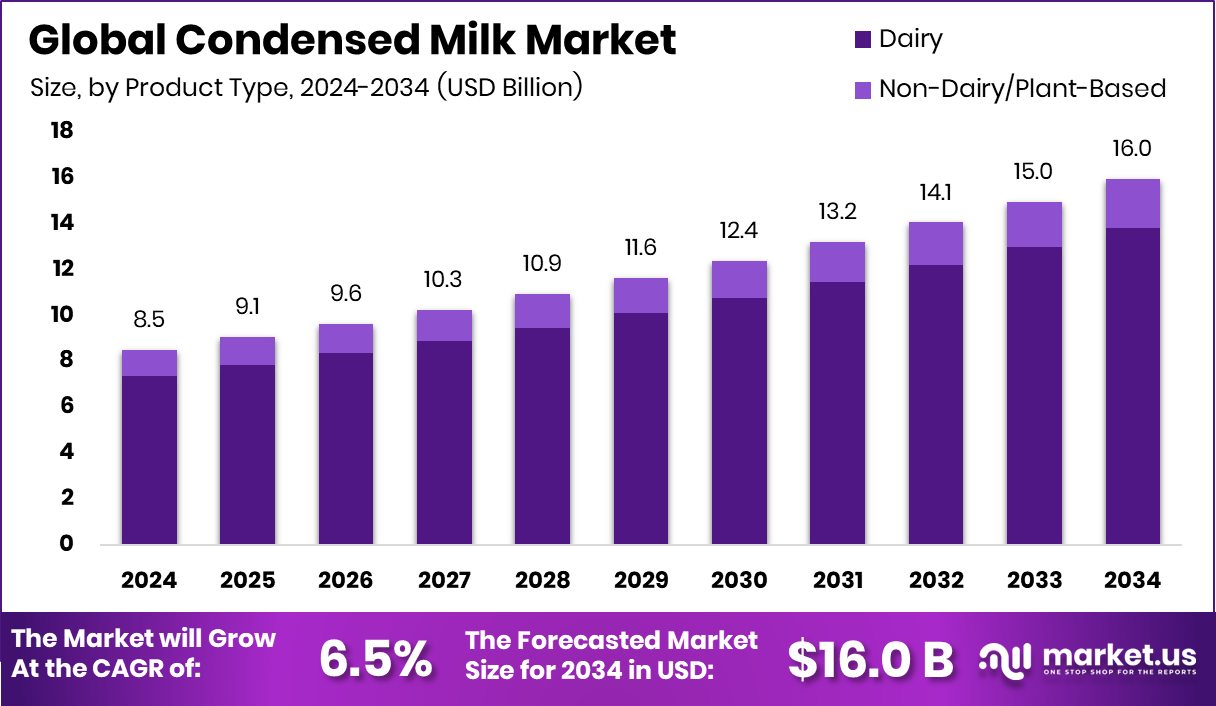

Global Condensed Milk Market is expected to be worth around USD 16.0 billion by 2034, up from USD 8.5 billion in 2024, and grow at a CAGR of 6.5% from 2025 to 2034. Strong demand for desserts and beverages supported North America’s 45.9% market dominance.

Condensed milk is a thick, sweetened form of cow’s milk from which water has been removed. It is typically made by simmering milk to reduce its water content, followed by the addition of sugar to increase shelf life. The result is a creamy, rich product used in a wide variety of culinary applications, especially in desserts, baked goods, and beverages. Due to its long shelf life and high energy content, condensed milk is also popular in regions with limited access to refrigeration.

The condensed milk market is driven by growing demand from the bakery, confectionery, and beverage sectors. Its ability to enhance texture, flavor, and richness in products such as cakes, cookies, puddings, and sweetened beverages supports its wide application across both industrial and household uses. Stellapps secures USD 26 million funding, aims pan-India expansion in value-added dairy. Rising urbanization, changes in dietary preferences, and a greater inclination toward ready-to-use cooking ingredients have further contributed to steady market growth.

Consumer preference for indulgent and premium desserts is a major growth factor. As incomes rise, particularly in developing economies, there is an increasing demand for rich and high-quality sweeteners, of which condensed milk is a staple. Its use in traditional and fusion recipes has also increased, adding to its cultural and commercial appeal. Delhi-based dairy startup Doodhvale Farms raises USD 3 million in funding.

Opportunities are emerging through the rise in home baking trends, particularly since the pandemic period, when consumers began experimenting more with cooking at home. Additionally, the growing demand for convenient and long-shelf-life products in rural and remote regions provides further scope for market expansion. Milk Mantra Dairy raises USD 10 million in fresh funding round.

Key Takeaways

- Global Condensed Milk Market is expected to be worth around USD 16.0 billion by 2034, up from USD 8.5 billion in 2024, and grow at a CAGR of 6.5% from 2025 to 2034.

- Dairy-based products dominate the condensed milk market, holding a strong 86.7% share in 2024 globally.

- Sweetened condensed milk leads the category, accounting for 72.3% of total market demand across applications.

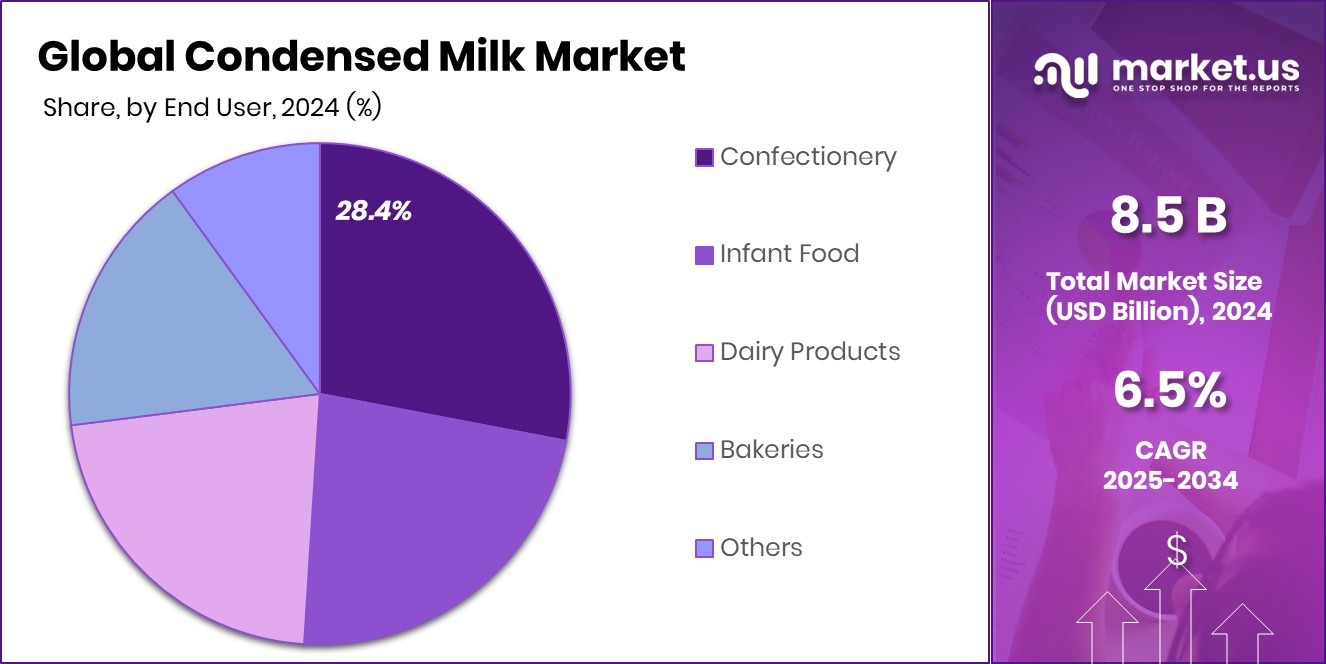

- The confectionery segment drives end-user demand, capturing a 28.4% share due to wide usage in sweets.

- Supermarkets and hypermarkets remain primary sales channels, representing 45.9% of the total condensed milk market distribution.

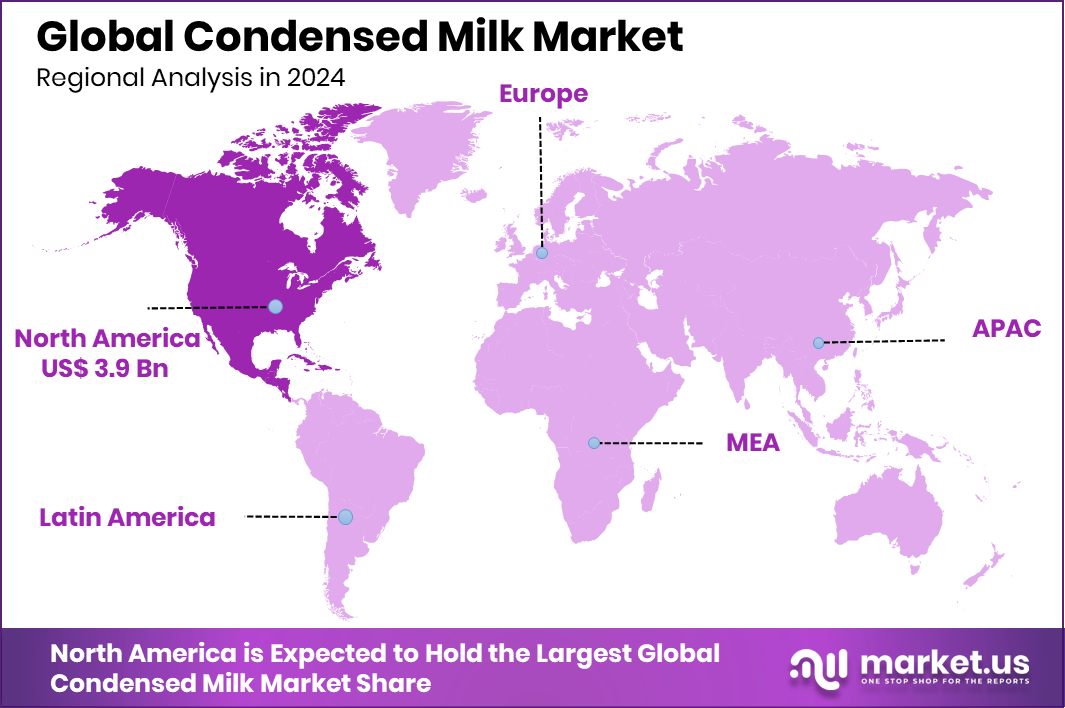

- North America recorded a market value of USD 3.9 billion in 2024.

By Product Type Analysis

Dairy-based products dominate the condensed milk market with an 86.7% share.

In 2024, Dairy held a dominant market position in the By Product Type segment of the Condensed Milk Market, with an 86.7% share. This substantial share is primarily attributed to the widespread use of dairy-based condensed milk in traditional recipes, desserts, and beverages across both household and commercial kitchens.

Its rich taste, creamy texture, and nutritional value make it a preferred choice among consumers and food manufacturers alike. The dominance of dairy condensed milk is further supported by its long-standing cultural familiarity in many cuisines, where it plays an essential role in sweet preparations.

The popularity of dairy condensed milk is also driven by its high compatibility with a range of applications such as baking, confectionery, and ready-to-drink beverages. Its ability to act as a natural sweetener and milk substitute adds to its functional benefits, particularly in regions where refrigeration access is limited and shelf-stable products are preferred.

Additionally, the strong consumer trust associated with traditional dairy ingredients has reinforced its leadership in the segment. As demand for indulgent, convenient, and flavorful ingredients continues to rise globally, dairy-based condensed milk is expected to maintain its dominant market position in the foreseeable future.

By Category Analysis

Sweetened condensed milk leads category preference with 72.3% market share.

In 2024, Sweetened Condensed Milk held a dominant market position in the By Category segment of the Condensed Milk Market, with a 72.3% share. This leading share reflects the widespread preference for sweetened variants in both household consumption and industrial food processing.

The addition of sugar not only enhances flavor but also extends shelf life, making it an ideal choice for various applications, especially in desserts, confections, and beverages. Its thick consistency and sweet taste have made it a staple in recipes that require rich, caramelized notes and smooth textures.

The popularity of sweetened condensed milk is strongly supported by its versatility in culinary use, particularly in baked goods and traditional sweets. In regions with strong dessert cultures, its usage has become almost indispensable. Moreover, the convenience of a ready-to-use product that combines both milk and sweetener appeals to busy consumers and foodservice providers seeking time-saving solutions without compromising on taste or quality.

Its stability in storage and consistent taste profile further drive its widespread acceptance. As consumers continue to seek indulgent food experiences and reliable ingredients for homemade and commercial treats, sweetened condensed milk is expected to maintain its stronghold within the category segment of the condensed milk market.

By End User Analysis

The confectionery industry accounts for 28.4% of condensed milk usage.

In 2024, Confectionery held a dominant market position in the By End User segment of the Condensed Milk Market, with a 28.4% share. This leading position is primarily driven by the high utilization of condensed milk in the production of various confectionery products, where its rich sweetness, smooth consistency, and long shelf life make it an ideal ingredient.

From fudge and caramel to toffees and filled chocolates, sweetened condensed milk is a key component that enhances flavor, texture, and mouthfeel in a wide range of confectionery items.

The strong presence of condensed milk in the confectionery sector is also supported by its functional versatility. It acts as a natural sweetener, moisture-retaining agent, and binder in many sweet formulations, offering manufacturers a dependable solution for quality consistency and extended product stability. Its application not only improves sensory appeal but also simplifies production processes, especially in large-scale manufacturing environments.

The rising consumer preference for indulgent and creamy sweets further supports its dominance. As global demand for premium and traditional confectionery products continues to rise, the confectionery segment is expected to retain its significant share in the end-user category of the condensed milk market.

By Distribution Channel Analysis

Supermarkets and hypermarkets distribute 45.9% of condensed milk globally.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Condensed Milk Market, with a 45.9% share. This dominance is largely attributed to the wide product visibility, large shelf space, and promotional activities these retail formats offer. Supermarkets and hypermarkets serve as one-stop destinations for daily grocery needs, and their ability to stock multiple brands and product variations in bulk enhances consumer access to condensed milk.

The preference for this channel is also driven by consumer trust and convenience. Shoppers benefit from the opportunity to physically inspect products, compare prices, and take advantage of periodic discounts and bundled offers. These retail spaces often maintain a well-organized dairy section where condensed milk products are prominently displayed, further encouraging impulse purchases.

With strong supply chain networks and continued urban retail expansion, supermarkets and hypermarkets remain the preferred point of sale for a wide consumer base. As urbanization rises and more consumers gravitate toward organized retail formats, this distribution channel is expected to continue driving a significant share of condensed milk sales.

Key Market Segments

By Product Type

- Dairy

- Non-Dairy/Plant-Based

By Category

- Sweetened Condensed Milk

- Unsweetened Evaporated Milk

By End User

- Confectionery

- Infant Food

- Dairy Products

- Bakeries

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Driving Factors

Rising Demand for Sweet and Creamy Foods Globally

One of the main driving factors of the condensed milk market is the growing global demand for sweet, creamy foods and desserts. Consumers across regions are increasingly choosing rich, indulgent food options such as cakes, puddings, traditional sweets, and flavored beverages. Condensed milk, known for its thick texture and sweet taste, is widely used in these products to improve flavor and consistency.

As incomes rise and urban lifestyles become busier, people are turning to convenient ingredients like condensed milk that save time and deliver great taste. Its long shelf life and easy storage also make it ideal for both home kitchens and large-scale food manufacturing, making it a favored ingredient in many countries around the world.

Restraining Factors

Health Concerns Over Sugar and Fat Content

A key restraining factor in the condensed milk market is increasing health concerns related to its high sugar and fat content. As awareness about healthy eating rises, many consumers are becoming cautious about including high-calorie and sugar-rich products in their diets. Condensed milk, while flavorful and convenient, contains a significant amount of added sugar, which can contribute to obesity, diabetes, and other health problems when consumed in excess.

This shift in consumer behavior is leading to reduced demand among health-conscious individuals. Additionally, dietary trends favoring low-fat, low-sugar, or plant-based alternatives are growing, which may limit the growth of traditional condensed milk products unless healthier versions are developed and promoted to match changing preferences.

Growth Opportunity

Innovation in Healthier Condensed Milk Alternatives

A significant growth opportunity in the condensed milk market lies in the innovation of healthier product alternatives. As consumers increasingly focus on wellness, there is rising interest in low-sugar, reduced-fat, and plant-based condensed milk options. By developing versions that use natural sweeteners, milk from almonds, oats, or coconuts, and lactose-free formulations, manufacturers can respond to dietary trends without sacrificing flavor or consistency.

These healthier alternatives can appeal to those managing weight, diabetes, or lactose intolerance while expanding market reach. Moreover, aligning these products with clean-label trends—emphasizing simple, familiar ingredients—can build trust. By investing in research and development to create health-conscious variants, the condensed milk industry can drive growth by attracting new segments and meeting evolving consumer demands.

Latest Trends

Home Baking Trend Boosting Condensed Milk Use

One of the latest trends in the condensed milk market is the growing popularity of home baking. Since the pandemic, more people have started cooking and baking at home, leading to a surge in the use of ingredients like condensed milk. It is widely used in recipes for cakes, cookies, fudges, and traditional sweets due to its rich texture and natural sweetness.

Social media platforms have also played a major role, as home chefs and food bloggers frequently share recipes that include condensed milk. This trend has increased retail sales and encouraged manufacturers to offer smaller, easy-to-use packaging formats.

Regional Analysis

In 2024, North America led the condensed milk market with a 45.9% share.

In 2024, North America dominated the condensed milk market with a 45.9% share, valued at USD 3.9 billion. The region’s strong market presence is driven by high demand from the food and beverage industry, particularly in dessert applications and ready-to-consume products. The extensive retail network, including supermarkets and hypermarkets, also contributes to its market leadership.

Europe follows with substantial consumption, driven by the demand for sweetened condensed milk in bakery and confectionery products. The region’s growing interest in indulgent food products and traditional recipes supports steady market growth, though it remains smaller than North America.

Asia Pacific, while witnessing rapid growth, has been expanding its market share due to increasing demand for dairy products and the rise in disposable incomes, especially in countries like China and India. These nations have shown a growing preference for convenience foods that use condensed milk, propelling market demand.

The Middle East and Africa exhibit moderate growth due to the growing use of condensed milk in sweets and desserts, driven by cultural food preferences. Latin America remains a smaller market, but steady consumption patterns, particularly in dairy-rich countries, provide potential for gradual expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé continued to maintain a strong global presence in the condensed milk market, benefiting from its extensive distribution network and brand reputation. The company’s ability to innovate packaging formats and promote product quality under well-known labels supported stable sales across both developed and emerging markets. Its global reach ensures that it can capitalize on rising demand in regions such as Asia Pacific and Latin America, even as it reinforces its dominance in established markets.

FrieslandCampina demonstrated a solid performance in 2024 by leveraging its cooperative model and strong dairy sourcing in Europe. The company focused on quality and sustainability, which resonated with health- and environment-conscious consumers. Its regional specialization, particularly in Europe and parts of Asia, allowed it to capture a meaningful share of the mid- to premium-price segments in the condensed milk category, contributing to its steady market positioning.

Arla Foods continued to secure a reliable position in global condensed milk supply by leveraging its cooperative member base in Europe. The company’s emphasis on high-quality dairy inputs and regional distribution partnerships supported its performance. Its presence in export-driven markets also enabled Arla to tap into emerging demand from Asia Pacific and Middle East & Africa, reinforcing the company’s strategic growth focus in 2024.

Top Key Players in the Market

- Nestlé S.A.

- FrieslandCampina N.V.

- Eagle Family Foods Group LLC

- Arla Foods amba

- Vinamilk

- PT Indofood CBP (Indolakto)

- Hochwald Foods GmbH

- Dana Dairy Group Ltd.

- Gujarat Co-operative Milk Marketing Fed. (Amul)

- Morinaga Milk Industry Co., Ltd.

- Santini Foods, Inc.

- Nature’s Charm Co. Ltd.

- Alaska Milk Corp.

- Fraser & Neave Holdings Bhd.

Recent Developments

- In April 2025, Arla Foods announced intentions to merge with Germany’s Deutsches Milchkontor (DMK), aiming to form Europe’s largest dairy cooperative with a combined revenue of €19 billion.

- In October 2024, Vinamilk updated its iconic “Ông Thọ” condensed milk packaging with a new resealable lid for the 1 kg carton. This change enhances pouring ease and reduces waste.

Report Scope

Report Features Description Market Value (2024) USD 8.5 Billion Forecast Revenue (2034) USD 16.0 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dairy, Non-Dairy/Plant-Based), By Category (Sweetened Condensed Milk, Unsweetened Evaporated Milk), By End User (Confectionery, Infant Food, Dairy Products, Bakeries, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestlé S.A., FrieslandCampina N.V., Eagle Family Foods Group LLC, Arla Foods amba, Vinamilk, PT Indofood CBP (Indolakto), Hochwald Foods GmbH, Dana Dairy Group Ltd., Gujarat Co-operative Milk Marketing Fed. (Amul), Morinaga Milk Industry Co., Ltd., Santini Foods, Inc., Nature’s Charm Co. Ltd., Alaska Milk Corp., Fraser & Neave Holdings Bhd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nestlé S.A.

- FrieslandCampina N.V.

- Eagle Family Foods Group LLC

- Arla Foods amba

- Vinamilk

- PT Indofood CBP (Indolakto)

- Hochwald Foods GmbH

- Dana Dairy Group Ltd.

- Gujarat Co-operative Milk Marketing Fed. (Amul)

- Morinaga Milk Industry Co., Ltd.

- Santini Foods, Inc.

- Nature's Charm Co. Ltd.

- Alaska Milk Corp.

- Fraser & Neave Holdings Bhd.

- Nestlé S.A.

- FrieslandCampina N.V.

- Eagle Family Foods Group LLC

- Arla Foods amba

- Vinamilk

- PT Indofood CBP (Indolakto)

- Hochwald Foods GmbH

- Dana Dairy Group Ltd.

- Gujarat Co-operative Milk Marketing Fed. (Amul)

- Morinaga Milk Industry Co., Ltd.

- Santini Foods, Inc.

- Nature's Charm Co. Ltd.

- Alaska Milk Corp.

- Fraser & Neave Holdings Bhd.