Global Commercial Aircraft Battery Market Size, Share, And Enhanced Productivity By Type (Lithium-based Battery, Nickel-based Battery, Lead Acid Battery), By Topology (Centralized, Modular, Distributed), By Application (Power Supply Management, Energy Storage Management, Flight Control Systems, Safety Monitoring Systems, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169097

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

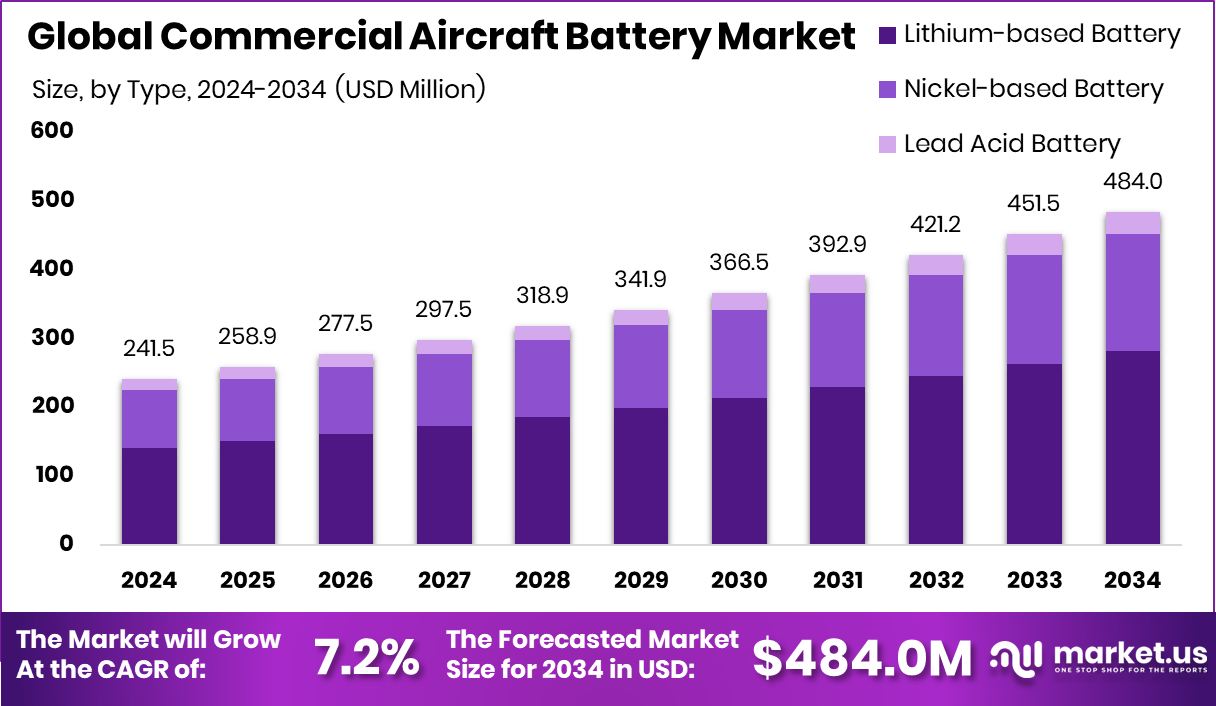

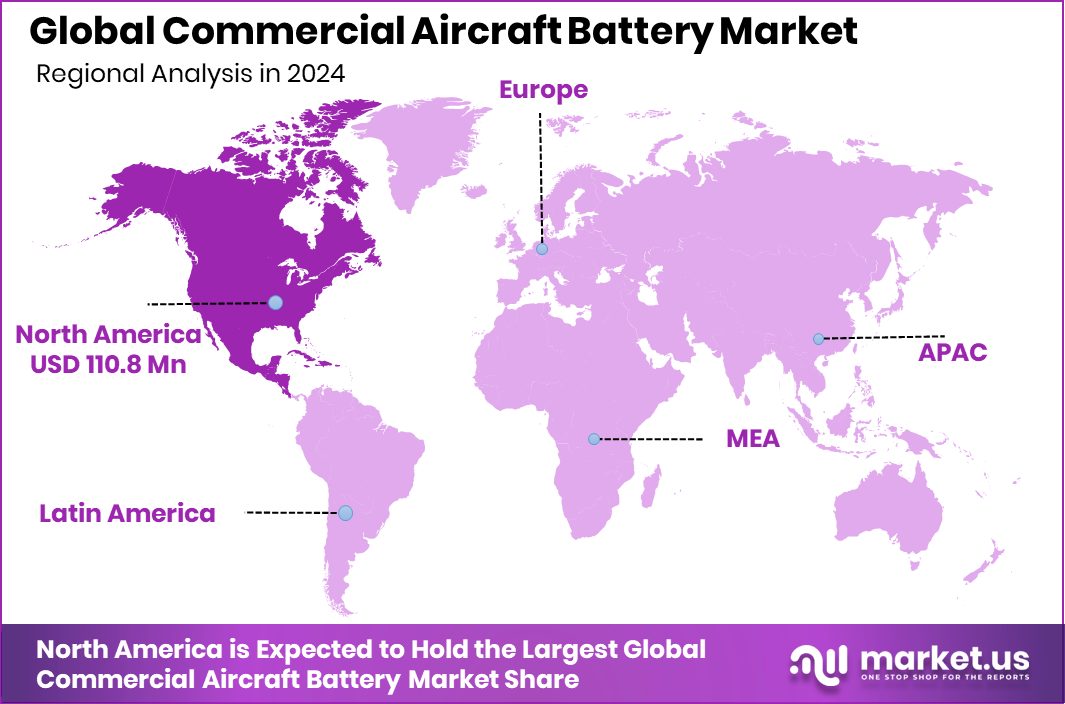

The Global Commercial Aircraft Battery Market is expected to be worth around USD 484.0 million by 2034, up from USD 241.5 million in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034. High fleet utilization across North America reinforced market control at 45.90%, totaling USD 110.8 Mn.

A Commercial Aircraft Battery is a certified energy storage system used in passenger and cargo aircraft to power critical onboard functions. These include engine start, backup power, avionics, lighting, flight controls, and emergency systems. Modern aircraft increasingly rely on high-energy lithium-based batteries to support more electric architectures and improve overall fuel efficiency.

The Commercial Aircraft Battery Market covers battery technologies, integration systems, maintenance, and replacement used across narrow-body, wide-body, regional, and business aircraft. The market is shaped by airline fleet expansion, aircraft electrification, and stricter safety and reliability standards tied to aviation operations.

Growth factors are closely linked to rising aircraft deliveries, increased use of electric and hybrid systems, and government-backed investment across battery value chains. Recent momentum is visible as TACC secured ₹1,230 cr in SBI funding for a lithium-ion anode plant, while Waaree Energies invested ₹300 cr in an advanced lithium-ion ACC facility, strengthening long-term supply readiness.

Demand is driven by fleet modernisation, heavier use of onboard electronics, and stricter redundancy requirements. Beyond manufacturing, sustainability is shaping procurement decisions, supported by initiatives such as an £8.1m UK consortium program, a €26.1 million grant for advanced recycling, and ₹12 crore seed funding for recycling operations.

Opportunities are emerging in alternative chemistries and circular energy systems. Innovation momentum is highlighted by India’s Offgrid raising $15M to reduce lithium dependence, opening pathways for safer, more resilient aircraft battery solutions.

Key Takeaways

- The Global Commercial Aircraft Battery Market is expected to be worth around USD 484.0 million by 2034, up from USD 241.5 million in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034.

- Lithium-based batteries held a 58.3% share in the Commercial Aircraft Battery Market due to high energy density.

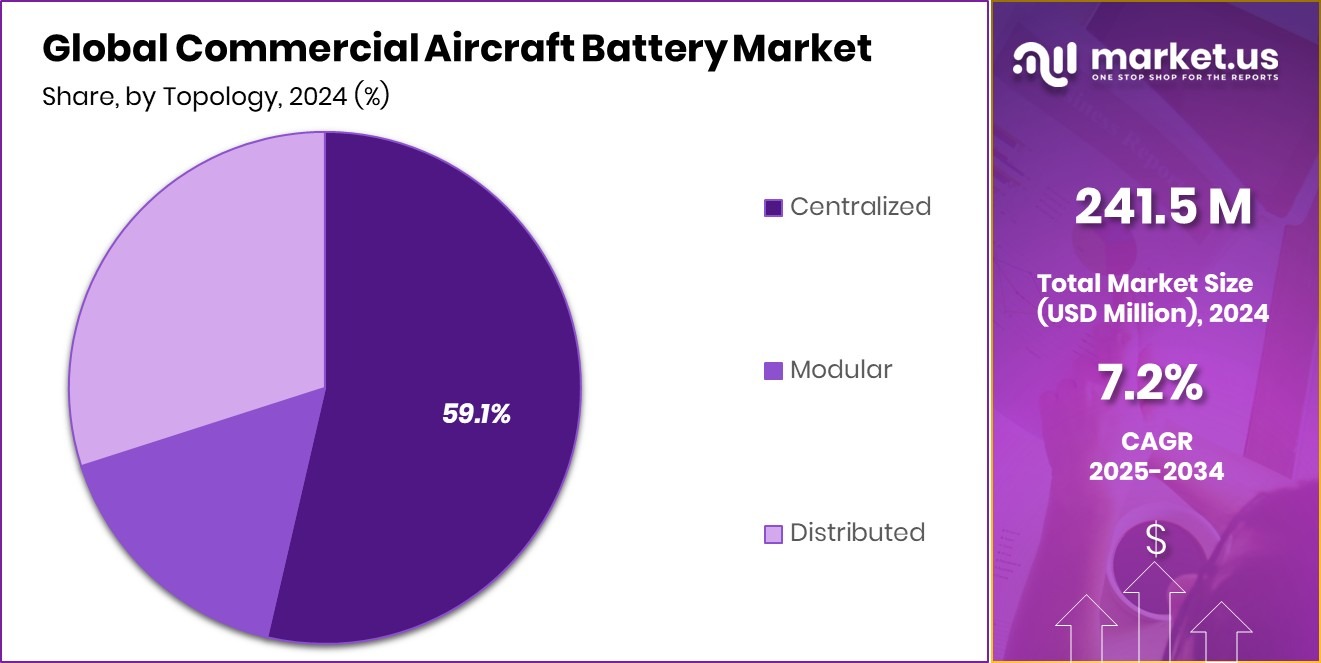

- Centralised battery topology dominated the Commercial Aircraft Battery Market with 59.1%, enabling simplified power control.

- Power supply management led applications with 33.7%, supporting reliable energy distribution across aircraft systems.

- Strong aviation infrastructure in North America supports battery demand, sustaining its 45.90% share, worth USD 110.8 Mn.

By Type Analysis

Lithium-based batteries (58.3%) dominate the commercial aircraft battery market due to high energy density.

In 2024, Lithium-based Battery held a dominant market position in the By Type segment of the Commercial Aircraft Battery Market, with a 58.3% share. This dominance reflects the technology’s strong alignment with modern aircraft power requirements, where high energy density and weight efficiency are critical. Lithium-based batteries support reliable engine start, backup power, and continuous operation of avionics and flight-control systems.

Their established certification track record and predictable performance under demanding aviation conditions further reinforce adoption. Airlines and aircraft operators favor these batteries due to consistent power delivery and longer operational life compared to conventional alternatives.

In addition, the compatibility of lithium-based batteries with more-electric aircraft architectures strengthens their role across both new aircraft programs and retrofit activities. As fleet electrification advances, lithium-based batteries remain the preferred choice for meeting strict safety, reliability, and performance expectations in commercial aviation applications.

By Topology Analysis

Centralised topology (59.1%) leads the commercial aircraft battery market by simplifying power management.

In 2024, Centralized held a dominant market position in the By Topology segment of the Commercial Aircraft Battery Market, with a 59.1% share. This leadership is mainly driven by its proven system architecture, which allows power to be managed from a single, well-defined location within the aircraft. Centralized topology supports simplified monitoring, maintenance, and fault detection, which are critical in commercial aviation operations.

Aircraft operators value this configuration because it reduces system complexity while ensuring stable and reliable power delivery to critical onboard functions. Its long-standing use across commercial fleets has built strong operational confidence, making it a preferred choice during aircraft design and retrofit programs.

As a result, centralized battery topology continues to play a key role in maintaining efficiency, safety, and standardized power management across commercial aircraft platforms.

By Application Analysis

Power Supply Management (33.7%) drives the Commercial Aircraft Battery Market with critical reliability needs.

In 2024, Power Supply Management held a dominant market position in the By Application segment of the Commercial Aircraft Battery Market, with a 33.7% share. This position reflects the essential role batteries play in ensuring uninterrupted and stable power flow across commercial aircraft systems. Power supply management applications rely on batteries to balance electrical loads, support voltage regulation, and provide continuity during power transitions.

Airlines and aircraft operators prioritize this application because any interruption can directly affect flight safety and operational reliability. Consistent battery performance in power supply management also helps reduce system stress and improve overall electrical efficiency.

Its widespread integration across commercial aircraft platforms reinforces steady demand, as reliable power management remains fundamental to meeting strict operational standards and maintaining uninterrupted performance throughout all phases of flight.

Key Market Segments

By Type

- Lithium-based Battery

- Nickel-based Battery

- Lead Acid Battery

By Topology

- Centralized

- Modular

- Distributed

By Application

- Power Supply Management

- Energy Storage Management

- Flight Control Systems

- Safety Monitoring Systems

- Others

Driving Factors

Aircraft Electrification Accelerates High-Reliability Battery Demand

The commercial aircraft battery market is strongly driven by the rapid electrification of aircraft systems, where dependable onboard power has become essential for safe and efficient operations. Modern aircraft rely heavily on batteries for power stability, system redundancy, and smooth energy distribution during all flight phases.

As more electric architectures expand, demand rises for batteries that can deliver consistent output under strict safety standards. This shift is further reinforced by global investment interest in next-generation battery technologies.

Momentum in the wider battery ecosystem is evident as a US battery startup secured $200m to support strategic asset expansion, while a separate $350 million strategic push toward iron-based batteries highlights growing confidence in alternative chemistries. These developments indirectly strengthen innovation pipelines, supporting long-term advancements tailored for commercial aviation power needs.

Restraining Factors

High Certification Costs Slow Battery Technology Adoption

One major restraining factor in the commercial aircraft battery market is the high cost and long timeline required for certification and safety validation. Aircraft batteries must meet strict performance, fire resistance, and reliability rules before they are approved for use. These requirements slow the introduction of newer battery designs and limit rapid technology shifts.

Testing cycles are lengthy, documentation is extensive, and even small design changes may require requalification. As a result, manufacturers and aircraft operators remain cautious about adopting new chemistries at scale.

This challenge is visible across the wider battery landscape, where companies must commit large capital efforts before reaching market readiness, as reflected by EnerVenue’s move to raise $515M to support long-term development. Such realities highlight how regulatory pressure continues to restrain faster battery innovation in commercial aviation.

Growth Opportunity

Alternative Battery Chemistries Open New Aviation Pathways

A key growth opportunity in the commercial aircraft battery market lies in the development of alternative battery chemistries beyond conventional lithium systems. Supply uncertainty around raw materials has encouraged interest in safer and more stable options that reduce dependence on specific mining regions.

Recent setbacks, such as Indonesia’s policy uncertainty after a major $11b nickel investment plan was withdrawn, underline the need for diversified battery materials. At the same time, innovation momentum is building around next-generation solutions, highlighted by a $50M push led by Argonne to advance sodium-ion battery technology.

These technologies offer potential benefits such as improved safety profiles, lower material risk, and more predictable costs. For aviation, this opens long-term opportunities to adopt batteries designed for reliability, regulatory acceptance, and sustainable supply chains.

Latest Trends

Battery Recycling And Safer Chemistries Gain Momentum

A clear latest trend in the commercial aircraft battery market is the growing focus on battery recycling and safer chemistry development. As aircraft batteries have strict life-cycle and safety expectations, end-of-life handling is becoming a priority for the aviation ecosystem.

Recycling helps recover valuable materials while supporting regulatory and sustainability goals. This trend is reflected by RecycleKaro’s plan to invest INR 100 cr to set up a dedicated battery recycling plant, strengthening circular battery infrastructure.

In parallel, interest in safer, non-lithium battery formats is increasing, highlighted by a nickel-zinc battery storage startup raising US$54 million to scale its technology. Together, these developments signal a shift toward cleaner disposal, material reuse, and safer battery systems aligned with long-term commercial aviation needs.

Regional Analysis

North America led the Commercial Aircraft Battery Market, capturing 45.90%, valued at USD 110.8 Mn.

North America dominates the Commercial Aircraft Battery Market, holding a leading 45.90% share, valued at USD 110.8 Mn. This dominance is supported by a mature commercial aviation ecosystem, high aircraft utilization rates, and strong demand for reliable onboard power systems. The region’s focus on operational safety and electrical system reliability continues to sustain battery integration across commercial aircraft platforms, reinforcing its leading market position.

Europe represents a steady and technologically driven market, supported by stringent aviation safety standards and a strong emphasis on electrical system efficiency. The region benefits from structured aircraft maintenance practices and ongoing upgrades within existing fleets. These factors contribute to the consistent adoption of advanced battery systems across commercial aviation operations.

Asia Pacific is shaped by expanding air travel and increasing aircraft deployment across major and emerging economies. Growth is supported by rising passenger traffic and continuous investment in aviation infrastructure. Airlines in the region focus on electrical reliability and operational uptime, supporting steady demand for commercial aircraft batteries.

Middle East & Africa show gradual progress, driven by airline expansion plans and long-haul operations requiring dependable onboard power solutions. Fleet modernization and efficient power management remain key focus areas across the region’s commercial aviation sector.

Latin America reflects moderate development, supported by improving airline connectivity and ongoing fleet maintenance activities. Battery demand in the region is closely tied to aircraft service reliability and operational continuity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, RTX Corporation plays a critical role in shaping technologies linked to power reliability and electrical systems used in commercial aviation. Its strong aerospace focus allows continuous refinement of energy management solutions aligned with aircraft safety and performance needs. RTX’s long-standing integration with aircraft platforms positions it as a key contributor to battery-supported flight operations and system resilience.

Honeywell International Inc. remains influential through its deep involvement in aircraft systems, avionics, and power solutions that rely on stable battery performance. In 2024, Honeywell’s strategic emphasis on smarter, more integrated aircraft systems reinforces the importance of dependable energy storage. Its broad engineering capabilities support batteries as part of larger electrical architectures, improving efficiency, monitoring, and operational reliability across commercial fleets.

Safran brings a strong engineering and aircraft-equipment background that directly supports the evolution of onboard electrical and energy systems. The company’s focus on aircraft safety, power distribution, and system optimization strengthens the role of batteries in modern commercial aircraft. In 2024, Safran’s continued alignment with next-generation aviation platforms positions it as a key player in advancing battery-supported systems essential for efficient, safe, and reliable commercial flight operations worldwide.

Top Key Players in the Market

- RTX Corporation

- Honeywell International Inc.

- Safran

- Thales Group

- EaglePicher Technologies, LLC

- Saft Groupe SAS

- Concorde Battery Corporation

- GS Yuasa Corporation

- EnerSys

- BAE Systems plc

- General Electric Company

Recent Developments

- In June 2025, RTX’s subsidiary Pratt & Whitney Canada announced that its hybrid-electric flight demonstrator — combining a thermal engine with an electric motor and a battery pack — achieved full-power testing successfully. The 200 kWh battery system (supplied via a partner supported by RTX) is charged and discharged via a high-voltage mobile charging unit. The project aims for improved fuel efficiency and eventual flight-test certification.

- In June 2024, Honeywell announced a new software solution named “Battery Manufacturing Excellence Platform (Battery MXP)” designed to help battery-cell producers improve yields and speed up factory start-ups. While aimed at large-scale battery manufacturing, this could support future aviation-grade battery supply pipelines.

Report Scope

Report Features Description Market Value (2024) USD 241.5 Million Forecast Revenue (2034) USD 484.0 Million CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Lithium-based Battery, Nickel-based Battery, Lead Acid Battery), By Topology (Centralized, Modular, Distributed), By Application (Power Supply Management, Energy Storage Management, Flight Control Systems, Safety Monitoring Systems, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape RTX Corporation, Honeywell International Inc., Safran, Thales Group, EaglePicher Technologies, LLC, Saft Groupe SAS, Concorde Battery Corporation, GS Yuasa Corporation, EnerSys, BAE Systems plc, General Electric Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Aircraft Battery MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Commercial Aircraft Battery MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- RTX Corporation

- Honeywell International Inc.

- Safran

- Thales Group

- EaglePicher Technologies, LLC

- Saft Groupe SAS

- Concorde Battery Corporation

- GS Yuasa Corporation

- EnerSys

- BAE Systems plc

- General Electric Company