Global Colloidal Silicon Dioxide Market Size, Share Analysis Report By Form (Dry Powder, Aqueous Suspension, Granules), By Application (Pharmaceuticals, Food And Beverages, Personal Care, Rubber And Plastics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163621

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

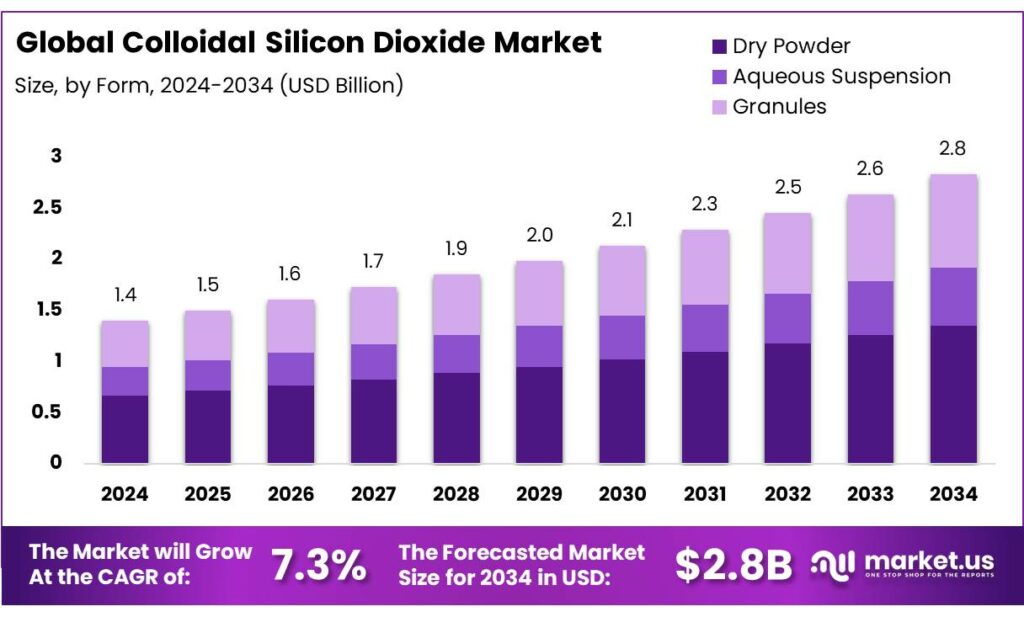

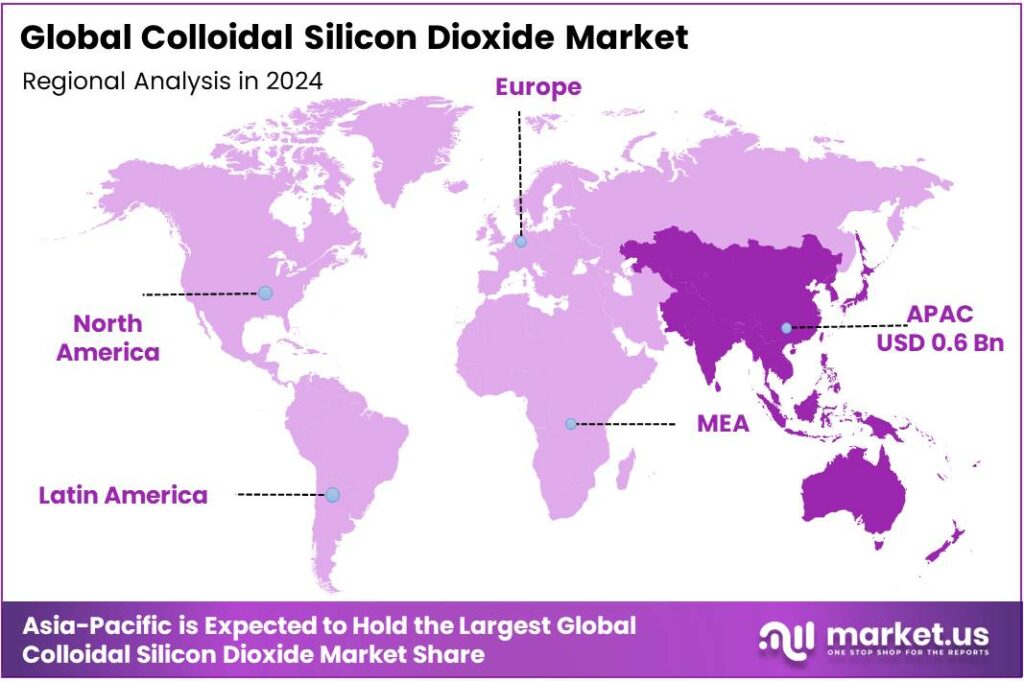

The Global Colloidal Silicon Dioxide Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 45.8% share, holding USD 0.6 Billion in revenue.

Colloidal silicon dioxide (CSD)—a stable dispersion of amorphous silica nanoparticles—serves as a rheology modifier, anti-caking agent, and precision polishing medium across pharmaceuticals, food, electronics, foundry binders, and investment casting. Industrially, CSD benefits from abundant upstream silica resources: in 2023, U.S. industrial sand & gravel production was 130 million tons valued at $7.0 billion, underscoring a robust raw-material base for silica derivatives.

- In semiconductors—where colloidal silica is a core abrasive in CMP slurries—global chip sales reached $627.6 billion in 2024, up 19.1% year-over-year, setting a new record and signaling higher consumables pull-through into 2025. Public funding further supports capacity additions that indirectly lift CSD consumption: the U.S. CHIPS programs provide about $50 billion for R&D and manufacturing implementation; the EU Chips Act mobilizes over €43 billion in policy-driven investment; and India’s approved semiconductor/display initiative totals ₹76,000 crore.

Regulatory safety assessments also underpin adoption. The EFSA re-evaluation in October 2024 concluded that silicon dioxide does not raise a safety concern for all population groups at reported uses and levels, including foods for infants under 16 weeks, refining earlier 2018 work on specifications and exposure. Similarly, the WHO/FAO JECFA lists amorphous silicon dioxide with an ADI not specified, reflecting low toxicological concern at typical technological levels. The U.S. FDA reiterates approved food uses and has published analytical characterizations for amorphous silicon dioxide used as a food additive, reinforcing quality expectations for manufacturers.

Policy momentum further supports advanced-materials adoption. In the United States, the Department of Energy announced USD 3 billion of awards for 25 battery-manufacturing and recycling projects across 14 states to strengthen domestic supply chains—funding that accelerates production of electrodes, components, and coatings where colloidal silica can function as a binder or dispersion aid. DOE’s Advanced Materials and Manufacturing Technologies Office also selected USD 25.54 million for platform battery-manufacturing technologies, including nanolayered films and smart-manufacturing approaches that are complementary to colloidal silica–based formulations.

Energy-transition buildouts add another structural leg to demand. The IEA projects renewable capacity additions of 666 GW in 2024, with solar PV driving the majority of growth; between 2024–2030, solar PV is expected to account for ~80% of renewable-capacity growth. This surge expands wafering and cell lines that use colloidal-silica CMP and texturing steps, tying CSD volumes to PV manufacturing throughput. At the same time, industrial safety and compliance frame operating practices: U.S. OSHA’s permissible exposure limit for respirable crystalline silica is 50 µg/m³ while CSD is amorphous, facilities often co-handle silica forms and therefore design controls to meet this numeric standard.

Key Takeaways

- Colloidal Silicon Dioxide Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 7.3%.

- Dry Powder held a dominant market position, capturing more than a 47.9% share of the global colloidal silicon dioxide market.

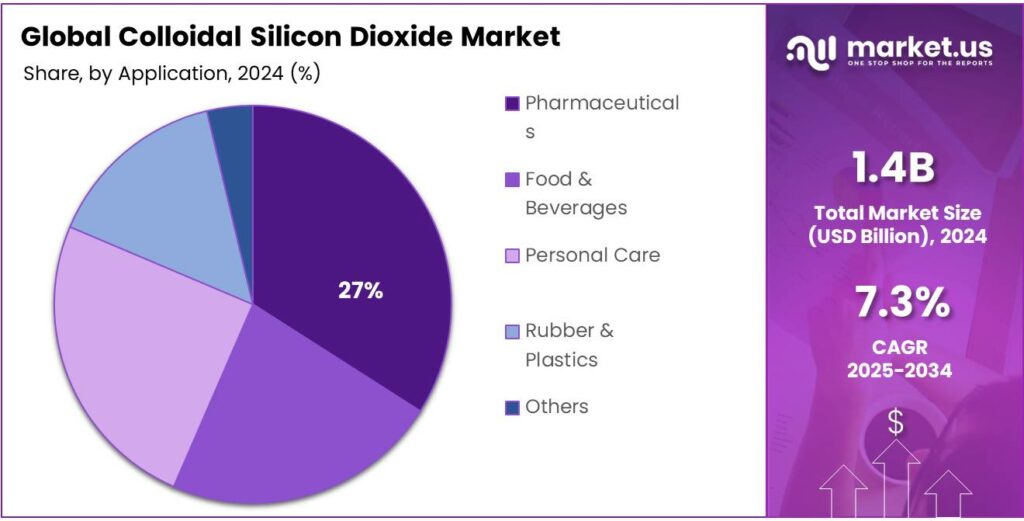

- Pharmaceuticals held a dominant market position, capturing more than a 27.4% share of the global colloidal silicon dioxide market.

- Asia-Pacific (APAC) region held a dominant market position, capturing more than 45.8% of the global colloidal silicon dioxide market, with an estimated valuation of around USD 0.6 billion.

By Form Analysis

Dry Powder Form Leads with 47.9% Share Owing to Its Wide Industrial Usability and Stability

In 2024, Dry Powder held a dominant market position, capturing more than a 47.9% share of the global colloidal silicon dioxide market. The dry powder form has remained the preferred choice across multiple industries, particularly in pharmaceuticals, food processing, and electronics, due to its superior flowability, ease of blending, and longer shelf stability compared to liquid dispersions. Pharmaceutical manufacturers widely use dry colloidal silicon dioxide as a glidant and anti-caking agent in tablet and capsule formulations, helping maintain uniformity and improve production efficiency. The form’s low moisture content and high purity levels have made it suitable for sensitive formulations that demand strict quality control standards.

In 2025, the demand for dry powder colloidal silicon dioxide is projected to expand steadily, supported by the rising global production of solid oral dosage pharmaceuticals and increased adoption in nutraceuticals and food additives. Its role as a rheology modifier in powdered beverages and instant foods has also grown, as manufacturers seek better flow control and product consistency. Additionally, the form’s transport and storage advantages—owing to reduced handling risks and cost-effective packaging—have strengthened its position in international trade.

By Application Analysis

Pharmaceuticals Lead the Market with 27.4% Share Driven by Strong Demand in Drug Formulations

In 2024, Pharmaceuticals held a dominant market position, capturing more than a 27.4% share of the global colloidal silicon dioxide market. The growth of this segment is primarily supported by its essential role as an excipient in drug formulation, where colloidal silicon dioxide functions as a glidant, anti-caking, and adsorption agent. Its fine particle size and high surface area enhance powder flowability and tablet uniformity, which are critical parameters in large-scale pharmaceutical manufacturing. The material is widely incorporated in tablets, capsules, and suspensions to ensure consistent dosing and improved stability of active ingredients.

The pharmaceutical application is expected to witness steady expansion, driven by the rising global demand for oral solid dosage forms and the continued growth of the generic drug industry. Increasing healthcare expenditure and greater access to over-the-counter medicines in developing economies such as India, Brazil, and Indonesia are also supporting the market’s upward trajectory. Moreover, the growing focus on quality and compliance with regulatory standards from the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) has encouraged pharmaceutical manufacturers to use high-purity colloidal silicon dioxide to enhance formulation reliability.

Key Market Segments

By Form

- Dry Powder

- Aqueous Suspension

- Granules

By Application

- Pharmaceuticals

- Food & Beverages

- Personal Care

- Rubber & Plastics

- Others

Emerging Trends

Clean-label and sustainable anti-caking solutions rise for powdered foods.

One of the strongest new trends for the use of colloidal or food-grade Silicon dioxide (often called E 551) in food systems is the push toward clean-label and sustainable anti-caking solutions in powdered foods. Consumers and food manufacturers alike are asking not only for ingredients that work, but for ingredients that look and sound simpler, more transparent, less artificial—and that align with environmental and waste-reduction goals.

Numerical evidence supports the momentum: although traditional sources show the overall “anti-caking agents” market is expanding, one summary of trends emphasises “natural and clean-label ingredients” as a major driver. For example a recent industry commentary states that common anti-caking agents are being innovated with “rice husk-derived silicon dioxide” and other sustainable feedstocks, and used at very low addition levels of 0.1% to 2.0% of dry powder to deliver function while improving label perception. Meanwhile, a broader report highlights that clean‐label and plant‐based alternatives are generating strong interest among food ingredient manufacturers and are explicitly cited as “one of the key emerging trends” in the category of anti‐caking agents.

Several regulatory or institutional developments further reinforce this trend. For instance, in the EU the European Food Safety Authority (EFSA) completed a re-evaluation of E 551 and concluded that “E 551 does not raise a safety concern in any population group, including infants under 16 weeks” within the reported uses and levels. This kind of regulatory reaffirmation provides ingredient suppliers and food formulators the confidence to explore new formulations and communicate about them openly. At the same time, the EU’s regulation on food additives (Reg (EC) 1333/2008) emphasises that any change in particle size counts as a “significant change” that may require a new authorisation.

Drivers

Reliable flow and shelf-life in fortified and powdered foods

A clear, durable driver for colloidal silicon dioxide is its role as a proven anti-caking aid that keeps large-scale food systems flowing—from iodized table salt and spice blends to powdered beverages and infant nutrition. Regulators explicitly allow it for this purpose. In the United States, the Food and Drug Administration permits silicon dioxide as an anti-caking agent in foods at levels up to 2% by weight, and even as a processing aid in brewing. This creates a firm compliance backbone for formulators who need predictable powder flow and pack performance in humid or long-haul supply chains.

Public-health fortification programs amplify this demand. Iodized salt must reach households as free-flowing crystals to deliver iodine reliably; caking undermines dose uniformity and consumer trust. The Codex Alimentarius (FAO/WHO) framework backs silicon dioxide (INS 551) for anti-caking across multiple food categories, with explicit maximum levels in sensitive uses, while many categories operate under good-manufacturing-practice (GMP) controls. These clear numerical guardrails help salt and dry-mix producers choose colloidal silica confidently.

Scale matters: universal salt iodization is one of the world’s most widespread nutrition policies, and powders must stay free-running from factory to kitchen. UNICEF estimates that 89% of the global population uses salt with some iodine, a reminder that billions of meals depend on consistent powder handling and dosing. The World Health Organization notes that programs should target >90% household coverage with adequately iodized salt, which is only achievable if salt blends don’t cake during storage and distribution—precisely the problem colloidal silica helps prevent.

Safety and acceptance also support adoption in sensitive segments. The European Food Safety Authority recently re-evaluated E 551 and concluded it does not raise a safety concern at reported uses and use levels, including in products for infants under 16 weeks when used as authorized. That modern, conservative position reassures infant-formula and medical-nutrition manufacturers who depend on consistent powder flow for accurate dosing, tight fill tolerances, and minimal wastage.

Restraints

Tighter nano-spec scrutiny and use-level caps are raising friction

A growing brake on colloidal silicon dioxide is regulatory scrutiny around particle size and tighter expectations for how the additive is characterized. In the EU, EFSA’s landmark re-evaluation of silicon dioxide (E551) found that existing specifications were “insufficient to adequately characterise” the additive and explicitly highlighted the need for clearer particle-size information because the material can contain nano-sized fractions.

In the U.S., FDA considers amorphous silicon dioxide an approved food additive, mainly as an anti-caking aid, yet the agency’s own science brief notes “limited data on the particle size distribution of commercially available” food-grade material. That gap, flagged publicly by FDA scientists in 2023, nudges brand owners to commission extra characterization and to demand tighter certificates of analysis from suppliers—time- and budget-intensive steps that can slow specifications and new launches. For everyday operations, these frictions feel like a restraint even when the additive itself remains permitted.

Hard numeric caps also narrow headroom. Under U.S. regulations, silicon dioxide may be used only in foods where an anti-caking effect is demonstrated and not above what’s necessary—capped at 2% by weight of the food. Those ceilings limit formulators seeking to push flowability in tricky, hygroscopic systems and can force multisource anti-caking blends, adding complexity and cost. Because these limits are embedded in rule text, not guidance, they also shape how QA teams design in-process checks and label claims.

Global harmonization adds another layer. Codex’s General Standard for Food Additives lists silicon dioxide (amorphous) as an anti-caking and antifoaming agent with category-specific maximum levels—for example, 10 mg/kg in certain infant-formula categories and GMP in others like ground herbs—forcing exporters to juggle multiple dossiers and keep batch records aligned with the tightest market. That patchwork creates operational drag, especially for SMEs serving both infant-nutrition and mainstream dry-mix channels.

Opportunity

Fortification And humanitarian nutrition are expanding powder flows that need better anti-caking

A major tailwind for colloidal silicon dioxide is the rapid scale-up of fortified foods and micronutrient supplements moving through public-health and humanitarian channels—almost all of which are powder-heavy and sensitive to caking. The public-health need is large and urgent. The World Health Organization estimates that 30.7% of women aged 15–49 had anaemia in 2023, with 35.5% of pregnant women affected; among children 6–59 months, global prevalence remains near 40%.

UNICEF and partners now promote Multiple Micronutrient Supplementation (MMS) in pregnancy—15 essential vitamins and minerals per tablet—which evidence shows is 13% more effective than iron–folic acid alone at reducing low birthweight. MMS rollouts mean more tablet and sachet filling, more premix handling, and more humidity-exposed last-mile logistics—exactly the conditions where a silica flow-agent prevents lumping, segregation, and under- or over-dosing at point of use.

Humanitarian food volumes underscore the addressable base. The World Food Programme assisted 124.4 million people in 2024 and delivered 16.1 billion daily rations, with procurement running to 2.4 million metric tons of food in 2023. A substantial share is low-moisture commodities—flours, blended foods, fortified rice, pulses, and specialized nutritious foods—that must resist clumping through ocean freight, warehousing, and hot-humid field storage.

In the U.S., 75% of adults report using dietary supplements, according to the Council for Responsible Nutrition’s 2024 survey—sustained, high penetration that keeps contract manufacturers busy with tablets, capsules, and drink powders where silica is already familiar to QA teams. Meanwhile, the U.S. FDA recognizes amorphous silicon dioxide as a permitted food additive, commonly used in powdered products—an anchor point for multinationals aligning global specs.

Regional Insights

Asia-Pacific Leads the Market with 45.8% Share Valued at USD 0.6 Billion, Driven by Expanding Industrial and Pharmaceutical Production

In 2024, the Asia-Pacific (APAC) region held a dominant market position, capturing more than 45.8% of the global colloidal silicon dioxide market, with an estimated valuation of around USD 0.6 billion. The region’s leadership is attributed to rapid industrialization, expanding pharmaceutical manufacturing capacity, and strong demand from the food and electronics industries. Countries such as China, India, Japan, and South Korea have emerged as major production and consumption hubs due to the availability of raw materials, lower production costs, and growing export capabilities.

China remains the largest contributor within APAC, supported by its extensive base of pharmaceutical and electronics manufacturers utilizing colloidal silicon dioxide in drug formulations, polishing slurries, and coating applications. India follows closely, driven by its robust generic drug production industry, which accounts for nearly 20% of the global pharmaceutical export volume according to the Indian Brand Equity Foundation (IBEF). In Japan and South Korea, high-purity colloidal silica finds significant use in semiconductor fabrication, where it serves as a critical polishing material for wafer processing.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Evonik Industries AG – The German specialty-chemicals giant manufactures ultra-high-purity colloidal silica under the brand IDISIL® for CMP slurries in semiconductor fabrication, emphasising monodisperse nanoscale particles with trace-metal impurities in the parts-per-billion range. In 2023/24 it committed US $7.9 million to build its first North American ultra-pure colloidal silica plant in Weston, Michigan, scheduled for 2024 start-up.

Cabot Corporation – Based in Boston (USA), Cabot Corporation offers colloidal and fumed silica products (e.g., the CAB-O-SIL® line) where synthetic amorphous colloidal silicon dioxide is described as “unique” in particle-characteristics for performance uses. In May 2022 the company announced global price increases for its hydrophobic and colloidal silica grades, indicating premium positioning and cost-pass through.

Wacker Chemie AG – Germany’s Wacker develops a broad range of silicon-based products, including pyrogenic (fumed) silicas marketed under HDK® brand and which underpin many speciality chemical applications. While its published data around colloidal silica is less explicit, the firm’s silicon-based portfolio (≈ 65 % of sales) supports its relevance in the specialty silica arena.

Top Key Players Outlook

- Evonik Industries AG

- Cabot Corporation

- Wacker Chemie AG

- Solvay SA

- Tokuyama Corporation

- Tata Chemicals Ltd.

- Shandong LinkSilica

- OCI Company Ltd.

Recent Industry Developments

In 2024, Evonik Industries AG reported total revenue of €15.2 billion and an adjusted EBITDA of €2.1 billion.

In 2024, Cabot Corporation posted net sales of USD 3,994 million and reported that its Performance Chemicals segment achieved sales of USD 1,250 million, up from USD 1,225 million a year earlier.

In 2024 Tokuyama Corporation reported net sales of ¥343,073 million, with operating profit rising by 16.9% to ¥29,968 million and profit attributable to owners increasing 31.8% to ¥23,388 million.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 2.8 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Dry Powder, Aqueous Suspension, Granules), By Application (Pharmaceuticals, Food And Beverages, Personal Care, Rubber And Plastics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Evonik Industries AG, Cabot Corporation, Wacker Chemie AG, Solvay SA, Tokuyama Corporation, Tata Chemicals Ltd., Shandong LinkSilica, OCI Company Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Colloidal Silicon Dioxide MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Colloidal Silicon Dioxide MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Evonik Industries AG

- Cabot Corporation

- Wacker Chemie AG

- Solvay SA

- Tokuyama Corporation

- Tata Chemicals Ltd.

- Shandong LinkSilica

- OCI Company Ltd.