Global Collision Avoidance System Market Size, Share, Growth Analysis By Technology (Radar, Camera, Ultrasound, LiDAR), By Device (Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS), Lane Departure Warning System (LDWS), Parking Assistance, Others), By Application (Automotive, Aerospace, Railway, Marine, Construction & Mining, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170988

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

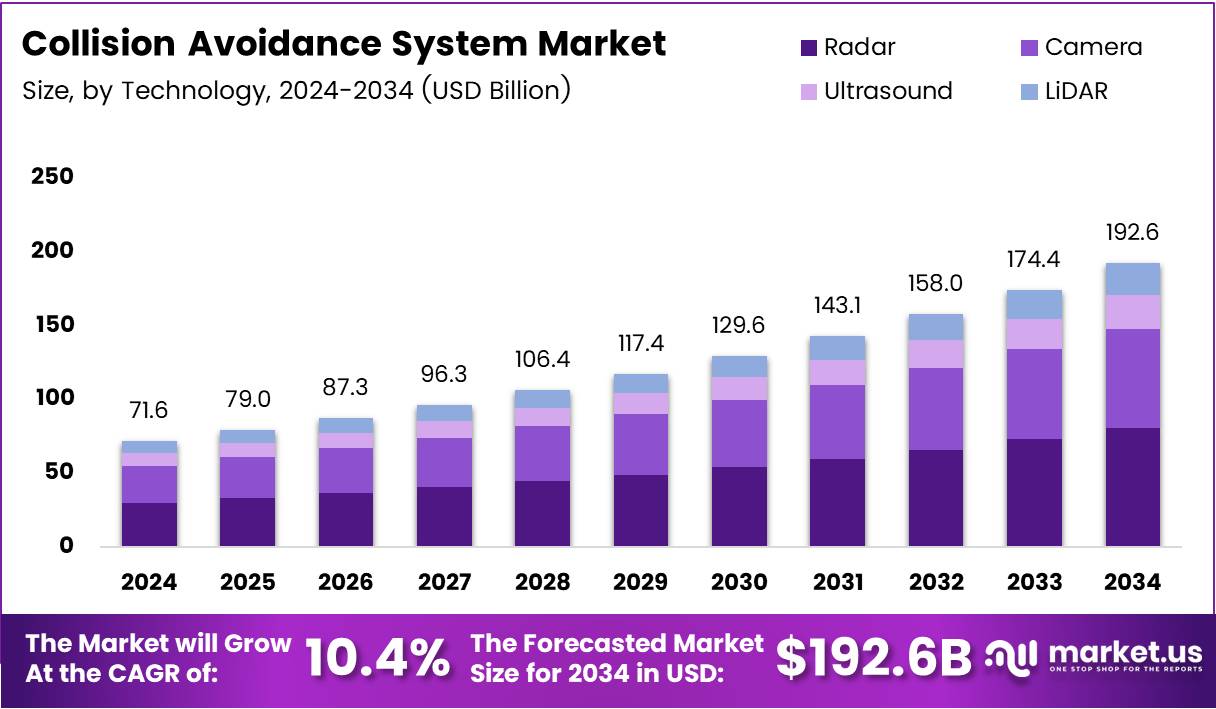

The Global Collision Avoidance System Market is projected to reach approximately USD 192.6 Billion by the 2034 from USD 71.6 Billion in 2024, expanding at a CAGR of 10.4% during the forecast period. This robust growth trajectory reflects the critical transformation underway in vehicle safety technologies worldwide.

Collision avoidance systems represent advanced driver assistance solutions designed to prevent or mitigate vehicular accidents through real-time threat detection. These systems leverage sophisticated sensor technologies including radar, cameras, ultrasound, and LiDAR to monitor vehicle surroundings continuously. Subsequently, they alert drivers or autonomously intervene when collision risks are identified.

The market is experiencing unprecedented expansion driven by stringent regulatory mandates for active safety systems. Governments globally are implementing mandatory ADAS requirements, compelling automotive manufacturers to integrate collision avoidance technologies as standard equipment. Consequently, OEM installation rates have accelerated significantly across passenger and commercial vehicle segments.

Rising global road fatality rates remain a critical concern, prompting regulatory bodies and insurance providers to advocate preventive safety measures. Consumer awareness regarding vehicle safety has simultaneously intensified, with buyers increasingly prioritizing advanced protection features. This behavioral shift is fundamentally reshaping automotive purchasing decisions and manufacturer product strategies.

Technological convergence is creating substantial opportunities as collision avoidance systems integrate with autonomous driving platforms and connected vehicle ecosystems. The automotive sector dominates market applications, yet aerospace, railway, marine, and construction industries are progressively adopting these technologies. Multi-sensor fusion approaches combining radar, camera, and LiDAR capabilities are replacing single-sensor configurations.

Government investments in intelligent transportation infrastructure are further catalyzing market growth. Additionally, aftermarket retrofit solutions are gaining traction among fleet operators seeking to upgrade existing vehicle inventories. Commercial fleet adoption across logistics and public transport sectors represents a significant growth vector.

According to ScienceDirect research, forward collision warning systems reduced rear-end struck crash rates by approximately 27%, with even greater reductions when paired with autonomous emergency braking. Furthermore, the MITRE PARTS study revealed that Forward Collision Warning penetration increased dramatically from 12.8% in model year 2015 to 94% in model year 2023. However, the GAO reports that between 27% and 79% of vehicle owners surveyed have misperceptions about crash avoidance technology capabilities, highlighting the ongoing need for consumer education initiatives.

Key Takeaways

- Global Collision Avoidance System Market projected to reach USD 192.6 Billion from USD 71.6 Billion in 2024 at 10.4% CAGR

- Radar technology segment commands 37.4% market share as dominant technology

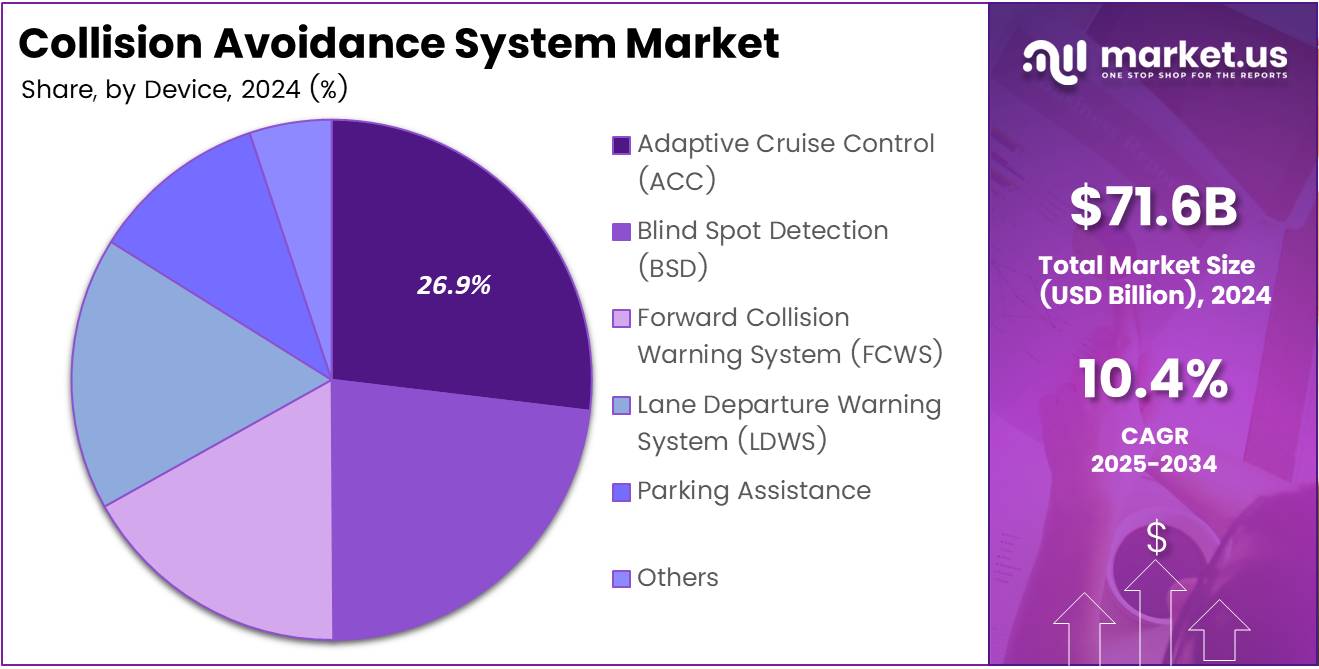

- Adaptive Cruise Control holds 26.9% share in device segment

- Automotive application dominates with 57.8% market share

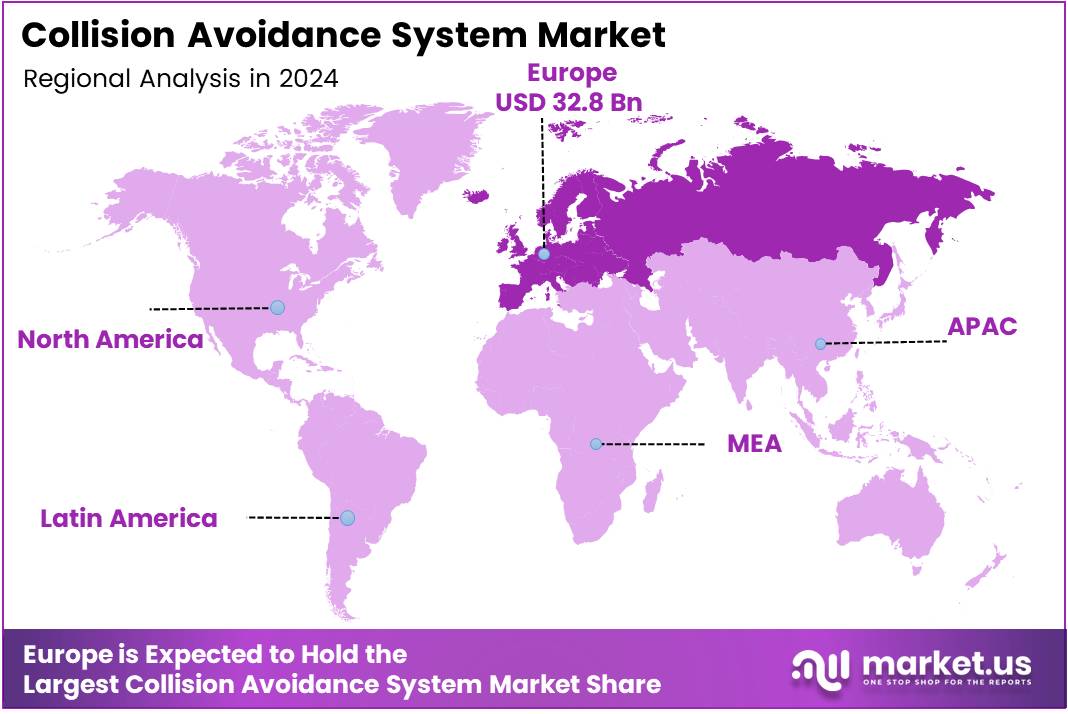

- Europe leads regional market with 45.90% share valued at USD 32.8 Billion

Technology Analysis

Radar dominates with 37.4% market share due to superior all-weather performance and cost-effectiveness.

In 2024, Radar held a dominant market position in the By Technology segment of Collision Avoidance System Market, with a 37.4% share. Radar technology delivers reliable object detection across diverse environmental conditions including fog, rain, and darkness. Its ability to accurately measure distance and velocity makes it indispensable for adaptive cruise control and collision warning applications. Automotive manufacturers favor radar for its proven reliability and relatively lower implementation costs compared to alternative sensing technologies.

Camera-based systems are gaining substantial traction as secondary sensing solutions within collision avoidance architectures. These visual sensors excel at lane detection, traffic sign recognition, and pedestrian identification through advanced image processing algorithms. Furthermore, cameras enable comprehensive environmental understanding when combined with machine learning capabilities. Their integration with radar creates powerful sensor fusion systems that enhance overall detection accuracy and reduce false positives.

Ultrasound technology serves critical short-range detection requirements particularly in parking assistance and low-speed maneuvering applications. These sensors provide precise proximity measurements within immediate vehicle surroundings at economical price points. Additionally, ultrasound systems complement longer-range sensors by covering blind spots and near-field zones effectively.

LiDAR represents the premium sensing technology offering exceptional three-dimensional environmental mapping capabilities. Despite higher costs, LiDAR delivers unmatched precision for autonomous driving applications requiring centimeter-level accuracy. Consequently, luxury vehicle manufacturers and autonomous vehicle developers are increasingly integrating LiDAR into advanced collision avoidance systems for superior performance capabilities.

Device Analysis

Adaptive Cruise Control dominates with 26.9% share driven by regulatory support and consumer preference.

In 2024, Adaptive Cruise Control held a dominant market position in the By Device segment of Collision Avoidance System Market, with a 26.9% share. ACC systems automatically adjust vehicle speed to maintain safe following distances from preceding vehicles. This technology significantly reduces driver fatigue during highway travel while enhancing safety through automated speed management. Regulatory incentives and consumer demand for convenience features are accelerating ACC adoption across mid-range and premium vehicle segments globally.

Blind Spot Detection systems address critical visibility limitations by monitoring adjacent lanes and alerting drivers to hidden vehicles. These devices reduce lane-change accidents significantly by providing timely warnings through visual or auditory signals. Fleet operators particularly value BSD technology for commercial vehicle safety improvements. Moreover, insurance providers increasingly recognize BSD-equipped vehicles with premium reductions.

Forward Collision Warning Systems serve as foundational safety devices alerting drivers to imminent frontal impact risks. FCWS technology continuously monitors forward traffic conditions and calculates collision probabilities in real-time. When integrated with autonomous emergency braking, these systems can initiate automatic stopping procedures. Consequently, FCWS has become standard equipment in many markets due to proven crash reduction effectiveness.

Lane Departure Warning Systems prevent unintentional lane drift through camera-based road marking detection. LDWS alerts drivers when vehicles cross lane boundaries without signaling, addressing drowsiness and distraction-related incidents. Advanced implementations include lane-keeping assist that actively steers vehicles back into proper lanes. Subsequently, LDWS adoption is expanding rapidly across commercial fleets and passenger vehicles alike.

Parking Assistance devices simplify low-speed maneuvering through ultrasonic sensor networks and automated steering control. These systems have evolved from simple warning mechanisms to fully automated parking solutions. Urban drivers particularly appreciate parking assistance for navigating tight spaces safely. Additionally, parking systems reduce property damage claims and improve overall vehicle protection.

Other collision avoidance devices encompass rear cross-traffic alert, driver drowsiness detection, and pedestrian detection systems. These supplementary technologies address specific safety scenarios beyond primary collision avoidance functions. Innovation continues expanding device portfolios as manufacturers develop comprehensive safety suites targeting diverse accident prevention scenarios.

Application Analysis

Automotive dominates with 57.8% market share driven by regulatory mandates and safety consciousness.

In 2024, Automotive held a dominant market position in the By Application segment of Collision Avoidance System Market, with a 57.8% share. The automotive sector represents the largest and fastest-growing application area for collision avoidance technologies. Mandatory safety regulations across major markets are compelling manufacturers to integrate these systems as standard equipment. Consumer preference for advanced safety features combined with decreasing technology costs is accelerating market penetration across vehicle segments from economy to luxury.

Aerospace applications utilize collision avoidance systems for aircraft ground operations and airborne traffic management. These sophisticated systems prevent runway incursions and mid-air conflicts through precise positioning and trajectory prediction. Aviation safety authorities mandate collision avoidance capabilities for commercial aircraft operations. Subsequently, next-generation air traffic management systems are incorporating enhanced collision prevention technologies for increased airspace capacity.

Railway applications deploy collision avoidance systems for train control and track safety management. These systems monitor train positions, speeds, and track conditions to prevent collisions between trains or with obstacles. Urban transit networks particularly benefit from automated collision prevention during high-frequency operations. Furthermore, railway collision avoidance technologies are essential components of positive train control implementations worldwide.

Marine applications utilize collision avoidance systems for vessel traffic management and navigation safety. Radar and AIS technologies enable ships to detect and avoid other vessels in congested waterways. Autonomous vessel development is driving advanced collision avoidance system requirements. Additionally, commercial shipping operators implement these systems to reduce accident risks and insurance costs.

Construction and Mining sectors adopt collision avoidance technologies to protect heavy equipment operators and ground personnel. These systems address visibility challenges in industrial environments through proximity detection and automated warnings. Mining operations particularly value collision avoidance for preventing equipment-to-equipment and equipment-to-personnel accidents. Consequently, safety regulations in extraction industries are mandating collision prevention technologies for heavy machinery.

Other applications span agriculture, material handling, and port operations where collision avoidance enhances operational safety. These diverse sectors increasingly recognize collision prevention technologies as essential safety investments. Innovation continues expanding application possibilities as system costs decline and performance capabilities improve across industrial environments.

Key Market Segments

By Technology

- Radar

- Camera

- Ultrasound

- LiDAR

By Device

- Adaptive Cruise Control (ACC)

- Blind Spot Detection (BSD)

- Forward Collision Warning System (FCWS)

- Lane Departure Warning System (LDWS)

- Parking Assistance

- Others

By Application

- Automotive

- Aerospace

- Railway

- Marine

- Construction & Mining

- Others

Drivers

Mandatory Safety Regulations Accelerate Collision Avoidance System Adoption Worldwide

Regulatory mandates requiring advanced driver assistance systems are fundamentally transforming automotive safety standards globally. Governments across major markets have implemented legislation requiring collision avoidance technologies as standard equipment in new vehicles. These regulations compel OEMs to integrate forward collision warning, automatic emergency braking, and related safety systems across vehicle portfolios.

Rising global road fatality rates continue driving regulatory action toward preventive safety measures. Transportation authorities recognize collision avoidance systems as proven technologies capable of significantly reducing accident severity and frequency. Insurance providers simultaneously incentivize system adoption through premium discounts for equipped vehicles, creating additional market momentum beyond regulatory compliance.

Consumer demand for advanced safety features has intensified significantly as awareness of collision avoidance capabilities grows. Vehicle buyers increasingly prioritize safety technologies when making purchase decisions, pressuring manufacturers to offer comprehensive protection systems. This shift in consumer preferences reinforces regulatory trends and accelerates market penetration across price segments from entry-level to premium vehicles globally.

Restraints

High Implementation Costs Limit Collision Avoidance System Market Penetration

System complexity driven by multi-sensor fusion requirements creates substantial cost barriers for widespread adoption. Integrating radar, cameras, and advanced processors demands significant engineering investment and sophisticated calibration procedures. These expenses are particularly challenging for economy vehicle segments where price sensitivity constrains feature inclusion. Consequently, collision avoidance technologies remain concentrated in mid-range and premium vehicle categories despite safety benefits.

Performance limitations in adverse conditions undermine system reliability and user confidence in collision avoidance technologies. Heavy rain, snow, fog, and poor road markings significantly degrade sensor accuracy and detection capabilities. Mixed-traffic environments with unpredictable pedestrian and cyclist behavior present additional challenges for algorithm performance. These technical constraints result in false positives and missed detections that frustrate users and limit system effectiveness.

Consumer misperceptions about system capabilities create unrealistic expectations and potential safety risks. Studies indicate substantial portions of vehicle owners misunderstand collision avoidance system limitations and operational boundaries. This knowledge gap can lead to over-reliance on technologies not designed for complete autonomous operation. Subsequently, education initiatives are required to ensure proper system utilization and maintain user trust.

Growth Factors

Commercial Fleet Adoption Drives Collision Avoidance System Market Expansion

Logistics companies and public transport operators are rapidly deploying collision avoidance systems across vehicle fleets. Commercial fleet managers recognize these technologies as cost-effective investments that reduce accident rates, insurance premiums, and liability exposure. Fleet safety programs increasingly mandate collision prevention systems as standard equipment for all vehicles. This institutional adoption creates substantial market volume beyond individual consumer purchases.

Aftermarket retrofit solutions are gaining momentum as fleet operators seek to upgrade existing vehicle inventories. Low-cost sensor packages designed for older vehicles enable safety enhancement without complete fleet replacement. This retrofit market addresses the massive installed base of vehicles lacking factory-installed collision avoidance capabilities. Consequently, aftermarket channels represent significant growth opportunities complementing new vehicle installations.

Two-wheeler and off-highway vehicle segments present emerging opportunities through compact, affordable sensor solutions. Motorcycle manufacturers are beginning to integrate collision warning systems as safety concerns extend beyond passenger vehicles. Construction and agricultural equipment producers similarly recognize collision prevention value for industrial applications. These expanding application areas diversify market growth beyond traditional automotive channels significantly.

Emerging Trends

Artificial Intelligence Integration Transforms Collision Avoidance System Capabilities

Multi-sensor fusion architectures combining radar, camera, and LiDAR are replacing single-sensor approaches across premium vehicle segments. This integration enables comprehensive environmental perception with redundancy that enhances reliability and reduces false warnings. Sensor fusion algorithms process diverse data streams simultaneously to create accurate situational awareness. Subsequently, system performance improves dramatically compared to isolated sensor implementations.

Artificial intelligence and deep learning algorithms are revolutionizing real-time object detection and behavioral prediction capabilities. Neural networks trained on massive datasets can identify pedestrians, cyclists, and vehicles with exceptional accuracy. These AI systems predict trajectory intentions and collision probabilities more effectively than traditional rule-based approaches. Consequently, collision avoidance systems deliver faster, more accurate threat assessments that improve safety outcomes.

Software-defined vehicle architectures enable over-the-air updates that continuously enhance collision avoidance performance throughout vehicle lifecycles. Manufacturers can deploy algorithm improvements, expanded functionality, and bug fixes remotely without service visits. This capability transforms collision avoidance from static hardware to evolving software platforms. Additionally, vehicle-to-everything communication integration allows systems to leverage infrastructure data for enhanced collision prevention beyond onboard sensors alone.

Regional Analysis

Europe Dominates the Collision Avoidance System Market with a Market Share of 45.90%, Valued at USD 32.8 Billion

Europe maintains market leadership driven by stringent Euro NCAP safety standards and comprehensive ADAS regulations. The European Commission has mandated advanced safety systems for new vehicles, accelerating manufacturer compliance and technology deployment. European consumers demonstrate strong safety consciousness with high willingness to pay for collision avoidance features. The region’s market share stands at 45.90% with a valuation of USD 32.8 Billion, reflecting its dominant position in global collision avoidance adoption.

North America Collision Avoidance System Market Trends

North America represents a substantial market propelled by NHTSA safety initiatives and insurance industry support for collision prevention technologies. Major automakers headquartered in the region are investing heavily in ADAS development and deployment across vehicle lineups. Fleet operators throughout the United States and Canada are rapidly adopting collision avoidance systems to reduce accident costs and improve driver safety performance.

Asia Pacific Collision Avoidance System Market Trends

Asia Pacific is experiencing rapid growth driven by expanding automotive production in China, Japan, and India. Rising vehicle ownership combined with increasing safety awareness is accelerating collision avoidance system demand. Government safety regulations across the region are progressively mandating ADAS technologies, particularly in passenger vehicles. Japanese and Korean manufacturers are leading regional technology development and market penetration efforts.

Middle East and Africa Collision Avoidance System Market Trends

Middle East and Africa markets are gradually adopting collision avoidance technologies as premium vehicle sales increase. Government initiatives focused on reducing traffic fatalities are beginning to influence safety system requirements. Commercial fleet operators in the region recognize collision prevention as valuable for protecting assets and reducing operational disruptions from accidents.

Latin America Collision Avoidance System Market Trends

Latin America is emerging as a growth market with increasing regulatory attention to vehicle safety standards. Brazilian and Mexican automotive markets are experiencing rising demand for advanced safety features as consumer income levels improve. Regional manufacturers are beginning to offer collision avoidance systems as optional equipment across mid-range vehicle segments to meet evolving buyer preferences.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Collision Avoidance System Company Insights

The global collision avoidance system market features established automotive technology leaders and semiconductor specialists competing for market share.

Robert Bosch Manufacturing Solutions GmbH maintains a dominant position through comprehensive ADAS portfolios spanning radar, camera, and sensor fusion solutions deployed across major automotive manufacturers worldwide. The company’s extensive research and development capabilities enable continuous innovation in collision prevention technologies.

Continental AG leverages extensive automotive expertise to deliver integrated collision avoidance systems combining hardware sensors with advanced software algorithms for precise threat detection and response capabilities. Their solutions are widely adopted across passenger and commercial vehicle segments globally.

DENSO CORPORATION supplies critical collision avoidance components to Japanese automakers and global OEMs, focusing on millimeter-wave radar and camera-based detection systems that meet stringent quality and reliability standards. The company maintains strong partnerships with leading automotive manufacturers for integrated safety system development.

ZF Friedrichshafen AG combines collision avoidance technologies with braking and steering systems to create integrated active safety solutions that enable coordinated vehicle responses to detected threats. Their comprehensive approach addresses multiple safety scenarios through unified system architectures.

These industry leaders invest substantially in research and development to advance multi-sensor fusion capabilities and artificial intelligence integration. Strategic partnerships between technology suppliers and automotive manufacturers are accelerating collision avoidance system innovation and market penetration. Component suppliers are simultaneously developing modular, scalable solutions that enable cost-effective deployment across diverse vehicle segments and price points globally.

Market competition is intensifying as semiconductor manufacturers expand their presence in automotive safety applications. Companies are focusing on miniaturization, cost reduction, and performance enhancement to address mass-market adoption requirements. The convergence of collision avoidance with autonomous driving technologies is reshaping competitive dynamics and creating opportunities for technology providers offering comprehensive perception and decision-making solutions.

Key Companies

- Analog Devices, Inc.

- Continental AG

- DENSO CORPORATION

- Infineon Technologies AG

- Murata Manufacturing Co., Ltd.

- Panasonic Holdings Corporation

- Robert Bosch Manufacturing Solutions GmbH

- ZF Friedrichshafen AG

Recent Developments

- October 2025: Akerman Advises Graycliff Partners in Platform Acquisition of Rosco Vision, strengthening portfolio capabilities in commercial vehicle safety systems and collision avoidance technologies for fleet applications.

- September 2025: Pro-Vision Expands Fleet Safety Capabilities with Acquisition of Spartan Radar, enhancing advanced sensing technologies and broadening collision prevention solutions for logistics and transportation sectors.

- September 2025: SARTA showcases the new anti-collision bus technology coming soon to Stark County, demonstrating public transit commitment to advanced safety systems that protect passengers and pedestrians.

- July 2025: GMV to Enhance Collision Avoidance Capabilities with New ESA-Funded Project, advancing space-based collision detection technologies and expanding applications beyond terrestrial vehicle safety systems.

Report Scope

Report Features Description Market Value (2024) USD 71.6 Billion Forecast Revenue (2034) USD 192.6 Billion CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Radar, Camera, Ultrasound, LiDAR), By Device (Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS), Lane Departure Warning System (LDWS), Parking Assistance, Others), By Application (Automotive, Aerospace, Railway, Marine, Construction & Mining, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Analog Devices, Inc., Continental AG, DENSO CORPORATION, Infineon Technologies AG, Murata Manufacturing Co., Ltd., Panasonic Holdings Corporation, Robert Bosch Manufacturing Solutions GmbH, ZF Friedrichshafen AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Collision Avoidance System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Collision Avoidance System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Analog Devices, Inc.

- Continental AG

- DENSO CORPORATION

- Infineon Technologies AG

- Murata Manufacturing Co., Ltd.

- Panasonic Holdings Corporation

- Robert Bosch Manufacturing Solutions GmbH

- ZF Friedrichshafen AG