Global Coconut Milk Powder Market Size, Share Analysis Report By Product (Conventional, Organic), By Type (Sweetened, Unsweetened), By Application (Beverages, Savories, Bakery and Confectionery, Dairy and Frozen Products, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153990

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

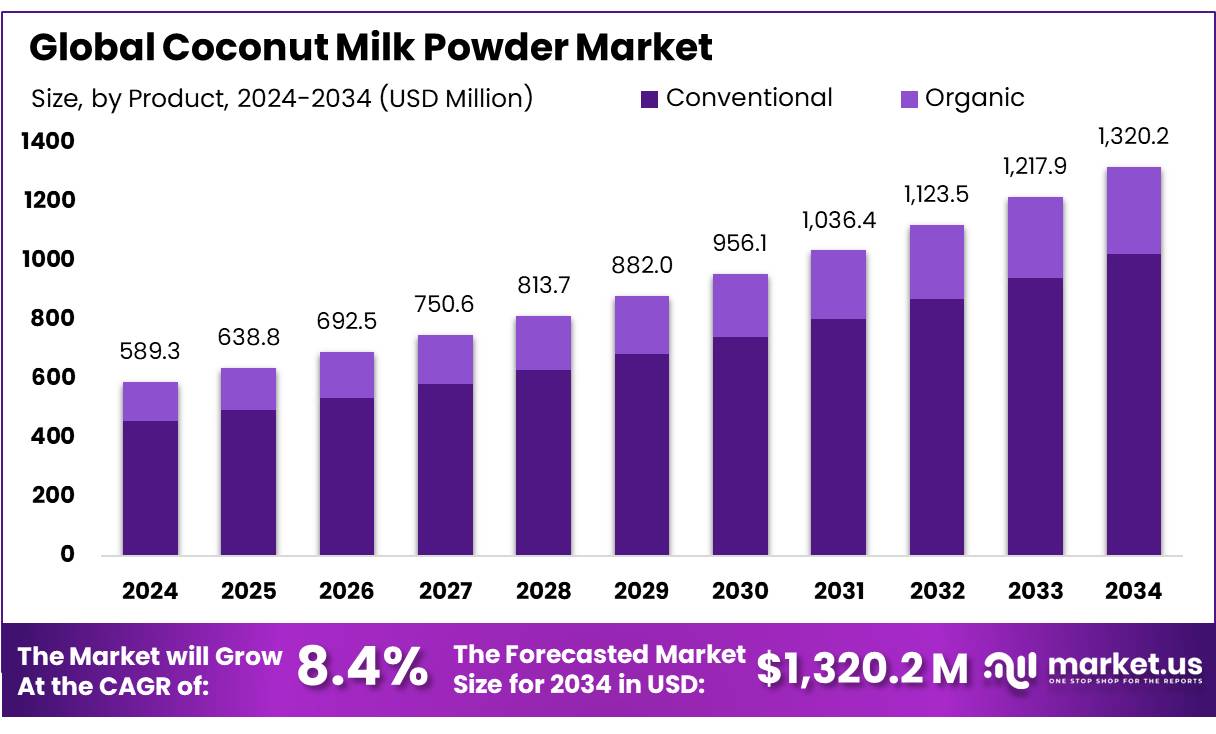

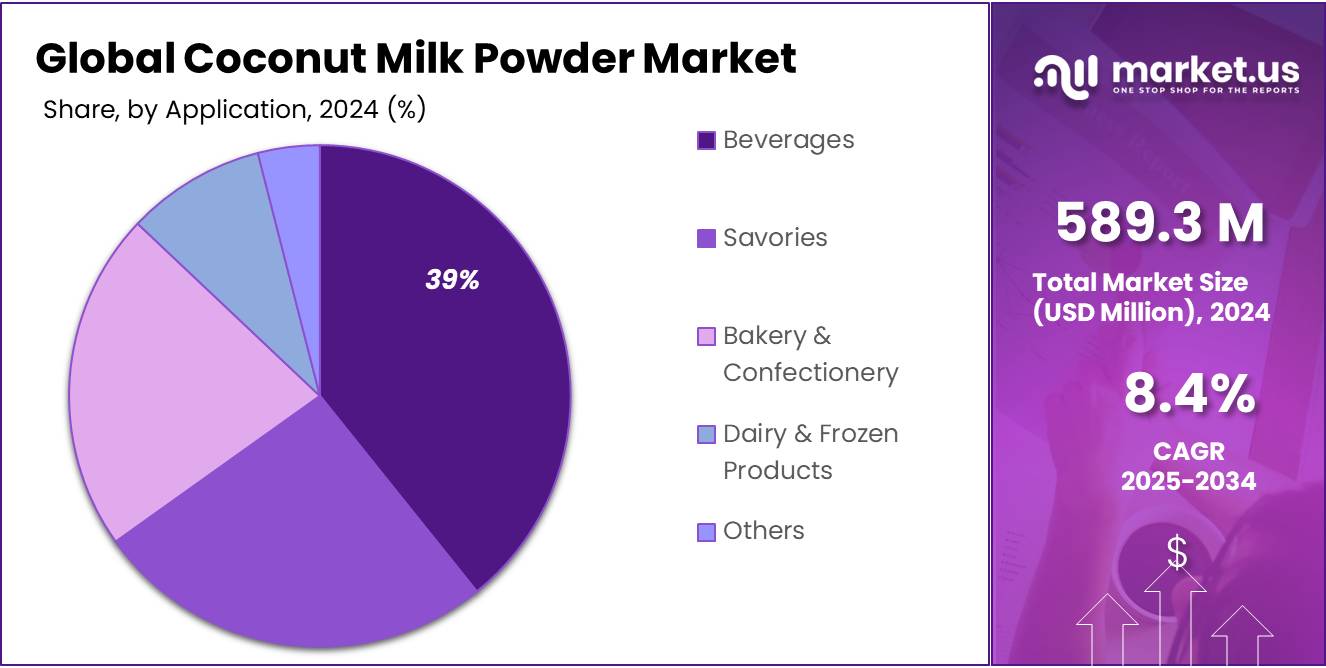

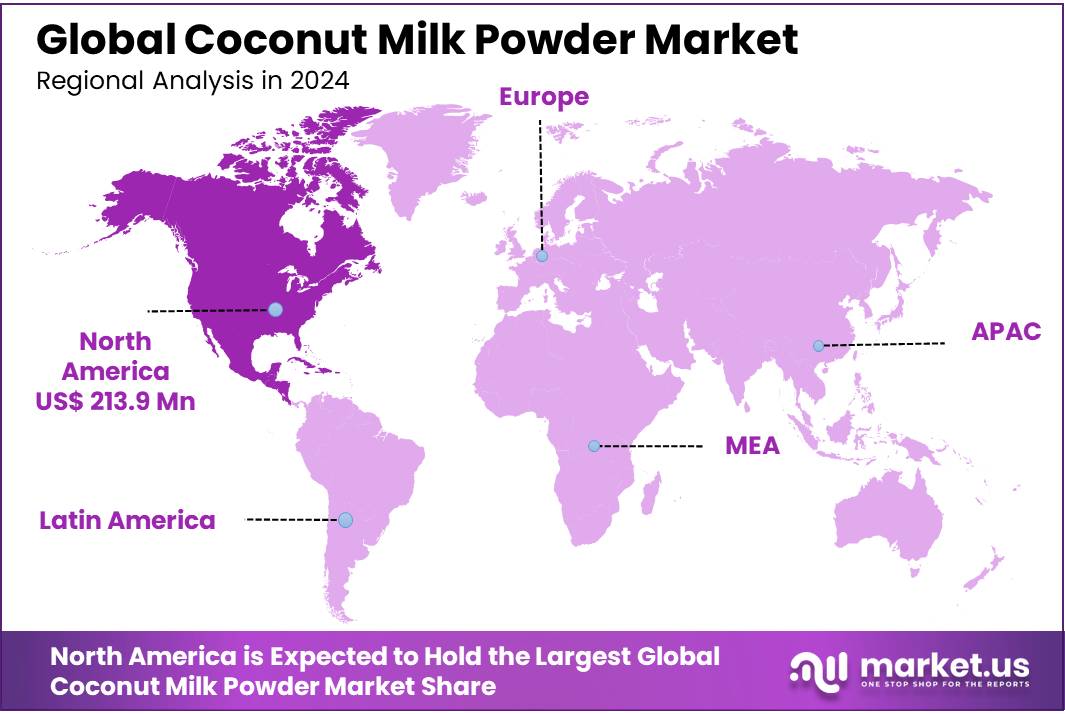

The Global Coconut Milk Powder Market size is expected to be worth around USD 1320.2 Million by 2034, from USD 589.3 Million in 2024, growing at a CAGR of 8.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.3% share, holding USD 213.9 Million in revenue.

The industrial production of coconut milk powder concentrates comprises the drying and concentration of mature coconut milk into a powdered form, enabling extended shelf life, simplified logistics, and broader applications in beverages, culinary preparations, and food manufacturing. The primary input is copra or freshly expressed coconut milk, which is processed via spray drying or roller drying to yield powder concentrations with consistent fat and solids content.

The industrial scenario for coconut milk powder concentrates is characterized by a growing preference for organic and conventional variants. Conventional coconut milk powder, produced through standard farming and processing methods, dominates the market due to its affordability and widespread availability. However, the organic segment is witnessing rapid growth, driven by increasing consumer demand for natural and additive-free products. This trend is reflected in the global market, where the coconut milk powder segment holds a dominant 93% market share and is expected to continue leading growth from 2025 to 2035.

Several factors contribute to the expansion of the coconut milk powder concentrate industry in India. Technological advancements in spray drying techniques have enhanced the efficiency and quality of production. The Coconut Development Board (CDB), under the Ministry of Agriculture, Government of India, provides technology for manufacturing coconut cream and spray-dried coconut milk powder, facilitating small-scale and large-scale production. Additionally, the PM Formalisation of Micro Food Processing Enterprises (PMFME) Scheme supports the establishment of integrated processing units capable of handling up to 400,000 coconuts daily, promoting value addition and entrepreneurship in the sector.

The Coconut Milk Processing Unit model project, with a capacity of 60 MT per annum, exemplifies the sector’s potential. The project outlines a step-by-step process from deshelling and grinding mature coconuts to extracting and pasteurizing coconut milk, followed by spray drying to produce powder concentrate. This model emphasizes the importance of quality control, cost management, and strategic marketing to ensure profitability and market penetration.

Key Takeaways

- The Coconut Milk Powder Market is projected to grow from USD 589.3 million in 2024 to approximately USD 1,320.2 million by 2034, registering a CAGR of 8.4%.

- Conventional coconut milk powder held the leading position, accounting for over 77.5% of the global market share.

- The Unsweetened variant dominated the market, capturing more than 67.3% of the total share.

- Beverages emerged as the top application, holding over 39.4% of the global market share.

- Supermarkets and Hypermarkets led the sales channel, contributing more than 39.2% of the market share.

- North America was the dominant regional market, securing a 36.3% share, equivalent to approximately USD 213.9 million in 2024.

By Product Analysis

Conventional Coconut Milk Powder dominates with 77.5% share in 2024, driven by affordability and wide use

In 2024, Conventional held a dominant market position, capturing more than a 77.5% share in the global coconut milk powder market. This strong lead can be attributed to its cost-effectiveness, longer shelf life, and higher availability across retail and industrial supply chains. Unlike organic variants, conventional coconut milk powder is widely produced using traditional cultivation and processing techniques, making it more affordable for both manufacturers and end consumers.

It is commonly used in packaged foods, bakery products, ready-to-eat meals, and beverages, especially in cost-sensitive markets such as Southeast Asia, Africa, and parts of Latin America. The year 2024 also saw a steady demand for conventional powder from the foodservice sector and small-scale food processors, who rely on consistent quality and bulk availability. As organic options remain niche due to higher price points, conventional variants continue to lead the segment in both volume and revenue terms.

By Type Analysis

Unsweetened Coconut Milk Powder leads with 67.3% share in 2024, fueled by health-conscious demand

In 2024, Unsweetened held a dominant market position, capturing more than a 67.3% share in the global coconut milk powder market. This segment’s strong performance reflects the growing consumer preference for low-sugar and clean-label ingredients across food and beverage applications. Unsweetened coconut milk powder is widely used in health-focused recipes, including ketogenic, vegan, and diabetic-friendly diets, making it a top choice for both individual consumers and food manufacturers.

Its neutral profile allows easy integration into savory dishes, protein shakes, soups, and curries without altering the taste with added sugars. The shift toward mindful eating and rising awareness about the health risks of excessive sugar intake in 2024 further drove demand for unsweetened formats, especially in North America and Europe. Moreover, the foodservice industry and packaged food brands increasingly chose unsweetened powder as a flexible base for customized flavor profiles, reinforcing its leading position throughout the year.

By Application Analysis

Beverages dominate coconut milk powder use with 39.4% share in 2024, supported by rising plant-based drink trends

In 2024, Beverages held a dominant market position, capturing more than a 39.4% share in the global coconut milk powder market. This leadership is mainly driven by the rising demand for plant-based drinks and dairy alternatives across both developed and emerging markets. Coconut milk powder is widely used in ready-to-drink products, smoothies, health beverages, and powdered drink mixes due to its creamy texture and natural flavor.

It offers a convenient and shelf-stable option for beverage manufacturers looking to develop non-dairy formulations without compromising taste. In 2024, increased consumer interest in vegan and lactose-free diets significantly boosted usage in functional and wellness beverages. Brands across Asia, Europe, and North America integrated coconut milk powder into flavored drinks, sports nutrition, and café-style instant blends, further strengthening its role in this segment. The ease of solubility and compatibility with other ingredients also made it a preferred choice in commercial beverage processing throughout the year.

By Distribution Channel Analysis

Supermarkets and Hypermarkets lead with 39.2% share in 2024, driven by easy product access and variety

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 39.2% share in the global coconut milk powder market. This segment’s leadership was primarily supported by their wide geographical presence, organized shelf displays, and the ability to offer multiple brands and product varieties under one roof. Consumers prefer purchasing coconut milk powder from these large-format retail stores due to the convenience of in-person comparison, bulk discounts, and immediate availability.

In 2024, as more households adopted plant-based and dairy-free alternatives, these stores expanded their health food aisles to accommodate growing demand, especially in urban areas. The trust and familiarity associated with established retail chains also played a key role in boosting sales. Additionally, promotional offers, in-store tastings, and better visibility of new launches helped supermarkets and hypermarkets maintain their leading position throughout the year.

Key Market Segments

By Product

- Conventional

- Organic

By Type

- Sweetened

- Unsweetened

By Application

- Beverages

- Savories

- Bakery & Confectionery

- Dairy & Frozen Products

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retailers

- Others

Emerging Trends

Surge in Demand for Organic Coconut Milk Powder

A significant trend shaping the coconut milk powder concentrate market is the increasing consumer preference for organic and clean-label products. This shift is driven by growing health consciousness, environmental concerns, and a desire for transparency in food sourcing. Consumers are increasingly seeking products free from synthetic pesticides, chemicals, and artificial additives, leading to a surge in demand for organic coconut milk powder.

Government initiatives are playing a crucial role in supporting this trend. The Coconut Development Board (CDB), under the Ministry of Agriculture and Farmers Welfare, has implemented various programs to promote organic coconut cultivation and processing. These initiatives include providing financial assistance for organic certification, offering training to farmers on organic farming practices, and facilitating access to markets for organic coconut products . Such support is essential for meeting the growing demand for organic coconut milk powder and ensuring a sustainable supply chain.

The rise in demand for organic coconut milk powder also aligns with global trends towards sustainable and ethical consumption. Consumers are increasingly aware of the environmental impact of their food choices and are opting for products that align with their values. This shift is encouraging manufacturers to invest in organic sourcing and transparent labeling, thereby enhancing consumer trust and brand loyalty.

Drivers

Rising Consumer Demand for Plant-Based Products

The demand for plant-based products, including coconut milk powder concentrate, is rapidly growing, driven by an increasing shift toward healthier and sustainable food choices. This trend is particularly evident among health-conscious consumers, those with lactose intolerance, vegans, and individuals looking to reduce their carbon footprint. Coconut milk powder offers an excellent alternative to dairy milk, boasting a rich flavor and creamy texture, which makes it an ideal ingredient for a wide range of products, from beverages to desserts and savory dishes.

This surge is largely due to increasing urbanization, higher disposable incomes, and a growing awareness of the health benefits of plant-based diets. Additionally, the versatility of coconut milk powder in both cooking and beverages makes it a popular choice among consumers who are shifting from traditional dairy products to non-dairy alternatives. The ease of storage and extended shelf life of coconut milk powder concentrate further contribute to its appeal in the market.

Government initiatives in India are also playing a significant role in promoting the growth of this market. For example, the Coconut Development Board (CDB) under the Ministry of Agriculture and Farmers Welfare provides technical and financial support for coconut-based industries, including coconut milk processing . The One District One Product (ODOP) program, which focuses on the promotion of coconut products, particularly in regions like Andhra Pradesh, is helping local farmers and businesses expand their production capabilities, thereby boosting the supply chain and increasing market access.

Restraints

High Production Costs and Limited Raw Material Availability

One of the major restraining factors for the coconut milk powder concentrate market is the high production costs associated with coconut farming and processing. Despite the growing demand for plant-based products, the cost of sourcing raw coconuts and the technology required for processing coconut milk into powder remains a challenge for many producers. Coconuts are often subject to seasonal fluctuations, and their availability can be inconsistent, leading to price volatility. Additionally, the process of turning coconut milk into a concentrated powder involves several steps, including extraction, pasteurization, and spray drying, which further increase production costs.

In India, the coconut milk market is expected to grow at a compound annual growth rate (CAGR) of 17.20%, but the high cost of production remains a challenge for producers looking to scale their operations. According to the Coconut Development Board (CDB), the cost of setting up a coconut milk processing unit can be significant, especially for small and medium-sized enterprises (SMEs) who are looking to enter the market. These high costs are mainly due to the need for advanced processing technologies and skilled labor. Moreover, the volatility of raw material prices—primarily driven by weather patterns and agricultural yields—can lead to fluctuations in the cost of coconut milk powder concentrate.

Government initiatives like the Technology Mission by the Coconut Development Board (CDB) are aimed at providing technical support and financial assistance to coconut farmers and processors. However, the high capital investment required to set up a processing facility and purchase modern equipment remains a barrier to entry for many smaller producers. These cost constraints may limit the ability of smaller businesses to capitalize on the growing demand for coconut milk powder and restrict market growth in the short term.

Opportunity

Expansion of Export Markets and Value-Added Products

One of the most promising growth opportunities for the coconut milk powder concentrate industry lies in expanding export markets and developing value-added products. India, being the world’s largest coconut producer, accounts for approximately 31.45% of global production . This abundant supply positions the country to meet the increasing global demand for plant-based dairy alternatives.

The Coconut Development Board (CDB), under the Ministry of Agriculture and Farmers Welfare, has been instrumental in promoting the export of coconut-based products. Through initiatives like the Technology Mission, the CDB provides technical support and financial assistance to coconut processors, enabling them to enhance product quality and meet international standards . These efforts have led to a steady increase in coconut product exports from India.

Additionally, the government’s One District One Product (ODOP) program has identified coconut-based products as key items for export promotion. This initiative focuses on developing and marketing unique coconut products from specific districts, thereby creating a niche in international markets .

The rising global trend towards veganism and lactose-free diets further amplifies the demand for coconut milk powder concentrate. Countries in North America, Europe, and Asia-Pacific are increasingly adopting plant-based diets, creating a lucrative market for Indian coconut products.

Regional Insights

North America stands as the leading region with 36.3% share, accounting for USD 213.9 million in 2024

In 2024, North America emerged as the dominant region in the coconut milk powder market, securing a 36.3% share, which translated to approximately USD 213.9 million in regional revenue. This robust position reflects the early adoption of plant-based lifestyles, heightened lactose intolerance awareness, and the expanding presence of alternatives to dairy products across both the United States and Canada. The region’s consumers increasingly prefer coconut milk powder in beverage formulations, baking mixes, health foods, and industrial food processing, reinforcing North America’s industry leadership.

The principal drivers include increasing consumer preference for vegan and lactose-free diets, heightened health consciousness, and innovative clean-label product offerings. Retail distribution via supermarkets, online stores, and specialty health stores accelerated accessibility, while large-format retailers supported visibility and brand trust. E‑commerce expansion further bolstered regional penetration, especially among younger, tech-savvy consumers. The United States continues to lead consumer adoption, but Canada also contributes meaningfully as demand for natural and convenient ingredients grows.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cocomi Bio Organic is a prominent brand specializing in organic coconut-based products, including coconut milk powder. Known for its commitment to sustainability and high-quality standards, Cocomi Bio Organic produces premium, ethically sourced products. Its coconut milk powder is popular among consumers seeking organic, non-dairy alternatives. The company’s market strategy includes a focus on promoting health-conscious and eco-friendly food options, enabling it to gain a significant foothold in the growing global plant-based food market.

GraceKennedy Limited is a major player in the global food and beverage sector, offering a wide range of products, including coconut milk powder. The company is known for its high-quality, authentic Caribbean food products, and its coconut-based offerings are no exception. GraceKennedy’s coconut milk powder is marketed as a premium product, catering to both health-conscious consumers and those seeking traditional, flavorful ingredients. With an established distribution network and a strong brand reputation, GraceKennedy is positioned to further expand its market share in the coconut milk powder segment.

Bramble Berry, Inc. is known for its high-quality ingredients used in natural and organic skincare products, including coconut milk powder. Though the company primarily focuses on the personal care sector, its coconut-based ingredients have seen growing demand within the food industry. Bramble Berry’s commitment to quality sourcing and its established customer base provide it with an opportunity to expand into new markets, meeting the growing demand for coconut milk powder as a health-focused and eco-friendly alternative.

Top Key Players Outlook

- Associated British Foods PLC

- Ayam Sarl

- BareOrganics

- Bramble Berry, Inc.

- Cocomi Bio Organic

- GraceKennedy Limited

- McCormick & Company, Inc.

- Nestle S.A.

- Renuka Foods PLC

- S & P Industries Sdn Bhd

- The Coconut Company (UK) Ltd.

Recent Industry Developments

In 2024 GraceKennedy Limited, achieved a historic revenue of J$167 billion, marking a 7.8% increase from the previous year, with a profit before tax surpassing J$12 billion for the first time.

In 2024, ABF reported revenues of £20.073 billion, with an operating income of £1.998 billion and a net income of £1.480 billion.

Report Scope

Report Features Description Market Value (2024) USD 589.3 Mn Forecast Revenue (2034) USD 1320.2 Mn CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Conventional, Organic), By Type (Sweetened, Unsweetened), By Application (Beverages, Savories, Bakery and Confectionery, Dairy and Frozen Products, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Associated British Foods PLC, Ayam Sarl, BareOrganics, Bramble Berry, Inc., Cocomi Bio Organic, GraceKennedy Limited, McCormick & Company, Inc., Nestle S.A., Renuka Foods PLC, S & P Industries Sdn Bhd, The Coconut Company (UK) Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Coconut Milk Powder MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Coconut Milk Powder MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Associated British Foods PLC

- Ayam Sarl

- BareOrganics

- Bramble Berry, Inc.

- Cocomi Bio Organic

- GraceKennedy Limited

- McCormick & Company, Inc.

- Nestle S.A.

- Renuka Foods PLC

- S & P Industries Sdn Bhd

- The Coconut Company (UK) Ltd.