Global Coal Fired Generation Market Size, Share, And Enhanced Productivity By Type (Pulverized Coal Systems, Cyclone Furnaces, Fluidized-bed Combustion, Coal Gasification, Others), By Technology (Subcritical, CHP, Supercritical, Ultra-supercritical), By Application (Industrial, Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167971

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

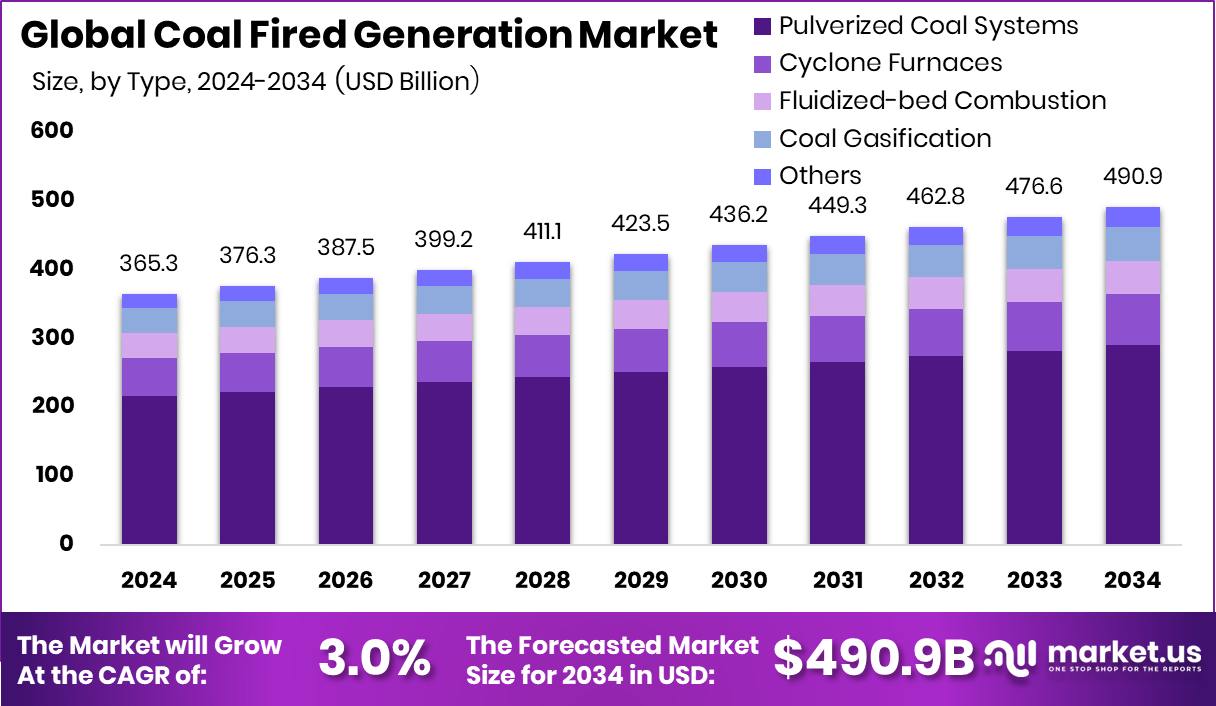

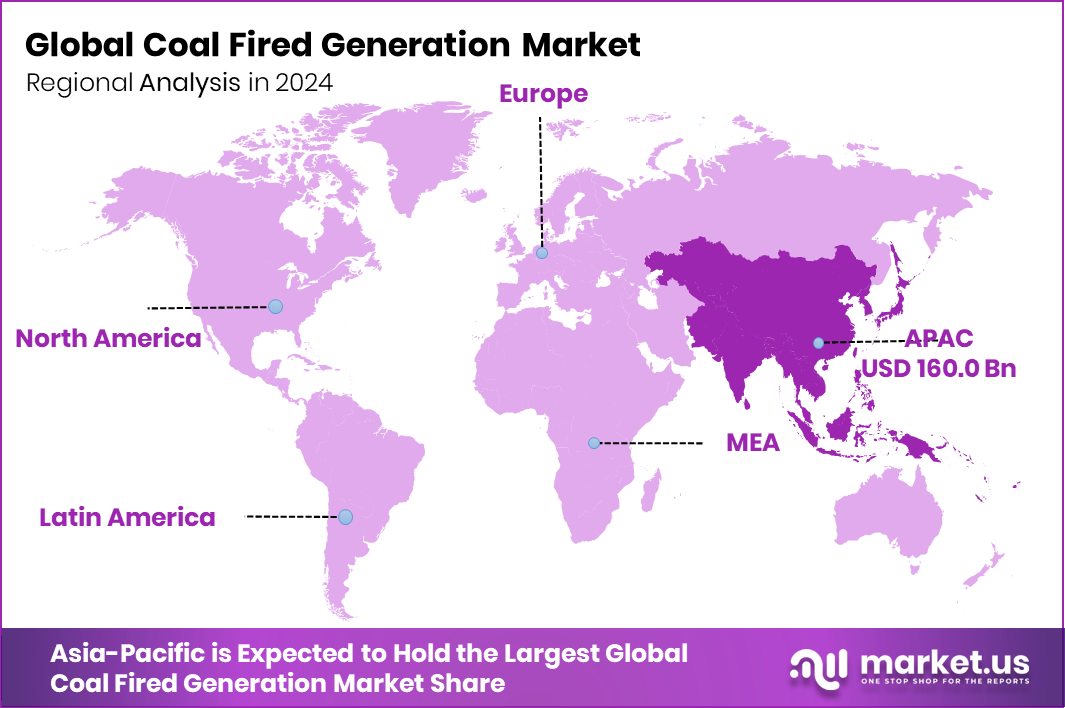

The Global Coal Fired Generation Market is expected to be worth around USD 490.9 billion by 2034, up from USD 365.3 billion in 2024, and is projected to grow at a CAGR of 3.0% from 2025 to 2034. Asia-Pacific dominates coal fired market at 43.80%, reaching a USD 160.0 Bn value globally.

Coal-fired generation refers to the production of electricity by burning coal to produce steam, which drives turbines connected to generators. It has long supported base-load power needs because coal plants operate continuously and can deliver stable electricity for industrial and grid reliability requirements.

Growth in coal-fired generation is increasingly linked to modernisation and efficiency upgrades rather than capacity expansion alone. Governments are supporting cleaner coal pathways such as coal gasification. In India, the Ministry of Coal has announced ₹2,400 crore in funding, alongside a review of a 15% VGF cap to encourage advanced coal conversion projects.

Demand for coal-fired generation continues in regions facing rising electricity consumption, grid instability, and limited alternatives for round-the-clock power. Heavy industries, fertilisers, and large infrastructure projects still rely on coal-based power due to fuel availability and price stability compared with imported energy sources.

Opportunities are shifting toward coal gasification-linked power and downstream products. Projects like Talcher Fertilisers received ₹4,000 crore in loan support, while others secured ₹1,983 crore in funding. However, projects must manage financial risks, as seen in Indonesia, where coal gasification losses could reach US$377 million annually.

Overall, coal-fired generation’s opportunity lies in integration with value-added gasification, policy support, and careful financial structuring to remain viable during the energy transition.

Key Takeaways

- The Global Coal Fired Generation Market is expected to be worth around USD 490.9 billion by 2034, up from USD 365.3 billion in 2024, and is projected to grow at a CAGR of 3.0% from 2025 to 2034

- Pulverised Coal Systems lead the Coal-Fired Generation Market with 59.2% due to efficiency, widespread adoption, and stable fuel handling.

- Subcritical technology holds a 46.8% share in the coal-fired generation Market, driven by lower costs and existing capacity.

- Industrial applications account for 56.4% of the Coal Fired Generation Market, supported by continuous power demand and reliability.

- Asia-Pacific region holds coal fired market share of 43.80% totalling USD 160.0 Bn.

By Type Analysis

Pulverised Coal Systems dominate the Coal Fired Generation Market with a 59.2% share globally.

In 2024, Pulverised Coal Systems held a dominant market position in the By Type segment of the Coal Fired Generation Market, with a 59.2% share. This dominance reflects their widespread adoption across large-scale coal power plants due to their proven operational reliability and consistent combustion performance.

Pulverised coal systems allow coal to be finely ground, enabling efficient burning and stable heat generation, which supports continuous electricity output. Power producers rely on this system type to maintain steady base-load generation while managing large fuel volumes with operational control.

The established infrastructure around pulverised coal systems further supports their market leadership, as utilities favour technologies with long service life and predictable performance. As a result, this segment continues to anchor coal-fired generation capacity across regions where coal remains a primary energy source.

By Technology Analysis

Subcritical technology holds a 46.8% share in the coal-fired generation Market worldwide.

In 2024, Subcritical held a dominant market position in the By Technology segment of the Coal Fired Generation Market, with a 46.8% share. This leadership is driven by the widespread use of subcritical technology in existing coal-based power infrastructure, where reliability and operational familiarity remain critical.

Subcritical systems operate under well-established temperature and pressure conditions, making them easier to maintain and operate over long plant lifecycles. Utilities continue to rely on this technology due to stable performance and predictable operating behaviour, particularly in regions with legacy coal assets.

The strong installed base of subcritical units supports their ongoing role in electricity generation, reinforcing their position as the leading technology choice within coal-fired power generation systems.

By Application Analysis

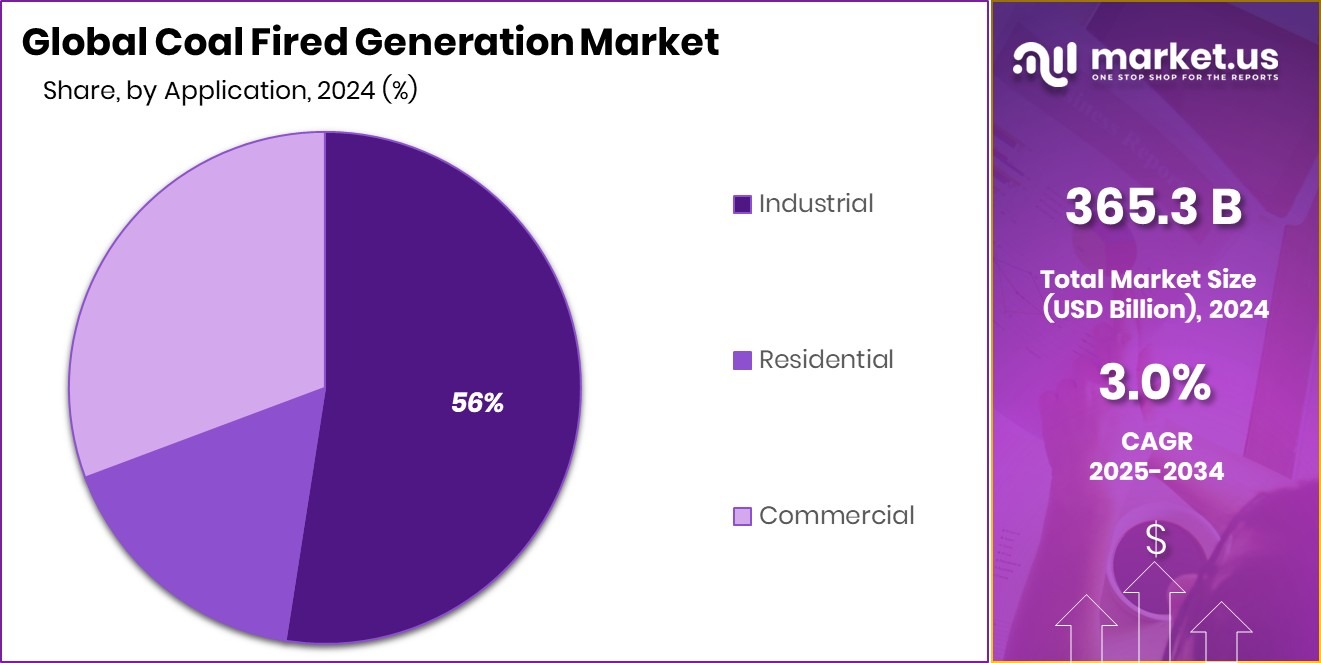

Industrial applications lead the Coal Fired Generation Market with a 56.4% usage share.

In 2024, Industrial held a dominant market position in the By Application segment of the Coal Fired Generation Market, with a 56.4% share. This dominance reflects the continued dependence of energy-intensive industries on coal-based power for a stable and uninterrupted electricity supply.

Industrial users value coal-fired generation for its ability to support continuous operations, high load requirements, and predictable output over long operating hours. Manufacturing units and large processing facilities often rely on dedicated or grid-linked coal power to manage energy costs and ensure operational continuity.

The established use of coal-fired electricity across industrial clusters reinforces this segment’s strong share, as industries prioritise reliability and consistent power availability within their energy mix.

Key Market Segments

By Type

- Pulverised Coal Systems

- Cyclone Furnaces

- Fluidized-bed Combustion

- Coal Gasification

- Others

By Technology

- Subcritical

- CHP

- Supercritical

- Ultra-supercritical

By Application

- Industrial

- Residential

- Commercial

Driving Factors

Modernising Coal Plants to Improve Reliability

A major driving factor for the coal fired generation market is the push to modernise ageing coal power plants to keep them reliable and grid-ready. Many coal plants still play a key role in supplying steady electricity, especially during peak demand and grid stress.

Governments are focusing on upgrades rather than shutdowns to improve efficiency, safety, and operational control. This approach is clearly reflected in recent public support, including the U.S. Department of Energy is directing $100 million to modernise declining coal plants.

The funding focuses on improving performance, extending plant life, and reducing operational risks. For operators, modernisation helps lower breakdowns and improve output stability. For power systems, upgraded coal plants continue to provide dependable baseload electricity while supporting grid resilience during the energy transition.

Restraining Factors

High Emissions Pressure Limits Coal Expansion

A key restraining factor for the coal fired generation market is the growing pressure to reduce air pollution and greenhouse gas emissions. Coal-based power plants release high levels of carbon emissions along with sulfur and particulate matter, which raises serious environmental and health concerns.

As public awareness increases, governments are tightening emission norms and setting stricter compliance rules. These regulations increase operating costs and make plant approvals more difficult.

Many regions now require additional controls, monitoring systems, and higher maintenance standards, which puts financial strain on coal power operators. As cleaner energy options gain acceptance, coal-fired generation faces resistance from policymakers and communities, limiting its expansion and long-term role in future power systems.

Growth Opportunity

Coal Gasification Creates New Value Chains

A major growth opportunity in the coal fired generation market lies in the use of coal gasification alongside power generation. Instead of only burning coal for electricity, gasification allows coal to be converted into cleaner fuel gas that can be used for power, chemicals, and industrial feedstock. This approach improves fuel use efficiency and creates additional revenue opportunities from the same resource.

Power plants linked with gasification can support industries such as fertilisers and manufacturing while maintaining steady electricity output. By integrating power generation with value-added applications, coal-based energy systems can remain economically useful even as traditional coal demand faces pressure, opening new pathways for long-term utilisation.

Latest Trends

Retrofitting Coal Plants for Extended Grid Support

One of the latest trends in the coal fired generation market is the retrofitting and recommissioning of existing coal power plants instead of building new ones. Many coal plants still have usable infrastructure but need technical upgrades to meet today’s grid and operational needs.

Retrofitting focuses on improving plant flexibility, efficiency, and reliability so these units can operate during peak demand or grid emergencies. This trend is reinforced by strong policy action, as the U.S. Department of Energy announced a $625 million investment to retrofit and recommission coal-fired power plants.

The funding highlights a shift toward using upgraded coal assets as backup and stability resources, supporting grid resilience while older plants adapt to changing power system requirements.

Regional Analysis

Asia-Pacific coal fired market leads with 43.80% share valued at USD 160.0 Bn.

Asia-Pacific dominates the Coal Fired Generation Market, holding a 43.80% share and valued at USD 160.0 Bn. This leadership is driven by the region’s large population base, strong industrial activity, and continued reliance on coal for stable base-load electricity. Coal-fired power remains critical for grid stability and industrial production across several Asia-Pacific economies, supporting manufacturing, mining, and heavy industries that require an uninterrupted power supply.

North America represents a mature coal-fired generation landscape, where existing plants continue operating primarily for grid reliability and peak demand support. The region focuses on maintaining operational efficiency of installed capacity rather than large-scale expansion, using coal power as a balancing source within diversified energy systems.

In Europe, coal-fired generation plays a gradually declining but still functional role. Certain regions continue to rely on coal plants to ensure energy security, especially during periods of supply volatility, supporting transitional power needs.

The Middle East & Africa region maintains coal-fired generation to support industrial growth and infrastructure development. Coal power is often used to provide consistent electricity where alternative base-load sources remain limited.

Latin America shows selective coal-fired generation presence, mainly supporting industrial clusters and stable power requirements where hydropower variability affects supply continuity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

STEAG GmbH continues to play a focused role in coal fired generation through its experience in operating and managing thermal power assets. In 2024, the company’s approach reflects a balance between maintaining a reliable coal-based electricity supply and improving the operational efficiency of existing plants. Its long-standing expertise supports grid stability, especially in regions where coal remains important for base-load power and system reliability.

Shenhua Group Corporation Limited remains a major force in coal fired generation due to its strong integration across coal mining and power production. Its operations benefit from secure coal supply chains and large-scale generation capacity, allowing stable electricity output for industrial and regional demand. In 2024, Shenhua’s coal power segment continues to anchor energy availability in areas where large industrial loads depend on continuous power delivery.

Shikoku Electric Power Company Inc. maintains coal fired generation as part of a diversified electricity portfolio. The company relies on coal power to ensure a steady supply and grid balance, particularly during high-demand periods. In 2024, its coal-based assets contribute to energy security and operational flexibility, supporting regional power requirements while managing demand fluctuations.

Top Key Players in the Market

- Tenaga Nasional Bhd

- STEAG GmbH

- Shenhua Group Corporation Limited

- Shikoku Electric Power Company Inc.

- RWE AG

- National Thermal Power Corporation Limited

- Korea Electric Power Corporation

- Jindal India Thermal Power Limited

- Georgia Power Company

- Eskom Holdings SOC Ltd.

Recent Developments

- In June 2024, STEAG applied to decommission its hard-coal plant, Herne 4 power plan,t by March 2025. The plant, with a net capacity of 460 MW, had served electricity and district heating demand for decades. The move reflects a strategic shift as electricity prices dropped sharply, making continual operation less economically viable.

- In March 2024, RWE permanently shut down five lignite-fired power plant units in the Rhenish mining area, removing about 2,100 MW of coal-powered capacity from the grid.

Report Scope

Report Features Description Market Value (2024) USD 365.3 Billion Forecast Revenue (2034) USD 490.9 Billion CAGR (2025-2034) 3.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pulverized Coal Systems, Cyclone Furnaces, Fluidised-bed Combustion, Coal Gasification, Others), By Technology (Subcritical, CHP, Supercritical, Ultra-supercritical), By Application (Industrial, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tenaga Nasional Bhd, STEAG GmbH, Shenhua Group Corporation Limited, Shikoku Electric Power Company Inc., RWE AG, National Thermal Power Corporation Limited, Korea Electric Power Corporation, Jindal India Thermal Power Limited, Georgia Power Company, Eskom Holdings SOC Ltd. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Coal Fired Generation MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Coal Fired Generation MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- TenagaNasionalBhd

- STEAG GmbH

- Shenhua Group Corporation Limited

- Shikoku Electric Power Company Inc.

- RWE AG

- National Thermal Power Corporation Limited

- Korea Electric Power Corporation

- Jindal India Thermal Power Limited

- Georgia Power Company

- Eskom Holdings SOC Ltd.