Global Clean Fine Coal Market Size, Share, And Business Benefit By Type (Below 12.5%, 12.5%-16%, Above 16%), By Form (Pellets, Powder, Lump), By Application (Power Generation, Cement Production, Steel Manufacturing, Chemical Production, Others), By End Use (Industrial, Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164819

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

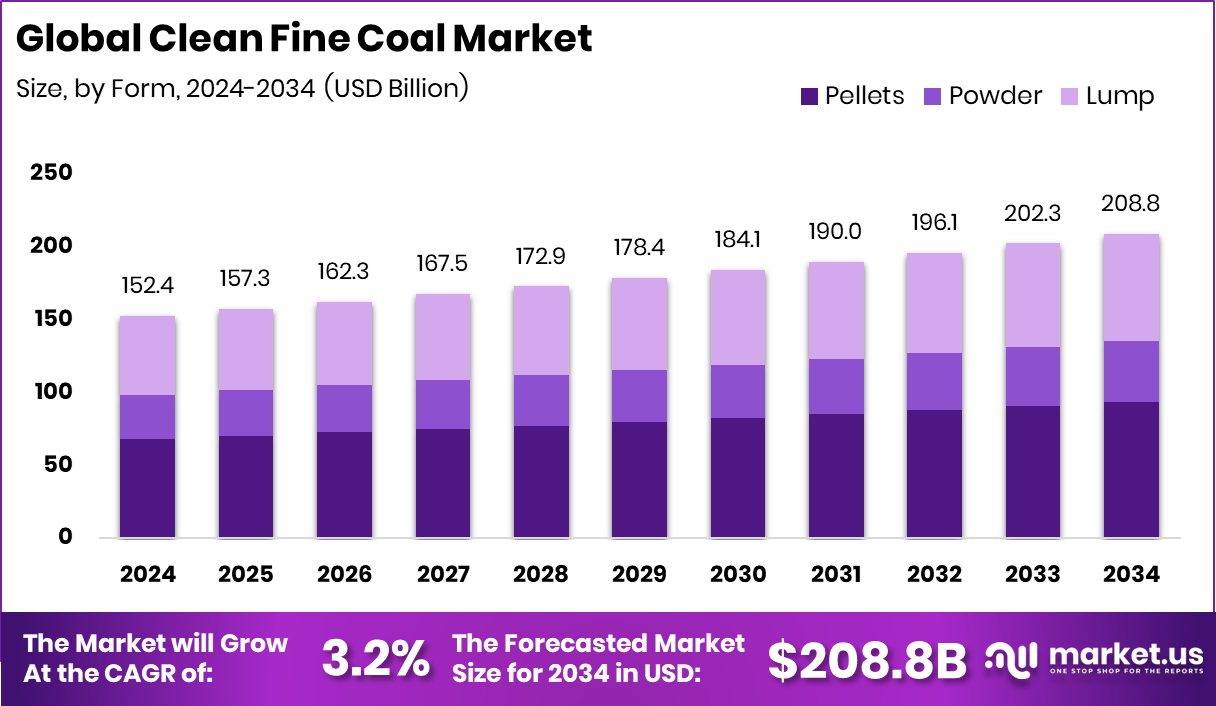

The Global Clean Fine Coal Market is expected to be worth around USD 208.8 billion by 2034, up from USD 152.4 billion in 2024, and is projected to grow at a CAGR of 3.2% from 2025 to 2034. Strong industrial adoption across North America boosted the market to USD 69.9 million, holding a 45.90% share.

Clean fine coal refers to very small coal particles that have been processed to remove impurities like ash, moisture, and sulfur. These fine particles, often generated during mining and washing, are upgraded using advanced beneficiation methods to improve their energy content and reduce emissions. Clean fine coal burns more efficiently and produces less pollution, making it suitable for modern power plants and industrial users seeking cleaner fuel options.

The clean fine coal market focuses on recovering and refining fine coal particles into higher-value, low-emission fuel products. It includes processing technologies, transport systems, and end-use sectors like power generation, metallurgy, and cement. The market is growing as industries seek efficient use of coal resources, reduce waste, and comply with tightening environmental standards worldwide.

The major growth factor is the push for cleaner energy and efficient use of coal residues. As environmental rules tighten, industries are investing in advanced washing and drying systems to minimize carbon footprints. Recovery of fine coal from waste streams also reduces land contamination and boosts productivity. Rising energy needs in developing countries continue to support these advancements.

There is a major opportunity to utilize previously discarded coal fines as valuable fuel. Strong funding momentum supports this transition—Evotrex closed $16 million Pre-A funding for power-generating trailers; Ohio announced a $100 million Energy Opportunity Initiative; Core Energy Systems secured ₹200 crore; the government approved ₹5,400 crore for 30 GWh battery storage; and the US$500 million DRE Nigeria Fund was launched.

Key Takeaways

- The Global Clean Fine Coal Market is expected to be worth around USD 208.8 billion by 2034, up from USD 152.4 billion in 2024, and is projected to grow at a CAGR of 3.2% from 2025 to 2034.

- In the clean fine coal market, the 12.5%-16% ash type dominates with a 56.2% share.

- Pellet form leads the clean fine coal market, accounting for 44.8% due to easier handling and efficiency.

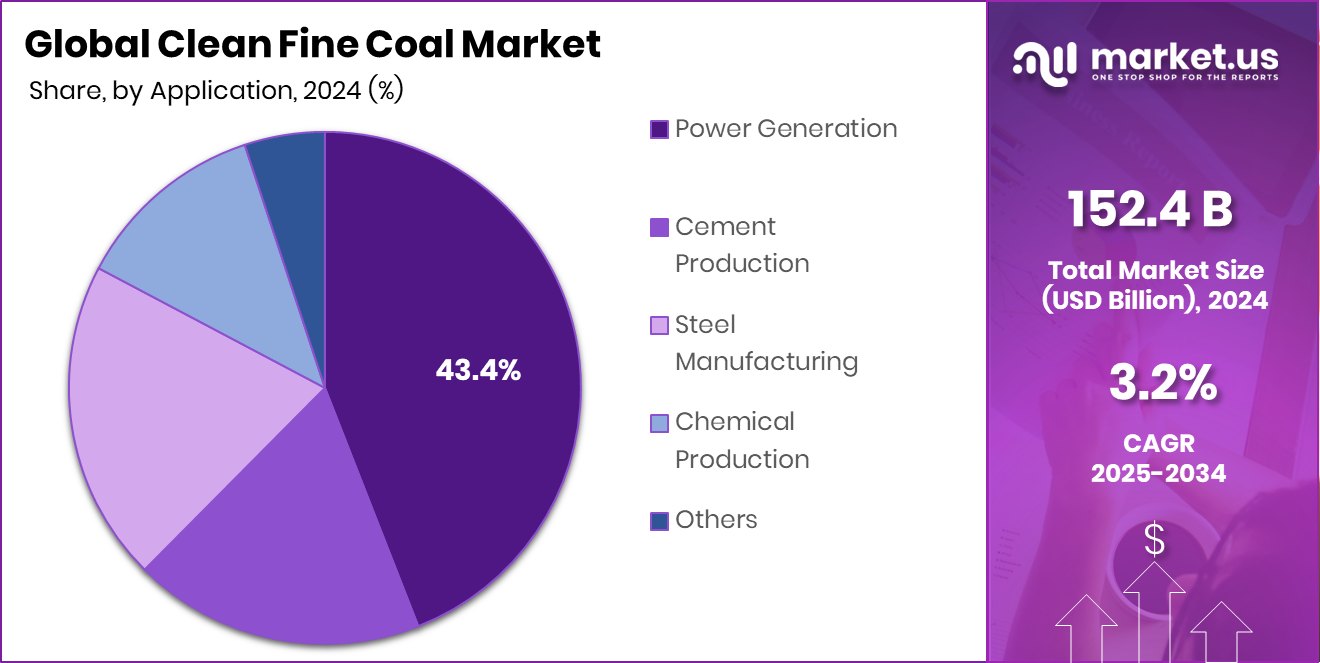

- Power generation holds a 43.4% share in the clean fine coal market, driven by cleaner combustion performance.

- The industrial sector dominates the clean fine coal market with a 66.3% share, emphasizing sustainable energy usage.

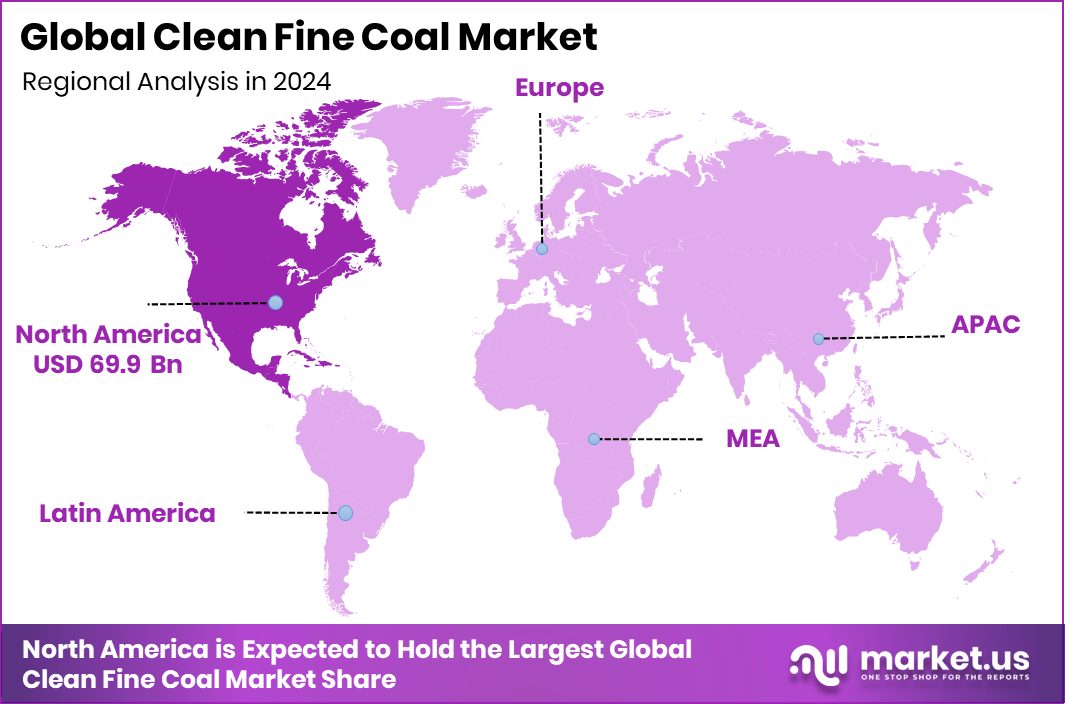

- The North American region dominated due to rising clean energy demand, totaling USD 69.9 million or 45.90%.

By Type Analysis

In the Clean Fine Coal Market, the 12.5%-16% type holds 56.2%.

In 2024, 12.5%–16% held a dominant market position in the By Type segment of the Clean Fine Coal Market, capturing a strong 56.2% share. This range represents the optimal ash content level preferred by industrial and power generation users for balanced efficiency and lower emissions. The segment’s dominance is driven by its cleaner combustion profile and higher calorific efficiency compared to other grades.

Industries are increasingly adopting this type due to its stable performance in boilers and its compatibility with existing energy infrastructure. Additionally, as regulatory norms tighten around emission control, the 12.5%–16% clean fine coal type continues to serve as a sustainable and economically viable choice across major end-use applications.

By Form Analysis

The Clean Fine Coal Market sees pellets form dominating with 44.8%.

In 2024, Pellets held a dominant market position in the By Form segment of the Clean Fine Coal Market, accounting for a 44.8% share. This form gained prominence due to its uniform size, improved combustion efficiency, and ease of handling during storage and transport. Pelletized clean fine coal offers consistent energy output and reduced dust generation, making it a preferred choice for industrial boilers and power plants.

The growing adoption of pelletized fuel aligns with cleaner energy practices, as it minimizes waste and optimizes the use of fine coal particles. Additionally, its compatibility with automated feeding systems and lower emissions has strengthened its acceptance across major industrial applications.

By Application Analysis

Power generation leads the Clean Fine Coal Market application segment at 43.4%.

In 2024, Power Generation held a dominant market position in the By Application segment of the Clean Fine Coal Market, capturing a 43.4% share. This dominance stems from the rising demand for cleaner and more efficient coal-based energy solutions. Clean fine coal, with reduced ash and moisture content, ensures better combustion efficiency and lower emissions, making it suitable for modern power plants focused on sustainability and cost optimization.

Utilities increasingly prefer clean fine coal for its ability to enhance thermal performance while meeting environmental compliance targets. As global energy needs expand, power generation continues to remain the primary end-use sector driving consistent consumption of clean fine coal across major industrial regions.

By End Use Analysis

Industrial end use drives the Clean Fine Coal Market with 66.3%.

In 2024, Industrial held a dominant market position in the By End Use segment of the Clean Fine Coal Market, securing a 66.3% share. This dominance is attributed to the widespread use of clean fine coal across manufacturing, cement, and metal processing industries that demand consistent heat and energy efficiency. Industrial users favor this form of coal for its stable combustion, reduced emissions, and lower operational costs compared to untreated fines.

The use of clean fine coal also supports sustainability goals by minimizing waste and improving fuel utilization rates. Its ability to deliver reliable thermal energy has positioned it as a preferred energy source for industrial operations seeking both efficiency and environmental compliance.

Key Market Segments

By Type

- Below 12.5%

- 12.5%-16%

- Above 16%

By Form

- Pellets

- Powder

- Lump

By Application

- Power Generation

- Cement Production

- Steel Manufacturing

- Chemical Production

- Others

By End Use

- Industrial

- Commercial

- Residential

Driving Factors

Rising Investments in Sustainable Energy Infrastructure

One of the key driving factors for the Clean Fine Coal Market is the growing investment in sustainable and cleaner energy infrastructure. Governments and the private sector are increasingly funding projects that focus on reducing carbon emissions while improving energy efficiency.

Such initiatives create a favorable environment for clean fine coal technologies, which utilize advanced washing and processing methods to lower pollution. The sector benefits indirectly from the rising funding in green and energy-efficient solutions.

A notable example includes Terra CO₂ securing US$124.5 million in extra Series B funding for sustainable cement production, showcasing global confidence in low-emission materials. These types of funding efforts highlight the shift toward environmentally responsible energy and industrial applications, indirectly supporting demand for cleaner coal solutions.

Restraining Factors

High Processing Costs and Technology Barriers

One major restraining factor for the Clean Fine Coal Market is the high cost of processing and advanced technology requirements. Producing clean fine coal involves complex steps like washing, drying, and separating impurities, which demand expensive equipment and skilled operation. Many small and mid-sized producers find it difficult to adopt these technologies due to limited budgets and infrastructure.

Additionally, fluctuating coal prices and strict emission norms make long-term investments uncertain. Although global funding is shifting toward clean innovations—such as the Green Steel Hub set to share £44 million of innovation funding—the focus often remains on greener alternatives rather than cleaner coal. This imbalance slows technology adoption and creates economic pressure on the clean fine coal industry.

Growth Opportunity

Expanding Role of Clean Fuels in Industry

A major growth opportunity for the Clean Fine Coal Market lies in the rising industrial transition toward cleaner and low-carbon fuel sources. As industries aim to reduce emissions without fully abandoning coal-based energy, clean fine coal provides a practical bridge—offering efficiency, reduced ash, and lower pollution. The growing need for dependable, affordable, and cleaner heat sources across cement, metal, and power sectors is creating new space for advanced coal beneficiation technologies.

Recent funding activities also signal strong global support for sustainable material innovation. For instance, Queens Carbon secured US$10 million in seed funding for low-carbon cement, showcasing investor confidence in cleaner energy-related technologies. Such funding indirectly supports advancements that enhance the relevance and adoption of clean fine coal.

Latest Trends

Rise of Digital & AI-Enabled Cleaner Coal Processing

One of the latest trends in the clean fine coal market is the increasing use of digital tools and AI-driven technologies to optimise processing, handling, and quality control of coal fines. By applying data analytics, machine-learning models, and real-time sensors, operators can now more precisely monitor moisture, ash content, and particle size, thereby reducing waste and improving fuel performance.

This digital transformation complements funding flows directed at low-carbon manufacturing: for example, Tata Steel UK secured £7 million in funding to develop AI-driven advanced low-carbon steels for automotive and packaging applications. Although this is steel rather than coal, it signals how digital/AI investment in energy-materials chains is growing — and clean fine coal processing stands to benefit as the broader materials industry shifts toward smarter, cleaner operations.

Regional Analysis

In 2024, North America held a 45.90% share of the Clean Fine Coal Market, reaching USD 69.9 million in value.

In 2024, North America held a dominant market position in the global Clean Fine Coal Market, accounting for 45.90% share, with a market value of USD 69.9 million. The region’s leadership is supported by advanced coal beneficiation technologies and a strong focus on cleaner energy generation across industrial and utility sectors. Government initiatives promoting low-emission energy systems and efficient fuel utilization have further strengthened the adoption of clean fine coal.

In Europe, regulatory frameworks promoting carbon reduction and sustainable fuel use are driving moderate growth, particularly in industrial power and heating applications. Asia Pacific is witnessing steady expansion, supported by rising energy demand and the modernization of coal-fired power infrastructure. Meanwhile, the Middle East & Africa region is gradually integrating cleaner coal technologies to balance energy diversification goals.

Latin America shows emerging interest in clean coal utilization, backed by growing industrialization and infrastructure development. Overall, North America remains the clear leader due to its technological readiness and policy support, while other regions are steadily advancing their clean coal capacities to align with energy efficiency and sustainability goals.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Peabody, a major coal producer, has focused on efficiency-driven operations and emission control systems within its coal beneficiation processes. The company continues to emphasize responsible mining and advanced cleaning technologies to improve fine coal recovery and reduce environmental impact.

Shenhua Group, China’s leading energy and coal enterprise, has strengthened its role by investing in clean coal conversion technologies and integrating fine coal into energy-efficient power generation. Its initiatives align with China’s clean energy transition, ensuring cleaner combustion and reduced carbon output.

Meanwhile, Anglo American has advanced the market through its commitment to sustainable resource management and low-carbon fuel initiatives. The company’s operational strategy centers on technological upgrades that enhance product quality and minimize waste. Collectively, these players underscore a strong global movement toward cleaner utilization of coal resources.

Top Key Players in the Market

- Peabody

- Shenhua Group

- Anglo American

- New Hope Corporation

- Peabody Energy

- Cobra Resources

- Warrior Met Coal

- Yanzhou Coal Mining Company

- Foresight Energy

Recent Developments

- In August 2025, Peabody terminated its $3.78 billion bid for Anglo American’s Australian coking coal mines, citing a material adverse change after a fire at the Moranbah North mine—this pulls back the earlier acquisition plan and may impact its clean-fine/coarse coal portfolio strategy.

- In August 2025, China Shenhua announced a major asset acquisition plan — it will purchase coal mining, pit-mouth power generation, coal-to-oil/coal-to-gas chemical assets from 13 of its controlling shareholder’s subsidiaries. The move aims to integrate mining, power, chemicals, and logistics into one platform, strengthen its coal conversion and clean-processing capabilities.

Report Scope

Report Features Description Market Value (2024) USD 208.8 Billion Forecast Revenue (2034) USD 208.8 Billion CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Below 12.5%, 12.5%-16%, Above 16%), By Form (Pellets, Powder, Lump), By Application (Power Generation, Cement Production, Steel Manufacturing, Chemical Production, Others), By End Use (Industrial, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Peabody, Shenhua Group, Anglo American, New Hope Corporation, Peabody Energy, Cobra Resources, Warrior Met Coal, Yanzhou Coal Mining Company, Foresight Energy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clean Fine Coal MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Clean Fine Coal MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Peabody

- Shenhua Group

- Anglo American

- New Hope Corporation

- Peabody Energy

- Cobra Resources

- Warrior Met Coal

- Yanzhou Coal Mining Company

- Foresight Energy