Global CIS Tin Market Size, Share, And Business Benefits By Product Form (Tin Ingots, Tin Alloys, Tin Foil, Tin Wire, Others), By Application (Soldering Materials, Coatings, Packaging, Electronics Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160689

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

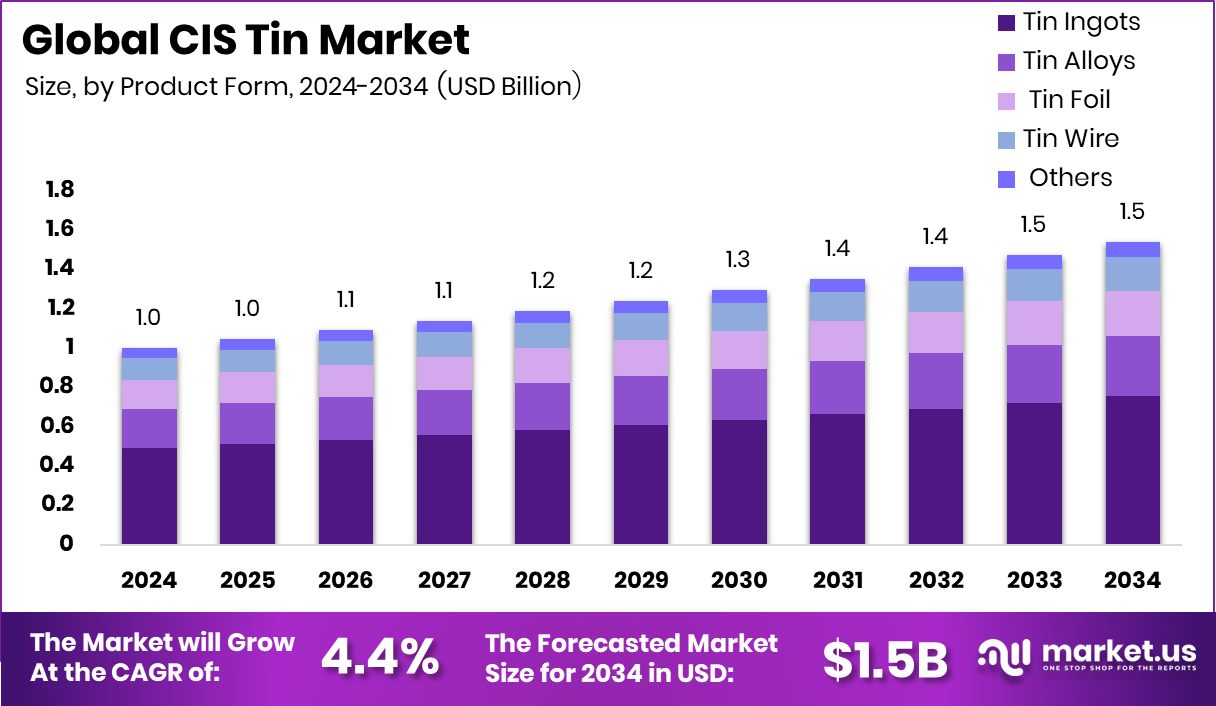

The Global CIS Tin Market is expected to be worth around USD 1.5 billion by 2034, up from USD 1.0 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Strong industrial demand and expanding manufacturing sectors supported Asia-Pacific’s 38.90% leading market position.

“CIS Tin” generally refers to tin sourced from or used within the CIS region (Commonwealth of Independent States) or tin products in the industry linked to that region. The CIS Tin Market is the ecosystem around production, trade, processing, and consumption of tin (ingots, alloys, tinplate, solder) within or through that region. It encompasses miners, smelters, refiners, traders, and downstream users. The market’s dynamics are shaped by supply constraints, geopolitical factors, cost of extraction, trade policies, and shifts in demand from electronics, packaging, and industrial sectors.

One growth driver is the shift toward lead-free electronics and more stringent environmental standards, pushing the use of tin in solder and coatings. As industries abandon toxic materials, tin becomes more attractive. Also, rising industrialization in emerging economies around the CIS increases demand for infrastructure, electronics, and packaging, thereby pulling tin consumption upward. Another factor is technological innovation: better purification, recycling, and alloying techniques reduce cost and wastage, thus expanding the usable supply. Moreover, improved logistics and trade relationships among CIS and neighboring regions help integrate markets and reduce friction in crossing borders.

The demand for tin in the CIS market is heavily tied to downstream industries. Electronics is a major consumer — printed circuit boards, connectors, and microchips require tin-based solder. Packaging, particularly tinplate for cans, is another key end use. Additionally, in chemical, glass, and specialty alloy sectors, tin compounds and alloys are used as stabilizers, coatings, and corrosion materials. As CIS nations develop their manufacturing base (automotive, consumer goods, appliances), internal demand for tin components rises. Recycling and secondary tin supply (from scrap) also contribute to satisfying that demand.

One opportunity lies in leveraging advanced coating, materials, and thin-film technologies that incorporate tin or tin compounds, opening new high-value markets (e.g., corrosion resistance, barrier layers, flexible electronics). Also, investing in improved mining, refining, and recycling infrastructure within the CIS region can reduce import dependency and improve margins.

In parallel, the broader materials and coatings space is attracting capital: Nature Coatings secured $2.45 m led by The 22 Fund and Regeneration.VC; Brightplus raised EUR 2 million to scale a textile coating innovation; Kriya Materials raised €3 mln to roll out its product portfolio; and German material tech company FibreCoat raised €18.9 M targeting space and defense sectors. These flows suggest investor confidence in advanced materials, which could spill over into tin-based innovations or composite systems in the CIS tin supply chain.

Key Takeaways

- The Global CIS Tin Market is expected to be worth around USD 1.5 billion by 2034, up from USD 1.0 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- In 2024, tin ingots dominated the CIS Tin Market, capturing 48.9% share due to industrial applications.

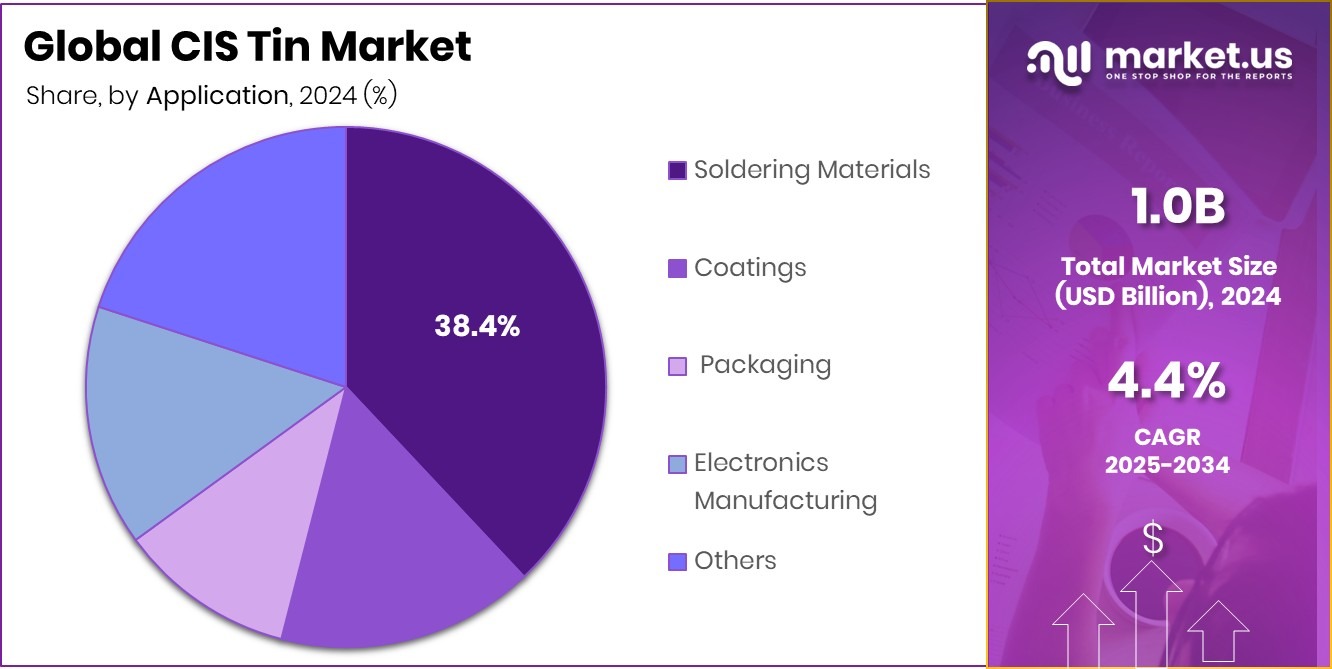

- Soldering materials held a 38.4% share in the CIS Tin Market, supported by electronics manufacturing expansion.

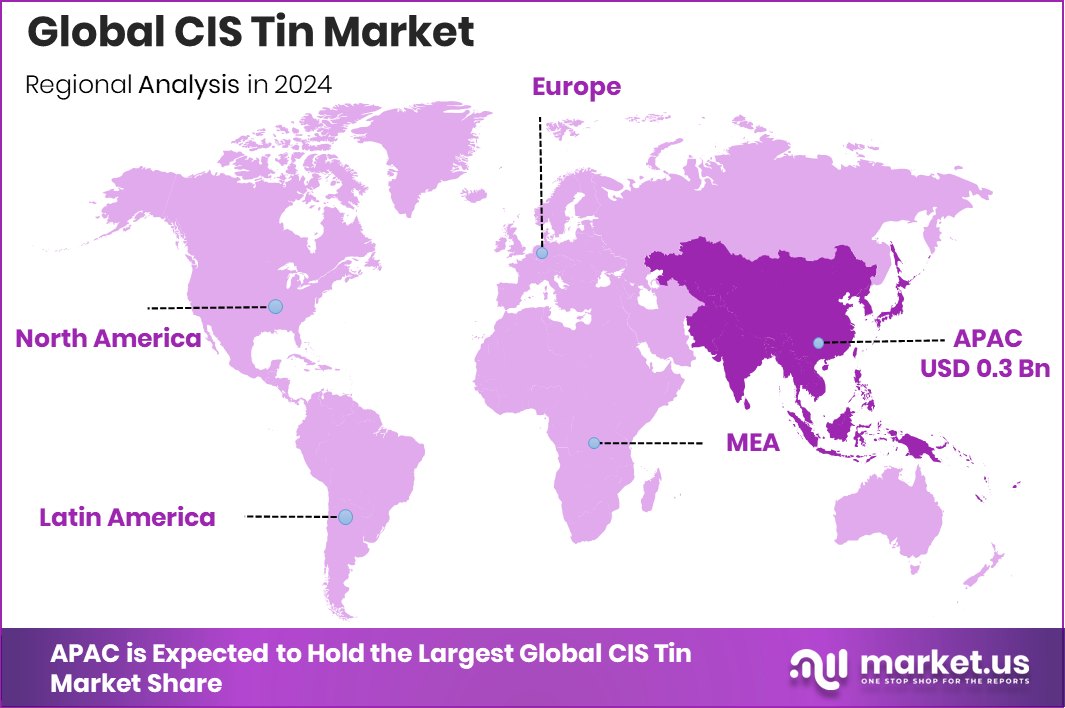

- The Asia-Pacific generated approximately USD 0.3 billion in market revenue that year.

By Product Form Analysis

In 2024, tin ingots held a 48.9% share in the CIS tin market.

In 2024, Tin Ingots held a dominant market position in the By Product Form segment of the CIS Tin Market, with a 48.9% share. This leadership reflects the extensive use of tin ingots in metallurgical and industrial applications, particularly in soldering, tin plating, and alloy production. The region’s established smelting operations and steady demand from downstream manufacturing sectors such as electronics, automotive, and packaging supported this dominance.

Tin ingots offer high purity, consistency, and ease of transport, making them the preferred choice for large-scale industrial buyers. Their versatility in various production processes has reinforced their market strength, positioning tin ingots as a key contributor to the overall value chain of the CIS Tin Market in 2024.

By Application Analysis

In 2024, Soldering Materials captured a 38.4% share in the CIS tin market.

In 2024, Soldering Materials held a dominant market position in the By Application segment of the CIS Tin Market, with a 38.4% share. This dominance is primarily driven by the widespread use of tin-based solder in the electronics and electrical industries, where reliable and lead-free joining materials are essential. The region’s growing manufacturing base for electronic components, circuit boards, and consumer appliances further strengthened the demand for soldering materials.

Tin’s superior conductivity and compatibility with various metals make it an ideal choice for precision soldering applications. The continued shift toward environmentally compliant, high-performance solders solidified the leading position of soldering materials within the CIS Tin Market during 2024.

Key Market Segments

By Product Form

- Tin Ingots

- Tin Alloys

- Tin Foil

- Tin Wire

- Others

By Application

- Soldering Materials

- Coatings

- Packaging

- Electronics Manufacturing

- Others

Driving Factors

Rising Demand for Lead-Free Solder Materials

One of the major driving factors of the CIS Tin Market is the rising demand for lead-free solder materials. As global industries move toward safer and eco-friendly manufacturing practices, tin-based solders have become the preferred alternative to traditional lead alloys. Electronics manufacturers across the CIS region increasingly rely on tin for its strong bonding ability, corrosion resistance, and superior conductivity. This shift is further supported by stricter regulations on hazardous substances, pushing producers to adopt sustainable materials.

Additionally, innovation in coating and optical technologies highlights the growing investment in advanced material solutions. For example, Flō Optics raised $35 million in Series A funding to replace traditional lens coatings with printed technology, reflecting growing confidence in material innovation.

Restraining Factors

High Production Costs and Limited Refining Capacity

A key restraining factor in the CIS Tin Market is the high production cost combined with limited refining capacity across the region. Extracting and processing tin requires advanced technology and significant energy input, which raises operational expenses for producers. Many CIS countries still depend on older smelting infrastructure, leading to inefficiencies and higher waste output. In addition, fluctuating energy prices and logistics challenges further strain production economics, reducing competitiveness against global suppliers.

These limitations hinder capacity expansion and discourage small producers from entering the market. Meanwhile, investment interest in sustainable materials remains strong, as seen when Pigment Start-Up Nature Coatings secured $2.45 million to scale eco-friendly pigment solutions, showing broader attention to material efficiency innovations

Growth Opportunity

Expanding Use of Tin in Sustainable Coatings

A major growth opportunity for the CIS Tin Market lies in the expanding use of tin within sustainable and bio-based coating applications. As industries move toward eco-friendly solutions, tin compounds are increasingly valued for their protective and anti-corrosive properties in coatings, packaging, and electronics. This shift aligns with global sustainability goals and the growing demand for recyclable and non-toxic materials.

The CIS region, with its access to raw materials and developing industrial base, can play a vital role in supporting this transition. Supporting this trend, Brisbane-based Earthodic raised $6 million in seed funding to develop recyclable bio-based coatings for paper packaging, demonstrating the rising global investment in sustainable material technologies that can complement tin applications.

Latest Trends

Growing Adoption of Advanced and Biodegradable Coatings

One of the latest trends shaping the CIS Tin Market is the growing adoption of advanced and biodegradable coating technologies. Tin-based materials are increasingly used in eco-friendly coatings that enhance product durability while reducing environmental impact. Manufacturers are focusing on innovative formulations that offer corrosion resistance and sustainability, aligning with global environmental standards. This trend is also influenced by rising investment in next-generation coating technologies.

For instance, Xampla secured $7 million in funding to scale up biodegradable coating production, while P.E.I.-based MDS Coating Technologies announced a $100 million expansion to boost aerospace coating capacity. These developments highlight a broader shift toward sustainable, high-performance coating solutions, creating new avenues for tin applications within the CIS region.

Regional Analysis

In 2024, the Asia-Pacific held a 38.90% share of the CIS Tin Market.

In 2024, the Asia-Pacific region dominated the CIS Tin Market, capturing a 38.90% share, valued at USD 0.3 billion. This dominance is supported by the region’s strong industrial base, expanding electronics manufacturing, and growing demand for tin-based solder materials. The presence of large-scale production facilities and steady growth in downstream applications such as packaging and coatings further strengthened its leadership.

North America maintained a stable demand driven by the electronics and automotive sectors, where tin is widely used in soldering and component fabrication. Europe focused on sustainability and lead-free manufacturing, contributing to increased adoption of refined tin materials.

Meanwhile, the Middle East & Africa showed gradual growth, driven by infrastructural expansion and industrial diversification efforts. Latin America exhibited steady market potential through developing electronics assembly industries and metal recycling initiatives. Collectively, these regions contributed to shaping the global tin trade balance, but Asia-Pacific remained the clear leader due to its manufacturing capabilities, technological advancements, and regional trade integration.

The region’s strong industrial policies and increasing focus on sustainable materials positioned it as a crucial hub for tin processing and consumption in 2024, maintaining its competitive advantage across both domestic and export-oriented markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Yunnan Tin Company Group Limited, one of the leading tin producers, continued to strengthen its refining and smelting operations, ensuring a high-purity tin supply for electronics, solder, and industrial applications. The company’s focus on efficiency, sustainability, and value-added processing helped maintain a steady export flow to major Asian and CIS economies.

PT Timah Tbk, an integrated tin mining and refining enterprise, emphasized responsible mining and production efficiency, aligning its operations with global sustainability expectations. Its exploration programs and refined product quality positioned it as a stable supplier for industrial-grade tin.

Malaysia Smelting Corporation Berhad sustained its strong position through advancements in smelting technology and the recovery of secondary tin, supporting circular economy initiatives. Its commitment to environmental compliance and product consistency further enhanced its credibility in international trade.

Meanwhile, PT Koba Tin maintained its regional importance through ongoing mining and refining activities, focusing on operational optimization and resource management. Collectively, these companies demonstrated significant strategic importance to global tin supply chains, supporting a steady flow of raw materials to the CIS region. Their continuous investments in processing technology and sustainability practices in 2024 reinforced the overall stability and resilience of the CIS Tin Market amid evolving industrial and regulatory landscapes

Top Key Players in the Market

- Yunnan Tin Company Group Limited

- PT Timah Tbk

- Malaysia Smelting Corporation Berhad

- PT Koba Tin

Recent Developments

- In August 2025, PT Timah launched a subsidiary, PT Timah Industri, which focuses on moving downstream into tin chemicals and solder production.

- In September 2024, Yunnan Tin and PT Timah established a strategic partnership aimed at strengthening their positions in refined tin production and trade

Report Scope

Report Features Description Market Value (2024) USD 1.0 Billion Forecast Revenue (2034) USD 1.5 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Form (Tin Ingots, Tin Alloys, Tin Foil, Tin Wire, Others), By Application (Soldering Materials, Coatings, Packaging, Electronics Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Yunnan Tin Company Group Limited, PT Timah Tbk, Malaysia Smelting Corporation Berhad, PT Koba Tin Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Yunnan Tin Company Group Limited

- PT Timah Tbk

- Malaysia Smelting Corporation Berhad

- PT Koba Tin